NEWS

9 Jun 2022 - Is this a buying opportunity?

|

Is this a buying opportunity? Equitable Investors May 2022 "RECAPITALISATION" OPPORTUNITY The $US146 billion of equity capital raised globally in the March quarter of 2022 sounds like a huge number but was down 69% from $US476 billion a year earlier and 58% from the December quarter (using dealogic data). The current quarter is running lower still. We have identified almost 400 "cash burners" on the ASX (ex resources). Nearly half of these cash burners did not have the funds to make it past 12 months based on their March quarter cash burn. It may not be a complete surprise to you that the sector with the most companies facing one year or less of cash funding is Software and Services. Biotech and Health Care unsurprisingly represent nearly 30% of these companies. The great opportunity in this is for investors to identify situations where capital availability can make a huge difference to valuation, either in isolation or with a few changes and greater fiscal discipline. We think this "recapitalisation" opportunity is a huge opportunity and an exciting time for a firm such as Equitable Investors that applies bottom-up, fundamental research and constructively engages with companies. We are inviting follow-on and new investments in Dragonfly Fund to pursue such opportunities over the next 12 months. Applications (for wholesale investors only) can be made here.

Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions.Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components.Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog |

8 Jun 2022 - Performance Report: Bennelong Long Short Equity Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | In a typical environment the Fund will hold around 70 stocks comprising 35 pairs. Each pair contains one long and one short position each of which will have been thoroughly researched and are selected from the same market sector. Whilst in an ideal environment each stock's position will make a positive return, it is the relative performance of the pair that is important. As a result the Fund can make positive returns when each stock moves in the same direction provided the long position outperforms the short one in relative terms. However, if neither side of the trade is profitable, strict controls are required to ensure losses are limited. The Fund uses no derivatives and has no currency exposure. The Fund has no hard stop loss limits, instead relying on the small average position size per stock (1.5%) and per pair (3%) to limit exposure. Where practical pairs are always held within the same sector to limit cross sector risk, and positions can be held for months or years. The Bennelong Market Neutral Fund, with same strategy and liquidity is available for retail investors as a Listed Investment Company (LIC) on the ASX. |

| Manager Comments | The Bennelong Long Short Equity Fund has a track record of 20 years and 4 months and has outperformed the ASX 200 Total Return Index since inception in February 2002, providing investors with an annualised return of 12.84% compared with the index's return of 8.17% over the same period. On a calendar year basis, the fund has experienced a negative annual return on 3 occasions in the 20 years and 4 months since its inception. Over the past 12 months, the fund's largest drawdown was -21.77% vs the index's -6.35%, and since inception in February 2002 the fund's largest drawdown was -29.14% vs the index's maximum drawdown over the same period of -47.19%. The fund's maximum drawdown began in September 2020 and has lasted 1 year and 8 months, reaching its lowest point during May 2022. During this period, the index's maximum drawdown was -15.05%. The Manager has delivered these returns with 0.17% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 five times over the past five years and which currently sits at 0.74 since inception. The fund has provided positive monthly returns 64% of the time in rising markets and 61% of the time during periods of market decline, contributing to an up-capture ratio since inception of 5% and a down-capture ratio of -126%. |

