NEWS

26 Nov 2024 - 10k Words | November 2024

|

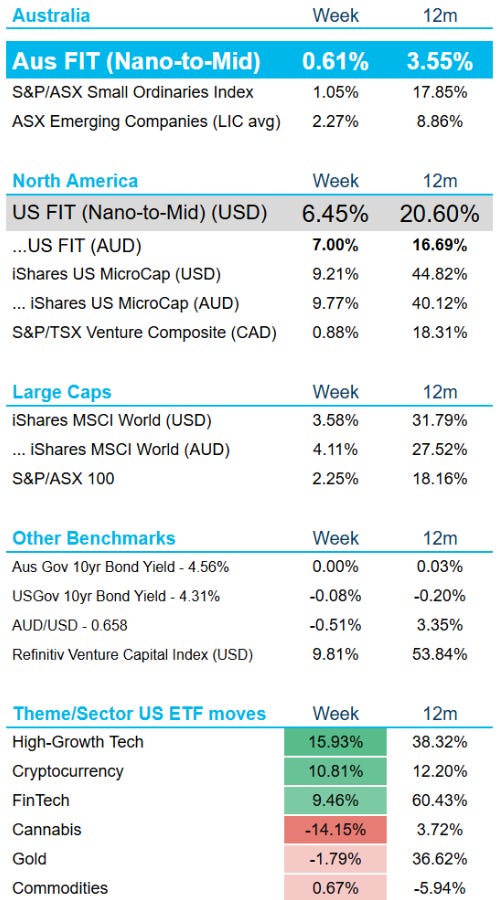

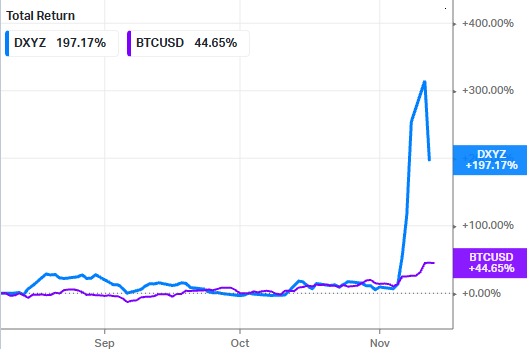

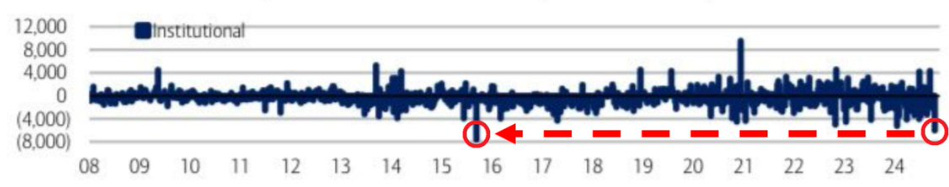

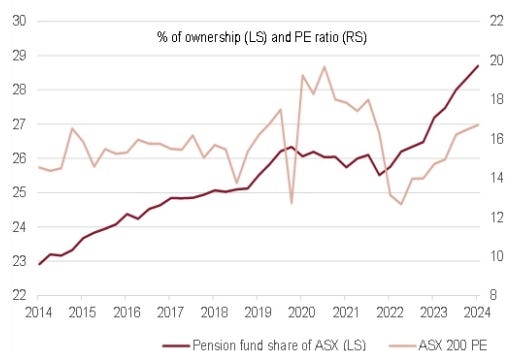

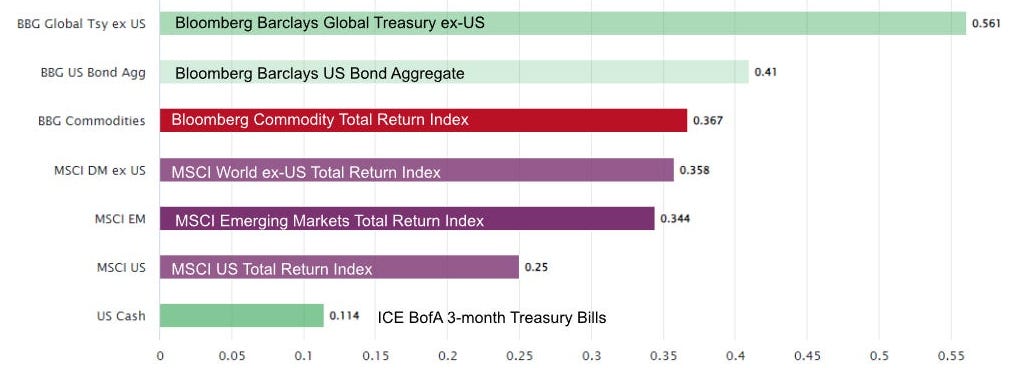

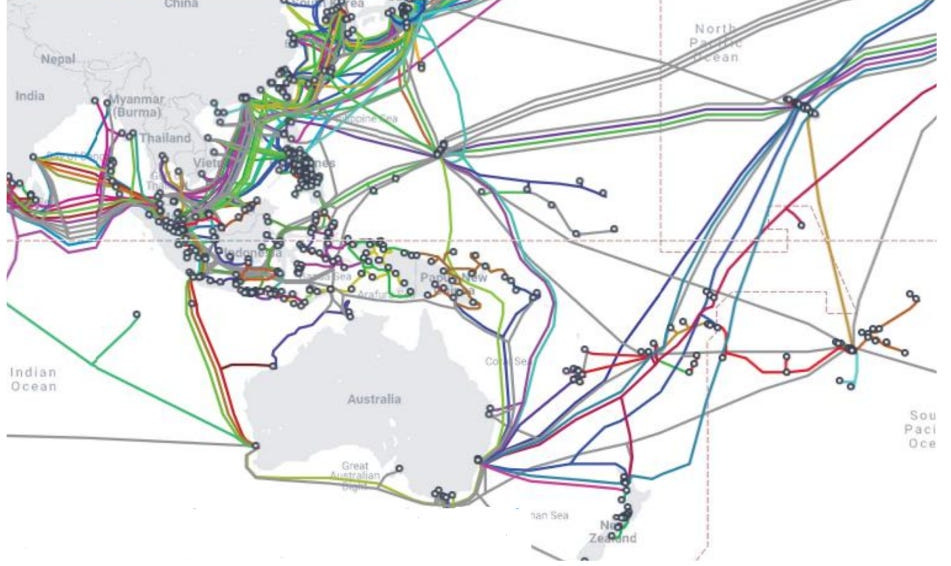

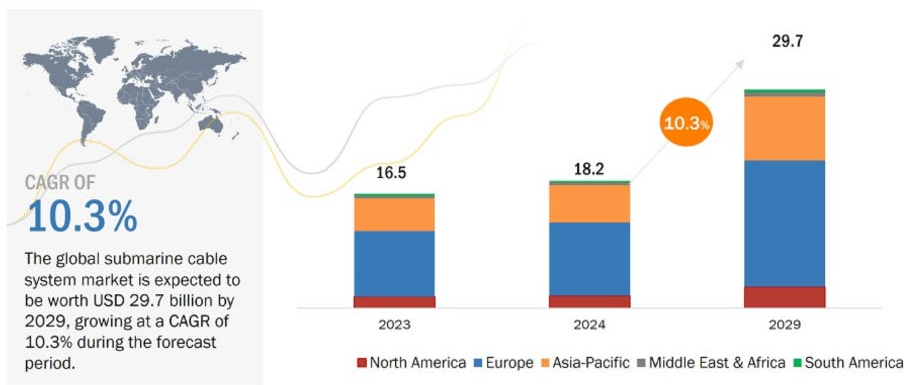

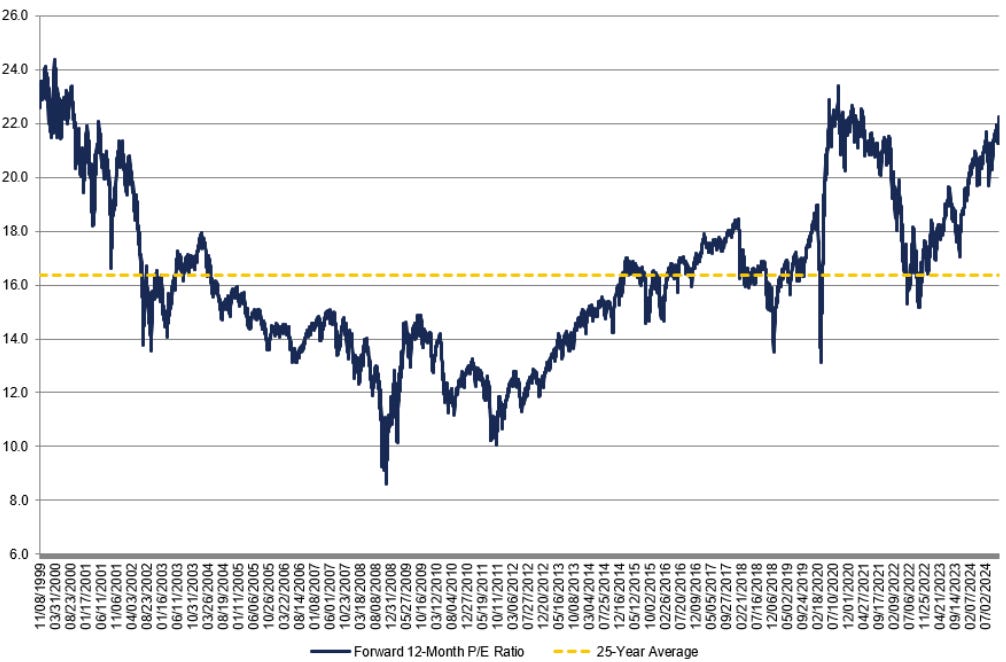

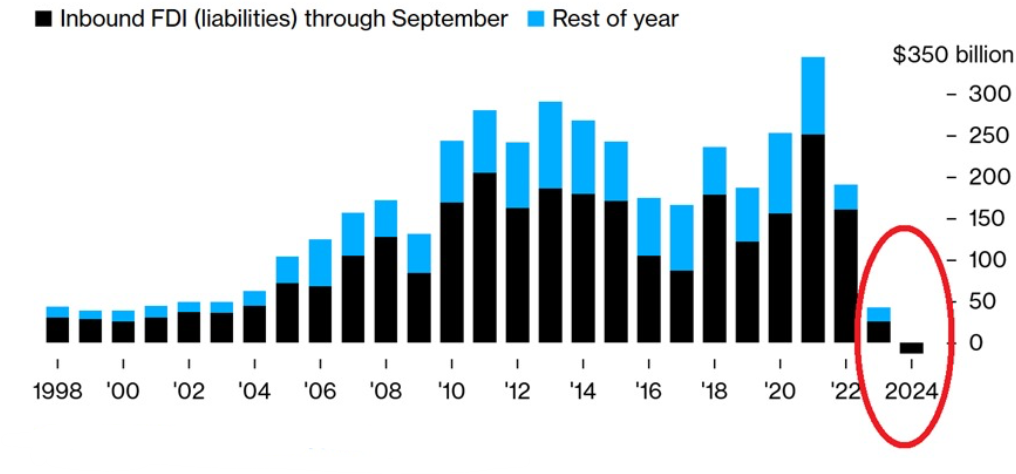

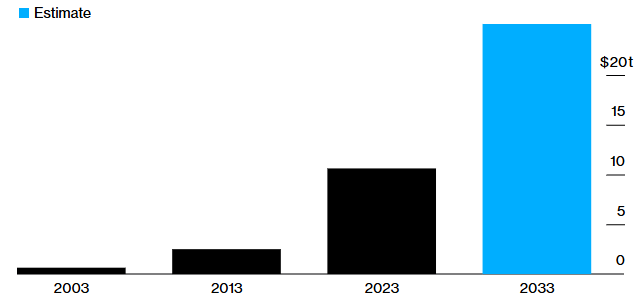

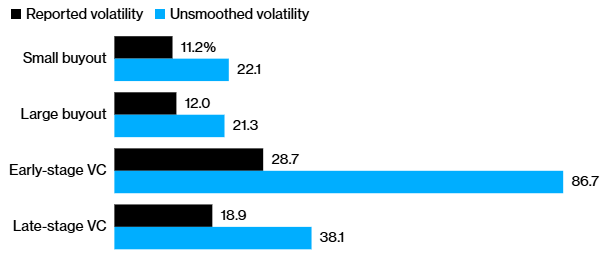

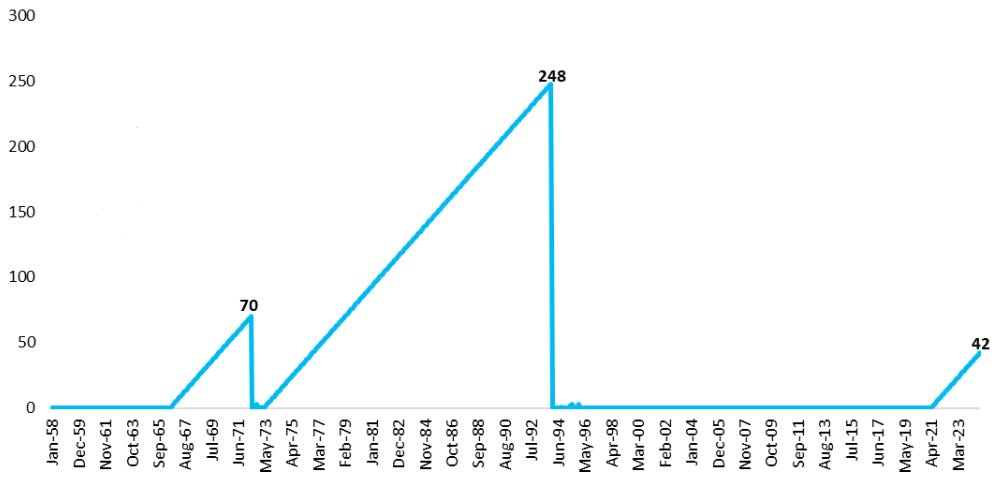

10k Words Equitable Investors November 2024 The "Trump Bump" in full effect, with bitcoin not the greatest benficiary and fund managers allocating away from equities beforehand; the "Super Bump" in Australian equities, as evident in the P/E multiple of CBA; gold's correlation; subsea cable spend creating opportunities; funds flowing out of Chinese investment markets; the boom in private equities and