NEWS

17 Dec 2024 - Performance Report: Glenmore Australian Equities Fund

[Current Manager Report if available]

17 Dec 2024 - Proprietary Data - Strategic AI Advantage

|

Proprietary Data - Strategic AI Advantage Insync Fund Managers December 2024 Proprietary data sets provide businesses with competitive advantages due to their uniqueness, quality and relevance. They are often more specific, accurate, and tailored to a company's particular needs or industry, providing a rich data source for AI algorithms. RELX Plc is a global provider of information-based analytics and decision tools providing products that help researchers advance scientific knowledge across medical, legal, financial services, and government sectors. They recently showcased their Legal division's advancements highlighting cutting-edge AI-enabled tools like Lexis+ and its next-generation AI assistant, Protégé. This division underwent a remarkable transformation, shifting from print and basic electronic reference services to advanced analytics and decision-making platforms. Growth rates have accelerated by 14%, with the division now targeting an 8% growth rate by 2025.

RELX's competitive advantage lies in its extensive proprietary datasets, leading brands, and a robust installed user base. Analysts increasingly recognize RELX as an AI beneficiary.

By integrating RELX's vast 100+ billion document datasets with clients' internal knowledge, their AI assistant addresses legal professionals' top demands, enhancing productivity. This unlocks a 20% total addressable market (TAM) expansion. At Insync, we see RELX as a prime example of technology driving structural growth. The company's accelerating growth and discounted valuation relative to peers underscore our conviction, making RELX one of our key holdings. Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund Disclaimer |

16 Dec 2024 - Performance Report: Bennelong Emerging Companies Fund

[Current Manager Report if available]

16 Dec 2024 - Investment Perspectives: Why a Trump presidency could be deflationary

13 Dec 2024 - Hedge Clippings | 13 December 2024

|

|

|

|

Hedge Clippings | 13 December 2024 As soon as Governor Michele Bullock had given the first indications of a softening of the RBA Board's stance on inflation, and with it the possibility of a rate cut, markets responded by factoring in 2 cuts prior to the election. Of course she still cautioned that inflation remained too high, and the outlook remains uncertain - standard fare for post board meeting comments. How much of that softening in tone has been as a result of pressure from your boss, The Treasurer, will probably never be known. And for those who think the RBA Governor's role is independent, just consider who appoints them to the role. If you're dependent on that, you're not independent, and they're the boss! However, market enthusiasm was dampened pretty quickly by Thursday, with the ABS announcing that the November unemployment rate had fallen to just 3.9%. The RBA has previously indicated unemployment would need to be 4.5% or above to dampen demand, and hopefully inflation. So back to the uncertain outlook, and with the Board not sure to meet again until the third week in February, when at least they'll have CPI data for November and December to chew on. Of course, the other additional information they'll have by then is almost a month of Donald Trump's presidency, an issue that Deputy Governor Andrew Hauser focused on in a speech this week, particularly referring to the potential for a tit-for-tat trade war between the US and China, and for that matter other countries, and the effects on Australia. While noting that nothing can be ruled in or out (particularly true when it comes to Trump) Hauser did emphasise that among a long list of 35 world economies, Australia is the least exposed to the negative effect on GDP of a 10% additional US import tariff. This is also reinforced by this week's article from PinPoint Economics, Part 2 of Risks and Issues for 2025 which is included below. PinPoint are suggesting we shouldn't look for a rate cut any time soon - in spite of other central banks cutting theirs. One interesting chart in PinPoint's analysis is titled "Measures of Misery", a term we hadn't been introduced to before - at least not in stark economic statistical terms. PinPoint's growth scenario depends on consumers opening their wallets again, however noting one certainty - at the end of 2024 consumers are miserable, and that the Enhanced Misery Index (based on a mix of CPI, unemployment, debt, and rents) is at the high end of the range over the past 30 years! Bank Hybrids and Franking Credits: Meanwhile back to the Treasurer's wish for influence on the RBA. Certainly no such independence across at APRA, in spite of protestations from head honcho John Lonsdale that this week's decision announcing the phasing out of Bank Hybrids by 2032 was to protect retail investors and ensure stability of the banking sector in times of stress. The decision was clearly a result of a directorate from Treasury (and presumably the Treasurer) with the intention of removing the $1bn per year in franking credit benefits from retail investors. To add insult to injury, APRA claimed that the submissions they invited from those in the industry were broadly supportive of APRA's move. Nicholas Chaplin, Senior Portfolio Manager at Seed Funds Management, whose Hybrid Income Fund has returned 8.52% over the past 12 months, noted that that the move also significantly reduces direct access to listed fixed income opportunities for Australian retail investors, and that professionally managed funds will no doubt benefit. Bill Shorten tried unsuccessfully to abolish franking credits on equities for mum and dad investors and pensioners, and in doing so lost the 2019 election, and his tilt at the Lodge. At the time, Hedge Clippings penned a poem warning "Wee Willy Short-One" that those investors and pensioners would vote - as they did - and also that Albo was breathing down his neck - as he was! The net result is that potentially the $43 billion in hybrids will now be forced into riskier bank equity, with potentially lower returns. That's great for the stability of the banking system in a crisis, but also an indication that when it comes to franking credits on equities, the government - or this government - still has its eyes on them. News & Insights How Trump will impact equity markets | Magellan Asset Management Mixed market sentiment for 2025 driven by global geopolitics and central bank easing cycles Risks & Issues in 2025 - Part 2 | PinPoint Macro Analytics November 2024 Performance News Skerryvore Global Emerging Markets All-Cap Equity Fund Bennelong Concentrated Australian Equities Fund Bennelong Twenty20 Australian Equities Fund Argonaut Natural Resources Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

13 Dec 2024 - Performance Report: 4D Global Infrastructure Fund (Unhedged)

[Current Manager Report if available]

13 Dec 2024 - Performance Report: Argonaut Natural Resources Fund

[Current Manager Report if available]

13 Dec 2024 - Performance Report: Bennelong Twenty20 Australian Equities Fund

[Current Manager Report if available]

13 Dec 2024 - Risks & Issues in 2025 - Part 2

13 Dec 2024 - Trump trade 2.0 - Who is going to buy all this stuff?

|

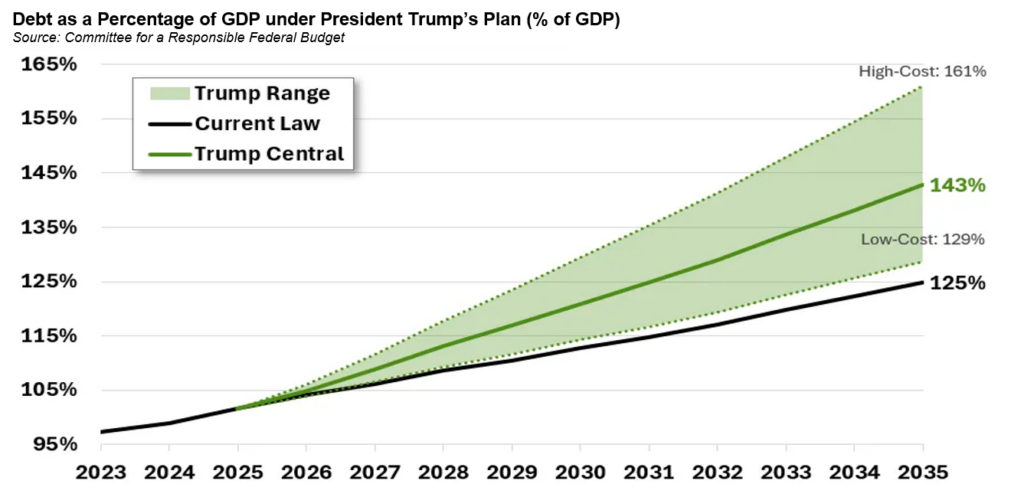

Trump trade 2.0 - Who is going to buy all this stuff? Challenger Investment Management November 2024 In 2016 the election of Donald Trump as president of the United States caused an initial panic in markets with S&P500 futures plunging over 5% as his shock win became more likely. Wall Street had favoured Clinton, fearing Trump's positions on trade. Markets settled down on the US open as investor fears of the most extreme policies abated. Fast forward to 2024 and Trump has returned with Republicans controlling the House and Senate on the back of a similar policy agenda centred around trade and immigration. This time however equities rallied prior to the election on expectation of a Trump win and post the election once his victory was confirmed. The key difference between 2016 and 2024 is the state of the US balance sheet. In 2016 the debt to GDP ratio was 105%, peaking at 132% in the second quarter of 2020 and stands at 120% today. The deficit in 2016 was 3% of GDP. In 2023 it was over 6% and according to Deutsche Bank, will average around 7% over the Trump presidency, higher than the 6% average projected by the Congressional Budget Office. Prior to the election the bipartisan Committee for a Responsible Federal Budget estimated that a Trump presidency would result in an 18% increase in the public debt to GDP ratio relative to the current trajectory (note the below chart shows the debt held by the public and excludes debt held by federal trust funds and other government accounts).

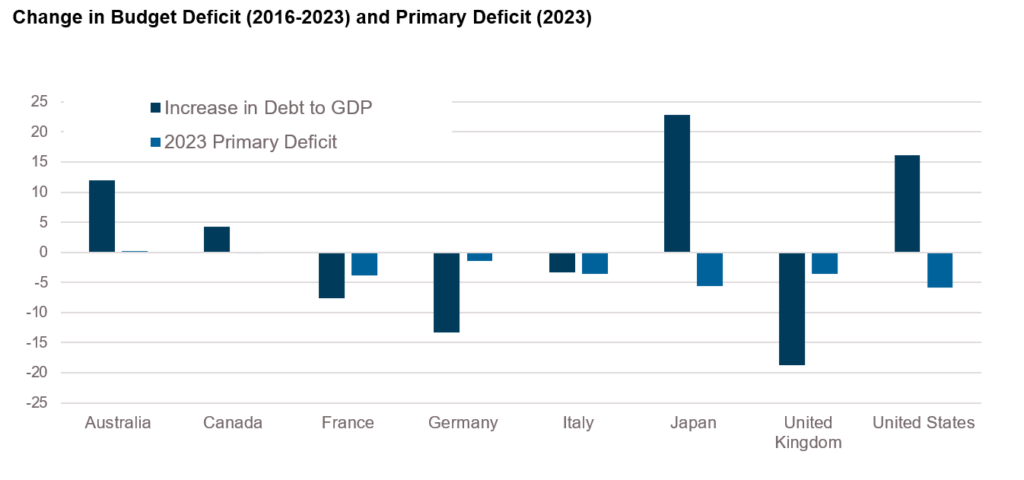

The problem for the United States is not so much the change in the deficit but that it is so much more than those observed by its peers. From 2016 to 2023, the debt to GDP in the United States increased by more than 15%, second most of the peer group above. Perhaps even more concerningly, the primary deficit in 2023 was the worst amongst these nations suggesting, if the above projections hold, the United States debt to GDP ratio will be the second highest amongst developed nations only trailing Japan.

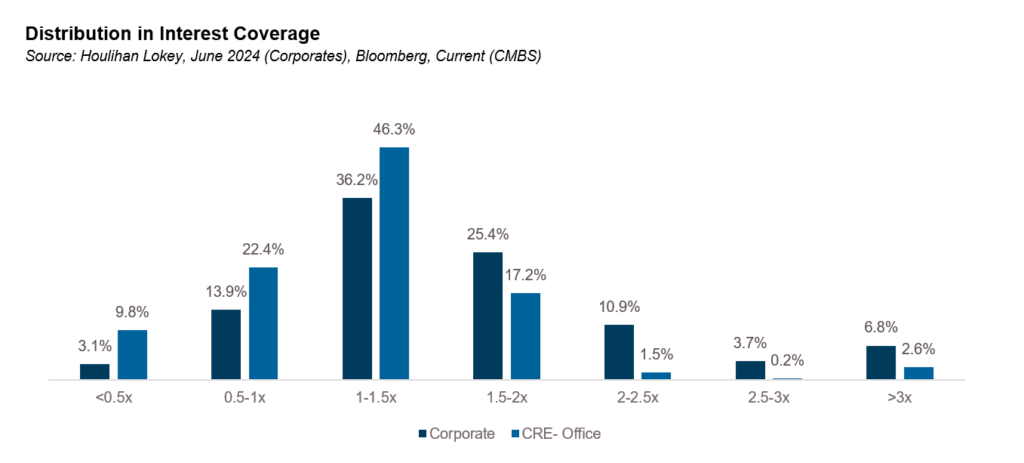

Adding to the supply story is the demand side of the equation. During periods of quantitative easing the Federal Reserve is a classic example of a price insensitive buyer. However, since mid-2022 they have been a price insensitive net seller (effectively, by not reinvesting principal repayments) with the balance sheet down by around US$0.75 trillion to US$7 trillion over the last 12 months. The Fed is currently allowing up to US$25 billion in Treasuries and up to US$35 billion in MBS to mature without reinvestment monthly which could result in another $0.7 trillion reduction over 2025 i.e. a quantitative tightening period. Contrast to 2016 when there was virtually no change to the Fed balance sheet. With the Federal Reserve out of the equation the marginal buyers over the past 12 months have been largely price sensitive buyers; money market funds (up US$1.2 trillion), private foreigners (up US$0.5 trillion) and households and nonprofits (up $0.35 trillion). Commercial banks, a price insensitive buyer has increased their holdings, up US$0.15 trillion in the 12 months to 30 June 2024. With supply increasing and the marginal buyer of treasuries transitioning from a price insensitive one to a price sensitive one the bias would seem to be for yields to move higher. Of course, the Federal Reserve remains the buyer of last resort but in all likelihood will only step in where absolutely necessary. Markets are now pricing the Fed Funds rate declining to around 3.75% by early 2026, a full 100 basis points higher than what was priced only two months ago. To be clear our view is not that Trump's election and the Republican sweep of the House and Senate will result in systemic issues within the treasury market in the United States. We're also not suggesting that treasuries now entail some level of credit risk given the increases in the debt to GDP ratio that we expect over the coming years. We would argue that tail risks have increased given the unpredictability of this administration compared to the more orthodox Biden administration which is a topic worthy of discussion (and something we'll get to in a future piece) but our central position is that a Trump presidency cements the higher for longer thesis. So, what does higher for longer mean for credit? For the most part, corporate credit has been resilient to higher interest rates and has weathered the hiking cycle well with higher earnings muting the impact of higher interest rates. For the S&P500, EBITDA has increased by 15% from the point at which interest rates started increasing. For middle market borrowers, the effect has been even more pronounced with earnings increasing by around 20% over the corresponding period. Interest coverage has stabilised at around 1.5 times with around 15% of borrowers with coverage of less than 1 times. This will improve as interest rates decline. The problem child for credit markets remains commercial real estate markets which is most acutely impacted by higher interest rates. A Bloomberg search of adjustable rate office loans contained in CMBS transactions shows that over three quarters currently have serviceability ratios of less than 1.5 times with one third below 1 time.

It's ironic given the Trump family made their name in commercial real estate that the sector we expect to be most impacted by his presidency is CRE but it is the one that is more leveraged to interest rates. And while wider equity markets have rallied strongly to the new administration, mortgage finance REITs are flat for the month. Author: Pete Robinson | Head of Investment Strategy - Fixed Income Funds operated by this manager: Challenger IM Credit Income Fund, Challenger IM Multi-Sector Private Lending Fund For Adviser & Investors Only Disclaimer: The information contained in this publication has been prepared solely for solely for the addressee. The information has been prepared on the basis that the Client is a wholesale client within the meaning of the Corporations Act 2001 (Cth), is general in nature and is not intended to constitute advice or a securities recommendation. It should be regarded as general information only rather than advice. Because of that, the Client should, before acting on any such information, consider its appropriateness, having regard to the Client's objectives, financial situation and needs. Any information provided or conclusions made in this report, whether express or implied, do not take into account the investment objectives, financial situation and particular needs of the Client. Past performance is not a guide to future performance. Neither Fidante Partners Limited ABN 94 002 895 592 AFSL 234 668 (Fidante Partners) nor any other person guarantees the repayment of capital or any particular rate of return of the Client portfolio. Except to the extent prohibited by statute, Fidante Partners or any director, officer, employee or agent of Fidante Partners, do not accept any liability (whether in negligence or otherwise) for any errors or omissions contained in this report. |