NEWS

20 May 2022 - Hedge Clippings |20 May 2022

|

|

|

|

Hedge Clippings | Friday, 20 May 2022

Well, with one day to go, we're finally at the end of the road - or depending on one's perspective, one day from the start of a new one. Maybe that should be a fork in the road, depending on one's pronunciation of the word "fork". Come to think of it, with the recorded number of postal votes (for which counting doesn't start until Sunday) and the potential for a hung parliament, the outcome might not be known for a few days, or even weeks. The polls are suggesting a high proportion of undecided voters, or maybe that should be a large number who aren't that happy with Scomo, but haven't been swayed or convinced by the slogans (most, as far as we can work out, devoid of solid policy to back them up) of those hoping to take his place. Slogans or otherwise, it does indicate there's a level of underlying dissatisfaction in general in the community. One Scomo hater (and certainly not undecided) we spoke to this week complained he'd handled COVID badly (actually badly is a polite version of his rant) which of all the negative things he might reference, Scomo's handling of COVID, or the results, shouldn't be in question. This week the USA passed the sad milestone of 1 million COVID related deaths for a population of 332 million or one in every 332 Americans. Australia's COVID fatalities are now at 7,986, or 1 in 3,180 of our population. In round terms, we're 10 times less likely to have died from COVID than an American. While our number is 7,986 more than we'd like it to be, it hardly warrants the criticism that it's been badly handled. Of all the slogans, promises, or policies that have been announced, the most detailed and well publicised has been the respective support from both major parties for first home buyers, which, from our understanding, were both well intentioned, but targeting a different demographic. Albanese's "Help to Buy" policy was narrowly cast, both by virtue of the limit of 10,000 recipients each year, (so only 6.6% of the 150,000 first home buyers each year) and their annual income eligibility - $90,000 for singles, and $120,000 for couples, and only required a deposit of 2%. The government would fund up to 40% of the purchase price interest free, which would be capped depending on location. On the other side, Scomo's "Super Home Buyer Scheme" offer was more widely cast, allowing first home buyers to withdraw up to 40% of their super (up to a maximum of $50,000) to help fund their first home, in reality in most cases making it assistance with raising the deposit. Both schemes have their merits and deficiencies, or at least limitations, depending on one's financial position. A low income purchaser is unlikely to have sufficient super in the first case, and their issue is more likely to be being priced out of the housing market, which Albo's scheme, however limited, would resolve. For the wider audience, and possibly those on a higher income, an extra $50,000 towards the deposit, could make the difference, albeit it would likely be less than 10% of the purchase price of the property. Critics of both schemes came out of the woodwork. Industry Super Australia (ISA) presumably more concerned about missing out on fees than their members being able to gain a foothold in the housing market, (and therefore set themselves up to own their own home outright on retirement) claimed it was financially risky for the new home buyer and would hurt all Australians with a super account. Others said it would push the price of property up and therefore be self defeating. ISA's concern seems somewhat self-serving, given that in both cases the funds "borrowed" have to be returned on the sale of the property, along with a proportion of the capital gain. Over the last 10 years, the average capital gain on city residential property has been 5.61% vs an average of 8% for super, so technically they're correct (except those results were to June 2021 and ignore the latest down-turn). Except that ignores the fact that most aspiring first home buyers would readily forgo 2% p.a. to not paying rent, and at least get a foot on the bottom rung of the (CGT free) property ladder. It's unfortunate, politics being politics, that whoever wins the election can't offer both schemes, one targeted (correctly) at those unlikely to ever own their own property, and the other at those slightly more fortunate, but who still need assistance with their deposit in the over heated (but we suspect falling) property market. Meanwhile, what neither side seemed to have focused on (or have chosen not to) is what happens when the first home buyer wants to "trade up" to their next home in say 10 years' time? Under Albo's scheme (but less under Scomo's) 40% of their first home's sale price will go back from whence it came, meaning they'll either need to stay where they are forever, "trade down", or go back to the government of the day and ask for more. Therein lies an (Oliver) twist. News & Insights New Funds | FundMonitors.com What have rubber bands got to do with successful stock selection? | Insync Fund Managers Nestlé: innovation strengthens the moat | Magellan Asset Management Perception vs Reality: When a good story trumps rationality | Airlie Funds Management |

|

|

April 2022 Performance News Insync Global Quality Equity Fund Glenmore Australian Equities Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