| More Information |

8 Jun 2022 - With markets falling, is it safe to invest again?

|

With markets falling, is it safe to invest again? Montgomery Investment Management 26 May 2022 In the famed 1970s thriller, Marathon Man, Nazi dentist Dr Christian Szell - who is looking for a stash of stolen diamonds - repeatedly asks the character played by Dustin Hoffman "Is it safe?" Right now, many people are likely asking the same question about investing in the share market. With the distraction of local politics behind us, investors can return to matters that will shape their short and medium-term returns. Given a lack of clarity about where the safe havens are, and notwithstanding the supply shocks associated with the war in Ukraine and the recent shuttering of China's economy, what follows is a summary of the issues confronting equity markets and a possible answer to the question of whether it is time to add to your investment in equities. InflationWidespread and stubborn U.S. inflation, driven by surging oil and rents, as well as rising wages, has inspired inflation expectations for next year to more than six per cent, from near one per cent in 2020. U.S. core Personal Consumption Expenditure inflation, which excludes more volatile food and energy, has risen from sub-two per cent in the first quarter of 2021 to an annual rate of 4.9 per cent, the highest since September of 1983. Slowing U.S. economic growthEquity investors are of course aware of this trend and the persistence of supply chain bottlenecks that are in no small part responsible. Perhaps less obvious, but no less concerning, are the rapid reductions being applied by forecasters to U.S. economic growth. According to Bloomberg, forecast U.S. GDP growth for 2022 was above four per cent back in Q3'21 but has recently plunged towards 2.75 per cent. Meanwhile the 2.5 per cent GDP forecasts for 2023 in place at the beginning of this year have given way to forecasts of 2.1 per cent. Falling earningsSlowing U.S. GDP growth is important for share prices. Remembering that much of the equity market correction to date has been the consequence of PE compression - which always accompanies rising rates and accelerating inflation - a slowing rate of growth raises the spectre of reduced earnings. And when the 'E' in the PE ratio also declines, equity market losses can and often compound. As waves of liquidation have hit U.S. equities amid a winding back of the Federal Reserve stimulus and rising interest rates, declining total returns for the S&P500 have exceeded the total return losses in treasuries. These returns are highly correlated to 12-month forward S&P500 earnings per share estimates. Consequently, the earnings estimates are now declining, from growth of circa 55 per cent year-on-year, to 27 per cent today. The winding back of earnings expectations, and the broadening of the bear market, may still have some way to go, even as 50 per cent of NASDAQ Composite constituents - the most vulnerable being thematic and concept stocks, small cap tech and small cap growth, for example - have fallen by more than 50 per cent, and 72 per cent of constituents have fallen by more than 25 per cent (see Table 1.). Table 1. Bear market in stealth mode Declining U.S. real disposable incomesHeaping burning coals on the declining earnings outlook will be the decline in real disposable incomes, which are near minus 12 per cent year-on-year and represent the sharpest decline since at least 1960. The decline is of course partly due to the high support/stimulus payments received last year but much of it can also be attributable to the sharp rise in inflation. Historically, when real income contractions of this magnitude have occurred, they were followed by a marked slowdown in consumer spending. We believe, therefore, at the very least, investors should not expect upgrades from, or re-ratings for, companies exposed to consumers just yet. Is it time to invest?However, the baby is being thrown out with the proverbial bathwater and high-quality names across a broad variety of sectors and industries are now being sold down too. As we have witnessed many times in the last three or four decades, ultimately, indiscriminate selling gives way to discernment and finally selective buying. A capitulation sell-off may therefore eventually give way to another once-in-a-decade opportunity to improve the general quality of portfolios and lock in superior returns. Remember, the lower the price one pays, the higher the return. What are the factors investors should be watching to decide if it is safe to dip one's toe back in the water?The current sell-off has been largely macro-driven. Concerns about inflation and rising interest rates, and now slowing growth (stagflation), are principally responsible for the current reassessment of equity investor returns. These seem likely to remain this year. It seems reasonable to conclude the expectation of good news on these fronts will be necessary for the current 'risk-off' sentiment to ease before reversing. The question of course, is where are the revelations going to be? Will slowing growth lead to recession, which restores bonds as a safe haven, reducing their yield and setting equities up for a recovery post-recession? Or will we see high inflation and strong economic growth, empowering only companies with pricing power to improve margins through a combination of higher volumes and higher prices? Finally, do we end up with Jerome Powell's 'soft-landing' scenario, which will be positive for both equities and bonds? In the short run, the market seems very oversold making it susceptible to a sharp short-term recovery (Figure 1.) Figure 1. Negative change in PE historically significant and fully factored in rising rates As can be seen in Figure 1., the pace of PE compression is historically significant and is nearing a point (red line) from which PEs have historically expanded again. The PE compression reflects rising interest rate expectations but importantly, however, it does not appear the market has factored in any recession or even any slow-down in earnings. The slow-down in earnings growth estimates however still suggests investors are factoring in some growth. And investors should not ignore the tax-like impact on consumers and growth from the combination of rising interest rates, rising fuel costs and the rising U.S. dollar (which of course saps capital from and fuels inflation for importing nations). The market has not factored in a contraction in earnings (keep also in mind the very steep slump in real disposable income cited above) and for this reason many commentators believe further declines in the stock market should be expected. And unlike previous bear market episodes, the Federal Reserve does not appear to be coming to the rescue of investors. Indeed, if anything, the Fed's Jerome Powell has toughened his Hawkish stance. Meanwhile, as liquidity is being withdrawn, money supply growth continues to slow relative to bank credit growth, meaning there is less liquidity for financial assets. Finally, while some commentators and macro economists point to evidence, and warn, of more frequent bear markets (US S&P500 drawdowns of 20 per cent or greater) during periods of rising inflation (Figure 2.), I note my firm belief long-term declines in union membership and rapid advancement in autonomous technology will keep a lid on long-term wages growth and ultimately on inflation. Figure 2. S&P500 sell offs during rising inflation (1965-80) and declining inflation Investors should be sharpening their pencils and working on the stocks and funds in which they plan to invest, in preparation for making additional equity market investments. Author: Roger Montgomery, Chairman and Chief Investment Officer Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund |

8 Jun 2022 - Why 15 stocks are all you need

|

Why 15 stocks are all you need Claremont Global May 2022

With a mandate of owning 10-15 stocks, I am often asked: "How do I sleep at night given the concentration risk?" This has been a familiar refrain for most of the 25 years I have been managing client capital and where I have always run concentrated portfolios with 10-25 stocks. The thinking suggests that with a concentrated portfolio, you are running excess risk and one would be better served having a more "diversified" portfolio. My answer is always the same - it all depends on how you define risk. If you define risk as the chance of underperforming an index or benchmark in the short term - then I would agree this is "risky". This is the classic fund manager's "career risk" - the chance of underperforming a benchmark and putting your job on the line or losing client FUM. In the words of John Maynard Keynes: "It is better for reputation to fail conventionally than to succeed unconventionally". But to earn returns that are better than the market, it is really quite simple - you have to own portfolios that are different from the market. Robert Hagstrom in his excellent book The Essential Buffett - timeless principles for the New Economy ran a 10-year study from 1987-96 where he had a computer randomly assemble 3,000 portfolios from 1,200 companies and broke the results down as follows:

It is interesting to note the 15-stock portfolio achieved an average return not much different to the 250-stock portfolio but with a much wider range of outcomes (i.e. much higher career risk!). However, the chances of beating the market were also more than 13 times higher. In addition, Lorie & Fisher showed in their 49-year study of NYSE-traded stocks between 1926-65 that 90 per cent of stock risk can be diversified with a 16-stock portfolio. But we define risk as the possibility of permanently impairing client capital or not achieving a satisfactory return for the risk taken. And we target a long-term return of eight to twelve per cent per annum over a five to seven-year period. We believe a permanent impairment to capital is most likely to arise in the following ways: Buying heavily leveraged businessesMany management teams are very happy to layer on debt in the good times by "returning capital" to shareholders and achieving artificial EPS growth to satisfy short-term and poorly defined incentive targets. There is no better example of this than the actions of American Airlines in the five years to 2019. The company "returned" $13bn in buybacks - this was despite the fact there was no capital to return, as free cash flow over the period was a NEGATIVE $3.2bn! The ratio of debt to earnings before income, taxes, depreciation and amortisation (EBITDA) was 4.2-times in 2019 at the peak of the cycle. In our opinion this is highly irresponsible, given the industry already has a high degree of operational gearing, has a large amount of off-balance sheet debt in the form of leases and is vulnerable to rising oil prices. And then when tough times hit, these companies go cap-in-hand to the government and/or shareholders to repair balance sheets at very depressed equity prices, resulting in severe value destruction. By contrast, our portfolio has a weighted net debt/EBITDA of 0.7x. Excess leverage is just not a risk we are willing to run. Balance sheet strength is a given in our portfolio. We know that the future is always uncertain and rather than trying to forecast when the good times will end (folly in our opinion), we assume that recessions are a natural part of economic life and we prepare accordingly. The added benefit of this is that when recessions occur, our companies can play offence - buying quality assets or their own shares at favorable prices and maintaining or even increasing the dividend. We have companies in our portfolio that have consistently paid rising dividends for over 40 years. Buying businesses that rely on an accurate forecast of some hard-to-predict variableThese variables can be interest rates, moves by the Federal Reserve, commodity prices, regulation, innovation and election results, amongst many others in a complex world. In 2016 I didn't know many people who predicted Trump would be elected ― and for those who did, how many predicted that markets would rally? Or in March of this year, who would have thought the market would be at an all-time high in December, when the global economic contraction has been the largest since the Great Depression? Another favourite of mine in recent years has been buying banks on the "yield steepening trade", only to then see rates collapse. Or the oil majors in 2014, who spent billions on exploration with a forecast of oil being above $100 a barrel, only to see oil collapse with the advent of shale oil. We deliberately avoid businesses that rely on us correctly forecasting commodity prices, interest rates, elections, drug discoveries, economic growth or political outcomes. Experience has taught us that very few people are able to do this on a consistent basis. Yogi Berra put it well: "Forecasts are hard, especially about the future". Buying inferior businesses with no competitive advantageOver time, competition does a pretty good job of taking away excess returns for most businesses. And over time, it is very hard for an investor to earn a return much different than the underlying economics of the business one owns. If an investor wants to earn an excess return, logic suggests that the best place to start is with owning businesses that themselves earn excess returns on shareholder capital. Superior returns on capital normally arise from some form of competitive advantage - be it a brand, network effect, scale, reputation, data, client relationships, IP or technology. But the allure of buying "cheap" businesses is often too much for some. Even Warren Buffett himself made this mistake when buying textile company Berkshire Hathaway at a steep discount to its underlying asset value. But as he said many years later, once he came to realize his mistake and finally exited the business: "Berkshire Hathaway's pricing power lasted the best part of a morning". Our preference is to own businesses that have been proven over many years and cycles. The average age of our businesses is over 70 years, with the oldest dating back to the end of the US Civil War. They have been tested through wars, product cycles, recessions, political upheaval, inflation and financial crises. The competitive advantage in our portfolio is evidenced by an operating margin of 27 per cent and a return on invested capital of 18 per cent - both over 2x the average listed business. It is interesting to note the average listed business earns a return of 9 per cent - not far from the level equities have actually achieved over the long term.

Aggressive management or those who allocate capital poorlyUnfortunately, it is a fact of life that the people who end up running businesses are often no "shrinking violets". They are usually very confident in their ability and their normal starting point is to aggressively "grow the business". This can often involve straying away from their core competence into new areas, where their "skill" will translate into superior returns to shareholders. The worst situation occurs where management take on a lot of debt at the peak of the cycle, pay an inflated price for an asset, heap goodwill on the balance sheet, only to reverse the deal many years later ― and more often under new management. A classic example of this is GE, who took a very good industrial business and then ventured into credit cards, property, insurance, media ... the list goes on. The end result was to take a AAA rated balance sheet and turn it into one that is now barely above junk status. Or closer to home - who can forget Woolworths ill-timed home improvement venture against the toughest of competitors, or even Bunnings themselves and their venture into the UK? Would it not have made sense to focus capital on the competitive advantage that made the company a market leader in the first place and then return excess capital to shareholders? And finally, my all-time favorite - the Vodafone purchase of Mannesmann at the peak of the TMT mania for $173bn, which saw Vodafone CEO Chris Gent earn a bonus of $16m for the "value" he created. In 2006, Vodafone quietly wrote the asset down by $28bn, but not before Sir Chris Gent received a knighthood for "services to the telecom industry." I wonder whether he should have received the highest German accolade "for services to the German pension fund industry." To quote Michael Porter, the doyen of competitive advantage: "The biggest impediment to strategy and competitive advantage is an overly reliant focus on growth". By contrast, we prefer our management teams to relentlessly focus on competitive advantage, customers, employees, communities and reinvest back in the business for the long term. And once this is done, to make sensible bolt-on acquisitions, pay dividends and buy back their stock when it is decent value. The last trait is very hard to find - there are very few management teams who treat buying their shares like they would any other acquisition. For most management teams, the logic is if I can borrow at, say 2 per cent, as long as I pay no more than 50x earnings - this enhances earnings per share. And unfortunately, most management teams will happily buy their stock in bull markets using cheap debt, only to stop this when their shares are cheap, as this is the "prudent" thing to do. Buying businesses at prices that are well above their fair valueEven if one buys businesses that have superior economics, strong balance sheets and are well managed - even the most disciplined can be lured into paying inflated prices, especially in the upper reaches of a bull market. The narrative always follows a similar pattern that excess growth will last forever, interest rates will never rise, the company has changed (very few do), the company deserves a lower beta and the list goes on. When valuing companies, we do not change our discount rates, terminal growth assumptions, or market multiples, preferring to use "through the cycle" value inputs. Neither do we use a weighted average cost of capital (WACC) or beta to justify higher prices. Read any book by the doyen of valuation, Aswath Damodaran, and he will argue that if you are to drop your risk-free rate, you should also drop your terminal growth rate. This makes sense as a lower risk-free rate suggests a lower nominal gross domestic product (GDP) growth rate. Yet, in the upper reaches of a bull market, it is not uncommon to see lower risk-free rates and higher terminal growth rates to justify valuations! ConclusionSo, to return to the original client question posed at the beginning of this article: "How do I sleep well at night with only 10-15 stocks?" The question assumes that I would sleep better if we owned more stocks. Well, to do that, we would have to add lesser quality names or those with lower expected returns. Would I sleep better then? It would decrease our research intensity, whilst potentially lowering the quality and/or the expected return of the portfolio. I could load up on "cheap" bank stocks but would now be exposing myself to balance sheet risk ― at 20x geared, these businesses can literally go to zero as we saw in the global financial crisis (GFC) ― as well as interest rate risk, economic risk and a large amount of regulatory risk (witness the halting of dividends in Europe recently). Or, I could load up on "cheap" oil stocks, but I would be up late at night poring over demand/supply dynamics, vaccine developments and economic data. These are areas where the future is difficult to define and instead of allowing me to sleep better, it would have the opposite effect! This is not our way. Instead, we prefer to construct a portfolio of 10-15 high quality businesses, whose earnings have a very good chance of growing well ahead of inflation over a long period of time ― and when the inevitable bad times come, we know we own time-tested business models, fortress balance sheets and seasoned management teams that will get us through to the other side. We may see share prices fall ― in some cases quite dramatically like the GFC or the March sell-off ― but for those with the fortitude to see it through, this is unlikely to be a permanent destruction of capital. This approach has served me well through hyperinflation in Zimbabwe, the TMT bubble, the GFC, the European debt crisis and more recently the COVID-19 pandemic. For one known to like his sleep, it allows me to sleep well. And more importantly, our clients too. Author: Bob Desmond, Head of Claremont Global & Portfolio Manager Funds operated by this manager: |

7 Jun 2022 - The Expanding Role of ESG in Private Debt

6 Jun 2022 - Performance Report: Argonaut Natural Resources Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | At times, ANRF may consider holding higher levels of cash (max 30%) if valuations are full and it is difficult to find attractive investment opportunities. The Fund does not borrow for investment or any other purposes, but it may short sell securities as part of its portfolio protection strategies. |

| Manager Comments | The Argonaut Natural Resources Fund has a track record of 2 years and 5 months and therefore comparison over all market conditions and against its peers is limited. However, the fund has outperformed the ASX 200 Total Return Index since inception in January 2020, providing investors with an annualised return of 53.14% compared with the index's return of 6.85% over the same period. On a calendar year basis, the fund hasn't experienced any negative annual returns in the 2 years and 5 months since its inception. Over the past 12 months, the fund's largest drawdown was -4.55% vs the index's -6.35%, and since inception in January 2020 the fund's largest drawdown was -14.61% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in February 2020 and lasted 3 months, reaching its lowest point during March 2020. The fund had completely recovered its losses by May 2020. The Manager has delivered these returns with 1.99% more volatility than the index, contributing to a Sharpe ratio for performance over the past 12 months of 3.01 and for performance since inception of 2.15. The fund has provided positive monthly returns 80% of the time in rising markets and 44% of the time during periods of market decline, contributing to an up-capture ratio since inception of 201% and a down-capture ratio of -2%. |

| More Information |

6 Jun 2022 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

|

|||||||||||||||||

| Milford Conservative Fund | |||||||||||||||||

|

|||||||||||||||||

|

Milford Trans Tasman Equity Fund |

|||||||||||||||||

|

|||||||||||||||||

|

Ruffer Total Return International - Australia Fund |

|||||||||||||||||

|

|||||||||||||||||

|

|

|||||||||||||||||

| GAM LSA Private Shares AU Fund | |||||||||||||||||

|

|||||||||||||||||

| View Profile | |||||||||||||||||

|

|

|||||||||||||||||

| Tectonic Opportunities Fund | |||||||||||||||||

|

|||||||||||||||||

|

|

|||||||||||||||||

|

|||||||||||||||||

|

|||||||||||||||||

| View Profile | |||||||||||||||||

|

Want to see more funds? |

|||||||||||||||||

|

Subscribe for full access to these funds and over 650 others |

6 Jun 2022 - Markets pivot from reflation to deflationary bust

|

Markets pivot from reflation to deflationary bust Watermark Funds Management May 2022 MONTH IN REVIEW The Australian share market saw a small contraction in April with the All-Ordinaries Index down 0.83%, much less than the 8.7% contraction seen in the S&P 500. The modest move in the index disguised material moves in underlying sectors. Sell-offs were concentrated in Technology and Consumer Discretionary, down 10.4% and 3.2% respectively, while Utilities was the strongest sector, up 9.3%, and continuing its strong run as a safe haven against inflation. For the first time in 2022 the Materials sector fell, down 4.3%, which is an important development for the Australian market. We discuss further below. In terms of factor leadership, growth surprisingly outperformed value in April. While the Technology sector was week, 'growth' stocks in Consumer and Healthcare sectors traded better. The 'value' factor was also dragged down by the Materials sector which has now started to fall, as mentioned above. While May has started poorly for share markets globally, the hedges in our portfolio have so far protected the fund from any drawdown. The strategy is very well suited for the environment we find ourselves in. In April capital markets pivoted from reflation to deflationary bust as investors started to factor in a recession next year. We saw this play out clearly as commodities and commodity currencies fell sharply, including the Australian dollar. With this, late-cyclical sectors such as resources, which had held up relatively well, joining the rout in growth shares. The catalyst for this shift was a further tightening in financial conditions and lockdowns in China weighing on growth in the world's second largest economy. China historically has acted as a counterweight to growth trends in the west, this was particularly evident coming out of the financial crisis. With low vaccination rates amongst seniors in their community they have resolutely stuck to COVID-zero policies. Rolling lockdowns are weighing on growth and further disrupting supply chains into western markets. This is unlikely to change in the medium term given the virulence of Omicron. With China already in a recession, it is unable to play its typical role of balancing weakness in the west. The other major development last month was the breakdown in US mega-cap technology shares. This group of companies has led the share market higher in recent years. Together they account for one quarter of the value of the S&P 500. Until April they managed to escape the broader weakness in the NASDAQ. The 'Generals' as they are often called, reported disappointing results for Q1 2022, with Apple, Amazon, Netflix, and Facebook either missing expectations or providing weak guidance. The NASDAQ and Russell 2000 having fallen more than 20% now, joining emerging market equities and growth sectors in a new bear market. The Australian share market had been resilient through this earlier weakness in shares offshore only to fall sharply as commodities and mining shares broke down with the news out of China and broader concerns of a pending global recession. China almost certainly is already in a recession with growth in business activity and household spending in full retreat. If you break down the Financial Conditions Index (FCI) into asset values (falling); interest rates across the term structure (rising); and the US dollar (rising), FCI is tightening quickly, and we are only just embarking on a tightening cycle. The incidence of central banks tightening to combat inflation is the highest in many decades. This will likely end in recession in advanced economies. As these economies slow, profit expectations for public companies will fall along with valuation multiples as real interest rates continue to move higher. This is what a bear market looks like and we are almost certainly in one. Bear markets don't end until policy reverses course and financial conditions start to ease. We are still early in this tightening cycle, there is a long way to go. Liquidity will tighten further as central banks become sellers of the assets they have accumulated through COVID emergency measures. Bear markets typically last 18 months to 2 years and don't end until the liquidity spigot is turned back on again. Central banks are fully committed to combatting inflation and will not reverse course until inflation comes back into their target range of 2%. There is no central bank 'put option' this time around - falling asset values only helps Central Banks in their crusade to kill excess demand. While we are probably at peak inflation now and Consumer Price Index (CPI) and Personal Consumption Expenditures Price Index (PCE) will moderate in the months ahead as we cycle inflated data from last year, any moderation will happen slowly. Key components of the inflation basket - energy, food and shelter will remain under upward pressure for years to come. Labour markets remain acutely tight, employment needs to fall (recession) to reduce pressure on wages. We are in a 'secular' bull market for commodities, resource security and de-carbonisation will ensure ongoing investment in the sector for decades to come. Australia should benefit from this. While activity will slow in Australia, particularly if our major trading partner China is in recession, our economy should prove resilient even if advanced economies move into recession. There is a good chance Australia avoids the recession bullet once again. Having said that, commodities and mining shares are in a 'cyclical' bear along with other risk assets and will fall through the balance of this year. Share markets globally are over sold short term, sentiment is extremely bearish, and positioning is light. Shares should recover in the weeks ahead, an improvement in COVID cases in China would be particularly helpful. Any rally though should be used as an opportunity to reposition into defensive, quality names that will outperform in a slowing economy. Volatility will remain high into the second half of the year as financial conditions tighten further. We are still to see an exodus of retail investors who invested $1.3 trillion globally in equities through COVID. As markets fall in the second half of the year and investors come to realise, there is no central bank bailout this time around, a weaker tape could easily turn into a rout as we close the year. The bear is just getting started. SECTORS IN REVIEW The Consumer sector made a positive contribution for the month, with gains in Fuel marketing longs partially offset by losses on Agriculture shorts. Our long position in the Fuel Marketers has been gaining momentum as fuel security becomes an increasing issue for Western Governments. Ampol (ALD) and Viva Energy (VEA) refining assets, which are generally loathed by the market, are now generating super returns and driving upgrades for both companies. This sector is under-owned and offers defensive exposure at a cheap multiple. While coming at a cost to near-term performance in April, the Agriculture sector is building as fertile ground for short ideas. Share prices have risen aggressively, given the confluence of a strong domestic grain harvest, and sky-high soft commodity prices driven by supply-chain dislocation. We know however, as with all highly cyclical industries, that conditions are ever changing, and we should be careful extrapolating at either the top or the bottom of the cycle. To overcome this issue focus should always be given to mid-cycle analysis. Given decades of data on the Australian grain crop, we can predict with some certainty what mid-cycle earnings for companies like GrainCorp (GNC) might look like. On these mid-cycle earnings, current valuation multiples look extreme. Financials had a disappointing month in April. The primary driver was our long position in EML Payments (EML). EML delivered a guidance downgrade two months after its result in February. Given the volatility in the market, earnings dependability is currently paramount. As such, unexpected downgrades are seeing stocks punished by investors, with EML nearly halving over the month. In March, we saw press coverage that EML was being stalked by Private equity player Bain Capital, this saw the price above $3.00. We are cautiously optimistic that EML is forced to negotiate a reasonable price, which we view as the best outcome for investors. The TMT portfolio was a slight detractor of performance during the month. Our shorts in internet companies delivered as investors focused on deteriorating housing market drivers. They have also been caught up in a broader global technology sell off. Offsetting this was our technology portfolio, where losses were largely driven by our position in Life360 (360). 360 gave a quarterly update, where it reinstated guidance. We viewed the update as overall positive and were surprised to see the share price negatively impacted. We continue to see absolute and relative value in the name. The Mining sector was hit hard in April on lockdowns in China. The best performers recently were impacted the hardest with lithium names in particular retracing recent gains. Commodity prices were also weaker with lithium chemical and rare earths prices falling off peak levels. Coal continued to perform with our investment in Stanmore Resources (SMR) making a strong contribution. Healthcare: The medical device names are struggling with supply chain issues. Notably, ResMed (RMD) has had trouble locating components out of Asia. Industrials: Defensive industrial shares outperformed with Amcor (AMC) and Brambles (BXB) leading. Elsewhere housing names continued to struggle as investors adopted a more bearish view of housing activity and the property market- the building material names in particular were weak. Funds operated by this manager: Watermark Absolute Return Fund, Watermark Australian Leaders Fund, Watermark Market Neutral Fund Ltd (LIC) |

3 Jun 2022 - Hedge Clippings |03 June 2022

|

|

|

|

Hedge Clippings | Friday, 03 June 2022

Once an election is done and dusted - or in this case lost and won - it's usual for the incoming government to switch from promising how well - or much better - they'll be at managing the economy, to suddenly trying to dampen voters' expectations. So it was this week, as the incoming treasurer, Dr. Jim Chalmers, warned of inflation "almost out of control" and "skyrocketing", at the same time as GDP growth came in ahead of forecasts, and a trade surplus of $10.5 billion, more than $1 billion ahead of consensus expectations. It's no wonder then to discover that Treasurer Chalmers' Ph.D. was not awarded in economics, but in political science, writing his doctoral thesis on none other than Paul Keating, the great political brawler. Blaming the previous mob for the problems facing the incoming government is as old as the hills - just ask Tony Abbott, who reminded us of the perils of the Rudd/Gillard/Rudd years for as long as he could until even his own party grew tired of it and gave him the heave-ho. For an incoming Treasurer, and a Dr. of Political Science to boot, it was pretty inevitable, but we're not sure it fooled too many, other than his own diehard supporters. Generally we haven't noticed too much of such political point scoring to date, with PM Albanese a refreshing change from "Bulldozer" Scomo. However, new energy minister Chris Bowen, last time around a hopeful treasurer himself until he and Bill Shorten shot themselves in their collective feet, couldn't help himself when talking about the unfolding gas crisis, which we understood in the immediate term might have more to do with the problems in Ukraine. Which leads us away from politics to finance and ESG investing, or at least consideration of ESG in funds management. This trend has been building for some time, and AGL's well publicised issues at the hands of Mike Cannon-Brookes, supported by big super, is - if you'll excuse the analogy - the canary in the coal mine. With climate and the environment front and centre (perhaps not all the way to the right) both nationally and globally, ESG credentials and investing will be one of the dominant fund management themes of the future. Rightfully, the incoming government has a clear mandate (particularly if you add in the Green and Teal vote) to act on energy/climate change and the environment. The challenge will be the speed and cost - in all its forms - of the transition away from fossil fuels, particularly coal. Meanwhile, there's been little to nothing heard about a push to nuclear energy as a reliable source of base load power. It's unlikely to happen under a Labour government, particularly one with the presence of the Greens in the Senate, but support for at least the investigation of Small Scale Nuclear should be on the table. If the Labour party can support nuclear powered submarines, and their small scale nuclear powered propellers, surely there's a precedent? News & Insights New Funds on FundMonitors.com Market Insights & Fund Performance | L1 Capital 10k Words | Equitable Investors Natural gas and midstream assets | 4D Infrastructure |

|

|

April 2022 Performance News Bennelong Australian Equities Fund May 2022 Performance News |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

