NEWS

8 Jun 2022 - Why 15 stocks are all you need

|

Why 15 stocks are all you need Claremont Global May 2022

With a mandate of owning 10-15 stocks, I am often asked: "How do I sleep at night given the concentration risk?" This has been a familiar refrain for most of the 25 years I have been managing client capital and where I have always run concentrated portfolios with 10-25 stocks. The thinking suggests that with a concentrated portfolio, you are running excess risk and one would be better served having a more "diversified" portfolio. My answer is always the same - it all depends on how you define risk. If you define risk as the chance of underperforming an index or benchmark in the short term - then I would agree this is "risky". This is the classic fund manager's "career risk" - the chance of underperforming a benchmark and putting your job on the line or losing client FUM. In the words of John Maynard Keynes: "It is better for reputation to fail conventionally than to succeed unconventionally". But to earn returns that are better than the market, it is really quite simple - you have to own portfolios that are different from the market. Robert Hagstrom in his excellent book The Essential Buffett - timeless principles for the New Economy ran a 10-year study from 1987-96 where he had a computer randomly assemble 3,000 portfolios from 1,200 companies and broke the results down as follows:

It is interesting to note the 15-stock portfolio achieved an average return not much different to the 250-stock portfolio but with a much wider range of outcomes (i.e. much higher career risk!). However, the chances of beating the market were also more than 13 times higher. In addition, Lorie & Fisher showed in their 49-year study of NYSE-traded stocks between 1926-65 that 90 per cent of stock risk can be diversified with a 16-stock portfolio. But we define risk as the possibility of permanently impairing client capital or not achieving a satisfactory return for the risk taken. And we target a long-term return of eight to twelve per cent per annum over a five to seven-year period. We believe a permanent impairment to capital is most likely to arise in the following ways: Buying heavily leveraged businessesMany management teams are very happy to layer on debt in the good times by "returning capital" to shareholders and achieving artificial EPS growth to satisfy short-term and poorly defined incentive targets. There is no better example of this than the actions of American Airlines in the five years to 2019. The company "returned" $13bn in buybacks - this was despite the fact there was no capital to return, as free cash flow over the period was a NEGATIVE $3.2bn! The ratio of debt to earnings before income, taxes, depreciation and amortisation (EBITDA) was 4.2-times in 2019 at the peak of the cycle. In our opinion this is highly irresponsible, given the industry already has a high degree of operational gearing, has a large amount of off-balance sheet debt in the form of leases and is vulnerable to rising oil prices. And then when tough times hit, these companies go cap-in-hand to the government and/or shareholders to repair balance sheets at very depressed equity prices, resulting in severe value destruction. By contrast, our portfolio has a weighted net debt/EBITDA of 0.7x. Excess leverage is just not a risk we are willing to run. Balance sheet strength is a given in our portfolio. We know that the future is always uncertain and rather than trying to forecast when the good times will end (folly in our opinion), we assume that recessions are a natural part of economic life and we prepare accordingly. The added benefit of this is that when recessions occur, our companies can play offence - buying quality assets or their own shares at favorable prices and maintaining or even increasing the dividend. We have companies in our portfolio that have consistently paid rising dividends for over 40 years. Buying businesses that rely on an accurate forecast of some hard-to-predict variableThese variables can be interest rates, moves by the Federal Reserve, commodity prices, regulation, innovation and election results, amongst many others in a complex world. In 2016 I didn't know many people who predicted Trump would be elected ― and for those who did, how many predicted that markets would rally? Or in March of this year, who would have thought the market would be at an all-time high in December, when the global economic contraction has been the largest since the Great Depression? Another favourite of mine in recent years has been buying banks on the "yield steepening trade", only to then see rates collapse. Or the oil majors in 2014, who spent billions on exploration with a forecast of oil being above $100 a barrel, only to see oil collapse with the advent of shale oil. We deliberately avoid businesses that rely on us correctly forecasting commodity prices, interest rates, elections, drug discoveries, economic growth or political outcomes. Experience has taught us that very few people are able to do this on a consistent basis. Yogi Berra put it well: "Forecasts are hard, especially about the future". Buying inferior businesses with no competitive advantageOver time, competition does a pretty good job of taking away excess returns for most businesses. And over time, it is very hard for an investor to earn a return much different than the underlying economics of the business one owns. If an investor wants to earn an excess return, logic suggests that the best place to start is with owning businesses that themselves earn excess returns on shareholder capital. Superior returns on capital normally arise from some form of competitive advantage - be it a brand, network effect, scale, reputation, data, client relationships, IP or technology. But the allure of buying "cheap" businesses is often too much for some. Even Warren Buffett himself made this mistake when buying textile company Berkshire Hathaway at a steep discount to its underlying asset value. But as he said many years later, once he came to realize his mistake and finally exited the business: "Berkshire Hathaway's pricing power lasted the best part of a morning". Our preference is to own businesses that have been proven over many years and cycles. The average age of our businesses is over 70 years, with the oldest dating back to the end of the US Civil War. They have been tested through wars, product cycles, recessions, political upheaval, inflation and financial crises. The competitive advantage in our portfolio is evidenced by an operating margin of 27 per cent and a return on invested capital of 18 per cent - both over 2x the average listed business. It is interesting to note the average listed business earns a return of 9 per cent - not far from the level equities have actually achieved over the long term.

Aggressive management or those who allocate capital poorlyUnfortunately, it is a fact of life that the people who end up running businesses are often no "shrinking violets". They are usually very confident in their ability and their normal starting point is to aggressively "grow the business". This can often involve straying away from their core competence into new areas, where their "skill" will translate into superior returns to shareholders. The worst situation occurs where management take on a lot of debt at the peak of the cycle, pay an inflated price for an asset, heap goodwill on the balance sheet, only to reverse the deal many years later ― and more often under new management. A classic example of this is GE, who took a very good industrial business and then ventured into credit cards, property, insurance, media ... the list goes on. The end result was to take a AAA rated balance sheet and turn it into one that is now barely above junk status. Or closer to home - who can forget Woolworths ill-timed home improvement venture against the toughest of competitors, or even Bunnings themselves and their venture into the UK? Would it not have made sense to focus capital on the competitive advantage that made the company a market leader in the first place and then return excess capital to shareholders? And finally, my all-time favorite - the Vodafone purchase of Mannesmann at the peak of the TMT mania for $173bn, which saw Vodafone CEO Chris Gent earn a bonus of $16m for the "value" he created. In 2006, Vodafone quietly wrote the asset down by $28bn, but not before Sir Chris Gent received a knighthood for "services to the telecom industry." I wonder whether he should have received the highest German accolade "for services to the German pension fund industry." To quote Michael Porter, the doyen of competitive advantage: "The biggest impediment to strategy and competitive advantage is an overly reliant focus on growth". By contrast, we prefer our management teams to relentlessly focus on competitive advantage, customers, employees, communities and reinvest back in the business for the long term. And once this is done, to make sensible bolt-on acquisitions, pay dividends and buy back their stock when it is decent value. The last trait is very hard to find - there are very few management teams who treat buying their shares like they would any other acquisition. For most management teams, the logic is if I can borrow at, say 2 per cent, as long as I pay no more than 50x earnings - this enhances earnings per share. And unfortunately, most management teams will happily buy their stock in bull markets using cheap debt, only to stop this when their shares are cheap, as this is the "prudent" thing to do. Buying businesses at prices that are well above their fair valueEven if one buys businesses that have superior economics, strong balance sheets and are well managed - even the most disciplined can be lured into paying inflated prices, especially in the upper reaches of a bull market. The narrative always follows a similar pattern that excess growth will last forever, interest rates will never rise, the company has changed (very few do), the company deserves a lower beta and the list goes on. When valuing companies, we do not change our discount rates, terminal growth assumptions, or market multiples, preferring to use "through the cycle" value inputs. Neither do we use a weighted average cost of capital (WACC) or beta to justify higher prices. Read any book by the doyen of valuation, Aswath Damodaran, and he will argue that if you are to drop your risk-free rate, you should also drop your terminal growth rate. This makes sense as a lower risk-free rate suggests a lower nominal gross domestic product (GDP) growth rate. Yet, in the upper reaches of a bull market, it is not uncommon to see lower risk-free rates and higher terminal growth rates to justify valuations! ConclusionSo, to return to the original client question posed at the beginning of this article: "How do I sleep well at night with only 10-15 stocks?" The question assumes that I would sleep better if we owned more stocks. Well, to do that, we would have to add lesser quality names or those with lower expected returns. Would I sleep better then? It would decrease our research intensity, whilst potentially lowering the quality and/or the expected return of the portfolio. I could load up on "cheap" bank stocks but would now be exposing myself to balance sheet risk ― at 20x geared, these businesses can literally go to zero as we saw in the global financial crisis (GFC) ― as well as interest rate risk, economic risk and a large amount of regulatory risk (witness the halting of dividends in Europe recently). Or, I could load up on "cheap" oil stocks, but I would be up late at night poring over demand/supply dynamics, vaccine developments and economic data. These are areas where the future is difficult to define and instead of allowing me to sleep better, it would have the opposite effect! This is not our way. Instead, we prefer to construct a portfolio of 10-15 high quality businesses, whose earnings have a very good chance of growing well ahead of inflation over a long period of time ― and when the inevitable bad times come, we know we own time-tested business models, fortress balance sheets and seasoned management teams that will get us through to the other side. We may see share prices fall ― in some cases quite dramatically like the GFC or the March sell-off ― but for those with the fortitude to see it through, this is unlikely to be a permanent destruction of capital. This approach has served me well through hyperinflation in Zimbabwe, the TMT bubble, the GFC, the European debt crisis and more recently the COVID-19 pandemic. For one known to like his sleep, it allows me to sleep well. And more importantly, our clients too. Author: Bob Desmond, Head of Claremont Global & Portfolio Manager Funds operated by this manager: |

7 Jun 2022 - The Expanding Role of ESG in Private Debt

6 Jun 2022 - Performance Report: Argonaut Natural Resources Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | At times, ANRF may consider holding higher levels of cash (max 30%) if valuations are full and it is difficult to find attractive investment opportunities. The Fund does not borrow for investment or any other purposes, but it may short sell securities as part of its portfolio protection strategies. |

| Manager Comments | The Argonaut Natural Resources Fund has a track record of 2 years and 5 months and therefore comparison over all market conditions and against its peers is limited. However, the fund has outperformed the ASX 200 Total Return Index since inception in January 2020, providing investors with an annualised return of 53.14% compared with the index's return of 6.85% over the same period. On a calendar year basis, the fund hasn't experienced any negative annual returns in the 2 years and 5 months since its inception. Over the past 12 months, the fund's largest drawdown was -4.55% vs the index's -6.35%, and since inception in January 2020 the fund's largest drawdown was -14.61% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in February 2020 and lasted 3 months, reaching its lowest point during March 2020. The fund had completely recovered its losses by May 2020. The Manager has delivered these returns with 1.99% more volatility than the index, contributing to a Sharpe ratio for performance over the past 12 months of 3.01 and for performance since inception of 2.15. The fund has provided positive monthly returns 80% of the time in rising markets and 44% of the time during periods of market decline, contributing to an up-capture ratio since inception of 201% and a down-capture ratio of -2%. |

| More Information |

6 Jun 2022 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

|

|||||||||||||||||

| Milford Conservative Fund | |||||||||||||||||

|

|||||||||||||||||

|

Milford Trans Tasman Equity Fund |

|||||||||||||||||

|

|||||||||||||||||

|

Ruffer Total Return International - Australia Fund |

|||||||||||||||||

|

|||||||||||||||||

|

|

|||||||||||||||||

| GAM LSA Private Shares AU Fund | |||||||||||||||||

|

|||||||||||||||||

| View Profile | |||||||||||||||||

|

|

|||||||||||||||||

| Tectonic Opportunities Fund | |||||||||||||||||

|

|||||||||||||||||

|

|

|||||||||||||||||

|

|||||||||||||||||

|

|||||||||||||||||

| View Profile | |||||||||||||||||

|

Want to see more funds? |

|||||||||||||||||

|

Subscribe for full access to these funds and over 650 others |

6 Jun 2022 - Markets pivot from reflation to deflationary bust

|

Markets pivot from reflation to deflationary bust Watermark Funds Management May 2022 MONTH IN REVIEW The Australian share market saw a small contraction in April with the All-Ordinaries Index down 0.83%, much less than the 8.7% contraction seen in the S&P 500. The modest move in the index disguised material moves in underlying sectors. Sell-offs were concentrated in Technology and Consumer Discretionary, down 10.4% and 3.2% respectively, while Utilities was the strongest sector, up 9.3%, and continuing its strong run as a safe haven against inflation. For the first time in 2022 the Materials sector fell, down 4.3%, which is an important development for the Australian market. We discuss further below. In terms of factor leadership, growth surprisingly outperformed value in April. While the Technology sector was week, 'growth' stocks in Consumer and Healthcare sectors traded better. The 'value' factor was also dragged down by the Materials sector which has now started to fall, as mentioned above. While May has started poorly for share markets globally, the hedges in our portfolio have so far protected the fund from any drawdown. The strategy is very well suited for the environment we find ourselves in. In April capital markets pivoted from reflation to deflationary bust as investors started to factor in a recession next year. We saw this play out clearly as commodities and commodity currencies fell sharply, including the Australian dollar. With this, late-cyclical sectors such as resources, which had held up relatively well, joining the rout in growth shares. The catalyst for this shift was a further tightening in financial conditions and lockdowns in China weighing on growth in the world's second largest economy. China historically has acted as a counterweight to growth trends in the west, this was particularly evident coming out of the financial crisis. With low vaccination rates amongst seniors in their community they have resolutely stuck to COVID-zero policies. Rolling lockdowns are weighing on growth and further disrupting supply chains into western markets. This is unlikely to change in the medium term given the virulence of Omicron. With China already in a recession, it is unable to play its typical role of balancing weakness in the west. The other major development last month was the breakdown in US mega-cap technology shares. This group of companies has led the share market higher in recent years. Together they account for one quarter of the value of the S&P 500. Until April they managed to escape the broader weakness in the NASDAQ. The 'Generals' as they are often called, reported disappointing results for Q1 2022, with Apple, Amazon, Netflix, and Facebook either missing expectations or providing weak guidance. The NASDAQ and Russell 2000 having fallen more than 20% now, joining emerging market equities and growth sectors in a new bear market. The Australian share market had been resilient through this earlier weakness in shares offshore only to fall sharply as commodities and mining shares broke down with the news out of China and broader concerns of a pending global recession. China almost certainly is already in a recession with growth in business activity and household spending in full retreat. If you break down the Financial Conditions Index (FCI) into asset values (falling); interest rates across the term structure (rising); and the US dollar (rising), FCI is tightening quickly, and we are only just embarking on a tightening cycle. The incidence of central banks tightening to combat inflation is the highest in many decades. This will likely end in recession in advanced economies. As these economies slow, profit expectations for public companies will fall along with valuation multiples as real interest rates continue to move higher. This is what a bear market looks like and we are almost certainly in one. Bear markets don't end until policy reverses course and financial conditions start to ease. We are still early in this tightening cycle, there is a long way to go. Liquidity will tighten further as central banks become sellers of the assets they have accumulated through COVID emergency measures. Bear markets typically last 18 months to 2 years and don't end until the liquidity spigot is turned back on again. Central banks are fully committed to combatting inflation and will not reverse course until inflation comes back into their target range of 2%. There is no central bank 'put option' this time around - falling asset values only helps Central Banks in their crusade to kill excess demand. While we are probably at peak inflation now and Consumer Price Index (CPI) and Personal Consumption Expenditures Price Index (PCE) will moderate in the months ahead as we cycle inflated data from last year, any moderation will happen slowly. Key components of the inflation basket - energy, food and shelter will remain under upward pressure for years to come. Labour markets remain acutely tight, employment needs to fall (recession) to reduce pressure on wages. We are in a 'secular' bull market for commodities, resource security and de-carbonisation will ensure ongoing investment in the sector for decades to come. Australia should benefit from this. While activity will slow in Australia, particularly if our major trading partner China is in recession, our economy should prove resilient even if advanced economies move into recession. There is a good chance Australia avoids the recession bullet once again. Having said that, commodities and mining shares are in a 'cyclical' bear along with other risk assets and will fall through the balance of this year. Share markets globally are over sold short term, sentiment is extremely bearish, and positioning is light. Shares should recover in the weeks ahead, an improvement in COVID cases in China would be particularly helpful. Any rally though should be used as an opportunity to reposition into defensive, quality names that will outperform in a slowing economy. Volatility will remain high into the second half of the year as financial conditions tighten further. We are still to see an exodus of retail investors who invested $1.3 trillion globally in equities through COVID. As markets fall in the second half of the year and investors come to realise, there is no central bank bailout this time around, a weaker tape could easily turn into a rout as we close the year. The bear is just getting started. SECTORS IN REVIEW The Consumer sector made a positive contribution for the month, with gains in Fuel marketing longs partially offset by losses on Agriculture shorts. Our long position in the Fuel Marketers has been gaining momentum as fuel security becomes an increasing issue for Western Governments. Ampol (ALD) and Viva Energy (VEA) refining assets, which are generally loathed by the market, are now generating super returns and driving upgrades for both companies. This sector is under-owned and offers defensive exposure at a cheap multiple. While coming at a cost to near-term performance in April, the Agriculture sector is building as fertile ground for short ideas. Share prices have risen aggressively, given the confluence of a strong domestic grain harvest, and sky-high soft commodity prices driven by supply-chain dislocation. We know however, as with all highly cyclical industries, that conditions are ever changing, and we should be careful extrapolating at either the top or the bottom of the cycle. To overcome this issue focus should always be given to mid-cycle analysis. Given decades of data on the Australian grain crop, we can predict with some certainty what mid-cycle earnings for companies like GrainCorp (GNC) might look like. On these mid-cycle earnings, current valuation multiples look extreme. Financials had a disappointing month in April. The primary driver was our long position in EML Payments (EML). EML delivered a guidance downgrade two months after its result in February. Given the volatility in the market, earnings dependability is currently paramount. As such, unexpected downgrades are seeing stocks punished by investors, with EML nearly halving over the month. In March, we saw press coverage that EML was being stalked by Private equity player Bain Capital, this saw the price above $3.00. We are cautiously optimistic that EML is forced to negotiate a reasonable price, which we view as the best outcome for investors. The TMT portfolio was a slight detractor of performance during the month. Our shorts in internet companies delivered as investors focused on deteriorating housing market drivers. They have also been caught up in a broader global technology sell off. Offsetting this was our technology portfolio, where losses were largely driven by our position in Life360 (360). 360 gave a quarterly update, where it reinstated guidance. We viewed the update as overall positive and were surprised to see the share price negatively impacted. We continue to see absolute and relative value in the name. The Mining sector was hit hard in April on lockdowns in China. The best performers recently were impacted the hardest with lithium names in particular retracing recent gains. Commodity prices were also weaker with lithium chemical and rare earths prices falling off peak levels. Coal continued to perform with our investment in Stanmore Resources (SMR) making a strong contribution. Healthcare: The medical device names are struggling with supply chain issues. Notably, ResMed (RMD) has had trouble locating components out of Asia. Industrials: Defensive industrial shares outperformed with Amcor (AMC) and Brambles (BXB) leading. Elsewhere housing names continued to struggle as investors adopted a more bearish view of housing activity and the property market- the building material names in particular were weak. Funds operated by this manager: Watermark Absolute Return Fund, Watermark Australian Leaders Fund, Watermark Market Neutral Fund Ltd (LIC) |

3 Jun 2022 - Hedge Clippings |03 June 2022

|

|

|

|

Hedge Clippings | Friday, 03 June 2022

Once an election is done and dusted - or in this case lost and won - it's usual for the incoming government to switch from promising how well - or much better - they'll be at managing the economy, to suddenly trying to dampen voters' expectations. So it was this week, as the incoming treasurer, Dr. Jim Chalmers, warned of inflation "almost out of control" and "skyrocketing", at the same time as GDP growth came in ahead of forecasts, and a trade surplus of $10.5 billion, more than $1 billion ahead of consensus expectations. It's no wonder then to discover that Treasurer Chalmers' Ph.D. was not awarded in economics, but in political science, writing his doctoral thesis on none other than Paul Keating, the great political brawler. Blaming the previous mob for the problems facing the incoming government is as old as the hills - just ask Tony Abbott, who reminded us of the perils of the Rudd/Gillard/Rudd years for as long as he could until even his own party grew tired of it and gave him the heave-ho. For an incoming Treasurer, and a Dr. of Political Science to boot, it was pretty inevitable, but we're not sure it fooled too many, other than his own diehard supporters. Generally we haven't noticed too much of such political point scoring to date, with PM Albanese a refreshing change from "Bulldozer" Scomo. However, new energy minister Chris Bowen, last time around a hopeful treasurer himself until he and Bill Shorten shot themselves in their collective feet, couldn't help himself when talking about the unfolding gas crisis, which we understood in the immediate term might have more to do with the problems in Ukraine. Which leads us away from politics to finance and ESG investing, or at least consideration of ESG in funds management. This trend has been building for some time, and AGL's well publicised issues at the hands of Mike Cannon-Brookes, supported by big super, is - if you'll excuse the analogy - the canary in the coal mine. With climate and the environment front and centre (perhaps not all the way to the right) both nationally and globally, ESG credentials and investing will be one of the dominant fund management themes of the future. Rightfully, the incoming government has a clear mandate (particularly if you add in the Green and Teal vote) to act on energy/climate change and the environment. The challenge will be the speed and cost - in all its forms - of the transition away from fossil fuels, particularly coal. Meanwhile, there's been little to nothing heard about a push to nuclear energy as a reliable source of base load power. It's unlikely to happen under a Labour government, particularly one with the presence of the Greens in the Senate, but support for at least the investigation of Small Scale Nuclear should be on the table. If the Labour party can support nuclear powered submarines, and their small scale nuclear powered propellers, surely there's a precedent? News & Insights New Funds on FundMonitors.com Market Insights & Fund Performance | L1 Capital 10k Words | Equitable Investors Natural gas and midstream assets | 4D Infrastructure |

|

|

April 2022 Performance News Bennelong Australian Equities Fund May 2022 Performance News |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