20 May 2022 - Performance Report: Paragon Australian Long Short Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Paragon's unique investment style, comprising thematic led idea generation followed with an in depth research effort, results in a concentrated portfolio of high conviction stocks. Conviction in bottom up analysis drives the investment case and ultimate position sizing: * Both quantitative analysis - probability weighted high/low/base case valuations - and qualitative analysis - company meetings, assessing management, the business model, balance sheet strength and likely direction of returns - collectively form Paragon's overall view for each investment case. * Paragon will then allocate weighting to each investment opportunity based on a risk/reward profile, capped to defined investment parameters by market cap, which are continually monitored as part of Paragon's overall risk management framework. The objective of the Paragon Fund is to produce absolute returns in excess of 10% p.a. over a 3-5 year time horizon with a low correlation to the Australian equities market. |

| Manager Comments | The Paragon Australian Long Short Fund has a track record of 9 years and 2 months and has outperformed the ASX 200 Total Return Index since inception in March 2013, providing investors with an annualised return of 13.24% compared with the index's return of 8.57% over the same period. On a calendar year basis, the fund has only experienced a negative annual return once in the 9 years and 2 months since its inception. Over the past 12 months, the fund's largest drawdown was -27.05% vs the index's -6.35%, and since inception in March 2013 the fund's largest drawdown was -45.11% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in January 2018 and lasted 2 years and 7 months, reaching its lowest point during March 2020. The fund had completely recovered its losses by August 2020. The Manager has delivered these returns with 12.25% more volatility than the index, contributing to a Sharpe ratio which has fallen below 1 four times over the past five years and which currently sits at 0.55 since inception. The fund has provided positive monthly returns 69% of the time in rising markets and 45% of the time during periods of market decline, contributing to an up-capture ratio since inception of 107% and a down-capture ratio of 84%. |

| More Information |

20 May 2022 - Mid-Cycle correction or a new bear market?

|

Mid-Cycle correction or a new bear market? Watermark Funds Management April 2022 The question everyone is asking, Is this a mid-cycle slowdown or have we moved into a new bear market for shares? We are firmly in the latter camp. The balance sheet recession that followed the financial crisis was a powerful deflationary force. Households and businesses de-levered while governments exercised fiscal restraint allowing Central banks to reflate without creating inflation. Low growth with deflation was a 'goldilocks' era for risk assets, not too hot and not too cold. In Fig 1 below, you can see four very clear and discrete mini business cycles of four years each starting in March of 2009, as Central Banks' eased and then tightened policy. Together they make up the 14-year secular bull market in shares. The cycle has turned, the bear is here

In each reflation episode, real interest rates moved lower and lower and 'financial assets' such as shares and bonds, moved higher and higher. At the same time as real interest rates turned negative, capital was re-allocated away from short-duration 'hard' assets such as commodities. The share market has followed each of these business cycles peaking on each occasion at the blue advance line in Fig 1 as it has once again in December of last year. As policy support is once again withdrawn we have moved into the next 'cyclical' bear. Market bulls will have you believe policymakers can engineer yet another soft landing, pivot, and reflate one more time. It's highly unlikely this time however as we no longer have these deflationary tailwinds, instead, we have inflation at the highest level in 40 years in many western economies.

In the last tightening cycle in 2018 (Fig 2), the US Federal Reserve started raising interest rates much earlier while the economy was still expanding rapidly (PMI was rising). They didn't even reach the neutral interest rate however where policy pivots from accommodative to restrictive (the dotted line) before economic activity fell sharply and they were forced to reverse course and ease rates again. Back then, inflation was barely at 2%, and the Fed was still trying to push inflation higher! US Federal Reserve Target Interest Rate

This time will be very different, they are late and are tightening as growth slows. Furthermore, to bring inflation back under control, theoretically, policy must 'overshoot'. They need to move beyond the neutral rate (dotted line) to slow demand enough to stimy inflation. Goldman Sachs have suggested this overshoot may require interest rates as high as 4% or above to curb inflation. Interest Rate markets are clearly well below this level today and with an inverted yield curve, bond investors are already signalling a recession is ahead. Given central banks are late and tightening into a slowing economy and the need for a policy overshoot to curb inflation, the prospect of a recession in advanced economies next year is high. A soft landing and another round of asset reflation is equally unlikely. Not just any bear. A new secular bear.This will not just be a 'cyclical' bear market like the four prior episodes but the beginning of a new secular bear where shares move sideways for many years to come. As with secular bulls (the last one lasted 14 years), secular bears typically last 10-15 years

