NEWS

12 Jul 2022 - Earnings risk is being contemplated by markets

|

Earnings risk is being contemplated by markets QVG Capital Management June 2022 Inflation driving higher rates and earnings risk (given recession fears), combined with tax-loss selling and flows out of equities, to deliver a horror month for the Small Ords. The benchmark fell -13.1% for June delivered the second worst monthly return since the GFC. The Aussie 10-year bond rate started the month at 3.34% and finished it at 3.66% but not before touching a high of 4.25% intra-month. The US 10-year Treasury Bond interest rate showed a similar pattern, starting the month with a 2.83% yield and finishing it at 3.06% via a 3.48% high. The moves lower in global and domestic equities are starting to price these higher rates. The new fear gripping markets is earnings risk. Depending on who you read, the average US recession sees -13% to -17% earnings cuts (the GFC was a lot worse). It is this earnings risk that is now being contemplated by markets. We have managed money in rising and falling rate environments and know which we prefer! In the past, rising rate environments have been gradual enough so that the earnings growth of our portfolio has compensated for multiple compression from higher rates. The unique feature of this market is not the magnitude but the speed of the move in rates which has led to the fastest compression of valuations ever as shown here: Valuations have never before compressed so quickly Year-on-year change in trailing Price/Earnings multiple of the S&P 500

The chart above shows we have been sailing into the wind, but it won't always be this way. Given the next leg of this bear market is likely to be a focus on earnings not multiples, we have been positioning the portfolio towards companies we believe have greater earnings certainty. This ought to mitigate the impact on the portfolio of a recessionary or slowing growth environment should it occur. Funds operated by this manager: |

11 Jul 2022 - Performance Report: Bennelong Long Short Equity Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | In a typical environment the Fund will hold around 70 stocks comprising 35 pairs. Each pair contains one long and one short position each of which will have been thoroughly researched and are selected from the same market sector. Whilst in an ideal environment each stock's position will make a positive return, it is the relative performance of the pair that is important. As a result the Fund can make positive returns when each stock moves in the same direction provided the long position outperforms the short one in relative terms. However, if neither side of the trade is profitable, strict controls are required to ensure losses are limited. The Fund uses no derivatives and has no currency exposure. The Fund has no hard stop loss limits, instead relying on the small average position size per stock (1.5%) and per pair (3%) to limit exposure. Where practical pairs are always held within the same sector to limit cross sector risk, and positions can be held for months or years. The Bennelong Market Neutral Fund, with same strategy and liquidity is available for retail investors as a Listed Investment Company (LIC) on the ASX. |

| Manager Comments | The Bennelong Long Short Equity Fund has a track record of 20 years and 5 months and has outperformed the ASX 200 Total Return Index since inception in February 2002, providing investors with an annualised return of 12.67% compared with the index's return of 7.65% over the same period. On a calendar year basis, the fund has experienced a negative annual return on 3 occasions in the 20 years and 5 months since its inception. Over the past 12 months, the fund's largest drawdown was -23.37% vs the index's -11.9%, and since inception in February 2002 the fund's largest drawdown was -30.59% vs the index's maximum drawdown over the same period of -47.19%. The fund's maximum drawdown began in September 2020 and has lasted 1 year and 9 months, reaching its lowest point during June 2022. During this period, the index's maximum drawdown was -15.05%. The Manager has delivered these returns with 0.32% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 five times over the past five years and which currently sits at 0.73 since inception. The fund has provided positive monthly returns 64% of the time in rising markets and 60% of the time during periods of market decline, contributing to an up-capture ratio since inception of 5% and a down-capture ratio of -121%. |

| More Information |

11 Jul 2022 - ASML: a once in a lifetime buying opportunity

|

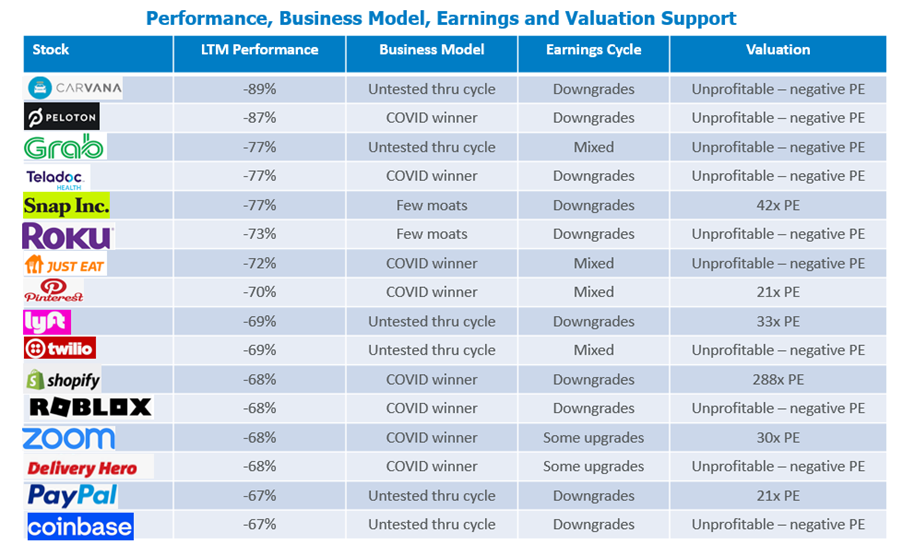

ASML: a once in a lifetime buying opportunity Alphinity Investment Management June 2022 There are 3 important criteria for identifying a once in a generation buying opportunity: 1) confidence that the business model will still be viable in a generation; 2) confidence that the stock has moved out of an earnings downgrade cycle into an earnings upgrade cycle; and 3) valuation support that signals a true buying opportunity, not an opportunity to catch a falling knife. Global equity markets have pulled back sharply in 2022 and it may be tempting to view some previously high-flying stocks as once in a generation buying opportunities. However, caution is needed because many of the worst preforming stocks year to date do not meet the 3 criteria outlined above. The following table shows stocks in the MSCI World Index that are down 65% or more in the last 12 months. Arguably, the vast majority of these do not meet the first criteria of a durable business model that will definitely be around for generations to come. In addition, most of these stocks are not in an earnings upgrade cycle, nor do they have strong valuation support even at these levels. Caveat emptor for these types of stocks

Source: Bloomberg, 31 May 2022, Alphinity Unlike the stocks in the table above, ASML is a high-quality stock that has corrected over 30% from its late 2021 high and meets the criteria of a durable business model, earnings upgrades and valuation support. A Business Model with Staying PowerASML is definitely going to be around in a generation as evidence by the fact that the stock listed in 1995 and has seen a few cycles already. ASML's enviable market share of around 70% provides confidence that there are deep moats around the business that can outlast periods of strong competition or disruption. Looking forward, ASML management likes to talk about the 3 main drivers of their stock being structural (AI, Internet of Things, 5G, Electric Vehicles, etc), cyclical (semi shortages and ongoing semi supply chain disruptions) and geopolitical (reshoring of semi capacity to the US and potentially Europe to reduce the risks associated with China/Taiwan). The combination of these 3 drivers is very powerful and supports a strong long term business case for ASML. Earnings Upgrade CycleASML's 1Q22 result came out slightly ahead while guidance for the FY22 maintained top line growth of ~20% and strong gross margins of ~52%. The bigger earnings story from the recent Capital Markets Day was a substantial upgrade to capacity targets for FY25 based on very strong demand. The potential upgrades here are significant - in the order of +50% revenue potential over the medium term. Valuation SupportASML is currently trading on a PE of less than 30x versus almost 50x PE at the end of FY21. This valuation is now below its 5 year average PE and represents an attractive PEG ratio of just over 1x. Furthermore, ASML's net cash balance sheet, 65% ROE and strong Free-Cash-Flow yield provide confidence in downside support for the stock. As shown in the table below, ASML's valuation support is in sharp contrast to many of the unprofitable or barely profitable tech stocks with no valuation support even at these levels. If markets continue to trend down, then many of the stocks that have been crushed in the last 12 months can continue to fall further. ConclusionStick with high quality stocks with durable business models, earnings leadership and valuation support. In this context, ASML looks very attractive. Happy hunting for once in a generation buying opportunities! This information is for adviser & wholesale investors only |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Sustainable Share Fund Disclaimer |

8 Jul 2022 - Hedge Clippings |08 July 2022

|

|

|

|

Hedge Clippings | Friday, 08 July 2022 It's disappointing when a source of Hedge Clippings' inspiration (to use the word lightly) departs from centre stage, although sometimes with mixed feelings. Take former POTUS "The Donald" for instance: A prime candidate (and narcissist) if ever there was one, who was regularly mentioned in these paragraphs, but who we were happy to see the back of - albeit that he's threatening to make a comeback in 2024. This week, it seems another of Hedge Clipping's favourite targets, Boris "Bozo" Johnson, looks to be headed for the EXIT sign, both from Downing Street, and thus the pages of our weekly musings. Donald Trump is still convinced he was robbed in the November 2020 US presidential election, such that he thought if he said it loudly enough, and often enough, he would stay in the White House for another 4 years. As a BBC commentator noted this morning, having two such leaders at the same time, both of whom were seemingly devoid of the ability to focus on detail or tell the truth, made the world a more interesting place. Unfortunately, being interesting isn't the most important credential for a President or Prime Minister, particularly in troubled times. While Australia's past penchant for regular and rapid prime ministerial turnover was the subject of much incredulity (and mirth) in both the UK and US, we do at least have an effective exit system, either via the ballot box, or the knife behind one's colleagues' back. David Cameron, Boris's fellow ex Etonian and himself a former resident of 10 Downing Street, once described the scruffily charismatic ex PM (in waiting) as a "greased piglet," owing to his ability to slip (or lie) his way out of tight situations. Even as he's on the way out, it looks as if he's going to hang around as interim PM for long enough to hold his wedding reception at Chequers on July 30th. Maybe that was in the back of his mind as he steadfastly refused to accept the inevitable, such that it took 60 or so of his colleagues to resign in protest. Sadly, while his handling of multiple crises, such as COVID, parties at Number 10 during lockdown, and dealing leniently with the truth, were eventually his undoing, the always unconventional Boris also pulled off some amazing achievements. BREXIT (like it or not), and his leadership in supporting Ukraine were significant. His departure, at least the timing of it, will leave a dangerous void that Putin will no doubt attempt to capitalise on. Leaving politics aside, this week saw the RBA follow market expectations by lifting the official interest rate by 50 basis points to 1.35% in an effort to curb consumer consumption, and in turn inflation. The RBA's post meeting statement expects inflation to peak later this year before declining back towards the 2-3% range next year, and that "the Board expects to take further steps in the normalisation of monetary conditions in Australia over the months ahead". That signals a further 2 or 3 moves over the next 3-6 months towards 2.5%. Whilst the current 1.35% is low by historical standards, as is the expectation of 2.5 or 3%, that's going to bite, and bite hard given the level of household debt, particularly hitting the property market. While the RBA points to unemployment at 3.9% and a resilient economy, they also point out their uncertainty over the outlook for household spending, which will be impacted by consumer confidence. Once that confidence evaporates - and there's anecdotal evidence that is already happening - then part of the RBA's job is done. The danger is they've done it too well, and getting confidence back will be the new challenge. In the US expectations are for a further 75 bps rate hike in July, with the Fed indicating that taming inflation is their priority, even at the risk of recession. If so, that will certainly break confidence. Following a brutal June in which the ASX200 fell 8.77%, and the S&P500 by 8.25%, equity markets seem to have settled somewhat. The forthcoming reporting season will give a better idea of earnings, and therefore if valuations are considered reasonable, or prices have further to fall. News & Insights National Infrastructure Briefings 2022 | Magellan Asset Management You should probably be turning off the news | Insync Fund Managers Rate Hike Volatility: Winter Comes in June for Crypto | Laureola Advisors |

|

|

June 2022 Performance News Insync Global Capital Aware Fund L1 Capital Long Short Fund (Monthly Class) |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

8 Jul 2022 - Performance Report: Argonaut Natural Resources Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | At times, ANRF may consider holding higher levels of cash (max 30%) if valuations are full and it is difficult to find attractive investment opportunities. The Fund does not borrow for investment or any other purposes, but it may short sell securities as part of its portfolio protection strategies. |

| Manager Comments | The Argonaut Natural Resources Fund has a track record of 2 years and 6 months and therefore comparison over all market conditions and against its peers is limited. However, the fund has outperformed the ASX 200 Total Return Index since inception in January 2020, providing investors with an annualised return of 41.34% compared with the index's return of 2.77% over the same period. On a calendar year basis, the fund hasn't experienced any negative annual returns in the 2 years and 6 months since its inception. Over the past 12 months, the fund's largest drawdown was -19.06% vs the index's -11.9%, and since inception in January 2020 the fund's largest drawdown was -19.06% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in April 2022 and has lasted 2 months, reaching its lowest point during June 2022. During this period, the index's maximum drawdown was -11.9%. The Manager has delivered these returns with 4.18% more volatility than the index, contributing to a Sharpe ratio for performance over the past 12 months of 1.62 and for performance since inception of 1.58. The fund has provided positive monthly returns 80% of the time in rising markets and 40% of the time during periods of market decline, contributing to an up-capture ratio since inception of 201% and a down-capture ratio of 34%. |

| More Information |

8 Jul 2022 - Rate Hike Volatility: Winter Comes in June for Crypto

|

Rate Hike Volatility: Winter Comes in June for Crypto Laureola Advisors 22 June 2022 The S&P 500 was flat in May but at the time of writing is down 5.8% in June and -22.9% ytd. Most financial assets are down negative double digits ytd: Nasdaq -31%, 10-year US Treasuries -15%, and Bitcoin -56%. The growing volatility and uncertainty in the financial markets globally is being driven in large part by the overdue and somewhat chaotic reaction of Central Banks to persistent inflation. The US Fed hiked rates by 75 bps in June - the largest hike in 27 years. The 10-year US real yields soared 150 bps in 60 days and most other bond markets suffered - the Australian 10-year yield rose 57 bps in 2 days. The persistent inflation, made worse by supply chain problems from lockdowns in China and war in the Ukraine, is starting to bite consumer spending and reduce economic growth around the world. In Europe, the 80% rise in the price of natural gas is one problem; the 50% reduction in deliveries by Russia is a worse problem. Europe may not be able to buy all the gas they need for next winter at any price. Investors fearing more volatility may want to raise cash to be "safe". But if cash buys 8% fewer goods and services next year compared to this year, too much cash may not be safe. A well-managed Life Settlements strategy can contribute to investors' portfolios in these turbulent times: it will be non-correlated with the equity and bond market turmoil, and it offers a return that has a strong probability of keeping up with inflation. PORTFOLIO CONSTRUCTION: THE ROLE OF LIFE SETTLEMENTS - The Role of the Laureola Fund in Portfolios of Private Clients and Family Offices Last month we discussed the role of LS in institutional portfolios showing that, mathematically, a small allocation to LS could both reduce portfolio volatility (risk) and increase returns over most 5-year periods because of its diversification characteristics, even if single digits returns are assumed. But there are other definitions of investment risk sometimes used by Private Clients and Family Offices. Some are simple and straightforward, but still very useful in analysis - maybe even more useful. Many strategies that promise diversification in bull markets fail to deliver the needed diversification in bear markets. But the Laureola Fund does. The Fund has outperformed all asset classes (except for commodities) ytd in 2022 including hedge funds as measured by the Barclay HF index (-5.7% ytd). The Fund has delivered positive returns in 7 of the 10 worst months for the S&P since inception, and in 2 of the 3 months when both had negative returns the negative return of the Fund was insignificant. The Fund has helped investors keep up with inflation delivering 6.7% net over the past 3 years. For once the theory and the practice align: The Laureola Fund can make a positive contribution to investors' portfolios in turbulent times no matter what analysis is used. Funds operated by this manager: |

8 Jul 2022 - Why are insurance stocks undervalued?

|

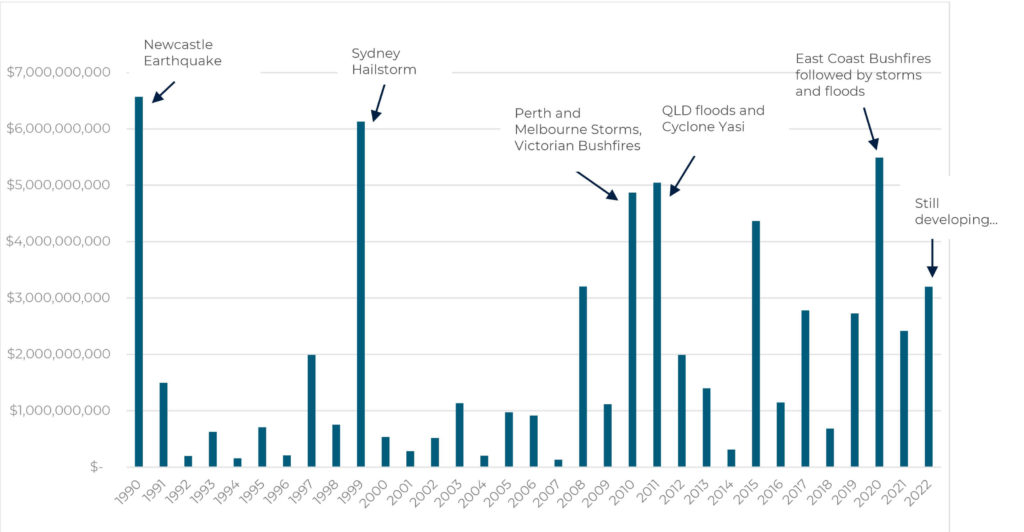

Why are insurance stocks undervalued? Tyndall Asset Management June 2022 There are a number of unique characteristics that make the insurance sector attractive in the current environment, including some company-specific factors which have led to valuation-based investment opportunities. Valuing the insurance sector Valuing insurance companies remains difficult due to the potential mismatch of estimated claims verses actual claims paid which may take years to finalise. Large catastrophes can take several years to be resolved—such as the New Zealand earthquakes—and injury claims can be stuck in the legal process for a long time. As a result, errors in claim loss forecasts can impact a company over many years. As investors, we look at a combined ratio calculation to measure the profitability of insurance companies, which is the sum of operating expenses and claim losses divided by premium revenue. A ratio below 100% indicates profitable insurance underwriting. Chart 1. Insured losses by Financial Years (in constant $2017)

Source: Insurance Council of Australia The chart is a reminder that disasters happen, and that risk is why people buy insurance to protect them from the impact of a disaster. A well-run insurance company prices risk appropriately. Insurance companies have accepted that there is an impact on the size and frequency of claims as a result of climate change, and premiums have increased to reflect this. What makes insurance companies attractive in the current market climate? The current market environment is characterised by rising interest rates, energy price spikes and higher inflation. This has led to a softening in economic growth and growing fears of recession. Stagflation or recession will negatively impact profit margins and valuations for companies. One of the things that makes the insurance sector unique is that premiums are billed and collected up-front, delivering in a premium float before claims are paid. The float is usually large and is invested to generate additional returns on top of an underwriting margin. Typically, this large premium float is invested in a mixture of cash and bonds, and possibly a small proportion in shares and other assets. Insurance companies aim to make an insurance margin which includes a return on the float that is akin to a leveraged investment return, since the return is earned on the premium float. The insurance sector is one of a handful that benefits from higher interest rates, with a 1% increase in rates equating to 10-20% earnings upside. The insurance Industry structure in Australia is attractive, operating as a functional oligopoly with the two major domestic insurers—QBE and IAG—taking approximately 70% market share. What makes the structure of insurance companies different? The business service provided by insurance companies is the pricing and pooling of risk. It does not require an inventory of raw materials or finished goods, freight costs, or energy consumption. Premiums are typically a function of asset value and rise with the insured value. The rate of return on insurance floats improves as interest rates rise, which is the opposite outcome experienced by most companies. Inflation can flow into claims costs, though insurers do generally mitigate this by adjusting premium prices upwards. Furthermore, insurers would face similar pressure and typically be less likely to compete in an inflationary environment. Why are the insurance stocks undervalued? The recent increase in the frequency of disasters and associated claims has weighed on investor sentiment, with concerns that estimated losses and exposure protection limits would be exceeded. To date, the measures in place have provided adequate protection. In addition to claim frequency, a series of operating missteps have dented investor confidence. Most notably, QBE, IAG, as to a lesser extent Suncorp, were forced to raise provisions for Business Interruption claims relating to COVID-19 and to manage costs associated with insurance policy documents incorrectly referencing the Quarantine Act 1908 (rather than Biosecurity Act 2015). IAG was disproportionately impacted by this and had to raise equity. Litigation has so far favoured the insurers, which may lead to the future release of surplus provisions for claims. Investor confidence in IAG waned further after the company suffered humiliating make-goods as a result of failing to apply group policy discounts and payroll errors. Accusations that IAG retained risk to the Greensill financial collapse proved unfounded, with the company clarifying that the business division that had this exposure had been sold and the risk transferred to the purchaser. What are the signs that things are improving? Consistent with IAG and Suncorp's February results commentary concerning premium rate increases, QBE released a performance update in early May which confirmed a healthy 22% growth in constant currency gross insurance premium revenue. QBE indicated that after the increase in risk rates and a 9% reallocation into riskier assets, the expected running yield on the investment portfolio has almost tripled to an exit rate of ~2%. The operating missteps of IAG and QBE have rattled investor confidence. Suncorp has fared better following its focus on cost reductions and dividends, and this has been rewarded by the market through share price gains. We expect a recovery in market valuation and dividend payments from both IAG and QBE as: (i) the cost impact of remediation fades; and (ii) the industry-wide improvements in premium pricing are earned and higher running yields on the premium float are delivered. The valuation, dividend profile, and sensitivity to rates, inflation, and the risk of stagflation leave IAG, QBE, and Suncorp well placed to outperform. And with high dividend payouts expected to persist, the Tyndall Australian Share Income Fund remains happily overweight the sector. Author: Michael Maughan, Portfolio Manager, Tyndall Australian Share Income Fund Funds operated by this manager: Tyndall Australian Share Concentrated Fund, Tyndall Australian Share Income Fund, Tyndall Australian Share Wholesale Fund Important information: This material was prepared and is issued by Yarra Capital Management Limited (formerly Nikko AM Limited) ABN 99 003 376 252 AFSL No: 237563 (YCML). The information contained in this material is of a general nature only and does not constitute personal advice, nor does it constitute an offer of any financial product. It does not take into account the objectives, financial situation or needs of any individual. For this reason, you should, before acting on this material, consider the appropriateness of the material, having regard to your objectives, financial situation, and needs. The information in this material has been prepared from what is considered to be reliable information, but the accuracy and integrity of the information is not guaranteed. Figures, charts, opinions and other data, including statistics, in this material are current as at the date of publication, unless stated otherwise. The graphs and figures contained in this material include either past or backdated data, and make no promise of future investment returns. Past performance is not an indicator of future performance. Any economic or market forecasts are not guaranteed. Any references to particular securities or sectors are for illustrative purposes only and are as at the date of publication of this material. This is not a recommendation in relation to any named securities or sectors and no warranty or guarantee is provided. |

7 Jul 2022 - The Rate Debate: Leaders indicators warn of global recession

|

The Rate Debate - Episode 29 Leaders indicators warn of global recession Yarra Capital Management 05 July 2022 Leaders indicators warn of global recession Central banks state they are not seeing signs of a recession as they continue hiking rates to curb spiralling inflation. But with forward indicators flashing red across the board, low consumer confidence, declining forward sales, the US yield curve beginning to invert, and the continued drop in the global equities, markets are telling us they see slowing growth ahead. Will the RBA pause in August, or will they continue to tighten at the fastest rate we have seen in 30 years and drive the country into a recession? Speakers: |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

7 Jul 2022 - How will the energy transition impact Asia?

|

How will the energy transition impact Asia? abrdn June 2022 For those who prefer to read, the transcript is below. In this episode, the focus is on energy transition in the Asia Pacific region and a look at opportunities versus challenges.

SPEAKERS Paul Diggle, Deputy Chief Economist Paul 00:06 Hello and welcome to macro bytes the economics and politics podcast from abrdn. My name is Paul Diggle Deputy Chief Economist at abrdn, and today we are talking about the energy transition. It's a topic we have tackled a couple of times before on the podcast. But we're specifically going to focus on the energy transition in the Asia Pacific region in this episode. And that's because the region is a crucial battleground in the world's fight to decarbonize with many large emitters base there. And it's also a region replete with opportunities and challenges as part of that transition. So joining me in this discussion are Jeremy Lawson, our chief economist, and Anna Moss, our climate change scenario, analyst. And Jeremy and Anna have recently authored a paper on exactly this topic, so it's going to be great to get into it with them. So Jeremy, let's start with you. Perhaps you could start by laying out why the Asia Pacific region matters so much in the fight against climate change and the transition to clean energy. So I Jeremy 01:10 think the simplest way to put it is that in the last 20 years, almost all of the net increase in global emissions has come from the Asia Pacific region. That's because you have reductions in emissions in the United States. Here are some other advanced economies, and modest increases in places like Latin America, Middle East and Africa. But they're broadly offsetting service, all of the aggregate increase, and you've got to the three world's largest emitters are based in the region, China and India. And then, as I say, other very large emitters, like Indonesia, and so there can be no energy transition, unless there's an energy transition in the APAC region, any chances of holding temperature increases to one and a half degrees above pre industrial levels, the rest on rapid decarbonisation in the Asia Pacific. And in fact, one of the really important reasons why we don't think that that type of pathway is likely, and even a blue two degree pathway is going to be hard to achieve is because the Asia Pacific region in aggregate, and almost all of the major countries within it are not on net zero trajectories themselves. Paul 02:29 Brilliant. And AIPAC is, of course, a very big region very heterogeneous in terms of the stage of development climate policy in individual countries. Could you give us a sense of some of that heterogeneity that difference across countries? Jeremy 02:45 Well, exactly. So think about it through the prism of net zero targets themselves. So we have everything from net 02 1015 targets in places like Australia, Japan, South Korea, then you have a number of countries on China has got a net zero 2060, objective, India's is net 02 1070. So governments very clearly signaling different different policy pathways. You have some of the wealthiest countries in the world in the region. And still some of the poorest, particularly of us sort of expand to include the Pacific Islands, but also parts of Southeast Asia, and parts of southern parts of southern Asia. The credibility of policy very significantly, funnily enough, China is actually the only country that really has a national carbon pricing regime in place through its emissions trading scheme, whereas actually, the advanced economies who look like they have more aggressive climate targets, have actually not managed to put those types of instruments in place. So actually, the credibility of their objectives is even more under question. And so it becomes very, very important to take these types of variation into account, manufacturing shares of GDP, renewable energy, intensity of the energy system, all these sort of things into account when sort of considering the nature of the risks and opportunities that are going to be facing investors looking to get exposure within the region. Paul 04:18 So I know you're very closely involved in the climate scenario modelling work that you and Jeremy have undertaken. And this is a quantitative framework that we've applied to AIPAC, but also globally to understand different paths for climate change the energy transition, the fortunes of individual sectors and companies. Can you tell us a bit more about the modelling framework? How does it work? What have we done with the modelling? Anna Moss 04:42 Yeah, so we're about to commence what will be our third year of climate scenario analysis. And I'd say that that really reflects the importance that we place on the potential insights that this type of analysis really can provide to us. And I'd say that also our unique approach Ah chi, that analysis also emphasises that commitment, because rather than relying on publicly available tools, and simply relying on off the shelf scenarios, which can typically have more simplistic assumptions that are built into, that they're built upon. And instead, we've created our own bespoke scenarios. And this allows us to input our sectoral and critically here our regional insights and research. And this means that we can create is more plausible scenarios, where regions and sectors are able to vary within a global pathway. So, as Jeremy has illustrated in his outlining of the importance of the APAC region, there are distinct and important characteristics between regions and between countries in those regions. And it's important for scenario analysis to be able to reflect these. So our approach means, for example, we can reflect China's that China's expanded policy commitments mean, it's likely to decarbonize more quickly than the average across emerging markets, or how the policy ambition and the timescales of that ambition for countries like Japan or Australia, for example, are significantly different to those of Thailand and India, for example. But as Jeremy pointed out, because we need to also the credibility of all those targets. It says right, in terms of the simple off the shelf approaches, these tend to focus on, if you like, the stress testing, approach to climate scenario analysis. So that means that they're concentrating on more the tail risks. And this will flag up the major risks and potential opportunities, but it doesn't allow you to consider what would be the more likely impacts of climate change. So instead, we've, we have a large suite of scenarios and that we apply probabilities. And that then provides us with a really good depth as well as the breadth. So this allows us to explore the differing impact impacts of, for example, limiting warming to the degree two degrees, more ambitious scenarios that are critically aiming for the 1.5 degrees, the hothouse world use of a continuation of work where basically current policy fails to scale up. And also the varying degrees in between, including our current view. That is that the likely figure is around 2.2 degrees in terms of global warming. Paul 08:01 Brilliant. So we've got this set of bespoke climate scenarios. And our model takes into account alternative paths for climate change the energy transition emissions, the global temperature rise, and gives us impairments of individual sectors and companies that we might invest in. Jeremy, could you bring to life a little bit what the average scenario looks like? So there's the 2.2 degree temperature rise, but what else do we have in terms of technological path or regulatory path bring this to life for us? Jeremy 08:34 Sure. So I think it's very important for the listing to understand how this framework is built. We have a baseline scenario, which really reflects what we think is priced into assets today across geographies and sectors. And this is a really important starting point for investing, because any investor always has to begin with the question of what is in the price of assets. Then what we do, as I said, we build this array of scenarios, which we think are more likely more plausible, because they build in technology and variation across technology and policy variation across sectors and geographies. And then the mean the probability weighted mean that we generate as a result, then that dictates the extent of the impairment that different securities are exposed to. And this is going to generate very different results than what a standard scenario analytical framework will sort of generate. So they give a couple of examples. We're able to build in the fact that for example, the European Palace sector is decarbonizing more quickly than the power sector in the typical emerging Asian economy. And it's going to matter a lot, because implicitly that means that the carbon price trajectory in Europe in the power sector is going to be higher than it is going to be in emerging Asia. That's also therefore going to significantly influence the after tax. Earning streams of companies differently. So all these things are going to matter quite a lot in terms of what is the demand for products look like? What is the carbon price sort of trajectory look like? How was the ability of companies to pass on changes in carbon prices. So effectively in this model, carbon pricing closes the system, it effectively generates a pathway that ensures that emissions drop in line with the overall sort of temperature, or emission sort of trajectory. And again, if we think about some of the key inputs around, for example, electrical vehicle penetration, or when does global oil demand peak, or how much coal is used in the future, each of these things is going to look a lot different in our main scenario than they do in those extreme tail scenarios. So there's gonna be a lot more fossil fuels use in our main scenario than in one and a half degree or below two degree Well, however, there's going to be a lot less used than in the current policy world says, say most investors, when they gauge a scenario analysis, they're going to get these types of risks that vary widely available, they're commonly used by just kind of precise enough. Ultimately, assets will be dictated by what happens in the real world, not in highly stylized scenarios that reflects the tail probabilities that are very unlikely. And so our The unique part of our framework is the ability to build that in as a feature. And so we're looking for example, for how is BHP Billiton affected by the energy transition, our framework will generate a very different impact than what are the frameworks will. Paul 11:36 Brilliant and one of the findings of the modelling, Jeremy is that the typical aggregate equity market impairment from the transition is often quite small. There are lots of winners and losers. But you find the aggregate they largely net out at a global level. But that's not the case in a pack, is it especially not for some specific countries, say like India, where you find pretty large aggregate impairments to tell us what it is about Asia Pacific equity markets, that mean that you actually get some pretty big aggregate impairments from the energy transition, you're envisaging. Jeremy 12:14 I think the simplest way to explain it is that if you look at, say, equity indices across the Asia Pacific region, for the most part, they had larger concentrations in the sectors that are negatively affected under the transition scenario we have in mind. So for example, energy materials, consumer discretionary, each of these sectors that on average, is negatively impaired in our main scenario. And so naturally, if those sectors have got a larger weight in the indices, that will drag the aggregate down in India's case, for example, in very significant weight to materials, but materials that are in some sense, brown rather than green materials. And so that has a negative effect on the aggregate results. But it is still very important to recognise that even though it's true, that the index level effects are a little bit larger, on average, across Asia, and across emerging economies than in the major advanced economies. That it's still the case that dispersion of the impacts of fair valuation impacts is predominantly a security level phenomenon. Right? So So knowing what country the firm is, in knowing what sector even a firm is, is in tells you relatively little about the true exposures, the different types of climate risk and opportunity. Paul 13:37 And that's the great insight, of course, or of the framework you've built. It allows you to think about individual companies and their exposure to the energy transition, which as you say, Jeremy, varies considerably. And Anna, so a potentially surprising result of your modelling work within a PAC specifically is that Chinese indices actually have quite a low negative exposure to the energy transition. Could you explain why that is? Yeah, so Anna Moss 14:07 as you say, it is quite a surprising result, given the carbon intensity of the Chinese economy. One of the reasons for this is that some of the country's most fossil fuel intensive firms are actually non listed state owned enterprises and that means that the energy sector which is the most negatively impacted sector, and she has a very small weight in the in the aggregate index, as Jamie pointed out, is quite critical that the weight of these sectors within their indices and that results in therefore a smaller set tall drag on valuation for China in comparison to some these other markets. But also, as Jeremy pointed out, this importance of the dispersion within a sector and whilst the the overall whilst overall the energy sector is very negatively exposed. There's still many firms which do show significant uplift in valuation in our mean scenario. And some of these are actually coal producers based in China, which again, is perhaps surprising to people. And that's because coal remains a dominant fuel type in China, under continuation of current policy, and even in the most stricter and early action scenarios, the projected role for coal actually remains a dominant figure for the dominant figure in terms of few types of much longer in China can compared to other regions. And if you add to that, the issue around carbon pricing so as Jeremy pointed out in although they do have this carbon price pricing scheme in place, it is projected the prices still projected remain pretty low in China across our scenario sweet. So those coal producers in the region have the potential to benefit from the continuing demand, whilst at the same time, their regional peers are potentially going to be hit by higher carbon prices. And along with this dwindling demand that they would face that would see them exiting, exiting the market sooner. So although this car, these coal producers do see a large downturn in net zero scenarios, the uplift from these other scenarios is enough to pull through a positive result in the mean scenario. Jeremy 16:43 And it's just a Can I just pulled this out a couple of things to that that are probably work, you will help people sort of understand even more in any sort of asset pricing framework, you will have a discounting mechanism taking place, right, and so the further out, the change in earnings occurs generally will, the less weight it has in the valuation, because in emerging economies, including in China, a lot of the policy action, the most aggressive policy actions projected to take place, say after 2030, the biggest negative effects on fossil fuel usage are occurring in periods that are going to be more heavily discounted within the framework. So another way of thinking about that is if we rolled this all forward 10 years and we were doing the analysis, then those same companies might look quite poorly, they still had the same structure reliance on coal. The other one there's a sector element as well is that the Chinese power sector is definitely on a decarbonisation pathway that a lot of coal is used in the industry sector in China, and industry is the sector, it was one of the sectors that we think is going to decarbonize much more slowly, in part because alternative technologies aren't available didn't, then the sheer growth rate of China can sort of create sort of still healthy demand for coal through that particular channel. So again, it's the real importance of taking these nuances into account rather than sort of, say, coal bed renewables good. It's much more complex than that in terms of modelling. Paul 18:14 Right. And and Or another nuance then is that individual firms can actually take measures to limit their impairment through the energy transition, can't they? So they can they can move to net zero, they can set carbon targets, can you tell us about the sort of measures firms might take that would mean, they they can do well, through the energy transition? Anna Moss 18:39 Yeah, so I guess the the measures really fall into two broad categories. So limiting rising costs from their emissions, and also reducing the risk of, of losing market share as demand for their products and services declined. So sort of changing how they're the products changing the actual products that they're producing. And so the most common measures fall into that first category with companies announcing commitments to reduce emissions. So basically, as the carbon prices rise, they can improve their position relative to competitors by by basically reducing their costs. But also, there are companies that are announcing targets to adjust their revenue splits to move away from their high carbon products, and increased production of low carbon products. So they're not disadvantaged by these these changing demand dynamics Paul 19:37 in the auto industry might be an example of that. Anna Moss 19:41 Yeah, yeah. I'd say definitely the the auto industry is a important one to bring in there. And really, that's so if you consider in terms of the changing in the revenue split, particularly there, you're seeing auto companies announcing In their commitment to change their their split much more favourably towards electric vehicles. And I'd say a lot of the time the devil can really be in the detail. So there can be considerable variation between companies, not just in terms of addition, but also in terms of the the type of permissions that they're including within those targets. And also in terms of whether they're considering the milestones that they'll need to achieve, achieve those those targets. So if we look back at consider our analysis. So climate scenario analysis, although the the policy and technology pathways that underpin it are forward looking, we are working now to introduce a way to incorporate the kind of dynamic responses that individual companies are also likely to make. So we're exploring how to integrate those company level targets into the modelling. But we really do need to consider this this credibility issue. So just as we consider the credibility of targets at country levels, we also need to consider the credibility of these targets being announced by companies. So for that reason, we're also developing a credibility framework in house that can consider the track record in terms of decarbonisation of these companies, how detailed the targets are, and whether these they have these milestones to transition, whether they're operating in jurisdictions where the policy and the regulations, or perhaps like the hinder their plans. And also really crucially, this this issue that the Jeremy touched on earlier about the viability of the technologies that are actually needed to aid their transition, because a lot, a lot of the technological developments that are going to be needed to achieve net zero. In across, most sectors are yet to actually be proven at scale. And in many cases, they've not even made it to market yet. So if you consider going back to your question about the autos, so that's a sector where even where we have proven technology, we're already seeing companies falling short of the targets that that they've set, and majority of the world's car makers already lagging behind with regard to the necessary switch to electric vehicles, Paul 22:50 right. So credibility is absolutely key when assessing individual again, Jeremy 22:54 and again, to emphasise how unique this is because it's already the case in our standard work, we're able to take into account policy variation across sectors and geographies and technology variation way but other frameworks don't. But now our ability to take into account dynamic corporate strategies with a layer of credibility will take this work to the next stage in the next level. So it really needs to be thought of as an innovation that makes it even more relevant to investment decision making. And the framework already was and takes a long way beyond this, the standard risk based assessments that are that are mostly sort of prevailing in the industry. Paul 23:33 And Jeremy, tell us how how we're incorporating this into investment decision making, ultimately, how are our portfolio managers changing their decisions, using this research, this great modelling framework that you and Anna have developed. Jeremy 23:49 So it's very important to emphasise that the modelling the analysis does not dictate any investment decision. It's a model poll, you're very familiar with the strengths and weaknesses of different model their representation of the world, but never a perfect one. And we want to really emphasise that there are things that are going to be influencing asset prices over different frameworks, including the energy transition, you can never sort of fully capture in a single framework. But what it is being used for in large parts of the businesses is like a think of it as a as a screen as an input into decision making helps people sort of understand well, okay, so how exposed might this firm be? How does that weigh against other things that might be influencing you know, the company, how should I think about long term value compared to short term value? Maybe it can be used in the way where it's being used in the way we engage with companies. So a lot of corporates themselves do scenario analysis, but some of them cherry pick those scenarios to represent favourable futures and say, Hey, we're already on the right track. We don't need to do anything. But when we're armed with our own analysis, we can say, Oh, actually, when you look at it this way you're exposed Asia looks a bit different. How are you? You know, how are you counteracting that? So it's sort of it's, I sort of see it as, like any sort of good model as a way to make better decisions to influence the not dictate and make sure that we've just got a better way of capturing of avoiding risk capturing opportunity. Alongside the other things, they're gearing towards the value of companies and, and the way that we make investment decisions over short, medium and long term timeframes. Paul 25:29 Anna Jeremy, thank you both for a fascinating set of insights. The full report on the energy transition in Asia Pacific and how we are using it in our in our modelling in our stock selection, portfolio construction, and company engagement can be found on abrdns website and we'll link to it in the show notes as well. Thank you to you for listening to macro bites, we'd love you to give a like or subscribe to the podcast on your platform of choice. But until next time, Goodbye and good luck out there. 26:08 This podcast is provided for general information only and assumes a certain level of knowledge of financial markets. It is provided for informational purposes only and should not be considered as an offer investment, recommendation or solicitation to deal in any of the investments or products mentioned herein and does not constitute investment research. The views in this podcast are those of the contributors at the time of publication and do not necessarily reflect those of abrdn. The companies discussed in this podcast have been selected for illustrative purposes only, or to demonstrate our investment management style and not as an investment recommendation or indication of their future performance. The value of investments and the income from them can go down as well as up and investors make it back less than the amount invested. Past performance is not a guide to future returns, return projections or estimates and provide no guarantee of future results. |

|

Funds operated by this manager: Aberdeen Standard Actively Hedged International Equities Fund, Aberdeen Standard Asian Opportunities Fund, Aberdeen Standard Australian Small Companies Fund, Aberdeen Standard Emerging Opportunities Fund, Aberdeen Standard Ex-20 Australian Equities Fund (Class A), Aberdeen Standard Focused Sustainable Australian Equity Fund, Aberdeen Standard Fully Hedged International Equities Fund, Aberdeen Standard Global Absolute Return Strategies Fund, Aberdeen Standard Global Corporate Bond Fund, Aberdeen Standard International Equity Fund , Aberdeen Standard Life Absolute Return Global Bond Strategies Fund, Aberdeen Standard Multi Asset Real Return Fund, Aberdeen Standard Multi-Asset Income Fund |

6 Jul 2022 - National Infrastructure Briefings 2022

|

National Infrastructure Briefings 2022 Magellan Asset Management June 2022 Speakers: Gerald Stack, Head of Infrastructure Time stamps: |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |