NEWS

12 Nov 2021 - Performance Report: DS Capital Growth Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The investment team looks for industrial businesses that are simple to understand, generally avoiding large caps, pure mining, biotech and start-ups. They also look for: - Access to management; - Businesses with a competitive edge; - Profitable companies with good margins, organic growth prospects, strong market position and a track record of healthy dividend growth; - Sectors with structural advantage and barriers to entry; - 15% p.a. pre-tax compound return on each holding; and - A history of stable and predictable cash flows that DS Capital can understand and value. |

| Manager Comments | The DS Capital Growth Fund has a track record of 8 years and 11 months and has consistently outperformed the ASX 200 Total Return Index since inception in January 2013, providing investors with a return of 16.39%, compared with the index's return of 9.71% over the same time period. On a calendar basis the fund has had 1 negative annual return in the 8 years and 11 months since its inception. Its largest drawdown was -22.53% lasting 6 months, occurring between February 2020 and August 2020 when the index fell by a maximum of -26.75%. The Manager has delivered these returns with -2.29% less volatility than the index, contributing to a Sharpe ratio which has never fallen below 1 and currently sits at 1.29 since inception. The fund has provided positive monthly returns 90% of the time in rising markets, and 35% of the time when the market was negative, contributing to an up capture ratio since inception of 73% and a down capture ratio of 46%. |

| More Information |

12 Nov 2021 - Performance Report: Cyan C3G Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Cyan C3G Fund is based on the investment philosophy which can be defined as a comprehensive, clear and considered process focused on delivering growth. These are identified through stringent filter criteria and a rigorous research process. The Manager uses a proprietary stock filter in order to eliminate a large proportion of investments due to both internal characteristics (such as gearing levels or cash flow) and external characteristics (such as exposure to commodity prices or customer concentration). Typically, the Fund looks for businesses that are one or more of: a) under researched, b) fundamentally undervalued, c) have a catalyst for re-rating. The Manager seeks to achieve this investment outcome by actively managing a portfolio of Australian listed securities. When the opportunity to invest in suitable securities cannot be found, the manager may reduce the level of equities exposure and accumulate a defensive cash position. Whilst it is the company's intention, there is no guarantee that any distributions or returns will be declared, or that if declared, the amount of any returns will remain constant or increase over time. The Fund does not invest in derivatives and does not use debt to leverage the Fund's performance. However, companies in which the Fund invests may be leveraged. |

| Manager Comments | The Cyan C3G Fund has a track record of 7 years and 3 months and has outperformed the ASX Small Ordinaries Total Return Index since inception in August 2014, providing investors with a return of 16.15%, compared with the index's return of 9.63% over the same time period. On a calendar basis the fund has had 1 negative annual return in the 7 years and 3 months since its inception. Its largest drawdown was -36.45% lasting 16 months, occurring between October 2019 and February 2021 when the index fell by a maximum of -29.12%. The Manager has delivered these returns with -0.24% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 five times and currently sits at 0.94 since inception. The fund has provided positive monthly returns 85% of the time in rising markets, and 42% of the time when the market was negative, contributing to an up capture ratio since inception of 68% and a down capture ratio of 48%. |

| More Information |

12 Nov 2021 - Performance Report: Airlie Australian Share Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund is long-only with a bottom-up focus. It has a concentrated portfolio of 15-35 stocks (target 25). The fund has a maximum cash holding of 10% with an aim to be fully invested. Airlie employs a prudent investment approach that identifies companies based on their financial strength, attractive durable business characteristics and the quality of their management teams. Airlie invests in these companies when their view of their fair value exceeds the prevailing market price. It is jointly managed by Matt Williams and Emma Fisher. Matt has over 25 years' investment experience and formerly held the role of Head of Equities and Portfolio Manager at Perpetual Investments. Emma has over 8 years' investment experience and has previously worked as an investment analyst within the Australian equities team at Fidelity International and, prior to that, at Nomura Securities. |

| Manager Comments | The Airlie Australian Share Fund has a track record of 3 years and 5 months and therefore comparison over all market conditions and against the fund's peers is limited. However, since inception in June 2018, the fund has outperformed the ASX 200 Total Return Index, providing investors with an annualised return of 14.05%, compared with the index's return of 9.91% over the same time period. On a calendar basis the fund has had 1 negative annual return in the 3 years and 5 months since its inception. Its largest drawdown was -23.8% lasting 9 months, occurring between February 2020 and November 2020 when the index fell by a maximum of -26.75%. The Manager has delivered these returns with -0.45% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 twice and currently sits at 0.87 since inception. The fund has provided positive monthly returns 100% of the time in rising markets, and 8% of the time when the market was negative, contributing to an up capture ratio since inception of 113% and a down capture ratio of 92%. |