A secular bear market

Strategists often refer to the 1970's secular bear as a precedent for what lies ahead. You can see in Fig 3 above this was not a unique period. Inflation eventually kills most secular bull markets and that should be our base case this time also. It is dangerous to expect this time will be different. Within this secular bear we will still have the four-year business cycle playing out as shares rise and fall, but within a broadly sideways trend. A new secular bear for bonds alsoWith the return of inflation, it looks like the 31-year secular bull in bonds is also now complete. It is clear from the momentum signal in the bottom panel below the low for bond yields (the high for bond prices) is in. Most risk assets are priced off the long bond - the very low yield on these securities has led to a re-rate of other long-duration risk assets like shares. The P/E re-rate of shares and for growth shares in particular is an extension of the depths bond yields have fallen too. As commodities are an inflation hedge, secular trends in commodities have historically been negatively correlated with financial assets. You can see this indicated in red below. A new secular bull market in commodities has probably begun. Secular bear in bonds/a secular bull in commodities

US Treasury Yield % (10 year) Further confirmation of a reversal in bond prices is near to hand. In Fig 5 below you can see bond yields across multiple durations are pushing up against the 30-year downtrend as we speak. If yields break through here, we will be at a seminal moment for risk assets. The 30-year tailwind for share market valuations will have reversed. How it plays out for shares this year

Following the strong bear market rally in March, shares are likely to track sideways in the months ahead but will fall short of prior highs. It is still too early for a major draw, shares still offer decent profit growth this year and analysts are still upgrading profit estimates. Furthermore, with money pouring out of the bond market, investors have few alternatives other than to invest in shares. The next major drawdown in the share market is likely to occur later in the year as economies slow and the street starts cutting profit estimates. As shares start to move lower and investors come to realise there will be no Central Bank bailout this time around, share markets will fall hard led by mega-cap technology - the last and largest bubble still to burst. Closer to home, we may well see a replay of the Teck Wreck and the GFC where the lucky country once again misses the recession bullet given our exposure to a resurgent resources sector. Given our markets' heavy weighting to resources, the ASX may still make a new high in the months ahead. From here, I would advise thinking of the Australian share market as two discrete markets - the All Industrials share market which today is still 7% below the August 2021 high and a resources market which is making new highs as I write this piece. Don't chase it though, the initial advance in commodities is nearly complete. As late cyclicals, resource shares will also fall in the second half of the year as global growth slows. Funds operated by this manager: Watermark Absolute Return Fund, Watermark Australian Leaders Fund, Watermark Market Neutral Fund Ltd (LIC) |

19 May 2022 - Performance Report: Delft Partners Global High Conviction Strategy

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The quantitative model is proprietary and designed in-house. The critical elements are Valuation, Momentum, and Quality (VMQ) and every stock in the global universe is scored and ranked. Verification of the quant model scores is then cross checked by fundamental analysis in which a company's Accounting policies, Governance, and Strategic positioning is evaluated. The manager believes strategy is suited to investors seeking returns from investing in global companies, diversification away from Australia and a risk aware approach to global investing. It should be noted that this is a strategy in an IMA format and is not offered as a fund. An IMA solution can be a more cost and tax effective solution, for clients who wish to own fewer stocks in a long only strategy. |

| Manager Comments | The Delft Partners Global High Conviction Strategy has a track record of 10 years and 9 months and has outperformed the Global Equity Index since inception in August 2011, providing investors with an annualised return of 14.65% compared with the index's return of 13.23% over the same period. On a calendar year basis, the strategy has experienced a negative annual return on 2 occasions in the 10 years and 9 months since its inception. Over the past 12 months, the strategy's largest drawdown was -6.74% vs the index's -10.7%, and since inception in August 2011 the strategy's largest drawdown was -13.33% vs the index's maximum drawdown over the same period of -13.19%. The strategy's maximum drawdown began in February 2020 and lasted 1 year, reaching its lowest point during July 2020. The strategy had completely recovered its losses by February 2021. The Manager has delivered these returns with 1.32% more volatility than the index, contributing to a Sharpe ratio which has fallen below 1 four times over the past five years and which currently sits at 1.08 since inception. The strategy has provided positive monthly returns 88% of the time in rising markets and 13% of the time during periods of market decline, contributing to an up-capture ratio since inception of 100% and a down-capture ratio of 92%. |

| More Information |

19 May 2022 - Performance Report: Bennelong Emerging Companies Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | |

| Manager Comments | The Bennelong Emerging Companies Fund has a track record of 4 years and 6 months and therefore comparison over all market conditions and against its peers is limited. However, the fund has outperformed the ASX 200 Total Return Index since inception in November 2017, providing investors with an annualised return of 23.5% compared with the index's return of 9.35% over the same period. On a calendar year basis, the fund has only experienced a negative annual return once in the 4 years and 6 months since its inception. Over the past 12 months, the fund's largest drawdown was -11.38% vs the index's -6.35%, and since inception in November 2017 the fund's largest drawdown was -41.74% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in December 2019 and lasted 10 months, reaching its lowest point during March 2020. The fund had completely recovered its losses by October 2020. The Manager has delivered these returns with 14.55% more volatility than the index, contributing to a Sharpe ratio which has fallen below 1 three times over the past four years and which currently sits at 0.85 since inception. The fund has provided positive monthly returns 81% of the time in rising markets and 35% of the time during periods of market decline, contributing to an up-capture ratio since inception of 270% and a down-capture ratio of 120%. |

| More Information |

19 May 2022 - Nestlé: innovation strengthens the moat

|

Nestlé: innovation strengthens the moat Magellan Asset Management April 2022 Vrimp, the vegan alternative to shrimp, is made from peas, seaweed and konjac root, a vegetable found in Asia. The vEGGie, a vegan egg, is a mixture of soy protein and omega-3 fatty acids. Wunda is a pea-based alternative milk. Offered too are the Vuna, a vegan tuna alternative, and vegan burgers, while an experiment is underway to make vegan chicken that comes with fake skin and bones. These products add to the plant-based dairy alternatives for chocolate, coffee, creamers, ice cream and malt beverages. Such are newest offerings of the Swiss-based Nestlé, the world's biggest food and drinks maker, as it responds to the latest twist in consumer demand. The innovation drive extends to the staples that bring in so much of Nestlé's revenue, which reached 87.1 billion Swiss francs in fiscal 2021, a jump of 7.5% on an organic basis from 2020 and the fastest pace in 13 years. Coffee (26% of fiscal 2021 sales) has benefited from the launch of Starbucks at Home, a tie-up with Starbucks and Nespresso, and a revamped approach to producing Nescafe instant coffee. Bean selection is now approached in much the same way as wine makers grade grapes and there's an organic option. Of note is that in 2021 Nestlé scientists discovered two novel plant varietals of the coffee tree that produces Robusta beans. The result is a jump in yields by up to 50%, lower carbon emissions and people can now enjoy a super-premium barista blend in their soluble coffee. And every second of every day, the world enjoys another 5,500 cups of Nescafé, including the premium Nescafé Gold. The pet care staple (18% of sales) has become personalised (animalised?) and much science has gone into producing healthy high-end labels. In many parts of the world at production volumes that achieve economies of scale, Fido can receive a unique blend of dog food and supplements delivered to the home with his name stamped on the front. For house pets so inclined, there's a pet food line where insects and plant protein from fava beans and millet are mixed with meat. Pet carers are considered too. Improved online ordering means people don't have to lug home heavy packets. The KitKat staple, which was revitalised by a marketing campaign in Japan in 2014 that exploited how the Japanese pronunciation of KitKat (kitto katto) resembles the phrase 'you will win' (kitto katsu), now has stand-alone stores. These 'KitKat bars' offer almost countless flavours including a vegan option (KitKat V) and let people devise their own recipes - 'create your break'. Such is the revamp of a company with a history stretching to 1866 since Mark Schneider became CEO in 2017. Key drivers of success under Schneider include a switch into healthier products such as plant-based foods and vitamins and supplements, and a focus on novel products and faster times to market with the latest offerings. Schneider has reinvigorated the company's portfolio of assets by conducting at least 85 divestments and acquisitions over the past five years. Nestlé shares are trading around the record high set in November last year because investors recognise that an overhauled company with great brands is enjoying a virtuous cycle kicked off by digitalisation. The enhanced consumer insights improve innovation, which leads to the creation and successful launch of better products produced at economies of scale that bestow an unassailable competitive advantage on the company. What brands the company has. Nestlé has 31 'mega-brands' including Coffee mate, Haagen-Dazs ice cream, Maggi noodles, Milo, Nescafé, Nesquik, Nespresso, Purina pet care and San Pellegrino mineral water. Each has loyal consumers, which means these products command a premium price and superior access to supermarket shelves. Each generates global sales of more than one billion Swiss francs every year. Nestlé, in all, boasts 2,000-plus brands that are sold in 186 countries and many hold the No. 1 or No. 2 positions in their categories. The brands are split across seven segments. These are in order of fiscal 2021 sales: powdered & liquid beverages (28%), pet care (18%), nutrition & healthcare (15%), prepared dishes & cooking aids (14%), milk products & ice cream (12%), confectionery (9%) and water (5%). Nestlé's great brands mean the company has steady cash flow and earnings streams no matter the state of the economy. As such, the stock has a 'defensive' appeal, which is why it's held up better than most during the share slide so far in 2022. Since Nestlé is well positioned to achieve its sales growth target of 4% to 6% in coming years, the stock is likely to generate superior returns for investors for a long while yet. To be sure, Nestlé products face ferocious competition. Some products (chocolate) are struggling to boost sales. But the success of coffee and pet foods make up for these laggards. The health push exposes the food processor to charges of hypocrisy because many of its goods are unhealthy and cannot easily be made wholesome. But the company is out to reduce that percentage and sales show junk food is popular enough. For all its global reach, Nestlé is overexposed to a downturn in the US, where it sources about 33% of its sales and profits. The company has warned that higher costs for its agricultural ingredients, packaging, energy and shipping threaten margins. Russia's invasion of Ukraine has intensified that challenge, especially that wheat and energy prices are rising. But as a third of sales come from premium products, Nestlé is better placed than most of its peers. A business that has changed so much since two Americans established the Anglo-Swiss Condensed Milk Company 156 years ago (that eventually merged with a company Henri Nestlé founded to sell milk-based baby food one year later) is used to overcoming challenges. If Nestlé can make such a successful start to going vegan and vegetarian (sales of 800 billion Swiss francs in fiscal 2021), what can't it do? Sources: Company filings and website, Bloomberg News and Dunn & Bradstreet. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

