NEWS

29 Jul 2022 - Is it time to hit the 'buy' button?

|

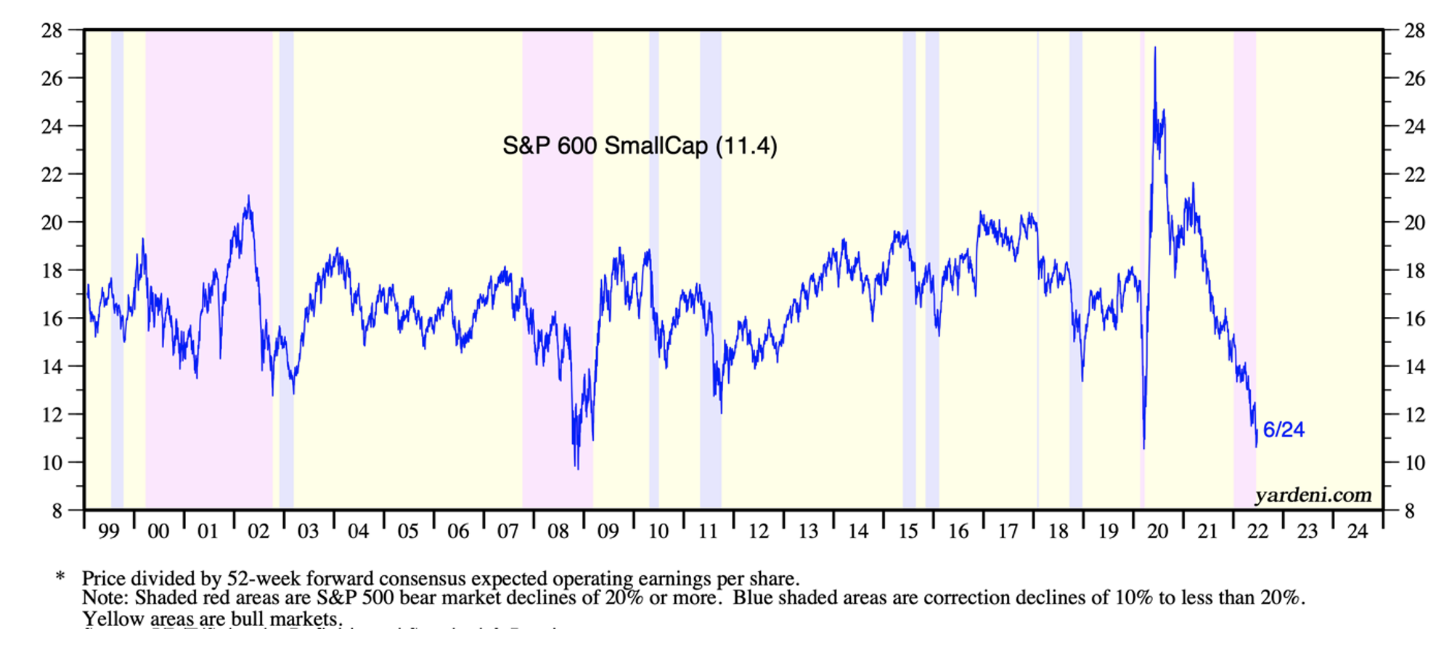

Is it time to hit the 'buy' button? Montgomery Investment Management 11 July 2022 If there's one investing axiom to hang your hat on, it's this: the lower the price you pay, the better your returns over the longer term. With the price-to-earnings (P/E) ratios of many high-quality businesses compressing, I, therefore, think it's time for long-term investors to buy while so many others are fearful. P/E ratios have compressed materially and quickly. Most of the compression is due of course to rising bond yields, which in turn are a response to inflation concerns. But in some cases, some of the P/E compression can be attributable to rising earnings. Keep the latter point in mind. Let's talk about a bear marketA bear market is a 20% slide from its peak but at the point of a bear market, investors make a 25% return just from the market returning to its previous high. If the market falls 50%, investors who buy at the trough make 100% just from the market recouping its losses and returning to previous highs. The lower the price one pays, the higher the return. Looking at every bear market (fall of 20% or more) since WWII, the average length of time it takes for the S&P500 to reach its nadir is 12 months and the average decline is 32.7%. Finally, the average length of time it has taken for the S&P500 to return to its previous high is a further 21 months. At the time of writing, the S&P500 is at 3900 points, down 19% from its high of 4818.63 recorded on 4 January 2022. The index has been as low as 24% below its all-time high. If the market played to the historical averages (unlikely) the S&P500 would fall to 3242 points (down 32.7% from its high, and another 11.5% from its recent low) on 4 January 2023. It would then reacquire its previous high of 4818.62 on 6 October 2024. While the averages are unlikely to be repeated (the events create the averages not the other way around) what is interesting is an investor who buys the S&P500 index today at 3900 would generate a return of 23.5% over the next two years, three months and eight days. That's equivalent to 9.75% per annum if the market were to follow the averages. And it is also only applicable to the index. As we aren't in the business of buying indices, rather we seek to own individual companies, the above 'analysis' is only useful in that history offers encouragement the market will reacquire its previous highs, eventually. Investing in individual companiesEncouraged by the prospect of an eventual broader market recovery we can now examine the arithmetic of investing in individual companies. First, if I buy a share on 10 times the earnings per share (EPS) of the company - a Price to Earnings (P/E) ratio of 10 times - and sell the shares on the same P/E ratio in a future year, and EPS grow at 15%, then my annual return will be 15%, the same as the earnings per share growth rate. It matters not what the P/E ratio is, if they are the same at the time of acquisition and disposal, my return will equal the EPS growth rate achieved by the company. Second, as Figure 1 illustrates, the P/E ratio reflects the bipolar nature of markets. Frequently market sentiment swings to reflect popularity for equities, and equally frequently sentiment reverts to being depressed and despondent with P/E ratios correspondingly slumping. Figure 1. PEs reflect the bipolar nature of market sentiment

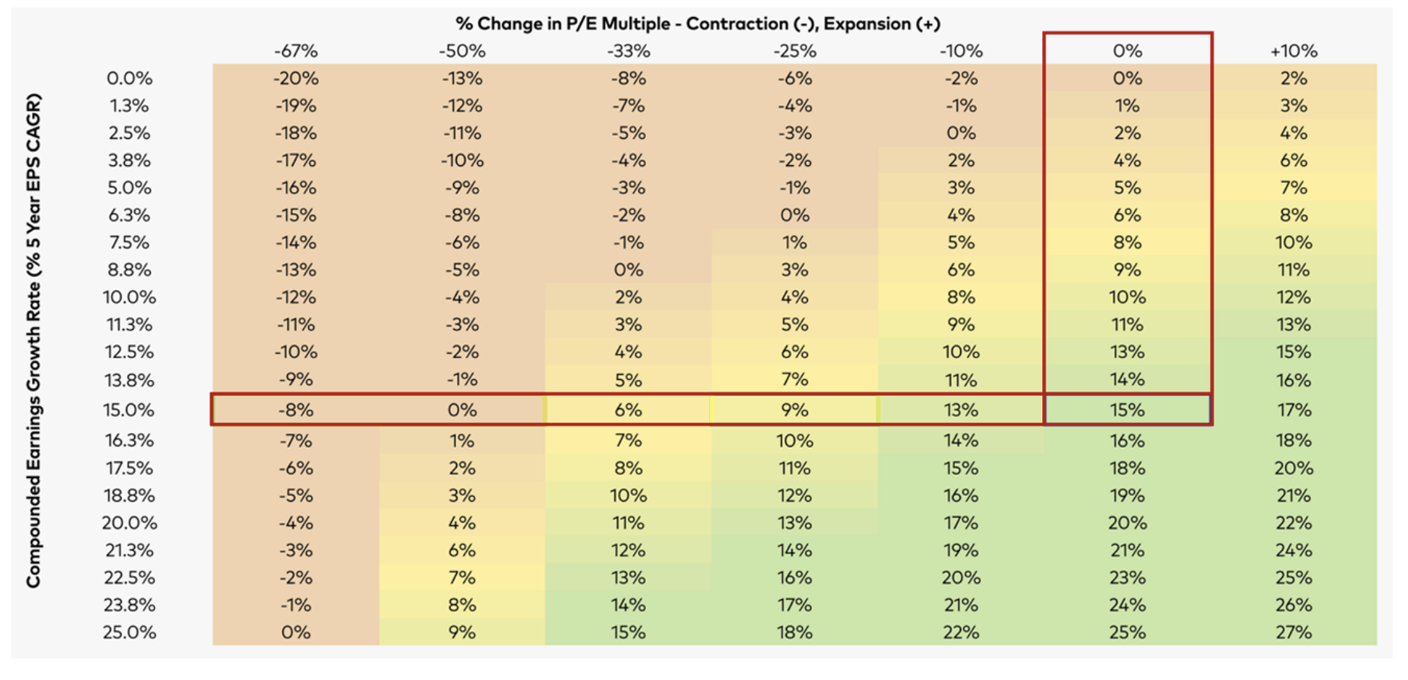

Source: Yardeni Research Inc. P/E ratios are a measure of popularity. The more popular equities are, the higher the multiple of earnings investors are willing to pay and therefore, the higher the P/E ratio. When equities are unpopular, the lower the multiple of earnings investors are willing to pay. We can take advantage of this bipolar behaviour by focusing buying activity around periods when sentiment, as reflected by P/E ratios, is depressed. We can also take encouragement, from the reliable bipolar market behaviour, that P/Es will eventually reflect buoyant optimism again. And further encouragement comes again from the arithmetic of EPS growth and P/E compression and expansion. I have published Table 1. previously but it is worth dwelling upon again. Table 1. PE compression v. PE expansion

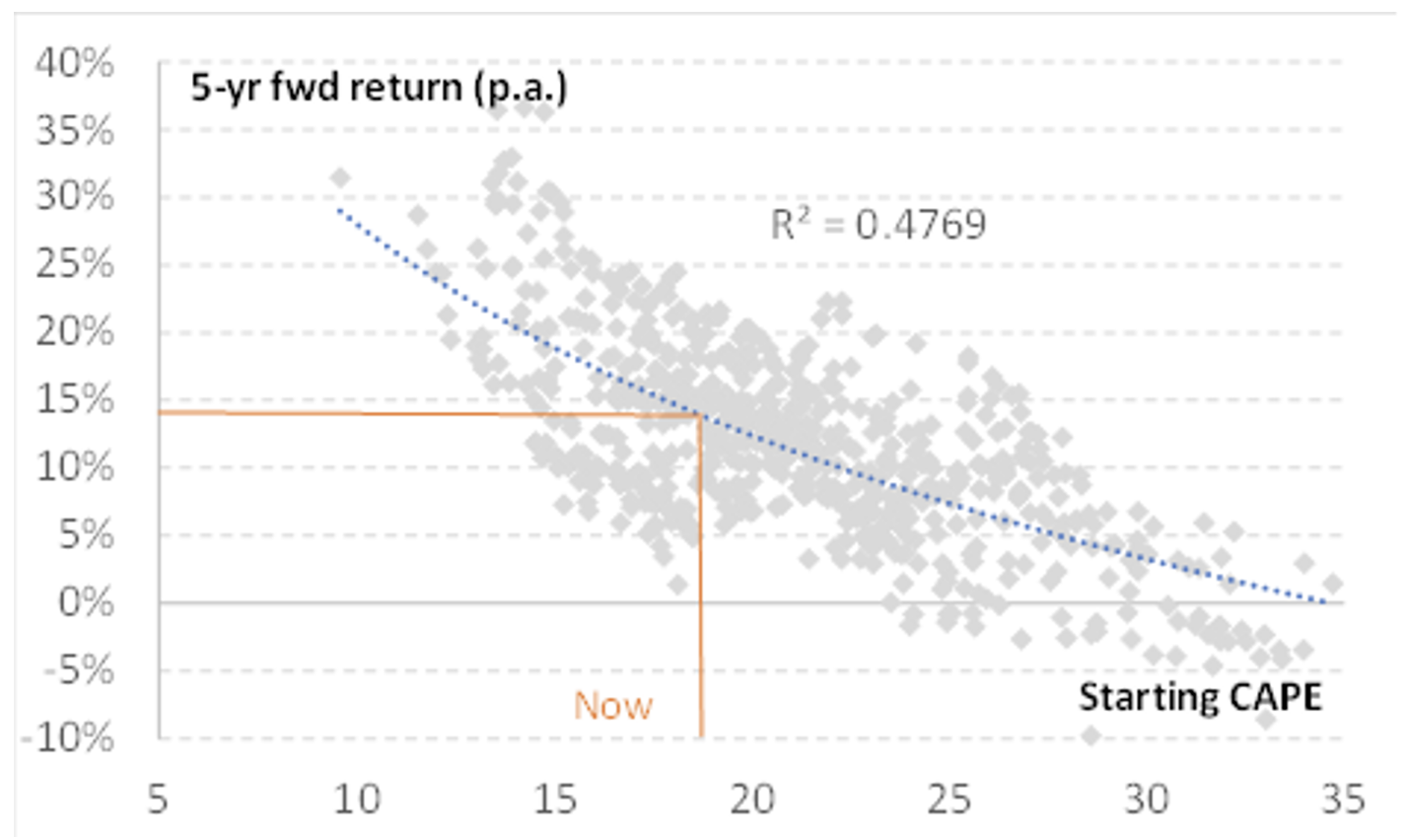

The vertical axis represents various levels of earnings per share growth. The 15% row assumes the purchase of shares in a company whose earnings per share grows at 15% per annum for five years. The column headings across the top represent the change in the P/E ratio at the end of the five-year period. The 15% and the 0% column interest at 15%. Purchasing shares in a company whose earnings per share grows at 15% per annum, will return 15% per year to the investor if the P/E ratio does not change. The intersection of the 15% row and the -25% column is 9%. Nine per cent is the annual return to the investor, over five years, from buying shares in a company whose earnings per share grow at 15% per annum and the P/E ratio declines by a quarter and fails to recover over the five years. You will see a 0% return is received where the 15% row intersects with the column representing a P/E contraction of 50%. Buying a share of a company growing its EPS by 15% per annum over five years, produces a nil return when the P/E ratio falls by half and stays there. The investor would also have to hold the shares for the five years to break even. But a nine per cent return is received, even if the P/E ratio halves when shares are purchased in a company able to grow earnings by 25% per year. The best chance of attractive returnsIt should be apparent by now buying shares in companies able to compound earnings at high rates over a long period, offers the best chance of attractive returns even if the popularity of shares were to collapse and remain in the doldrums. But as we have previously noted, this is unlikely. PE ratios reflect popularity which swings frequently and reliably. Figure 2. ASX Cyclically adjusted PE (CAPE) five year forward return (dot plots)

Finally, stockbroker MST has conducted a historical analysis of returns from Australian shares based on the P/E at which the investment was made. It is clear from the data, the axiom referred to earlier - the higher the price one pays, the lower the return and vice versa - holds true. A higher starting P/E produces a lower return. Regression analysis of historical returns (note my comments about averages) reveals paying today's P/E ratio should result in a return over the subsequent five years of approximately 15% per annum. The range of historical returns at the current P/E however is five per cent to 25% per annum. In any case, history and math are on the side of the long-term investor brave enough to invest when others are fearful, as they are today. Author: Roger Montgomery, Chairman and Chief Investment Officer Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund |

28 Jul 2022 - Semiconductors: The Next Big Opportunity?

|

Semiconductors: The Next Big Opportunity? Loftus Peak July 2022 Interest rate hikes, inflation, geopolitical tension… Portfolio Manager Anshu Sharma discusses semiconductors (chips) and why we think they are so important over the next three to five years.

Funds operated by this manager: |

28 Jul 2022 - Markets muddle through the five stages of grief

|

Markets muddle through the five stages of grief Jamieson Coote Bonds July 4 2022

As the second quarter ends, investors are licking their wounds from negative asset returns as policy withdrawal corrodes asset values around the world. Investor sentiment has swung wildly throughout the year but now seems firmly entrenched in Kubler-Ross's famed five stages of grief - denial, anger, bargaining, depression and acceptance. Make no mistake, things do not look good in the near term for economies as central banks raise rates the world over, lifting interest servicing costs and reducing discretionary spending. Bond markets have already priced in the most substantial and violent rate hiking cycle in generations - far beyond the 2.5 per cent US Federal Reserve rate hiking cycle peak of 2018 that crashed the corporate credit markets (and ultimately the equity market). As investors are entering the bargaining phase of grief, perhaps there is some glimmer of hope emerging, as inflation data and the inventory cycle (the bullwhip effect) can help ease the pathways into 2023. It is very likely there will be some depression as the markets continue to adjust (illiquid assets need to play rapid catch-up to listed assets) and finally an acceptance that our new geopolitical world order requires a vast recalibration of energy and labour markets that will have far-reaching effects, add risk premia to asset classes in higher volatilities and crimp the lofty growth valuations seen in the last cycle. Government bonds led asset underperformance, correctly signalling tougher times ahead for the economy as reopening inflation was turbocharged by the Russia-Ukraine conflict and further China lockdowns. Early in the year, many investors seemed in ''denial'' that markets could fall abruptly, despite the early warning signs from the bond market that funding interest rates would be moving significantly higher, tightening the economy at significant pace despite the economy opening the year in great health. No doubt significant ''anger'' has been experienced as many risk assets followed the lead of bonds over the second quarter, playing catch-up and slingshot in a spectacular fashion (the US Nasdaq is now down 29 per cent). The cult of crypto has been forced to stare into the abyss and contemplate life without self-reinforcing feedback loops, amid nasty infighting among the tribal communities. Australian equities have thankfully been well insulated from larger global declines to date, thanks to heavy commodity exposures which have outperformed significantly so far in a supplyconstrained world. This requires some investor consideration should growth fall substantially, as commodities can flip from leader to laggard very quickly despite supply constraints - in the Global Financial Crisis of 2008, oil fell from $140 a barrel to $44 in a matter of months. Are we somewhere around the ''bargaining'' phase currently - looking for pathways that can deliver a soft economic landing? There are certainly signs that goods inflation has significantly abated in the US - major retailers such and Walmart and Target have reported a surge in inventory accumulation and expect consequential goods discounting as a result. Supply lines are healing, and freight costs have fallen - this is known as the ''bullwhip'' effect, where inventory can flip from deficit to surplus almost instantaneously. Many businesses perhaps over-order inventory, knowing their order may be scaled back, but as supply lines heal one day the entire order arrives and they find themselves overstocked, leading to poor inventory turnaround times. This may also be the result of changing consumer demand, but either way discounting occurs and inflation pressures ease as a result until the excess inventory is cleared to restore equilibrium. This should help inflation begin to moderate, along with a more stable energy complex (oil peaked at $US130 after the outbreak of the Russia-Ukraine conflict; now $US106). However, services inflation is still expected to rise in the near term, leading to an ongoing, volatile series of outcomes in the inflation data. We expect that inflation will moderate over the balance of the year which will help central bankers find a change of narrative towards a ''pause'' of policy from the highly restrictive settings they are currently embarking upon. Sadly, while this improvement in inflation will help lift the angle of decay, we still have some difficult times to navigate as interest rates rise over the balance of the year, as expected by the bond market which has fully priced these expected outcomes. And so the ''depression'' phase may remain ahead as a ''pause'' of policy may help alleviate the declines, they will not bring back the financial asset lunacy of 2021 (anyone for a digital ape drawing for a few hundred thousand?). Assets are finding new valuation ranges for a post-Covid geopolitical world. This is probably a world where inflation can oscillate from inflationary (supply disruptions from war) to disinflationary (capitalism solves the problem) as secular forces clash and government policy stimulates or destroys demand, chasing inflation mandates. Investors must finally find ''acceptance'' that the pandemic uprooted a rule-based system, led to the great resignation, accelerated working from home - essentially it threw the economic and social jigsaw puzzle into the air and pieces have landed all over the place. Incredible government policy saved economies from their stark realities at that time, but the entropy of that volatility has returned and will leave us with a more unstable world. Part of that acceptance will be to realise that asset allocation is paramount for investors, who will be reminded that some equity is worthless, some dividend policies are best endeavours only, some credit will default, and many boring and and conservative assets play a critical role. In combination, strong and diverse asset allocation will generate good outcomes through the uncertainty we continue to face. Contractually and legally binding bond coupons from highly rated governments are close to certain for income investors (unless you think the governments will not exist in time to repay you). They might find growing acceptance in a world where the only certainties are death and taxes. |

|

Funds operated by this manager: CC Jamieson Coote Bonds Active Bond Fund (Class A), CC Jamieson Coote Bonds Dynamic Alpha Fund, CC Jamieson Coote Bonds Global Bond Fund (Class A - Hedged), CC Jamieson Coote Bonds Global Bond Fund (Class B - Unhedged) |

27 Jul 2022 - Performance Report: Bennelong Twenty20 Australian Equities Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | |

| Manager Comments | The Bennelong Twenty20 Australian Equities Fund has a track record of 12 years and 8 months and has outperformed the ASX 200 Total Return Index since inception in November 2009, providing investors with an annualised return of 9.13% compared with the index's return of 7.19% over the same period. On a calendar year basis, the fund has experienced a negative annual return on 2 occasions in the 12 years and 8 months since its inception. Over the past 12 months, the fund's largest drawdown was -22.27% vs the index's -11.9%, and since inception in November 2009 the fund's largest drawdown was -26.09% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in February 2020 and lasted 9 months, reaching its lowest point during March 2020. The fund had completely recovered its losses by November 2020. The Manager has delivered these returns with 0.6% more volatility than the index, contributing to a Sharpe ratio which has fallen below 1 five times over the past five years and which currently sits at 0.55 since inception. The fund has provided positive monthly returns 95% of the time in rising markets and 7% of the time during periods of market decline, contributing to an up-capture ratio since inception of 117% and a down-capture ratio of 98%. |

| More Information |

27 Jul 2022 - Consider the evidence for long term returns

|

Consider the evidence for long term returns Glenmore Asset Management June 2022 Market commentary June was a very weak month for equities globally, driven by continued investor concern around the quantum and pace of interest rate increases and a weakening US (and global) economy. Central banks (correctly in our view) appear committed to reducing inflation via aggressively increasing interest rates, even if it means reducing economic growth in the short term. In the US, the S&P 500 was down -8.4%, the Nasdaq fell -8.7%, whilst in the UK, the FTSE fell -5.8%. In Australia, the All Ordinaries Accumulation index fell -9.4%, whilst the Small Ordinaries Accumulation index was down -13.1%. On the ASX, the best performing sector was consumer staples, whilst resources was the worst performer, impacted by lower commodity prices and growth concerns regarding the Chinese economy. The underperformance of small/mid cap stocks vs large cap is not a new situation and has indeed occurred in all of the months in the last five years where the ASX has seen large falls. Whilst we agree that inflation, interest rate rises and weakening economic growth are all valid current concerns for investors, we also believe the falls in stocks across the board have been quite material and hence from a stock specific basis, there are now some very attractive investment opportunities for investors willing to take a 2-3 year view. As always during periods of market stress, it is very important to take a long term view and think about how long the current negative conditions will be in place over the medium term. Whilst concerns around an economic slowdown are warranted currently, we believe in 12-24 months time, this risk is likely to have reduced as central banks are further down the path of interest rate hikes. It is also important to remember that on average, bear markets last for 12-15 months, hence the current challenging conditions will not be in place permanently. Also, we would stress over the next 12- 18 months, whether Australia and/or global economies actually have a recession is not the key issue (even though it will generate a lot of media discussion). Rather for investors in the Fund, the key issue is the investment opportunities that are thrown up from the sell-off in equities, that can provide the basis of investment returns over the next 3-5 years. It should also be noted that as the stock market is very forward looking, stock prices historically fall well ahead of any economic downturn, in particular small/mid cap stocks on the ASX. Funds operated by this manager: |

26 Jul 2022 - Performance Report: Delft Partners Global High Conviction Strategy

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The quantitative model is proprietary and designed in-house. The critical elements are Valuation, Momentum, and Quality (VMQ) and every stock in the global universe is scored and ranked. Verification of the quant model scores is then cross checked by fundamental analysis in which a company's Accounting policies, Governance, and Strategic positioning is evaluated. The manager believes strategy is suited to investors seeking returns from investing in global companies, diversification away from Australia and a risk aware approach to global investing. It should be noted that this is a strategy in an IMA format and is not offered as a fund. An IMA solution can be a more cost and tax effective solution, for clients who wish to own fewer stocks in a long only strategy. |

| Manager Comments | The Delft Partners Global High Conviction Strategy has a track record of 10 years and 11 months and has outperformed the Global Equity Index since inception in August 2011, providing investors with an annualised return of 14.17% compared with the index's return of 12.41% over the same period. On a calendar year basis, the strategy has experienced a negative annual return on 2 occasions in the 10 years and 11 months since its inception. Over the past 12 months, the strategy's largest drawdown was -8.81% vs the index's -15.77%, and since inception in August 2011 the strategy's largest drawdown was -13.33% vs the index's maximum drawdown over the same period of -15.77%. The strategy's maximum drawdown began in February 2020 and lasted 1 year, reaching its lowest point during July 2020. The strategy had completely recovered its losses by February 2021. During this period, the index's maximum drawdown was -13.19%. The Manager has delivered these returns with 1.24% more volatility than the index, contributing to a Sharpe ratio which has fallen below 1 four times over the past five years and which currently sits at 1.05 since inception. The strategy has provided positive monthly returns 88% of the time in rising markets and 14% of the time during periods of market decline, contributing to an up-capture ratio since inception of 100% and a down-capture ratio of 90%. |

| More Information |

26 Jul 2022 - 10k Words

|

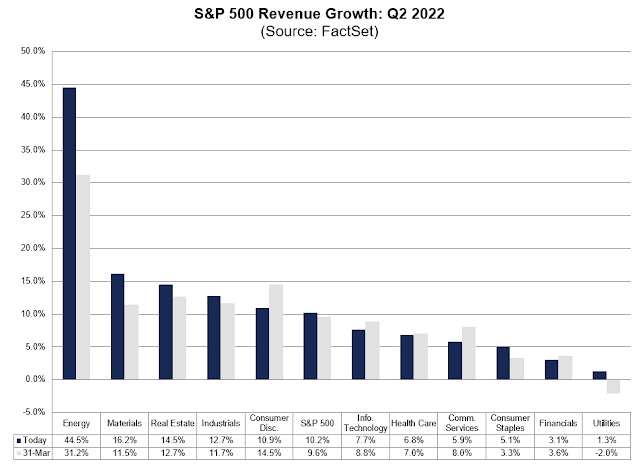

10k Words Equitable Investors 11 July 2022 Revenue multiples have returned to pre-2020 levels for high growth software companies, based on Octahedron's index. The downturn in valuations was accompanied by a 23% year-on-year decline in March quarter VC funding for late-stage and technology growth funding, crunchbase calculated - although it found seed and angel investment held up better, growing 9% year-on-year. The Information found VC firms buying listed tech stocks, meanwhile consensus data from FactSet shows the tech sector is not expected to have been among the strongest growth areas of the S&P 500 in the June quarter - energy and materials stocks have the most expected of them. Kailash Capital shows that price growth for the S&P 500 in the 2017-2021 period has doubled the long-term average return. Finally, Bloomberg charts the rise of self-employment in the US. Octahedron Growth Software Index (EV / NTM Rev) Source: Octahedron Global Venture Dollar Volume by quarter Source: Crunchbase Global Seed and Angel Investment by quarter Source: Crunchbase VC Firms Buying Publicly Listed Shares Source: The Information S&P 500 Revenue Growth Expectations Source: FactSet S&P 500 historical average returns Source: Kailash Capital Americans increasingly shifting to self-employment Source: Bloomberg July Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions. Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components. Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog |

26 Jul 2022 - How quickly will central bankers change their tune?

|

How quickly will central bankers change their tune? Eley Griffiths Group July 2022 The downward trajectory of global equity markets continued in June as central banks displayed a willingness to hike rates aggressively in the near term to fight inflation. This hard stance increased concerns of a swift contraction in global economic activity. The US Fed delivered a 75bp rate hike in June, the largest rise since 1994, after May's CPI accelerated at the fastest rate since 1981 (8.6%). Chair Powell signalled another large hike in July to fight inflation "expeditiously." Likewise in Australia, the RBA surprised markets with the largest rate hike in 22 years (50bp) to bring the cash rate to 0.85%. Small resources retracted by 22% on weaker commodity prices and shrinking demand concerns. The price of copper, a 'bellwether' for the economy, dropped below $US8000 for the first time in almost 18 months and is now down 17% year to date. Developers and explorers were sold off more heavily than producers, albeit no one was immune. As a slew of earnings downgrades and profit warnings started to build momentum across the market, outperforming in the month were defensive portfolio holdings. Litigation financer Omni Bridgeway (+5%) highlighted the benefits of being uncorrelated to the broader economic environment at present, as well as announcing the launch of an 8th Fund. With signs of economic fragility proliferating, investors finished the month speculating how quickly central bankers will change their tune. Last week, the closely watched Atlanta Fed's GDPNow estimate of real GDP was slashed to -2.1% in the second quarter, highlighting the prospect that the US economy may already be in recession. As a result, bond markets are now trimming their expectations for future rate hikes and investors are betting the deteriorating consumer and business confidence will be enough for central bankers to call a pause or slow their hiking cycle. Funds operated by this manager: Eley Griffiths Emerging Companies Fund, Eley Griffiths Small Companies Fund |

25 Jul 2022 - Performance Report: Digital Asset Fund (Digital Opportunities Class)

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund offers a choice of three investment classes, each of which adopts a different investment strategy: - The Digital Opportunities Class identifies and trades low risk arbitrage opportunities between different exchanges and a number of digital assets; - The Digital Index Class tracks the performance of a basket of digital assets; - The Bitcoin Index Class tracks the performance of Bitcoin. Digital Opportunities Class: This class appeals to investors seeking an active exposure to the digital asset markets with no directional bias. The Digital Opportunities Class employs a high frequency inspired Market Neutral strategy trading 24/7 which uses a systematic approach designed to offer uncorrelated returns to the underlying highly volatile cryptocurrency markets. The strategy systematically exploits low-risk arbitrage opportunities across the most liquid and active digital asset markets on the most respected exchanges. When appropriate the Fund may obtain leverage, including through borrowing cash, securities and other instruments, and entering into derivative transactions and repurchase agreements. DAFM has a currency hedging policy in place for the Units in the Fund. Units in the Fund will be hedged against exposure to assets denominated in US dollars through a trading account with spot, forwards and options as directed by DAFM. |

| Manager Comments | The Digital Asset Fund (Digital Opportunities Class) has a track record of 1 year and 2 months and therefore comparison over all market conditions and against its peers is limited. However, the fund has outperformed the S&P Cryptocurrency Broad Digital Market Index since inception in May 2021, providing investors with an annualised return of 48.02% compared with the index's return of -60.61% over the same period. Over the past 12 months, the fund hasn't had any negative monthly returns and therefore hasn't experienced a drawdown. Over the same period, the index's largest drawdown was -71.98%. Since inception in May 2021, the fund's largest drawdown was 0% vs the index's maximum drawdown over the same period of -71.98%. The Manager has delivered these returns with 48.96% less volatility than the index, contributing to a Sharpe ratio for performance over the past 12 months of 4.18 and for performance since inception of 1.75. The fund has provided positive monthly returns 100% of the time in rising markets and 100% of the time during periods of market decline, contributing to an up-capture ratio since inception of 9% and a down-capture ratio of -49%. |

| More Information |

25 Jul 2022 - Performance Report: Collins St Value Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The managers of the fund intend to maintain a concentrated portfolio of investments in ASX listed companies that they have investigated and consider to be undervalued. They will assess the attractiveness of potential investments using a number of common industry based measures, a proprietary in-house model and by speaking with management, industry experts and competitors. Once the managers form a view that an investment offers sufficient upside potential relative to the downside risk, the fund will seek to make an investment. If no appropriate investment can be identified the managers are prepared to hold cash and wait for the right opportunities to present themselves. |

| Manager Comments | The Collins St Value Fund has a track record of 6 years and 5 months and has outperformed the ASX 200 Total Return Index since inception in February 2016, providing investors with an annualised return of 16.09% compared with the index's return of 8.6% over the same period. On a calendar year basis, the fund hasn't experienced any negative annual returns in the 6 years and 5 months since its inception. Over the past 12 months, the fund's largest drawdown was -11.41% vs the index's -11.9%, and since inception in February 2016 the fund's largest drawdown was -27.46% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in February 2020 and lasted 7 months, reaching its lowest point during March 2020. The fund had completely recovered its losses by September 2020. The Manager has delivered these returns with 3.44% more volatility than the index, contributing to a Sharpe ratio which has fallen below 1 four times over the past five years and which currently sits at 0.88 since inception. The fund has provided positive monthly returns 84% of the time in rising markets and 63% of the time during periods of market decline, contributing to an up-capture ratio since inception of 79% and a down-capture ratio of 42%. |

| More Information |

.png)