3 Jun 2022 - Decarbonisation - A Risk To Dividends?

|

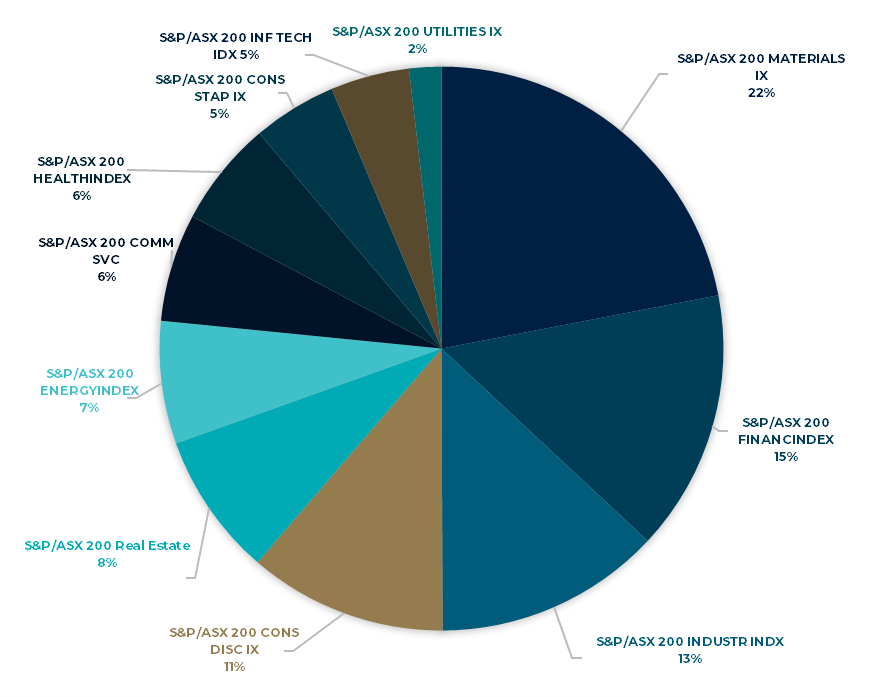

Decarbonisation - A Risk To Dividends? Tyndall Asset Management May 2022 In this article, Michael Maughan, Portfolio Manager of the Tyndall Australian Share Income Fund, discusses the impact on the big dividend payers from decarbonisation and where he sees opportunities for equity income investors. Knowing where a company or industry is in its economic cycle, allows investors the ability to judge when to invest, and when to wait for a cheaper opportunity. This is because companies are subject to different economic cycles. For example, the mining sector aligns more with Chinese growth than the US. Understanding Capex cycles—including the coming decarbonisation cycle—are relevant for dividend-focused investors due to the deployment of cashflows within those companies. Where has the Australian market's dividends come from historically? First, we need to look at which sectors have yielded the highest dividends for investors. Chart 1 shows that 37% of the yield over the past ten years has come from financials and materials. Not surprising given they are the largest sectors in the Australian market but perhaps surprising given mining companies often have a poor record in the capital discipline. That mix has changed over time, and those two sectors made up 56% of the yield in 2021. Chart 1. 10 years of ASX200 dividends

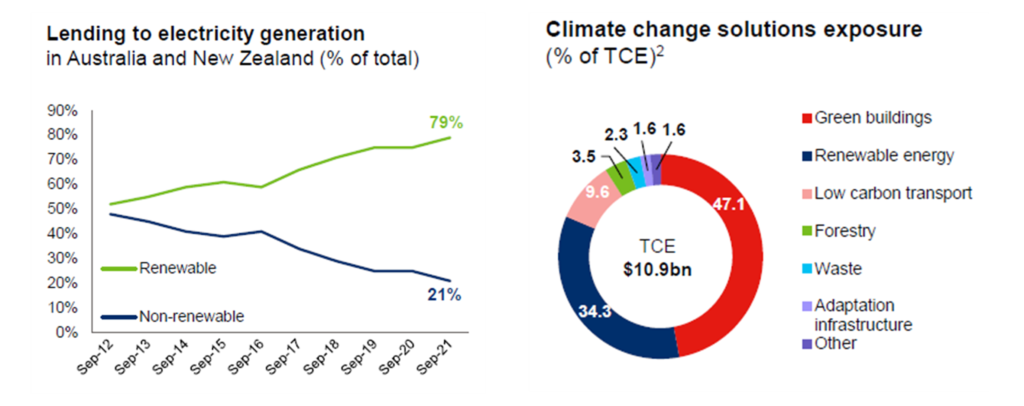

Banks have been consistent in their dividend payments except for a brief hiatus at the peak of COVID uncertainty. Materials have been more volatile with a big step down as China slowed and progressive dividend policies ceased in 2015/16, and a big step up in the past couple of years as commodity prices have boomed. However, going further back, the ability of miners to pay dividends was a function of the CAPEX they were spending and the prevailing commodity prices. Over the past ten years, we have seen this trade-off between dividends and investment in energy names like Oil Search (now part of Santos) and Woodside. Oil Search prioritised LNG projects in PNG over dividend payments, and Woodside had a fluctuating dividend structure depending on its balance between producing assets and its LNG projects in WA. As we discuss later in this piece, this balance could be changing. So how could the energy transition impact big dividend payers' ability to maintain dividends? Decarbonisation is a capex cycle to play out over 20-30 years. Firstly, companies are decarbonising their operations. Secondly, globally we need to spend trillions of dollars on new nickel, lithium, copper, and cobalt mines to renewably electrify the world. While this doesn't sound great for dividends, the market has already factored much of this in. BHP and RIO Tinto have been explicit about the investments they are making to decarbonise their operations. BHP will increase capex by U$200 million p.a, for the next five years, and RIO Tinto will spend an extra U$500 million p.a. over the next three years. The majority of this will go to renewable power generation in the Pilbara. Therefore, if there are extra costs of decarbonising operations (that may or may not be recovered in premium pricing), there is the capex opportunity to meet the demand created by the need for additional wires and batteries. Copper demand could double, and nickel demand could quadruple to meet Paris targets through ongoing electrification. Net-net, this is a positive story for the diversified miners. Having growth opportunities to invest in that will generate cash and dividends in the future is much better than being a declining business with a high payout ratio. Share prices never assumed this level of cash flow was forever. The banks have an opportunity to fund renewable projects through lending discussed by Brad Potter, Tyndall's Head of Australian Equities, in his article: Banks funding renewables set to drive growth. Chart 2. shows that Westpac has been skewing away from fossil fuels towards renewables for 10 years already. Whether the Australian banks will be able to compete with the global interest to lend to these projects is unknown, but it is more opportunity than risk. Chart 2. Westpac's electricity generation lending over time and climate change solutions exposure Source: The Westpac Group Can dividends benefit from decarbonisation over the coming decades? In the medium term, we expect that the traditional energy companies will be investing less capex, and concentrating on harvesting their current assets to facilitate the energy transition, meaning more cash being returned to shareholders through dividends and buybacks. The mergers of Oil Search with Santos and Woodside with BHP petroleum create more balanced businesses with pristine balance sheets, strong cash flows, and a higher percentage of producing assets to fund growth opportunities or return cash to shareholders. Interestingly, Macquarie is aggressively pursuing growth in both renewables and electricity infrastructure and have a model that develops assets on the balance sheet and then sells them down into funds in the same way the Goodman Group does for industrial property. This focus has received a lot of attention and has been part of the stock's rerating. However, they also have one of the world's biggest energy trading businesses and therefore have been huge beneficiaries of the volatility in traditional energy markets. The holy grail is a company that is exposed to the energy transition without necessarily being as capital intensive as a miner. One of the issues with the growth in renewables is that the transmission networks are not built for this decentralised generation structure. We have lots of small producers, batteries that need electricity going in and out, and even household solar has changed the nature of the grid. The result is that Australia need to add 10km of transmission lines to the existing 45km but current capacity to roll out is only 700m pa. Downer Group is in a prime position to capitalize on this as highlighted in chart 3 as a leading player in electrical engineering and construction with 70 years' experience. Worley is also growing the part of their business that consults with the hydrogen industry, although their core fossil fuels business has associated downside risks. Chart 3. Downer capabilities leveraged to decarbonization