18 May 2022 - Performance Report: Insync Global Quality Equity Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Insync invests in a concentrated portfolio of high quality companies that possess long 'runways' of future growth benefitting from Megatrends. Megatrends are multiyear structural and disruptive changes that transform the way we live our daily lives and result from a convergence of different underlying trends including innovation, politics, demographics, social attitudes and lifestyles. They provide important tailwinds to individual stocks and sectors, that reside within them. Insync believe this delivers exponential earnings growth ahead of market expectations. Insync screens the universe of 40,000 listed global companies to just 150 that it views as superior. This includes profitability, balance sheet performance, shareholder focus and valuations. 20-40 companies are then chosen for the portfolio. These reflect the best outcomes from further analysis using a proprietary DCF valuation, implied growth modelling, and free cash flow yield; alongside management, competitor, and industry scrutiny. The Fund may hold some cash (maximum of 5%), derivatives, currency contracts for hedging purposes, and American and/or Global Depository Receipts. It is however, for all intents and purposes, a 'long-only' fund, remaining fully invested irrespective of market cycles. |

| Manager Comments | The Insync Global Quality Equity Fund has a track record of 12 years and 7 months and has outperformed the Global Equity Index since inception in October 2009, providing investors with an annualised return of 12.23% compared with the index's return of 10.9% over the same period. On a calendar year basis, the fund has only experienced a negative annual return once in the 12 years and 7 months since its inception. Over the past 12 months, the fund's largest drawdown was -22.17% vs the index's -10.7%, and since inception in October 2009 the fund's largest drawdown was -22.17% vs the index's maximum drawdown over the same period of -13.59%. The fund's maximum drawdown began in January 2022 and has lasted 3 months, reaching its lowest point during April 2022. During this period, the index's maximum drawdown was -10.7%. The Manager has delivered these returns with 1.48% more volatility than the index, contributing to a Sharpe ratio which has fallen below 1 five times over the past five years and which currently sits at 0.86 since inception. The fund has provided positive monthly returns 82% of the time in rising markets and 21% of the time during periods of market decline, contributing to an up-capture ratio since inception of 83% and a down-capture ratio of 85%. |

