NEWS

25 Jan 2022 - Performance Report: Equitable Investors Dragonfly Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund is an open ended, unlisted unit trust investing predominantly in ASX listed companies. Hybrid, debt & unlisted investments are also considered. The Fund is focused on investing in growing or strategic businesses and generating returns that, to the extent possible, are less dependent on the direction of the broader sharemarket. The Fund may at times change its cash weighting or utilise exchange traded products to manage market risk. Investments will primarily be made in micro-to-mid cap companies listed on the ASX. Larger listed businesses will also be considered for investment but are not expected to meet the manager's investment criteria as regularly as smaller peers. |

| Manager Comments | In December the fund returned -3.18%. NZ-listed tradie app developer Geo Limited (GEO:NZ) was sold down on light volume in during the month, causing >70% of the decline in NAV for the month before bouncing straight back in the first few weeks of January 2022. GEO has been a key contributor to performance of the Fund over CY2021. The investments that contributed the most to the 25% advance in NAV were a pair of businesses not listed on the ASX (NZ-listed GEO and unlisted digital diagnostics company Ellume) and a pair of takeover situations (IT consulting business Empired and traffic monitoring business Redflex). Equitable Investors noted they are excited about the year ahead for their core, high conviction investments. They continue to focus on the value catalysts and growth opportunities for the fund's individual investments. |

| More Information |

25 Jan 2022 - Performance Report: Surrey Australian Equities Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Investment Manager follows a defined investment process which is underpinned by detailed bottom up fundamental analysis, overlayed with sectoral and macroeconomic research. This is combined with an extensive company visitation program where we endeavour to meet with company management and with other stakeholders such as suppliers, customers and industry bodies to improve our information set. Surrey Asset Management defines its investment process as Qualitative, Quantitative and Value Latencies (QQV). In essence, the Investment Manager thoroughly researches an investment's qualitative and quantitative characteristics in an attempt to find value latencies not yet reflected in the share price and then clearly defines a roadmap to realisation of those latencies. Developing this roadmap is a key step in the investment process. By articulating a clear pathway as to how and when an investment can realise what the Investment Manager sees as latent value, defines the investment proposition and lessens the impact of cognitive dissonance. This is undertaken with a philosophical underpinning of fact-based investing, transparency, authenticity and accountability. |

| Manager Comments | The Surrey Australian Equities Fund has a track record of 3 years and 7 months and therefore comparison over all market conditions and against the fund's peers is limited. However, since inception in June 2018, the fund has outperformed the ASX 200 Total Return Index, providing investors with an annualised return of 12.14%, compared with the index's return of 10.09% over the same time period. On a calendar basis the fund has had 1 negative annual return in the 3 years and 7 months since its inception. Its largest drawdown was -26.75% lasting 6 months, occurring between February 2020 and August 2020 when the index fell by a maximum of -26.75%. The Manager has delivered higher returns but with higher volatility than the index, resulting in a Sharpe ratio which has fallen below 1 three times and currently sits at 0.63 since inception. The fund has provided positive monthly returns 83% of the time in rising markets, and 8% of the time when the market was negative, contributing to an up capture ratio since inception of 126% and a down capture ratio of 110%. |

| More Information |

25 Jan 2022 - Performance Report: Bennelong Emerging Companies Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | |

| Manager Comments | The Bennelong Emerging Companies Fund has a track record of 4 years and 2 months and therefore comparison over all market conditions and against the fund's peers is limited. However, since inception in November 2017, the fund has outperformed the ASX 200 Total Return Index, providing investors with an annualised return of 28.44%, compared with the index's return of 9.77% over the same time period. On a calendar basis the fund has had 1 negative annual return in the 4 years and 2 months since its inception. Its largest drawdown was -41.74% lasting 10 months, occurring between December 2019 and October 2020 when the index fell by a maximum of -26.75%. The Manager has delivered higher returns but with higher volatility than the index, resulting in a Sharpe ratio which has fallen below 1 three times and currently sits at 0.97 since inception. The fund has provided positive monthly returns 83% of the time in rising markets, and 40% of the time when the market was negative, contributing to an up capture ratio since inception of 298% and a down capture ratio of 117%. |

| More Information |

25 Jan 2022 - Webinar Recording | Paragon Australian Long Short Fund

|

Webinar recording: Paragon Australian Long Short Fund

|

25 Jan 2022 - Some stuff you don't want to think about - but should

|

Some stuff you don't want to think about - but should Delft Partners January 2022 |

|

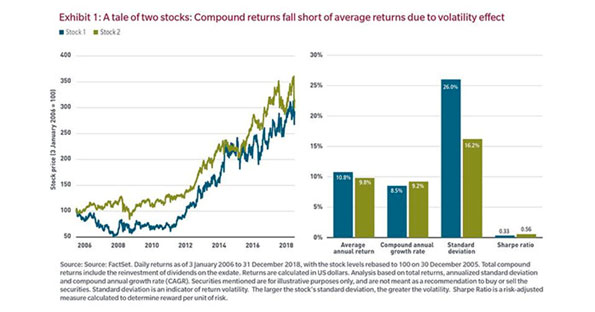

Or Risk is the independent variable and Return, the dependent one. Ever been on a car journey as a passenger where the driver was going too fast; being reckless; and essentially taking chances? Over and under-taking, switching lanes without looking, going too fast and braking too hard. We all have. It's not so pleasant especially as you get older and realise how much is at risk from a needless mistake: your health, your life even; the realisation that family members depend on you staying healthy and not becoming a burden; your enjoyment from their growing old. So, we try to avoid such a scenario. It's relatively easy since reckless driving is usually associated with inexperienced younger members of society in fast cars. So, we can avoid such journeys as being readily identifiable in advance. And yet we often find that a similar journey, multi-generational wealth investing, has older wealthy members indifferent to risk and unaware of the loss of wealth that occurs when insufficient attention is paid to the risk path taken by their managers. Investing Is not so different from a car journey? It's a path to an end point with risk to be managed; speed, comfort, time horizon all matter for investing as much as they do for being driven. Better to get to the end point safely and aware of risks on the way, and how to drive defensively at such times, than to get there at speed dangerously? And yet here we are, perhaps caused by years of unorthodox monetary policy, where many managers and clients perceive risk as irrelevant and an irritant? All focus is upon return - those 'sexy' growth stocks, that 10 bagger PE fund, that property that will inevitably benefit from a lick of paint or a change of use permission, and of course the free put option available to all investors that has been a feature of monetary policy in essentially the last 25 years. So were going to bore you with a brief article on the independent variable known as risk. Return, the glamourous bit, is the dependent variable. No risk, no return. So, if you can't define, measure, and manage risk then your returns are a function of luck. Not a lot of people know that. We spend a lot of time obsessing about risk especially in multi-asset portfolios, whose Alphas and Betas are both correlated at different extents at different times, and where they offer differing opportunities for active and passive approaches at different times. The cost of variance or variance drain The variance of returns over time directly impacts our ability to grow wealth. $100 invested at 5% interest for 30 years grows to become $432. Of that, $100 is of course your initial capital, $150 is the total amount of simple interest paid, and $182 is the effect of compounding - interest on interest. (Let's assume away the taxman?!) Once uncertainty in returns (volatility) is introduced into the mathematics, there is an immediate noticeable drain. If that same investment still yields 5% but now with a volatility of 17% (like a typical equity index ) the cumulative growth rate - the rate your wealth actually grows over time including rises and falls - is now just 3.56%. After 30 years you will have instead of $432 just $285, and you will have lost almost $150 to volatility. Risk is expensive!1 A lower-return investment with a lower risk may often outperform a high-return high-risk alternative.

Multi-asset portfolios of course mitigate the high volatility from equity and many investors choose hard assets to go into the mix since their price is 'not volatile'. However, bonds, especially high yield bonds, can behave like equities at certain times 2 and an absence of price volatility shouldn't be equated with an absence of risk 3. For example, if you own a physical property whose revenues are derived from retail tenants, and your equity portfolio is heavily weighted to retail and consumer companies, guess what happens when a general consumer recession hits. That 'lack' of volatility in the property will suddenly not be so lacking as your cash flows from rental payments dry up and the next valuation of the property will be a jump down in value, and a reduction in re-investable cash flows, just when you most needed to be immune from volatility as a drain on wealth. The infrequent tails that happen too frequently We tend to think of "drawdowns", crashes, corrections, shocks or other sudden unusual "non-Normal" events as a completely different animal from typical market volatility. When we consider investments, we should consider not just volatility or tracking error but also the incidence of these drawdowns. Simple mathematics to transform mean and volatility without drawdowns to equivalent numbers that correctly include the effect of such infrequent drawdowns has been known for almost 100 years 4. If we make this adjustment to historical return series, we observe two troubling effects. First, the historical "alpha" that is often reported in academic papers and relied on by active managers from factors like Momentum, Size, Value, or Beta, once adjustments for drawdowns have been made, either radically shrinks, or disappears, or reverses sign and becomes a persistent drag. This phenomenon is described at length in one of Northfield's recently published journal articles 5. Secondly, adjusted volatility numbers are usually much bigger than the unadjusted numbers - meaning that these investments have both a lower return and a higher risk than would at first appear. The effect of that higher risk is once again, as above, to reduce the effectiveness of compounding. Investments that experience periodic shocks have both lower return than would appear at first glance, and higher risk. Drawdowns are also expensive! The evasive Alpha Another closely related aspect is uncertainty in active management. Unfortunately, Alpha is hard to find, easy to lose, and always changing. Because Alpha is uncertain, we should include that uncertainty in our calculations of risk - in this case it is "the risk of being wrong" or strategy risk 6. It may come as some surprise that usual risk measures completely ignore this and assume that the managers' return is known with certainty. We wish it was. With active management we deliberately move away from the benchmark return and believe that we have a new mean return (our alpha) that is bigger than the benchmark. Tracking error, which originated in passive management, or value at risk, or any other measure that is based on volatility measures variability or uncertainty around the mean (alpha) and says nothing about variability or uncertainty of the mean (alpha) itself. As with all the previous examples - you might be spotting a pattern here - correct inclusion of strategy risk makes the total actual risk of the investment larger, which once again negatively impacts compounding. Active management where big bets are taken is risky and being wrong is very expensive indeed! There is no such thing as linear in the world of risk There is one additional implication of compounding that is utterly ignored - if we consider the compound return, as we should, given its importance to us, then return no longer increases linearly with risk as we are told by the textbooks 7. It is now a convex function, and as risk increases past the peak, our return begins to decline with increasing risk. This has serious implications for asset allocation. In every market there will be a "peak beta", beyond which as explained returns decline with increasing risk, so we must stay to the left of that peak. This tends naturally to send us looking for lower beta stocks, or into multi-asset class portfolios 8. So, what to do? Experienced judgement helps. By experienced we mean professionals whose careers extend back to when corporate failure was possible, when central banks tightened monetary policy as much as they engaged in QE and granted a free put option, and when dividends and balance sheets mattered. Models also help to provide a framework for identifying, measuring, and managing the Betas and the Alphas and their correlations and payoffs. Many fund managers do not use risk models and are ignorant of the absence of diversification of the risk sources in their portfolios. Many don't want to know and prefer a 'pedal to the metal' approach. We acknowledge that all models are 'wrong' but believe that some are useful. The useful ones such as the Northfield model we use (northinfo) allow liquid and illiquid asset forecasts to be combined; have data on bonds as well as equities, allow scenario and stress testing, and incorporate the multi-generational time horizon and planning for periods of investment and consumption that many plan sponsors will have to manage. We conclude that successful wealth management requires carefully nurtured compounding. This compounding can only occur when three forms of risk are carefully managed the exposure to volatility from risk factors and asset-specific sources, the risk of drawdowns, and strategy risk - the risk of being wrong. Portfolios are constructed by focusing risk exposures only in areas the manager has skill. |

|

Funds operated by this manager: Delft Partners Global High Conviction Strategy, Delft Partners Asia Small Companies Strategy, Delft Partners Global Infrastructure Strategy

|

25 Jan 2022 - Airlie Market Outlook, January 2022

|

Airlie Market Outlook, January 2022 Airlie Funds Management 17 January 2022 |

|

Matt Williams, Portfolio Manager, offers his views on the year ahead, the challenges he sees for Australian companies and discusses investments in the portfolio. Funds operated by this manager: Airlie Australian Share Fund |

24 Jan 2022 - Performance Report: Bennelong Concentrated Australian Equities Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | |

| Manager Comments | The Bennelong Concentrated Australian Equities Fund has a track record of 13 years and has consistently outperformed the ASX 200 Total Return Index since inception in February 2009, providing investors with a return of 17.44%, compared with the index's return of 10.54% over the same time period. On a calendar basis the fund has had 2 negative annual returns in the 13 years since its inception. Its largest drawdown was -24.11% lasting 6 months, occurring between February 2020 and August 2020 when the index fell by a maximum of -26.75%. The Manager has delivered higher returns but with higher volatility than the index, resulting in a Sharpe ratio which has fallen below 1 once and currently sits at 1.02 since inception. The fund has provided positive monthly returns 91% of the time in rising markets, and 20% of the time when the market was negative, contributing to an up capture ratio since inception of 157% and a down capture ratio of 91%. |

| More Information |

24 Jan 2022 - Peer Groups

|

Peer Groups FundMonitors.com If you are interested in how a particular fund has performed compared to its competitors or how different sectors have performed against each other, you can use FundMonitors.com to access and compare peer groups. |

|

|

24 Jan 2022 - Why you can be cautious on markets and 100% invested

|

Why you can be cautious on markets and 100% invested Aoris Investment Management 14 January 2022 2022 began with global stock markets around record levels, leaving many investors primed to sell equities. However, timing the market is more likely to reduce your returns than enhance them. Importantly, you can be cautious on the market and 100% invested provided you're in the right stocks. Here's why. A December 2021 Livewire reader survey found that 'overvalued stock bubbles' are the #1 concern of readers, by a factor of two! Many investors have an opinion, often strongly held, on whether the stock market in aggregate is cheap or expensive. If the market is viewed as being too pricey, they may increase the cash weight in their portfolio with a view to buying back into equities at lower prices. While conceptually appealing, history shows that attempting to profit from the market's zigs and zags along its upwards journey is far more likely to detract from investment returns than add to them. Aswath Damodaran, a highly esteemed Professor of Finance at New York University's Stern School of Business, has studied market timing strategies. He looked at asset allocation mutual funds in the US, so called because rather than being 100% in equities they can time the market by moving between stocks, bonds and cash. As such, they should do better than the equity market. Over the 10 years to 1998 these market timing funds on average underperformed the S&P500 by 5.0% p.a. I recall telling clients in January of 2013 that markets are fully priced and to expect a zero return from the index in the coming year (the S&P500 put on 30% that year!). I've learnt a few things since then. Today, I have no view, positive or negative, on the value or the direction of the equity market in totality. Nor do I believe it's necessary to have one as an equity manager. Timing the market is an example of what is known as the fallacy of composition, meaning the belief that what is true of the whole is also true of all the component parts. It's common for investors who've formed a view on the equity market in totality to then project this view onto all equities - all stocks and all funds. However, the returns from any individual security will look nothing like the average. Thinking about equity market indices in aggregate misses the vast dispersion of stock returns within an index. To illustrate this dispersion, in 2021 the returns of the best 20% of the global equity market exceeded those of the worst 20% by almost 90%.

What matters is what you own, which in the case of Aoris is just 15 exceptional businesses. The index is mostly made up of businesses you don't own. I've seen many poor investment decisions made as a result of confusing these two constructs. What matters is what you do own. The index is mostly made up of businesses you don't own. If you own the right type of business, and you own them at or below their fair value, then time is on your side and being fully invested makes sense. By the right type of business, I mean those that have been around a long time, are understandable, have leadership positions in growing markets, and grow earnings per share at an attractive rate on a sustainable basis. I believe the intrinsic value of the 15 companies we own at Aoris is rising at a rate of around 10% a year and I believe we own them at or below their intrinsic worth. Therefore, cash represents a considerable opportunity cost. To hold $1 of portfolio capital in cash rather than in one of our companies, in the expectation that its share price may fall 10% or more from an already attractive level, would not be judicious. I believe it is far better to invest all of one's portfolio capital in these types of businesses and participate fully in that 10% p.a. growth in value. To maximise your long-term returns, recognise the futility of trying to optimise short-term returns. Invest to win the main game, the long-term game. Recognise that your equity portfolio is not the equity index. Rather, it's a discrete set of businesses whose returns will look nothing like the market average. If the businesses you own are profitable, durable, competitively strong and growing in intrinsic value at around 10% p.a., and you own them at or below today's fair value, then it makes sense to be fully invested. Written By Stephen Arnold, Managing Director & Chief Investment Officer Funds operated by this manager: |

21 Jan 2022 - Hedge Clippings |21 January 2022

|

|||||

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|