NEWS

16 Jan 2025 - Performance Report: Seed Funds Management Hybrid Income Fund

[Current Manager Report if available]

16 Jan 2025 - 2024 In Review & 2025 Outlook

|

2024 In Review & 2025 Outlook Alphinity Investment Management January 2025 |

|

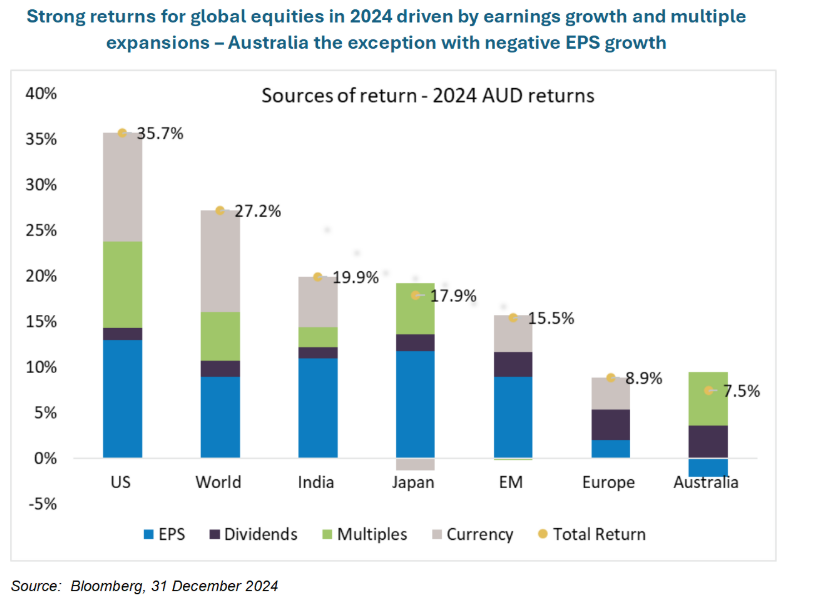

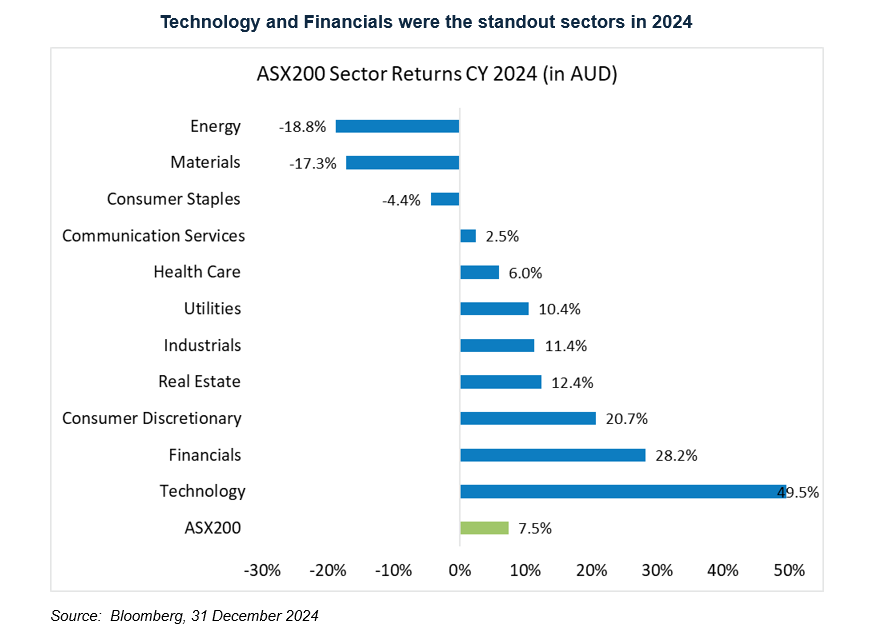

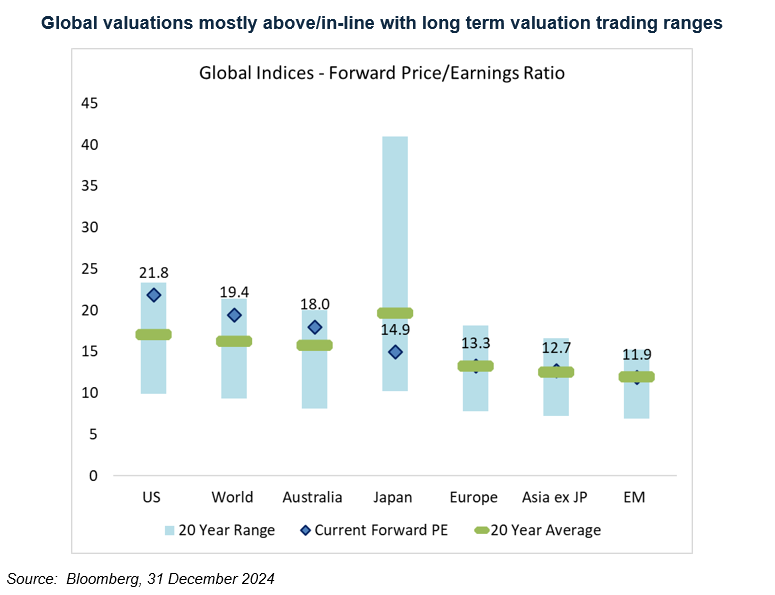

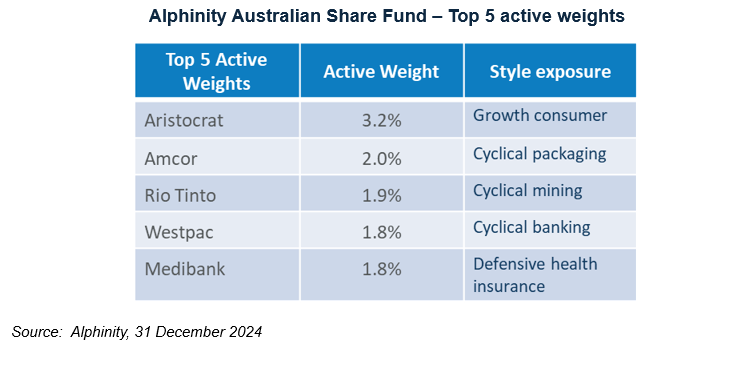

If 2024 was the year of Elections, Economics, Evolutions and Earnings, what is in store for Australian equities in 2025? The year 2024 proved to be a remarkable one, both in absolute terms and relative to expectations. As the year unfolded, it brought numerous surprises and developments that shaped the global economic and political landscape. From election outcomes (and associated geopolitics), diverging economic growth (and interest rate changes), to the AI evolution (and associated ripple effects) and finally the return of earnings revisions as a key relative individual stock performance driver. Elections, economics, evolutions and earnings - a fitting summary of some of the primary forces behind the global equity rally as 2024 draws to a close. Below we explore these themes in more detail, share our outlook for 2025 and how the Alphinity Australian Funds are positioned going into the New Year. 2024 in review: As we entered 2024 a year ago, there were widespread expectations of significant rate cuts in the United States. However, as the year progressed, only a handful materialised, accompanied by a soft landing for the economy. In Australia, the Reserve Bank maintained a resolute stance against rate cuts, though some cracks in this position began to appear towards the year's end. The U.S. presidential election was a focal point of 2024, filled with twists and turns. The outcome, with Donald Trump's victory, is likely to usher in policies and a political and regulatory environment perceived as pro-business and pro-market. Meanwhile, China's attempts at economic stimulus, while showing some much-needed strong intent, fell short of expectations in the detail, failing to provide the anticipated boost to global growth just yet. In the financial markets, the U.S. stock indices continued their upward trajectory, propelled by the "Magnificent Seven" tech giants and artificial intelligence advancements. This momentum had a positive spillover effect on the Australian market, with the technology sector the highest contributor to returns despite the pullback in December (+49% YTD). Outside of the tech sector, the strong performance in the US had a broader positive impact in the Australian