| More Information |

18 May 2022 - Performance Report: Bennelong Concentrated Australian Equities Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | |

| Manager Comments | The Bennelong Concentrated Australian Equities Fund has a track record of 13 years and 3 months and has outperformed the ASX 200 Total Return Index since inception in February 2009, providing investors with an annualised return of 15.07% compared with the index's return of 10.37% over the same period. On a calendar year basis, the fund has experienced a negative annual return on 2 occasions in the 13 years and 3 months since its inception. Over the past 12 months, the fund's largest drawdown was -20.9% vs the index's -6.35%, and since inception in February 2009 the fund's largest drawdown was -24.11% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in February 2020 and lasted 6 months, reaching its lowest point during March 2020. The fund had completely recovered its losses by August 2020. The Manager has delivered these returns with 1.81% more volatility than the index, contributing to a Sharpe ratio which has fallen below 1 five times over the past five years and which currently sits at 0.86 since inception. The fund has provided positive monthly returns 90% of the time in rising markets and 19% of the time during periods of market decline, contributing to an up-capture ratio since inception of 137% and a down-capture ratio of 94%. |

| More Information |

18 May 2022 - Perception vs Reality: When a good story trumps rationality

|

Perception vs Reality: When a good story trumps rationality Colins St Asset Management April 2022 |

|

|

Despite our best efforts, human nature dictates that in life and in investing we often find ourselves making irrational decisions. That's not to say that those decisions aren't reasonable, but instead that most people prefer to act 'reasonably' rather than rationally.

In the early 1900's a doctor by the name of Julius Wagner-Lauregg began testing the premise that a fever as treatment for certain ailments could dramatically reduce mortality. He tested his theory on patients with neurosyphilis and discovered that his patients (with an induced fever) had twice the survival rate of patients left untreated. Dr Wagner-Lauregg went on to win a Nobel Prize in 1927 for his discovery before Penicillin was discovered and made his treatments redundant. Nonetheless, his research clearly identified the healing properties of a fever, and its usefulness in treating illness. Yet, despite his discovery, and despite the fact that modern medicine recognises the fever's role in the healing process, I know very few people who wouldn't immediately offer their sick child Panadol at the earliest signs of an increased temperature. The challenge is that what we know and how we feel are in direct conflict. We may recognise the benefits of the fever, but at the same time, we can't stand the thought of our child suffering. The same is often the case in investments. Even for those not speculating, for those who know the underlying value of a business, it's no easy feat to watch the value of one's holdings fall (considerably) and not feel the pull of the emotional pain of that loss. The Cost of Loss: Most parents and investors act reasonably in their avoidance of pain and suffering. Reasonably, but not rationally. Rational investment decision making requires one to look past how they feel about an idea, and instead focus on the numbers. However, that is a concept far simpler in principle than in practice. You see, psychological studies have often found that the pain felt from an investment loss is considerably greater than the joy felt by a gain. In fact, that loss:gain coefficient is thought to be as high as 2.5x. Take a moment for yourself as you read this now to consider what your own loss:gain coefficient might be. Consider a coin toss scenario (a 50/50 toss). Now consider a meaningful stake; a potential loss of $250,000 (for some that might be $200, or $2million). How much would you need to be offered to win in order to risk losing that $250,000?

The psychology is very interesting, and within that psychology lies the vast majority of our opportunities as fund managers. Our role is quite simple: recognise those emotional drivers that push investors into irrational decision making, and when the difference between the reasonable and the rational is wide enough, to take advantage. Keeping Things Simple: Even in the face of identifying emotional behaviours in the market it's not enough. At the risk of stretching an analogy, there are plenty of tasty looking fruit on the tree, and common thinking seems to be that investors should focus first on those lowest hanging fruit. We take a different approach. We don't want to pick fruit at all. Why stretch and stress when there are wonderful ideas already lying on the floor. I'd rather pick up a watermelon (investment idea) off the floor than stretch to pick an apple any day of the week. And there are plenty of 'watermelon' ideas available to those looking for them. They aren't necessarily as exciting as the more complex highly prospective ideas, but they are simple, they are profitable, and there is far less chance of falling off a ladder (getting oneself into financial trouble) if you aren't climbing one. "The fewer the steps between an idea and its success the better." That may seem anecdotally obvious, but the numbers describe a very compelling story. Imagine for a moment that we were investing geniuses. So good are we at investing that we could accurately predict outcomes at a rate of 70%. Now by most accounts, a 70% accuracy rating in investing terms would generate extraordinary outcomes. Simply by predicting earnings outcomes would mean that we are right 7 out of 10 times, and no doubt our results would be great. But what if, on top of having to accurately predict earnings, we also needed to predict market growth rates, or margins, or the outcome of a strategy adjustment? Well, if we need to predict two factors accurately to generate a positive investment outcome, our strike rate falls from 70% to (70%x70%) 49%! If we are required to accurately predict three factors to generate a positive outcome, that rate falls all the way down to 34%. The more decisions we need to get right, the lower our strike rate. And from what started off as an enviable and impressive 70% very rapidly deteriorates to getting things wrong more often than getting them right. It's not just unnecessary to invest in complex ideas, it's hubris to think that we as investors have the capacity to know the full impact of each variation and how it may play out in markets. Recognising the importance of keeping things simple truly is the ultimate indication of investing sophistication.