3 Jun 2022 - Decarbonisation - A Risk To Dividends?

|

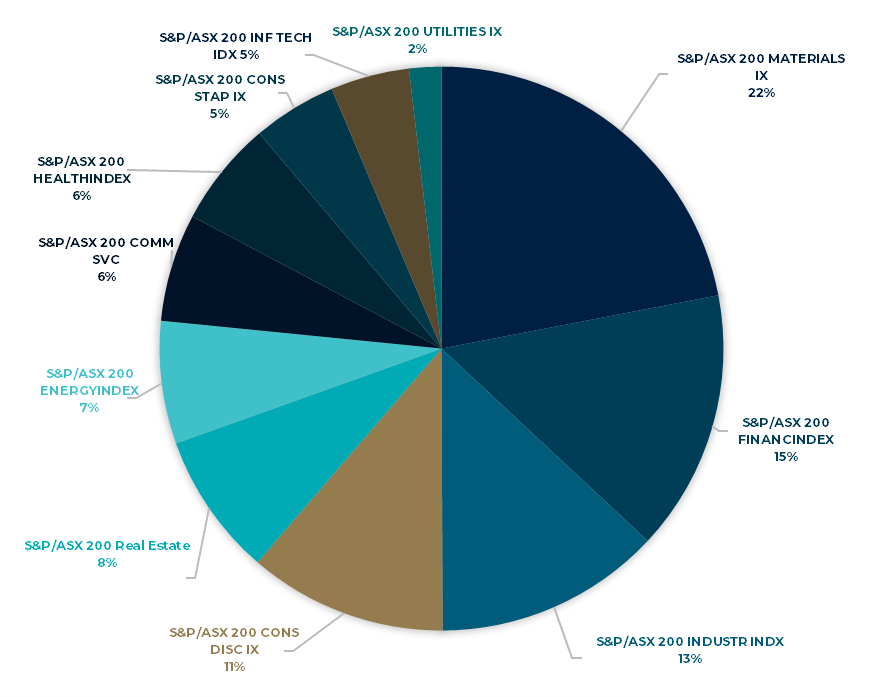

Decarbonisation - A Risk To Dividends? Tyndall Asset Management May 2022 In this article, Michael Maughan, Portfolio Manager of the Tyndall Australian Share Income Fund, discusses the impact on the big dividend payers from decarbonisation and where he sees opportunities for equity income investors. Knowing where a company or industry is in its economic cycle, allows investors the ability to judge when to invest, and when to wait for a cheaper opportunity. This is because companies are subject to different economic cycles. For example, the mining sector aligns more with Chinese growth than the US. Understanding Capex cycles—including the coming decarbonisation cycle—are relevant for dividend-focused investors due to the deployment of cashflows within those companies. Where has the Australian market's dividends come from historically? First, we need to look at which sectors have yielded the highest dividends for investors. Chart 1 shows that 37% of the yield over the past ten years has come from financials and materials. Not surprising given they are the largest sectors in the Australian market but perhaps surprising given mining companies often have a poor record in the capital discipline. That mix has changed over time, and those two sectors made up 56% of the yield in 2021. Chart 1. 10 years of ASX200 dividends

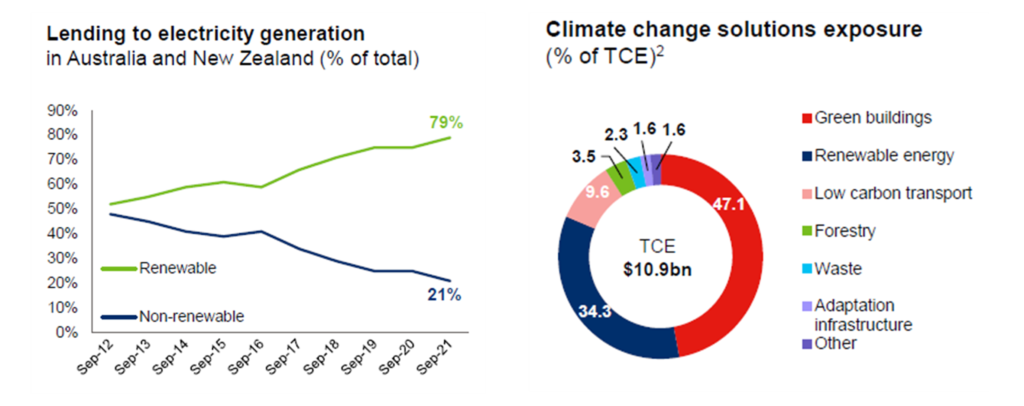

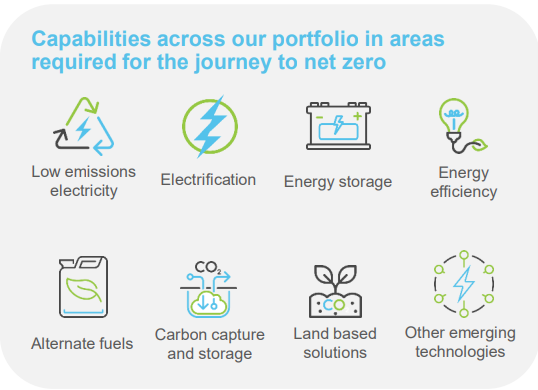

Banks have been consistent in their dividend payments except for a brief hiatus at the peak of COVID uncertainty. Materials have been more volatile with a big step down as China slowed and progressive dividend policies ceased in 2015/16, and a big step up in the past couple of years as commodity prices have boomed. However, going further back, the ability of miners to pay dividends was a function of the CAPEX they were spending and the prevailing commodity prices. Over the past ten years, we have seen this trade-off between dividends and investment in energy names like Oil Search (now part of Santos) and Woodside. Oil Search prioritised LNG projects in PNG over dividend payments, and Woodside had a fluctuating dividend structure depending on its balance between producing assets and its LNG projects in WA. As we discuss later in this piece, this balance could be changing. So how could the energy transition impact big dividend payers' ability to maintain dividends? Decarbonisation is a capex cycle to play out over 20-30 years. Firstly, companies are decarbonising their operations. Secondly, globally we need to spend trillions of dollars on new nickel, lithium, copper, and cobalt mines to renewably electrify the world. While this doesn't sound great for dividends, the market has already factored much of this in. BHP and RIO Tinto have been explicit about the investments they are making to decarbonise their operations. BHP will increase capex by U$200 million p.a, for the next five years, and RIO Tinto will spend an extra U$500 million p.a. over the next three years. The majority of this will go to renewable power generation in the Pilbara. Therefore, if there are extra costs of decarbonising operations (that may or may not be recovered in premium pricing), there is the capex opportunity to meet the demand created by the need for additional wires and batteries. Copper demand could double, and nickel demand could quadruple to meet Paris targets through ongoing electrification. Net-net, this is a positive story for the diversified miners. Having growth opportunities to invest in that will generate cash and dividends in the future is much better than being a declining business with a high payout ratio. Share prices never assumed this level of cash flow was forever. The banks have an opportunity to fund renewable projects through lending discussed by Brad Potter, Tyndall's Head of Australian Equities, in his article: Banks funding renewables set to drive growth. Chart 2. shows that Westpac has been skewing away from fossil fuels towards renewables for 10 years already. Whether the Australian banks will be able to compete with the global interest to lend to these projects is unknown, but it is more opportunity than risk. Chart 2. Westpac's electricity generation lending over time and climate change solutions exposure Source: The Westpac Group Can dividends benefit from decarbonisation over the coming decades? In the medium term, we expect that the traditional energy companies will be investing less capex, and concentrating on harvesting their current assets to facilitate the energy transition, meaning more cash being returned to shareholders through dividends and buybacks. The mergers of Oil Search with Santos and Woodside with BHP petroleum create more balanced businesses with pristine balance sheets, strong cash flows, and a higher percentage of producing assets to fund growth opportunities or return cash to shareholders. Interestingly, Macquarie is aggressively pursuing growth in both renewables and electricity infrastructure and have a model that develops assets on the balance sheet and then sells them down into funds in the same way the Goodman Group does for industrial property. This focus has received a lot of attention and has been part of the stock's rerating. However, they also have one of the world's biggest energy trading businesses and therefore have been huge beneficiaries of the volatility in traditional energy markets. The holy grail is a company that is exposed to the energy transition without necessarily being as capital intensive as a miner. One of the issues with the growth in renewables is that the transmission networks are not built for this decentralised generation structure. We have lots of small producers, batteries that need electricity going in and out, and even household solar has changed the nature of the grid. The result is that Australia need to add 10km of transmission lines to the existing 45km but current capacity to roll out is only 700m pa. Downer Group is in a prime position to capitalize on this as highlighted in chart 3 as a leading player in electrical engineering and construction with 70 years' experience. Worley is also growing the part of their business that consults with the hydrogen industry, although their core fossil fuels business has associated downside risks. Chart 3. Downer capabilities leveraged to decarbonization

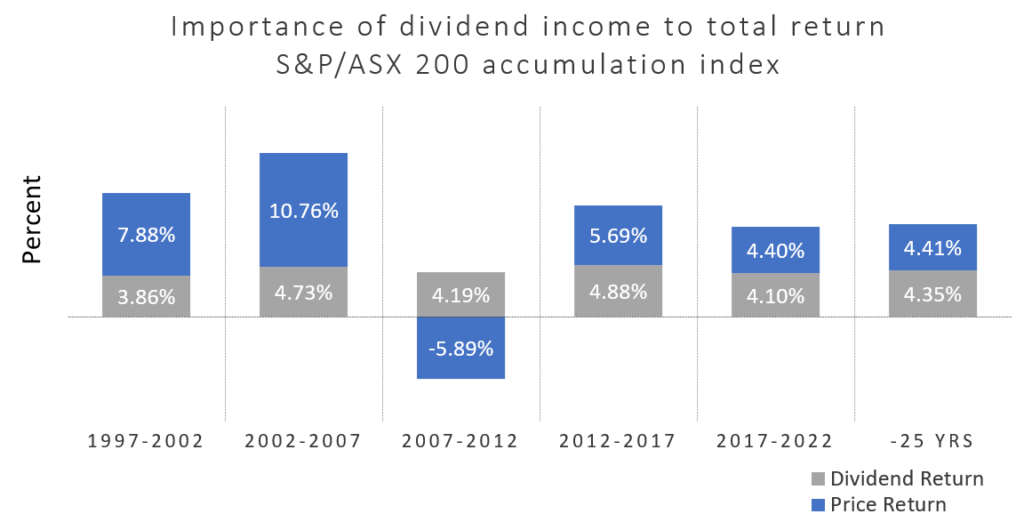

Source: Downer Group Conclusion While we see a peak in capital returns from miners due to unprecedented supply/demand imbalances and low CAPEX pipelines, the expected increased investment in decarbonisation programs is unlikely to wipe out the traditionally high yield of the Australian equity market. The tax structure still incentivises Australian companies to pay franked dividends, and the index composition is skewed to cash-generating companies. Over decades the Australian market has delivered net yields in the 4% range as shown in Chart 4 (5%+ grossed up for franking), and we don't expect that to change materially in the future.

Chart 4. The importance of dividend income to total return Source: S&P/ASX; IRESS; Sub-periods are rolling five-years to illustrate consistency of income Author: Michael Maughan, Portfolio Manager, Tyndall Australian Share Income Fund Funds operated by this manager: Tyndall Australian Share Concentrated Fund, Tyndall Australian Share Income Fund, Tyndall Australian Share Wholesale Fund Important information: This material was prepared and is issued by Yarra Capital Management Limited (formerly Nikko AM Limited) ABN 99 003 376 252 AFSL No: 237563 (YCML). The information contained in this material is of a general nature only and does not constitute personal advice, nor does it constitute an offer of any financial product. It does not take into account the objectives, financial situation or needs of any individual. For this reason, you should, before acting on this material, consider the appropriateness of the material, having regard to your objectives, financial situation, and needs. The information in this material has been prepared from what is considered to be reliable information, but the accuracy and integrity of the information is not guaranteed. Figures, charts, opinions and other data, including statistics, in this material are current as at the date of publication, unless stated otherwise. The graphs and figures contained in this material include either past or backdated data, and make no promise of future investment returns. Past performance is not an indicator of future performance. Any economic or market forecasts are not guaranteed. Any references to particular securities or sectors are for illustrative purposes only and are as at the date of publication of this material. This is not a recommendation in relation to any named securities or sectors and no warranty or guarantee is provided. |