NEWS

17 Jun 2022 - Performance Report: DS Capital Growth Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The investment team looks for industrial businesses that are simple to understand, generally avoiding large caps, pure mining, biotech and start-ups. They also look for: - Access to management; - Businesses with a competitive edge; - Profitable companies with good margins, organic growth prospects, strong market position and a track record of healthy dividend growth; - Sectors with structural advantage and barriers to entry; - 15% p.a. pre-tax compound return on each holding; and - A history of stable and predictable cash flows that DS Capital can understand and value. |

| Manager Comments | The DS Capital Growth Fund has a track record of 9 years and 5 months and has outperformed the ASX 200 Total Return Index since inception in January 2013, providing investors with an annualised return of 13.43% compared with the index's return of 9.19% over the same period. On a calendar year basis, the fund has only experienced a negative annual return once in the 9 years and 5 months since its inception. Over the past 12 months, the fund's largest drawdown was -15.83% vs the index's -6.35%, and since inception in January 2013 the fund's largest drawdown was -22.53% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in February 2020 and lasted 6 months, reaching its lowest point during March 2020. The fund had completely recovered its losses by August 2020. The Manager has delivered these returns with 1.81% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 five times over the past five years and which currently sits at 1.02 since inception. The fund has provided positive monthly returns 89% of the time in rising markets and 34% of the time during periods of market decline, contributing to an up-capture ratio since inception of 66% and a down-capture ratio of 59%. |

| More Information |

17 Jun 2022 - Fears about green inflation overblown

|

Fears about green inflation overblown abrdn 07 June 2022 Fears that the global transition to a low-carbon economy will drive inflation over the long term are overblown, with the tightening of monetary policy set to have far greater implications for portfolios. Some observers point to the energy transition as inherently inflationary, with companies compelled to invest less in fossil-fuel energy at a time when the costs for renewable energy remain elevated. The market has labelled this green inflation - the contribution that environmental policies have on the cost of delivering goods and services that is passed on via supply chains to consumer prices. In truth, there are a variety of regulations and policies that can influence inflation. The international push-back against globalisation - for example, the continued imposition of trade tariffs - is one of the forces putting upward pressure on prices. While the pandemic has highlighted the fragility of global supply chains and logistical networks, Russia's invasion of Ukraine has extended inflationary drivers by delaying the recovery process and amplifying commodity price pressures as the war restricts access to energy, metals and grains. However, the reason that the US has an inflation problem is not due to climate policies, but because its economy was overstimulated as it emerged from Covid-19. The US retained accommodative monetary and fiscal policies for too long, and now its labour market is running red hot. A multi-year commodity boom in areas of renewable energy that require specialist components - such a rare earth metals - is possible owing to high demand and limited supply. But overall, we don't see green inflation as a meaningful contributor to rising consumer prices over the long term. Climate policies tend to operate over decades, meaning they're a structural driver of relative prices. However, at an aggregate level, consumers will only ever experience sustained high inflation if major central banks allow that to happen. Even if we were to see sustained commodity price increases, we would not expect headline inflation to remain above central bank targets for extended periods. We urge investors to look beyond the short term and think about the likely disinflationary consequences of prolonged global policy-tightening in the pipeline. We urge investors to think about the likely disinflationary consequences of prolonged global policy-tightening in the pipeline. What we're seeing now is central banks reacting to excess inflation, and we expect them to prioritise anchoring inflation over growth. We don't think we'll be debating green inflation in two years' time, rather the consequences of a US recession that came sooner than expected. Really, the narrative around green inflation is being driven by what's happening in the West. On the whole, inflation is far lower across Asia Pacific, where climate policy is at a much earlier stage of implementation and there aren't the same constraints on the fossil fuel sector. Moreover, delays in the reopening of Asian economies post Covid-19 has led to more subdued activity levels. Asia's growing importanceOne key question for investors to consider is the role that Asia Pacific will play in the technological innovation required to effect the global energy transition, and whether that will be disinflationary. From a macroeconomic perspective, policy initiatives by governments and central banks in Asia Pacific have been more prudent, with less willingness to prop up markets artificially. The region has far lower debt levels, fewer constraints on governments and strong state capacity to act. There's tremendous capital available to Asian governments and companies to effect the energy transition. We believe Asian companies will play an increasingly prominent role in investor portfolios. There can be no energy transition without Asia, where industrial pollution has forced governments to act. Heavy investment has brought the cost of technology down sharply over the past decade. Solar power became cheaper than coal-fired energy by 2015 in India, enabling it to invest in renewable energy quite aggressively. We think the technological innovation we are seeing at Asian companies to solve real world problems should be better reflected in portfolios. Some of these companies are working hard to bring down the cost of green hydrogen. Nowhere is this more relevant than China's highly polluting manufacturing sector, which needs to embrace new energies to clean up entire supply chains. China wants to do for green hydrogen what it has already done for solar technology and some wind turbine technologies. We're optimistic, since it will only take progress in countries such as India and China to have a marked impact on correcting some problems the planet is facing. Ultimately, we want to see the power of capitalism and innovation turned towards the global energy transition. But wealthier nations need to live up to their commitments to assist poorer countries so that they don't routinely get left behind. While China will continue to play a critical role in bringing down the costs of technology, this will take time and poorer countries will need support in the interim. Of course, asset managers have parameters on what they can and can't invest in. Poor countries often have low credit ratings, governance problems or capital markets not fully formed. We must find a way to mobilise capital to benefit these countries; it's part of the equation that needs solving. In the near term, some solutions will appear inflationary. Electric vehicles, for example, are more expensive than those with internal combustion engines. Yet electric vehicles is where we see relative prices falling the most - and that's true of a wide range of renewable technologies, such as solar PV. But forces that appear inflationary today can be disinflationary in future. There will also come a time when commodity prices fall, and as a big commodity importer Asia would be a major beneficiary. What's incumbent on asset managers when promoting sustainable investments is to communicate that it's a long-term decision. Commodity and fossil-fuel-intensive businesses are doing well because production costs have risen more slowly than prices, which is good for earnings and valuations. Conversely, valuations among renewables became expensive at times last year because many of the businesses are growth firms, so as the interest-rate structure increased, the discount rate applied to their earnings also increased - leading to significant underperformance. What it underlines is that investors are likely to experience plenty of variance along the way. Even if you're confident that central banks will get on top of this problem eventually, strategies that seek to manage inflation and volatility will be appealing from a portfolio perspective over the near term.

Author: Jeremy Lawson, Chief Economist, abrdn Research Institute |

|

Funds operated by this manager: Aberdeen Standard Actively Hedged International Equities Fund, Aberdeen Standard Asian Opportunities Fund, Aberdeen Standard Australian Small Companies Fund, Aberdeen Standard Emerging Opportunities Fund, Aberdeen Standard Ex-20 Australian Equities Fund (Class A), Aberdeen Standard Focused Sustainable Australian Equity Fund, Aberdeen Standard Fully Hedged International Equities Fund, Aberdeen Standard Global Absolute Return Strategies Fund, Aberdeen Standard Global Corporate Bond Fund, Aberdeen Standard International Equity Fund , Aberdeen Standard Life Absolute Return Global Bond Strategies Fund, Aberdeen Standard Multi Asset Real Return Fund, Aberdeen Standard Multi-Asset Income Fund |

17 Jun 2022 - The Rate Debate - Episode 28

|

The Rate Debate - Episode 28 Yarra Capital Management 04 May 2022 Has the RBA hit panic mode? With rates on the rise, higher inflation and wages below expectation, has Australia's central bank panicked by hiking rates by 50bps, the largest monthly move in over 20 years? The RBA's charter is to ensure the economic prosperity and welfare of the Australian people, which increasingly appears to be being overlooked in favour of an inflation target that isn't easily achievable without causing recession. |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

16 Jun 2022 - Performance Report: ASCF High Yield Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Does not require full valuations on loans <65% LVR. Borrowing rates are from 12% per annum on 1st mortgage loans and 16% per annum on 2nd mortgage/caveat loans. Pays investors between 5.55% - 6.25% per annum depending on their investment term. |

| Manager Comments | The ASCF High Yield Fund has a track record of 5 years and 3 months and has outperformed the Bloomberg AusBond Composite 0+ Yr Index since inception in March 2017, providing investors with an annualised return of 8.63% compared with the index's return of 1.39% over the same period. On a calendar year basis, the fund hasn't experienced any negative annual returns in the 5 years and 3 months since its inception. Over the past 12 months, the fund hasn't had any negative monthly returns and therefore hasn't experienced a drawdown. Over the same period, the index's largest drawdown was -10.81%. Since inception in March 2017, the fund's largest drawdown was 0% vs the index's maximum drawdown over the same period of -11.09%. The Manager has delivered these returns with 3.75% less volatility than the index, contributing to a Sharpe ratio which has consistently remained above 1 over the past five years and which currently sits at 23.51 since inception. The fund has provided positive monthly returns 100% of the time in rising markets and 100% of the time during periods of market decline, contributing to an up-capture ratio since inception of 87% and a down-capture ratio of -79%. |

| More Information |

16 Jun 2022 - Performance Report: Bennelong Australian Equities Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | |

| Manager Comments | The Bennelong Australian Equities Fund has a track record of 13 years and 4 months and has outperformed the ASX 200 Total Return Index since inception in February 2009, providing investors with an annualised return of 12.71% compared with the index's return of 10.09% over the same period. On a calendar year basis, the fund has only experienced a negative annual return once in the 13 years and 4 months since its inception. Over the past 12 months, the fund's largest drawdown was -24.06% vs the index's -6.35%, and since inception in February 2009 the fund's largest drawdown was -24.32% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in February 2020 and lasted 6 months, reaching its lowest point during March 2020. The fund had completely recovered its losses by August 2020. The Manager has delivered these returns with 1.46% more volatility than the index, contributing to a Sharpe ratio which has fallen below 1 five times over the past five years and which currently sits at 0.74 since inception. The fund has provided positive monthly returns 91% of the time in rising markets and 17% of the time during periods of market decline, contributing to an up-capture ratio since inception of 129% and a down-capture ratio of 99%. |

| More Information |

16 Jun 2022 - Why it's all about Earnings Growth

|

Why it's all about Earnings Growth Insync Fund Managers May 2022 Why it's all about Earnings Growth Companies that sustainably grow their earnings at high rates over the long term are called Compounders. Investing in a portfolio of Compounders is an ideal way to generate wealth for longer-term oriented investors that tend to also beat market averages with less risk. This chart shows the tight correlation between returns of the S&P 500 (orange line) and earnings growth (blue line) since 1926. NB: Grey bars are US recessions

Insync's focus is on investing in the most profitable businesses with long runways of growth resulting in a portfolio full of Compounders. Inflation & interest rate impacts By focusing on identifying businesses benefitting from megatrends with sustainable earnings growth, means we do not need to concern ourselves with market timing, economic growth forecasts, inflation, or the future of interest rates. Throughout the last 100 years we've experienced periods of high economic growth, recessions, different inflation and interest rate settings, wars, pandemics, crisis and on it goes, but the one thing that has remained consistent... Over the long term, share prices follow the growth in their earnings. Media and many market 'experts' continue to be concerned about the risk of a sustained period of higher inflation. They worry over a short-term 'rotation' from quality growth stocks of the type Insync seek to own to value stocks. The latter in many cases is simply taken as equating to lowly rated companies and reopening stocks, such as airlines, energy, and transport. There are 3 problems with this view that can trap investors:

In sharp contrast good businesses remain strong at this stage of the cycle. They continue delivering the earnings growth that propel share prices over the long term. This is what makes their share price progress both sustainable and well founded. High margins and superior pricing power from Insync's portfolio of 29 highly profitable companies across 18 global Megatrends offers "the holy grail" of inflation-busting companies. Pricing power, sound debt management and margin control allow great companies to handle inflation and interest rates well. LVMH and Microsoft (featured in October update) are portfolio examples that recently increased prices of their products with no impact on their sales growth. Profitability + Revenue Growth Short term, investors typically fret over interest rate rises and all growth stocks suffer initially, as they adopt an indiscriminate machine-gun approach to selling. Over time however, the more profitable businesses with strong revenue growth start to reassert their upward trajectory in their share prices, as investors appreciate their long-term consistent earnings power. Stocks with "quality growth" attributes, such as high returns on capital, strong balance sheets, and consistent earnings growth, have typically outperformed in past situations similar to what we face today (Mid-2014 through early 2016 and from 2017 through mid-2019. Source- Goldman Sachs).

This is in sharp contrast to stocks with strong revenue growth projections that also have negative margins or low current profitability. They are highly sensitive to changes in interest rates (These stocks propelled the short-term returns of many of the Growth funds in 2021). Many of them lack profit and cash flow, which doesn't give you much downside protection if they don't deliver. Many rely on the constant supply of new capital to fund their operations. These types of companies have very long durations because their present values are driven primarily by expectations of positive cash flows at a distant point in the future. We call this HOPE. As the saying goes; we don't rely on hope as a sound strategy. Stocks with valuations entirely dependent on future growth in the distant future are vulnerable to a dramatic drop in price if rates rise sharply or revenue growth expectations are reduced. This chart (performance of the Goldman Sachs Non-Profitable Tech Basket) shows the downside risk to this sector of unprofitable high revenue growth companies. The index has fallen by close to 40% from its peak in February 2021. The index consists of non-profitable US listed companies in innovative industries.

Unsurprisingly, popular "new era" stocks held by high growth managers have also suffered a similar fate with examples noted below.

Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund Disclaimer |

15 Jun 2022 - Performance Report: Airlie Australian Share Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund is long-only with a bottom-up focus. It has a concentrated portfolio of 15-35 stocks (target 25). The fund has a maximum cash holding of 10% with an aim to be fully invested. Airlie employs a prudent investment approach that identifies companies based on their financial strength, attractive durable business characteristics and the quality of their management teams. Airlie invests in these companies when their view of their fair value exceeds the prevailing market price. It is jointly managed by Matt Williams and Emma Fisher. Matt has over 25 years' investment experience and formerly held the role of Head of Equities and Portfolio Manager at Perpetual Investments. Emma has over 8 years' investment experience and has previously worked as an investment analyst within the Australian equities team at Fidelity International and, prior to that, at Nomura Securities. |

| Manager Comments | The Airlie Australian Share Fund has a track record of 4 years and therefore comparison over all market conditions and against its peers is limited. However, the fund has outperformed the ASX 200 Total Return Index since inception in June 2018, providing investors with an annualised return of 10.78% compared with the index's return of 8.65% over the same period. On a calendar year basis, the fund hasn't experienced any negative annual returns in the 4 years since its inception. Over the past 12 months, the fund's largest drawdown was -7.3% vs the index's -6.35%, and since inception in June 2018 the fund's largest drawdown was -23.8% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in February 2020 and lasted 9 months, reaching its lowest point during March 2020. The fund had completely recovered its losses by November 2020. The Manager has delivered these returns with 0.34% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 three times over the past four years and which currently sits at 0.7 since inception. The fund has provided positive monthly returns 97% of the time in rising markets and 13% of the time during periods of market decline, contributing to an up-capture ratio since inception of 106% and a down-capture ratio of 95%. |

| More Information |

15 Jun 2022 - Performance Report: Bennelong Kardinia Absolute Return Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | There is a slight bias to large cap stocks on the long side of the portfolio, although in a rising market the portfolio will tend to hold smaller caps, including resource stocks, more frequently. On the short side, the portfolio is particularly concentrated, with stock selection limited by both liquidity and the difficulty of borrowing stock in smaller cap companies. Short positions are only taken when there is a high conviction view on the specific stock. The Fund uses derivatives in a limited way, mainly selling short dated covered call options to generate additional income. These typically have less than 30 days to expiry, and are usually 5% to 10% out of the money. ASX SPI futures and index put options can be used to hedge the portfolio's overall net position. The Fund's discretionary investment strategy commences with a macro view of the economy and direction to establish the portfolio's desired market exposure. Following this detailed sector and company research is gathered from knowledge of the individual stocks in the Fund's universe, with widespread use of broker research. Company visits, presentations and discussions with management at CEO and CFO level are used wherever possible to assess management quality across a range of criteria. |

| Manager Comments | The Bennelong Kardinia Absolute Return Fund has a track record of 16 years and 1 month and has outperformed the ASX 200 Total Return Index since inception in May 2006, providing investors with an annualised return of 7.69% compared with the index's return of 6.42% over the same period. On a calendar year basis, the fund has experienced a negative annual return on 2 occasions in the 16 years and 1 month since its inception. Over the past 12 months, the fund's largest drawdown was -10.03% vs the index's -6.35%, and since inception in May 2006 the fund's largest drawdown was -11.71% vs the index's maximum drawdown over the same period of -47.19%. The fund's maximum drawdown began in June 2018 and lasted 2 years and 6 months, reaching its lowest point during December 2018. The fund had completely recovered its losses by December 2020. During this period, the index's maximum drawdown was -26.75%. The Manager has delivered these returns with 6.41% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 five times over the past five years and which currently sits at 0.64 since inception. The fund has provided positive monthly returns 87% of the time in rising markets and 32% of the time during periods of market decline, contributing to an up-capture ratio since inception of 16% and a down-capture ratio of 55%. |

| More Information |

15 Jun 2022 - Manager Insights | Magellan Asset Management

|

|

|

|

Damen Purcell, COO of FundMonitors.com, speaks with Chris Wheldon, Portfolio Manager at Magellan Asset Management. The Magellan High Conviction Fund has a track record of 8 years and 8 months. On a calendar year basis, the fund has only experienced a negative annual return once since its inception and has provided positive returns 88% of the time, contributing to an up-capture ratio for returns since inception of 83.03%.

|

15 Jun 2022 - Why "making dirty cleaner" is key to 2030

|

Why "making dirty cleaner" is key to 2030 Yarra Capital Management May 2022

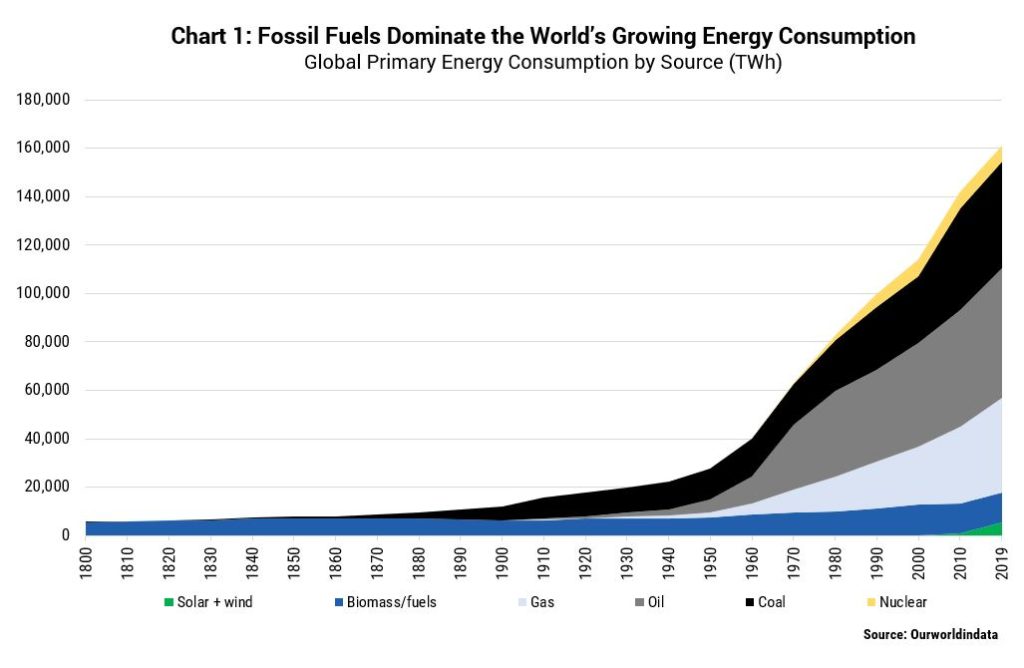

As Australia resets to a more ambitious 2030 emissions target under a new Labor government, it's time we address the largest opportunity on our pathway to net zero emissions: "making dirty cleaner". David Gilmour, Portfolio Analyst and ESG Specialist, details why. As Australia resets to a more ambitious 2030 emissions target under a new Labor government, it's time we address the largest opportunity on our pathway to net zero emissions: "making dirty cleaner". For too long, sustainability investment has centred on future facing industries, like renewables, and blatantly ignored the dirtiest industries. The focus has been on the cure to emissions, with no consideration to prevention. Divestment has been the weapon of choice. The Ukraine-Russia war has been a wake-up call. Fossil fuels, despite Western efforts to curb supply, are necessary for energy security when global trade is dividing into geopolitical blocks. What's more, they continue to dominate the world's growing demand for energy (Chart 1). To break their nexus with economic growth - and simultaneously transition without widening wealth inequality - we need to solve the demand side for both industry and the consumer. And that requires investor support and engagement.

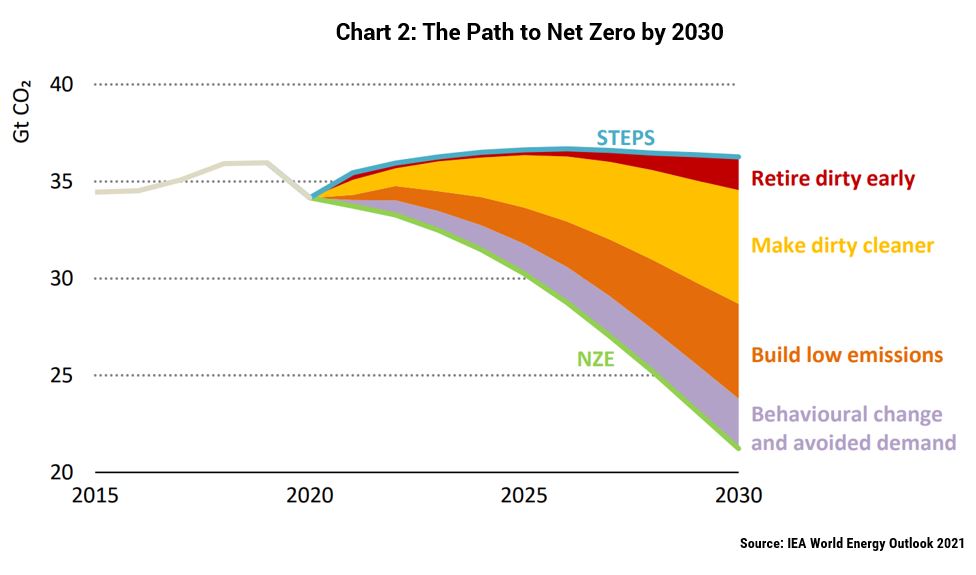

According to the International Energy Agency (IEA), we cannot simply divide energy investments into "clean" and "dirty". In fact, the largest part of emissions reductions under its net zero scenario - the same one purists cite when arguing to cease new fossil fuel production - comes from a middle ground of "transition" investments (Chart 2). Examples include project enhancements to reduce methane leakage, efficiency or flexibility measures in industrial processes, coal-to-gas switching (e.g. new gas boilers), refurbishments of power plants to support co-firing with low emissions fuels, and gas-fired plants that enable higher renewables penetration.

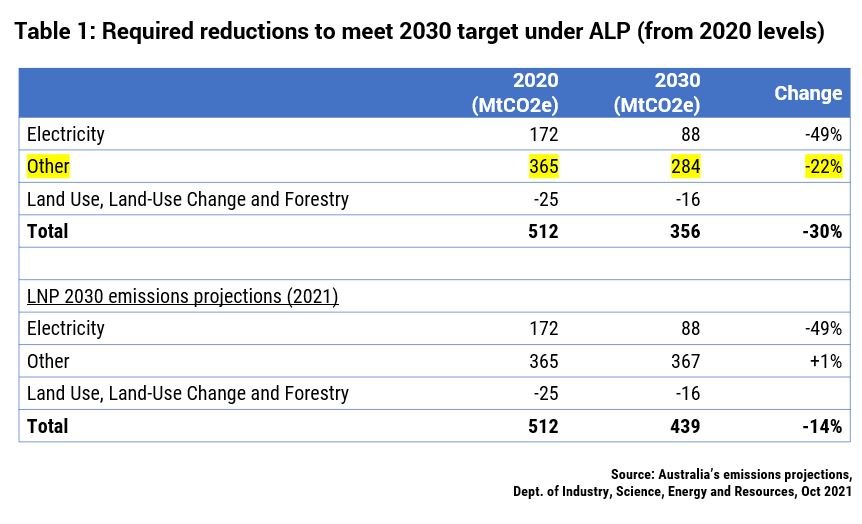

Within Goldman Sachs' latest forecast for a 37% fall in US emissions by 2030[1] (below the Biden Administration's target 50-52% reduction), energy efficiency is the first of three themes driving emissions lower over the short term. Outside Utilities, GS forecasts the biggest reductions to come from Oil & Gas Producers, Diversified Metals & Mining and Aluminium[2] - sectors where ownership by ESG focused investors is limited. Domestically it's a similar story. Like the US, Australia's electricity sector only accounts for around 30% of total emissions. Labor's new target for a 43% reduction on emissions to 2030 (based on 2005 levels) will require substantive efforts from Industry and Transport since, as we discussed last year, the Electricity sector is already stretched to its limit with a forecast 49% reduction by 2030 from today's levels. When you dig into the numbers, Labor's target equates to -30% on 2020 emissions levels, from 512MT today to 356Mt in 2030. This compares to the Coalition's projection for 439MT by 2030 (-14%) (Table 1). If we assume no further emissions reductions in the electricity sector under Labor, then it needs a -22% reduction in emissions from the "Other" sources, versus the Coalition's former forecast for +1%.

The new Federal government has also committed to strengthening the existing Safeguard Mechanism (SGM) to support its national target. Currently, Australia's largest emitting facilities (>100,000 tonnes per annum) have to purchase credits (ACCUs) when their emissions rise above generously set baselines. We support Labor's proposal to reduce these baselines over time which, if enacted, will drive greater energy efficiency and lowest-cost abatement solutions. Investors must also play an important role. We believe strongly in company engagement over exclusion; the former can lead to outperformance, while the latter shifts ownership to parts of the market with less oversight and deprives companies of capital when they need it most. That's why we are shareholders in high emitters such as Alumina (AWC), a company with a harder pathway to net zero but has the capability to benefit from the transition. AWC is already among the lowest emitters among major alumina producers, is pursuing early-stage technologies and is a clear beneficiary of green capex given the expected growth in demand for aluminium (39% demand growth to 2030[3]). We are also overweight Worley (WOR), which is well positioned to capture higher structural demand from energy transition work over and above its traditional work for the oil & gas industry. Once we solve the demand side, we expect supply from the oil & gas industry will take care of itself as customers evaporate. Until then Australian gas producers enjoy a privileged position. They are low sovereign risk for European countries weaning themselves off Russian gas, and will contribute significantly to lowering emissions in Asia as coal-to-gas switching takes place. Early this year we established a position in Woodside Petroleum (WPL), a company which predominantly produces gas and has a new strategy to invest $US5bn in new energy opportunities by 2030. Our focus remains on working with management to strengthen its 2030 interim target and lower its reliance on offsets. As ever, we continue to test the resolve of Australian companies to reduce their exposure to climate change risks and whether they are pursuing the right opportunities in the transition. Importantly, we have no intention of sidelining companies that provide critical products, especially when cleaning up their operations will cause the largest reductions in global emissions to a low carbon future. |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund [1] Source: Goldman Sachs: The path to lower US emissions, and what can drive impact, May 2022.

|