| More Information |

12 Nov 2021 - 10k Words - November Edition

|

10k Words - November Edition Equitable Investors November 2021 We kick off with Australia outpacing Hong Kong in IPO activity, as highlighted by Bloomberg. We can't avoid the inflation discussion and FactorInvestor charts US inflation expectations, while we go back to Bloomberg for a look at inflation-protected treasury yields, which have not followed the script of 2013. IFM Investors looked at how Australia's monthly inflation (using the Melbourne Institute monthly inflation gauge) was still accelerating in year-on-year terms, despite decelerating in terms of month-on-month increases. Then we turn to equity valuation where Redpoint's Tomasz Tunguz explores the phenomenon of Software-as-a-Service (SaaS) valuation multiples rising to 100x their Annualised Recurring Revenue (ARR); while Axios charts the explosion in valuation of rental car companies, aided by hype around electric cars. Finally, Kailash Capital shows that S&P 500 stocks analysts dislike are priced at a 34% discount to the market, based on a multiple of sales, while stocks that are analyst "darlings" trade at a 17% premium to the market. The unanswered question is whether the pricing is caused by analyst popularity or whether analysts tend to like stocks that are already strongly supported by the market (Kailash suspects there is "self-reinforcing price action as high average returns... force analysts to shift to buy ratings").

Australia outdoing Hong Kong in IPO activity Source: Bloomberg Tracking US inflation expectations Source: FactorInvestor

Yields on Treasury Inflation-Protected Securities (TIPS) now v 2013 Source: Bloomberg Australian Bureau of Statistics (ABS) quarterly headline inflation v Melbourne Institute inflation gauge Source: IFM Investors Listed Software-as-a-Service (SaaS) valuation as a multiple of Annualised Recurring Revenue (ARR) Source: Tomasz Tunguz of Redpoint Market capitalisation of rental car companies Hertz & Avis Source: Axios, FactSet Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions.Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components.Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog Funds operated by this manager: |

11 Nov 2021 - Three key topics dominating global equity markets

|

Three key topics dominating global equity markets Antipodes Partners Limited 27 October 2021 Three key issues - inflation, the power crunch, and China's economy - reverberated during the third quarter of 2021 and continue to present a complex backdrop for global equity investors. As we move into 2022, we think it will be critical that global equity portfolios are appropriately positioned to provide exposure to the potential opportunities while providing protection against risks that may emerge such as an economic growth shock (perhaps from a hard landing in China), or an inflation shock. There's also the possibility of a combination of both - the stagflation scenario. InflationAntipodes has been saying for some time that we think inflation is going to be more sticky than transient, while central banks have taken the view that near-term inflation will fade.

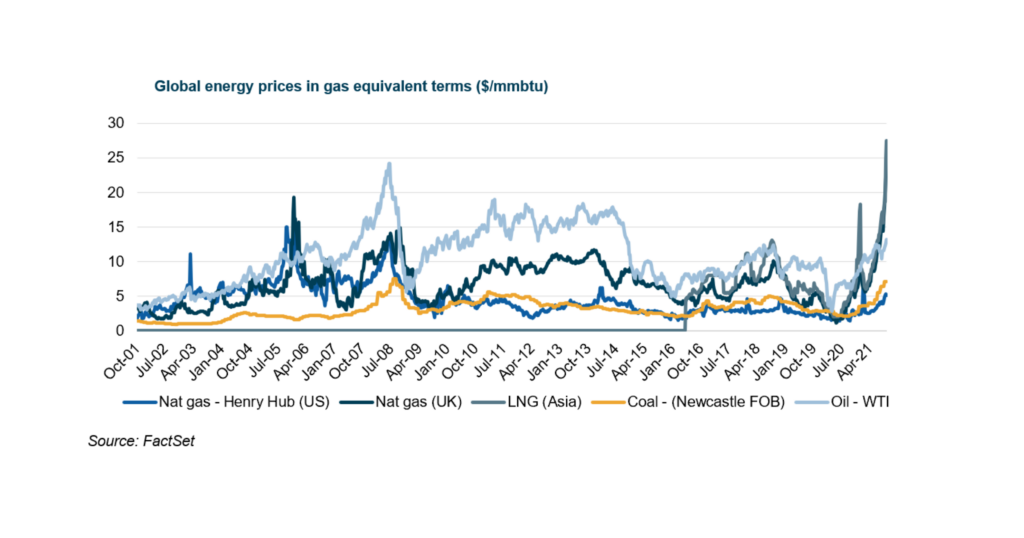

It's almost a certainty that tapering will begin before the end of the year and rate hikes may start from late 2022 as opposed to 2023. The risk is that the Fed is tightening as economic growth is slowing, which may compound the problem. A power crunch?Europe's gas price is at a record high, the US gas price has more than doubled over the year, and oil is back above $80 per barrel, the highest level since 2014. Energy is becoming another pressure point. Europe is facing a shortage of gas due to a strong rebound in economic activity, coupled with supply issues and an underinvestment in power infrastructure. In recent days Russia declined to pump extra gas into continental Europe which compounded fears. Moscow's position may change in the coming months, but even if Russia does decide to supply some additional gas, Europe is unlikely to find enough volume from traditional suppliers to fill the deficit. With LNG and European gas prices equivalent to $150 per barrel of oil we're seeing a shift to burning oil in Asia. This shows how the gas rally is also fuelling an oil rally. Consumers are going to start to feel this. The cost of filling the tank will rise, as will the cost to power and heat homes in the northern hemisphere's peak winter demand season. At the same time, power shortages have hit China. China's power demand has been strong due to domestic and global activity, but hydropower output - which is almost 20% of total power in China - has been hit due to low rainfall, and coal production has also been subdued due to capacity controls and tightening policies around mine safety and emissions. We've started to see shutdowns in high energy intensive industries, and if this accelerates through the broader industrial sector there will be implications for domestic and global economic growth.

The Chinese economyChina has been tightening property policies on and off over the last five years. Growth had become unsustainably high again in the first half of this year, so policy was tightened again to curb speculation and house price inflation. Housing starts began contracting in August, which quickly exposed the weaker property developers. We all know the Evergrande story - but the Chinese banking system can handle an Evergrande default, if it comes to that.

The bigger question is whether an Evergrande default seizes up financing for other developers, which spills over into weaker housing prices and a broader economic slowdown. Residential development accounts for around 10% of GDP, so it's a material contributor to China's economic activity. There would also be implications for commodity prices, particularly commodities where China is a major consumer but an immaterial producer. Copper and iron ore look the most vulnerable here. However, with Government debt less than 70% of GDP, China has the firepower to re-stimulate - and we think it's a question of when rather than if. This time around we think stimulus will focus on consumption, reinforcing the social safety net and decarbonisation. China wants to accelerate its transition to a consumption and services driven economy. To do this, household spending needs to grow at a faster pace than incomes via running down China's extraordinarily high savings rate. With changes in the regulatory backdrop now well-progressed, investors are going to start to re-focus on long-term opportunities, particularly around consumption trends. Funds operated by this manager: Antipodes Asia Fund, Antipodes Global Fund, Antipodes Global Fund - Long Only (Class I) |

10 Nov 2021 - Net Zero - Offsetting our carbon emissions

10 Nov 2021 - We are our own worst enemy

|

We are our own worst enemy Ty Archibald, Aoris Investment Management 29 October 2021 Most of us read about behavioural biases and acknowledge they exist, yet there is no evidence the financial community is any better at dealing with them. Understanding the impact of biases improves our ability to apply guardrails and combat them, leading to better decisions and investment outcomes. With that in mind, let's look at three of the most common biases, where we come across them in everyday life and investing, and how we can minimise their impact. Optimism biasIt is natural to take the view that good things will happen more often than they do. While positive thinking makes life more pleasant, the evidence suggests excessive optimism can be to our detriment. Optimism bias regularly appears in investment thinking. For example, the graph below shows the change in analyst earnings per share estimates for the S&P 500 across each calendar year from 2006-2020. Of the 14 years included, 10 showed meaningful downgrades. On average, analysts overestimated EPS growth by about two times. The high proportion of downgrades illustrates analysts repeatedly overestimating business prospects at the beginning of each period, demonstrating optimism bias in practice.

Optimism bias can be exaggerated when investing in companies with a wide range of outcomes, where little past information is relied on for the basis of bold future assumptions. By focusing attention on the large potential gains, it can be difficult for investors to visualise potential losses. For example, the electric vehicle market is in its early stages, and it is difficult to gauge how stable the market will be and which manufacturers will ultimately succeed. How can we combat our natural optimism bias without turning ourselves into killjoys? Paying attention to history will help keep our expectations grounded. Social proof biasSocial proof is a phenomenon that involves people copying the actions of others in situations of uncertainty. Humans naturally believe there is safety in numbers and want to fit in with the crowd. We also avoid confrontation, so going along with what others think provides the path of least resistance. Humans feel there is safety in numbers. Investors can panic amid a sell-off and follow the crowd, even if selling is contrary to the information they have on hand. In contrast, at the peak of an economic cycle investors can flock to well-performing stocks in an attempt to ride the momentum wave and avoid the dreaded feeling of FOMO (fear of missing out). FOMO and the impact of herding behaviour can have very real consequences. For example, in Singapore in the 1980s an unexpected bus strike had created an abnormally large crowd at a bus stop outside a bank. Local customers mistook the gathering as people waiting to make a withdrawal, so they too lined up thinking the bank must be in financial trouble if there were so many customers waiting. The bank was forced to shut its doors to prevent an actual bank run. How do we counter social proof? A simple (but not easy) way to combat this behaviour involves developing independent thoughts and conclusions, with reference to objective reasoning and facts and not the "sway" of the herd. Anchoring biasAnchoring bias causes us to rely too heavily on the first piece of information we are given about a topic. We then typically adjust slightly away from the original anchor point when making decisions, even if it has little relevance to the problem we are trying to solve. Anchors are used in negotiations every day. Take the used car salesperson for example, who will always give you their best price upfront. They have now dropped an anchor, and any price you can get below that will seem like a better deal to you when it could still be a price well above the car's value. This will now play a larger role in your decision, rather than more relevant indicators of value such as the age of the car and its current condition.

Similar behaviour regularly occurs in equity markets. Investors have a tendency to anchor on the current stock price and use that as a gauge on where the stock will go in the future, or use current multiples compared to historical values. Like the car salesperson example above, this single indicator has little relevance and offers no insight into the value of the underlying business. How do we deal with anchoring? Dropping your own anchor is an effective way to combat this. Thinking about the value of a business independent of the current price or purchase price can keep the focus on business fundamentals. Key takeawaysIn conclusion, let's reinforce the key considerations for investors when dealing with the three behavioural biases mentioned above. Optimism bias: If we participate in parts of the market characterised by narrower ranges of outcomes, it mitigates the chances of excessive optimism. Exciting themes, emergent markets and unproven technologies are fertile grounds for optimism bias. Social proof bias: Maintain independent thoughts and conclusions. Be wary of herd following behaviour and think carefully about the reasons for a purchase or sale. Anchoring bias: Delay decisions and drop your own anchor. Slowing down our decisions allows us to develop a more holistic view of the problem we are facing and can avoid anchoring off that first piece of information we receive. We can make more informed transaction decisions if we focus on the value of the underlying business, without reference to the current price or our original purchase price. Funds operated by this manager: |

9 Nov 2021 - Revolution in Art

|

Revolution in Art Michael Frazis, Frazis Capital Partners 01 November 2021 This is a strange moment in crypto. Some are still debating the extent to which the entire complex is a Ponzi scheme, while at the same time many of the smartest people I know are quitting incredible jobs and going all in on Web31. And for good reason. There are simultaneous revolutions in all kinds of fields going on right now and it's all so exciting and moving so fast it's hard to keep track. NFTs2 confer and prove ownership backed by the strength of globally distributed crypto networks. As is so common in Web3, this codifies and strengthens behaviour that already exists: people were already paying up for signed album prints! The human impulse is the same, only Web3 signatures are better, as the resulting NFTs are tradable all over the world and verifiably secure in a way that a signed baseball cap simply can't be.

Art When future generations write their version of the 'Story of Art', this moment in time will feature heavily. This book needs a new chapter or two

For thousands of years, with rare exceptions, a life spent making art was a life spent in poverty. Now, for the first time ever, artists are making the kind of coin that puts financiers to shame. Earlier in the year an artist called Beeple made a digital artwork every day for 5,000 days and sold the lot as an NFT for $69 million as '"Everydays: The First 5000 Days".

This seemed large at the time, but volumes have exploded on exchanges like Opensea and ImmutableX. NFTs, which use the security of crypto to confer ownership, have gone up seven-fold to over US$10 billion over the last three months alone. New things are now possible. An artist can now sell an NFT and receive an ongoing share of future sales. In the past, a young artist might sell work for a pittance and receive no ongoing royalties as their career progressed, with all profit accruing to collectors. Many NFTs are conventional artworks, but there has been an explosion of creative activity. The current craze is for collections of say, punks, the cheapest of which are now priced in the hundreds of thousands of dollars. These are an extremely exclusive club right now - which of course is the point. There are all kinds of copycats of varying quality, like Bored Ape Yacht Club, (you might pick one up for $100,000). Part of the attraction of these is their link to personal identity. These go on your twitter handle, your discord, and wherever you represent yourself on the internet. How on earth are people paying for all of this? One way is through the ~$2.5 trillion of crypto wealth sitting on the personal balance sheets of some of the strangest and most forward-looking people on the planet. It's not surprising they are spending a small portion of that on art. The trick to understanding all this is that art has always been ludicrous and illogical. Why pay more for this painting than that? On the surface it looks like some mix of fashion, history, and aesthetics. But the real answer is that it has been that pricing simply comes down to what people choose to do with their wealth. Understand that - and you understand what's going on in NFTs. The next level, of course, is realising that NFTs enable all kinds of entirely new models such as in photography.

Photography Stock images are terrible for everyone except a small group of gatekeepers. Firms like Adobe charge a small fortune for photo catalogues and pay photographers next to nothing. Photography is widely plagiarised and to be honest, selling it upfront or charging commissions to anyone who makes use of an image online isn't practical in today's world. Enter NFTs, where in a single sale you can generate vastly more than stock image sites will pay, while giving true, verifiable ownership to the purchaser. Cath Simard for example sold one NFT of her widely copied photograph and then made it free for all to use. Everyone wins, and no doubt the value of that NFT is higher now for all the publicity.

