NEWS

17 Dec 2021 - Why we invest in both petrol stations and the EV revolution

|

Why we invest in both petrol stations and the EV revolution Montgomery Investment Management 01 December 2021 Despite the world speeding along on the road to electrification, we think the humble petrol station will still be needed for some years to come, particularly here in Australia. Which is why the Montgomery Small Companies Fund has invested in both Waypoint REIT (ASX:WPR), and mining companies producing the lithium that goes into electric vehicles batteries. Throughout the year, we have written about the once-in-a-generation shift from the internal combustion engines to electric power trains. And we're delighted you've been paying attention. Indeed, some investors have gone further, noting our enthusiasm for electric vehicles (EVs) and lithium demand, and querying our investment in WPR by the Montgomery Small Companies Fund. So, here's our thinking. Waypoint REITThere are 20 million registered vehicles on Australia's roads (including motorbikes presumably). Each year about one million new vehicles are sold with about 300,000 of those added to the total fleet and the remaining 700,000 replacing existing vehicles. According to the Australian Electric Vehicle Council, 6718 EVs were sold in 2019. In 2020 that number rose to 6900 and while sales surged in the first half of 2021, only 7248 electric vehicles were sold in addition to 1440 plug-in hybrids (PHEV). Even if every new car sold was an EV or PHEV, and the total Australian fleet continued to grow at the current rate of 1.5 per cent (with the current 3.5 per cent of the fleet replaced each year), it would take 23 years before the entire Australian fleet is fully electric. Today, only 1.4 per cent of annual sales are EVs (albeit sales are accelerating). At this rate, it will take more than three decades, and perhaps four, for Australia's internal combustion engine fleet to be entirely replaced by EVs. So the petrol stations owned by WPR will have a purpose for some time yet. Furthermore, we don't think the portfolio value reduces to zero in an EV only world. Many petrol stations are strategically located along major transport routes and could provide EV charging services while drivers rest and grab a bite to eat. Alternatively, some metro sites might eventually be redeveloped for alternative uses for a tidy profit. The trajectory for lithiumElsewhere in the world, however, the take-up rate of EVs is much faster, and consequently demand for upstream inputs is roaring. EV sales in the US and China are surging despite the semiconductor memory chip shortage. In Europe sales are also strong. In China, EV sales are running at 366,000 per month (up more than seven per cent in September over August) with Tesla and Berkshire-owned BYD dominating. In Germany, by way of example, plug-in vehicle sales are 30 per cent of total vehicle sales. That demand is having a serious impact on the price of lithium. In US$/t, lithium hydroxide (LiOH) has jumped more than 50 per cent year-to-date and lithium carbonate equivalent (LCE) has doubled. In China, 99 per cent LCE priced in RMB/t has jumped 250 per cent and LiOH 275 per cent. Spodumene (US$/t ) is up almost 250 per cent year to date. Spodumene has rallied from US$4,000/t in January this year to over US$18,000, while Asia LCE has risen from US$8,000/t to US$19,000/t. Unsurprisingly, and as we warned might occur, Mineral Resources' (ASX:MIN) share price is up over 80 per cent this year, Orocobre (ASX:ORE) has risen over 25 per cent and Plibara Minerals (ASX:PLS) is up about 20 per cent. Annual global EV sales, including passenger, bus and commercial vehicles, are forecast to grow 13-fold by 2030 from 3.1 million vehicle sales in 2020 to 40 million in 2030. All these vehicles need batteries. Measured in gigawatt hours (GWh), and including energy storage and EV batteries, demand is forecast to grow twelve-fold in nine years from 195 GWh in 2019 to 2,583 GWh in 2030. Nine years isn't long in terms of investment horizon. Of course, there are various EV batteries, including those using a variety of nickel-cobalt-manganese combinations in their cathodes, but all require lithium. Even if all 'probable' lithium mines were ramped up, total lithium supply will be in shortage by 2025. If ever there was a clear reason for a commodity price to rise significantly, this is it, and Australian based producers may just be in the box seat. Written By Roger Montgomery Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund |

16 Dec 2021 - Performance Report: Paragon Australian Long Short Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Paragon's unique investment style, comprising thematic led idea generation followed with an in depth research effort, results in a concentrated portfolio of high conviction stocks. Conviction in bottom up analysis drives the investment case and ultimate position sizing: * Both quantitative analysis - probability weighted high/low/base case valuations - and qualitative analysis - company meetings, assessing management, the business model, balance sheet strength and likely direction of returns - collectively form Paragon's overall view for each investment case. * Paragon will then allocate weighting to each investment opportunity based on a risk/reward profile, capped to defined investment parameters by market cap, which are continually monitored as part of Paragon's overall risk management framework. The objective of the Paragon Fund is to produce absolute returns in excess of 10% p.a. over a 3-5 year time horizon with a low correlation to the Australian equities market. |

| Manager Comments | The Paragon Australian Long Short Fund has a track record of 8 years and 10 months and has consistently outperformed the ASX 200 Total Return Index since inception in March 2013, providing investors with a return of 15.28%, compared with the index's return of 8.49% over the same time period. On a calendar basis the fund has had 1 negative annual return in the 8 years and 10 months since its inception. Its largest drawdown was -45.11% lasting 2 years and 7 months, occurring between January 2018 and August 2020 when the index fell by a maximum of -26.75%. The Manager has delivered higher returns but with higher volatility than the index, resulting in a Sharpe ratio which has fallen below 1 five times and currently sits at 0.65 since inception. The fund has provided positive monthly returns 69% of the time in rising markets, and 47% of the time when the market was negative, contributing to an up capture ratio since inception of 113% and a down capture ratio of 76%. |

| More Information |

16 Dec 2021 - Performance Report: Quay Global Real Estate Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund will invest in a number of global listed real estate companies, groups or funds. The investment strategy is to make investments in real estate securities at a price that will deliver a real, after inflation, total return of 5% per annum (before costs and fees), inclusive of distributions over a longer-term period. The Investment Strategy is indifferent to the constraints of any index benchmarks and is relatively concentrated in its number of investments. The Fund is expected to own between 20 and 40 securities, and from time to time up to 20% of the portfolio maybe invested in cash. The Fund is $A un-hedged. |

| Manager Comments | The Quay Global Real Estate Fund has a track record of 5 years and 10 months and has consistently outperformed the S&P/ASX 200 A-REIT Index since inception in January 2016, providing investors with a return of 10.22%, compared with the index's return of 9.22% over the same time period. On a calendar basis the fund has had 1 negative annual return in the 5 years and 10 months since its inception. Its largest drawdown was -19.68% lasting 16 months, occurring between February 2020 and June 2021 when the index fell by a maximum of -38.29%. The Manager has delivered these returns with -8.43% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 four times and currently sits at 0.79 since inception. The fund has provided positive monthly returns 77% of the time in rising markets, and 26% of the time when the market was negative, contributing to an up capture ratio since inception of 45% and a down capture ratio of 56%. |

| More Information |

16 Dec 2021 - How Amazon founder Jeff Bezos' shareholder letters made me a better investor - 7 lessons learnt

|

How Amazon founder Jeff Bezos' shareholder letters made me a better investor - 7 lessons learnt Montaka Global Investments 01 December 2021 Many investors have poured over Warren Buffett's letters to Berkshire Hathaway's shareholders to glean insights from the investment legend. But another investment legend, Baillie Gifford's James Anderson, said something interesting: that an investor today needed to read not just Buffett's words, but also the shareholder letters of Amazon founder, Jeff Bezos.

In Amazon, Bezos has created an online retailing and cloud computing behemoth that dominates many markets and now has a market cap reaching towards US$2 trillion. I took note of Anderson's tip and immersed myself in Bezos's shareholder letters, getting inside the great man's thinking. I realised that if I could understand the secret to Bezos and Amazon's success, I will be much better placed to identify and ride the 'next Amazon': the next company that revolutionises an industry and delivers ten or even 100-bag returns for shareholders. Below are 7 key lessons that emerged. The importance of becoming the most customer-centric companyFrom the start, Bezos has famously placed this goal at the centre of Amazon, which it describes as part of its 'Day 1' culture. Amazon relentlessly puts the customer first. When it develops a product, it works backward from the customer's needs. New products are derived from a customer problem, even problems customers don't realise they have. Many companies develop a product and only then search for customers.

