NEWS

2 Jun 2022 - Sustainable earnings growth over multiple cycles

|

Sustainable earnings growth over multiple cycles Insync Fund Managers May 2022 Markets tend to wrong-foot many investors, regardless of investment style, with 2022 becoming a year of extremes. Central banks are dealing with the prospect of stagflation, an environment that bankers do not have experience in, as this last occurred in the early 70's. Investors trading with a short-term time horizon have rushed into expensive defensive plays boosting their price further such as utilities, consumer staples and energy. They're attempting a 'momentum play'. To succeed, their timing will need to be impeccable at both ends. Later on, we will explain by example why this is contradictory to common sense and how you can avoid this risk. History consistently shows that investing on the basis of the short term economic outlook leads to poor outcomes. In 2021 the consensus was that 22' will be a period of reasonable economic growth and low inflation. That narrative changed quickly to a year where inflation is rising and concerns over recession looms. It is very likely that consensus will be wrong again. Insync's focus is always on longer term outcomes. Thus, we invest only in businesses that have the capacity to generate sustainable earnings growth through the cycle and over multiple cycles. Whilst recent fund returns have been disappointing, the businesses in our portfolio continue to deliver strong growth in their revenues and their profits despite the current market backdrop. The consistently longer term strong share price rises of highly profitable growth companies like these, over many decades, supports this approach to investing. In last month's edition we showed how stock prices over time tracks to this result. For now, the Insync portfolio is trading at a discount well in excess of 50% of our proprietary based DCF methodology. As an investor this is worth reflecting upon: after the pull back in the markets of some of the most profitable secular growth companies in our portfolio that typically trade on higher P/Es, they are now perversely trading on much lower P/Es, as markets presently ignore their superior financial metrics and earnings power! This will not continue beyond the short term as we explain later on. We strongly believe that for long-term investors, quality growth stocks are now available at bargain prices.

Short-Lived Disconnects (reality V price) Investors have flocked into defensive sectors to hide in the short-term. Fears of markets falling further has resulted in quality growth stocks becoming attractively valued. In times of volatility, investors are presented with an outstanding opportunity to invest in these enduring businesses.

Here is a real example today of investors losing sight of business realities versus current prices.

Company A - A well-known technology company. It's recently been aggressively sold down. Yet it's continuing to be one of the most profitable global businesses, with over 90% market share and compounding revenues at 20+% p.a. for the past 5 years. Despite this investors are attributing a low price to earnings ratio to the business. Company B - The leading soft drinks company. One which investors have flocked to for safety in the current market clime. It's significantly less profitable than Company A. Revenue growth has been negative over the past 5 years with total revenues today sitting at -19% below 10 years ago in 2012. Despite poor operating performance with no revenue growth for 10 years and no prospects of such, investors are attributing a high price to earnings ratio to the business. Which would you own?

A quirk of markets today that is worth knowing For now, most investors have flocked to industries and businesses that resemble Company B. Go figure? Interestingly many of the sectors that capital is pouring into since February - and pushing up their prices will likely suffer far more financially than those like Company A and its industry; especially if the dire economic forecasts for the years ahead come true. Again, go figure? By now you would have worked out that Company A is Alphabet and Company B is Coca-Cola. Clearly there is today a temporary disconnect between fundamentals and share prices! Over the long term the share price of a company follows its earnings growth. Broad indiscriminate market corrections often provide investors a once in a cycle opportunity to invest in the most profitable companies such as Alphabet. This will set them up nicely to achieve strong returns in the future. How price follows earnings once again

Whilst short term volatility may persist, Insync's concentrated portfolio of quality stocks across 16 global megatrends is well positioned to perform strongly over the long term. Why? The consistent strong earnings growth these companies are set to deliver should result in much higher share prices over time once markets adjust after the initial shift- as they always do. Whilst headlines and prices across all tech stocks have been hit hard, only some deserved it. Markets don't care initially; they just treat all growth stocks the same, quality or not. Only after this period is over the market separates the wheat from the chaff. This table highlights examples of those probably deserving of such a negative move. It depicts their price declines from their all-time recent highs. None of these companies exhibit the financial abilities we at Insync require.

Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund Disclaimer |

2 Jun 2022 - Superbugs are outsmarting antibiotics

|

Superbugs are outsmarting antibiotics Magellan Asset Management April 2022 In 1938, Ernst Chain,[1] a German-born biochemist working at Oxford University, found an article on penicillin written nine years earlier by UK bacteriologist Alexander Fleming.[2] In 1928, by fluke, Fleming noticed a zone around an invading fungus on an agar plate in which the bacteria did not grow. After isolating the mould, Fleming identified it as belonging to the Penicillium genus.[3] But doing anything more with the unstable compound was beyond Fleming's skills, which is where Chain stepped in. He proposed to his supervisor, Australian pathologist Howard Florey,[4] that they isolate, purify and test the compound to see if it could kill microorganisms without harming their host. Florey, seeing penicillin's potential, assembled a team that in 1939 oversaw experiments where only treated mice survived. By 1941, the group was experimenting on sick people. Because a UK stretched by war was incapable of producing enough penicillin, Florey travelled to the US to convince drug companies and officials to produce penicillin. When the US was drawn into World War II later that year, the government took over the mass production of penicillin to ensure the drug would be available for Allied forces. (It was by 1943).[5] In 1942, Fleming, who obtained some of the Oxford team's scarce penicillin, saved a UK woman who was dying of an infection. The Times of the UK published the feat, without referring to Fleming or Florey. Fleming's boss wrote to the newspaper praising Fleming who boasted in press interviews while Florey refused to speak to the media. Thus, many people today wrongly believe Fleming gifted penicillin to the world, even though Chain, Fleming and Florey equally shared the Nobel Prize for Physiology or Medicine 1945 and those in the know thought a self-promoter stole the credit from Florey.[6] What matters more is Florey's vision led to one of history's key medical feats. The drug's breakthrough advantage was how cheap it was to produce. The antibiotic became a worldwide cure and boosted life expectancy, mainly by reducing childhood deaths. By 1954, for instance, pneumonia's death toll on US toddlers had plunged 75% from 1939 levels.[7] Penicillin's wonders inspired the development of other affordable antibiotics that could combat an ever-wider array of ailments.[8] As antibiotics, antifungals, antiviral and other drugs that are grouped as antimicrobials were developed, optimists dared talk of a world without deadly infections. What could go wrong? Four things. First, in the advanced world where prescriptions are regulated, doctors overprescribed and misused antimicrobials. Second, in the unregulated emerging world, people can buy antibiotics (many counterfeit)[9] at pharmacies without prescriptions and even find them at markets and shops. People thus mistreat or overtreat themselves with these medicines because it's cheaper and easier than seeing a doctor. The result is that up to 70% of human use may be inappropriate.[10] Third, 80% of antibiotic use worldwide is to fatten farm livestock and prevent livestock infections.[11] Efforts to curb such misuse have failed.[12] The fourth problem is that antibiotic and antifungal residue is too prevalent in third-world drug-making hubs such as India's Hyderabad. The result? The natural immunity microbes develop over time has accelerated. 'Superbugs' have built resistance to antimicrobials and global deaths from drug-resistant bugs are mounting. Before antibiotics, only about one in 10 million bacteria would prove resistant to antibiotics. Now, given that bacteria vulnerable to antibiotics can't survive, it is estimated that up to 90% of bacteria causing infections are immune to previously effective antibiotics.[13] As for deaths, a study led by researchers from the University of Washington out in January attributed 6.22 million deaths worldwide in 2019 to drug-resistant microbes (of which 1.27 million were a "direct result" of superbugs).[14] A 2016 UK-government-commissioned study predicted that as "routine surgeries and minor infections will become life-threatening once again" deaths would reach 10 million annually by 2050 - by when the accumulated cost of superbugs would be US$100 trillion due to the need to use costlier treatments and longer hospital stays to save lives.[15][16] The University of Washington study suggested five ways to combat superbugs. First, improve sanitation and hygiene, especially for water, to limit infections. Second, prevent infections through vaccinations where possible. Third, reduce antimicrobial use in animals. Fourth, minimise the misuse of these drugs with people. Fifth, boost investment to find drugs that can defeat superbugs.[17] Here lies a key handicap in the battle against infections that fail to respond to treatment. Few superbug-busting drugs are appearing because investment in the field is minimal compared with other spheres of public health. Only about US$1 billion a year worldwide is spent on research to combat superbugs compared with US$50 billion a year tackling HIV/AIDS in low- and middle-income countries[18] or an estimated US$157 billion to be spent on covid-19 vaccines through to 2025.[19] Pharmaceutical companies, which rely on prescription-based sales for revenue, aren't investing enough because they can't recoup an adequate return for three reasons. First, the cheapness of antimicrobial generics makes hospitals reluctant to pay high prices for superbug stoppers. Another problem is that medical facilities use new superbug-busters as a fallback when generic treatments fail. A third hitch is that antimicrobials are taken for a short time only, whereas profitable drugs are usually ones that people take daily for years. The outcome is that sales volumes are too small to make new drugs profitable. As a sign of how fragile are the economics in this sphere, Big Pharma players have abandoned the superbug fight and smaller antibiotic-development companies struggle to survive, even after gaining approval for their finds. A crisis around superbugs is building. A market failure means capitalism can't yet derive a solution to diffuse a foreseeable catastrophe. Governments need to do more when it comes to funding research and offering financial incentives for private enterprise because only alarming levels of deaths will improve the economics. Even though the pharmaceutical industry is likely to solve the problem in extremis, it would be too late for millions of people. To be fair, policymakers are trying to stop the misuse of antibiotics - but with little success in the emerging world. To be fair again, authorities have tried to help develop superbug-busters. The PASTEUR Act of 2021 before US Congress provides incentives for research.