Cath Simard's image can now be downloaded and used for free, guiltlessly

Music The Web2 era of YouTube and Spotify has not been great to musicians, apart from the very most popular. Companies like Spotify pay pittances to most artists while building tens of billions of dollars of equity value, (though to be fair at least part of this is to do with rent extraction by art labels). Less than 14,000 artists out of 8 million make more than $50,000. In other words, the vast majority can't make a living. Only 12% of industry revenue goes to musicians. The annoying thing is that most of us love music, listen to it for significant parts of our days, and in other parts of our lives, pay much more, for less. Some musicians are already making more out of NFTs than the paltry pennies thrown their way by Spotify. One artist sold one NFT and made as much as ~7 million hours of Spotify streaming. RAC made more from a single NFT than ten years of album sales. Web3 allows the coding of all kinds of different business models. For example, artists can sell album NFTs that offer a share of future streaming revenues. So those hip enough to find artists before they are cool can both support their development and also share in their future success. This is the closest thing to this is equity ownership which revolutionized capital and financed the last few centuries of extraordinary progress. The beauty of Web3, which we'll see in context after context, is the ability to code any kind of new business model. This is very much needed. This is better than what we had before

Did these pathways exist in Web2? Yes, but really no. Photographers, artists and designers could indeed create a page on Instagram or facebook and have access to a significant part of the global population. But they would be posting their work for free, and it was Facebook and the like who accrued the hundreds of billions of dollars of value. None of this went to the content providers. Perhaps artists could include a link to a page or something. Apple is similarly exploitative. You can't buy books on Kindle app because Apple demands a 30% rent. In fact, Apple charges a 30% tax on all digital goods sold through their platform, as does Google Play. It's a good thing there are now globally distributed alternatives. Web2 companies exploited visual art for their own commercial aims, and in doing so, spammed us with advertising, of which far too much was political. And by focusing on attention and advertising, promoted increasingly radicalising and enraging (engaging) content. The possibilities of Web3 simply didn't exist before crypto.

Why this matters When I was younger, art and music seemed like subjects to be taken for fun. There never seemed a serious prospect of working in the space in the adult world. In 2021 going into 2022, it's hard to think of a skill set more valuable than an eye for design, understanding of colour, and the energy to create something new and exciting. As a teenager I knew many who were obsessed with making art and music. The majority are now working in uncreative industries. At the critical moments they simply had to get a job. Today's teenagers, digitally and increasingly cryptonative, have other options. You only need a handful of fans to make a living, and with crypto, there is now a pathway. The result of all this is an explosion of creative energy. Think of all the talented musicians and artists that never found an audience and ended up spending their lives doing something different. Web2 gave everyone access to an audience, but value was captured by a small number of companies. Web3, with all its unexplored potential, and over $2 trillion of internet-native capital behind it, has enabled more people than ever to get the early financial wins necessary to spend their life making art. And that is great news for the rest of us. 1 Web1, Web2, Web3: three stages of internet growth. Web 1.0 - connecting information and getting on the net. Web 2.0 - connecting people / social participation. Web 3.0 - use of machine learning and artificial intelligence to create more open, connected, and intelligent websites or web applications; includes decentralised apps that run on blockchain. 2 A non-fungible token is a unique and non-interchangeable datum stored on a digital ledger. NFTs can be used to represent easily reproducible items such as photos, videos, audio, and other types of digital files as unique items, and use blockchain technology to establish a verified and public proof of ownership. Funds operated by this manager: |

