NEWS

21 Jan 2022 - Performance Report: Glenmore Australian Equities Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The main driver of identifying potential investments will be bottom up company analysis, however macro-economic conditions will be considered as part of the investment thesis for each stock. |

| Manager Comments | The Glenmore Australian Equities Fund has a track record of 4 years and 7 months and therefore comparison over all market conditions and against the fund's peers is limited. However, since inception in June 2017, the fund has outperformed the ASX 200 Total Return Index, providing investors with an annualised return of 25.89%, compared with the index's return of 9.99% over the same time period. On a calendar basis the fund has never had a negative annual return in the 4 years and 7 months since its inception. Its largest drawdown was -36.91% lasting 13 months, occurring between October 2019 and November 2020. The Manager has delivered higher returns but with higher volatility than the index, resulting in a Sharpe ratio which has fallen below 1 twice and currently sits at 1.15 since inception. The fund has provided positive monthly returns 92% of the time in rising markets, and 41% of the time when the market was negative, contributing to an up capture ratio since inception of 233% and a down capture ratio of 99%. |

| More Information |

21 Jan 2022 - Performance Report: Bennelong Australian Equities Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | |

| Manager Comments | The Bennelong Australian Equities Fund has a track record of 13 years and has consistently outperformed the ASX 200 Total Return Index since inception in February 2009, providing investors with a return of 15.41%, compared with the index's return of 10.54% over the same time period. On a calendar basis the fund has had 1 negative annual return in the 13 years since its inception. Its largest drawdown was -24.32% lasting 6 months, occurring between February 2020 and August 2020 when the index fell by a maximum of -26.75%. The Manager has delivered higher returns but with higher volatility than the index, resulting in a Sharpe ratio which has fallen below 1 once and currently sits at 0.91 since inception. The fund has provided positive monthly returns 92% of the time in rising markets, and 18% of the time when the market was negative, contributing to an up capture ratio since inception of 145% and a down capture ratio of 95%. |

| More Information |

21 Jan 2022 - Sitting On The Mountain, Watching The Tigers Fight

|

Sitting On The Mountain, Watching The Tigers Fight Arminius Capital 11 January 2022 According to the Chinese zodiac, 2022 is the Year of the Tiger. Tigers are bold, powerful and dangerous, but in Chinese astrology they are also impulsive, short-tempered, and have difficulty getting on with others. There is an old Chinese saying about "sitting on the mountain, watching the tigers fight", which means that, when the situation is violent and confusing, it's best to stand back and see how things work out. There are a lot of tigers around this year:

The outlook for the Australian share market is better than for most of the world. Inflation is low, wage pressures are minimal, and the Federal election due by end-May is unlikely to produce major policy changes. As investors focus on fundamentals, stocks with solid earnings will come back into favour, and speculative stocks will lose popularity. For the big four banks, 2021 was the year of recovery: 2022 will be much harder, and the big banks are likely to underperform. Funds operated by this manager: |

20 Jan 2022 - Performance Report: DS Capital Growth Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The investment team looks for industrial businesses that are simple to understand, generally avoiding large caps, pure mining, biotech and start-ups. They also look for: - Access to management; - Businesses with a competitive edge; - Profitable companies with good margins, organic growth prospects, strong market position and a track record of healthy dividend growth; - Sectors with structural advantage and barriers to entry; - 15% p.a. pre-tax compound return on each holding; and - A history of stable and predictable cash flows that DS Capital can understand and value. |

| Manager Comments | The DS Capital Growth Fund has a track record of 9 years and 1 month and has consistently outperformed the ASX 200 Total Return Index since inception in January 2013, providing investors with a return of 16.3%, compared with the index's return of 9.79% over the same time period. On a calendar basis the fund has had 1 negative annual return in the 9 years and 1 month since its inception. Its largest drawdown was -22.53% lasting 6 months, occurring between February 2020 and August 2020 when the index fell by a maximum of -26.75%. The Manager has delivered these returns with -2.29% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 once and currently sits at 1.29 since inception. The fund has provided positive monthly returns 90% of the time in rising markets, and 37% of the time when the market was negative, contributing to an up capture ratio since inception of 72% and a down capture ratio of 45%. |

| More Information |

20 Jan 2022 - Performance Report: Airlie Australian Share Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund is long-only with a bottom-up focus. It has a concentrated portfolio of 15-35 stocks (target 25). The fund has a maximum cash holding of 10% with an aim to be fully invested. Airlie employs a prudent investment approach that identifies companies based on their financial strength, attractive durable business characteristics and the quality of their management teams. Airlie invests in these companies when their view of their fair value exceeds the prevailing market price. It is jointly managed by Matt Williams and Emma Fisher. Matt has over 25 years' investment experience and formerly held the role of Head of Equities and Portfolio Manager at Perpetual Investments. Emma has over 8 years' investment experience and has previously worked as an investment analyst within the Australian equities team at Fidelity International and, prior to that, at Nomura Securities. |

| Manager Comments | The Airlie Australian Share Fund has a track record of 3 years and 7 months and therefore comparison over all market conditions and against the fund's peers is limited. However, since inception in June 2018, the fund has outperformed the ASX 200 Total Return Index, providing investors with an annualised return of 14.51%, compared with the index's return of 10.09% over the same time period. On a calendar basis the fund has had 1 negative annual return in the 3 years and 7 months since its inception. Its largest drawdown was -23.8% lasting 9 months, occurring between February 2020 and November 2020 when the index fell by a maximum of -26.75%. The Manager has delivered these returns with -0.44% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 twice and currently sits at 0.91 since inception. The fund has provided positive monthly returns 100% of the time in rising markets, and 15% of the time when the market was negative, contributing to an up capture ratio since inception of 114% and a down capture ratio of 90%. |

| More Information |

20 Jan 2022 - Performance Report: 4D Global Infrastructure Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The fund is managed as a single portfolio including regulated utilities in gas, electricity and water, transport infrastructure such as airports, ports, road and rail, as well as communication assets such as the towers and satellite sectors. The portfolio is intended to have exposure to both developed and emerging market opportunities, with country risk assessed internally before any investment is considered. The maximum absolute position of an individual stock is 7% of the fund. |

| Manager Comments | The 4D Global Infrastructure Fund has a track record of 5 years and 10 months and has outperformed the S&P Global Infrastructure TR Index (AUD) since inception in March 2016, providing investors with a return of 9.75%, compared with the index's return of 8.45% over the same time period. On a calendar basis the fund has had 1 negative annual return in the 5 years and 10 months since its inception. Its largest drawdown was -19.77% lasting 1 year and 10 months, occurring between February 2020 and December 2021 when the index fell by a maximum of -24.67%. The Manager has delivered these returns with -0.54% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 five times and currently sits at 0.75 since inception. The fund has provided positive monthly returns 95% of the time in rising markets, and 14% of the time when the market was negative, contributing to an up capture ratio since inception of 102% and a down capture ratio of 94%. |

| More Information |

20 Jan 2022 - Distinctively different and driven to perform Unlocking the opportunity of 'special situations'

|

Distinctively different and driven to perform Unlocking the opportunity of 'special situations' Colins St Asset Management January 2022

|

|

|

|

|

|

Michael Goldberg (Managing Director / Portfolio Manager) and Rob Hay (Head of Distribution & Investor Relations) from Collins St Asset Management share insights into how 'special situation' investment opportunities have been implemented within the Collins St Value Fund. Recorded 27 October 2021.

|

20 Jan 2022 - Mineral Resources

|

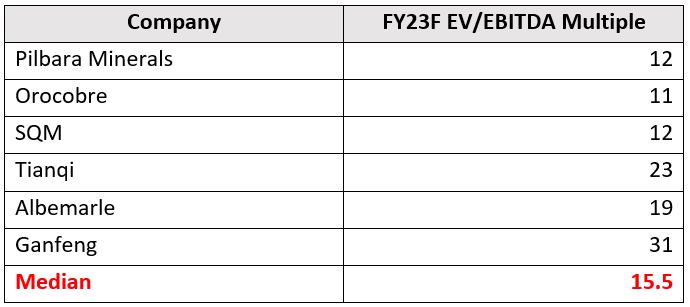

Mineral Resources Emma Fisher, Airlie Funds Management 12 November 2021 The cheapest lithium stock in the market. I know, I know. Bullish thought pieces on lithium are as dime a dozen today as Warren Buffett quotes in a fund manager investor letter. However, we think there is a standout sleeping giant in lithium that is incredibly cheap right now and worth discussing. The precipitous fall in the iron ore price since August has wiped more than 35% off the value of Mineral Resources (ASX:MIN), which now has a market cap of roughly $7.3 billion. We are astounded at the valuations the market is willing to ascribe to 'pure-play' lithium companies and consider Mineral Resources the cheapest lithium stock in the market. Let's compare it to one such pure-play peer, Pilbara Minerals (ASX:PLS), which has an asset right next door to Mineral Resources' Wodgina mine. Pilbara Minerals has a market cap of roughly $7 billion, so basically the pair are neck and neck in valuation. Comparing Mineral Resources with Pilbara MineralsPilbara Minerals' assets add up to 536 kt p.a. of spodumene capacity, consisting of two mines: What about future expansion plans?Pilbara Minerals is aiming to expand production to 1 million tonnes p.a. of spodumene (so roughly double what it produces today). The company has given no firm dates on these expansion plans so we consider them longer-dated (five-plus years). What is $1 billion in lithium earnings worth?Lithium producers are trading on elevated multiples. If we look at FY23F EV/EBITDA for major lithium producers globally, multiples range from 11 times to a whopping 31 times for Ganfeng, with a median EV/EBITDA of 15.5 times.

If we ascribed all of Mineral Resources' current enterprise value to its future lithium EBITDA potential of $1 billion, it equates to 7 times. Valuing the lithium assets in line with the low end of peer multiples, at 11x EBITDA, gives $58 per share value versus the current share price of $38. In short, the fear around a falling iron ore price has created a unique opportunity to buy the cheapest lithium stock in the world, Mineral Resources. A quick Google Translate from English into Buffett yields: "be greedy when others are fearful". Written By Emma Fisher, Airlie Portfolio Manager |

|

Funds operated by this manager: Airlie Australian Share Fund |

19 Jan 2022 - Performance Report: Delft Partners Global High Conviction Strategy

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The quantitative model is proprietary and designed in-house. The critical elements are Valuation, Momentum, and Quality (VMQ) and every stock in the global universe is scored and ranked. Verification of the quant model scores is then cross checked by fundamental analysis in which a company's Accounting policies, Governance, and Strategic positioning is evaluated. The manager believes strategy is suited to investors seeking returns from investing in global companies, diversification away from Australia and a risk aware approach to global investing. It should be noted that this is a strategy in an IMA format and is not offered as a fund. An IMA solution can be a more cost and tax effective solution, for clients who wish to own fewer stocks in a long only strategy. |

| Manager Comments | The Delft Partners Global High Conviction Strategy has a track record of 10 years and 6 months and has outperformed the Global Equity Index since inception in August 2011, providing investors with a return of 15.92%, compared with the index's return of 14.92% over the same time period. On a calendar basis the strategy has had 2 negative annual returns in the 10 years and 6 months since its inception. Its largest drawdown was -13.33% lasting 12 months, occurring between February 2020 and February 2021 when the index fell by a maximum of -13.19%. The Manager has delivered higher returns but with higher volatility than the index, resulting in a Sharpe ratio which has fallen below 1 three times and currently sits at 1.17 since inception. The strategy has provided positive monthly returns 88% of the time in rising markets, and 14% of the time when the market was negative, contributing to an up capture ratio since inception of 100% and a down capture ratio of 93%. |

| More Information |

19 Jan 2022 - Performance Report: Bennelong Long Short Equity Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | In a typical environment the Fund will hold around 70 stocks comprising 35 pairs. Each pair contains one long and one short position each of which will have been thoroughly researched and are selected from the same market sector. Whilst in an ideal environment each stock's position will make a positive return, it is the relative performance of the pair that is important. As a result the Fund can make positive returns when each stock moves in the same direction provided the long position outperforms the short one in relative terms. However, if neither side of the trade is profitable, strict controls are required to ensure losses are limited. The Fund uses no derivatives and has no currency exposure. The Fund has no hard stop loss limits, instead relying on the small average position size per stock (1.5%) and per pair (3%) to limit exposure. Where practical pairs are always held within the same sector to limit cross sector risk, and positions can be held for months or years. The Bennelong Market Neutral Fund, with same strategy and liquidity is available for retail investors as a Listed Investment Company (LIC) on the ASX. |

| Manager Comments | The Bennelong Long Short Equity Fund has a track record of 20 years and 1 month and has outperformed the ASX 200 Total Return Index since inception in February 2002, providing investors with a return of 14.22%, compared with the index's return of 8.42% over the same time period. On a calendar basis the fund has had 3 negative annual returns in the 20 years and 1 month since its inception. Its largest drawdown was -23.77% lasting 15 months, occurring between September 2020 and December 2021 when the index fell by a maximum of -15.05%. The Manager has delivered these returns with -0.35% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 over five times and currently sits at 0.84 since inception. The fund has provided positive monthly returns 65% of the time in rising markets, and 63% of the time when the market was negative, contributing to an up capture ratio since inception of 6% and a down capture ratio of -144%. |

| More Information |