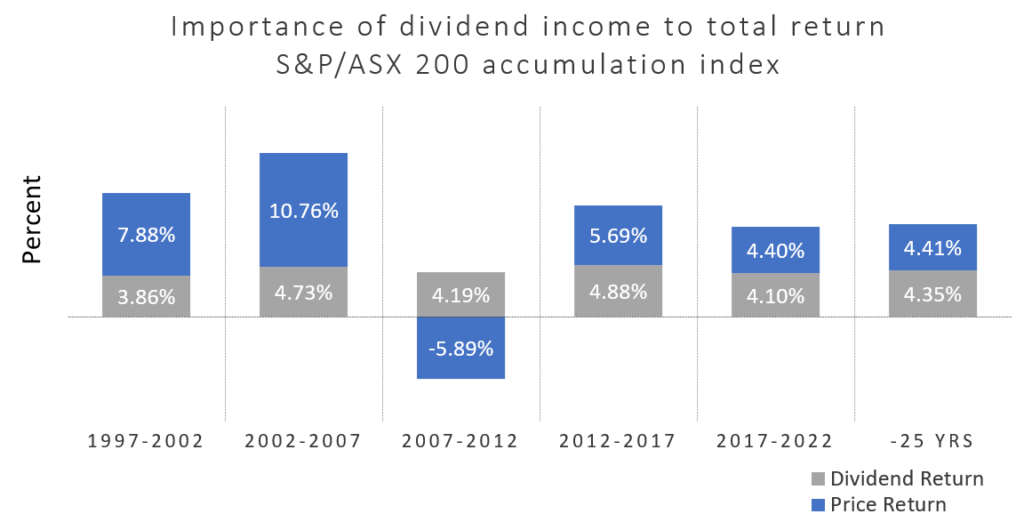

Source: Downer Group Conclusion While we see a peak in capital returns from miners due to unprecedented supply/demand imbalances and low CAPEX pipelines, the expected increased investment in decarbonisation programs is unlikely to wipe out the traditionally high yield of the Australian equity market. The tax structure still incentivises Australian companies to pay franked dividends, and the index composition is skewed to cash-generating companies. Over decades the Australian market has delivered net yields in the 4% range as shown in Chart 4 (5%+ grossed up for franking), and we don't expect that to change materially in the future.

Chart 4. The importance of dividend income to total return Source: S&P/ASX; IRESS; Sub-periods are rolling five-years to illustrate consistency of income Author: Michael Maughan, Portfolio Manager, Tyndall Australian Share Income Fund Funds operated by this manager: Tyndall Australian Share Concentrated Fund, Tyndall Australian Share Income Fund, Tyndall Australian Share Wholesale Fund Important information: This material was prepared and is issued by Yarra Capital Management Limited (formerly Nikko AM Limited) ABN 99 003 376 252 AFSL No: 237563 (YCML). The information contained in this material is of a general nature only and does not constitute personal advice, nor does it constitute an offer of any financial product. It does not take into account the objectives, financial situation or needs of any individual. For this reason, you should, before acting on this material, consider the appropriateness of the material, having regard to your objectives, financial situation, and needs. The information in this material has been prepared from what is considered to be reliable information, but the accuracy and integrity of the information is not guaranteed. Figures, charts, opinions and other data, including statistics, in this material are current as at the date of publication, unless stated otherwise. The graphs and figures contained in this material include either past or backdated data, and make no promise of future investment returns. Past performance is not an indicator of future performance. Any economic or market forecasts are not guaranteed. Any references to particular securities or sectors are for illustrative purposes only and are as at the date of publication of this material. This is not a recommendation in relation to any named securities or sectors and no warranty or guarantee is provided. |

2 Jun 2022 - Sustainable earnings growth over multiple cycles

|

Sustainable earnings growth over multiple cycles Insync Fund Managers May 2022 Markets tend to wrong-foot many investors, regardless of investment style, with 2022 becoming a year of extremes. Central banks are dealing with the prospect of stagflation, an environment that bankers do not have experience in, as this last occurred in the early 70's. Investors trading with a short-term time horizon have rushed into expensive defensive plays boosting their price further such as utilities, consumer staples and energy. They're attempting a 'momentum play'. To succeed, their timing will need to be impeccable at both ends. Later on, we will explain by example why this is contradictory to common sense and how you can avoid this risk. History consistently shows that investing on the basis of the short term economic outlook leads to poor outcomes. In 2021 the consensus was that 22' will be a period of reasonable economic growth and low inflation. That narrative changed quickly to a year where inflation is rising and concerns over recession looms. It is very likely that consensus will be wrong again. Insync's focus is always on longer term outcomes. Thus, we invest only in businesses that have the capacity to generate sustainable earnings growth through the cycle and over multiple cycles. Whilst recent fund returns have been disappointing, the businesses in our portfolio continue to deliver strong growth in their revenues and their profits despite the current market backdrop. The consistently longer term strong share price rises of highly profitable growth companies like these, over many decades, supports this approach to investing. In last month's edition we showed how stock prices over time tracks to this result. For now, the Insync portfolio is trading at a discount well in excess of 50% of our proprietary based DCF methodology. As an investor this is worth reflecting upon: after the pull back in the markets of some of the most profitable secular growth companies in our portfolio that typically trade on higher P/Es, they are now perversely trading on much lower P/Es, as markets presently ignore their superior financial metrics and earnings power! This will not continue beyond the short term as we explain later on. We strongly believe that for long-term investors, quality growth stocks are now available at bargain prices.

Short-Lived Disconnects (reality V price) Investors have flocked into defensive sectors to hide in the short-term. Fears of markets falling further has resulted in quality growth stocks becoming attractively valued. In times of volatility, investors are presented with an outstanding opportunity to invest in these enduring businesses.

Here is a real example today of investors losing sight of business realities versus current prices.

Company A - A well-known technology company. It's recently been aggressively sold down. Yet it's continuing to be one of the most profitable global businesses, with over 90% market share and compounding revenues at 20+% p.a. for the past 5 years. Despite this investors are attributing a low price to earnings ratio to the business. Company B - The leading soft drinks company. One which investors have flocked to for safety in the current market clime. It's significantly less profitable than Company A. Revenue growth has been negative over the past 5 years with total revenues today sitting at -19% below 10 years ago in 2012. Despite poor operating performance with no revenue growth for 10 years and no prospects of such, investors are attributing a high price to earnings ratio to the business. Which would you own?

A quirk of markets today that is worth knowing For now, most investors have flocked to industries and businesses that resemble Company B. Go figure? Interestingly many of the sectors that capital is pouring into since February - and pushing up their prices will likely suffer far more financially than those like Company A and its industry; especially if the dire economic forecasts for the years ahead come true. Again, go figure? By now you would have worked out that Company A is Alphabet and Company B is Coca-Cola. Clearly there is today a temporary disconnect between fundamentals and share prices! Over the long term the share price of a company follows its earnings growth. Broad indiscriminate market corrections often provide investors a once in a cycle opportunity to invest in the most profitable companies such as Alphabet. This will set them up nicely to achieve strong returns in the future. How price follows earnings once again

Whilst short term volatility may persist, Insync's concentrated portfolio of quality stocks across 16 global megatrends is well positioned to perform strongly over the long term. Why? The consistent strong earnings growth these companies are set to deliver should result in much higher share prices over time once markets adjust after the initial shift- as they always do. Whilst headlines and prices across all tech stocks have been hit hard, only some deserved it. Markets don't care initially; they just treat all growth stocks the same, quality or not. Only after this period is over the market separates the wheat from the chaff. This table highlights examples of those probably deserving of such a negative move. It depicts their price declines from their all-time recent highs. None of these companies exhibit the financial abilities we at Insync require.

Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund Disclaimer |

2 Jun 2022 - Superbugs are outsmarting antibiotics

|

Superbugs are outsmarting antibiotics Magellan Asset Management April 2022 In 1938, Ernst Chain,[1] a German-born biochemist working at Oxford University, found an article on penicillin written nine years earlier by UK bacteriologist Alexander Fleming.[2] In 1928, by fluke, Fleming noticed a zone around an invading fungus on an agar plate in which the bacteria did not grow. After isolating the mould, Fleming identified it as belonging to the Penicillium genus.[3] But doing anything more with the unstable compound was beyond Fleming's skills, which is where Chain stepped in. He proposed to his supervisor, Australian pathologist Howard Florey,[4] that they isolate, purify and test the compound to see if it could kill microorganisms without harming their host. Florey, seeing penicillin's potential, assembled a team that in 1939 oversaw experiments where only treated mice survived. By 1941, the group was experimenting on sick people. Because a UK stretched by war was incapable of producing enough penicillin, Florey travelled to the US to convince drug companies and officials to produce penicillin. When the US was drawn into World War II later that year, the government took over the mass production of penicillin to ensure the drug would be available for Allied forces. (It was by 1943).[5] In 1942, Fleming, who obtained some of the Oxford team's scarce penicillin, saved a UK woman who was dying of an infection. The Times of the UK published the feat, without referring to Fleming or Florey. Fleming's boss wrote to the newspaper praising Fleming who boasted in press interviews while Florey refused to speak to the media. Thus, many people today wrongly believe Fleming gifted penicillin to the world, even though Chain, Fleming and Florey equally shared the Nobel Prize for Physiology or Medicine 1945 and those in the know thought a self-promoter stole the credit from Florey.[6] What matters more is Florey's vision led to one of history's key medical feats. The drug's breakthrough advantage was how cheap it was to produce. The antibiotic became a worldwide cure and boosted life expectancy, mainly by reducing childhood deaths. By 1954, for instance, pneumonia's death toll on US toddlers had plunged 75% from 1939 levels.[7] Penicillin's wonders inspired the development of other affordable antibiotics that could combat an ever-wider array of ailments.[8] As antibiotics, antifungals, antiviral and other drugs that are grouped as antimicrobials were developed, optimists dared talk of a world without deadly infections. What could go wrong? Four things. First, in the advanced world where prescriptions are regulated, doctors overprescribed and misused antimicrobials. Second, in the unregulated emerging world, people can buy antibiotics (many counterfeit)[9] at pharmacies without prescriptions and even find them at markets and shops. People thus mistreat or overtreat themselves with these medicines because it's cheaper and easier than seeing a doctor. The result is that up to 70% of human use may be inappropriate.[10] Third, 80% of antibiotic use worldwide is to fatten farm livestock and prevent livestock infections.[11] Efforts to curb such misuse have failed.[12] The fourth problem is that antibiotic and antifungal residue is too prevalent in third-world drug-making hubs such as India's Hyderabad. The result? The natural immunity microbes develop over time has accelerated. 'Superbugs' have built resistance to antimicrobials and global deaths from drug-resistant bugs are mounting. Before antibiotics, only about one in 10 million bacteria would prove resistant to antibiotics. Now, given that bacteria vulnerable to antibiotics can't survive, it is estimated that up to 90% of bacteria causing infections are immune to previously effective antibiotics.[13] As for deaths, a study led by researchers from the University of Washington out in January attributed 6.22 million deaths worldwide in 2019 to drug-resistant microbes (of which 1.27 million were a "direct result" of superbugs).[14] A 2016 UK-government-commissioned study predicted that as "routine surgeries and minor infections will become life-threatening once again" deaths would reach 10 million annually by 2050 - by when the accumulated cost of superbugs would be US$100 trillion due to the need to use costlier treatments and longer hospital stays to save lives.[15][16] The University of Washington study suggested five ways to combat superbugs. First, improve sanitation and hygiene, especially for water, to limit infections. Second, prevent infections through vaccinations where possible. Third, reduce antimicrobial use in animals. Fourth, minimise the misuse of these drugs with people. Fifth, boost investment to find drugs that can defeat superbugs.[17] Here lies a key handicap in the battle against infections that fail to respond to treatment. Few superbug-busting drugs are appearing because investment in the field is minimal compared with other spheres of public health. Only about US$1 billion a year worldwide is spent on research to combat superbugs compared with US$50 billion a year tackling HIV/AIDS in low- and middle-income countries[18] or an estimated US$157 billion to be spent on covid-19 vaccines through to 2025.[19] Pharmaceutical companies, which rely on prescription-based sales for revenue, aren't investing enough because they can't recoup an adequate return for three reasons. First, the cheapness of antimicrobial generics makes hospitals reluctant to pay high prices for superbug stoppers. Another problem is that medical facilities use new superbug-busters as a fallback when generic treatments fail. A third hitch is that antimicrobials are taken for a short time only, whereas profitable drugs are usually ones that people take daily for years. The outcome is that sales volumes are too small to make new drugs profitable. As a sign of how fragile are the economics in this sphere, Big Pharma players have abandoned the superbug fight and smaller antibiotic-development companies struggle to survive, even after gaining approval for their finds. A crisis around superbugs is building. A market failure means capitalism can't yet derive a solution to diffuse a foreseeable catastrophe. Governments need to do more when it comes to funding research and offering financial incentives for private enterprise because only alarming levels of deaths will improve the economics. Even though the pharmaceutical industry is likely to solve the problem in extremis, it would be too late for millions of people. To be fair, policymakers are trying to stop the misuse of antibiotics - but with little success in the emerging world. To be fair again, authorities have tried to help develop superbug-busters. The PASTEUR Act of 2021 before US Congress provides incentives for research.[20] The Combating Antibiotic-Resistant Bacteria Biopharmaceutical Accelerator, or CARB-X, which is a public-private initiative, is spending US$480 million from 2016 to 2022 to solve the problem.[21] A UK initiative unveiled in April could become a global template for encouraging research because it offers to pay drug companies a fixed fee for supplying antibiotics.[22] Success might come but moneywise these efforts don't compare with the billions Big Pharma spends on research in lucrative areas. Some superbugs arise out of nature so antibiotic misuse and overuse are not to blame for all of them.[23] Doctors are finding novel ways to combat superbugs. Phage therapy, the use of specific viruses to target bacterial infections, is one of them.[24] But greater efforts are needed. Surely in the medtech age, someone can discover a cure for superbugs. No one will care if self-promoters pinch the credit. A flawed model Before 1870, US pharmacies were virtually unregulated. Chemists sold remedies without prescriptions, heavily promoted quack cures and sold drugs now illegal such as cocaine, heroin and opium. Doctors overprescribed doses to be obtained from pharmacies because they knew chemists watered down medication. Newspapers so relied on advertising by drug companies they downplayed medical mishaps. By 1906, the harm to society was prominent enough to warrant the passing of the Pure Food and Drug Act, the first step in the US to regulate drug marketing.[25] The act gave rise to the Food and Drug Administration, the US's oldest consumer-protection agency. Tougher laws in 1938 meant new drugs required the body's approval and some medicines required doctor prescriptions.[26] This doctor oversight meant the big drug companies founded after World War II aimed their advertising at doctors, not the public - by 1961, about 60% of the advertising budgets of the 22 biggest drug firms was targeted at doctors.[27] Thus formed the pharmaceutical business model, whereby drug companies identify promising molecules, test them, and, once gaining approval, target the medical industry for sales. Success is a 'blockbuster drug' that reaps annual sales topping US$1 billion year after year. The model has provided the world with many wonder drugs but it's flawed at the same time. A major disadvantage is that many discoveries are so expensive as to be unaffordable. Another is a slowing rate of discovery of effective medicines - most of the breakthroughs such as antibiotics, the polio vaccine, heart treatments, chemotherapy and radiation for cancer were discovered between 1940 and 1980.[28] In terms of antibiotics, no major advances have come since the 1980s[29] - new drugs are variations rather than breakthroughs.[30] A third disadvantage with the pharmaceutical business model is that the economics of certain spheres of medical research are so poor Big Pharma avoids the area and specialist start-ups can't survive. Such is the fate of research against superbugs. In 2018, Novartis joined Allergan of the US, AstraZeneca of UK-Swedish origins, GlaxoSmithKline of the UK, The Medicines Company of the US and France-based Sanofi in quitting the fight against infections.[31] One comfort when Big Pharma companies dodge the superbug fight is they often sell their infection-disease research units to small biotechs. The Medicines Company, for instance, in 2017 sold its portfolio to Melinta Therapeutics of the US,[32] while AstraZeneca in 2018 hived off part of its antibiotic research to Entasis Therapeutics[33] (which just announced a promising cure).[34] But Little Pharma is besieged. The World Health Organisation says the smaller and mid-sized companies that dominate the preclinical and clinical antibiotic pipeline are "struggling to find investors to finance late-stage clinical development up to regulatory approval". As such, many companies disappear and so do their finds. Of 15 new antibiotics approved in the US in the decade to 2020, five were shelved as companies applied for bankruptcy or were sold.[35] Take, for example, the experience of Achaogen. The US company collapsed in 2019 after spending about US$1 billion over 15 years to win Food and Drug Administration approval for Zemdri, a drug for hard-to-treat urinary tract infections and one the World Health Organization classes as an essential medicine.[36] Somehow Zemdri is still available. To overcome the overall market failure that prevents the discovery of similar feats, the OECD said in 2017 it would take an extra US$500 million per year over a decade to make available four new 'first-in-class' antibiotics. Governments need to make this happen, just like the US government, thanks to Florey's efforts, ensured enough penicillin for the military in World War II.[37] |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund [1] Sir Ernst Boris Chain. British biochemist. Britannica biography. britannica.com/biography/Ernst-Boris-Chain [2] Alexander Fleming. Scottish bacteriologist. Britannica biography. britannica.com/biography/Alexander-Fleming [3] Robert Gaynes. 'The discovery of penicillin - new insights after more than 75 years of clinical use.' US National Library of Medicine. National Institute of Health. May 2017. ncbi.nlm.nih.gov/pmc/articles/PMC5403050/ [4] Howard Walter Florey, Baron Florey. Britannica biography. britannica.com/biography/Howard-Florey [5] Norman George Heatley. Biography. The Lancet. Published 7 February 2004. thelancet.com/journals/lancet/article/PIIS0140-6736(04)15511-6/fulltext [6] 'The Nobel Prize for Physiology or Medicine 1945.' The Nobel Prize. The prize-awarding committee credited Chain, Fleming and Florey with 'Prize share: 1/3.' nobelprize.org/prizes/medicine/1945/summary/ [7] Robert Gordon. 'The rise and fall of American growth.' Princeton University Press. 2016. Page 465. [8] By 2001, antibiotics had largely rid the US of tuberculosis; incidence of the disease that year was fewer than six cases per 100,000. [9] Financial Times. 'Antibiotic resistance in Africa: 'a pandemic that is already here'. 7 March 2022. ft.com/content/95f150df-5ce6-43cf-aa8d-01ac3bdcf0ef [10] Foreign Affairs. 'When antibiotics stop working.' 28 February 2022. foreignaffairs.com/articles/world/2022-02-28/when-antibiotics-stop-working [11] Foreign Affairs. Op cit. [12] See 'Antibiotic use in US farm animals was falling. Now it's not.' WIRED. 14 December 2021. wired.com/story/antibiotic-use-in-us-farm-animals-was-falling-now-its-not/ [13] Foreign Affairs. Op cit. [14] The study found that one in five deaths were of children under five years old, while nearly 80% of deaths were attributed to three causes: blood, intra-abdominal and lower respiratory and thorax infections. 'Antimicrobial resistance collaborators' (pen name of authors). The Lancet. 'Global burden of bacterial antimicrobial resistance in 2019: a systemic analysis.' Volume 399, Issue 10325. Pages 629 to 655. The study calculated that 1.27 million deaths were the "direct result" of drug-resistant bacterial infections and 4.95 million deaths were "associated" with them, many of them in the emerging world. Published on the web 19 January 2022. thelancet.com/journals/lancet/article/PIIS0140-6736(21)02724-0/fulltext. Excerpt. [15] Review on Antimicrobial Resistance. 'Tackling drug-resistant infections globally.' The review was commissioned in 2014 by then UK prime minister David Cameron. amr-review.org/. In 2019, the US Centers for Disease Control and Prevention warned that, as the US was recording 2.8 million drug-resistant infections a year, people should "stop referring to a coming post-antibiotic era - it's already here". Centers for Disease Control and Prevention. Antibiotic resistance threats in the United States.' 2019. Page V. cdc.gov/drugresistance/pdf/threats-report/2019-ar-threats-report-508.pdf [16] Centers for Disease Control and Prevention. Antibiotic resistance threats in the United States.' 2019. Page V. cdc.gov/drugresistance/pdf/threats-report/2019-ar-threats-report-508.pdf [17] 'Antimicrobial resistance collaborators'. Op cit. Pages 641 and 649. [18] Foreign Affairs. Op cit. [19] Reuters. 'World to spend $157 billion on covid-19 vaccines through 2025 - report.' 29 April 2021. reuters.com/business/healthcare-pharmaceuticals/world-spend-157-billion-covid-19-vaccines-through-2025-report-2021-04-29/ [20] US Congress. 'S.2076 - PASTEUR Act of 2021.' congress.gov/bill/117th-congress/senate-bill/2076 [21] Combating Antibiotic-Resistant Bacteria Biopharmaceutical Accelerator. 'Accelerating global antibacterial innovation.' carb-x.org/about/overview/ [22] 'UK launches world-first 'subscription' model for antibiotic supply.' Financial Times. 12 April 2022. ft.com/content/c7cbebe4-8597-4340-8c55-56c4b423c1d1 [23] 'Hedgehogs had MRSA superbug long before antibiotics use, research finds.' The Guardian. 7 January 2022. theguardian.com/science/2022/jan/06/hedgehogs-had-mrsa-superbug-long-before-antibiotics-use-research-finds [24] 'Phage therapy offers hope in fight against antibiotic resistance and superbugs.' Australian Broadcasting Corp. 15 January 2021. abc.net.au/news/2021-01-15/antibiotic-resistant-superbug-bacteriophage-therapy/12213010 [25] Gordon. Op cit. Pages 222 to 223. [26] Food and Drug Administration. 'FDA history.' fda.gov/about-fda/fda-history [27] Gordon. Op cit. Page 476. [28] Gordon. Op cit. Page 594. Jan Vijg, a Netherlands-born molecular geneticist and author of 'The American Technological Challenge: Stagnation and decline in the 21st century', blamed society's risk aversion for the spluttering growth rate. Medical advances are impeded or abandoned if even a minute fraction of people in clinical trials have adverse reactions. See 'Did we hit our innovation peak in 1970?' The Wall Street Journal. 16 June 2014. wsj.com/articles/BL-REB-26133 [29] See World Health Organisation. '2020 antibacterial agents in clinical and preclinical development: an overview.' 15 April 2021. who.int/publications/i/item/9789240021303 [30] See Monthly Review. 'Superbugs in the Anthropocene.' 1 June 2019. monthlyreview.org/2019/06/01/superbugs-in-the-anthropocene/ [31] Bloomberg News. 'Superbugs win another round as Big Pharma leaves antibiotics.' 13 July 2018. bloomberg.com/news/articles/2018-07-13/superbugs-win-another-round-as-big-pharma-leaves-antibiotics. See also Financial Times. 'How pharma economics hold back antibiotic development.' 7 March 2022. ft.com/content/29292a3c-321d-4187-9ff0-59d70eb796f4 [32] Businesswire. 'The Medicines Company announces definitive agreement to sell its infectious disease business unit to Melinta Therapeutics.' 29 November 2017. businesswire.com/news/home/20171129005573/en/The-Medicines-Company-Announces-Definitive-Agreement-to-Sell-its-Infectious-Disease-Business-Unit-to-Melinta-Therapeutics [33] Fierce Biotech publication. 'AstraZeneca spinout Entasis files for $86m IPO to fund antibiotic phase 3.' 20 August 2018. fiercebiotech.com/biotech/astrazeneca-spinout-entasis-files-for-86m-ipo-to-fund-antibiotic-phase-3 [34] Fierce Biotech publication. 'Entasis' antibiotic bests last resort treatment on path to become new weapon against drug-resistant bacteria.' 20 October 2021. fiercebiotech.com/biotech/entasis-zai-labs-antibiotic-sul-dur-beats-comparator-phase-3-trial [35] Bloomberg News. 'The world's next big health emergency is already here.' 27 January 2022. bloomberg.com/opinion/articles/2022-01-27/after-covid-antimicrobial-resistance-is-the-world-s-biggest-health-emergency [36] See 'Crisis looms in antibiotics as drug makers go bankrupt.' The New York Times. 25 December 2019. nytimes.com/2019/12/25/health/antibiotics-new-resistance.html [37] For suggestions of what governments could do, see 'Tackling antimicrobial resistance ensuring sustainable R&D.' OECD. 29 June 2017. oecd.org/g20/summits/hamburg/Tackling-Antimicrobial-Resistance-Ensuring-Sustainable-RD.pdf Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

1 Jun 2022 - How Nike is crushing digital to take control of its own destiny

|

How Nike is crushing digital to take control of its own destiny Claremont Global May 2022 Many would be familiar with Nike's direct-to-consumer (DTC) strategy, their ambition to generate the majority of sales through their own physical stores and online channels. In this article, we review why we believe the shift to DTC has helped Nike become stronger than ever ― and why the company is increasingly in control of its own destiny due to its ever-improving digital offer and power over product allocation as brand owners. Nike is currently one of the 14 stocks in the Claremont Global portfolio. NIKE INC. (NKE: NYSE)This company needs little introduction, being the world's leading sportswear company with sales of US$44.5 billion in FY21 across the Nike, Jordan and Converse brands. Direct-to-consumer, a clear strategy executed wellNike's DTC strategy was formally outlined in 2017 by then CEO Mark Parker as customers had been increasingly favoring Nike's own channels, and at the same time many wholesale partners were not delivering the level of customer and brand experience that Nike aims for. This strategy was supercharged by current CEO John Donohoe who brought significant digital and e-commerce experience from previous roles as the CEO of ServiceNow and eBay. As shown on the chart below, online penetration has accelerated significantly and in FY21 online sales reached 21 percent of total sales from seven percent in FY17 and DTC (i.e., online + stores) reached nearly 40 percent. This was achieved more than two years ahead of the original targets and momentum has continued as online sales accounted for 26 per cent of total sales last quarter. Nike's direct-to-consumer sales accounted for nearly 40% of sales in FY21. Source: Company reports, Claremont Global. Past performance is not a reliable indicator of future performance

Faster shift to digital underpins new growth ambitions Based on the law of large numbers, it would have been hard to believe that Nike could accelerate sales and earnings growth. However, as online penetration reached an inflection point, in June last year Nike provided new and improved financial targets expecting sales growth of around 10 percent per annum (p.a) and earnings per share growth of over 15 percent p.a. through to FY25. As shown on the chart below, as part of the new targets, Nike now expects online sales to account for around 40 percent of total sales by FY25 and wholesale sales to fall from over 60 percent in FY21 to 40 percent. Nike's sales by channel targets

Source: Company reports, Claremont Global. Past performance is not a reliable indicator of future performance Online and digital investments feeding the virtuous cycle Perhaps the most obvious benefit from the shift to its own channels is that Nike gets to keep the retail "markup" that would normally go to wholesale. As a rule of thumb, Nike generates around double the operating profit from an incremental unit sold online compared to wholesale. However, of equal importance in our view is the fact that when a customer shops at nike.com or in-store, Nike is in control of the customer experience. Nike has more than 300 million members (growing rapidly) and through the company's app universe ― which includes the Nike app, SNKRS, Nike Run Club and Nike Training Club ― Nike has been able to forge enviable customer engagement, while gathering valuable data in the process. Nike members growing strongly (million)

Source: Company reports, Claremont Global.. Past performance is not a reliable indicator of future performance Nike can leverage data from millions of members to deliver a more personalised offer, demand forecasting, insight gathering and inventory management. The company has been increasingly able to offer the right product at the right time, which results in higher full price sales and less markdowns. These benefits have been reflected in Nike's price realisation. As shown below, over the past four years Nike realized nearly a 20 percent improvement in average selling price (ASP). ASP has then contributed 100 basis points p.a. to gross margin on average over the same period. Nike's realized price (indexed ASP)

Source: Company reports, Claremont Global. Past performance is not a reliable indicator of future performance Nike came out of the pandemic stronger than ever We believe Nike's performance through the pandemic provided further evidence of the company's digital success and strong product offer (which is worthy of its own article). Nike not only recovered quicky, but as shown on the charts below, Nike's sales were around 10 percent above pre-pandemic levels (2019), while earnings were 35 percent ahead as the company grew significantly faster than trend. For comparison, adidas' earnings in 2021 were still below 2019 levels. Nike sales and earnings performance through the pandemic (billion, year to November*)

Source: Company reports, Claremont Global. * Figures are year to November for better representation (Nike financial year end is in May). Earnings = operating profit. Past performance is not a reliable indicator of future performance Nike is increasingly in control of its own destiny As the brand owner, Nike has control over product allocation. Over the past four years, Nike has cut the number of wholesale doors by 50 per cent and has now started to reduce allocation to large wholesale partners. For example, earlier this year Nike made the decision to allocate less of their products to Foot Locker. The reduction was sizeable as Foot Locker said that their allocation of Nike products would fall from more than 70 percent of their sales to around 55 percent. Consistent with our view, commenting on Nike's decision the CEO of Foot Locker said at their 4Q21 result call: "One of the things that Nike does the best is they control the flow of these high heat products into the marketplace, which keeps the demand high. So again, they will certainly benefit their DTC with some of that." 2025 targets are not a ceiling, online could be well over 40 percent of salesIt is important to re-emphasise that shift to digital has been driven by the consumer. Nike has continued to win market share and brand 'heat' remains very strong. Therefore, we believe the company has been able to recapture most, if not all of the sales that previously went to wholesale. Based on the company's targets, the wholesale business is still expected to account for around 40 percent of total sales by FY25. Therefore, we believe there will be plenty of opportunity for Nike to increase its online penetration beyond FY25.

Author: Chris Hernandez, Investment Analyst Funds operated by this manager: |