9 Nov 2021 - 'Reaching for yield' into corporate debt takes on a risky hue

|

'Reaching for yield' into corporate debt takes on a risky hue Magellan Asset Management October 2021 William White, a Canadian, became the top economist at the Bank for International Settlements (BIS) over a 14-year career to 2008 at the bank owned by central banks. Among those who heard of him, White became known as "the man no one wanted to hear".[1] From 2003, in an era when central banks prioritised inflation targeting (and yet the response to every crisis by the 'maestro' Federal Reserve chairman Alan Greenspan was to slash the US cash rate), White and his team studied the data the BIS gathered on banks worldwide. They judged that low interest rates meant too much money was sloshing around. They observed a bubble developing in US housing. They noted the obscure way mortgages were being securitised. They spotted the stellar ratings on dodgy mortgage-backed securities. They observed the increase in risky loans. White ensured that BIS publications were sprinkled with warnings that bubbles lead to financial upheavals.[2] On top of that, White aired his concerns through speeches and papers. Two of White's efforts stood out. The first was in 2003 at Jackson Hole in the US at the annual gathering of central bankers that included Greenspan, who then publicly snubbed White for his remarks.[3] What upset Greenspan was that White warned that, even though inflation was docile, liberalised financial markets allowing investors to take too much risk meant that "financial imbalances could build up ... possibly resulting in financial instability" so damaging that "central banks may need to push policy rates to zero".[4] White's other warning of note was a 2006 paper titled Is price stability enough? In it, White concluded that "one hopes that it will not require a disorderly unwinding of current excesses to prove convincingly that we have indeed been on a dangerous path" by targeting inflation only.[5] The US subprime crisis of 2007 that morphed into the global financial crisis of 2008 was, of course, that chaotic unravelling. While no household name, White is acknowledged as the economist who foresaw the calamity, and the BIS is regarded as among the foremost voices on financial risks. That is the context in which to view a paper the BIS released in March this year that warns about the "bankruptcy gap". This term refers to the difference between expected and actual - "very low" - global bankruptcies since the pandemic began, even fewer insolvencies in some countries.[6] The BIS said ample credit from banks and the corporate-debt market means lockdown-hit companies in "airline, hotel, restaurant and leisure sectors" in particular are surviving on debt, not economic viability. "The more worrying scenario is the combination of higher debt levels and depressed earnings for credit-dependent firms", the BIS said, essentially warning that a spate of defaults could threaten financial stability. The concerns are centred on the lower-rated - or 'junk' - segments of the corporate debt market - where the US$11 trillion US market (of which about US$3 trillion is junk debt), as the world's benchmark, gets outsized attention. So too does China's US$17 trillion corporate-debt market, where recent defaults and property giant Evergrande's woes pushed the average yield on Chinese high-yield bonds issued offshore from 9.56% on June 30 to 15.45% at the end of September.[7] The risky form of finance that gained in global popularity from the 1980s has turned more hazardous due to ultra-loose monetary policies and the decision by key central banks to backstop their corporate bond markets - most notably, the Fed's historic decision in March last year to buy US investment-grade corporate bonds.[8] The combination prompted investors to pile into risky company debt to earn their required returns. This 'reach for yield' means that junk bonds are priced at little premium over investment-grade corporate debt and government bonds. In the US on September 30, for instance, the ICE BofA US High Yield Index Option Adjusted Spread of junk to government bonds had plunged from a record of 11.38% just before the Fed began buying corporate bonds on March 23 last year to only 4.21% on September 30, not far above the 3.94% set on September 15, its lowest since just before the subprime crisis of 2007.[9] Given that companies have used record low interest rates to lengthen the maturity of their debt holdings - and default risk rises over time - the barometer is at a de facto historic low. The rating companies are sounding similar concerns to the BIS (as, less directly, is the OECD).[10] Moody's and S&P Global Ratings told the Financial Times in August that a borrowing frenzy amounting to a record US$786 billion[11] in "speculative-grade" (the junkiest) debt so far in 2021 amid "clear signs of risk taking" meant "the current easy access to corporate financing might be laying the foundation for a future debt crisis" from "elevated levels of defaults".[12] The frenzy this year comes after a record US$1 trillion was invested in corporate debt. The wider concern is the systemic threat. Even if any corporate-bond crisis fails to inflict such damage, higher company debt loads foreshadow a downturn because higher repayments would force businesses to shed staff and refrain from investing as they prioritised reducing their debts (a 'balance sheet' recession, in the jargon). The risks around speculative-grade corporate debt raise the broader question of whether or not prolonged central-bank asset buying, by forcing investors to take excessive risk, could prove counterproductive. The verdict on the worth of quantitative easing will be obvious if junk bonds are at the centre of the next crisis. Let's acknowledge that bond investors helped many viable companies survive an emergency. Let's note too that the BIS is not pushing the warnings about the bankruptcy gap with the same urgency with which White voiced his concerns. Many forecasts obviously prove inaccurate, including those of the BIS, which is prone to alarm. If higher inflation proves transitory as officials expect, low interest rates could persist for a while yet and the reach for yield might prove innocuous. But benign investment markets might only prompt more investors to seek higher and riskier debt-based returns and that might presage a delayed, but bigger, blow-up. A crisis could start in many of the asset classes (including US housing again)[13] that have reached record highs in recent years. For sure. But problems arising anywhere could spread to junk bonds and magnify any upheaval. As household-name Warren Buffett warned in February 2020 as covid-19 was going global: "Reaching for yield is really stupid" that could have major "consequences over time".[14] No doubt White in his near-anonymity would agree. No way out On 23 May 2013, minutes were released from the Fed's policy-setting board meeting held about three weeks earlier. The document showed one board member, Esther George, president (still) of the Federal Reserve Bank of Kansas City, disagreed with the decision to keep monetary policy ultra-loose - where the cash rate was at zero and the Fed was buying assets worth US$85 billion a month. George "preferred to signal a near-term tapering of asset purchases", the record showed.[15] That phrase was among warnings about impending rises in bond yields that triggered such a violent reaction on financial markets the episode became known as the 'taper tantrum.' The same day those minutes were released, Fed chairman Ben Bernanke justified an expected tapering by warning Congress that a long period of low interest rates could "undermine financial stability" ... because "investors or portfolio managers dissatisfied with low returns may reach for yield by taking on more credit risk, duration risk or leverage".[16] Jerome Powell now leads a Fed that is buying assets at a rate of at least US$120 billion a month, whereby the central bank creates money (electronically) as an asset on its balance sheet and buys financial securities in the secondary market with interest-paying reserves. As the Fed's balance sheet has bloated by US$6 trillion over the past eight years to stretch to 30% of US GDP (while the total of major central banks is US$18 trillion), the risks are probably greater. While central-bank asset buying in emergencies can stabilise financial markets (as the Fed's corporate-bond buying did in 2020), the question being raised as investors await signs of an imminent tapering is whether prolonged asset buying might prove counterproductive. Disadvantages accruing from quantitative easing (some of which are intertwined with the zero cash-rate setting) build the case for why the asset buying needs to be unwound as soon as it can. One drawback is that asset buying lowers bond yields and thereby hurts savers who rely on interest income. That counteracts, to some extent, the boost lower rates give to the economy. Another is that quantitative easing seems to bolster asset prices to such an extent that risk appears mispriced and capital appears misallocated, while inequality rises. A third is that central-bank asset purchases create a future fiscal liability for taxpayers, even if it reduces government borrowing costs in the short term and the interest earned on a central bank's debt holdings is income for the treasury. Central banks pay a market-based rate of interest to holders of their reserves to stop these sums being lent out and risking inflation. Higher interest rates would thus burden public finances while giving banks unearned income. A fourth is that quantitative easing shortens the duration of the government's debt (by substituting overnight reserves for longer-term securities) at a time when low interest rates mean the government should be doing the opposite. Another is that quantitative easing undermines the independence of central banks - and thus their inflation-fighting credibility - by blurring the distinction between fiscal and monetary policies. A sixth is that, given the fragility of central-bank independence come an emergency, elevated government debt could prompt politicians to pressure central banks not to raise interest rates to control inflation because higher rates might trouble public finances. A further drawback is that central-bank actions can reduce the pressure on political leaders to use fiscal and other policies to help economies, especially if the asset buying reaches into funding the government's deficit. Last, and of relevance to the corporate-debt market, the asset buying can encourage excessive risking taking that results in a crisis. That's why central banks are afraid to reduce, let alone end, their purchases. The UK's House of Lords might best sum up this dilemma with the title of its evaluation of central-bank asset buying: Quantitative Easing - a dangerous addiction? As the report notes in what it calls "the no-exit paradigm," no central bank has managed to reverse its asset buying over the medium to long term.[17] The Fed has probably come closest. Many argue the economy could have absorbed Fed tapering in 2013. The concern now is that Fed tapering could well be the spark of trouble for corporate bond yields. Faster inflation - and US consumer prices jumped 5.4% in the 12 months to August - could hasten the day when the Fed needs to tighten monetary policy. Come any tapering, government yields are likely to rise and so too the premium on junk versus haven assets. At the same time, higher interest rates could slow economic growth and retard company sales. Yet interest payments would still need to be paid and maturing debt replaced by fresh borrowings. Yields on downgraded company debt could soar if the rating reduction were to sink from investment to non-investment grade. Debt reduced to junk ('fallen angels') reduces the number of investors who can invest because they have mandated minimum ratings on investments. Fed members have much to consider as they ponder the ending of the Fed's promiscuous monetary policy, though there's less pressure on Kansas City's George as she has no vote this time.[18] Wonder what the BIS's White, now in retirement, might advise. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund [1] Spiegel International. 'The man nobody wanted to hear. Global banking economist warned of coming crisis.' 7 August 2009. spiegel.de/international/business/the-man-nobody-wanted-to-hear-global-banking-economist-warned-of-coming-crisis-a-635051.html [2] The 2004 annual report charted the risk-taking of US investment banks and warned "uncertainties concerning the housing market could imply some direct and indirect risks to the financial system". Bank for International Settlements. '75th annual report. 1 April 2004 - 31 March 2005.' Pages 131 to 134. 27 June 2005. bis.org/publ/arpdf/ar2005e.pdf. The 2005 annual report noted US subprime mortgage originations in 2005 were seven times 2000 levels and that in the US and the UK "relaxation of lending standards due to competition and greater reliance on securitisation has contributed to a significant increase in lending to more risky households". Bank for International Settlements. '76th annual report. 1 April 2005-31 March 2006.' Page 134. bis.org/publ/arpdf/ar2006e.pdf. The credit risk transfer report of January 2003 is noted for its warnings. bis.org/publ/cgfs20.pdf [3] Spiegel International. Op cit. [4] Claude Borio and William White. BIS working papers No. 147. 'Whither monetary and financial stability? The implications of evolving regimes.' February 2004 dated version of paper presented in Jackson Hole, Wyoming on 28 to 30 August 2003. bis.org/publ/work147.pdf [5] William White. BIS Working Papers No. 205. Is price stability enough? April 2006. bis.org/publ/work205.pdf [6] Ryan Banerjee, Joseph Noss and Jose Maria Vidal Pastor. BIS Bulletin. No 40. 'Liquidity to solvency: Transition cancelled or postponed?' 25 March 2021. Bankruptcies "even fell" in many jurisdictions during 2020. bis.org/publ/bisbull40.pdf [7] Bloomberg data. Bloomberg Asia Ex-Japan US dollar credit China HY Index. [8] Federal Reserve. Primary Market Corporate Credit Facility. Set up 23 March 2020. federalreserve.gov/monetarypolicy/pmccf.html [9] Federal Reserve Bank of St Louis. Federal Reserve economic data. ICE BofA US High Yield Index Option Adjusted Spread. (BAMLHOAOHYM2). fred.stlouisfed.org/series/BAMLH0A0HYM2. On September 30, for instance, the average yield for bonds in the ICE BofA US High Yield Index was only 4.21%. By comparison, the yield on 10-year US government bonds was 1.52%. Three years earlier to the day, the equivalent reading on the High Yield Index was 6.23% compared with 2.85% on the US 10-year Treasury. FRED. ICE BofA US High Yield Index Effective Yield. (BAMLHOAOHYM2EY). fred.stlouisfed.org/series/BAMLH0A0HYM2EY. US Department of the Treasury. Resources center. Daily Treasury yield curve rates 2018. treasury.gov/resource-center/data-chart-center/interest-rates/pages/TextView.aspx [10] The latest OECD report on corporate bonds warned that in comparison to past 'credit cycles' the stock of outstanding corporate bonds "has lower overall credit quality, higher payback requirements, longer maturities and inferior investor protection" - and that was before the pandemic hit. OECD. 'Corporate debt continues to pile up.' Undated but February 2020. oecd.org/corporate/corporate-bond-debt-continues-to-pile-up.htm [11] 'Junk-debt sales soar toward record year.' The Wall Street Journal, quoting numbers for S&P. 19 September 2021. wsj.com/articles/junk-debt-sales-soar-toward-record-year-11632043982 [12] 'Rating agencies caution on corporate debt after US borrowing frenzy.' Financial Times. 18 August 2021. ft.com/content/32a57864-d983-46b0-bbfa-85fd2d2361e5 [13] On August 26, South Korea becomes first big Asian economy to raise interest rates after the central Bank of Korea decided fears over record household debt outweigh surging Covid threat. See Newsweek. 'Are we about to repeat the 2008 housing crisis?' Philip Pilkington. 20 August 2021. newsweek.com/are-we-about-repeat-2008-housing-crisis-opinion-1620249 [14] CNBC. 'Warren Buffett's sobering advice: 'Reaching for yield is really stupid but very human.' 24 February 2020. cnbc.com/2020/02/24/warren-buffett-reaching-for-yield-is-really-stupid-but-very-human.html [15] Federal Reserve. 'Minutes of the meeting of April 30 - May 1, 2013.' Page 9. Released 22 May 2013. federalreserve.gov/monetarypolicy/files/fomcminutes20130501.pdf [16] Federal Reserve. Chairman Ben Bernanke. Testimony. 'The economic outlook.' Before the Joint Economic Committee, US Congress. 22 May 2021. federalreserve.gov/newsevents/testimony/bernanke20130522a.htm [17] House of Lords. Economic Affairs Committee. First report of sessions 2021-22. 'Quantitative Easing - a dangerous addiction?' 16 July 2021. Page 52. publications.parliament.uk/pa/ld5802/ldselect/ldeconaf/42/42.pdf [18] Federal Reserve. Federal Open Markets Committee. 'About the FMOC.' federalreserve.gov/monetarypolicy/fomc.htm Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

8 Nov 2021 - Performance Report: AIM Global High Conviction Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | AIM are 'business-first' rather than 'security-first' investors, and see themselves as part owners of the businesses they invest in. AIM look for the following characteristics in the businesses they want to own: - Strong competitive advantages that enable consistently high returns on capital throughout an economic cycle, combined with the ability to reinvest surplus capital at high marginal returns. - A proven ability to generate and grow cash flows, rather than accounting based earnings. - A strong balance sheet and sensible capital structure to reduce the risk of failure when the economic cycle ends or an unexpected crisis occurs. - Honest and shareholder-aligned management teams that understand the principles behind value creation and have a proven track record of capital allocation. They look to buy businesses that meet these criteria at attractive valuations, and then intend to hold them for long periods of time. AIM intend to own between 15 and 25 businesses at any given point. They do not seek to generate returns by constantly having to trade in and out of businesses. Instead, they believe the Fund's long-term return will approximate the underlying economics of the businesses they own. They are bottom-up, fundamental investors. They are cognizant of macro-economic conditions and geo-political risks, however, they do not construct the Fund to take advantage of such events. AIM intend for the portfolio to be between 90% and 100% invested in equities. AIM do not engage in shorting, nor do they use leverage to enhance returns. The Fund's investable universe is global, and AIM look for businesses that have a market capitalisation of at least $7.5bn to guarantee sufficient liquidity to investors. |

| Manager Comments | The fund's Sharpe ratio is 2.37 for performance over the past 12 months, and over the past 24 months is 1.77. Since inception, the fund's Sharpe ratio is 1.58 vs the Global Equity Index's Sharpe of 1.32. Since inception in July 2019 in the months where the market was positive, the fund has provided positive returns 89% of the time, contributing to an up-capture ratio since inception of 107.99%. For performance over the past 12 month, the fund's up-capture ratio is 106.23%, and is 119.83% over the past 24 months. An up-capture ratio greater than 100% indicates that, on average, the fund has outperformed in the market's positive months. The fund has a down-capture ratio since inception of 82.83%. A down-capture ratio less than 100% indicates that, on average, the fund has outperformed in the market's negative months. |

| More Information |