NEWS

17 Feb 2022 - Performance Report: Bennelong Long Short Equity Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | In a typical environment the Fund will hold around 70 stocks comprising 35 pairs. Each pair contains one long and one short position each of which will have been thoroughly researched and are selected from the same market sector. Whilst in an ideal environment each stock's position will make a positive return, it is the relative performance of the pair that is important. As a result the Fund can make positive returns when each stock moves in the same direction provided the long position outperforms the short one in relative terms. However, if neither side of the trade is profitable, strict controls are required to ensure losses are limited. The Fund uses no derivatives and has no currency exposure. The Fund has no hard stop loss limits, instead relying on the small average position size per stock (1.5%) and per pair (3%) to limit exposure. Where practical pairs are always held within the same sector to limit cross sector risk, and positions can be held for months or years. The Bennelong Market Neutral Fund, with same strategy and liquidity is available for retail investors as a Listed Investment Company (LIC) on the ASX. |

| Manager Comments | The Bennelong Long Short Equity Fund has a track record of 20 years and has outperformed the ASX 200 Total Return Index since inception in February 2002, providing investors with an annualised return of 13.78% compared with the index's return of 8.03% over the same period. On a calendar year basis, the fund has experienced a negative annual return on 4 occasions in the 20 years since the start of its track record. Over the past 12 months, the fund's largest drawdown was -11.29% vs the index's -6.35%, and since inception in February 2002 the fund's largest drawdown was -23.77% vs the index's maximum drawdown over the same period of -47.19%. The fund's maximum drawdown began in September 2020 and lasted 1 year and 4 months, reaching its lowest point during March 2021. The fund had completely recovered its losses by January 2022. The Manager has delivered these returns with 0.34% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 five times over the past five years and which currently sits at 0.81 since inception. The fund has provided positive monthly returns 65% of the time in rising markets and 62% of the time during periods of market decline, contributing to an up-capture ratio since inception of 6% and a down-capture ratio of -128%. |

| More Information |

17 Feb 2022 - Which retailers have weathered the market storm?

|

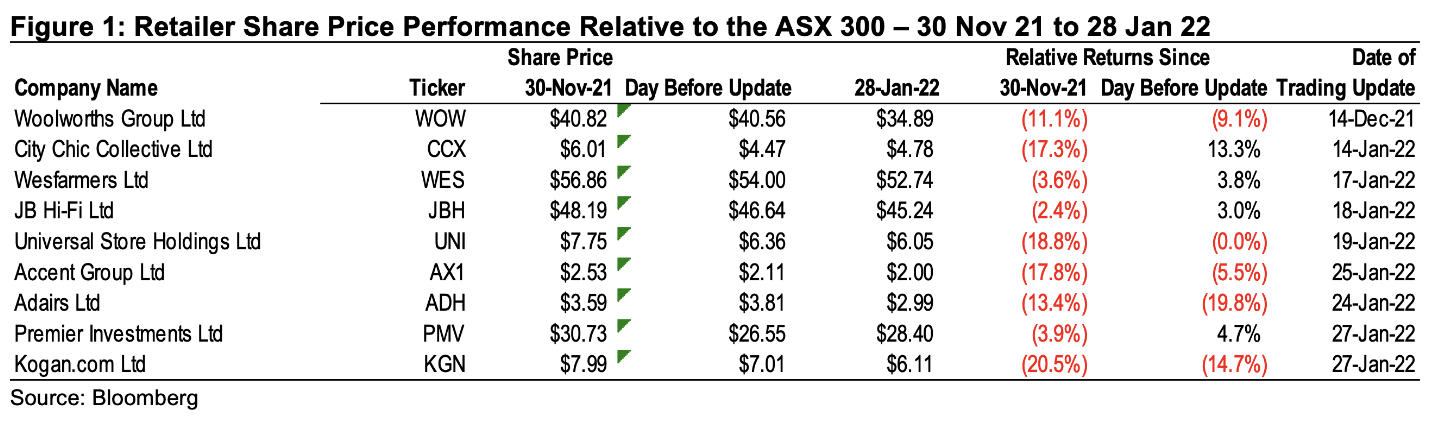

Which retailers have weathered the market storm? Montgomery Investment Management 04 February 2022 In response to recent trading updates, the share prices of many listed retailers have been hit for six. With retail sales falling short of expectations, supply chain disruptions, and the risk of excess inventories, some investors have been spooked, and have headed for the exits. Happily, the price falls have not hit every business, and it's interesting to see which retailers have won the market's approval. A number of retailers have released trading updates in the last couple of weeks. It has been a volatile period for retailers, with the 6 months starting with lockdowns in New South Wales and Victoria. The opening up of these regions was greeted by the market with an expectation of a surge in consumer spending heading into Christmas. Then the Omicron variant took hold, with self-imposed lockdowns severely reducing foot traffic in stores during the later parts of December. This was complicated by its impacts on staff availability and supply chain capacity, adding increased costs and stock availability issues to what was already going to be a period of lower than expected sales. With sales not meeting expectations, on top of a lengthened supply chain due to disruptions, the risk of excess inventories has also increased for the retailers over the last month. Looking at the performance of the retailers that have reported trading updates since mid-December, most have underperformed the market since the end of November. However, most of the underperformance occurred prior to the release of the update, highlighting that the market had already started to factor in a weakening outlook as a result of the Omicron wave. Almost half of the companies have outperformed the broader market since the release of their updates, while the larger companies have generally outperformed the small retailers.

Of course, these impacts are likely to be temporary, but the duration remains unknown at this point and the market does not like uncertainty. The City Chic and Premier Investments trading updates were better than the market feared, with sales holding up better than competitors and more limited disruptions to their supply chain to date. JB HiFi's performance through this period has been better than the market had expected with robust demand for appliances and consumer electronics, while gross margins remained well managed despite increasing freight costs. Wesfarmers noted a material impact on its Kmart and Target operations, while Catch had been impacted by inventory clearance and slowing sales growth as it cycles a difficult comparable period. There has also been a material step up in costs to manage the pandemic adding to the increased investment in the digital part of the business. Sales at Officeworks were also negatively impacted by the combination of lockdowns and omicron in the period. While the performance of these businesses was materially worse than market expectations, the other businesses within Wesfarmers' portfolio offset this deterioration, in particular its chemicals and Bunnings operations, with overall group earnings meeting market expectations. As a result, Wesfarmers has been one of the better performing retailers since the end of November. What is happening to small cap retailers?The share prices of the smaller retailers have been relatively poor performers. This is likely due in part to the more momentum driven nature of the small cap market. The trading updates from The Universal Store and Accent Group indicated that after an initial jump in sales upon reopening in November, sales in December progressively deteriorated. Like for like store sales growth was negative for both companies in December. Universal performed better than Accent through this period but conditions are likely to remain tough through January. The positive was that inventories were in line with normal levels despite the weaker sales outcome. This could deteriorate in January, but the balance sheet of both companies remains in good shape, and a pipeline of strong new store roll out reduces the risk of a build-up of excess and ageing stock. The greater risk is likely to be a shortage of stock if supply disruptions continue through the year. Adairs had been expected to hold up through December given the apparent strength in the hardware and other home categories. It reported sales that were slightly weaker than market expectations, but of greater concern was the dramatic reduction of margins in the period as a result of rising supply chain and freight costs as well as increased discounting to clear stock. Higher staff and warehouse costs created additional operating leverage along with the step up in marketing investment for the digital businesses. The market had not factored the same degree of risk into the Adairs share price. Consequently, the market reaction to the miss was far greater than for other retailers. The question is whether this overstates the medium to long term risk given that at least some of the cost increases that caused the margin miss, such as running the old distribution centre in parallel and elevated staff and freight costs, are temporary. Written By Stuart Jackson Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund |

16 Feb 2022 - Performance Report: Quay Global Real Estate Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund will invest in a number of global listed real estate companies, groups or funds. The investment strategy is to make investments in real estate securities at a price that will deliver a real, after inflation, total return of 5% per annum (before costs and fees), inclusive of distributions over a longer-term period. The Investment Strategy is indifferent to the constraints of any index benchmarks and is relatively concentrated in its number of investments. The Fund is expected to own between 20 and 40 securities, and from time to time up to 20% of the portfolio maybe invested in cash. The Fund is $A un-hedged. |

| Manager Comments | The Quay Global Real Estate Fund has a track record of 6 years and has outperformed the S&P/ASX 200 A-REIT Index since inception in January 2016, providing investors with an annualised return of 9.95% compared with the index's return of 8.03% over the same period. On a calendar year basis, the fund has experienced a negative annual return on 2 occasions in the 6 years since the start of its track record. Over the past 12 months, the fund's largest drawdown was -4.67% vs the index's -9.52%, and since inception in January 2016 the fund's largest drawdown was -19.68% vs the index's maximum drawdown over the same period of -38.29%. The fund's maximum drawdown began in February 2020 and lasted 1 year and 4 months, reaching its lowest point during September 2020. The fund had completely recovered its losses by June 2021. The Manager has delivered these returns with 8.63% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 three times over the past five years and which currently sits at 0.77 since inception. The fund has provided positive monthly returns 78% of the time in rising markets and 25% of the time during periods of market decline, contributing to an up-capture ratio since inception of 45% and a down-capture ratio of 56%. |

| More Information |

16 Feb 2022 - Sustainable Strategy Update

|

Sustainable Strategy Update Magellan Asset Management January 2022 Dom Giuliano, Deputy CIO and Head of ESG at Magellan, provides colour on some promising renewable-energy stocks, the efforts three portfolio companies - Amazon, Eversource Energy and Nestlé - are making to reduce their carbon footprint, and new investment Booking.com. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund |

16 Feb 2022 - Public & private - perfecting the blend - Part 2

|

Public & private - perfecting the blend - Part 2 (Adviser & wholesale investors only) CIP Asset Management January 2022 Continued from yesterday's article - click the NEWS tab at the top of the screen to see our Newsfeed As we noted in part one of our recent primer on private and public credit markets, Public and private - perfecting the blend, the asset class of fixed income has changed dramatically in the past few years. Refer to part one to understand these aspects of present-day credit:

In this conclusion, we examine how co-mingling public and private credit in a single portfolio can be an attractive investment. THE LIQUIDITY TRADE-OFFS BETWEEN PUBLIC AND PRIVATE DEBTIn contrast to private markets, public debt market liquidity, while still ample in some areas like government bonds and bank debt, has become less abundant in the wake of post-GFC regulations that have made "warehousing" securities more capital intensive for market-making investment banks.

Furthermore, with bank market makers holding fewer securities in inventory and dedicating less capital to trading activities, the ability of the capital markets to accommodate rapidly shifting investor flows is compromised. This is exacerbated by different characteristics of the investor base for public debt - with a much higher concentration of leveraged investors who use repo or prime brokerage financing for their government bond holdings and most liquid corporate bonds, magnifying liquidity risk when fundamentals shift. This dynamic doesn't exist to nearly the same degree in private markets, insulating them from these leverage-driven liquidity events that are becoming more common in public markets. Moreover, liquidity is becoming more concentrated in the market's largest public credit issues, which often have large sector concentrations to bank financial credit, a trend that is particularly acute in Australia.

Source: Bloomberg, 19 October 2021 This has already shown to be exacerbated in "risk-off" market environments, as we saw in March 2020. In contrast, private debt markets typically finance smaller companies in less cyclical sectors and have limited exposure to the types of businesses that employ a steady stream of short-term funding, suggesting less exposure to funding risk in private debt markets than in public markets. Examples include banks and large corporates with access to the commercial paper market or who utilise factoring arrangements such as that facilitated by recently collapsed Greensill Capital. This all suggests that the liquidity trade-off for private debt investment in the future may not be as high as it has been historically and will also present a considerable opportunity for credit investors with the flexibility to take advantage of dislocated markets. This is particularly apparent as risk premiums in public markets have declined over time. Time series of risk premiums in public fixed income markets

Real ST Rate is the short term nominal yields less short term break even inflation. Inflation Premium is nominal short term yield over the Real ST rate. Duration premium is the difference between the long term nominal yield and the short term nominal yield. IG Credit Risk Premium is the difference between the investment-grade nominal yield and the risk-free nominal yield (duration adjusted). HY Credit Risk Premium is the difference between the high yield and investment-grade yields (duration adjusted). Source: Bloomberg, ICE BAML Indices, CIPAM calculations On the other side of the coin, private debt presents investors with a differentiated opportunity set that may complement their public debt holdings. Given the complexity of sourcing, structuring and analysing securities in the private markets relative to the public markets, a particularly skilled and sizeable private debt manager may have a notable advantage over the less-adept competition that can't leverage scale to the benefit of their investors.

Furthermore, since private debt strategies typically deploy investor capital over a multiple-year period rather than all at once, managers are structurally positioned to take advantage of shifting opportunities and valuations as they arise. And the limited liquidity in private debt suggests that in difficult market environments investors may be less adversely affected by the distressed selling of other investors and can often better control the ultimate outcome of an investment. THE CASE FOR COMBINING PUBLIC AND PRIVATE DEBT IN ONE PORTFOLIOHaving established that the liquidity divide between public and private debt markets is more nuanced than meets the eye, it stands to reason that perhaps there are good reasons that the two asset classes can coexist in the same portfolio.

However, unlike private equity, where a buyer must be found either by listing the asset on public markets, trade sale or selling to another private equity sponsor, in private debt markets the portfolio manager can manage the liquidity profile of the asset pool through the maturity and/or amortisation profile of the debt itself. This is a very important distinction between the two asset classes, and the critical reason why blending public and private debt in a single portfolio is possible when compared to managing public and private equities. Firstly, the illiquidity premium is also more valuable in a low-rate environment as its contribution to total return becomes more meaningful, as can be seen below. As returns from this risk premium are driven by very different factors to cash rates, duration and credit risk, it thus adds considerable and meaningful diversification to both a blended public/private credit portfolio as well as to a broader multi-asset portfolio. ISOLATING THE RETURN DRIVERS IN CREDIT

Source: CIPAM Calculations, August 2021 In addition, the traditional advantages of robust security selection and asset allocation processes on the public-only side are further enhanced by the differentiated opportunity set available in private markets. Compared to distinct public and private portfolios, a one-portfolio solution can offer investors:

A combined public/private portfolio also has an edge in capitalising on stressed financial conditions, as liquidity at the total portfolio level can be deployed across both public and private markets as appropriate to take advantage of market dislocations. Put another way, it enables investors to average into private debt markets across the cycle in a low-risk way, lowering the timing risk that one might otherwise face putting capital to work in a private-debt only strategy that needs to be fully invested as fast as possible irrespective of the asset class relative value on offer.

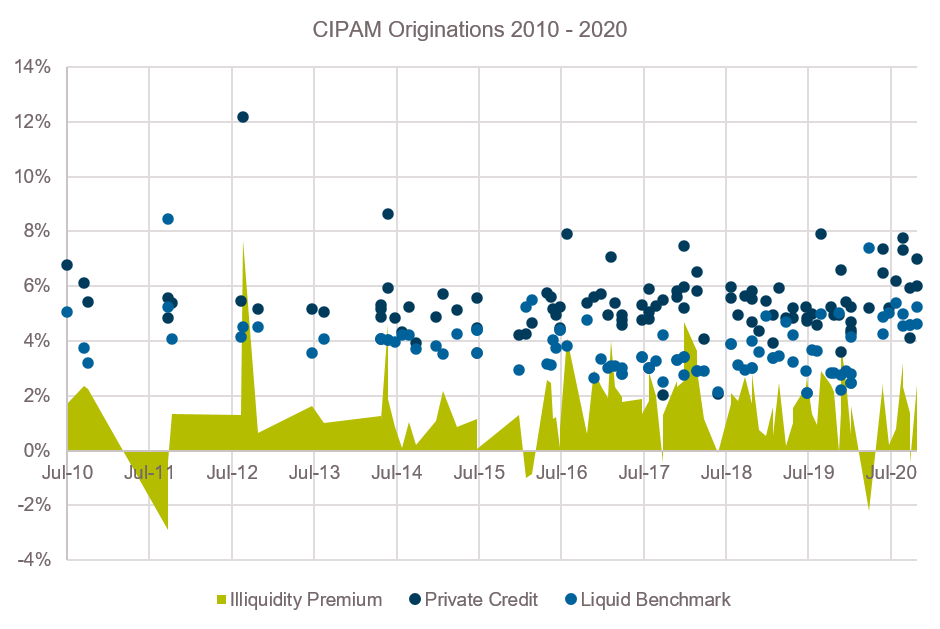

Furthermore, if you take the perspective that illiquidity premium is a real risk premium in the same vein that credit spreads or duration/term structure are as per above, then it can be helpful to analyse how it behaves relative to these other traditional fixed income risk premiums. The variation in illiquidity premiums reflects the inefficiency of private markets, meaning there is a cyclical and idiosyncratic component. Amidst CIPAM's historical deals, for example, historical average illiquidity premiums are 2.2% but there is significant variation. Anecdotally, it appears that the level of the risk premium is lower when public credit spreads tighten (i.e. when public markets are performing well) and higher when they widen. Historical illiquidity premiums in Australian and NZ credit

Dots represent a three-year discount margin on CIPAM-originated private deals. Liquid benchmark is the margin on a three-year bond of the same credit rating as the internal rating on the CIPAM private credit transaction While it may seem counterintuitive, managers of combined public and private debt strategies can also utilise market liquidity to their advantage. In times of dislocation within the liquid markets, new issue volume can slow due to heightened uncertainty. During these periods, agile managers can fill the void by providing much-needed liquidity to companies that might otherwise be able to tap public markets, often with enhanced terms. In addition, structures can be more lender-friendly due to the reduced number of financing solutions available.

Institutional and retail investors need liquidity for any number of reasons. We would argue that asset managers can deliver more attractive liquidity characteristics and capture attractive illiquidity premiums across both public and private debt markets in a combined portfolio than in separate liquid and illiquid mandates that are run in parallel. By delegating this asset allocation to the manager who is closest to liquidity conditions and relative value opportunities across both sides of the public/private spectrum, you can remove many of the frictions faced by an asset allocator having to manage these liquidity demands themselves and give them a known product-level liquidity profile (e.g. monthly liquidity with a 10% gate per month). Part of the liquidity enhancement in a one-portfolio solution is simply a function of the structure of some private investments. The short duration and amortising features typical of private securitisation deals create natural liquidity over time, for example, while private corporate or real estate debt issues also may generate pre-maturity liquidity events should the interest rate and spread environment incentivise borrowers to prepay their loans.

For example, short-duration public investments such as asset-backed securities or investment-grade floating-rate securities can be added to maximise portfolio income while also providing funding, over time, for private investments. Asset allocators running separate allocations or products are less able to do this as they won't be intimately familiar with the amortisation of the private debt profile and/or may have to hold zero-carry cash to fund capital calls for closed-ended private debt allocations with uncertain timing. As the opportunity set evolves and expands - particularly in diverse private markets - combined portfolios may be better positioned to capitalise on innovative new structures as well. This could include innovative structured finance arrangements where unique economics can be extracted by virtue of meeting unique needs (for example, regulatory capital relief structures for banks or unique securitisation arrangements for non-bank lenders or other types of corporates). INVESTOR APPLICATIONS OF COMBINED PUBLIC AND PRIVATE DEBT PORTFOLIOSA product or mandate offering a combined public/private debt strategy can be suitable for a range of investment objectives. These include: 1. Absolute return or higher targeted alpha strategiesBroad and flexible strategies tend to lend themselves to higher absolute or relative return objectives, as the expansive opportunity set naturally presents more possibilities. In addition, as any solution offering a meaningful private debt allocation is very unlikely to offer daily liquidity unless it is prepared to take significant fund lock-up risk, the greater flexibility public/private mandates have in deploying capital can help make absolute-return objectives more achievable, particularly if interest rates rise and credit spreads widen through avoiding redemption risk at the worst possible time and thus enabling higher conviction investing during times of market stress. 2. Liability-aware strategies or goal-based investment approachesFor investors operating in a liability-hedging framework or managing portfolios designed to fund certain future spending objectives at points in time (goals-based investing), public/private debt portfolios offer a number of advantages. For many of these portfolios, this type of highly opportunistic strategy can help generate additional returns and income as a complement to the liquid, high-quality investments held to match those liabilities or goals. In addition, given that many such portfolios have less need for current liquidity than traditional portfolios, we believe that a public/private combination can be beneficial to target higher income and returns and thus drive higher plan funding levels or probability of meeting the specified goal. 3. As a complement to core fixed incomeWith an environment of low interest rates, relatively low credit spreads and potentially declining diversification benefits from duration exposure, we believe investors also should consider an opportunistic-type allocation as a complement to their core strategies. Introducing private debt via a combined public/private portfolio can offer investors modest exposure to this market segment - and its potentially higher income and return levels and diversification benefits - without the complexity and with greater liquidity than a separate private debt allocation would demand. 4. As an alternative to traditional credit strategiesCombined public/private portfolios in one strategy potentially can be used as part of a long-term allocation strategy, allowing managers to deploy capital into private debt opportunistically over an extended period of time whilst maximising carry from public markets and benefiting from the market intelligence and a consistent approach to relative value assessment obtained through activities in both markets. With relatively low yields currently available in public markets, this type of unhurried approach may prove attractive to some investors. CONCLUSIONSThe traditional way of looking at both equity and fixed income asset classes is to divide them strictly along public and private market lines, and to allocate to separate strategies accordingly. While the nature of private equity favours highly binary and time-dependent liquidity profiles, hindering the ability to dynamically allocate across asset classes holistically from a relative value perspective in the same portfolio, the divide in liquidity between public and private credit is much more blurred. Furthermore, the liquidity premium itself has characteristics of being its own asset class from a diversification perspective, applying to both public and private debt assets, and time varying in quantum across the cycle. As demonstrated above, these asset classes have complementary qualities that can be exploited to efficiently manage exposures throughout the cycle, while building a portfolio that provides diversification and yield premium relative to traditional fixed income. Furthermore, an allocation to both public and private credit within a single portfolio management approach maximises an investor's ability to take advantage of dislocations across both markets. Co-authored by: Sam Morris, CFA - Senior Investment Specialist, Fidante Partners & |

|

Funds operated by this manager: |

15 Feb 2022 - Performance Report: Cyan C3G Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Cyan C3G Fund is based on the investment philosophy which can be defined as a comprehensive, clear and considered process focused on delivering growth. These are identified through stringent filter criteria and a rigorous research process. The Manager uses a proprietary stock filter in order to eliminate a large proportion of investments due to both internal characteristics (such as gearing levels or cash flow) and external characteristics (such as exposure to commodity prices or customer concentration). Typically, the Fund looks for businesses that are one or more of: a) under researched, b) fundamentally undervalued, c) have a catalyst for re-rating. The Manager seeks to achieve this investment outcome by actively managing a portfolio of Australian listed securities. When the opportunity to invest in suitable securities cannot be found, the manager may reduce the level of equities exposure and accumulate a defensive cash position. Whilst it is the company's intention, there is no guarantee that any distributions or returns will be declared, or that if declared, the amount of any returns will remain constant or increase over time. The Fund does not invest in derivatives and does not use debt to leverage the Fund's performance. However, companies in which the Fund invests may be leveraged. |

| Manager Comments | The Cyan C3G Fund has a track record of 7 years and 6 months and has outperformed the ASX Small Ordinaries Total Return Index since inception in August 2014, providing investors with an annualised return of 13.69% compared with the index's return of 8.08% over the same period. On a calendar year basis, the fund has experienced a negative annual return on 2 occasions in the 7 years and 6 months since the start of its track record. Over the past 12 months, the fund's largest drawdown was -11.61% vs the index's -9.14%, and since inception in August 2014 the fund's largest drawdown was -36.45% vs the index's maximum drawdown over the same period of -29.12%. The fund's maximum drawdown began in October 2019 and lasted 1 year and 4 months, reaching its lowest point during March 2020. The Manager has delivered these returns with 0.07% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 five times over the past five years and which currently sits at 0.79 since inception. The fund has provided positive monthly returns 85% of the time in rising markets and 40% of the time during periods of market decline, contributing to an up-capture ratio since inception of 67% and a down-capture ratio of 57%. |

| More Information |

15 Feb 2022 - Performance Report: Bennelong Twenty20 Australian Equities Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | |

| Manager Comments | The Bennelong Twenty20 Australian Equities Fund has a track record of 12 years and 3 months and has outperformed the ASX 200 Total Return Index since inception in November 2009, providing investors with an annualised return of 10.88% compared with the index's return of 7.78% over the same period. On a calendar year basis, the fund has experienced a negative annual return on 3 occasions in the 12 years and 3 months since the start of its track record. Over the past 12 months, the fund's largest drawdown was -8.84% vs the index's -6.35%, and since inception in November 2009 the fund's largest drawdown was -26.09% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in February 2020 and lasted 9 months, reaching its lowest point during March 2020. The fund had completely recovered its losses by November 2020. The Manager has delivered these returns with 0.53% more volatility than the index, contributing to a Sharpe ratio which has fallen below 1 five times over the past five years and which currently sits at 0.67 since inception. The fund has provided positive monthly returns 96% of the time in rising markets and 7% of the time during periods of market decline, contributing to an up-capture ratio since inception of 125% and a down-capture ratio of 97%. |

| More Information |

15 Feb 2022 - Public & private - perfecting the blend - Part 1

|

Public & private - perfecting the blend - Part 1 (Adviser & wholesale investors only) CIP Asset Management December 2021 The structure and valuations of fixed income markets have changed dramatically over the past decade or so. Most obviously, interest rates have decreased dramatically and the compensation for taking traditional forms of fixed income risk have declined in tandem. Some of these changes may unwind as we enter a world of higher inflation and withdrawal of central bank stimulus measures over the coming years, but other changes are much more structural in nature. In particular, regulations requiring banks to hold more capital are likely to persist, with an enduring impact being a withdrawal of banks from competing in certain types of lending and reducing their balance sheet commitments to liquidity provision in public credit markets during times of stress. This is creating both challenges and opportunities for asset managers and their investors as alternative sources of credit provision whilst navigating a disrupted liquidity environment and low returns for their traditional liquid bond portfolios. As such, institutional and retail investors have been forced to adjust their approach to fixed income because of these changing dynamics, with the embrace of private debt markets alongside exposure to traditional public credit allocations in an effort to boost returns. Private debt is a complex asset class that can offer a differentiated opportunity set with unique return, risk, liquidity, and diversification benefits. Part 1 of this paper will explore the issues above and, while Part 2 will examine how co-mingling public and private credit in a single portfolio can offer a solution to many of these issues and may offer one of the best opportunities to maximise the potential of each. Distinguishing between public and private debtPrivate credit is often also referred to as "direct lending" or "private lending" or even "alternative credit." Irrespective of the name, they are basically loans to borrowers originated directly by a non-bank asset manager rather than via an intermediary. Unlike traditional bond issues or even syndicated loans (such as US term and leveraged loans), there is little intermediation between borrower and lender. The lender basically arranges the loan to hold it, rather than originating to sell it. As such, the borrower and the lender have a much closer and more transparent relationship, directly negotiating the terms of the finance. In a recent Economist magazine special report on the asset management industry, one of their concluding forecasts was that private debt would become an increasingly important asset class. As the Economist notes,

Private debt is now a significant subset of broader credit markets globally. Underlying exposures include private loans to mid-size or non-listed corporates (often backed by private equity sponsors), commercial, industrial and residential real estate loans that sit outside the risk appetite of the banking sector, as well as loans secured by securitised assets such as mortgages, other loan receivables (particularly from non-bank lenders) or 'alternative' cashflow streams such as royalty streams, insurance premiums or solar panel lease payments. A key distinction-and advantage-across many types of private debt is the ability to customise lending terms thus exercise greater control over credit risk protection compared to public markets. Private credit investors can influence or dictate elements such as coupon and principal payment schedule (amortisation), loan covenants, information access and control rights, tailoring investments to their desired liquidity, return and credit risk profile. In addition, this customisation does not come at the expense of returns. By not introducing an intermediary to arrange the transaction, the fees otherwise paid to the arranger can be shared between borrower and lender, enhancing the overall return profile of the investment relative to syndicated transactions. Australia remains a relatively nascent market compared to offshore growth in private debt assets and corporate credit generally. But this comes with significant advantages due to the lack of competition from asset managers bidding down yields and credit protections to obtain deal flow means that underwriting standards and margins remain strong.

Sources: Private debt investor, Prequin, CIPAM Estimates What is the Illiquidity premium and why does it exist?Any risk premium in investing can be thought of as a transfer of economic rents from risk avoiders to risk takers. In equities, for example, there is a strong, academically established risk premium for investing in small cap companies. This is theorised to exist because these stocks often have less liquidity stemming from their lower overall market capitalisations and lower free float for external shareholders as well as less diversified revenue streams and/or robust balance sheets. In many respects, similar arguments can be made for the existence of a higher rate of return expectation for private debt over public credit.

This means that borrowers who obtain financing from such sources must pay a higher interest rate for a given level of implied credit risk to lenders, who need that higher rate of return to justify their reduced flexibility in managing their investment. Thus, by comparing the rate paid between private debt and public debt at the same assumed credit rating or risk level, one can establish a proxy for the quantum of the illiquidity premium. Term Adjustment based on difference between 5 and 3 year discount margins for Credit Suisse Leveraged Loan index. Rating Adjustment based on difference between the Credit Suisse Leveraged Loan index. Currency Adjustment based on the short term rolling cross currency basis of 10 basis points less the cost of holding 10% in liquids at a cost of 4% for hedging purposes. All figures based on 31 December, 2020. But this does not explain why borrowers choose to, or are forced to, access private debt financing in the first place. The Structural Decline in Bank Risk AppetiteObviously a structural decline in bank lending to non-investment grade corporates, commercial real estate debt, non-public asset backed securities financing (such as warehouse funding facilities (2) for non-bank lenders), long-term project finance and other sub-asset classes of the private debt universe due to tighter regulatory and capital rules has decreased the options available to such borrowers. This increased cost to hold risk has meaningfully altered bank business models. As a result, banks have grown more conservative as they now must consider the risk-adjusted returns of potential loans in the context of more stringent and complex capital requirements - pushing them towards prime home loan origination at the expense of lending to businesses, for example. Changes in bank lending patterns have an important implication for investors. Bank securities-both fixed income and equity-should have different risk-return profiles going forward, as investors in bank-issued bonds and stocks are much less exposed to mid-size corporate lending and many types of real estate financing as well as fixed income trading revenue via the balance-sheet activity of their bank holdings. Source: 1 APRA, 2 Standard eligible mortgage with no mortgage insurance While these regulations have made the global banking system safer and have reduced risk to the financial system, certain risk exposures have become prohibitively expensive for traditional banks as a result of the new rules, creating a funding gap that increasingly is being filled by non-bank market participants. These regulations also have ushered in the rise of 'fintech' lending platforms and financial-disintermediation technologies that provide individuals and small businesses access to new sources of financing. Private credit is often an important source of funding for such new business models, particularly via so called 'warehouse funding' prior to them being able to securitise assets into public markets. But other factors play a role as well. The Growth in Private Equity SponsorshipFirstly, the shift toward private markets has been a consistent macro trend over the past few decades: while private markets have grown substantially during this period, the number of publicly traded companies has declined over the past 20 years. As a result, there are more private companies that require debt financing to fund their growth. Therefore, making private loans to private-equity sponsor backed companies is a big source of private debt origination in Australia and offshore.

Secondly, these borrowers are accessing private debt because they are looking for partners they can rely on to participate alongside them in a journey toward their objectives. They are also looking for some degree of flexibility or tailoring to line up the terms of their debt financing with their business objectives as well as speed and certainty of execution (particularly in a time-pressured acquisition financing scenario). Some or all of these factors are why many borrowers are willing to pay a premium over other lending alternatives. Finally, many borrowers in private credit are too small to access liquid capital markets or don't have the revenue and resources to justify paying for and supporting the due diligence of public credit ratings agencies like Fitch, Moody's and S&P or covering the significant fees of an arranger (plus all the other service providers) who are tasked with structuring and distributing a debt package. Thus, private debt markets are an attractive source of funding for acquisitions, organic growth, and scaling through capital investment outside of raising additional equity. In many ways, the making of a loan is analogous to the manufacturing of a product. In some cases it makes sense to have each stage of the manufacturing process (the due diligence, structuring, documentation and syndication) completed by a different party. But often it is more cost effective for a borrower to work with an individual lender who has internalised the manufacturing of a loan for themselves. What the borrower pays in terms of a higher interest rate is offset by the lower cost of the manufacturing process.

Source: Prequin Pro 2020, Australian Investment Council (AIC) Lastly, an important distinction between public and private markets is that private lending markets are inefficient. In public markets, arrangers effectively run an auction process to establish the lowest yield at which they can sell all of the debt. In private markets, there is generally no auction process. Often a borrower will approach a very small number of lenders (in some cases only one lender, especially where there is a long-standing relationship) and consider the overall package- timeliness, flexibility of terms, execution risk (i.e. does the lender have to syndicate some risk in order to do the full deal), quality and reputation of the lender in addition to the cost of the borrowing. This inefficiency is an opportunity for private lenders, who arguably see more deals and have a better idea of risk and return than the borrower (or the borrower's owner), to identify the best opportunities. Continued in tomorrow's Newsfeed - look for Part 2 Co-authored by: Sam Morris, CFA - Senior Investment Specialist, Fidante Partners & |

|

Funds operated by this manager: |

15 Feb 2022 - From a Stroll to a Sprint - Confronting a Faster Tightening Cycle

|

From a Stroll to a Sprint - Confronting a Faster Tightening Cycle Ardea Investment Management 31 January 2022 IIn this episode of The Ardea Alternative podcast, Laura Ryan, Tamar Hamlyn and Alex Stanley discuss interest rate rises in response to inflation and what it might mean for fixed income assets. |

|

Funds operated by this manager: Ardea Australian Inflation Linked Bond Fund, Ardea Real Outcome Fund |

14 Feb 2022 - Performance Report: Bennelong Emerging Companies Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | |

| Manager Comments | The Bennelong Emerging Companies Fund has a track record of 4 years and 3 months and therefore comparison over all market conditions and against its peers is limited. However, the fund has outperformed the ASX 200 Total Return Index since inception in November 2017, providing investors with an annualised return of 25.13% compared with the index's return of 7.89% over the same period. On a calendar year basis, the fund has experienced a negative annual return on 2 occasions in the 4 years and 3 months since the start of its track record. Over the past 12 months, the fund's largest drawdown was -10.95% vs the index's -6.35%, and since inception in November 2017 the fund's largest drawdown was -41.74% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in December 2019 and lasted 10 months, reaching its lowest point during March 2020. The Manager has delivered these returns with 15.1% more volatility than the index, contributing to a Sharpe ratio which has fallen below 1 three times over the past four years and which currently sits at 0.88 since inception. The fund has provided positive monthly returns 83% of the time in rising markets and 38% of the time during periods of market decline, contributing to an up-capture ratio since inception of 298% and a down-capture ratio of 117%. |

| More Information |

0

0