[20] The Combating Antibiotic-Resistant Bacteria Biopharmaceutical Accelerator, or CARB-X, which is a public-private initiative, is spending US$480 million from 2016 to 2022 to solve the problem.[21] A UK initiative unveiled in April could become a global template for encouraging research because it offers to pay drug companies a fixed fee for supplying antibiotics.[22] Success might come but moneywise these efforts don't compare with the billions Big Pharma spends on research in lucrative areas. Some superbugs arise out of nature so antibiotic misuse and overuse are not to blame for all of them.[23] Doctors are finding novel ways to combat superbugs. Phage therapy, the use of specific viruses to target bacterial infections, is one of them.[24] But greater efforts are needed. Surely in the medtech age, someone can discover a cure for superbugs. No one will care if self-promoters pinch the credit. A flawed model Before 1870, US pharmacies were virtually unregulated. Chemists sold remedies without prescriptions, heavily promoted quack cures and sold drugs now illegal such as cocaine, heroin and opium. Doctors overprescribed doses to be obtained from pharmacies because they knew chemists watered down medication. Newspapers so relied on advertising by drug companies they downplayed medical mishaps. By 1906, the harm to society was prominent enough to warrant the passing of the Pure Food and Drug Act, the first step in the US to regulate drug marketing.[25] The act gave rise to the Food and Drug Administration, the US's oldest consumer-protection agency. Tougher laws in 1938 meant new drugs required the body's approval and some medicines required doctor prescriptions.[26] This doctor oversight meant the big drug companies founded after World War II aimed their advertising at doctors, not the public - by 1961, about 60% of the advertising budgets of the 22 biggest drug firms was targeted at doctors.[27] Thus formed the pharmaceutical business model, whereby drug companies identify promising molecules, test them, and, once gaining approval, target the medical industry for sales. Success is a 'blockbuster drug' that reaps annual sales topping US$1 billion year after year. The model has provided the world with many wonder drugs but it's flawed at the same time. A major disadvantage is that many discoveries are so expensive as to be unaffordable. Another is a slowing rate of discovery of effective medicines - most of the breakthroughs such as antibiotics, the polio vaccine, heart treatments, chemotherapy and radiation for cancer were discovered between 1940 and 1980.[28] In terms of antibiotics, no major advances have come since the 1980s[29] - new drugs are variations rather than breakthroughs.[30] A third disadvantage with the pharmaceutical business model is that the economics of certain spheres of medical research are so poor Big Pharma avoids the area and specialist start-ups can't survive. Such is the fate of research against superbugs. In 2018, Novartis joined Allergan of the US, AstraZeneca of UK-Swedish origins, GlaxoSmithKline of the UK, The Medicines Company of the US and France-based Sanofi in quitting the fight against infections.[31] One comfort when Big Pharma companies dodge the superbug fight is they often sell their infection-disease research units to small biotechs. The Medicines Company, for instance, in 2017 sold its portfolio to Melinta Therapeutics of the US,[32] while AstraZeneca in 2018 hived off part of its antibiotic research to Entasis Therapeutics[33] (which just announced a promising cure).[34] But Little Pharma is besieged. The World Health Organisation says the smaller and mid-sized companies that dominate the preclinical and clinical antibiotic pipeline are "struggling to find investors to finance late-stage clinical development up to regulatory approval". As such, many companies disappear and so do their finds. Of 15 new antibiotics approved in the US in the decade to 2020, five were shelved as companies applied for bankruptcy or were sold.[35] Take, for example, the experience of Achaogen. The US company collapsed in 2019 after spending about US$1 billion over 15 years to win Food and Drug Administration approval for Zemdri, a drug for hard-to-treat urinary tract infections and one the World Health Organization classes as an essential medicine.[36] Somehow Zemdri is still available. To overcome the overall market failure that prevents the discovery of similar feats, the OECD said in 2017 it would take an extra US$500 million per year over a decade to make available four new 'first-in-class' antibiotics. Governments need to make this happen, just like the US government, thanks to Florey's efforts, ensured enough penicillin for the military in World War II.[37] |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund [1] Sir Ernst Boris Chain. British biochemist. Britannica biography. britannica.com/biography/Ernst-Boris-Chain [2] Alexander Fleming. Scottish bacteriologist. Britannica biography. britannica.com/biography/Alexander-Fleming [3] Robert Gaynes. 'The discovery of penicillin - new insights after more than 75 years of clinical use.' US National Library of Medicine. National Institute of Health. May 2017. ncbi.nlm.nih.gov/pmc/articles/PMC5403050/ [4] Howard Walter Florey, Baron Florey. Britannica biography. britannica.com/biography/Howard-Florey [5] Norman George Heatley. Biography. The Lancet. Published 7 February 2004. thelancet.com/journals/lancet/article/PIIS0140-6736(04)15511-6/fulltext [6] 'The Nobel Prize for Physiology or Medicine 1945.' The Nobel Prize. The prize-awarding committee credited Chain, Fleming and Florey with 'Prize share: 1/3.' nobelprize.org/prizes/medicine/1945/summary/ [7] Robert Gordon. 