NEWS

18 Feb 2022 - Hedge Clippings |18 February 2022

|

|

|

|

Hedge Clippings | Friday, 18 February 2022 The world's a dangerous place, with Russia poised to invade Ukraine, having threatened to do so for some time. Why else would they amass 130,000 troops on the border if they weren't going to step, or fire, over it? For details on all funds: www.fundmonitors.com Mind you, given the ASX200 only returned 9.44% in the 12 months to the end of January, compared with the return of 23.29% for the S&P500, it could be argued it was much "easier" for those funds investing locally to outperform. Only 27% of global equity funds outperformed the respective index. As usual, the numbers re-enforce the value of stock-picking vs. index funds, and of course manager and fund selection, along with appropriate diversification, not only across manager and fund but also strategy, asset class, and geographic mandate. News & Insights Manager Insights | Equitable Investors Manager Insights | Magellan Asset Management |

|

|

January 2022 Performance News Glenmore Australian Equities Fund Insync Global Quality Equity Fund Bennelong Long Short Equity Fund Paragon Australian Long Short Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

18 Feb 2022 - Performance Report: Insync Global Capital Aware Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Insync invests in a concentrated portfolio of high quality companies that possess long 'runways' of future growth benefitting from Megatrends. Megatrends are multiyear structural and disruptive changes that transform the way we live our daily lives and result from a convergence of different underlying trends including innovation, politics, demographics, social attitudes and lifestyles. They provide important tailwinds to individual stocks and sectors, that reside within them. Insync believe this delivers exponential earnings growth ahead of market expectations. The fund uses Put Options to help buffer the depth and duration that sharp, severe negative market impacts would otherwide have on the value of the fund during these events. Insync screens the universe of 40,000 listed global companies to just 150 that it views as superior. This includes profitability, balance sheet performance, shareholder focus and valuations. 20-40 companies are then chosen for the portfolio. These reflect the best outcomes from further analysis using a proprietary DCF valuation, implied growth modelling, and free cash flow yield; alongside management, competitor, and industry scrutiny. The Fund may hold some cash (maximum of 5%), derivatives, currency contracts for hedging purposes, and American and/or Global Depository Receipts. It is however, for all intents and purposes, a 'long-only' fund, remaining fully invested irrespective of market cycles. |

| Manager Comments | The Insync Global Capital Aware Fund has a track record of 12 years and 4 months and has outperformed the Global Equity Index since inception in October 2009, providing investors with an annualised return of 12.18% compared with the index's return of 11.99% over the same period. On a calendar year basis, the fund has experienced a negative annual return on 2 occasions in the 12 years and 4 months since the start of its track record. Over the past 12 months, the fund's largest drawdown was -6.76% vs the index's -3.04%, and since inception in October 2009 the fund's largest drawdown was -10.98% vs the index's maximum drawdown over the same period of -13.59%. The fund's maximum drawdown began in September 2018 and lasted 7 months, reaching its lowest point during December 2018. The Manager has delivered these returns with 0.48% more volatility than the index, contributing to a Sharpe ratio which has consistently remained above 1 over the past five years and which currently sits at 0.93 since inception. The fund has provided positive monthly returns 81% of the time in rising markets and 24% of the time during periods of market decline, contributing to an up-capture ratio since inception of 59% and a down-capture ratio of 71%. |

| More Information |

18 Feb 2022 - Performance Report: Airlie Australian Share Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund is long-only with a bottom-up focus. It has a concentrated portfolio of 15-35 stocks (target 25). The fund has a maximum cash holding of 10% with an aim to be fully invested. Airlie employs a prudent investment approach that identifies companies based on their financial strength, attractive durable business characteristics and the quality of their management teams. Airlie invests in these companies when their view of their fair value exceeds the prevailing market price. It is jointly managed by Matt Williams and Emma Fisher. Matt has over 25 years' investment experience and formerly held the role of Head of Equities and Portfolio Manager at Perpetual Investments. Emma has over 8 years' investment experience and has previously worked as an investment analyst within the Australian equities team at Fidelity International and, prior to that, at Nomura Securities. |

| Manager Comments | The Airlie Australian Share Fund has a track record of 3 years and 8 months and therefore comparison over all market conditions and against its peers is limited. However, the fund has outperformed the ASX 200 Total Return Index since inception in June 2018, providing investors with an annualised return of 12.05% compared with the index's return of 7.9% over the same period. On a calendar year basis, the fund has experienced a negative annual return on 2 occasions in the 3 years and 8 months since the start of its track record. Over the past 12 months, the fund's largest drawdown was -6.59% vs the index's -6.35%, and since inception in June 2018 the fund's largest drawdown was -23.8% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in February 2020 and lasted 9 months, reaching its lowest point during March 2020. The Manager has delivered these returns with 0.36% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 two times over the past three years and which currently sits at 0.76 since inception. The fund has provided positive monthly returns 100% of the time in rising markets and 14% of the time during periods of market decline, contributing to an up-capture ratio since inception of 114% and a down-capture ratio of 92%. |

| More Information |

18 Feb 2022 - Performance Report: Glenmore Australian Equities Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The main driver of identifying potential investments will be bottom up company analysis, however macro-economic conditions will be considered as part of the investment thesis for each stock. |

| Manager Comments | The Glenmore Australian Equities Fund has a track record of 4 years and 8 months and therefore comparison over all market conditions and against its peers is limited. However, the fund has outperformed the ASX 200 Total Return Index since inception in June 2017, providing investors with an annualised return of 23.26% compared with the index's return of 8.27% over the same period. On a calendar year basis, the fund has only experienced a negative annual return once in the 4 years and 8 months since the start of its track record. Over the past 12 months, the fund's largest drawdown was -7.62% vs the index's -6.35%, and since inception in June 2017 the fund's largest drawdown was -36.91% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in October 2019 and lasted 1 year and 1 month, reaching its lowest point during March 2020. The fund had completely recovered its losses by November 2020. The Manager has delivered these returns with 7.08% more volatility than the index, contributing to a Sharpe ratio which has fallen below 1 two times over the past four years and which currently sits at 1.04 since inception. The fund has provided positive monthly returns 92% of the time in rising markets and 39% of the time during periods of market decline, contributing to an up-capture ratio since inception of 233% and a down-capture ratio of 101%. |

| More Information |

18 Feb 2022 - Carbon, Slavery and Poker

|

Carbon, Slavery and Poker Longwave Capital Partners January 2022 Efficiently adapting an integrated ESG investment process to new information inputs is essential for investors. Richer information helps us identify hidden risks in company operations and focus our engagement on weak actors. In 2021, we enhanced our in-house ESG scorecards with carbon emissions and modern slavery information and learnt a few things along the way. AGM voting season prompted us to wonder if some companies deserve a meme song: If you don't spill me baby I'll do anything I want. One of the persistent aspects of investing over the long term is that information inputs morph in response to corporate trends and regulatory reporting requirements. Investment processes need to adapt to this new information when it's relevant to investment decisions. With this in mind, Longwave was founded with the intention of always keeping an eye on the horizon and adapting to new information inputs. Our core investment philosophy never changes (that Quality small cap companies outperform over the long term). But we recognise that if we can systematically capture new information early, it may enrich or enhance our decision making on the fundamental side of our investment process. This need to adapt to new information is most obvious at the nexus of an integrated ESG approach. At the beginning of 2021 we observed the following changes in the ESG information landscape: carbon emissions data had significantly improved for small caps; companies have started to report their Modern Slavery approach and Sustainable Development Goals have started to turn up in company annual report commentary. At Longwave, our fundamental stock valuations are directly impacted by ESG scores. As more information becomes available, our research management tooling has enabled us to bring in new data and adapt our scorecards as the information landscape morphs. With this in mind, we set out at the beginning of 2021 to enhance our ESG scorecards with information on Carbon Emissions, Modern Slavery statements and SGD's. We love learning new things about companies and this ESG enhancement is no exception. In this report we share what we set out to do and what we learned and a few thoughts about how we think the information needs of ESG focused investors are likely to change in the next couple of years. Carbon We've believed for many years that the early 2020's would eventually be the turning point in the markets' focus and understanding of the gargantuan global task that climate change transition represents. One of our ESG goals for 2021 was to be able to measure Scope 1 and 2 emissions reliably and accurately across our portfolio. Up until this year, accurate GHG emissions data for small-cap companies has been hard to come by and very few companies have been reporting emissions. Our analytical needs are multiple and sit at both the portfolio and company level. We need to be able to:

This year a dataset with reported and relatively high confidence estimates became available for the small-cap universe. We incorporated it into our research management platform and using that as a base, have cross-checked it against reported information and started a conversation with some of the larger companies in the small-cap universe who appear to be outliers. As always with data projects, we learnt a few things during the process:

We are now able to see (at the click of a button) the Weighed Average Carbon intensity of our portfolio vs the index both at the aggregate, sector and company level. We were pleased to see that the portfolio carbon intensity is lower than the index without having expressly controlled for emissions.

We are also able to track changes in intensity through time. Finally, we used this as an opportunity to think about how the data might be used to reward companies that are making a genuine difference to climate change transition. If we think from first principals about what has to change between 2020 and 2050, companies with emissions intensive operations will need to invest in their asset bases (probably out-of-cycle) to lower their emissions intensity. The role financial markets play in that equation is to both provide the capital necessary for the transition and to reward the improvers with a lower cost of capital. Alongside a transition of the existing asset base, financial markets have a role to play in funding new technology solutions in a range of energy market and industrial equipment verticals. When we look at the Australian small cap universe, the companies with the lowest emissions intensity tend to be in that position naturally (due to business model or industry). As a result, they are unlikely to ever have a significant role to play in moving the economy further towards net-zero. Holding a portfolio of these carbon-light businesses might feel good, but in practical terms, your incremental capital investment (reinvested profit sitting inside each company you own) isn't actually being spent on the effort to transition to net-zero. On the other hand, some of the more emissions intensive businesses (such as Viva Energy) have a significant role to play in transitioning their asset base to net-zero and in the absence of government policy can choose to invest or not invest. We think companies who have higher emissions intensity but show big improvements year on year because they're investing incremental capital to facilitate transition should be rewarded for their efforts. And we think investors who truly want to ensure their money is contributing to transition in the most impactful way should be thinking about how their captive incremental dollar of capital spend is being put to work. Over 2022 and beyond we will use our new dataset to explore these ideas further. Modern Slavery In 2018 the Australian Government passed the Modern Slavery act. Any business with revenues over $100m is required to prepare a modern slavery report that outlines risk of exposure to modern slavery in the operations and supply chains of the company. These reports are supplied to the Australian Government and are generally made public on company websites. Our objective in incorporating Modern Slavery into our Social scorecard in 2021 was to analyse the statements produced by our portfolio holding companies and understand how each company identifies and manages the risks. Modern Slavery is what we think of as a slow-burn hidden reputational risk. A public exposure of particularly bad corporate actors has the potential to lead to large customer boycotts, fines or the need to re-point a global supply chain to higher cost suppliers. A better understanding of just how focused a company might be on these hidden risks can help us avoid or weight the portfolio away from companies with higher exposure. We are now able to see at the portfolio level, what percentage of our portfolio isn't reporting on modern slavery. We will use this to guide some of our ESG engagement in 2022.

We are also able to see the categorisation of our portfolio (and each company) into high, low and unknown risk. Again, this will help us form targeted engagement in 2022.

This process was rich with learning outcomes:

We will use these learnings to further enhance our qualitative data capture on modern slavery over 2022. Proxy Voting Observations And finally to Poker. We are often blown away by the greed which can be on show in the annual ritual of renumeration reports and votes. Philosophically, we believe that its fine for management to be paid for performance, but our active voting policy clearly spells out that we need to see appropriate and transparent hurdles. What's unique about Australia is that shareholders have the 2-strikes and a board spill tool at their disposal (if greed morphs into avarice). Nine companies in our systematic portfolio this year had board-spill motions put to shareholders. But within that 9, three stood out and prompted a discussion of what we term board-spill poker. Board-spill poker is when a board decide (after a first strike), to make either minor or no changes to the renumeration structure and put it back to shareholders. We can only assume they are intending to call the bluff of the shareholder base (most likely under pressure from founder managers). The remuneration report votes are advisory only, so if shareholders are unwilling to use the consequence option as it was intended, it's a toothless tool. In the absence of material personal consequences for being 'bad actors', the renumeration practices can continue unabated. By way of example, a well known retail company received a 41% AGAINST vote to its renumeration report (second strike), but a full 95% of investors voted AGAINST the board-spill motion. We are happy to say that Longwave was in the 5% of investors who decided that a consequence tool needs to be used. We will be interested to see the 2023 cycle of renumeration reports from these companies, but we wouldn't be surprised if there is no material change to their renumeration practices. Some of the significant vote issues we dealt with over the primary AGM season included 3 board spills, 2 shareholder resolutions and a range of renumeration structures that didn't meet our standards. A healthcare company we own continued to increase the CEO's base salary above inflation, despite having awarded an extremely large LTI package in 2019, followed by a 75% base salary increase in FY20 and large one-off retention bonuses. We had voted for the CEO LTI package two years ago, however we believe base salary increases continued to be excessive. We felt if didn't vote for a spill motion, the directors were unlikely to listen to a significant shareholder issue. A resources company we own put the same renumeration framework to shareholders 2 years in a row after a 93% vote against the Rem report in 2020. The board spill was an easy decision to make; there had been no change to the company's remuneration framework compared to the prior years and it really did solidify our concerns about board independence. We subsequently voted for board candidates (a mix of independent and major shareholder aligned) who we think will better align the renumeration structures to the economic interests of shareholders. Another resources company we own had a shareholder resolution put up that would have required the company to disclose, in subsequent annual reporting, a plan that demonstrates how the company's capital expenditure and operations for its coal assets will be managed in a manner consistent with a scenario in which global energy emissions reach net zero by 2050. We voted FOR this resolution as we believe that improved understanding of financial scenarios for capital allocation and cash flows back to shareholders under a net zero by 2050 scenario would be useful. It prompted us to think about a world in which coal asset-owners publicly publish their responsible shutdown plans matched to transition and how that might impact pricing of the equity. Unfortunately, the resolution was defeated. Finally, a founder-led telecommunications business we own sought to issue options to non-executive and executive directors because of the dilution they had suffered after successive capital-raises to fund the company's acquisitive growth strategy. The board of this company is non-independent. Executives and NED's are adequately cash compensated, and Executives also have in place adequate STI and LTI structures. We voted against this options issuance as we didn't believe the options were appropriate for directors. Options create alignment differences with shareholders which may compromise independence. Additionally, the reason proposed was to counter equity dilution from new acquisitions directors suffer - however all shareholders suffer similar dilution with no options granted, and it is the value accretion from the transaction which is required to add value over and above this dilution. Looking into 2022, as we increase our standards and engagement on environmental and social issues we may use director voting as a way of communicating a lack of action by boards on these matters. Written By Melinda White, Equity Portfolio Manager |

|

Funds operated by this manager: |

18 Feb 2022 - Everyday Respect: Rio Tinto's harmful workplace culture

|

Everyday Respect: Rio Tinto's harmful workplace culture (Adviser & wholesale investors only) Alphinity Investment Management 08 February 2022 Workplace harassment is a serious concern that prevails across the Australian miners. In February 2022, Rio Tinto (RIO) published the findings of an independent review of its workplace culture, a project it pro-actively commissioned in March 2021 to assess whether harmful, discriminatory behaviour occurred within its operations, and if so its extent. The eight-month study was conducted by former Australian Sex Discrimination Commissioner Elizabeth Broderick. It consisted of more than 10,000 people sharing their personal experiences via online surveys as well as 100 group listening sessions, 85 confidential individual listening sessions and close to 140 individual written submissions. We acknowledge the bravery of all the individuals who raised their voices and shared their stories. As shareholders of RIO, we commend the intent and transparency of the report, which should be a catalyst for positive change in the mining industry. Its findings are nonetheless confronting. We are saddened and disappointed by the extent of the bullying, harassment and racism revealed in the review. The report indicates these behaviours are systemic across the organisation, suggesting a broader cultural failing among its Australian mining company peers. Reading the statistics alongside witness recounts emphasises the severity of the problem: 28% of women and 7% of men have experienced sexual harassment at work; 21 women reported actual or attempted sexual assault; and 40% of men and 32% of women identifying as Aboriginal or Torres Strait Islander had experienced racism, as well as discrimination reported against other ethnicities. RIO's workforce is still close to 80% male despite efforts to increase diversity. While the report itself is deeply concerning, we give RIO, and particularly its renewed board and senior management team, credit for proactively launching such a comprehensive examination. The report is not just an act of transparency by RIO: the purpose of the 26 recommendations in its Framework for Action is to demonstrate the company's intent to propagate cultural change well into the future. As investors, the insights and recommendations are eye-opening and will prove valuable in our engagements with RIO and with other companies. Being the first of the Australian mining companies to publish its findings, the degree of media attention and criticism of the report is unsurprising. However, these issues do not appear to be confined to RIO alone. For example, BHP revealed last August that is had terminated 48 employees in the previous two years over sexual harassment claims. Last year's Western Australian parliamentary inquiry into the treatment of women at fly-in-fly-out mine sites received many submissions from mining companies, oil and gas companies, unions and other organisations involved in the industry. This suggests the issues are sadly widespread. Balancing our engagement tone We believe it is important that investors are careful in how they engage with companies that transparently report on difficult topics. If investors are too critical, it will likely deter further disclosures and honest discussion on problems and solutions. It could also discourage other companies from sharing detailed reports. But rewarding disclosure alone, without providing constructive feedback and continuing to engage and monitor progress, won't necessarily drive improvement. It is a double-edged sword and we need to think deeply when deciding how to respond. Instead of striking the messenger, we believe we should recognise RIO's courage in its transparency, focus on fully assessing the situation, and just as importantly, consider the actions that will substantively address the issues raised. So, what next? Evidence suggests that these issues are not confined to RIO alone. We therefore expect that other miners, mining service providers, and oil and gas companies should consider the findings of the report, and implement similar reviews into their own cultures. As investors, we see the findings from the RIO report as an opportunity for us to:

We have since conveyed a letter to investee companies in the mining, oil and materials sector, and others that might face similar issues. It introduced our concerns with the report findings and intent to open the conversation on culture and safety in upcoming engagements. We view this as a chance to raise the bar on how workplace culture is addressed in the resources industry and in Australia more broadly. Attitudes towards heritage management were transformed after the Juukan Gorge incident in 2020, and we now hope to see a similar material shift in the way the management of sexual harassment, bullying and discrimination is approached. Author: Moana Nottage, ESG and Sustainability Specialist |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Sustainable Share Fund |

17 Feb 2022 - Performance Report: Paragon Australian Long Short Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Paragon's unique investment style, comprising thematic led idea generation followed with an in depth research effort, results in a concentrated portfolio of high conviction stocks. Conviction in bottom up analysis drives the investment case and ultimate position sizing: * Both quantitative analysis - probability weighted high/low/base case valuations - and qualitative analysis - company meetings, assessing management, the business model, balance sheet strength and likely direction of returns - collectively form Paragon's overall view for each investment case. * Paragon will then allocate weighting to each investment opportunity based on a risk/reward profile, capped to defined investment parameters by market cap, which are continually monitored as part of Paragon's overall risk management framework. The objective of the Paragon Fund is to produce absolute returns in excess of 10% p.a. over a 3-5 year time horizon with a low correlation to the Australian equities market. |

| Manager Comments | The Paragon Australian Long Short Fund has a track record of 8 years and 11 months and has outperformed the ASX 200 Total Return Index since inception in March 2013, providing investors with an annualised return of 13.29% compared with the index's return of 7.85% over the same period. On a calendar year basis, the fund has experienced a negative annual return on 2 occasions in the 8 years and 11 months since the start of its track record. Over the past 12 months, the fund's largest drawdown was -15.05% vs the index's -6.35%, and since inception in March 2013 the fund's largest drawdown was -45.11% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in January 2018 and lasted 2 years and 7 months, reaching its lowest point during March 2020. The Manager has delivered these returns with 10.89% more volatility than the index, contributing to a Sharpe ratio which has fallen below 1 five times over the past five years and which currently sits at 0.57 since inception. The fund has provided positive monthly returns 69% of the time in rising markets and 46% of the time during periods of market decline, contributing to an up-capture ratio since inception of 110% and a down-capture ratio of 82%. |

| More Information |

17 Feb 2022 - Performance Report: Bennelong Long Short Equity Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | In a typical environment the Fund will hold around 70 stocks comprising 35 pairs. Each pair contains one long and one short position each of which will have been thoroughly researched and are selected from the same market sector. Whilst in an ideal environment each stock's position will make a positive return, it is the relative performance of the pair that is important. As a result the Fund can make positive returns when each stock moves in the same direction provided the long position outperforms the short one in relative terms. However, if neither side of the trade is profitable, strict controls are required to ensure losses are limited. The Fund uses no derivatives and has no currency exposure. The Fund has no hard stop loss limits, instead relying on the small average position size per stock (1.5%) and per pair (3%) to limit exposure. Where practical pairs are always held within the same sector to limit cross sector risk, and positions can be held for months or years. The Bennelong Market Neutral Fund, with same strategy and liquidity is available for retail investors as a Listed Investment Company (LIC) on the ASX. |

| Manager Comments | The Bennelong Long Short Equity Fund has a track record of 20 years and has outperformed the ASX 200 Total Return Index since inception in February 2002, providing investors with an annualised return of 13.78% compared with the index's return of 8.03% over the same period. On a calendar year basis, the fund has experienced a negative annual return on 4 occasions in the 20 years since the start of its track record. Over the past 12 months, the fund's largest drawdown was -11.29% vs the index's -6.35%, and since inception in February 2002 the fund's largest drawdown was -23.77% vs the index's maximum drawdown over the same period of -47.19%. The fund's maximum drawdown began in September 2020 and lasted 1 year and 4 months, reaching its lowest point during March 2021. The fund had completely recovered its losses by January 2022. The Manager has delivered these returns with 0.34% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 five times over the past five years and which currently sits at 0.81 since inception. The fund has provided positive monthly returns 65% of the time in rising markets and 62% of the time during periods of market decline, contributing to an up-capture ratio since inception of 6% and a down-capture ratio of -128%. |

| More Information |

17 Feb 2022 - Which retailers have weathered the market storm?

|

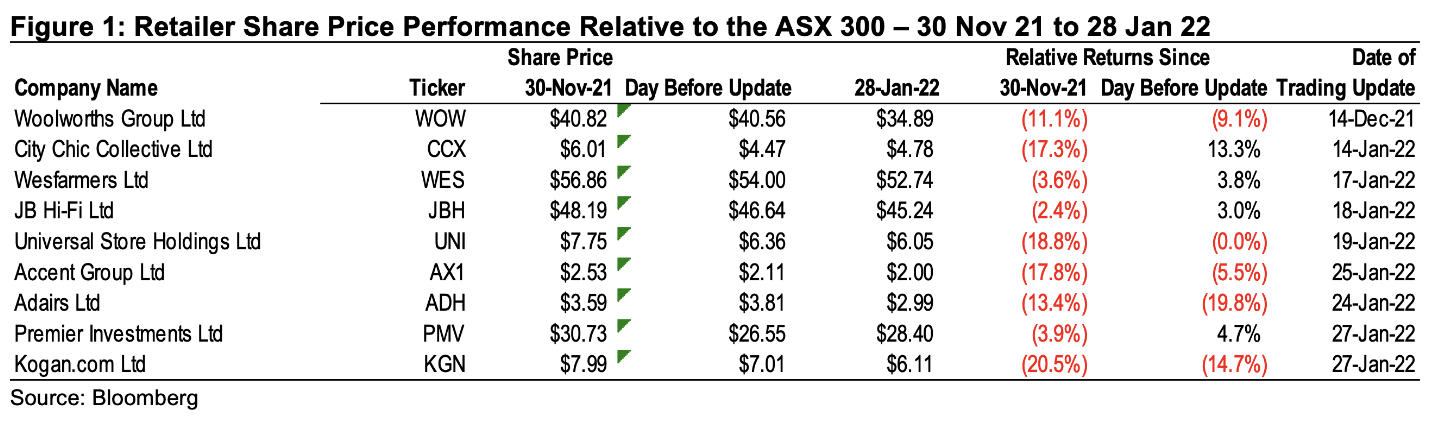

Which retailers have weathered the market storm? Montgomery Investment Management 04 February 2022 In response to recent trading updates, the share prices of many listed retailers have been hit for six. With retail sales falling short of expectations, supply chain disruptions, and the risk of excess inventories, some investors have been spooked, and have headed for the exits. Happily, the price falls have not hit every business, and it's interesting to see which retailers have won the market's approval. A number of retailers have released trading updates in the last couple of weeks. It has been a volatile period for retailers, with the 6 months starting with lockdowns in New South Wales and Victoria. The opening up of these regions was greeted by the market with an expectation of a surge in consumer spending heading into Christmas. Then the Omicron variant took hold, with self-imposed lockdowns severely reducing foot traffic in stores during the later parts of December. This was complicated by its impacts on staff availability and supply chain capacity, adding increased costs and stock availability issues to what was already going to be a period of lower than expected sales. With sales not meeting expectations, on top of a lengthened supply chain due to disruptions, the risk of excess inventories has also increased for the retailers over the last month. Looking at the performance of the retailers that have reported trading updates since mid-December, most have underperformed the market since the end of November. However, most of the underperformance occurred prior to the release of the update, highlighting that the market had already started to factor in a weakening outlook as a result of the Omicron wave. Almost half of the companies have outperformed the broader market since the release of their updates, while the larger companies have generally outperformed the small retailers.

Of course, these impacts are likely to be temporary, but the duration remains unknown at this point and the market does not like uncertainty. The City Chic and Premier Investments trading updates were better than the market feared, with sales holding up better than competitors and more limited disruptions to their supply chain to date. JB HiFi's performance through this period has been better than the market had expected with robust demand for appliances and consumer electronics, while gross margins remained well managed despite increasing freight costs. Wesfarmers noted a material impact on its Kmart and Target operations, while Catch had been impacted by inventory clearance and slowing sales growth as it cycles a difficult comparable period. There has also been a material step up in costs to manage the pandemic adding to the increased investment in the digital part of the business. Sales at Officeworks were also negatively impacted by the combination of lockdowns and omicron in the period. While the performance of these businesses was materially worse than market expectations, the other businesses within Wesfarmers' portfolio offset this deterioration, in particular its chemicals and Bunnings operations, with overall group earnings meeting market expectations. As a result, Wesfarmers has been one of the better performing retailers since the end of November. What is happening to small cap retailers?The share prices of the smaller retailers have been relatively poor performers. This is likely due in part to the more momentum driven nature of the small cap market. The trading updates from The Universal Store and Accent Group indicated that after an initial jump in sales upon reopening in November, sales in December progressively deteriorated. Like for like store sales growth was negative for both companies in December. Universal performed better than Accent through this period but conditions are likely to remain tough through January. The positive was that inventories were in line with normal levels despite the weaker sales outcome. This could deteriorate in January, but the balance sheet of both companies remains in good shape, and a pipeline of strong new store roll out reduces the risk of a build-up of excess and ageing stock. The greater risk is likely to be a shortage of stock if supply disruptions continue through the year. Adairs had been expected to hold up through December given the apparent strength in the hardware and other home categories. It reported sales that were slightly weaker than market expectations, but of greater concern was the dramatic reduction of margins in the period as a result of rising supply chain and freight costs as well as increased discounting to clear stock. Higher staff and warehouse costs created additional operating leverage along with the step up in marketing investment for the digital businesses. The market had not factored the same degree of risk into the Adairs share price. Consequently, the market reaction to the miss was far greater than for other retailers. The question is whether this overstates the medium to long term risk given that at least some of the cost increases that caused the margin miss, such as running the old distribution centre in parallel and elevated staff and freight costs, are temporary. Written By Stuart Jackson Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund |

16 Feb 2022 - Performance Report: Quay Global Real Estate Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund will invest in a number of global listed real estate companies, groups or funds. The investment strategy is to make investments in real estate securities at a price that will deliver a real, after inflation, total return of 5% per annum (before costs and fees), inclusive of distributions over a longer-term period. The Investment Strategy is indifferent to the constraints of any index benchmarks and is relatively concentrated in its number of investments. The Fund is expected to own between 20 and 40 securities, and from time to time up to 20% of the portfolio maybe invested in cash. The Fund is $A un-hedged. |

| Manager Comments | The Quay Global Real Estate Fund has a track record of 6 years and has outperformed the S&P/ASX 200 A-REIT Index since inception in January 2016, providing investors with an annualised return of 9.95% compared with the index's return of 8.03% over the same period. On a calendar year basis, the fund has experienced a negative annual return on 2 occasions in the 6 years since the start of its track record. Over the past 12 months, the fund's largest drawdown was -4.67% vs the index's -9.52%, and since inception in January 2016 the fund's largest drawdown was -19.68% vs the index's maximum drawdown over the same period of -38.29%. The fund's maximum drawdown began in February 2020 and lasted 1 year and 4 months, reaching its lowest point during September 2020. The fund had completely recovered its losses by June 2021. The Manager has delivered these returns with 8.63% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 three times over the past five years and which currently sits at 0.77 since inception. The fund has provided positive monthly returns 78% of the time in rising markets and 25% of the time during periods of market decline, contributing to an up-capture ratio since inception of 45% and a down-capture ratio of 56%. |

| More Information |

0

0