market through the year, despite quite different economic and earnings outcomes. For Australian investors, the strength of major banks, particularly Commonwealth Bank and Westpac, was also noteworthy, driven by small but persistent earnings upgrades. With earnings upgrades few and far between elsewhere (the market in total having net downgrades), financials continued to be well supported, almost regardless of valuations. From a portfolio and process perspective, it was encouraging to see the re-emergence of earnings revisions as a key individual stock driver and alpha generator over the last 12 months, something that went temporarily missing for much of 2022 and 2023 as large top down thematics and swings took precedence. This trend allowed for consistent momentum to be a key driver, which assisted all the Alphinity funds to capture positive alpha for our clients this year. The outlook for 2025: Looking ahead to 2025, the outlook appears more nuanced. A repeat of the robust absolute returns seen in 2024 seems less likely, given the high valuations and elevated expectations that now form a more challenging starting point. Unlike 12 months ago, everyone appears positioned for a "no-landing" or at worst a "soft-landing" already, with very little wall-of-worry to climb. However, a precipitous decline is not anticipated either. Several positive factors remain that could continue to drive the market forward. The U.S. economy continues to show resilience, and the new Trump administration is expected to implement pro-business, growth-oriented policies and a market friendly environment, at least initially. There's potential for more rate cuts in international markets (even though less than hoped for initially) including, but perhaps toto a lesser extent, in Australia. China, while still facing challenges, has demonstrated strong intent and retains some levers to stabilise its economy, potentially becoming less of a drag on global growth and sentiment. We have our own election here in Australia that is likely to lead to more fiscal stimulus promises from the major parties, and a focus on 'cost-of-living' pressures. Nevertheless, earnings expectations in the U.S. are already quite high, (less so here in Australia), making further PE expansion as the main market driver less likely unless we have a material change in interest rate view. The focus will need to shift to actual earnings outcomes. Uncertainties surrounding U.S. trade policies, inflation trajectories, interest rate movements, and geopolitical tensions add complexity to the outlook. While material growth in market indices may be harder