'The rise and fall of American growth.' Princeton University Press. 2016. Page 465. [8] By 2001, antibiotics had largely rid the US of tuberculosis; incidence of the disease that year was fewer than six cases per 100,000. [9] Financial Times. 'Antibiotic resistance in Africa: 'a pandemic that is already here'. 7 March 2022. ft.com/content/95f150df-5ce6-43cf-aa8d-01ac3bdcf0ef [10] Foreign Affairs. 'When antibiotics stop working.' 28 February 2022. foreignaffairs.com/articles/world/2022-02-28/when-antibiotics-stop-working [11] Foreign Affairs. Op cit. [12] See 'Antibiotic use in US farm animals was falling. Now it's not.' WIRED. 14 December 2021. wired.com/story/antibiotic-use-in-us-farm-animals-was-falling-now-its-not/ [13] Foreign Affairs. Op cit. [14] The study found that one in five deaths were of children under five years old, while nearly 80% of deaths were attributed to three causes: blood, intra-abdominal and lower respiratory and thorax infections. 'Antimicrobial resistance collaborators' (pen name of authors). The Lancet. 'Global burden of bacterial antimicrobial resistance in 2019: a systemic analysis.' Volume 399, Issue 10325. Pages 629 to 655. The study calculated that 1.27 million deaths were the "direct result" of drug-resistant bacterial infections and 4.95 million deaths were "associated" with them, many of them in the emerging world. Published on the web 19 January 2022. thelancet.com/journals/lancet/article/PIIS0140-6736(21)02724-0/fulltext. Excerpt. [15] Review on Antimicrobial Resistance. 'Tackling drug-resistant infections globally.' The review was commissioned in 2014 by then UK prime minister David Cameron. amr-review.org/. In 2019, the US Centers for Disease Control and Prevention warned that, as the US was recording 2.8 million drug-resistant infections a year, people should "stop referring to a coming post-antibiotic era - it's already here". Centers for Disease Control and Prevention. Antibiotic resistance threats in the United States.' 2019. Page V. cdc.gov/drugresistance/pdf/threats-report/2019-ar-threats-report-508.pdf [16] Centers for Disease Control and Prevention. Antibiotic resistance threats in the United States.' 2019. Page V. cdc.gov/drugresistance/pdf/threats-report/2019-ar-threats-report-508.pdf [17] 'Antimicrobial resistance collaborators'. Op cit. Pages 641 and 649. [18] Foreign Affairs. Op cit. [19] Reuters. 'World to spend $157 billion on covid-19 vaccines through 2025 - report.' 29 April 2021. reuters.com/business/healthcare-pharmaceuticals/world-spend-157-billion-covid-19-vaccines-through-2025-report-2021-04-29/ [20] US Congress. 'S.2076 - PASTEUR Act of 2021.' congress.gov/bill/117th-congress/senate-bill/2076 [21] Combating Antibiotic-Resistant Bacteria Biopharmaceutical Accelerator. 'Accelerating global antibacterial innovation.' carb-x.org/about/overview/ [22] 'UK launches world-first 'subscription' model for antibiotic supply.' Financial Times. 12 April 2022. ft.com/content/c7cbebe4-8597-4340-8c55-56c4b423c1d1 [23] 'Hedgehogs had MRSA superbug long before antibiotics use, research finds.' The Guardian. 7 January 2022. theguardian.com/science/2022/jan/06/hedgehogs-had-mrsa-superbug-long-before-antibiotics-use-research-finds [24] 'Phage therapy offers hope in fight against antibiotic resistance and superbugs.' Australian Broadcasting Corp. 15 January 2021. abc.net.au/news/2021-01-15/antibiotic-resistant-superbug-bacteriophage-therapy/12213010 [25] Gordon. Op cit. Pages 222 to 223. [26] Food and Drug Administration. 'FDA history.' fda.gov/about-fda/fda-history [27] Gordon. Op cit. Page 476. [28] Gordon. Op cit. Page 594. Jan Vijg, a Netherlands-born molecular geneticist and author of 'The American Technological Challenge: Stagnation and decline in the 21st century', blamed society's risk aversion for the spluttering growth rate. Medical advances are impeded or abandoned if even a minute fraction of people in clinical trials have adverse reactions. See 'Did we hit our innovation peak in 1970?' The Wall Street Journal. 16 June 2014. wsj.com/articles/BL-REB-26133 [29] See World Health Organisation. '2020 antibacterial agents in clinical and preclinical development: an overview.' 15 April 2021. who.int/publications/i/item/9789240021303 [30] See Monthly Review. 'Superbugs in the Anthropocene.' 1 June 2019. monthlyreview.org/2019/06/01/superbugs-in-the-anthropocene/ [31] Bloomberg News. 'Superbugs win another round as Big Pharma leaves antibiotics.' 13 July 2018. bloomberg.com/news/articles/2018-07-13/superbugs-win-another-round-as-big-pharma-leaves-antibiotics. See also Financial Times. 'How pharma economics hold back antibiotic development.' 7 March 2022. ft.com/content/29292a3c-321d-4187-9ff0-59d70eb796f4 [32] Businesswire. 'The Medicines Company announces definitive agreement to sell its infectious disease business unit to Melinta Therapeutics.' 29 November 2017. businesswire.com/news/home/20171129005573/en/The-Medicines-Company-Announces-Definitive-Agreement-to-Sell-its-Infectious-Disease-Business-Unit-to-Melinta-Therapeutics [33] Fierce Biotech publication. 'AstraZeneca spinout Entasis files for $86m IPO to fund antibiotic phase 3.' 20 August 2018. fiercebiotech.com/biotech/astrazeneca-spinout-entasis-files-for-86m-ipo-to-fund-antibiotic-phase-3 [34] Fierce Biotech publication. 'Entasis' antibiotic bests last resort treatment on path to become new weapon against drug-resistant bacteria.' 20 October 2021. fiercebiotech.com/biotech/entasis-zai-labs-antibiotic-sul-dur-beats-comparator-phase-3-trial [35] Bloomberg News. 'The world's next big health emergency is already here.' 27 January 2022. bloomberg.com/opinion/articles/2022-01-27/after-covid-antimicrobial-resistance-is-the-world-s-biggest-health-emergency [36] See 'Crisis looms in antibiotics as drug makers go bankrupt.' The New York Times. 25 December 2019. nytimes.com/2019/12/25/health/antibiotics-new-resistance.html [37] For suggestions of what governments could do, see 'Tackling antimicrobial resistance ensuring sustainable R&D.' OECD. 29 June 2017. oecd.org/g20/summits/hamburg/Tackling-Antimicrobial-Resistance-Ensuring-Sustainable-RD.pdf Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

1 Jun 2022 - How Nike is crushing digital to take control of its own destiny

|

How Nike is crushing digital to take control of its own destiny Claremont Global May 2022 Many would be familiar with Nike's direct-to-consumer (DTC) strategy, their ambition to generate the majority of sales through their own physical stores and online channels. In this article, we review why we believe the shift to DTC has helped Nike become stronger than ever ― and why the company is increasingly in control of its own destiny due to its ever-improving digital offer and power over product allocation as brand owners. Nike is currently one of the 14 stocks in the Claremont Global portfolio. NIKE INC. (NKE: NYSE)This company needs little introduction, being the world's leading sportswear company with sales of US$44.5 billion in FY21 across the Nike, Jordan and Converse brands. Direct-to-consumer, a clear strategy executed wellNike's DTC strategy was formally outlined in 2017 by then CEO Mark Parker as customers had been increasingly favoring Nike's own channels, and at the same time many wholesale partners were not delivering the level of customer and brand experience that Nike aims for. This strategy was supercharged by current CEO John Donohoe who brought significant digital and e-commerce experience from previous roles as the CEO of ServiceNow and eBay. As shown on the chart below, online penetration has accelerated significantly and in FY21 online sales reached 21 percent of total sales from seven percent in FY17 and DTC (i.e., online + stores) reached nearly 40 percent. This was achieved more than two years ahead of the original targets and momentum has continued as online sales accounted for 26 per cent of total sales last quarter. Nike's direct-to-consumer sales accounted for nearly 40% of sales in FY21. Source: Company reports, Claremont Global. Past performance is not a reliable indicator of future performance

Faster shift to digital underpins new growth ambitions Based on the law of large numbers, it would have been hard to believe that Nike could accelerate sales and earnings growth. However, as online penetration reached an inflection point, in June last year Nike provided new and improved financial targets expecting sales growth of around 10 percent per annum (p.a) and earnings per share growth of over 15 percent p.a. through to FY25. As shown on the chart below, as part of the new targets, Nike now expects online sales to account for around 40 percent of total sales by FY25 and wholesale sales to fall from over 60 percent in FY21 to 40 percent. Nike's sales by channel targets

Source: Company reports, Claremont Global. Past performance is not a reliable indicator of future performance Online and digital investments feeding the virtuous cycle Perhaps the most obvious benefit from the shift to its own channels is that Nike gets to keep the retail "markup" that would normally go to wholesale. As a rule of thumb, Nike generates around double the operating profit from an incremental unit sold online compared to wholesale. However, of equal importance in our view is the fact that when a customer shops at nike.com or in-store, Nike is in control of the customer experience. Nike has more than 300 million members (growing rapidly) and through the company's app universe ― which includes the Nike app, SNKRS, Nike Run Club and Nike Training Club ― Nike has been able to forge enviable customer engagement, while gathering valuable data in the process. Nike members growing strongly (million)

Source: Company reports, Claremont Global.. Past performance is not a reliable indicator of future performance Nike can leverage data from millions of members to deliver a more personalised offer, demand forecasting, insight gathering and inventory management. The company has been increasingly able to offer the right product at the right time, which results in higher full price sales and less markdowns. These benefits have been reflected in Nike's price realisation. As shown below, over the past four years Nike realized nearly a 20 percent improvement in average selling price (ASP). ASP has then contributed 100 basis points p.a. to gross margin on average over the same period. Nike's realized price (indexed ASP)

Source: Company reports, Claremont Global. Past performance is not a reliable indicator of future performance Nike came out of the pandemic stronger than ever We believe Nike's performance through the pandemic provided further evidence of the company's digital success and strong product offer (which is worthy of its own article). Nike not only recovered quicky, but as shown on the charts below, Nike's sales were around 10 percent above pre-pandemic levels (2019), while earnings were 35 percent ahead as the company grew significantly faster than trend. For comparison, adidas' earnings in 2021 were still below 2019 levels. Nike sales and earnings performance through the pandemic (billion, year to November*)

Source: Company reports, Claremont Global. * Figures are year to November for better representation (Nike financial year end is in May). Earnings = operating profit. Past performance is not a reliable indicator of future performance Nike is increasingly in control of its own destiny As the brand owner, Nike has control over product allocation. Over the past four years, Nike has cut the number of wholesale doors by 50 per cent and has now started to reduce allocation to large wholesale partners. For example, earlier this year Nike made the decision to allocate less of their products to Foot Locker. The reduction was sizeable as Foot Locker said that their allocation of Nike products would fall from more than 70 percent of their sales to around 55 percent. Consistent with our view, commenting on Nike's decision the CEO of Foot Locker said at their 4Q21 result call: "One of the things that Nike does the best is they control the flow of these high heat products into the marketplace, which keeps the demand high. So again, they will certainly benefit their DTC with some of that." 2025 targets are not a ceiling, online could be well over 40 percent of salesIt is important to re-emphasise that shift to digital has been driven by the consumer. Nike has continued to win market share and brand 'heat' remains very strong. Therefore, we believe the company has been able to recapture most, if not all of the sales that previously went to wholesale. Based on the company's targets, the wholesale business is still expected to account for around 40 percent of total sales by FY25. Therefore, we believe there will be plenty of opportunity for Nike to increase its online penetration beyond FY25.

Author: Chris Hernandez, Investment Analyst Funds operated by this manager: |

31 May 2022 - Natural gas and midstream assets

30 May 2022 - 10k Words

|

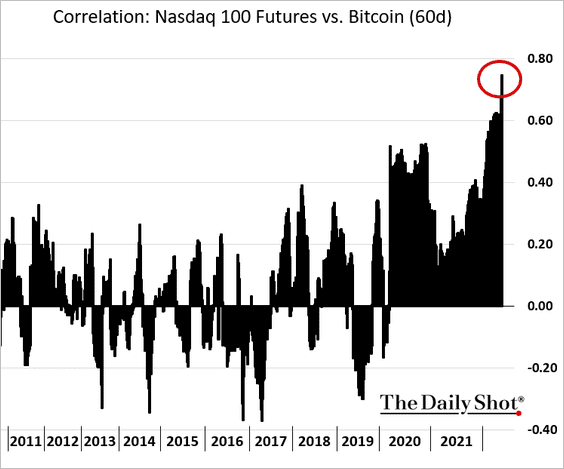

10k Words Equitable Investors May 2022 The drawdown in tech stocks remains in focus with carts from chrtr and a16z, while MarketWatch highlighted the inside selling that occured in 2021's tech IPOs ("You bought. They sold"). Retail investors who had a great time trading in 2020 and 2021 may have lost all that they gained, Morgan Stanley has estimated. The crypto space hasn't worked for punters either as correlation with tech stocks surges, as the Daily Shot charts, and the "hot" NFT space cools rapidly, as charted by NonFungible. Finally, fund managers surveyed by Bank of America have returned from briefly worrying about the Ukraine situation as their biggest tail risk to worrying about inflation and the interest rate environment.

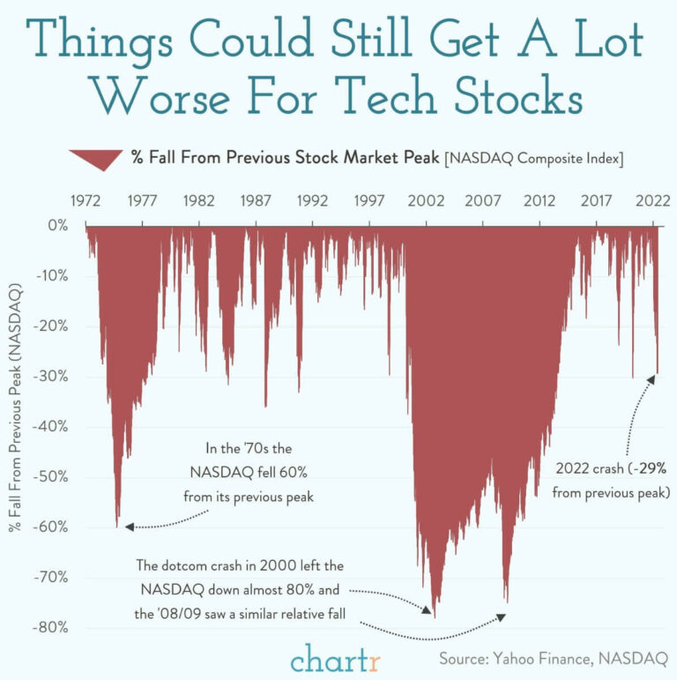

Nasdaq Composite Drawdowns Source: chartr, @_Prathna

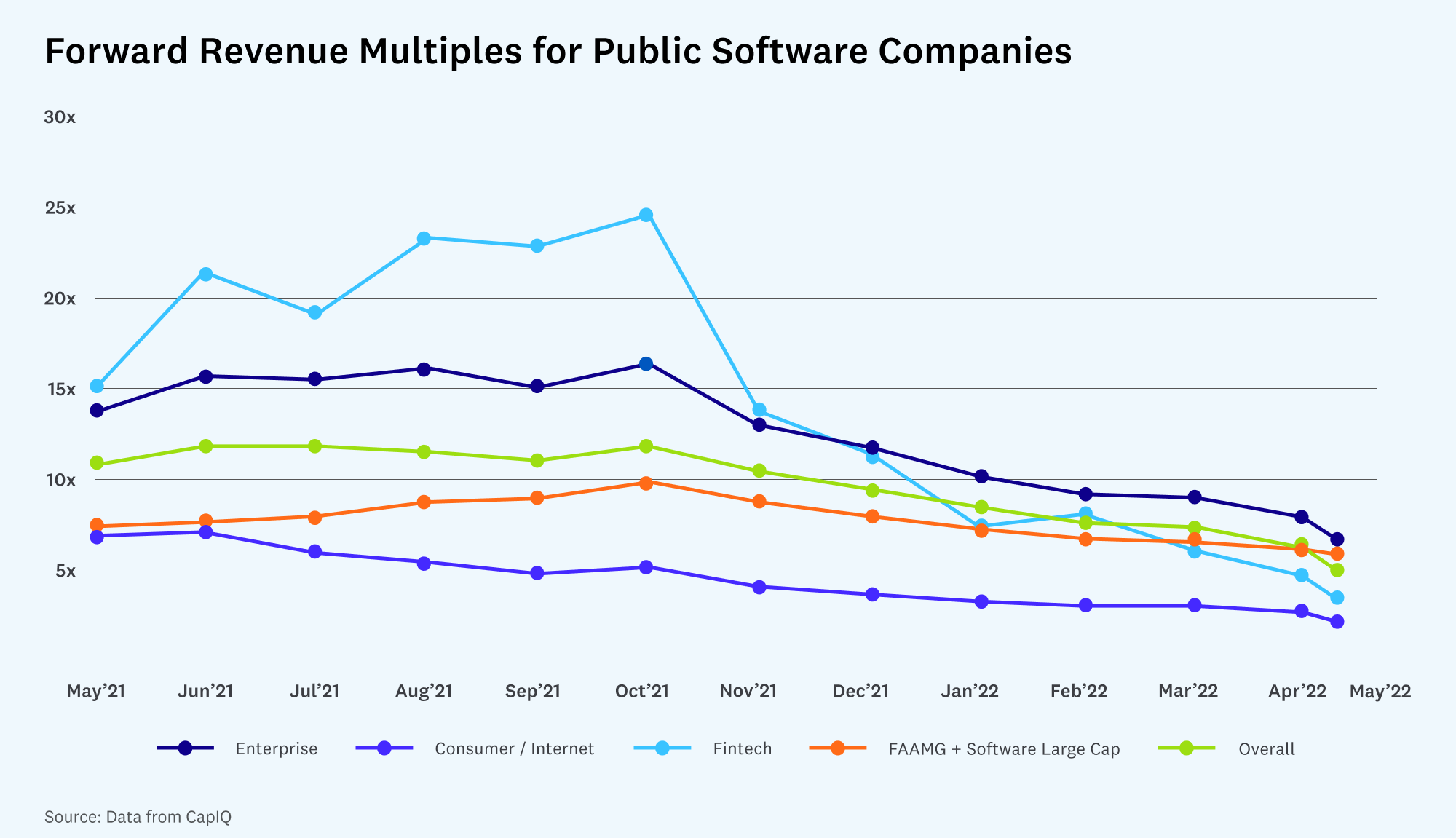

Forward Revenue Multiples on Listed Software Companies Source: a16z, CapitalIQ

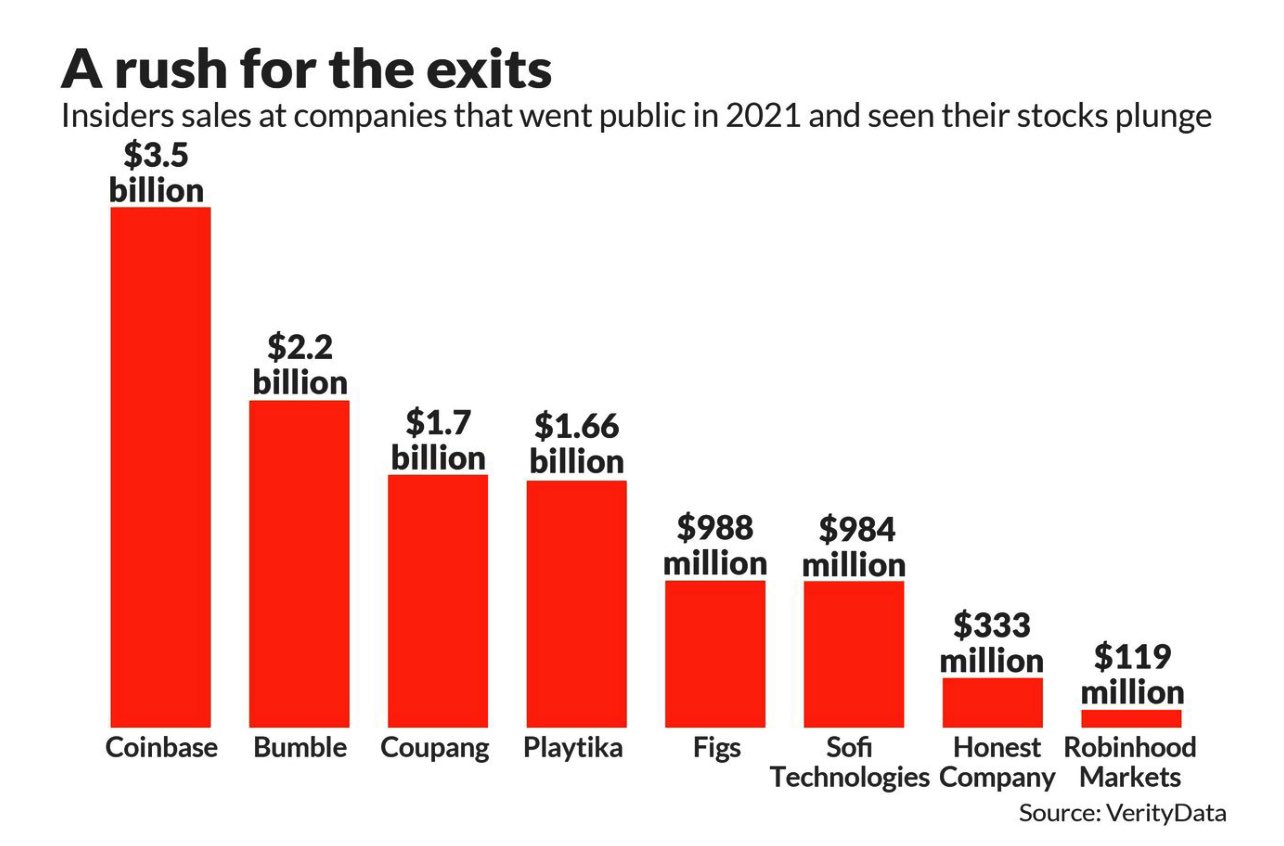

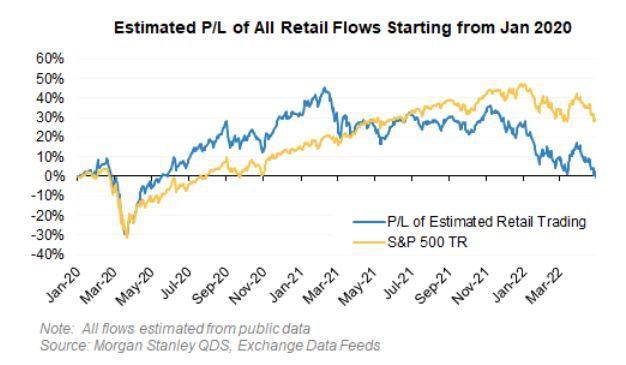

Insider sales at companies that went public in 2021 Source: MarketWatch, VerityData Estimated gains and losses from US retail flows Source: Morgan Stanley, @trengriffin Correlation between Nasdaq and Bitcoin

Number of Non-Fungible Tokens (NFTs) sold Source: NonFungible.com May 2022 Fund Manager Survey for "biggest tail risk" Source: Bank of America

May Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions.Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components.Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog |

30 May 2022 - 3 big megatrends boosting returns

|

3 big megatrends boosting returns Insync Fund Managers May 2022 The strong and consistent returns we obtain for our investors are achieved by investing in businesses that are highly profitable and cash generative, with strong balance sheets. But which ones? Over time, an increase in the share price of a company follows its earnings growth. Investing in those few, well positioned and highly profitable companies benefitting from megatrends, delivers 'best of the best' outcomes. Here are 3 of our 16 big megatrends boosting returns: Household Formation Enterprise Digitisation Internet of Things Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund Disclaimer |