the truth about volatility; and finally the inflation story is not over yet in the US. Benchmark returns in the week of the US Presidential election (Nov 4 - 8, 2024) Source: Equitable Investors' SmallTalk "Trump Bump" for NYSE-listed "closed end" SpaceX investor Destiny Tech100 (DXYZ) outshines bitcoin Source: Koyfin Second largest net sale by institutional clients in Bank of America fund manager survey history Source: Bank of America "Super Bump" for Australian equities Source: Evans & Partners Forward P/E multiple of Commonwealth Bank (ASX: CBA) Source: TIKR Correlations between gold and other assets classes over past six years Source: World Gold Council Rolling 6 month correlation between gold and other asset classes Source: World Gold Council Regional subsea cables being built Source: DXN Limited Forecast spend on submarine cables Source: Research & Markets S&P 500 forward 12-month P/E ratio: 25 years Source: FactSet Foreign investment into China drops in 2024 Source: @Kobeissiletter, China's State Administration of Foreign Exchange Global private equity assets under management Source: Bloomberg, Bain & Co The reported volatility of private funds v "unsmoothed" volatility

Source: Bloomberg, "Amortizing Volatility across Private Capital Investments" (Mark Anson, The Journal of Portfolio Management, Vol 50, Issue 7) US Core CPI Inflation (year-on-year % change) - consecutive months above 3% (seasonally adjusted) Source: @CharlieBilello, Creative Planning November 2024 Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Past performance is not a reliable indicator of future performance. Fund returns are quoted net of all fees, expenses and accrued performance fees. Delivery of this report to a recipient should not be relied on as a representation that there has been no change since the preparation date in the affairs or financial condition of the Fund or the Trustee; or that the information contained in this report remains accurate or complete at any time after the preparation date. Equitable Investors Pty Ltd (EI) does not guarantee or make any representation or warranty as to the accuracy or completeness of the information in this report. To the extent permitted by law, EI disclaims all liability that may otherwise arise due to any information in this report being inaccurate or information being omitted. This report does not take into account the particular investment objectives, financial situation and needs of potential investors. Before making a decision to invest in the Fund the recipient should obtain professional advice. This report does not purport to contain all the information that the recipient may require to evaluate a possible investment in the Fund. The recipient should conduct their own independent analysis of the Fund and refer to the current Information Memorandum, which is available from EI. |

25 Nov 2024 - Global Matters: The data centre opportunity for infrastructure investors

22 Nov 2024 - Hedge Clippings | 22 November 2024

|

|

|

|

Hedge Clippings | 22 November 2024 Following the build up, media frenzy and speculation leading to the US election, and then the surprise at Donald Trump's resounding victory (except to The Donald himself), everything has gone quiet, relatively speaking. Maybe it's just the media in limbo, save for regular announcements regarding key appointments. Trump himself, rarely short of a word over the past 6 months, has also gone quiet. Either he's taking a break prior to taking over in January, or maybe he's back on the golf course? Maybe it's just the lull before the storm? There's plenty of speculation on policy implementation, but even more on the reaction from China on tariffs, or immigration, or ending wars "in a day". Back in Australia the government is softening us up prior to the election due by May next year, which according to the polls is going to be much closer than one would have imagined after the last election. Much will come down to the economy (as it did in the end in the US) with inflation and interest rates taking centre stage. Treasurer Chalmers is trying to put a good spin on inflation, but is unlikely to fool anyone, and certainly not the RBA or the market. A big test will come next Wednesday when monthly CPI numbers are due for October. While the headline rate for the September Quarter seemed to be on the right track at 2.8%, that was significantly affected thanks to electricity rebates and lower fuel prices. Underlying inflation remained high at 3.5% which the RBA Bulletin noted was falling more slowly, and was not expected to return to target until the end of 2026 - in fact, the RBA expects that it will pick up in the September quarter 2025 when the energy rebates are due to end. Added to this, as noted in PinPoint Macro Analytics' weekly macro research (see below), the latest inflation figures in four major economies (US, UK, Eurozone and Canada) which had been falling, have all picked up. If Australia's CPI follows suit next week, then the chance of the RBA helping the embattled Albanese government out with a rate cut pre-election slips further. As PinPoint's Richard Grace points out, "the overnight index swap (OIS) market is the purest form of the market's expectation for what the RBA may do, and it is finally starting to push out the timing of the next interest rate cut." PinPoint also warns that the RBA Board has also said it is not ruling anything in or out. That might mean no rate cuts until after the election, or as an outside option, maybe a rate rise. That would certainly cook Albo's goose! News & Insights Manager Insights | East Coast Capital Management Hedge Clippings - Macro Research | PinPoint Macro Analytics US Election 2024: How will markets and sectors respond? | Magellan Asset Management Market Commentary - October | Glenmore Asset Management October 2024 Performance News Argonaut Natural Resources Fund Skerryvore Global Emerging Markets All-Cap Equity Fund Bennelong Long Short Equity Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

22 Nov 2024 - Performance Report: Digital Income Fund (Digital Income Class)

[Current Manager Report if available]

22 Nov 2024 - Performance Report: ECCM Systematic Trend Fund

[Current Manager Report if available]

22 Nov 2024 - Macro Research

22 Nov 2024 - Trump wins - what does it mean for sustainability?

|

Trump wins - what does it mean for sustainability? abrdn November 2024 What is the issue?Donald Trump is not known for being progressive on sustainability issues. He has previously promised to withdraw US participation in the Paris climate accord. But in terms of markets, what are the potential implications across sustainability themes from his second term in office? ClimateThere have been concerns that the Inflation Reduction Act (IRA) will be one of the first things to go. But we don't expect a full repeal; reforms are most likely. This is partially because the IRA mainly benefited red states (see below). It's also because Trump is pro-energy and investment, but he's agnostic on the energy source. He has pledged to increase oil and gas licences on federal land, which could happen quickly through an executive order. This also increased under Biden, but the rate is likely to accelerate. Investment in clean tech by voting district* during the Biden Harris Administration as of 10.31.24

$42B - Democratic districts | $161B - Republican districts Source: Bloomberg Opinion Article, Biden Is Giving Red Districts an Inconvenient Gift: Green Jobs, Published June 20, 2024, accessed 06/04/2024.

*Colour represents the voting of the 2022 House Representatives Elections. Investment in Republican (red) and Democratic (blue) districts pre and post the Inflation Reduction Act We expect that the US will withdraw from the Paris climate accord again. This won't happen at COP29 next week, but it will likely affect the US's ambition at the talks. During his campaign, Trump promised to end the "EV (electric vehicles) mandate", even though no such federal mandate exists [1]. We think a rollback of Biden's pro-EV policies, including sections of the IRA that incentivise EV production and adoption, are likely. On the surface, this would be potentially negative for his strong supporter Elon Musk who owns Tesla. Tesla's scale and scope could be an advantage over other EV producers if subsidies were removed. Tesla's stock was up almost 15% on Wednesday 6 November. Reforms to the IRA we think are likely:

*This one is highly complex and could go either way. On one side, continued funding will be highly lobbied by the energy sector. But on the other, Trump is not pro big-government and large tax-payer-funded projects, especially those with low technology readiness. Therefore, we are cautious. However, the funding mechanism that flows through the EPA could become an issue. As the agency's funding is likely to be cut significantly, this will make the final distribution of the funding slow. We also expect increased tariffs on imported clean tech (especially EVs), but not at the level Trump has stated. NatureThe Biden administration strengthened several nature-related regulations, like the Endangered Species Act, and pollution regulations. These should be safe in the short term, as they are unlikely to be an initial focus area. But the likely defunding of the EPA will take the teeth out of the regulations. Alongside the overturning of the Chevron deference (which gave federal agencies powers to interpret laws and decide the best ways to apply them), this will severely weaken the powers of the EPA. SocialThis could become challenging for corporations, as they were previously pressured by employees to make statements opposing government stances during Trump's first administration. Diversity, equity and inclusion are likely to be at risk. Investors looking for greater transparency and action are also likely to face increased scrutiny. Abortion rights were a key campaign topic, but this was more likely to see change under a Harris administration. Given the Republican win, the dynamics of the Supreme Court, and Trump's stated view that abortion rights should be decided on at a state level, we don't expect federal changes. Additional states might implement bans that could lead to repercussions for women's health and wellbeing, and their productivity in the workforce. Interestingly, abortion protections were on the ballots at this election and in many states these passed. Investee companies have faced pressure via resolutions tabled at annual general meetings (AGMs) to refuse employee healthcare benefits to those seeking abortion. A unified Republican Congress is likely to pass the H.R 2 bill. This would require employers to verify whether employees have the legal right to work in the US. If passed, the bill is likely to reduce the undocumented workforce and the flow of new arrivals into the US. It's therefore probable that the migrant workforce will be smaller under Trump, resulting in a negative shock to the labour market. GovernanceThis year, the Securities and Exchange Commission (SEC) introduced new rules mandating company disclosures on climate-related risks. Under a new Republican SEC chair, we expect these requirements to be removed. The SEC also eased restrictions on resolutions at AGMs, leading to a surge in proposals advocating for environmental, social and governance (ESG) issues - particularly climate and employee rights. This has been met with 'anti-ESG' resolutions questioning the allocation of resources to ESG matters and political advocacy, such as women's health rights. The new rules were not unanimously supported and could be reversed, potentially resulting in a rise of 'anti-ESG' resolutions at AGMs. We do not anticipate significant changes to board standards. Final thoughtsThe initial reactions affecting clean-tech stocks are subtle. The trajectory and implications for sustainability and specific stocks will become clearer once the administration's nominations are announced.

Author: Ann Meoni, Senior Sustainable Investment Manager 1https://www.factcheck.org/2023/10/trumps-misleading-claims-about-electric-vehicles-and-the-auto-industry/ |

||||||||||||||

|

Funds operated by this manager: abrdn Sustainable Asian Opportunities Fund, abrdn Emerging Opportunities Fund, abrdn Global Corporate Bond Fund (Class A), abrdn International Equity Fund, abrdn Multi-Asset Income Fund, abrdn Multi-Asset Real Return Fund, abrdn Sustainable International Equities Fund |

21 Nov 2024 - Performance Report: Seed Funds Management Hybrid Income Fund

[Current Manager Report if available]

21 Nov 2024 - Performance Report: Skerryvore Global Emerging Markets All-Cap Equity Fund

[Current Manager Report if available]

20 Nov 2024 - Performance Report: Bennelong Long Short Equity Fund

[Current Manager Report if available]