NEWS

5 Apr 2022 - 10k Words - March Edition

|

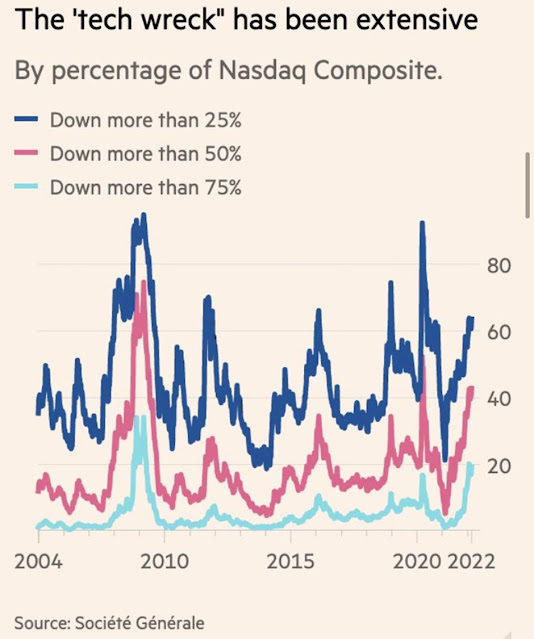

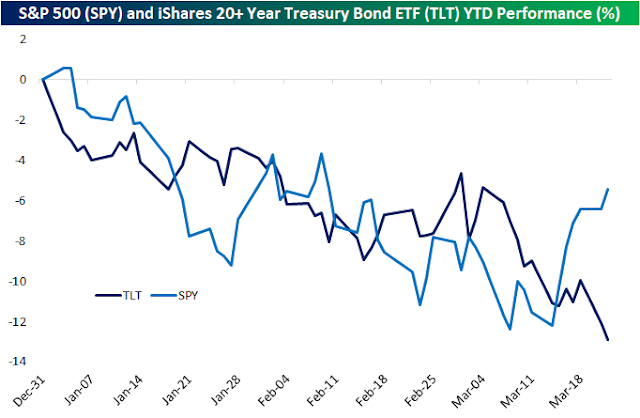

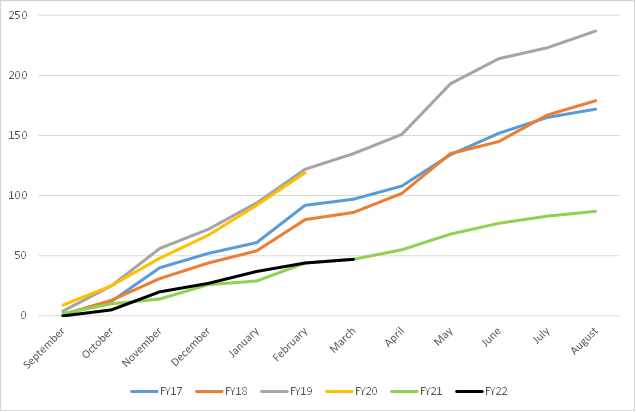

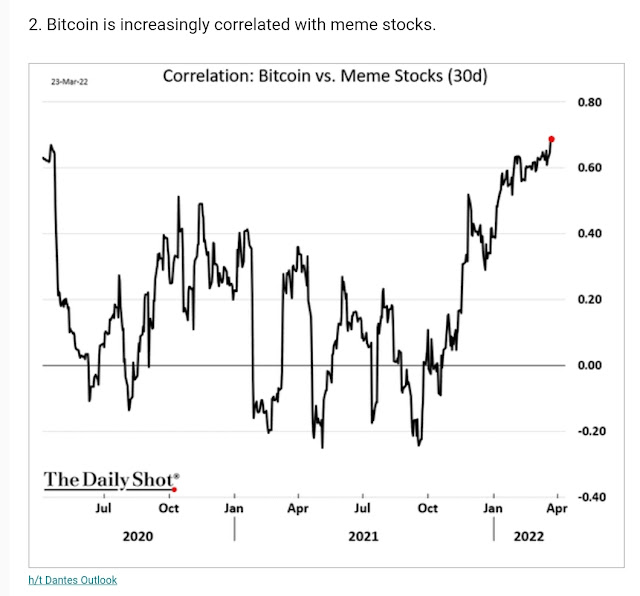

10k Words - March Edition Equitable Investors March 2022 Apparently, Confucius did not say "One Picture is Worth Ten Thousand Words" after all. It was an advertisement in a 1920s trade journal for the use of images in advertisements on the sides of streetcars. Even without the credibility of Confucius behind it, we think this saying has merit. Each month we share a few charts or images we consider noteworthy. The extent of the new "Tech Wreck" is highlighted by Societe Generale with 60%+ of stocks in the index down more than 25%, including 20% down more than 75%. But bonds have not delivered on their promise of safety as Bespoke and The Irrelevant Investor highlight. Back in Australia, Wilsons counts only 47 earnings downgrades in total for FY22 (so far), which is similar to FY21 but well below pre-Covid years. Wilsons also shows an unusually large spread between growth in small and large caps. The correlation of bitcoin with the more speculative parts of the equities market has been mapped courtesy of The Daily Shot. Finally, Bloomberg highlights that Australian polling indicates a change of federal government is on the cards. Nasdaq's latest "tech wreck"

Source: Societe Generale, @jsblokland

US equities (S&P 500) v long-term bonds (iShares 20+ Year Treasury Bond)

Source: Bespoke Bond market drawdowns: US equities (S&P 500) v Vanguard Total Bond Market ETF

Source: The Irrelevant Investor

Number of ASX downgrades per financial year

Source: Wilsons

ASX large cap growth less small cap growth

Source: Wilsons Bitcoin correlation with "meme" stocks

Source: The Daily Shot, Dantes Outlook Australia's election polls pointing to change in government

Source: Bloomberg, Newspoll Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions.Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components.Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog |

5 Apr 2022 - American bourbon and business insights

|

American bourbon and business insights Forager Funds Management 24 March 2021 Steve Johnson and Gareth Brown are in Chicago for an episode of 'Stocks Neat'. They taste-test an American bourbon and recap their research trip in the US. Tune in as they reflect on the impacts of inflation and supply chain disruptions on businesses in the US, and the potential impact of the war in Ukraine on the Australian economy. |

|

Funds operated by this manager: Forager Australian Shares Fund (ASX: FOR), Forager International Shares Fund |

4 Apr 2022 - Another step toward policy tightening - with a caveat

|

Another step toward policy tightening - with a caveat Kapstream Capital March 2022

Key Takeaways

In a well-telegraphed move, the Federal Reserve (Fed) raised its benchmark overnight policy rate by 25 basis points (bps) on Wednesday (March 16) to a range of 0.25% to 0.50%. Perhaps more importantly, the U.S. central bank's own forecast for the future path of rate hikes - as expressed in its "Dots" survey, which records each Fed official's projection for the federal funds rate - increased to seven hikes for this year and four for 2023. In the December survey, these expectations were for three hikes in each of these years. While some may interpret this as a continuation in the shift toward a hawkish bias, we are more circumspect. We believe that the seven 25 bps rate increases the futures market is pricing in for this year very much represent an upper limit of potential hikes and that this scenario is unlikely to materialize. Also, the current Dots survey comes with a considerable caveat: There were fewer voting members at this week's meeting due to the ongoing transition in the Fed's leadership composition and none of President Biden's nominees have taken their seat. Importantly, we believe that eventual new members will lean toward the dovish camp, reinforcing our view that the market's expectations have gotten ahead of reality. It's worth recalling that throughout Chairman Jerome Powell's tenure, when given the choice between two paths - and having not been mugged by multi-decade highs in inflation - he's opted for greater accommodation. About that Inflation The reality that Chairman Powell has been unable to avoid is that inflation remains on the march. In February, both the headline and core U.S. consumer price indexes reached multi-decade highs - 7.9% and 6.4%, respectively. Market expectations for price increases to drift toward the Fed's preferred 2.0% long-term range look slim. Inflation is expected to average 3.6% over the next five years based on the U.S. Treasury Inflation-Protected Securities (TIPS) market. For the 10-year horizon, the average is a modestly less ulcer-inducing 2.95%. We interpret these elevated levels as the market's growing recognition that the Fed will be more tolerant of a pace of inflation seldom seen in the U.S. over the past three decades. Yet the Fed faces a conundrum. Much of the current upward lurch in prices is due to supply constraints. The global pandemic famously caused supply disruptions in semiconductors and other important industrial inputs. Labor shortages have led to upward pressure on wages, which feed directly into inflation, especially in service-based economies. Unfortunately for the Fed, the blunt instrument of rate hikes tends to be less effective in combating inflation driven by supply factors than it is in quelling periods of accelerating prices driven by full-throttle demand. A Narrowing Policy Path The nature of this bout of inflation, which has been exacerbated by recent geopolitical events, amplifies our concerns about the potential for monetary policy error. Policymakers must perform a perilous balancing act. Should the Fed overtighten, the U.S. economy could slip into recession. If it falls behind the curve and higher inflation expectations become embedded, bond valuations could come under pressure as higher discounts are commanded to compensate for the diminished value of future cash flows. Caution Merited The expected template of a methodical pace of rate increases in 2022 has been turned upside down. We believe that every Fed meeting has the potential to be "live," meaning that a rate hike is possible. While it would likely be well-telegraphed per Chairman Powell's modus operandi, we cannot rule out a 50 bps hike at some point. The forced shift in the Fed's stance, however, means that the period of "peak policy uncertainty" has likely been extended. Our view is that the Fed will make every attempt to proceed with caution. Yet, this same caution could lead to even more volatility in longer-dated rates as the risk of higher-than-trend inflation becomes fixed in investors' minds. Consequently, we believe investors should treat interest rate exposure - or duration - with caution. Longer-dated bonds, in our view, appear most vulnerable to elevated volatility. And given the relative flatness of the yield curve, the incremental return for holding farther out maturities may not be worth the higher risk. Lastly, the geopolitical uncertainty emanating from events in Ukraine further reinforces our view that now is not the time to take on any undue risk in one's fixed income allocation. This information is for adviser & wholesale investors only Funds operated by this manager: |

1 Apr 2022 - Hedge Clippings |01 April 2022

|

|

|

|

Hedge Clippings | Friday, 01 April 2022

Today being April Fools Day, previously known as All Fools Day, it is fitting that yesterday was (assuming an election in May) the last sitting day of the current Parliament. Rather than try to come up with anything better, Hedge Clippings will defer to Phillip Coorey's column in today's AFR, who opened his piece with "If Anthony Albanese and Scott Morrison are both to be believed, the federal election will not be a battle between two parties with competing visions, but a fight between two lots of clueless old farts." Whilst Hedge Clippings is generally in agreement with the "clueless old farts" reference, the first issue we have is "are both to be believed". Since when did anyone believe anything that both the Prime Minister and Leader of the Opposition say? Or if it comes to that, given the level of cynicism currently prevailing, when did most people believe what either of them said? That's probably true irrespective if it's the PM or OL of the day, although it seems neither of the current incumbents are racing ahead in the polls. In a two horse race, we suppose one of them has to win (or possibly one loses more than the other) - probably with the support of minority parties - although the thought of the likes of Pauline Hanson and Clive Palmer holding the balance of power leaves a lot to be desired. Hedge Clippings originally assumed that Albo was just keeping the seat warm until someone in the Labour party with ability and at least some personality (our bet being Tanya Plibersek) would take over, but lo and behold, he's still in the race. And it seems ScoMo has managed to alienate so many sections of the community over the past couple of years that no one's giving him much chance of pulling off another miracle, come from behind victory. Of course, to some people, NOTHING Scomo does deserves credit. Which is a shame, because on the two big picture items - COVID and the economy - one can argue he's done a pretty good job unless that is you're a Scomo hater. Even if you're a ScoMo fan, it is difficult not to agree (again) with the AFR's post budget headline "Cash splash dash to the polls". Or to argue with the possibly cynical view that Albo's maintaining a small target by basically accepting everything in the Liberal budget, and just tacking on his own additional $2.5 billion cash splash on the politically sensitive aged care sector. Maybe the incredible shrinking Clive Palmer's correct in saying never trust the two major parties again, although when it comes to the trustworthy meter, Clive leaves a little to be desired. Just remember the Queensland Nickel saga, and his elusive (and also shrinking) nephew, Clive Mensink who still seems reluctant to have his day in court. So, if you're not already sick of politicians' promises, all or most of which you know will evaporate in the face of inflation, interest rates, or at the petrol pump, prepare yourself for six or seven weeks of full-on claims, counter claims and expensive advertising. 95% of which will be wasted given it's only the swinging voters (around 5%) who determine the outcome anyway. On a different, and sadder note, Australia and the cricketing world paused this week to remember Shane Keith Warne. Even for those who might not be cricket fans, it was impossible not to admire his talent, exploits, and his charisma, as we watched or listened to the tributes from his father, brother, and three brave children. At 52, gone far too young, he will long be remembered. Even ScoMo and Albo were in agreement on that. News & Insights A tumultuous start to '22! | Insync Fund Managers Do Multiples Matter? | Equitable Investors |

|

|

February 2022 Performance News |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

1 Apr 2022 - Semiconductors - transforming our lives

|

Semiconductors - transforming our lives Alphinity Investment Management 21 March 2022 That's not a peak……I still remember the time I thought I'd hit "peak technology". I had a new Nokia 3310 in my hand and after making a call and sending an SMS I found a game called Snake that helped to pass time in the cab while the driver fumbled through a UBD street directory to try and find my hotel. I was also carrying a new digital camera to document my trip and an MP3 player with music I'd burned from my existing CD's. And when I hit my destination all I needed to find was a telephone port to be able to connect back to the work files I needed to finish a presentation for the morning. What a time to be alive….…

It would have been impossible at that time for me to envisage what life would look like 20 years later. The phone I use is now a phone, internet, camera, music and TV device all in one, with the capability to run my entire life off a 6 inch by 3 inch screen. That cab I was in? Well now the guidance systems mean never pulling into a McDonalds to work out directions ever again, let alone the incredible advances in safety features and entertainment. Then we stand at the front edge of the electric vehicle migration while peering at autonomous driving looming on the horizon. Those files I need? Well now I can access them from anywhere and on any device as data migrates to the cloud. The changes to the way we live, and work have been astonishing and are accelerating.

While it is almost impossible to imagine what the next 20 years may look like, one thing we do know is that as technology marches ever forward, so does the required intensity of computing power. It is quite a leap from having a "snake" made of clunky pixels moving on a basic screen to cars that need to observe and assess all factors around them then calculate and execute the best course of action in fractions of a second. Let alone what other currently unimaginable technology extensions will emerge. Imagination and semiconductors - driving technological advancementUnderpinning this march in computational advancement have been semiconductors. It is advances in semiconductor technology that facilitates this rapid escalation in compute power while also keeping a restraint on device size. And it isn't just the complexity of the compute but the expansion in use cases that underpins the importance of semiconductors in the technology supply chain. Taking auto as an example, not only are the semis more advanced, but they have proliferated into almost every element of the car, from power to entertainment to guidance systems. The semiconductor company ONSemi estimate the content value of semis has lifted from $50 for an internal combustion engine with no advanced driver assist systems, to a future state of $1,600 for an electric vehicle approaching full autonomy.

Source: ONSemi Investor Day (Aug 21) This expansion of content value is occurring across a range of industries. From cars to phones to datacentres and our homes, content per unit is expected to lift by 50-100% when moving from 2020 to 2025. Smartphones are continually adding more functionality, datacentres are adding capacity to underpin advances such as AI, machine learning and the metaverse while compressing speed, and our homes are moving towards a degree of connectivity for almost every device.

Source: UBS (Jan 22), Applied Materials (April 2021) What does this mean for the semiconductor industry?This acceleration of technological development has driven a step change in semiconductor industry growth rates, with demand rising from a historical growth rate of 3-5% p.a. to an industry forecast to grow at 6-8% p.a. out to 2030, taking total industry revenue beyond $1bn. Where demand used to rise and fall with smartphone and PC demand, there are now much broader demand drivers, with particular areas of strength expected across autos, industrials and datacentres.

Source: ASML Investor Day (Sept 21), Gartner How do we invest in this opportunity?There are many ways to invest along the chain in semiconductors. From the equipment manufacturers (ASML, Lam Research, Applied Materials, ASMI) to the main manufacturers (TSMC, Samsung, Global Foundries, Intel) to the semiconductor companies exposed to different elements of end demand spanning data centre (Nvidia, AMD, Marvell), auto (ONsemi, IFX, Texas Instruments) and memory (Micron, Samsung, Hynix) to name just a few. Each discrete exposure brings with it a nuance to overall semiconductor cyclicality and underlying demand strength. Our goal is to balance end market demand strength, company positions and financial return metrics with a degree of resilience in the face of an ever present (and sometime violent) semiconductor cycle. Among the swathe of opportunities, our preference currently lies with:

Life in 2040?The changes to tech have been stunning in the past 20 years and it is difficult to imagine what the next 20 years will bring. But one thing we do know is that compute will advance, and semiconductors will be the key linchpin in assisting this drive forward. As such the future looks bright and the return profile compelling for those that can carve out a market position exposed to these key tech growth trends. Author: Trent Masters, Global Portfolio Manager This information is for adviser & wholesale investors only |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Sustainable Share Fund |

31 Mar 2022 - The headwinds facing Autosports Group

|

The headwinds facing Autosports Group Montgomery Investment Management March 2022 To understand the challenges facing the automotive sales industry, it is often helpful to examine a particular company, as Roger Montgomery did earlier this month. Autosports Group (ASX:ASG) operates car sales outlets in Sydney, Melbourne, Brisbane and the Gold Coast. Its share price has been on a rollercoaster ride since floating in 2016 and currently sits below the $2.40 listing price. ASG is profitable and reasonably priced, but investors should be mindful of the threats facing its business model. Established in 2006, Autosports Group owns and operates 40 retail businesses, including 23 luxury and prestige motor vehicle dealerships, two used wholesale motor vehicle dealerships and two specialised collision repair facilities in Sydney, Brisbane, the Gold Coast and Melbourne. Autosports Group represents Original Equipment Manufacturer (OEM) brands including Alpina, Aston Martin, Audi, Bentley, BMW, Jaguar, Lamborghini, Land Rover, Maserati, McLaren Mercedes Benz, Mini, Rolls-Royce, Volkswagen and Volvo. ASG offers new and used vehicles, finance and insurance, and back-end parts and servicing, including collision repair. Currently, car dealers are operating amid a veritable storm. Deliveries of new vehicles are hampered by a semiconductor chip shortage and the shuttering of manufacturing facilities due to COVID-19 associated isolation requirements. Booming demand for vehicles however is undiminished, thanks to consumers unable to travel, and flush with cash (e.g., a booming construction sector lining the pockets of builders and tradies). The eroded appeal of public transport is also driving demand for private transport. Unable to purchase a new car, buyers have turned to the used market where prices for many used vehicles have risen beyond their original purchase price of several years ago. The agency threat Meanwhile, in the background, the ever-present threat of OEMs moving to an Agency Model (Mercedes AG have already announced the change and are in court with dealers fighting for $650 million compensation) poses a revenue hazard to dealership revenues, putting investors on edge. Under the current dealership model, a brand retailer buys a vehicle from the OEM as inventory at a wholesale price. Typically the vehicle is only paid for by the dealer when it is sold. A margin for the dealer to cover costs is added and the salesperson then negotiates a transaction price with a customer. OEMs including Mercedes and Honda have expressed frustration with the traditional dealership/OEM relationship because dealer promotions including special offers, run-out deals, discounts and end-of-the-month sales all lower resale values and accelerates depreciation rates. But it hasn't all been the dealers' fault. Dealers note they have had to pay for manufacturer 'mistakes', overproduction on their floor plan charges, incorrect build combinations and obsolescence. This is the reason for the "race to the bottom" on new-vehicle margins. Under the Agency Model, dealers are paid a fee for a vehicle sale. For Honda dealers in NZ, this ranges from four per cent to seven per cent depending on meeting sales targets and customer satisfaction scores. Elsewhere, the customer places their order directly with the OEM and nominates a preferred delivery dealer. The price and dealership mark-up or commission is set by the OEM. The positive spin put on the agency model by OEMs says dealers aren't limited to selling just the cars allocated to them. They are free to sell any vehicle model in the brand's stable on order nationally. Dealers have access with access to the full range without incurring floorplan costs. The OEM owns all demonstration stock at the dealerships and all the new-car stock. New vehicles are held for sale at a national distribution centre and sales are made directly to the customer. The dealer therefore no longer finances an inventory of vehicles for sale, and all floorplan or finance costs are borne by the OEM. In Volkswagen's electric vehicle agency model in Europe, the dealer is offered a lease program for demos and loan vehicles. Across the globe, the use of agency models is more widespread. Mercedes-Benz has already introduced agency models in South Africa, Austria, Sweden and it will transition to one in Germany as well. Volkswagen is rolling it out for selling electric vehicles in Europe and Honda has been running the model in NZ since 2000. Back to ASG Navigating this tumult is a challenge attested to by a 30 per cent decline in ASG's share price since its high of $2.74 last June. Autosports Group reported its first half FY22 results recently noting the solid margins of the previous financial year continued, driving profit before tax to beat some estimates by more than 10 per cent. The company however reported revenue of A$911 million, which grew 0.8 per cent year-on-year (yoy) but missed consensus estimates for $1 billion. Revenue was down four per cent when adjusted for acquisitions, which contributed $44 million. EBITDA grew 27 per cent yoy to $48.6 million, beating some estimates by 10 per cent. Adjusted profit before tax of $39.2 million was up 35 per cent on the previous corresponding period and beat consensus estimates for $33.8 million by 16 per cent. Revenue for the sale of new vehicles was unchanged on the same period a year ago at $564 million, thanks to an inability to obtain sufficient stock. A combination of strong demand, and that inability to deliver new cars, has also resulted in the company's new vehicle order book doubling from a year ago. New orders written in the first half exceeded deliveries by 22 per cent. Over in the used car department, vehicle revenue of $209 million was also flat yoy but strong growth in the final quarter of the calendar year was implied by the fact the first quarter was down 12 per cent yoy due to lockdowns. The services department generated $59 million in revenue, which was nine per cent higher than the previous corresponding period and parts generated $60 million of revenue up 13 per cent yoy. The growth in profit, which exceeded revenue growth, was the result of higher selling prices (on less stock) and therefore improved margins. Gross margins of 19.2 per cent was an improvement on the 17.8 per cent generated in in the second half of FY21. The company's outlook remains clouded by a comprehensive lack of clarity about when deliveries will return to normal. Supply constraints are expected to last the remainder of the calendar year at least. Demand should therefore continue to exceed supply. The Used vehicle, Service and Parts divisions are expected to generate revenue growth of between six and ten per cent. Longer term the business model remains under the cloud of threats from OEMs moving to an agency selling model. Author: Roger Montgomery, Chairman and Chief Investment Officer Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund |

30 Mar 2022 - Performance Report: Argonaut Natural Resources Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | At times, ANRF may consider holding higher levels of cash (max 30%) if valuations are full and it is difficult to find attractive investment opportunities. The Fund does not borrow for investment or any other purposes, but it may short sell securities as part of its portfolio protection strategies. |

| Manager Comments | The Argonaut Natural Resources Fund has a track record of 2 years and 2 months and therefore comparison over all market conditions and against its peers is limited. However, the fund has outperformed the ASX 200 Total Return Index since inception in January 2020, providing investors with an annualised return of 56.23% compared with the index's return of 6.11% over the same period. On a calendar year basis, the fund hasn't experienced any negative annual returns in the 2 years and 2 months since its inception. Over the past 12 months, the fund's largest drawdown was -3.38% vs the index's -6.35%, and since inception in January 2020 the fund's largest drawdown was -14.61% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in February 2020 and lasted 3 months, reaching its lowest point during March 2020. The fund had completely recovered its losses by May 2020. The Manager has delivered these returns with 1.25% more volatility than the index, contributing to a Sharpe ratio for performance over the past 12 months of 3.07 and for performance since inception of 2.28. The fund has provided positive monthly returns 79% of the time in rising markets and 57% of the time during periods of market decline, contributing to an up-capture ratio since inception of 195% and a down-capture ratio of -16%. |

| More Information |

30 Mar 2022 - A tumultuous start to '22!

|

A tumultuous start to '22! Insync Fund Managers March 2022

Economy-wide events dominate the headlines Big inital swings are a typical reaction to a change in the macro-economic outlook and are not cause for us to react. This movement was primarily driven by the largest swing towards value stocks in over 20 years. As at the end of February, the 'value' style category fell -2.8% CYTD with 'growth' styles falling -12.5%, according to JP Morgan. The lesser known 'quality' style category where Insync resides is neither value nor growth, although we tend to hold stocks the market categorises as Growth. 2022 marked the 5th worst start for S&P 500 since 1927. Inflation fears have the market pricing in 5-6 interest rate rises this year, precipitating the heavy swing initially, with Ukraine's invasion by Russia creating price spikes in both energy and commodity prices as well. Markets hate uncertainty. It's no surprise then that material and energy stocks were the best performers in February (Insync has zero exposure to these sectors due to their low ROICs through the cycle). It's highly probable that the negative macro factors will slow economic growth. This in turn, will then favour a move back to profitable growth companies (rather than growth stocks overall). These are the type of stocks we hold. Thus, we liken the current portfolio to a coiled spring. When investors soon refocus on company fundamentals, the share price performance of quality businesses then rebound quickly and sharply. This usually 'surprises' commentators and investors alike. Earnings growth across the portfolio continues to compound strongly despite macro shifts, with valuations becoming more attractive.

Governance factors are why Russia and its peers don't appear with Insync Russia's invasion of Ukraine is one of the greatest tragedies of our lifetime. We have no direct exposure to Russian equities and virtually zero indirect exposure. The simple reason is that Russia is a Kleptocracy run by a ruler who has used his poitical power to systematically steal billions of dollars of its national treasure owned by its people. When there is no rule of law - and therefore no shareholder rights - valuations do not matter. The risk of near total loss of capital is too high. Companies with strong governance nearly always do the right thing and also deploy capital wisely.

Why we are confident that sustainable growth companies are poised to perform strongly Almost every big slowdown in the past has been preceded by a rise in energy prices and Federal Reserve rate hikes.Going forward then, markets will likely start shifting focus to the prospect of weaker economic growth and refocus on investing in businesses with durable, sustainable earnings growth and profitability. This economic backdrop propels precisely the kind of stocks we hold. Overlaid with identified megatrends, it enables these companies to thrive irrespective of higher rates or slower growth. Meantime, in the near term expect ongoing volatility in markets and most equity funds as well including our own.

We have often discussed the difficulty and danger of market timing. The probability of getting it right more often than wrong is extremely low. Right now, investor sentiment is very bearish with the AAII investor sentiment survey at its lowest point since April 2020. Fund managers overall reflect this view, holding the highest level of cash since the covid lows and at the bottom of the GFC.

This is why we remain fully invested when markets swing wildly as one would expect in these moments of macro-economic uncertainty. For good reason we didn't react in previous occasions such as now, and we won't in future ones either. This is also why we remain fully invested unlike many of our peers. Should timing be desired in the hope of avoiding the dips and riding the peaks, then we believe this is a decision for the investor and their adviser. We continue with our usual rifle-like approach of investing in the most profitable companies with a long runway of growth fuelled by megatrends. We refrain from trying to time these shifts, as this lowers risks and, longer term, aids returns. Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund |

30 Mar 2022 - Do Multiples Matter?

|

Do Multiples Matter? Equitable Investors March 2022

Do valuation multiples matter? There's broadly two schools of thought - one that purchase price dictates your future return and the other that good companies will deliver growth in time to drive value higher, whatever the current price is. Buying a stock on low multiples is no guarantee of either future multiple expansion or earnings growth. Outside times of panic you can expect there is some logic driving the sellers of those low multiple stocks. But an excessive price today can burden a company with implied growth expectations that it just can't meet. In a different era, former dot-com darling Sun Microsystems' CEO, Scott McNealy, expressed it well:

Size is an important factor - Sun was "at scale" with >$US10 billion of dollars of annual revenue and its ability to grow into its valuation was limited. A microcap today on 10x revenue that is just beginning to penetrate its market with a competitive advantage may well be able to prove it was a bargain retrospectively. So multiples only mean something with context and analysis. Funds operated by this manager: |

29 Mar 2022 - The central bank dilemma

|

The central bank dilemma Kardinia Capital March 2022 |

|

Jerome Powell's re-election as Federal Reserve chair late last year was a relief to investors, but a few short months later his credibility is now on the line. As economists continue to argue as to whether inflation is transitory or permanent, political parties know full well that inflation is disastrous at the ballot box. The US midterms will be held in November and polling doesn't look good for the Biden administration. While the 2024 full term election is still a while away, inflation is rising. Gasoline price increases are toxic to the US voter and the prices at the pump are already at record levels, recently surpassing the 2008 spike. CPI is almost certainly going to be north of 8-9% year on year over the next few months, which is going to light a fire under the Fed. 12-month percent change in CPI for All Urban Consumers (CPI-U), Inflation is taking off, but the outlook for the global economy remains uncertain. China has just announced a GDP growth target of 5.5% this year, the lowest in more than 30 years. Russian credit has just been downgraded to junk, while global sanctions are already creating material market distortions. Meanwhile, the effects of higher oil prices are rippling across the economy. We believe those prices are here to stay, due largely to geopolitical events and ESG trends. Russia is the world's largest net exporter of oil and gas combined. According to Goldman Sachs, Russia supplies 11% of global oil consumption and 17% of global natural gas consumption (and as much as 40% of Western European consumption). However, the US has banned the import of Russian oil and gas, the UK is phasing out oil imports by the end of 2022, and the EU announced plans to cut imports of Russian gas by two thirds within a year. The world needs to replace this supply, but OPEC has already announced that it has no plans to increase production in response to the Russia/Ukraine war. US trade envoys have been dispatched to Venezuela, with suggestions that a Saudi Arabian trip is in the planning. Of course, the US has the potential to bridge some of the shortfall by ramping up its own unconventional production; however, that appears unlikely given the US administration was elected on a clean energy platform. Energy supply was already under pressure from ESG trends. In 2020, BP announced a plan to cut oil and gas production by 40% over 10 years and pivot towards renewables. Last year, Shell announced that its oil production had peaked and would fall 1-2% per annum as it targeted net zero emissions by 2050. This supply shortfall is occurring just as energy demand is returning after the COVID-induced lockdowns of the past two years. There is no easy solution. We do not believe there will be a quick end to the Russia/Ukraine conflict, meaning energy and commodities prices will remain elevated. The resources and energy sectors should generate attractive returns in 2022, with Australia in the box seat to outperform the rest of the world given its stable, resource rich environment. It's also worthwhile watching the credit and debt markets, which are so deep and more liquid that equity markets (and often equity investors) overlook the signals these markets provide. The 2yr/10yr year US yield curve is flattening, with credit markets signalling that investors are losing confidence in the economy's growth outlook. Often it can be difficult to predict the trigger for an economic downturn, but in this case it could be the Fed raising the federal funds rate itself that causes a downturn. |

|

Funds operated by this manager: Bennelong Kardinia Absolute Return Fund |

|

The content contained in this article represents the opinions of the author/s. The author/s may hold either long or short positions in securities of various companies discussed in the article. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the author/s to express their personal views on investing and for the entertainment of the reader. |