NEWS

15 Mar 2022 - Investing in infrastructure: what's changed and where are the opportunities?

|

Investing in infrastructure: what's changed and where are the opportunities? Magellan Asset Management February 2022 The last two years has seen international travel upended, domestic transport challenged, 'essential services' redefined and a growing interest in the role infrastructure can play in decarbonisation. With this backdrop, does the case for investing in global listed infrastructure still stack up? |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund |

15 Mar 2022 - Inflation is here. Set quality to max.

|

Inflation is here. Set quality to max. Loftus Peak March 2022 It was a bad month for markets all around, as the US Federal Reserve finally leaned into its job - getting inflation out of the system. Its mechanism for doing this is to raise rates to curtail demand. This impacts share markets in two key ways. First, relatively higher interest rates will be less stimulative for economic growth, which feeds its way through to corporate profits and therefore valuations. Second, higher interest rates mean higher costs of capital to business (debt and equity). All else equal, higher costs of capital will reduce the present value of a company's cashflows and therefore its share price. And the further out (in time) those cashflows are, the more they are discounted, meaning that share prices of companies which are not profitable now are very badly hit. The chart below shows -23.8% underperformance of the Russell 2000 against the S&P500 over the past year. Just over half of that underperformance was notched in the past three months. The Russell 2000 is an index of small to mid cap US companies which generally carry less financial strength - and so may be of less quality - than the larger companies that dominate the S&P500.

Source: Bloomberg This is a big divergence in outcomes for higher quality companies compared with lower quality companies, but it's even worse than that for some funds and many companies, some of which are down -50% or more. Economic growth is only part of the storyIt is more than likely that rising interest rates will temper some of the stellar growth we are seeing in companies - this is of course incrementally negative for share markets. However economic growth is not the only ingredient for success in the companies that Loftus Peak holds. We believe a larger part of the success of our holdings is driven by secular trends resulting from changing business and consumer behaviour towards better, more efficient tools and solutions. So higher interest rates might change the pace, but not the destination. It is even conceivable that some of these trends accelerate and become more ingrained during a period of depressed growth as companies look to boost profitability by cutting costs, including by automation, moving to the cloud and cutting ineffective legacy advertising. Quality takes centre stage - profitability, cashflows, balance sheetsWe never shy away from highlighting the quality of the portfolio. Irrespective of macroeconomic conditions, this has always been an integral part of the portfolio construction process, and was a decision informed by the numerous corrections and crashes the investment team has witnessed over their lifetimes. Loftus Peak invests in disruptive companies; businesses driven by secular trends and structural change. The portfolio is therefore heavily tilted towards companies with differentiated, non-commoditised products and services, resulting in business models with relatively higher margins and better profitability. In an inflationary environment, which it appears we are heading into, greater differentiation and higher margins means the ability to pass on or even absorb increased input costs. The same cannot be said for many traditional businesses that are capital intensive and run on razor-thin margins. A key component of a quality company is one that is generating positive cash flows and has additional cash on the books for good measure. Why is this important? As monetary policy tightens and interest rates go up, economic growth will temper at the same time the cost of capital begins to increase. This can be a lethal combination for companies that haven't yet established their business models or a path to profitability, because plugging the hole with debt and equity raisings is going to become much more difficult (and costly). It is for this exact reason that a majority of Loftus Peak's holdings are in quality companies - those with established business models, strong balance sheets and cashflows, with a much lower allocation to 'riskier' companies. This has always been the case, but in more recent months we have increased the tilt to quality even more than usual. The portfolio's quality tilt

We realise that our focus on quality might mean we sacrifice some additional upside when things are going well, but it also ensures our investors are protected on the downside as the dust settles and the market begins seeking out companies that are strategically positioned, with solid fundamentals, positive cashflow generation and strong balance sheets. Despite the short-term volatility and underperformance of a select few names, we believe the Fund is well positioned for a period marked by slowing economic growth and rising costs of capital because of the inherent characteristics of disruptive companies and our portfolio construction process, which leans heavily toward strong balance sheets and business models, so is high on quality. Despite macro headwinds, disruption marches on… For Tesla, competitors are comingTesla is currently valued at more than double that of the entire global car industry (excluding itself, or course). While not wishing to in any way minimise Elon Musk's inestimable impact on these car makers (and the fossil fuels on which they run) it is simply not credible that the existing industry will not fight back. The table below shows the market share of the top ten car makers by production of electric vehicles. Generally, these sales represent only a small fraction of the car companies' overall output across internal combustion engines, but the takeaway is simple - Tesla has just 20% of the total market share in EV's worldwide.

Source: Morgan Stanley Take VW as an example, which since we wrote in our piece title "VW's car accident; don't waste a crisis" in Sept 2015, now has 10% of the battery electric vehicle market share. The company has not one but two battery technology pioneer companies in its orbit - Quantumscape and its US 24M, the latter of which is reportedly capable of energy density (kilowatt hours/kilogram) around 50% higher than Tesla. As we said in our piece . Another data point: The Wall Street Journal in January carried a review of BMW's new electric 4 series. "After a couple hundred kilometers soaring across Bavarian fairyland, here's my capsule review: glorious. Sweet, swift, swank, swell, fast as hell, hushed as a chapel, cool as marble. With its front and rear e-motors providing a digitally mastered 536 hp to the wheels, the i4 M50 accelerates like Derby Lane's electric rabbit-0-60 mph in 3.7 seconds. It's too bad earlier generations of car reviewers have squandered the phrase "corners like it's on rails," because the i4 M50 really does."

The 2022 BMW i4 M50 all-electric luxury sedan capable of 227-270 miles of range between charges and DC fast-charging capacity up to 200 kW. Source: BMW December quarter earnings highlight the resilience of secular trendsLast month we wrote extensively on the importance of semiconductors as the bedrock for much of the disruption and secular trends we are witnessing. Since then, many of our semiconductor companies have reported strong results driven by robust demand in their respective end markets (consumer - phones, cars, other devices - industrials and more). Many of our other core holdings - still beneficiaries of semiconductor advances - such as Apple, Amazon, Google and Microsoft all reported results that beat the market's subdued expectations. It is positive results like these that add to the conviction we have in the long-term secular trends we are exposing our clients to. Although the short term might remain volatile and uncertain, we believe that over the medium and long term the safest place to be is in quality companies riding secular tailwinds. As a reminder, those secular tailwinds include 5G and the Internet of Things, cloud computing, digital advertising, ecommerce, streaming, electrification and importantly the semiconductors underpinning it all. We do not believe the strong results will end here. Funds operated by this manager: |

14 Mar 2022 - Performance Report: Surrey Australian Equities Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Investment Manager follows a defined investment process which is underpinned by detailed bottom up fundamental analysis, overlayed with sectoral and macroeconomic research. This is combined with an extensive company visitation program where we endeavour to meet with company management and with other stakeholders such as suppliers, customers and industry bodies to improve our information set. Surrey Asset Management defines its investment process as Qualitative, Quantitative and Value Latencies (QQV). In essence, the Investment Manager thoroughly researches an investment's qualitative and quantitative characteristics in an attempt to find value latencies not yet reflected in the share price and then clearly defines a roadmap to realisation of those latencies. Developing this roadmap is a key step in the investment process. By articulating a clear pathway as to how and when an investment can realise what the Investment Manager sees as latent value, defines the investment proposition and lessens the impact of cognitive dissonance. This is undertaken with a philosophical underpinning of fact-based investing, transparency, authenticity and accountability. |

| Manager Comments | The Surrey Australian Equities Fund has a track record of 3 years and 9 months and therefore comparison over all market conditions and against its peers is limited. However, the fund has underperformed the ASX 200 Total Return Index since inception in June 2018, providing investors with an annualised return of 6.98% compared with the index's return of 8.33% over the same period. On a calendar year basis, the fund hasn't experienced any negative annual returns in the 3 years and 9 months since its inception. Over the past 12 months, the fund's largest drawdown was -15.32% vs the index's -6.35%, and since inception in June 2018 the fund's largest drawdown was -26.75% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in February 2020 and lasted 6 months, reaching its lowest point during March 2020. The fund had completely recovered its losses by August 2020. The Manager has delivered these returns with 4.87% more volatility than the index, contributing to a Sharpe ratio which has fallen below 1 three times over the past three years and which currently sits at 0.4 since inception. The fund has provided positive monthly returns 81% of the time in rising markets and 7% of the time during periods of market decline, contributing to an up-capture ratio since inception of 110% and a down-capture ratio of 112%. |

| More Information |

14 Mar 2022 - Performance Report: Bennelong Emerging Companies Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | |

| Manager Comments | The Bennelong Emerging Companies Fund has a track record of 4 years and 4 months and therefore comparison over all market conditions and against its peers is limited. However, the fund has outperformed the ASX 200 Total Return Index since inception in November 2017, providing investors with an annualised return of 24.45% compared with the index's return of 8.27% over the same period. On a calendar year basis, the fund has experienced a negative annual return on 2 occasions in the 4 years and 4 months since its inception. Over the past 12 months, the fund's largest drawdown was -11.38% vs the index's -6.35%, and since inception in November 2017 the fund's largest drawdown was -41.74% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in December 2019 and lasted 10 months, reaching its lowest point during March 2020. The fund had completely recovered its losses by October 2020. The Manager has delivered these returns with 14.98% more volatility than the index, contributing to a Sharpe ratio which has fallen below 1 four times over the past four years and which currently sits at 0.86 since inception. The fund has provided positive monthly returns 81% of the time in rising markets and 38% of the time during periods of market decline, contributing to an up-capture ratio since inception of 286% and a down-capture ratio of 117%. |

| More Information |

14 Mar 2022 - Inflation, interest rates and equities: the big question

|

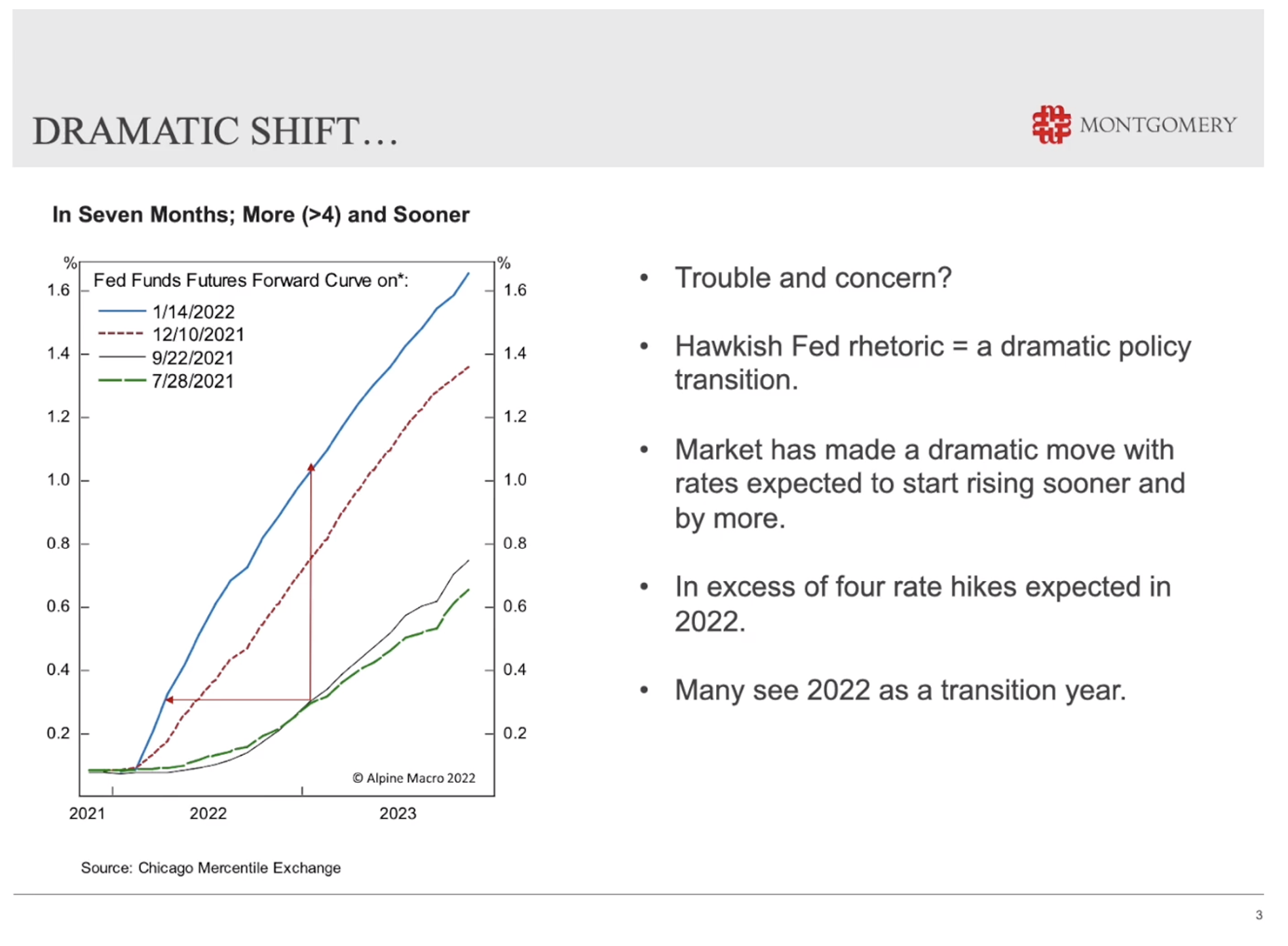

Inflation, interest rates and equities: the big question Montgomery Investment Management February 2022 Roger Montgomery (00:07): It is February 2022. And over the next few minutes, I'm going to address the question that is probably on the minds of most investors at the moment, and that is the interaction between inflation, short term interest rates, and equities. And what we'd like to do is present an argument that suggests that consensus may have their expectations with respect to inflation and interest rates wrong. If that's the case, then there is a very good argument for buying some of the beaten up stocks that have seen their PEs contract substantially over the last month or month and a half. With that in mind, it's very important to appreciate that we are going to be mentioning some individual company names. Roger Montgomery (00:56): This isn't a recommendation to buy those companies. In fact, we recommend only that you take personal professional advice. The last seven months or so has seen a substantial step change in interest rate expectations as a consequence of the appearance of inflation in the United States and around the world. You can see on this particular chart going back all the way to July last year 2021, that green dash line is a representation of where interest rates were expected to be back then. And you can see that since then moving to the blue line, not only have our interest rates expected to be higher, but they're expected to move sooner and more steeply.

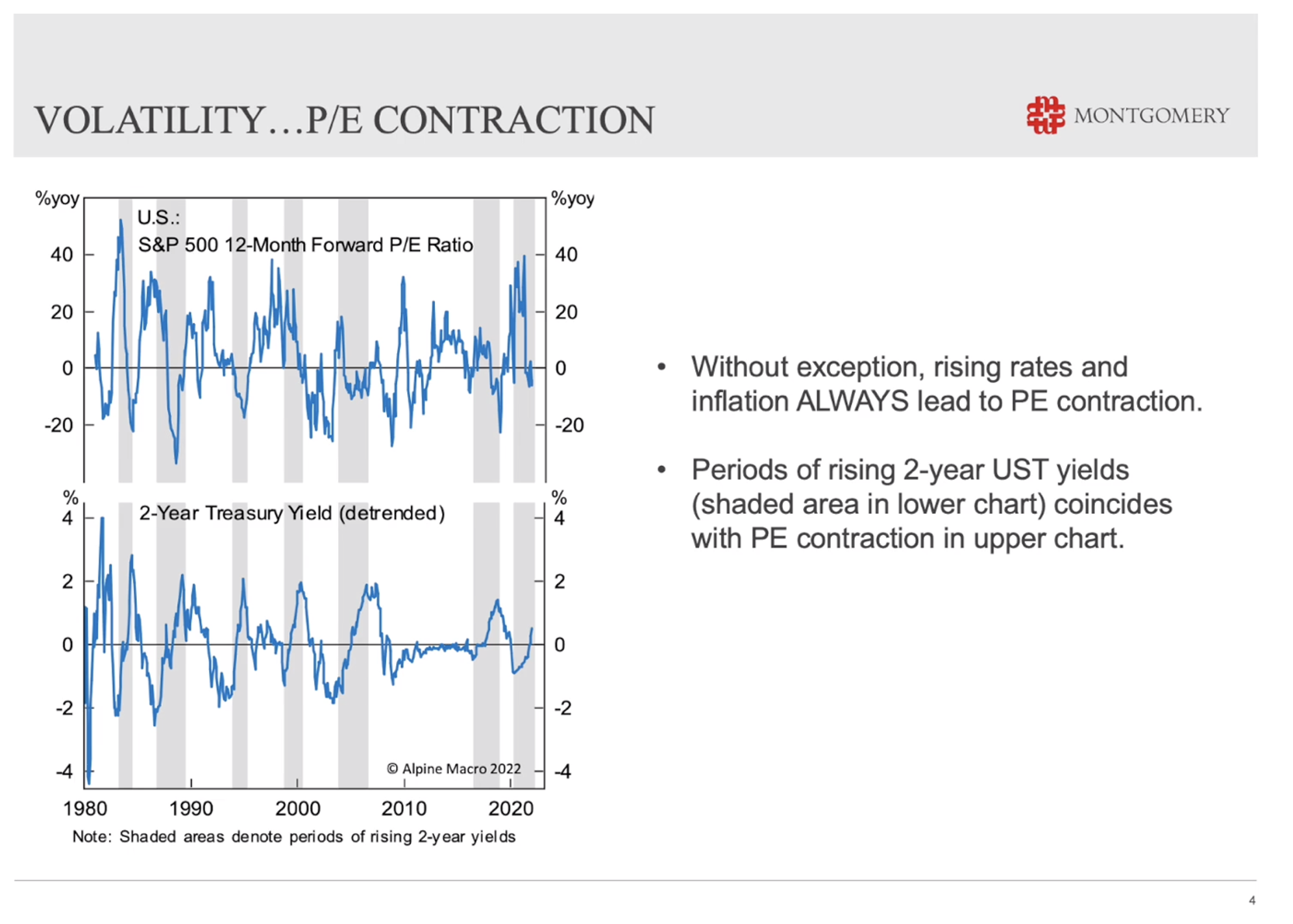

And that really has been a very dramatic change in expectations in the market. It stems from the very hawkish fed rhetoric that's coming out of both the FOMC, the Federal Open Market Committee meeting and Jerome Powell himself. And the question is, is this troubling and should investors be concerned at the moment? The expectation is that there are probably going to be more than four interest rate hikes this year. Many investors see 2022 as a transition year. I want you to remember that expectation of four rate hikes, or even five rate hikes this year, which is currently appears to be priced in to markets, because we're going to assess the legitimacy of that or the opportunity that it presents in just a moment. Roger Montgomery (02:36): Now, it's really important to understand that since the late 1970s, there's been a huge number of studies that have shown that in periods of inflation and also during periods of rising interest rates, PEs contract or the multiple of earnings that investors are willing to pay for a company contracts. And that is the case without exception as you can see in the lower chart here, those gray shaded areas represent periods since 1980, where the 2-year yield in the United States or 2-year US Treasury yields have increased. And that coincides with periods in the top chart where PEs have contracted, and that happens without exception. So, rising interest rates means PEs contract and inflation also results in PEs contracting.

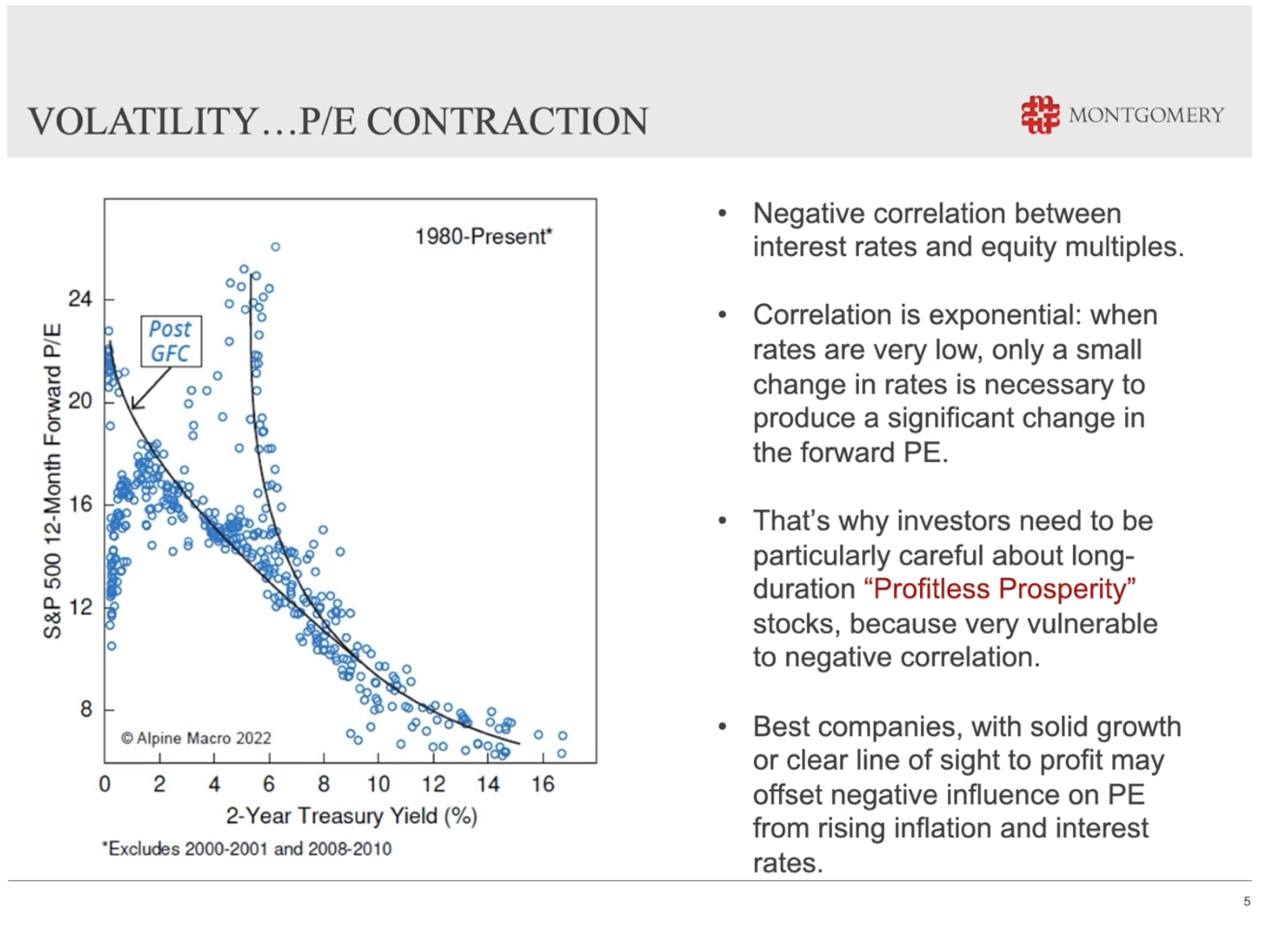

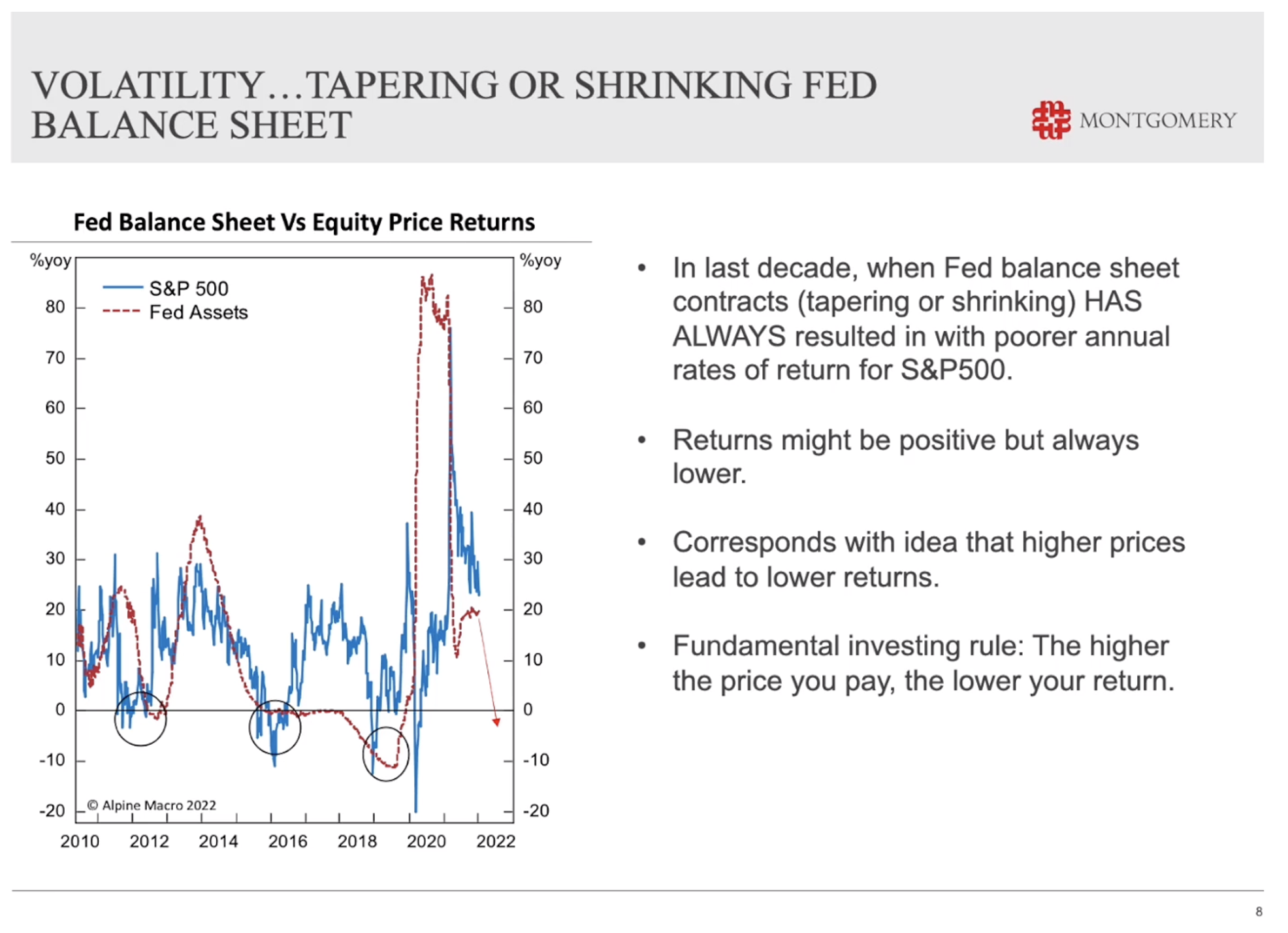

In fact, the greater the inflation, the greater the contraction in PEs. You can see on this particular chart also since 1982 to the present, not only is there a negative correlation between interest rates and PEs or equity multiples, but that correlation is somewhat exponential. Now, this is really important to understand, because what it means is that the lower interest rates are the greater the move on in PE, or the greater the contraction in PE for a given increase in interest rates. And that's why investors need to be particularly careful about what we've dubbed the profitless prosperity stocks. They're the stocks with profits pushed way out onto the horizon with no clear line of sight becoming profitable. They're the ones that tend to be most sensitive to interest rate increases or prospective interest rate increases. But of course, because they've contracted so much in terms of their PE, that could also be an opportunity which we'll address in just a moment. In Australia, we've seen that PE contraction occur substantially. Just in the month of January, in fact, from January the fourth, you can see there are companies like Pro Medicus and Transurban and Reese, ARB, IDP Education, Corporate Travel, REA Group, for example, all very high quality companies. And they've seen their PEs contract from between 14 per cent and by almost a third 33 per cent, in fact, contraction in price to earnings multiples. Roger Montgomery (05:09): So, people are willing to pay substantially less for these businesses, in many cases, very high quality businesses than they were just a month or month and a half ago, but the outlook for companies is very different to what their share prices have been doing. We know that share prices are far more volatile than business operations and the changes in business prospects. And you can see this survey from GLG conducted in early 2022, survey of 471 global CEOs, and 68 per cent of those CEOs believe and are very confident or confident that their revenues will grow over the next 12 months. So, what we've seen is this potential setup for great opportunity for investing, because we've seen PEs contract amid short term fees about interest rates and inflation. Roger Montgomery (06:03): But meanwhile, the underlying companies are reporting that they're confident or very confident in a large case of those surveyed, confident or very confident that their revenue are going to grow. So, businesses are continuing to grow. They're continuing to profit, they're continuing to demonstrate bright prospects, and yet their share prices have contracted substantially. So the question remains is, is this an opportunity? Well, before we answer that question, just have a look at the contraction, or think about the contraction that we've seen in the Fed's assets or in their balance sheet. We know that we've seen quantitative easing and that's tipping over to quantitative tapering now. Roger Montgomery (06:54): So in other words, the US Federal Reserve is buying fewer government bonds each month than what they were buying previously. And what you can see in this chart is that not only as we mentioned earlier, is there a relationship between rising interest rates and contracting PEs, but there is also a relationship between equity market returns and a contracting US Federal Reserve balance sheet. That relationship demonstrates that as the Fed contracts its balance sheet, as it goes from quantitative easing buying bonds in substantial amounts, to reducing the number of bonds that it buys, or the amount of bonds that it buys, and then to contracting its balance sheet, where it actually shrinks the balance sheet, rather than grows it at a slower rate.

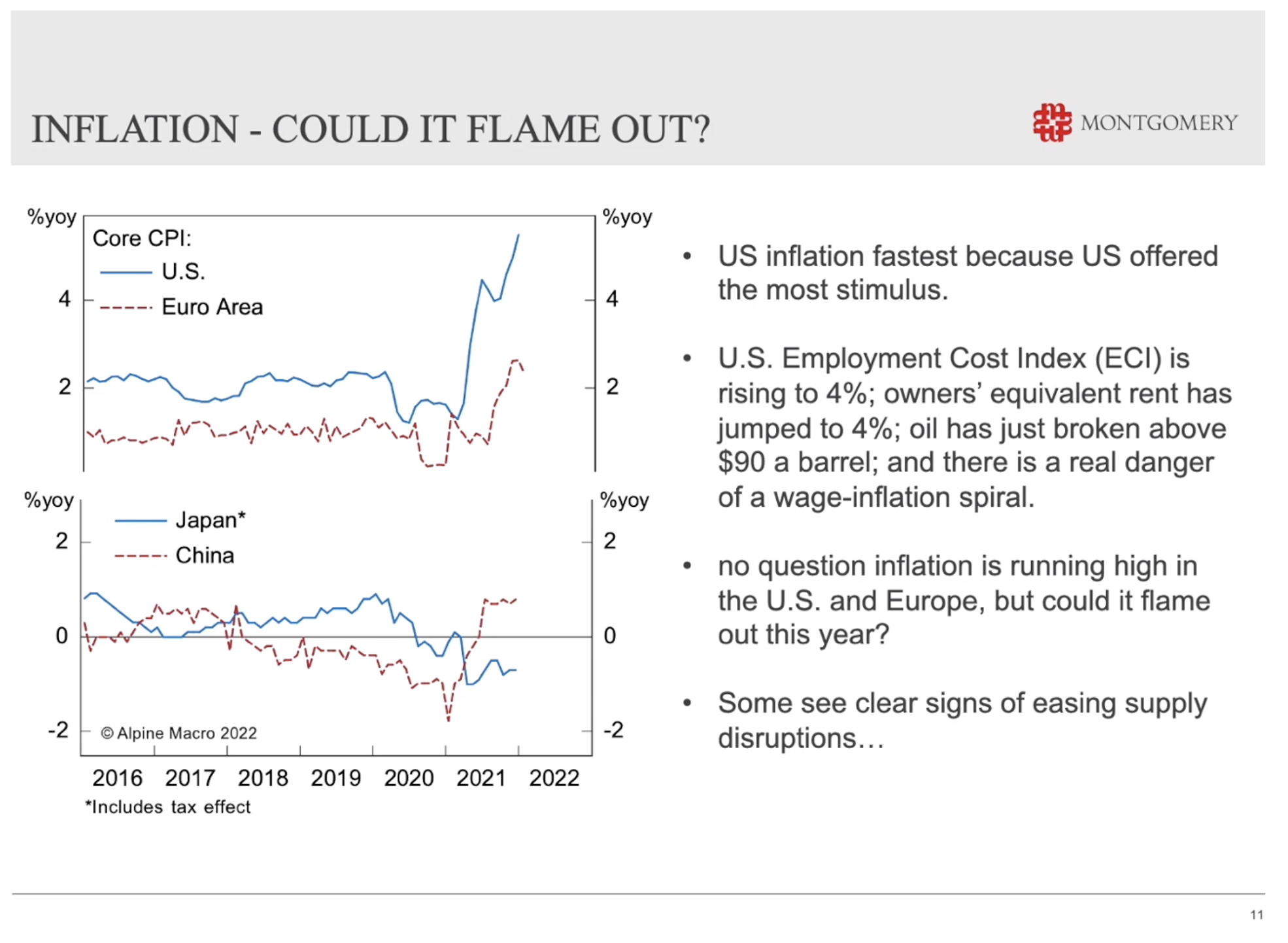

You can see that corresponds to returns on the stock market. The greater the balance sheet expansion, the greater the returns in the stock market. The greater the contraction of the balance sheet, the greater the negative return in the stock market. And that corresponds with a very simple idea that the higher the price you pay, the lower your return if you're paying very high prices for stocks. Then in the future at some point, you're going to end up with a lower return, particularly if you bought or paid high prices for stocks, when the US Federal Reserve's balance sheet was expanding. Now all of this, the prospect of rising interest rates in 2022, as well as a balance sheet contraction looks very similar to 2018. Roger Montgomery (08:26): In 2018, the US Federal Reserve hiked rates four times, and they contracted the balance sheet by about 10 per cent. So, Jerome Powell's hawkish statements recently offers a very similar prospect for 2022. Now, what we have to remember is back in 2015, we had an oil meltdown and a nominal recession in the United States. In 2016 and 2017, the economy then began recovering. The US was growing at about 3.8 per cent. We had Trump's tax cuts, and the economy was thought strong enough to support four rate hikes. For 2018, the conditions however weren't strong enough to support the Fed's four interest rate increases. The Fed arguably went too hard and that produced a stock market correction late in 2018 and importantly, that saw the fed stop raising interest rates. Roger Montgomery (09:24): Now for 2018, the US S&P 500 returned minus 7 per cent, after that stock market correction. And the Fed backed off. What's interesting is though that action of backing off raising interest rates actually saw the S&P 500 generate a 30 per cent return the following year in 2019. So, what is the possibility that the really hawkish statements we're seeing out of the US Federal Reserve now actually coincides with peak inflation fear, or even peak inflation? Is it possible that inflation has already turned the corner, and that we see lower rates of inflation in the future, which then sees the Fed pivot its current policy or current rhetoric to a more dovish and less hawkish rhetoric? Well, here's what the bond market thinks. Roger Montgomery (10:18): If you look at the difference between treasury constant maturity, securities, and treasury inflation index securities, which gives you an inflation break even curve, you can see that yes, expectations for inflation have risen slightly over the next 10 years, but it still remains steeply negative. That curve is steeply negative. Meaning, that inflation is seen by the bond market, at least as not persisting and in fact, temporary. I think about that in the context of what the bond market has actually had to absorb. They've seen 7 per cent inflation, which is massive in the United States. They've digested the possibility of four or five rate hikes from the US Federal Reserve. Roger Montgomery (11:00): They've heard tougher talk from the Fed, and there's also political pressure to deal with inflation. And despite all of that, the bond market remains firmly convinced based on this curve that inflation is a temporary phenomena. And in fact, it's not going to persist at all. In the US of course, inflation is on the front page and inflation has been very high there. And the reason why inflation is fastest in the US is because of course, the US offered the most stimulus. US employment cost index at the moment is rising to 4 per cent. Owner's equivalent rent has jumped to 4 per cent. Oil's just broken above $90 a barrel. So, there are real fears of a wage inflation spiral. Roger Montgomery (11:46): Look, there's no question that inflation in fact is running high at the moment. You can see it on this chart for the US, and it's running high in the US and Europe, but I wonder whether or not it could actually flame out. And in fact, there are some signs at the moment that the supply disruptions that have been partly responsible, or largely responsible for the jumping inflation are starting to ease.

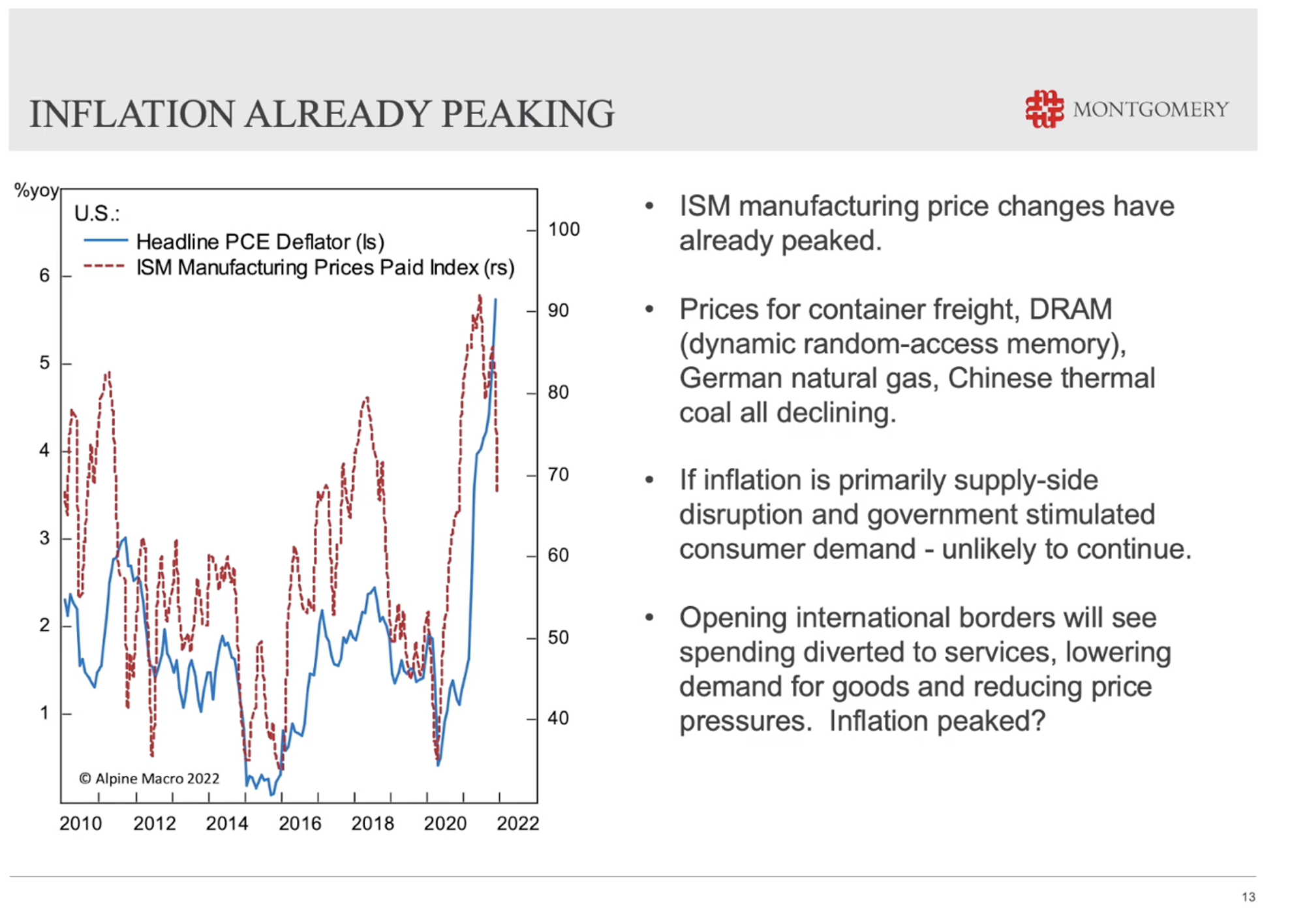

And that coincides with this chart of the ISM manufacturing prices paid index, which is already tipping over. We know that prices for container freight, dynamic random access memory, German natural gas, Chinese thermal coal prices, for all of those things are already starting to decline. So, if inflation is primarily a supply side disruption and government stimulated consumer demand, or the result of those things, then it's quite possible these things aren't going to continue. And of course, if we open international borders, we'll see spending diverted to services again or travel, and that means lower demand for goods. And that we'll see some of the price pressure on those goods start to ease.

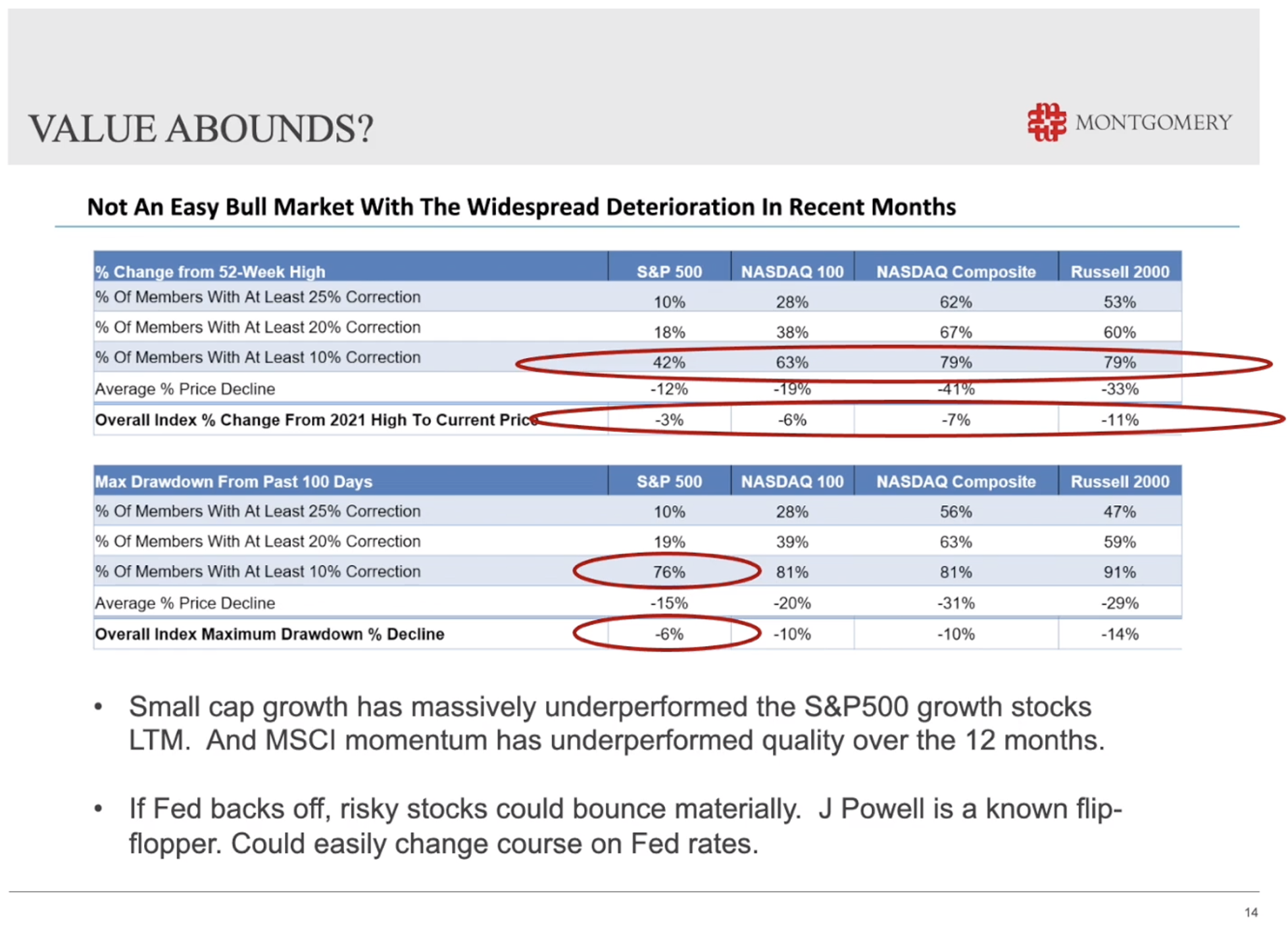

So, it's possible that inflation has actually peaked at the same time that the US Federal Reserve rhetoric is ramping up and causing all those fears in the stock market. And why is this an opportunity? This is an opportunity, simply because if you look at what the indices have done the S&P 500, our small caps index, if you look at the NASDAQ 100 in the United States or the NASDAQ Composite, you can see they've all fallen, but underneath those falls are much more substantial falls for individual issues. You can see on this table that something like 42 per cent of S&P 500 companies have fallen by more than 10 per cent, even though the S&P 500 has only fallen 3 per cent. You can see in the NASDAQ, for example, 79 per cent of companies have fallen by more than 10 per cent, even though the index has only fallen 7 per cent. The same story is true here in Australia, and that presents a host of opportunities. If you can find businesses that are still increasing their net worth, or increasing their value by generating high rates of return on equity, growing their equity by retaining profits, that process takes years to build value, yet the stock market abandons its long term plans, investors abandon their long term assumptions for companies and worry about the short term when interest rates are expected to go up, and inflation has been running in a million miles an hour, but there is an argument as I've just demonstrated that inflation is already peaking, that we'll see consecutive lower rates of inflation in the future. Roger Montgomery (14:39): And the Fed will ease its rhetoric around inflation and interest rate rises. If that happens, then the stock market could very well bounce quite violently. In fact, as violently as it's recently fallen, and that sets up investors for a terrific opportunity for 2022. Thanks for your time, look forward to talking to you again soon. Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund |

11 Mar 2022 - Hedge Clippings |11 March 2022

|

|

|

|

Hedge Clippings | Friday, 11 March 2022 As Russia's invasion (sorry, "reunification") of Ukraine drags into its third week, it is difficult to imagine Putin pulling his forces back - or out. Any such move in the face of defeat or sanctions would signify such a massive loss of face on his part that it seems unthinkable. As a result, there are not many alternative outcomes, assuming the US and Europe stick to their guns (apologies for the mixed metaphors) and refuse to either implement a no fly zone, or decline to let the Polish lend Ukraine their (Russian built) MIG fighters. In spite of the lopsided numbers, the Ukrainian armed forces, assuming they're not wiped out (or surrender, which seems as unlikely as Putin doing the same) could dig in for a long war of attrition. History shows that these types of conflict are rarely won by the initial aggressor, as Russia knows all too well, having lost 15,000 dead and 35,000 wounded (not to mention an estimated 2 million Afghans) before retreating from their 10 year invasion of Afghanistan. By all accounts, Putin's plans assumed another decisive victory, or a quick Ukrainian capitulation, and although it's still only early days, neither of which seem likely. So a long war of attrition on Europe's doorstep will be accompanied by equally long standing sanctions and the equally damaging economic fallout that will follow. As suggested previously, while Putin's unlikely to back down, and sanctions will be effective over time, but hurt both sides, the leverage that can be put on by the increasingly asset-less Oligarchs, and the mothers of Russian soldiers, are likely to be the solution. Unless of course, Putin decides to up the ante by resorting to his oft threatened nuclear solution, thereby giving the West no option but to get further involved, escalating to goodness knows where. Estimates currently suggest a 10% chance of this outcome within 12 months. To markets: Some investors will reduce their exposure, while some will watch, wait and worry, while others see opportunity in some oversold situations. Meanwhile, on the other side of the Atlantic, it seems almost certain that the sharp spike in inflation - 7.9% and the highest for 40 years - will see an increase in interest rates. Even taking food and energy out of the figures, the annual rate was still 6.4%, and the numbers to the end of February don't factor in the inflationary effects of the recent spike in oil prices. It is safe to assume that even though higher inflation and associated increases in interest rates have been flagged and factored in for some time, when the actual time comes for the announcement - from the US Federal Reserve or our own RBA - the market will react. And given that expectations are for further inflation to flow through the system, the rate increase is unlikely to be the only one, but the first in a series. Closer to home Adviser Ratings has released the results of their survey of financial adviser numbers in Australia, with just 17,266 still in the industry, bringing numbers down by 40% since the Hayne Royal Commission. There are a number of implications from this - one being that it is increasingly difficult for those people who need advice, to find or afford it. At the same time, the alternative of using technology to provide a "robo-solution" can only solve so many problems, given the investors needing the advice may not be suited to a robo solution. At the end of the day, in all walks of life, you tend to get what you pay for. News & Insights The question is, when should you invest? | Insync Fund Managers Markets Volatile; Ukraine Invaded | Laureola Advisors Aligning Interests: (no freeloading on my tab!) | Colins St Asset Management |

|

|

February 2022 Performance News Insync Global Quality Equity Fund Bennelong Long Short Equity Fund Bennelong Emerging Companies Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

11 Mar 2022 - Performance Report: ASCF High Yield Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Does not require full valuations on loans <65% LVR. Borrowing rates are from 12% per annum on 1st mortgage loans and 16% per annum on 2nd mortgage/caveat loans. Pays investors between 5.55% - 6.25% per annum depending on their investment term. |

| Manager Comments | The ASCF High Yield Fund has a track record of 5 years and has outperformed the Bloomberg AusBond Composite 0+ Yr Index since inception in March 2017, providing investors with an annualised return of 8.73% compared with the index's return of 2.73% over the same period. On a calendar year basis, the fund hasn't experienced any negative annual returns in the 5 years since its inception. The fund hasn't had any negative monthly returns and therefore hasn't experienced a drawdown. Since the fund's inception, the index's largest drawdown was -5.39%. The Manager has delivered these returns with 3.37% less volatility than the index, contributing to a Sharpe ratio which has consistently remained above 1 over the past five years and which currently sits at 23.78 since inception. The fund has provided positive monthly returns 100% of the time in rising markets and 100% of the time during periods of market decline, contributing to an up-capture ratio since inception of 87% and a down-capture ratio of -92%. |

| More Information |

11 Mar 2022 - Performance Report: Airlie Australian Share Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund is long-only with a bottom-up focus. It has a concentrated portfolio of 15-35 stocks (target 25). The fund has a maximum cash holding of 10% with an aim to be fully invested. Airlie employs a prudent investment approach that identifies companies based on their financial strength, attractive durable business characteristics and the quality of their management teams. Airlie invests in these companies when their view of their fair value exceeds the prevailing market price. It is jointly managed by Matt Williams and Emma Fisher. Matt has over 25 years' investment experience and formerly held the role of Head of Equities and Portfolio Manager at Perpetual Investments. Emma has over 8 years' investment experience and has previously worked as an investment analyst within the Australian equities team at Fidelity International and, prior to that, at Nomura Securities. |

| Manager Comments | The Airlie Australian Share Fund has a track record of 3 years and 9 months and therefore comparison over all market conditions and against its peers is limited. However, the fund has outperformed the ASX 200 Total Return Index since inception in June 2018, providing investors with an annualised return of 11.71% compared with the index's return of 8.33% over the same period. On a calendar year basis, the fund hasn't experienced any negative annual returns in the 3 years and 9 months since its inception. Over the past 12 months, the fund's largest drawdown was -6.79% vs the index's -6.35%, and since inception in June 2018 the fund's largest drawdown was -23.8% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in February 2020 and lasted 9 months, reaching its lowest point during March 2020. The fund had completely recovered its losses by November 2020. The Manager has delivered these returns with 0.35% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 two times over the past three years and which currently sits at 0.75 since inception. The fund has provided positive monthly returns 97% of the time in rising markets and 14% of the time during periods of market decline, contributing to an up-capture ratio since inception of 109% and a down-capture ratio of 92%. |

| More Information |

11 Mar 2022 - Performance Report: 4D Global Infrastructure Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The fund is managed as a single portfolio including regulated utilities in gas, electricity and water, transport infrastructure such as airports, ports, road and rail, as well as communication assets such as the towers and satellite sectors. The portfolio is intended to have exposure to both developed and emerging market opportunities, with country risk assessed internally before any investment is considered. The maximum absolute position of an individual stock is 7% of the fund. |

| Manager Comments | The 4D Global Infrastructure Fund has a track record of 6 years and has outperformed the S&P Global Infrastructure TR (AUD) Index since inception in March 2016, providing investors with an annualised return of 9.33% compared with the index's return of 8.3% over the same period. On a calendar year basis, the fund has experienced a negative annual return on 2 occasions in the 6 years since its inception. Over the past 12 months, the fund's largest drawdown was -3.9% vs the index's -1.2%, and since inception in March 2016 the fund's largest drawdown was -19.77% vs the index's maximum drawdown over the same period of -24.67%. The fund's maximum drawdown began in February 2020 and has lasted 2 years, reaching its lowest point during September 2020. The Manager has delivered these returns with 0.53% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 four times over the past five years and which currently sits at 0.73 since inception. The fund has provided positive monthly returns 95% of the time in rising markets and 14% of the time during periods of market decline, contributing to an up-capture ratio since inception of 101% and a down-capture ratio of 95%. |

| More Information |

11 Mar 2022 - Markets Volatile; Ukraine Invaded

|

Markets Volatile; Ukraine Invaded Laureola Advisors February 2022 THE INVESTMENT ENVIRONMENT - Markets Volatile; Ukraine Invaded The S&P 500 declined 5.3% in January. Gold and oil were up; crypto and bond prices down. The Russians invaded the Ukraine on 24th of February but markets already had a full slate of concerns prior to the invasion. Inflation refuses to go away: consumer prices were up 7.5% and housing prices up 18.8% in the USA with even smaller markets showing this level of increase. The Bloomberg Commodity Index is up over 12% ytd, led by crude and gasoline. Fertilizer is double the price from a year ago and the world's largest supplier of weedkiller - an important input in food production - declared a force majeure due to shortages of the key ingredient glyphosate. Many key commodities futures have slipped into backwardation indicating low stockpiles of the world's most important commodities (food, energy, metals) without the usual supply response. The Goldman Commodity analyst described the situation as "unprecedented". Our hearts go out to the brave Ukrainians in their struggle and of course their problems dwarf any investment issues. But the Russian invasion makes the global investment landscape even more uncertain: Russia is the 5th biggest trading partner with the EU, the #1 supplier of energy to the EU, and, with the Ukraine, an important exporter of corn and wheat. Uncertainties have increased; the value of a non-correlated investment strategy like Life Settlements is greater than ever. THE LIFE SETTLEMENT MARKETS - Markets Stable; Tertiary Markets Active LS Markets were stable with average gross, projected IRR's in the 12% to 14% range on completed transactions. There were interesting developments in the tertiary market where several larger portfolios were offered including one with over 100 policies. There was some indication that the sellers were motivated and that at least some of the portfolios were of good quality, which is a marked difference from most of the past two years where tertiary trades were mostly the undesired policies to be avoided at all costs. The Life Settlement news magazine "The Deal" reported encouraging developments in the fight to prevent insurance companies from competing with Life Settlements by offering special "enhanced cash surrender offers" which may violate insurance laws in at least some States, in part because the offers may favour some policy holders over others. The issue was raised and discussed at a recent meeting of the National Association of Insurance Commissioners with several States having already fined some carriers for such offers and other States starting to review their own legal and regulatory framework and how it applies to this relatively recent development. It appears to be another example of insurance companies trying to make life difficult for the Life Settlement industry with limited success, probably due to quality legal representation and lobbying of the LS industry and the fact that each policy holder has a vote. Written By Tony Bremness Funds operated by this manager: |

Roger Montgomery (01:44):

Roger Montgomery (01:44): Roger Montgomery (03:29):

Roger Montgomery (03:29): Roger Montgomery (04:20):

Roger Montgomery (04:20): Roger Montgomery (07:42):

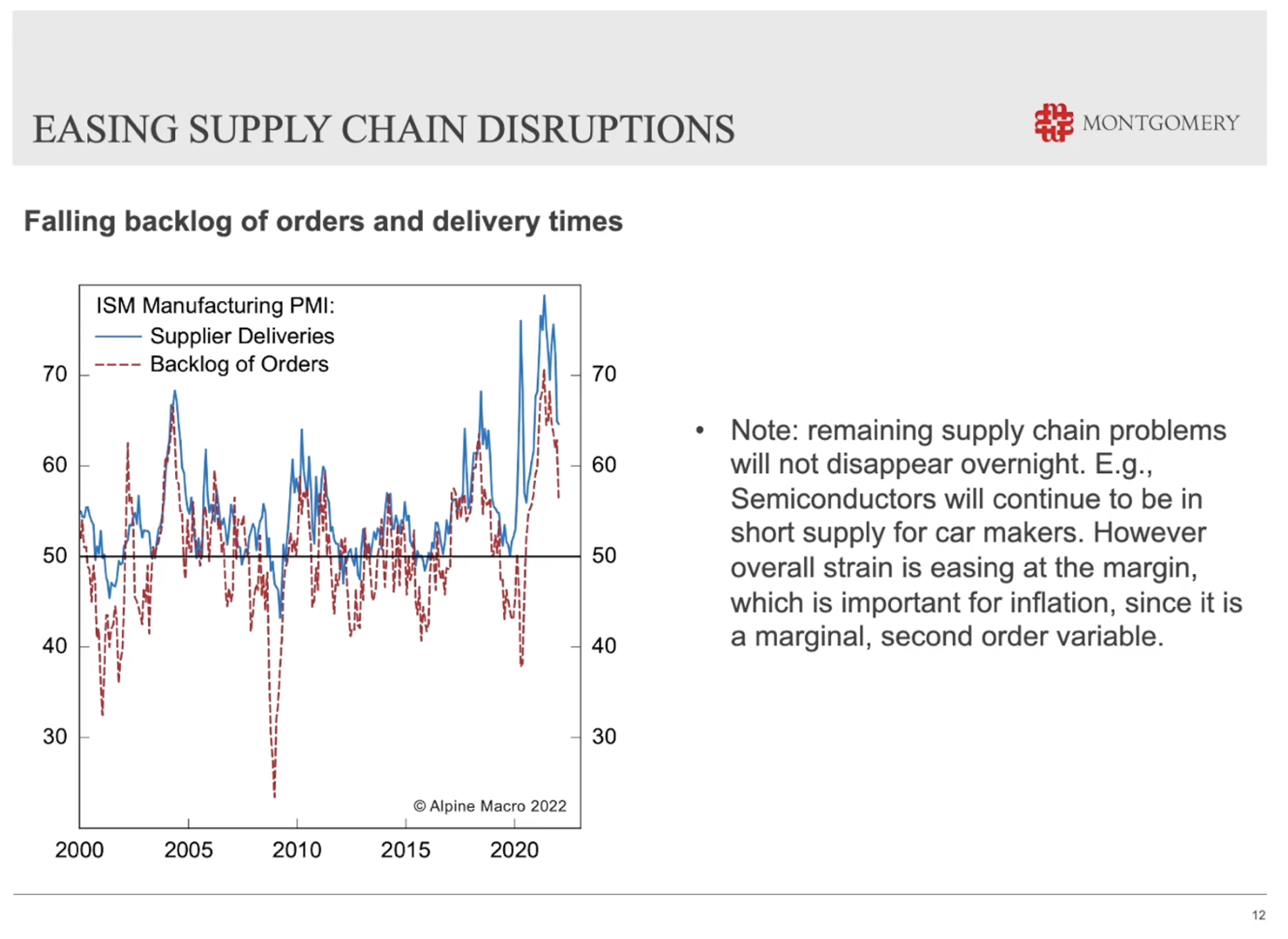

Roger Montgomery (07:42): If you look at this chart here, you can see that supply deliveries and backlog of orders are actually starting to decline already. Sure, there's still supply chain problems. They're not going to disappear overnight. But at the margin, we're seeing the overall strain in the supply chain start to ease as this chart demonstrates.

If you look at this chart here, you can see that supply deliveries and backlog of orders are actually starting to decline already. Sure, there's still supply chain problems. They're not going to disappear overnight. But at the margin, we're seeing the overall strain in the supply chain start to ease as this chart demonstrates. Roger Montgomery (12:28):

Roger Montgomery (12:28): Roger Montgomery (13:10):

Roger Montgomery (13:10): Roger Montgomery (14:00):

Roger Montgomery (14:00):