27 May 2022 - Hedge Clippings |27 May 2022

|

|

|

|

Hedge Clippings | Friday, 27 May 2022

So the election (thankfully) is over. The result, with the benefit of hindsight, was predictable or at least hiding in plain sight. Whether one is pleased, disappointed, or couldn't care less would depend on your political hue - blue, red, green, teal, or yellow. Although he navigated the country reasonably safely through COVID, Scomo certainly stirred up some ill feeling across sections of the community who would normally have voted Liberal. Meanwhile, Albo didn't seem to be across all the economic facts, was sidelined for a week with COVID, and didn't appear to be the most inspirational of campaigners. However, it looks like he'll just get across the line in his own right, albeit with less than one third of the primary vote. Irrespective of one's view either way, having a clear winner is positive. Having laid out his policies, the new PM and his team should be entitled to get on with implementing them, without being distracted or blackmailed by minority groups with their own agenda. They'll be able to do that in the lower house. The Senate might be a different matter. So now we can get back to normal - or should that be the "new normal", the economy? In many ways, not much has changed. Debt levels are sky high at the household level, thanks to over a decade of falling interest rates, and, over the last couple of years, government COVID assistance thrown by the bucket-load at a willing individual and business community, whether it was needed or not. The problem with throwing bucket-loads of anything is that while some hits the mark, much of it misses and lands up being wasted - or adding to the mess. Market wise, sooner or later there was going to be a day of reckoning, with inflation back with a vengeance, aided by COVID, supply chain issues, and a war in Europe's backyard. Meanwhile, valuations in the tech/crypto sector in particular defied long term history lessons, and investors are learning, or being reminded of the lessons - or benefits - of diversification. Diversification can take many forms - from the simple (and not always very effective) investment in a broadly based low cost "index" fund to a concentrated fund investing in just 15 or 20 companies within the same index. However, depending on the skill of the fund manager, the concentrated fund might outperform in one market environment but significantly underperform in another. Thus logically, the careful or risk averse investor (those that hope for the best, but plan for the worst) spread their investments across funds to avoid manager risk, across strategies, and across asset classes. Diversification works well, as long as one considers the correlation between funds, strategy and asset class. In addition to correlation, a key indicator to consider is a fund's Down Capture Ratio, which in effect just measures correlation in negative markets. All too often, particularly in rapidly falling markets, diversification doesn't work if the correlation is high (as it is at present) between equities and bonds. With over 650 funds on the Fundmonitors.com database, there's the dilemma, or difficulty, of too much choice. In rapidly changing market environments, particularly in negative or falling markets, make sure that your fund selections are not only diversified, but also not overly correlated. For instance, including long/short funds, or in the current environment, funds investing in "clean energy" minerals such as Argonaut's or Terra Capital's focus on lithium or nickel. Outside equities, alternatives such as Laureola's Life Settlements, which has zero correlation to any other market or asset class. News & Insights A brave new world | Kardinia Capital Equity risk premium | IQuay Global Investors Revenge Travel | Insync Fund Managers Infrastructure assets are well placed for an era of inflation | Magellan Asset Management |

|

|

April 2022 Performance News Bennelong Concentrated Australian Equities Fund Equitable Investors Dragonfly Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

27 May 2022 - Fund Review: Bennelong Long Short Equity Fund April 2022

BENNELONG LONG SHORT EQUITY FUND

Attached is our most recently updated Fund Review on the Bennelong Long Short Equity Fund.

- The Fund is a research driven, market and sector neutral, "pairs" trading strategy investing primarily in large-caps from the ASX/S&P100 Index, with over 20-years' track record and an annualised return of 12.90%.

- The consistent returns across the investment history highlight the Fund's ability to provide positive returns in volatile and negative markets and significantly outperform the broader market. The Fund's Sharpe Ratio and Sortino Ratio are 0.75 and 1.12 respectively.

For further details on the Fund, please do not hesitate to contact us.

27 May 2022 - Market Insights & Fund Performance

|

Market Insights & Fund Performance L1 Capital May 2022 WEBINAR REPLAY | L1 Capital Long Short Portfolio | May 19, 2022 Mark Landau, Joint Managing Director and Chief Investment Officer of L1 Capital, provides an update, including a look at key market drivers: Inflation, Energy and Re-opening trade. Funds operated by this manager: L1 Capital Long Short Fund (Daily Class), L1 Capital Long Short Fund (Monthly Class), L1 Capital U.K. Residential Property Fund IV, L1 Long Short Fund Limited (ASX: LSF) |

26 May 2022 - Fund Review: Bennelong Kardinia Absolute Return Fund April 2022

BENNELONG KARDINIA ABSOLUTE RETURN FUND

Attached is our most recently updated Fund Review. You are also able to view the Fund's Profile.

- The Fund is long biased, research driven, active equity long/short strategy investing in listed ASX companies.

- The Fund has significantly outperformed the ASX200 Accumulation Index since its inception in May 2006 and also has significantly lower risk KPIs. The Fund has an annualised return of 7.89% p.a. with a volatility of 7.70%, compared to the ASX200 Accumulation's return of 6.63% p.a. with a volatility of 14.14%.

- The Fund also has a strong focus on capital protection in negative markets. Portfolio Managers Kristiaan Rehder and Stuart Larke have significant market experience, while Bennelong Funds Management provide infrastructure, operational, compliance and distribution capabilities.

For further details on the Fund, please do not hesitate to contact us.