The result is that the company has spent decades consistently lowering prices, adding new features, and innovating on customers' behalf. Amazon, for example, launched its Prime subscription service, which began with fast, free shipping and has expanded to offer video, music, gaming, reading, exclusive deals and more, all at no extra cost. And AWS (Amazon Web Services) Trusted Advisor, which Amazon launched in 2012, scans AWS customer account infrastructure against best practices and notifies the customer where they can improve performance, enhance security, monitor service quotas, or reduce costs. Essentially, Trusted Advisor encourages you to pay Amazon less money.

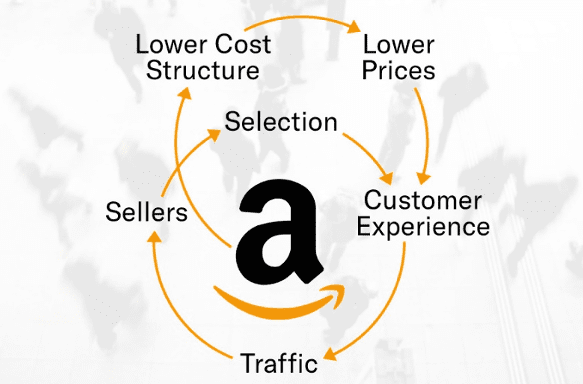

This insight is vital because it prevents Amazon from falling into the trap of extracting egregious profits from customers and ultimately losing them to rivals. Apple, for example, is taking value from developers via its App Store. As a result, an increasing number of developers are moving to blockchain-based projects where they control their own destiny and participate in all the economic upside of their work. A disgruntled value chain will naturally erode Apple's app ecosystem that customers love. By contrast, Facebook parent Meta has just announced they will spend at least $10 billion per year building metaverse platforms over the next decade, choosing to innovate alongside developers on behalf of their future customers instead of extracting greater profits today. We seek to own businesses with healthy and expanding value chains, from the supply chain down to the customer. This is fundamental to success but easily exploited thereafter. Many of our top technology holdings, such as Amazon, Meta, Unity and Microsoft, have built enormously successful businesses, but they continue to reinvest in their value chain to retain their powerful and growing ecosystems. The power of flywheelsIn his 2015 shareholder letter, Bezos commented that, "we've dropped [AWS] prices 51 times, in many cases before there was any competitive pressure to do so." Amazon can do this because of its 'scale economics shared' (SES) model where economies of scale allow the company to lower prices and boost its market share in the long term.

You can see the model in the Amazon.com marketplace 'flywheel' above, where consistently sharing value created with customers in the form of lower prices keeps the flywheel spinning. In his book, 'Good to Great', Jim Collins says building a great company is like a flywheel.

Amazon has taken this model and applied it to its cloud business, AWS, which was launched in 2006, and revolutionised modern business by starting the cloud computing era. The goal is always to increase scale, and today AWS leads the market with over 30% share of cloud computing and the business is projected to earn around $60 billion in revenues in 2021. As investors, we get excited when we find businesses with powerful flywheels such as Amazon's SES model, understanding that once a flywheel is in motion it is increasingly difficult to slow down. The value of transforming internal services into global platformsAnother key to Amazon's wild success has been its ability to develop products for internal use then repurpose them into global platforms. Amazon developed AWS to solve significant inefficiencies between the company's application engineers and network engineers. Amazon smartly realised that every business was going to need a scalable cloud solution like their own, so AWS was repurposed for general use and sold to customers. Amazon is uniquely able to develop and test internal products across their billions of customers, 1.5 million employees, and all the data that produces. This gives us confidence in their ability to continue innovating successfully in the future, with projects such as health and middle-mile logistics looking similarly exciting today. The willingness to take betsAmazon has an unusual willingness to make large bets on many long-term projects that have a small chance at an outsized payoff.

Amazon's latest big bets that are likely to emerge as successes are artificial intelligence (AI) and machine learning (ML) applications. Amazon is using ML across its vast array of internal business data sets, which has helped them to build natural language processing and Internet-of-Things (IoT) products, such as virtual assistant, Alexa. They also now sell these as pre-packaged ML models to customers who apply them to their own data to improve processes. A culture of builders

Bezos wrote this in his 2018 shareholder letter. This mindset is fundamental to achieving long-term success. Many great businesses get too large and fall into what Bezos would call a 'Day 2' mindset, where businesses fail to embrace powerful trends quickly and end up fighting the future. Instead, by hiring for a culture of builders, you achieve an internal drive that embraces change and continues to invent, invest and celebrate hurdles that may be tiny relative to Amazon but are enormous for the teams working on them, inspiring them to build for the long-term. Creating Earth's best employer and Earth's safest place to work

In his final letter before stepping down from CEO to Chairman this year, Bezos challenged Amazon to be 'Earth's best employer' and 'Earth's safest place to work', alongside 'Earth's most customer-centric company'. As the businesses has grown, Amazon has become increasingly scrutinized for their effect on the world (which I would argue has been extraordinarily positive), over and above their effect on customers. Amazon has long held a minimum wage well above competitors and recently increased it by another 20% to $18 per hour. They offer programs such as Career Choice, where they pre-pay 95% of employees' tuition to take courses for in-demand fields, even if that leads them into a non-Amazon career. Amazon is making progress toward its goal of 100% renewable energy by 2025. Less than two years after signing their Climate Pledge, 53 companies representing almost every sector of the economy have signed up too. Every quarterly earnings press release dedicates pages to their progress on ESG initiatives. Amazon is making the world a better place. Making employees ownersIn his very first letter in 1997, Bezos noted how important it is that employees are owners of their business.

This letter gets attached to every subsequent letter to reinforce its importance. Investing in owner-operator businesses gives us a lot of confidence as shareholders. These leaders are aligned with us and tend to make decisions that drive long-term outcomes rather than working to meet the next quarter or year's expectations. Insights into one of the great minds Jeff Bezos' shareholder letters offer insight into one of the great minds of the 21st century. Bezos has transformed the world in multiple ways and still has incredible ambitions to do much more. These lessons apply far beyond Amazon and teach us about entrepreneurship, business building, capital allocation, success, failure, how to care for the world and humanity, and the sheer human potential when driven and focused teams work together. All of these inform our decisions when building Montaka as a business for our clients, and when selecting the best investments to make and own alongside you. Written By Lachlan Mackay Funds operated by this manager: |

15 Dec 2021 - Performance Report: Premium Asia Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund is managed by Value Partners using a disciplined value-oriented approach supported by intensive, on-the-ground bottom-up fundamental research resulting in a portfolio of individual holdings, which are, in the view of Value Partners, undervalued and of high quality, on either an absolute or relative basis, and which have the potential for capital appreciation. The Fund will primarily have exposure to the equity securities of entities listed on securities exchanges across the Asia (ex-Japan) region, however, the Fund may also gain exposure to entities listed on securities outside the Asia (ex-Japan) region which have significant assets, investments, production activities, trading or other business interests in the Asia (ex-Japan) region as well as unlisted instruments with equity-like characteristics, such as participatory notes and convertible bonds. The Fund may also invest in cash and money market instruments, depositary receipts, listed unit trusts, shares in mutual fund corporations and other collective investment schemes (including real estate investment trusts), derivatives including both exchange-traded and OTC, convertible securities, participatory notes, bonds, and foreign exchange contracts. |

| Manager Comments | The Premium Asia Fund has a track record of 12 years and 1 month and has consistently outperformed the MSCI All Country Asia Pacific ex-Japan Index since inception in December 2009, providing investors with a return of 12%, compared with the index's return of 5.84% over the same time period. On a calendar basis the fund has had 2 negative annual returns in the 12 years and 1 month since its inception. Its largest drawdown was -21.41% lasting 1 year and 11 months, occurring between June 2015 and May 2017 when the index fell by a maximum of -19.56%. The Manager has delivered higher returns but with higher volatility than the index, resulting in a Sharpe ratio which has fallen below 1 three times and currently sits at 0.78 since inception. The fund has provided positive monthly returns 89% of the time in rising markets, and 20% of the time when the market was negative, contributing to an up capture ratio since inception of 161% and a down capture ratio of 91%. |

| More Information |

15 Dec 2021 - Performance Report: Cyan C3G Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Cyan C3G Fund is based on the investment philosophy which can be defined as a comprehensive, clear and considered process focused on delivering growth. These are identified through stringent filter criteria and a rigorous research process. The Manager uses a proprietary stock filter in order to eliminate a large proportion of investments due to both internal characteristics (such as gearing levels or cash flow) and external characteristics (such as exposure to commodity prices or customer concentration). Typically, the Fund looks for businesses that are one or more of: a) under researched, b) fundamentally undervalued, c) have a catalyst for re-rating. The Manager seeks to achieve this investment outcome by actively managing a portfolio of Australian listed securities. When the opportunity to invest in suitable securities cannot be found, the manager may reduce the level of equities exposure and accumulate a defensive cash position. Whilst it is the company's intention, there is no guarantee that any distributions or returns will be declared, or that if declared, the amount of any returns will remain constant or increase over time. The Fund does not invest in derivatives and does not use debt to leverage the Fund's performance. However, companies in which the Fund invests may be leveraged. |

| Manager Comments | The Cyan C3G Fund has a track record of 7 years and 4 months and has outperformed the ASX Small Ordinaries Total Return Index since inception in August 2014, providing investors with a return of 15.61%, compared with the index's return of 9.47% over the same time period. On a calendar basis the fund has had 1 negative annual return in the 7 years and 4 months since its inception. Its largest drawdown was -36.45% lasting 16 months, occurring between October 2019 and February 2021 when the index fell by a maximum of -29.12%. The Manager has delivered these returns with -0.19% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 five times and currently sits at 0.91 since inception. The fund has provided positive monthly returns 85% of the time in rising markets, and 41% of the time when the market was negative, contributing to an up capture ratio since inception of 68% and a down capture ratio of 50%. |

| More Information |

15 Dec 2021 - Performance Report: Bennelong Twenty20 Australian Equities Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | |

| Manager Comments | The Bennelong Twenty20 Australian Equities Fund has a track record of 12 years and 2 months and has consistently outperformed the ASX 200 Total Return Index since inception in November 2009, providing investors with a return of 11.82%, compared with the index's return of 8.24% over the same time period. On a calendar basis the fund has had 2 negative annual returns in the 12 years and 2 months since its inception. Its largest drawdown was -26.09% lasting 9 months, occurring between February 2020 and November 2020 when the index fell by a maximum of -26.75%. The Manager has delivered higher returns but with higher volatility than the index, resulting in a Sharpe ratio which has fallen below 1 four times and currently sits at 0.73 since inception. The fund has provided positive monthly returns 97% of the time in rising markets, and 8% of the time when the market was negative, contributing to an up capture ratio since inception of 129% and a down capture ratio of 96%. |

| More Information |

15 Dec 2021 - Active v passive debate: Ignore 'either-or' and choose 'both'

|

Active v passive debate: Ignore 'either-or' and choose 'both' Datt Capital 30 November 2021 Active investing within the fund management space seeks to utilise a hands-on approach to capital accumulation and preservation, benefiting from extensive research functions within investment teams that work in pursuit of discovering attractive investments within the marketplace. The main benefit from passive investing is within the low maintenance nature of allocating capital into particular investment classes or indices without the need of undertaking extensive analytical market research. Investors should be mindful that low-cost passive market exposure may come at higher potential downside risk. Risk reward Risk management plays a pivotal role in both investment styles. In particular, active investing facilitates fund managers to deploy highly involved strategies that are designed to generate returns regardless of the underlying economic environment. Such tactics may include capturing short-term opportunities, downside protection and appropriate sector allocation. Active fund managers are therefore better equipped to dynamically respond to such circumstances and may benefit those investors who are willing to broaden their risk tolerance to capture returns throughout the economic cycle. Portfolio diversification For experienced investors looking to diversify their portfolios, the added versatility of active investment may be a crucial element in ensuring that the level of risk vs reward is appropriately sustained. In essence, the difference between an experienced investor (such as a retiree) looking to generate returns, and an inexperienced younger investor simply investing in passive investments in the long-term is fundamentally differentiated from the impacts of time, willingness to take risk and their understanding of emerging and evolving new markets. Younger investors may sway towards passive style investments, as the quality of the investment class over the long run may better suit their financial needs. On the other hand, experienced investors may be seeking to preserve capital and benefit from returns that may be generated without the underlying influence of time, in which case, active investment may be more suitable. While younger investors may be more willing to allocate 100 per cent of their portfolio to passive investments such as ETFs, experienced investors may consider assigning a 40:60 ratio of active to passive investment. This ratio can be tailored to the individuals' financial needs and circumstances. Performance Equity investments over the past three years have generated substantial returns to managed funds, such as Datt Capital's Absolute Return Fund, which achieved 17.27 per cent per annum after fees (as at September 2021) within that time. Comparatively, the ASX 200 index achieved 11.92 per cent p.a, exemplifying the consistent yet lower return nature of some conservative indices. Striking the balance between active equity investment funds and other passive investments such as ETFs and the like can essentially provide investors with the best of both worlds, with the associated risk and return to be proportionally embedded within a particular portfolio. Experienced investors, therefore, may consider allocating a portion of their portfolio to both. Written By Emanuel Datt Funds operated by this manager: |

|

Disclaimer: This article does not take into account your investment objectives, particular needs or financial situation; and should not be construed as advice in any way. The author holds no exposure to the stock discussed |

14 Dec 2021 - Performance Report: Bennelong Emerging Companies Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | |

| Manager Comments | The Bennelong Emerging Companies Fund has a track record of 4 years and 1 month and therefore comparison over all market conditions and against the fund's peers is limited. However, since inception in November 2017, the fund has outperformed the ASX 200 Total Return Index, providing investors with an annualised return of 29.92%, compared with the index's return of 9.26% over the same time period. On a calendar basis the fund has had 1 negative annual return in the 4 years and 1 month since its inception. Its largest drawdown was -41.74% lasting 10 months, occurring between December 2019 and October 2020 when the index fell by a maximum of -26.75%. The Manager has delivered higher returns but with higher volatility than the index, resulting in a Sharpe ratio which has fallen below 1 twice and currently sits at 1 since inception. The fund has provided positive monthly returns 85% of the time in rising markets, and 40% of the time when the market was negative, contributing to an up capture ratio since inception of 321% and a down capture ratio of 117%. |

| More Information |

14 Dec 2021 - Family Offices Open to Private Credit in Defensive Strategies

|

Family Offices Open to Private Credit in Defensive Strategies Laureola Advisors December 2021 Family offices seem open to private credit in defensive strategies in a way that other investors are still to appreciate. All investors are searching for consistent returns within the defensive part of the portfolio. In essence, they are more open to investing in a business that creates consistent, repeatable returns rather than depending on the traditional coupon from a bond. John Swallow from Laureola has seen a great deal of the new business for the life settlements group coming from family offices in USA, Asia and now developing in Australia. Fixed income investors look to bonds to share in a company's progress by buying their debt and waiting for the interest payments and then the repayment of the capital. It's not working this century because of low interest rates, heavy government borrowing and now Covid-19 is disrupting markets and expectations on returns. And these problems won't change - the yield on bonds is very low and interest rates need to rise to make new bond offerings more attractive. And if interest rates do rise, the capital value of trillions of dollars of existing bonds will fall. Life settlements as an asset are non-correlated to markets. The life settlements sector - buying insurance policies off older Americans who no longer need the coverage. Life settlements are one example of a business where an investor is sharing immediately in the returns being generated as the life policies purchased come to maturity and insurance companies pay cash to the fund. And it is highly regulated and seen as an ESG outcome by regulators. This is about investing in a business which is producing cash flow - not simply buying bonds in a company and hoping that the coupons are paid on time and capital is returned. A well-managed life settlement fund can be expected to generate 7-11% pa returns (in AUD terms). Such levels of returns can be expected regardless of inflation scenarios. The returns in life settlements are stable and consistent over the years. Given the level of returns, life settlements can be relied upon as a bedrock in a portfolio. The only inflationary scenario where life settlements might struggle would be a hyper-inflationary one (like the Weimar Republic in the 1920s). Written By Tony Bremness Funds operated by this manager: |