|

18 May 2022 - The forgotten asset class set to outperform in 2022

|

The forgotten asset class set to outperform in 2022 Yarra Capital Management 05 May 2022

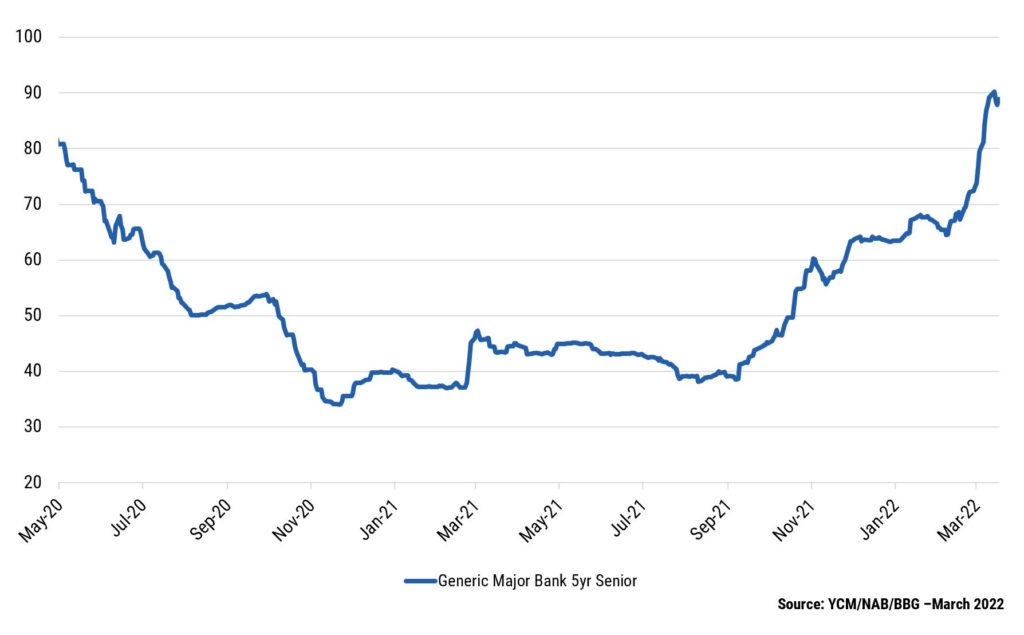

Against a backdrop of economic and geopolitical uncertainty, rising inflation and rate hikes, Australian investors are searching for investments that can benefit from these evolving market conditions. With credit spreads at attractive levels, now might be the opportune time to have exposure to hybrids and credit. With minimal returns on cash continuing to underpin strong demand for hybrid securities, we anticipate demand for yield to remain robust throughout 2022, resulting in strong returns over the year for this asset class. The upside of rising interest ratesRising inflation, above average GDP growth and the unwinding of quantitative easing (QE) in 2022 has seen financial markets reprice interest rate expectations. The rising rate environment will push the outright return on hybrid securities higher, without having a material impact on spreads given the strong economic backdrop. Given most hybrids are floating rate, investors will benefit via higher income from these rising short-term rates. Strong balance sheets you can bank onAustralian banks are the largest issuers of hybrids domestically and their balance sheets are in fantastic shape, with capital ratios at historical high levels. COVID-19 provided Australian banks with access to cheap funding via the Term Funding Facility (TFF), which provided them with a degree of funding certainty and lower funding costs. Following the withdrawal of the TFF in 2021, new bank issuance is coming to market at attractive credit margins, providing the ideal environment for active credit managers to identify the most positive risk adjusted opportunities. For instance, bank senior credit margins are significantly off their TFF lows, which is leading to an attractive re-pricing across all bank capital issuance (refer to Chart 1). Overvalued growth sectors are likely to lead an equity market sell off similar to 2000 - 02, but are unlikely to impact credit market returns. Chart 1: Bank senior credit margins - Well-Off their TFF 2021 lows

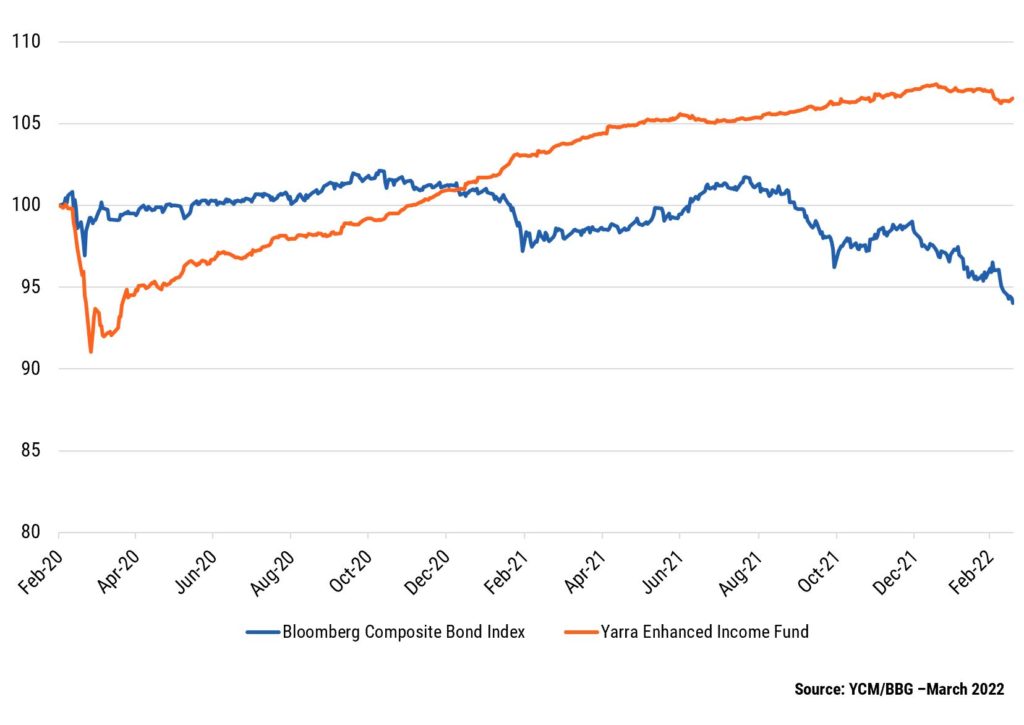

The higher the carry (running yield of an investment), the greater the protection it offers investors from adverse movements in credit margins. The carry for the Yarra Enhanced Income Fund is currently sitting at ~3.0% above cash. Based on an average portfolio maturity of ~3 years, we'd need to see an extreme 1.0% move wider in credit margins to wipe-out the carry. However, given the robust economic backdrop in 2022, we expect credit margins to remain relatively stable throughout, adding to floating rate credit's income generating credentials. This benign outlook is in contrast to the capital losses currently being observed in traditional fixed income due to the reset in interest rates and real yields. Usually, a rise in real yields will impact the value of everything long interest rate duration, from traditional fixed income to most equities. That's not the case with floating rate credit, since its short duration offers protection to portfolio valuations from rising interest rates. This is observable in EIF's outperformance compared to traditional fixed income (Bloomberg Composite Index) since February 2020 (see Chart 2). Chart 2: Floating rate credit with carry continues to outperform fixed rate with little carry

Making the gradeIn a world that seems to be getting riskier by the minute, investment grade hybrids look to be a safe haven for investors. Here's why:

Getting exposure to hybrids and creditBeing able to access fixed rate securities for floating rate portfolios remains a key competitive advantage for Yarra's clients. The Yarra Enhanced Income Fund invests in high yielding, floating rate credit and hybrid securities to deliver better returns than traditional cash management and fixed income investments. |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |