NEWS

19 Jan 2022 - Performance Report: Insync Global Quality Equity Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Insync invests in a concentrated portfolio of high quality companies that possess long 'runways' of future growth benefitting from Megatrends. Megatrends are multiyear structural and disruptive changes that transform the way we live our daily lives and result from a convergence of different underlying trends including innovation, politics, demographics, social attitudes and lifestyles. They provide important tailwinds to individual stocks and sectors, that reside within them. Insync believe this delivers exponential earnings growth ahead of market expectations. Insync screens the universe of 40,000 listed global companies to just 150 that it views as superior. This includes profitability, balance sheet performance, shareholder focus and valuations. 20-40 companies are then chosen for the portfolio. These reflect the best outcomes from further analysis using a proprietary DCF valuation, implied growth modelling, and free cash flow yield; alongside management, competitor, and industry scrutiny. The Fund may hold some cash (maximum of 5%), derivatives, currency contracts for hedging purposes, and American and/or Global Depository Receipts. It is however, for all intents and purposes, a 'long-only' fund, remaining fully invested irrespective of market cycles. |

| Manager Comments | The Insync Global Quality Equity Fund has a track record of 12 years and 4 months and has consistently outperformed the Global Equity Index since inception in October 2009, providing investors with a return of 14.91%, compared with the index's return of 12.24% over the same time period. On a calendar basis the fund has had 1 negative annual return in the 12 years and 4 months since its inception. Its largest drawdown was -12.64% lasting 7 months, occurring between September 2018 and April 2019 when the index fell by a maximum of -10.57%. The Manager has delivered higher returns but with higher volatility than the index, resulting in a Sharpe ratio which has never fallen below 1 and currently sits at 1.12 since inception. The fund has provided positive monthly returns 82% of the time in rising markets, and 22% of the time when the market was negative, contributing to an up capture ratio since inception of 83% and a down capture ratio of 73%. |

| More Information |

19 Jan 2022 - 10k Words - January Edition

|

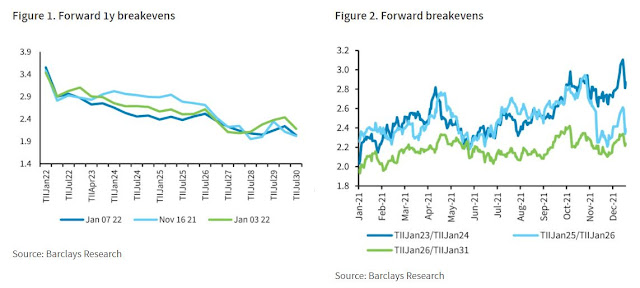

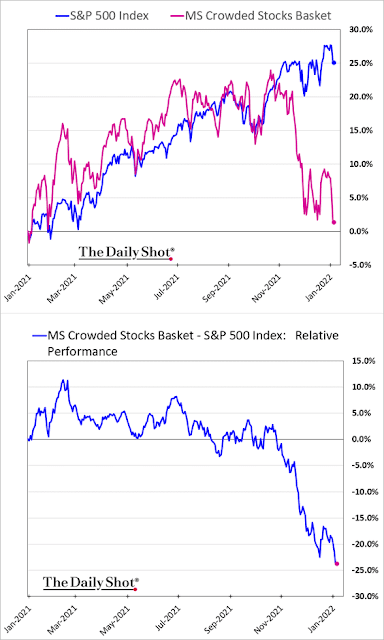

10k Words - January Edition Equitable Investors January 2022 Happy New Year to all! There's plenty of chart action in January covering inflation and interest rates. The implied probability of a Federal Reserve rate hike in March 2022 of at least 25 basis points has surged, as @charliebilello highlighted on Jan 6 (and had to update for a further surge a day later). Barclays set out the break-even rates (break-even inflation is the difference between the nominal yield on a fixed-rate investment and the real yield on a similar inflation-linked investment). On equities we see "crowded trades" and retail sentiment take a dive, courtesy of Morgan Stanley and @lizannsonders. Indeed Hiring Lab provides us a little insight into why unemployed Americans aren't hunting for work with urgency. Meanwhile, the number of Australians thinking this year will be better than last has slumped according to a Roy Morgan poll. Federal Reserve Rate Hike Probabilities (Jan 6, 2021) Source: @charliebilello

Federal Reserve Rate Hike Probabilities (Jan 6, 2021) Source: @charliebilello

Break-evens on inflation-indexed bonds Source: Barclays via Bloomberg

Collapse in "Crowded Stocks" Source: Morgan Stanley via The Daily Shot

Goldman Sachs Retail Sentiment Index Source: Ann Sonders

Why unemployed aren't showing urgency to find a job Source: Indeed Hiring Lab

Only 37% of Australians expect 2022 will be 'better' than 2021 - down 22% points on a year ago

Source: Roy Morgan Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions.Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components.Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog Funds operated by this manager: |

18 Jan 2022 - Performance Report: Bennelong Kardinia Absolute Return Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | There is a slight bias to large cap stocks on the long side of the portfolio, although in a rising market the portfolio will tend to hold smaller caps, including resource stocks, more frequently. On the short side, the portfolio is particularly concentrated, with stock selection limited by both liquidity and the difficulty of borrowing stock in smaller cap companies. Short positions are only taken when there is a high conviction view on the specific stock. The Fund uses derivatives in a limited way, mainly selling short dated covered call options to generate additional income. These typically have less than 30 days to expiry, and are usually 5% to 10% out of the money. ASX SPI futures and index put options can be used to hedge the portfolio's overall net position. The Fund's discretionary investment strategy commences with a macro view of the economy and direction to establish the portfolio's desired market exposure. Following this detailed sector and company research is gathered from knowledge of the individual stocks in the Fund's universe, with widespread use of broker research. Company visits, presentations and discussions with management at CEO and CFO level are used wherever possible to assess management quality across a range of criteria. |

| Manager Comments | On a calendar basis the fund has had 2 negative annual returns in the 15 years and 10 months since its inception. Its largest drawdown was -11.71% lasting 2 years and 6 months, occurring between June 2018 and December 2020 when the index fell by a maximum of -26.75%. The Manager has delivered these returns with -6.52% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 five times and currently sits at 0.75 since inception. The fund has provided positive monthly returns 87% of the time in rising markets, and 34% of the time when the market was negative, contributing to an up capture ratio since inception of 17% and a down capture ratio of 49%. |

| More Information |

18 Jan 2022 - Performance Report: Quay Global Real Estate Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund will invest in a number of global listed real estate companies, groups or funds. The investment strategy is to make investments in real estate securities at a price that will deliver a real, after inflation, total return of 5% per annum (before costs and fees), inclusive of distributions over a longer-term period. The Investment Strategy is indifferent to the constraints of any index benchmarks and is relatively concentrated in its number of investments. The Fund is expected to own between 20 and 40 securities, and from time to time up to 20% of the portfolio maybe invested in cash. The Fund is $A un-hedged. |

| Manager Comments | The Quay Global Real Estate Fund has a track record of 5 years and 11 months and has consistently outperformed the S&P/ASX 200 A-REIT Index since inception in January 2016, providing investors with a return of 10.75%, compared with the index's return of 9.96% over the same time period. On a calendar basis the fund has had 1 negative annual return in the 5 years and 11 months since its inception. Its largest drawdown was -19.68% lasting 16 months, occurring between February 2020 and June 2021 when the index fell by a maximum of -38.29%. The Manager has delivered these returns with -8.38% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 three times and currently sits at 0.84 since inception. The fund has provided positive monthly returns 78% of the time in rising markets, and 26% of the time when the market was negative, contributing to an up capture ratio since inception of 45% and a down capture ratio of 56%. |

| More Information |

18 Jan 2022 - Managers Insights | Glenmore Asset Management

|

|

||

|

Chris Gosselin, CEO of FundMonitors.com, speaks with Robert Gregory, Founder and Portfolio Manager at Glenmore Asset Management. The Glenmore Australian Equities Fund has a track record of 4 years and 5 months and since inception in June 2017 has outperformed the ASX 200 Total Return Index, providing investors with an annualised return of 25.88% compared with the index's return of 9.99% over the same time period.

|

18 Jan 2022 - Volatility Returns, Uncertainties Grow

|

Volatility Returns, Uncertainties Grow Laureola Advisors 21 December 2021 The S&P 500 was down 0.8% in November but this disguised higher volatility in many sectors and stocks as investors digested the end of QE and ZIRP. As we approach year end, investors are forced to deal with increasing uncertainties across the investment landscape: equity valuations, inflation, real world shortages, and the new Omicron strain. Bank of America strategists calculate the real earnings yield on US equities at -2.9%, a level last seen when Harry Truman was President. US insider selling is at record highs: 48 top executives have each sold more than $200 ml of shares. More Chinese developers are defaulting on their debt including Kaisa Group and China Aoyuan. Inflation continues to surprise Central Bankers: November CPI was up 6.8% y-o-y. Gasoline is up 55% in 2021, oil up 48%, and wheat up 23%. Lithium is up 300% as are electricity prices in Europe, which is bracing for rolling blackouts this winter if the weather is colder than average. The Omicron variant has caused many governments to reverse the re-opening measures which will have negative effects on the economy, possibly exacerbate shortages, and potentially add to social unrest. Faced with this wall of uncertainties, investors are placing more and more value on the genuine non-correlation and stable return profile available from the asset class of Life Settlements. SPECIAL REPORT - Potential Effect of Omicron Variant. Omicron is the name of the latest SARS-Covid variant and the 5th to be officially labelled a variant of concern. It spread quickly through S. Africa, is already the dominant strain in Europe, and has found its way to 60 countries including the USA. It is a development that could potentially impact the Life Settlement industry so needs some analysis, despite "Covid fatigue" and the fact that all current data is preliminary with many unknowns. There is strong evidence that Omicron spreads more quickly: some countries report a doubling of Omicron cases every 2- 3 days. It manages to get past most vaccines (although booster shots probably offer some protection) but produces a much higher percentage of cases that are mild. Death and hospitalisation rates appear lower than earlier variants. The USA is still battling the earlier Delta variant. When Omicron cases spike, as they will in all countries, the reaction of individuals and Governments is unknown. But the range of scenarios suggests a positive impact on the investment strategy: lock downs and travel bans (as in Europe) will reduce economic output and may force more to sell their policies. There will be some deaths and the overall effect on mortality will probably be modest, but is unlikely to decline. If the surge of cases or fear causes sick people to cancel their hospital visits and treatments, this could have an impact. The effect on Life Settlements across the scenarios ranges from no change to significantly positive. It will have the opposite effect on most other asset classes, demonstrating once again that Life Settlements has the ability to deliver positive returns when others can't. Funds operated by this manager: |

18 Jan 2022 - Fund Selector

|

Fund Selector FundMonitors.com FundMonitor.com's Fund Selector also allows you to filter your search by individual criteria. You can filter by strategy, fund structure, fund size, and a range of other metrics. |

|

|

17 Jan 2022 - Performance Report: Insync Global Capital Aware Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Insync invests in a concentrated portfolio of high quality companies that possess long 'runways' of future growth benefitting from Megatrends. Megatrends are multiyear structural and disruptive changes that transform the way we live our daily lives and result from a convergence of different underlying trends including innovation, politics, demographics, social attitudes and lifestyles. They provide important tailwinds to individual stocks and sectors, that reside within them. Insync believe this delivers exponential earnings growth ahead of market expectations. The fund uses Put Options to help buffer the depth and duration that sharp, severe negative market impacts would otherwide have on the value of the fund during these events. Insync screens the universe of 40,000 listed global companies to just 150 that it views as superior. This includes profitability, balance sheet performance, shareholder focus and valuations. 20-40 companies are then chosen for the portfolio. These reflect the best outcomes from further analysis using a proprietary DCF valuation, implied growth modelling, and free cash flow yield; alongside management, competitor, and industry scrutiny. The Fund may hold some cash (maximum of 5%), derivatives, currency contracts for hedging purposes, and American and/or Global Depository Receipts. It is however, for all intents and purposes, a 'long-only' fund, remaining fully invested irrespective of market cycles. |

| Manager Comments | The Insync Global Capital Aware Fund has a track record of 12 years and 4 months and has outperformed the Global Equity Index since inception in October 2009, providing investors with a return of 12.91%, compared with the index's return of 12.24% over the same time period. On a calendar basis the fund has had 2 negative annual returns in the 12 years and 4 months since its inception. Its largest drawdown was -10.98% lasting 7 months, occurring between September 2018 and April 2019 when the index fell by a maximum of -10.57%. The Manager has delivered higher returns but with higher volatility than the index, resulting in a Sharpe ratio which has never fallen below 1 and currently sits at 1.01 since inception. The fund has provided positive monthly returns 81% of the time in rising markets, and 24% of the time when the market was negative, contributing to an up capture ratio since inception of 59% and a down capture ratio of 66%. |

| More Information |

17 Jan 2022 - Performance Report: Premium Asia Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund is managed by Value Partners using a disciplined value-oriented approach supported by intensive, on-the-ground bottom-up fundamental research resulting in a portfolio of individual holdings, which are, in the view of Value Partners, undervalued and of high quality, on either an absolute or relative basis, and which have the potential for capital appreciation. The Fund will primarily have exposure to the equity securities of entities listed on securities exchanges across the Asia (ex-Japan) region, however, the Fund may also gain exposure to entities listed on securities outside the Asia (ex-Japan) region which have significant assets, investments, production activities, trading or other business interests in the Asia (ex-Japan) region as well as unlisted instruments with equity-like characteristics, such as participatory notes and convertible bonds. The Fund may also invest in cash and money market instruments, depositary receipts, listed unit trusts, shares in mutual fund corporations and other collective investment schemes (including real estate investment trusts), derivatives including both exchange-traded and OTC, convertible securities, participatory notes, bonds, and foreign exchange contracts. |

| Manager Comments | The Premium Asia Fund has a track record of 12 years and 2 months and has consistently outperformed the MSCI All Country Asia Pacific ex-Japan Index since inception in December 2009, providing investors with a return of 11.94%, compared with the index's return of 5.78% over the same time period. On a calendar basis the fund has had 2 negative annual returns in the 12 years and 2 months since its inception. Its largest drawdown was -21.41% lasting 1 year and 11 months, occurring between June 2015 and May 2017 when the index fell by a maximum of -19.56%. The Manager has delivered higher returns but with higher volatility than the index, resulting in a Sharpe ratio which has fallen below 1 three times and currently sits at 0.78 since inception. The fund has provided positive monthly returns 89% of the time in rising markets, and 22% of the time when the market was negative, contributing to an up capture ratio since inception of 161% and a down capture ratio of 91%. |

| More Information |

17 Jan 2022 - Managers Insights | Collins St Asset Management

|

|

||

|

Chris Gosselin, CEO of FundMonitors.com, speaks with Rob Hay, Head of Distribution & Investor Relations at Collins St Asset Management. The Collins St Value Fund has a track record of 5 years and 11 months and has consistently outperformed the ASX 200 Total Return Index since inception in February 2016. The Fund has returned 18.65% versus the Index's annualised return over the same period of 11.3%.

|