NEWS

22 Apr 2022 - Airlie Insight: The dominant narrative of 2022 for stocks

|

Airlie Insight: The dominant narrative of 2022 for stocks Airlie Funds Management April 2022

|

|

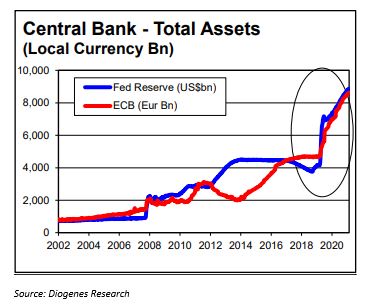

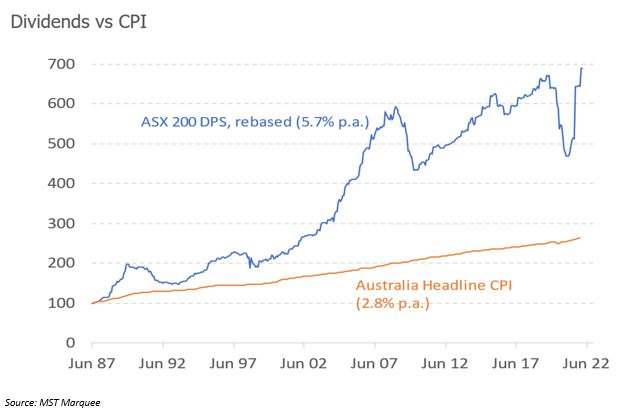

Last quarter we talked about the danger of following blindly (and reacting to) the 'dominant narrative' that is prevalent at any time in the market. However, there is no denying we are at the crossroads where inflation plus central bank tapering equals higher interest rates. Nothing encapsulates the excesses of the past decade better than the chart below showing central bank asset growth (i.e., buying assets/money printing). It seems unlikely that the similarity in the growth of global equity markets over this period is a coincidence. Is this inflation spike transitory or structural? Some of it is clearly transitory driven by covid-19-affected supply chain issues; however, add in the energy and commodity price shock from the Russian invasion of Ukraine and suddenly 2022 looks different from most of the past decade. The 'dominant narrative' is all-encompassing, and the first impact is an increase in volatility in equity markets. In 2021, the S&P 500 Index had the fewest market drops (or 'drawdowns' in the professional lexicon) in recent history. It seems reasonable that the uncertainty of just how high rates will go will lead to a lot more volatility, and this has certainly been the case thus far in fiscal 2022. From recent peaks, the NASDAQ and S&P 500 fell 22% and 13% respectively but have now rallied 13% and 9%. The S&P/ASX 200 has done even better - falling 10% from the January high only to rally 10%, leaving it only 1% from the all-time high set in August 2021. The Australian market has been bolstered by its high weighting to banks and energy and resource companies. Many pundits are calling this sudden snap-back rally a 'dead cat bounce' due to perhaps a view that the Russian-Ukrainian situation evolves into some sort of truce hopefully soon. At that time the 'dominant narrative' will then return and take charge leading to slowing economic growth and possibly recessions. The chart below shows that it's certainly been the case that markets do not do as well when inflation is both rising and is above 3%. This is the exact opposite situation of the past decade where we've had falling inflation and below 3%. Not shown on the chart is that markets produce negative returns when inflation persistently exceeds 6%. So, what does it all mean and what to do? Unfortunately, it's impossible to answer. We've met investors this year who have proudly told us they've gone to cash as the market hit the 10% drawdown because the 'dominant narrative' is obvious - equity markets will fall, economies will falter. They may ultimately be right, but I've wondered what they make of the rally back to within 1% of all-time highs? The performance of non-profitable tech, the return of so-called value stocks, and the valuation implication of higher rates lead us to think that the one-way trip of the market over the past decade and the return of volatility may mean stock-picking comes to the fore and there are increasing opportunities for active managers to differentiate themselves. Also not forgetting the fact that the equity market is the best place to counter inflation. The chart below shows that just the dividends alone from listed Australian equities have preserved investors' buying power over the long term. With all the doom and gloom and headline fodder provided by the above debates it's easy to forget that the Australian economy remains in good shape. The strength is widely spread across the economy: from households enjoying strong employment prospects with wage rises, increasing house prices, falling mortgage repayments (for now), to miners reaping solid commodity prices, farmers rebounding from the drought, and banks experiencing renewed credit growth. So where to from here? The case for further strength in equity markets is a relative one. Absolute valuations are high relative to history and are vulnerable overall to higher interest (discount) rates. The energy shock brought about by Russia's invasion of Ukraine and higher commodity prices generally are supportive in the short term to our resources-heavy market. Also, as the chart below shows; equally supportive is the forecast dividend yield available from the ASX 200 - a healthy dividend return of 4.0% - making it the equal-highest-yielding equity market in the world. Calendar year 2021 was a year of significant capital return for investors, as many ASX companies were carrying surplus capital: banks, miners, retailers, and many industrials had seen dramatic balance sheet improvements over the past 18 months. We expect continuing healthy capital returns to shareholders, notwithstanding the global uncertainty. By Matt Williams, Portfolio Manager Funds operated by this manager: Important Information: Units in the fund(s) referred to herein are issued by Magellan Asset Management Limited (ABN 31 120 593 946, AFS Licence No. 304 301) trading as Airlie Funds Management ('Airlie') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to an Airlie financial product or service may be obtained by calling +61 2 9235 4760 or by visiting www.airliefundsmanagement.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of an Airlie financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Airlie makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Airlie. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any third party trademarks contained herein are the property of their respective owners and Airlie claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks.. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Airlie. |

21 Apr 2022 - Performance Report: Bennelong Twenty20 Australian Equities Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | |

| Manager Comments | The Bennelong Twenty20 Australian Equities Fund has a track record of 12 years and 5 months and has outperformed the ASX 200 Total Return Index since inception in November 2009, providing investors with an annualised return of 10.97% compared with the index's return of 8.44% over the same period. On a calendar year basis, the fund has experienced a negative annual return on 2 occasions in the 12 years and 5 months since its inception. Over the past 12 months, the fund's largest drawdown was -10.54% vs the index's -6.35%, and since inception in November 2009 the fund's largest drawdown was -26.09% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in February 2020 and lasted 9 months, reaching its lowest point during March 2020. The fund had completely recovered its losses by November 2020. The Manager has delivered these returns with 0.47% more volatility than the index, contributing to a Sharpe ratio which has fallen below 1 four times over the past five years and which currently sits at 0.68 since inception. The fund has provided positive monthly returns 95% of the time in rising markets and 7% of the time during periods of market decline, contributing to an up-capture ratio since inception of 117% and a down-capture ratio of 97%. |

| More Information |

21 Apr 2022 - Performance Report: Airlie Australian Share Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund is long-only with a bottom-up focus. It has a concentrated portfolio of 15-35 stocks (target 25). The fund has a maximum cash holding of 10% with an aim to be fully invested. Airlie employs a prudent investment approach that identifies companies based on their financial strength, attractive durable business characteristics and the quality of their management teams. Airlie invests in these companies when their view of their fair value exceeds the prevailing market price. It is jointly managed by Matt Williams and Emma Fisher. Matt has over 25 years' investment experience and formerly held the role of Head of Equities and Portfolio Manager at Perpetual Investments. Emma has over 8 years' investment experience and has previously worked as an investment analyst within the Australian equities team at Fidelity International and, prior to that, at Nomura Securities. |

| Manager Comments | The Airlie Australian Share Fund has a track record of 3 years and 10 months and therefore comparison over all market conditions and against its peers is limited. However, the fund has outperformed the ASX 200 Total Return Index since inception in June 2018, providing investors with an annualised return of 12.87% compared with the index's return of 10.04% over the same period. On a calendar year basis, the fund hasn't experienced any negative annual returns in the 3 years and 10 months since its inception. Over the past 12 months, the fund's largest drawdown was -6.79% vs the index's -6.35%, and since inception in June 2018 the fund's largest drawdown was -23.8% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in February 2020 and lasted 9 months, reaching its lowest point during March 2020. The fund had completely recovered its losses by November 2020. The Manager has delivered these returns with 0.52% less volatility than the index, contributing to a Sharpe ratio which has only fallen below 1 once over the past three years and which currently sits at 0.81 since inception. The fund has provided positive monthly returns 97% of the time in rising markets and 14% of the time during periods of market decline, contributing to an up-capture ratio since inception of 106% and a down-capture ratio of 92%. |

| More Information |

21 Apr 2022 - Redwheel: How the green wave is influencing emerging markets

|

Redwheel: How the green wave is influencing emerging markets Channel Capital April 2022 For professional investors and advisers only The road to net zero emissions has the potential to set in place the conditions for a commodity super-cycle which has significant implications for emerging and frontier markets. Governments and authorities made many pledges following the two-week COP26 meeting in November 2021. More than 100 countries, including Brazil and Russia, agreed to end deforestation by 2030. Another 80, led by the US and the EU, pledged to cut methane emissions by at least 30% by 2030 while over 40 countries made new commitments to phase out coal power despite China, US, India and Australia holding back. These widespread commitments to achieve carbon neutrality are likely to intensify electrification and renewable energy efforts, creating multi-decade support for relevant industries. Solar is set to play a more important role while producers of "green wave" materials like copper, uranium and lithium may also be key beneficiaries of this trend. INVESTING IN CLIMATE CHANGE An estimated $56tn in incremental infrastructure investment should be needed to achieve net zero carbon emissions by 2050. This implies an average annual investment of $1.9tn in decarbonization worldwide. If politicians commit a fraction of the capital which they have talked about we believe that copper, aluminium, nickel, cobalt and lithium prices could increase significantly as supply and demand dynamics may create serious bottlenecks. The majority of these commodities is located in emerging markets. The economies which are net exporters of these metals should be beneficiaries of higher prices as the contribution of exports to GDP increases rapidly.

We see equity outperformance from companies that produce commodities related to the electrification of the global economy and businesses involved in the respective supply chains (e.g. copper/lithium, electricity transmission, energy storage). The Redwheel Emerging and Frontier Markets team has identified several key themes that look set to benefit from this long-term secular growth opportunity: Sustainable Energy, New Auto Tech and Copper. SUSTAINABLE ENERGY The International Energy Agency (IEA) estimates that global electricity demand could double by 2050 under a net zero scenario.¹ We believe that demand has the potential to grow more than that. As the world continues to focus on decarbonization, the majority of the new sources of electricity will have to be generated sustainably. We identify and invest in companies that are actively involved at any point in the supply chain of low carbon energy. The target of sustainable energy is to produce affordable and reliable energy for extended periods of time, while at the same time helping to combat climate change with the lowest possible emission of CO2 and other greenhouse or polluting gases. We have key portfolio holdings across different sectors such as solar power and nuclear energy. SOLAR POWER The development of solar power will be crucial in phasing out fossil fuels. Solar PV² is becoming the lowest-cost option for electricity generation in most of the world leading to significant investment in the coming years and strong growth for solar power manufacturers. In the solar sector, after years of expansion and consolidation, Chinese suppliers now represent more than 80% of the effective capacity in most segments across the solar supply chain.³ Chinese solar suppliers started to expand their capacity in 2019 on the back of stronger visibility on future demand. The robust performance of these companies in the equity market has enabled them to raise capital and further accelerate their expansion plans.

LONGi is the largest mono-silicon wafer producer in the world and is set to be a key enabler of the shift to solar power. We expect ongoing vertical integration (from wafer to cell and module) to potentially further boost LONGi's market share in the global module markets. Additionally, LONGi believes the distributed solar market in China, especially commercial and industrial, should see strong demand in 2022 driven by government policies. In 2021, distributed solar modules accounted for 15-20% of LONGi's total module shipment, which may increase to 35-40% in 2022. LONGi believes the distributed solar market has higher module price affordability than solar farms, leading to higher margins. URANIUM Nuclear energy has been brought back into the spotlight due to its low cost and high energy efficiency. Nuclear capacity is increasing in countries such as China and India due to the constant search for more sustainable forms of energy. This is offsetting the decommissioning and decline of nuclear as a source of electricity generation in Western countries. However, we believe that nuclear power will regain political support in the US and parts of Europe which will drive life extensions of existing reactors and positively impact medium term demand. Additionally, supply curtailments by key industry players such as Cameco and Kazatomprom could continue to drive uranium prices higher, benefitting low cost uranium miners.

Kazatomprom is the world's largest uranium producer commanding a direct share of 45% of the world's production. Its mines operating in Kazakhstan are also the lowest cost uranium producer globally. This uranium miner will be a key beneficiary from the expected rise in uranium prices.⁴

COPPER We have been bullish on the role of copper in the drive for global decarbonization for several years. Copper is one of the key metals and beneficiaries of the electrification of the global economy, whether through the production of electric vehicles or the electrification of industries and is crucial in the construction and build out of renewable energy. For example, electric vehicles use seven times more copper per car than vehicles powered by internal combustion engines while wind power is five times as copper intensive as thermal power stations. A wholesale switch would require the copper supply to almost double from today's levels.⁵ On the supply side, large existing copper producers are struggling to maintain copper production at current levels as higher cost underground mines are replacing above ground open pit mines. Ore grades have decreased substantially, and our research suggests new copper greenfield projects are only viable at sustainable prices of over $3.50 per pound of copper. These supply issues, combined with secular growth in demand, suggests that the outlook for the base metal is positive over the coming years. Emerging markets account for over 60% of the copper supply globally, therefore we see several emerging markets benefitting from the robust long-term supply-demand dynamics of copper.

In Zambia, First Quantum Minerals operates one of the largest copper mines globally. The company is set to benefit from an appreciation in the copper price over the next decade due to robust demand and subdued supply.

NEW AUTO TECHNOLOGY There is currently a dramatic change taking place in the world's transportation sector. New Energy Vehicles (NEVs) are replacing vehicles with internal combustion engines (ICEs). NEVs require different materials for construction and operation which lead to a new set of beneficiaries within the automobile supply chain. We believe there is a considerable growth opportunity within the upstream segment of the NEV value chain. Demand for commodities such as lithium, nickel, cobalt, copper and platinum group metals should rise exponentially as the penetration of NEVs increases worldwide. The supply dynamics of many of these commodities are strained which will likely lead to higher and more stable prices over the medium to long term. Electric vehicles are the main driver of future lithium demand, accounting for c30% of total lithium demand currently and potentially rising to over 60% by 2025e⁶. As a result, lithium demand is expected to grow 20-25% annually in the medium term. We expect lithium prices to be supported over the next decade by strong demand and lagging supply leading to deficits. SQM operates one of the world largest lithium mines in Chile and is well positioned to take advantage of this price environment. The company should see robust production growth through the end of the decade, while its projects have attractive positions on the cost curve. Additionally, SQM has a solid balance sheet to fund this growth and has significant leverage to lithium prices.

WHAT HAPPENS TO FOSSIL FUELS? The global economy will remain heavily reliant on fossil fuels for several decades to come despite the transition to a green economy. Even if all the currently announced climate pledges were fully implemented, oil demand in 2050 would still be 75m barrels per day, down only 25% from current levels (source: IEA, 13/10/2021). However, capex in the sector is down 50% from its peak in 2014. Thus, it is quite possible that the supply of fossil fuels will decline more than demand as the development of low carbon alternatives may not be adequate to keep the market balanced. Underinvestment in the hydrocarbons sector amid green transition efforts and changing government regulations could lead to growing energy scarcity.

This structural underinvestment in high carbon sectors is likely to drive hydrocarbon prices higher over the medium-to-longer term, raising affordability concerns, but also increasing the innovation of decarbonization technologies. CONCLUSION In conclusion, as the momentum behind the 'E' of ESG grows stronger, we will continue to see an increasing demand for greener materials and we believe Emerging Markets are set to benefit. However, unless more investment comes through, mined raw materials may become a bottleneck to tackling climate change. |

|

Funds operated by this manager: CC Redwheel Global Emerging Markets FundSources

Important Information No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. |

20 Apr 2022 - Performance Report: Insync Global Capital Aware Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Insync invests in a concentrated portfolio of high quality companies that possess long 'runways' of future growth benefitting from Megatrends. Megatrends are multiyear structural and disruptive changes that transform the way we live our daily lives and result from a convergence of different underlying trends including innovation, politics, demographics, social attitudes and lifestyles. They provide important tailwinds to individual stocks and sectors, that reside within them. Insync believe this delivers exponential earnings growth ahead of market expectations. The fund uses Put Options to help buffer the depth and duration that sharp, severe negative market impacts would otherwide have on the value of the fund during these events. Insync screens the universe of 40,000 listed global companies to just 150 that it views as superior. This includes profitability, balance sheet performance, shareholder focus and valuations. 20-40 companies are then chosen for the portfolio. These reflect the best outcomes from further analysis using a proprietary DCF valuation, implied growth modelling, and free cash flow yield; alongside management, competitor, and industry scrutiny. The Fund may hold some cash (maximum of 5%), derivatives, currency contracts for hedging purposes, and American and/or Global Depository Receipts. It is however, for all intents and purposes, a 'long-only' fund, remaining fully invested irrespective of market cycles. |

| Manager Comments | The Insync Global Capital Aware Fund has a track record of 12 years and 6 months and has underperformed the Global Equity Index since inception in October 2009, providing investors with an annualised return of 10.87% compared with the index's return of 11.2% over the same period. On a calendar year basis, the fund has experienced a negative annual return on 2 occasions in the 12 years and 6 months since its inception. Over the past 12 months, the fund's largest drawdown was -17.93% vs the index's -8.41%, and since inception in October 2009 the fund's largest drawdown was -17.93% vs the index's maximum drawdown over the same period of -13.59%. The fund's maximum drawdown began in January 2022 and has lasted 2 months, reaching its lowest point during March 2022. During this period, the index's maximum drawdown was -8.41%. The Manager has delivered these returns with 0.74% more volatility than the index, contributing to a Sharpe ratio which has fallen below 1 five times over the past five years and which currently sits at 0.8 since inception. The fund has provided positive monthly returns 81% of the time in rising markets and 23% of the time during periods of market decline, contributing to an up-capture ratio since inception of 59% and a down-capture ratio of 77%. |

| More Information |

20 Apr 2022 - Performance Report: Bennelong Australian Equities Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | |

| Manager Comments | The Bennelong Australian Equities Fund has a track record of 13 years and 2 months and has outperformed the ASX 200 Total Return Index since inception in February 2009, providing investors with an annualised return of 13.97% compared with the index's return of 10.51% over the same period. On a calendar year basis, the fund has only experienced a negative annual return once in the 13 years and 2 months since its inception. Over the past 12 months, the fund's largest drawdown was -15.95% vs the index's -6.35%, and since inception in February 2009 the fund's largest drawdown was -24.32% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in February 2020 and lasted 6 months, reaching its lowest point during March 2020. The fund had completely recovered its losses by August 2020. The Manager has delivered these returns with 1.23% more volatility than the index, contributing to a Sharpe ratio which has fallen below 1 four times over the past five years and which currently sits at 0.82 since inception. The fund has provided positive monthly returns 91% of the time in rising markets and 18% of the time during periods of market decline, contributing to an up-capture ratio since inception of 129% and a down-capture ratio of 97%. |

| More Information |

20 Apr 2022 - Looming French presidential election

|

Looming French presidential election 4D Infrastructure April 2022 The French presidential election is underway, with a first-round vote on Sunday 10 April and the run-off between the top two candidates on Sunday 24 April.

In a likely replay of 2017, the polls suggest incumbent President Emmanuel Macron will face far-right candidate Marine Le Pen in the run-off. In this piece we consider some of the key issues at play and the implications for us as infrastructure investors. Meet the candidatesFrom far-left to far-right, there are 12 official candidates for the election. As of 2 April, opinion polls are placing Emmanuel Macron ahead with 24% to 33% of vote intentions, with the other candidates fighting for the runner-up position. Key policy positionsThe table below summarises the key policy positions of the four leading candidates and how they may impact the current and potential future infrastructure investment environment. Impact on infrastructure investmentIn terms of sector specifics, energy/climate policies have dominated the campaign with all candidates expressing a view - albeit quite different ones - around need, support, funding and timing of the energy transition. These policies represent potential head and tail winds for the infrastructure sub-sectors exposed, but overall it means significant investment in the sector, potentially creating many future private sector investment opportunities. Outside the energy space, the argument of private versus public ownership of the transport sector has again come into play and could have ramifications for those stocks exposed, such as Vinci, Atlantia and ADP. A second Macron termA Macron win would not alter the fundamental outlook for the infrastructure sector relative to today. However, it will cement a positive infrastructure investment cycle with more than €10bn of investment towards energy transition and Russian gas independence. The pace to renewable energy as base load power could also accelerate and benefit renewable operators such as Neoen, Voltalia, Orsted. We would expect further integration with Europe in terms of security of energy supply benefiting the integrated players. We have also seen a shift in thinking around nuclear. We expect Macron, in a second term, to revive what had been an out-of-favour sector with important investment packages to both extend the life of existing plants and develop new generation reactors (to the benefit of Engie, EDF or Vinci). Outside the energy sector, we believe the current motorway network concessions could be extended in exchange for capital expenditure commitments, supporting improved motorway efficiency and growth profiles of the key players such as Vinci or Atlantia. A Le Pen winLe Pen has dropped her controversial proposal to exit the euro, which we believe reduces the risk to the overall French economy relative to 2017. Due to the extreme nature of her economic positions, a Le Pen victory would lead to clear winners and losers in the infrastructure space. The biggest threat from a Le Pen victory would be the nationalisation of assets of listed entities with toll roads and airports clear targets, which would be detrimental to domestic listed players such as ADP and Vinci as well as foreign players with exposure to French infrastructure. Regardless of whether nationalisation is a serious threat (legally or otherwise), it would be a clear overhang for the sector - much like a potential Jeremy Corbyn victory was for the UK in 2019. Even without nationalisation, in a Le Pen victory the infrastructure sector will likely experience stricter sector regulation (as far as it is possible within the concession construct). Positively, Le Pen has expressed a willingness to pursue the energy transition. However, certain sectors are definitely not in favour (wind), and she would push for limitation of the EU influence on French energy policy. ConclusionWe are expecting a Macron/Le Pen run off with Macron ultimately re-elected for a second term. However, unless Macron can also win a majority in the parliament, we could see a fragmented legislature with increased difficulty in policy execution stalling reforms. Regardless of who wins, we see continued positive momentum in energy transition and investment as all parties work towards this common goal, and more of a status quo for the transport names with existing earnings underpinned by long-term concessions. Should Le Pen win, we would revisit our transport exposure in the near term. |

|

Funds operated by this manager: 4D Global Infrastructure Fund, 4D Emerging Markets Infrastructure FundThe content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader. |

20 Apr 2022 - The Ardea Alternative - Foreign Currency Management

|

The Ardea Alternative - Foreign Currency Management Ardea Investment Management 28 March 2022 Key Portfolio Construction Trade-Offs Dr. Laura Ryan and Tamar Hamlyn are joined by Dr. Nigel Wilkin-Smith to discuss the importance of currency management for AUD investors, along with the backdrop created by the regulatory environment in superannuation, particularly the YFYS performance test. |

|

Funds operated by this manager: Ardea Australian Inflation Linked Bond Fund, Ardea Real Outcome Fund |

19 Apr 2022 - Performance Report: Collins St Value Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The managers of the fund intend to maintain a concentrated portfolio of investments in ASX listed companies that they have investigated and consider to be undervalued. They will assess the attractiveness of potential investments using a number of common industry based measures, a proprietary in-house model and by speaking with management, industry experts and competitors. Once the managers form a view that an investment offers sufficient upside potential relative to the downside risk, the fund will seek to make an investment. If no appropriate investment can be identified the managers are prepared to hold cash and wait for the right opportunities to present themselves. |

| Manager Comments | The Collins St Value Fund has a track record of 6 years and 2 months and has outperformed the ASX 200 Total Return Index since inception in February 2016, providing investors with an annualised return of 19.04% compared with the index's return of 11.22% over the same period. On a calendar year basis, the fund hasn't experienced any negative annual returns in the 6 years and 2 months since its inception. Over the past 12 months, the fund's largest drawdown was -5.4% vs the index's -6.35%, and since inception in February 2016 the fund's largest drawdown was -27.46% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in February 2020 and lasted 7 months, reaching its lowest point during March 2020. The fund had completely recovered its losses by September 2020. The Manager has delivered these returns with 3.59% more volatility than the index, contributing to a Sharpe ratio which has only fallen below 1 once over the past five years and which currently sits at 1.04 since inception. The fund has provided positive monthly returns 84% of the time in rising markets and 67% of the time during periods of market decline, contributing to an up-capture ratio since inception of 79% and a down-capture ratio of 28%. |

| More Information |

19 Apr 2022 - Performance Report: Quay Global Real Estate Fund (Unhedged)

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund will invest in a number of global listed real estate companies, groups or funds. The investment strategy is to make investments in real estate securities at a price that will deliver a real, after inflation, total return of 5% per annum (before costs and fees), inclusive of distributions over a longer-term period. The Investment Strategy is indifferent to the constraints of any index benchmarks and is relatively concentrated in its number of investments. The Fund is expected to own between 20 and 40 securities, and from time to time up to 20% of the portfolio maybe invested in cash. The Fund is $A un-hedged. |

| Manager Comments | The Quay Global Real Estate Fund (Unhedged) has a track record of 6 years and 3 months and has outperformed the BBAREIT Index since inception in January 2016, providing investors with an annualised return of 8.92% compared with the index's return of 6.6% over the same period. On a calendar year basis, the fund has only experienced a negative annual return once in the 6 years and 3 months since its inception. Over the past 12 months, the fund's largest drawdown was -8.2% vs the index's -11.14%, and since inception in January 2016 the fund's largest drawdown was -19.68% vs the index's maximum drawdown over the same period of -23.56%. The fund's maximum drawdown began in February 2020 and lasted 1 year and 4 months, reaching its lowest point during September 2020. The fund had completely recovered its losses by June 2021. The Manager has delivered these returns with 0.45% more volatility than the index, contributing to a Sharpe ratio which has fallen below 1 three times over the past five years and which currently sits at 0.69 since inception. The fund has provided positive monthly returns 74% of the time in rising markets and 36% of the time during periods of market decline, contributing to an up-capture ratio since inception of 70% and a down-capture ratio of 60%. |

| More Information |

.JPG)