to achieve in 2025, there is enough positive momentum to sustain current levels for some time. A period of market consolidation wouldn't be surprising however after the strong run in 2024, though a more significant correction would likely require catalysts beyond just high valuations (such as an economic, earnings or interest rate policy surprise). It is likely that rather than the level of the market, the key question for 2025 will revolve around potential sector and stock rotation. Will the current market leaders maintain their dominance, or will we see new market leadership emerge? For example, changes in monetary policy, such as rate cuts in Australia, could benefit domestic and consumer cyclical stocks. A recovery in China or more forceful policy might boost commodities, as would improved US and global economic growth. In a flatter or weaker market environment, defensive stocks might get their time in the sun yet again. Ultimately, whatever the market environment it is likely to be earnings driven. Market leadership will be driven by those companies that can produce better earnings outcomes than expected, which is what we saw eventuate in 2024. The key will be the flexibility to move to where earnings leadership is as the year unfolds. How are we positioned? Given these considerations, a relatively balanced portfolio approach seems prudent to start 2025, focusing on likely earnings outcomes in individual stocks rather than trying to second guess broader macro drivers. Some increased defensive positioning is likely advisable due to high market valuations, but maintaining some exposure to domestic interest rate-sensitive sectors could be beneficial for example if rates decrease. Our portfolios continue to be positioned in stocks with better earnings outlooks than the market expects, as per our investment process. While we do focus on earnings momentum and the quality of those earnings primarily, we also care about valuation. Valuation rarely tells you when a stock or market is going to turn, but it does tell you when risk is increasing. As such, without a better earnings outlook for the market overall, risks in the market have by definition increased alongside those higher valuations. So, the portfolio needs to be very vigilant around investing in stocks that are showing earnings leadership and delivering earnings upgrades. As the year unfolds and new earnings trends become clearer, we will continue to adjust our portfolios to align with new earnings leaders. |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Global Sustainable Equity Fund, Alphinity Sustainable Share Fund |

15 Jan 2025 - Performance Report: 4D Global Infrastructure Fund (Unhedged)

[Current Manager Report if available]

15 Jan 2025 - Performance Report: Bennelong Australian Equities Fund

[Current Manager Report if available]

15 Jan 2025 - 10k Words | January 2025

|

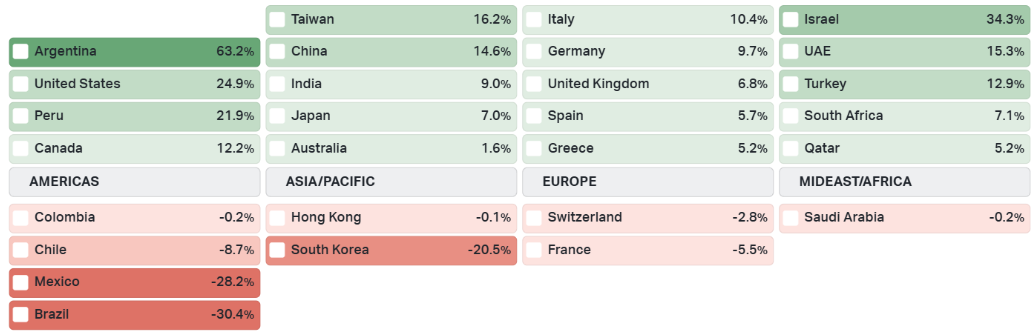

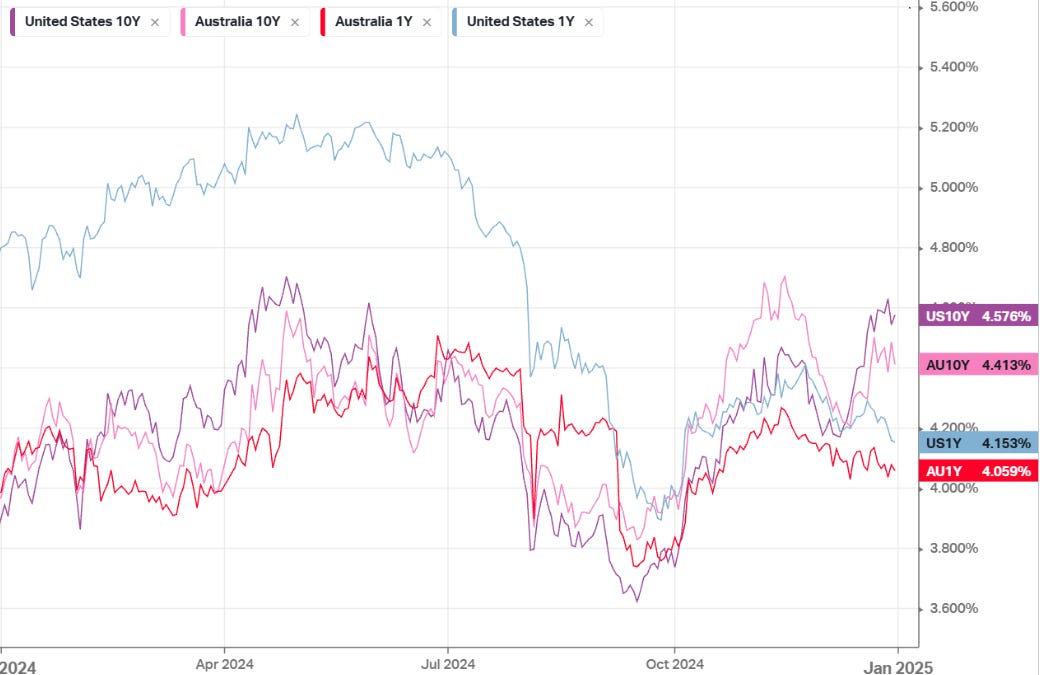

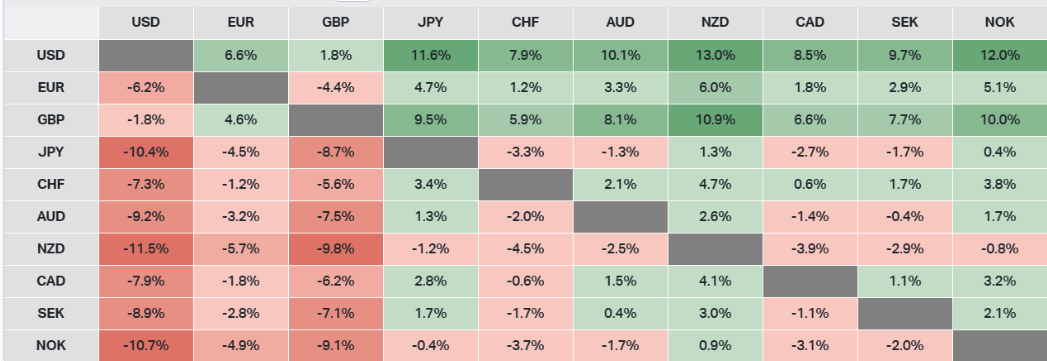

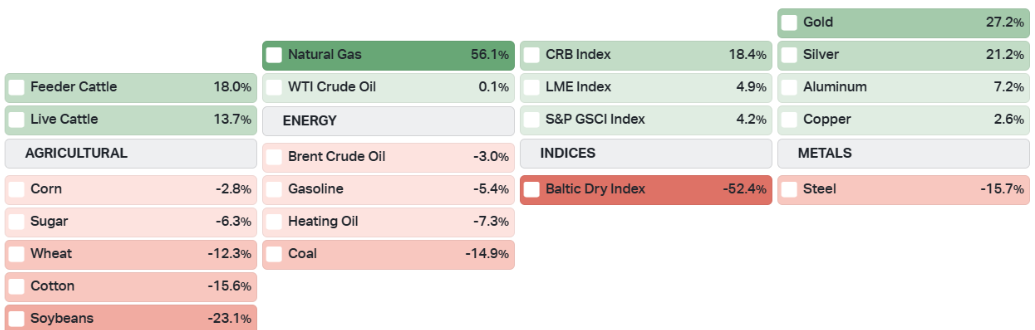

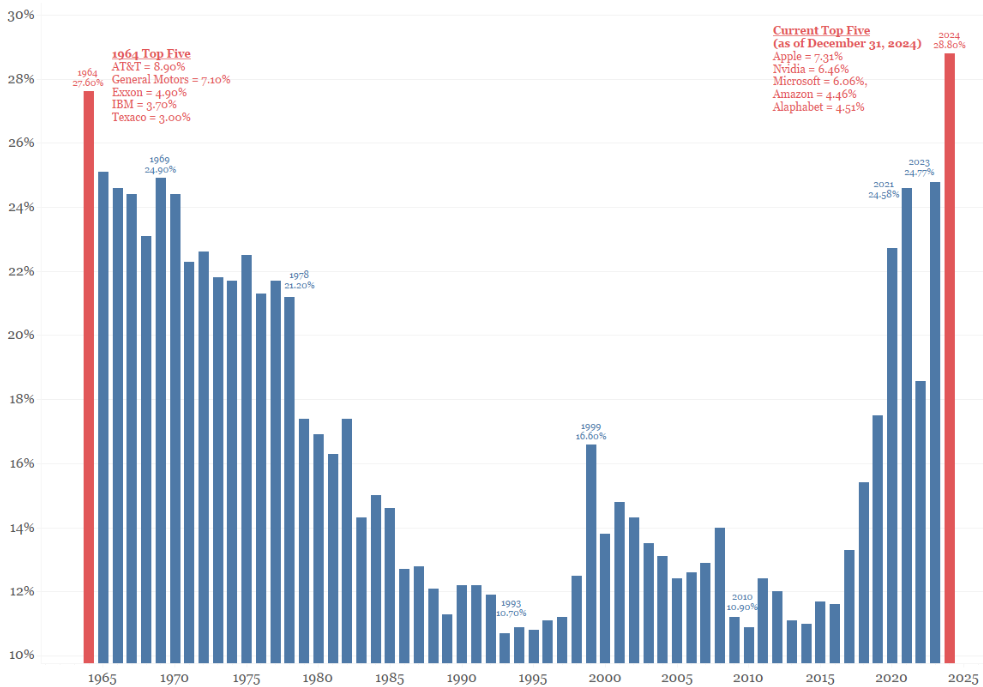

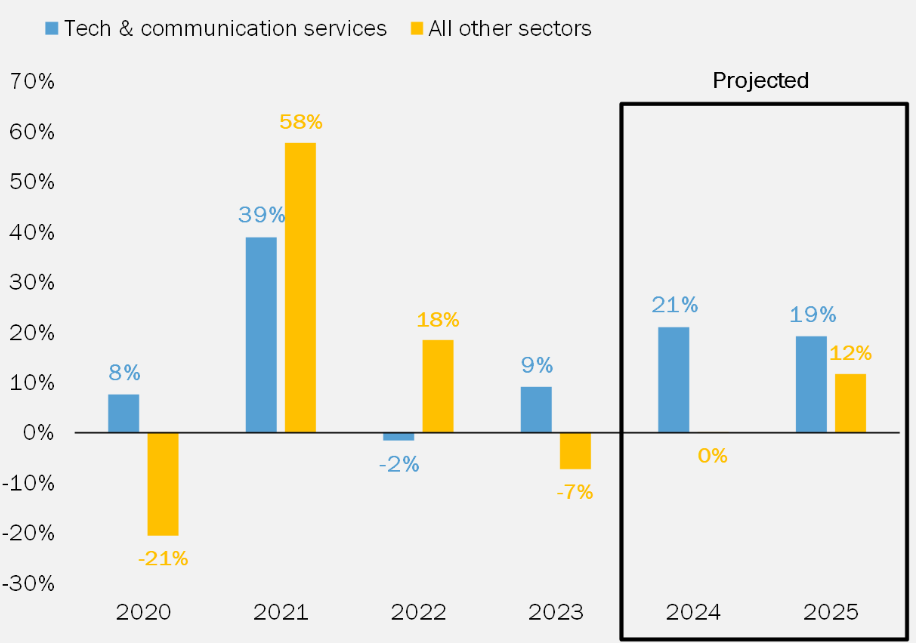

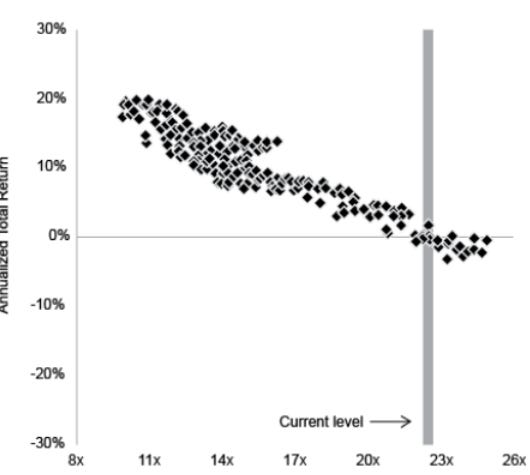

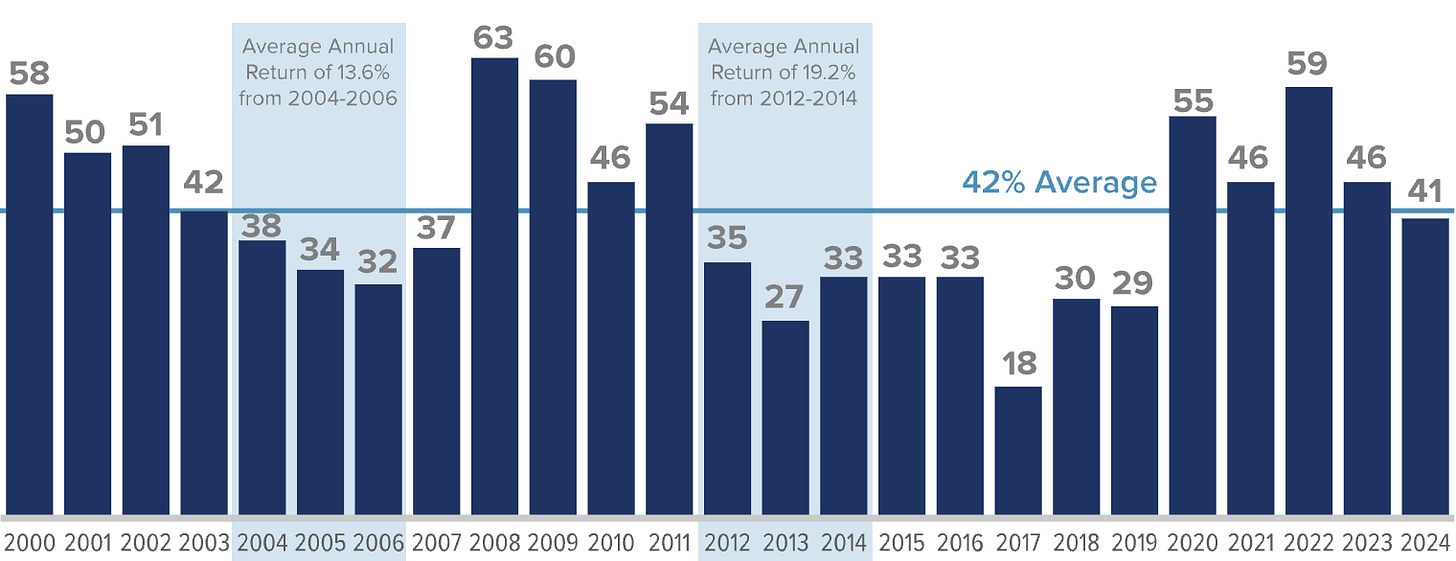

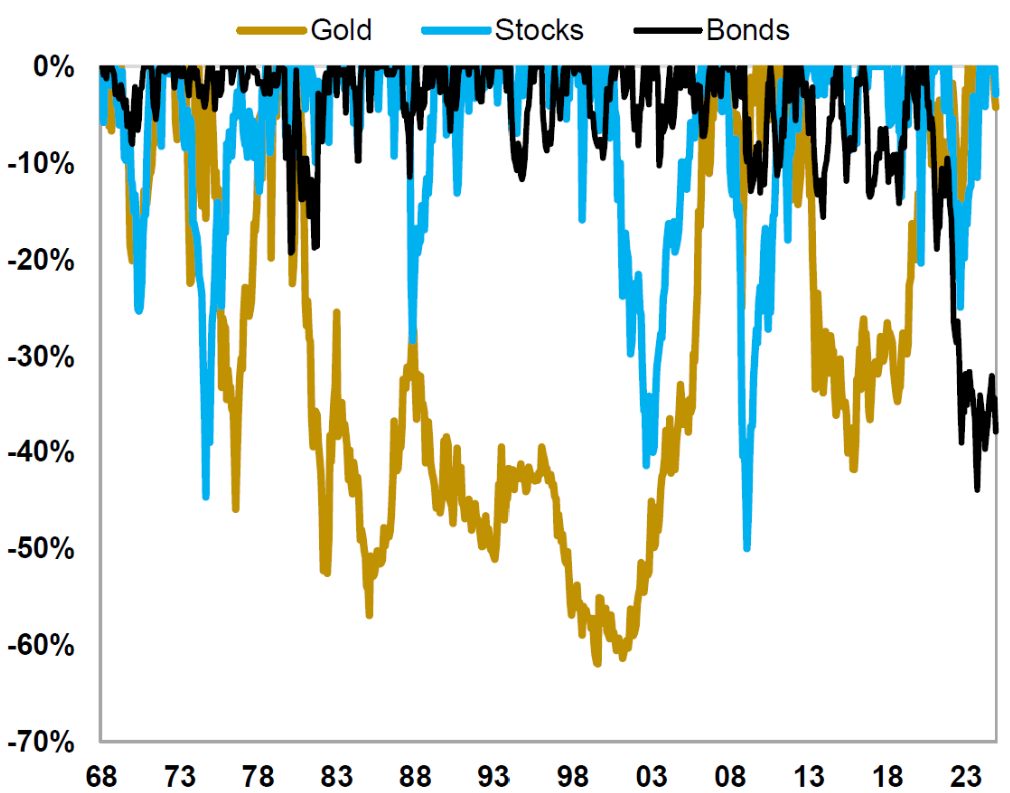

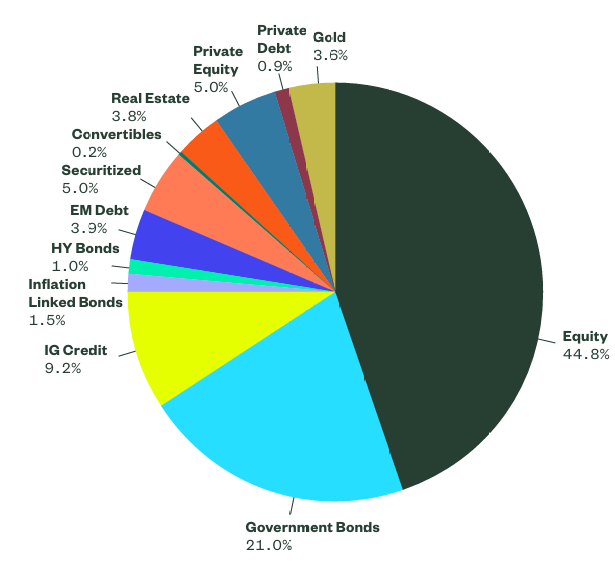

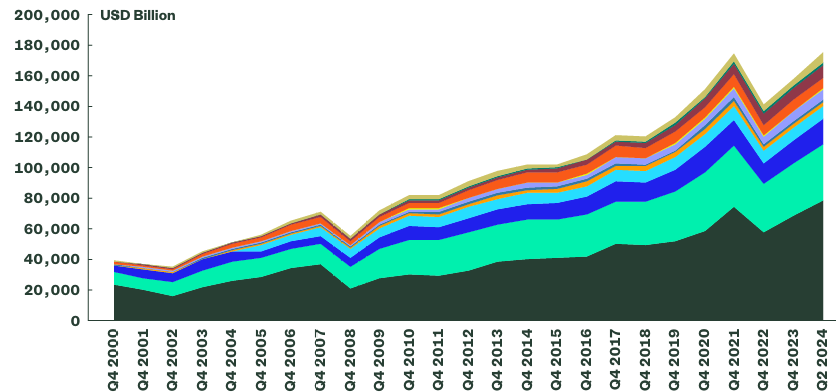

10k Words Equitable Investors January 2025 Only Argentina's sharemarket outpaced the US in CY2024, with a mediocre performance from Australia; 10-year bond yields expanded despite the Federal Reserve's rate cuts; the AUD battled while the USD went from strength-to-strength; while natural gas was the commodity of choice. We can't help but highlight the concentration in the US market once again; while its pricing is dependent on a resurgence in earnings outside the tech sector. The thing about high multiples for the S&P 500 is that they tend to be followed by low 10-year returns. Maybe that is why money flowed out of active equities funds in CY2024. We take a look at the implications of volatility on small cap returns and the severity of drawdowns that have been seen across asset classes through the decades. Then we see just how big a part of the global investment pie equities have become. Finally, we look at the increased role government borrowing has played in the US and government spending has played in Australia. Global equity ETF total returns for 2024 (in USD) Source: Koyfin, Equitable Investors Government bond yield movements in CY2024 Source: Koyfin, Equitable Investors Currency performance in CY2024 Source: Koyfin, Equitable Investors Commodities performance in CY2024 Source: Koyfin, Equitable Investors Share of total S&P 500 market cap held by 5 largest stocks Source: Bianco Research Year-on-year S&P 500 earnings growth - historical and projected Source: Callie Cox Media, Bloomberg S&P 500 forward P/E and subsequent 10-year returns Source: @thejoshviljoen Active equities fund outflows in 2024 Source: Financial Times Percentage of trading days with moves of 1% or more in the Russell 2000 over the last 25 years Source: Royce & Associates Drawdowns - the latest prices in relation to the previous all-time high Source: Topdown Charts Composition of the global market portfolio Source: State Street Global Advisors Evolution of the composition of the global market portfolio

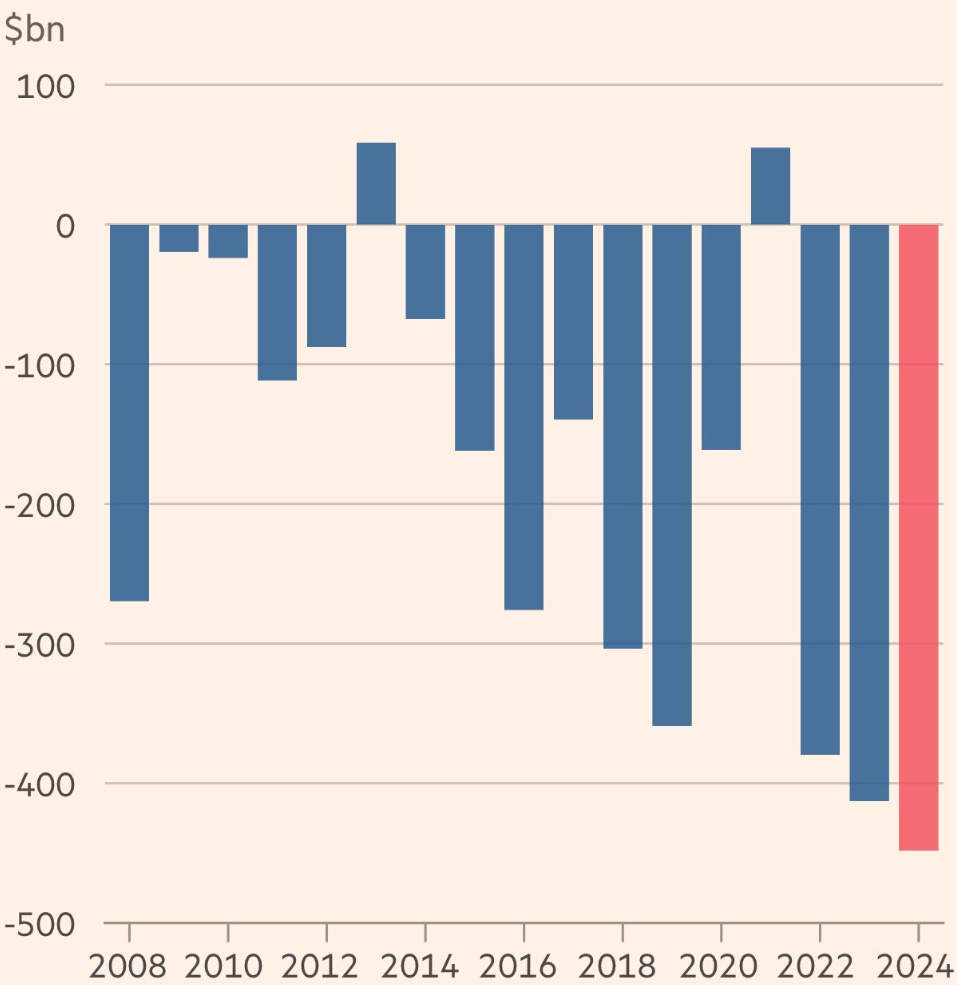

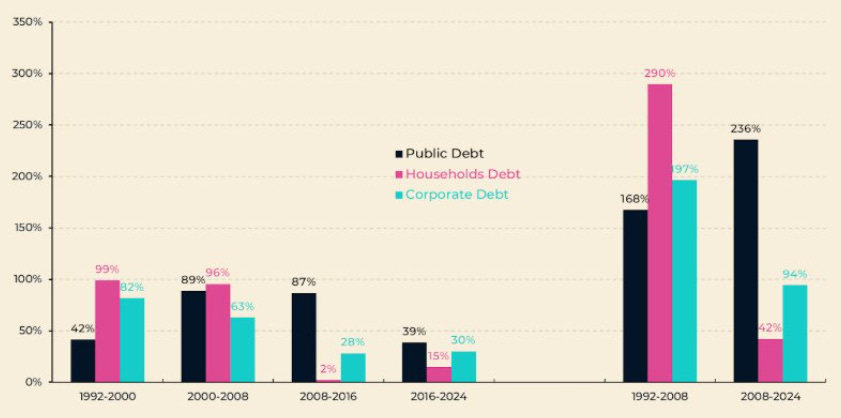

Source: State Street Global Advisors US debt growth breakdown

Source: @TheKingCourt Data demand growth driving a surge in data centre power use

Source: @AvidCommentator January 2025 Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Past performance is not a reliable indicator of future performance. Fund returns are quoted net of all fees, expenses and accrued performance fees. Delivery of this report to a recipient should not be relied on as a representation that there has been no change since the preparation date in the affairs or financial condition of the Fund or the Trustee; or that the information contained in this report remains accurate or complete at any time after the preparation date. Equitable Investors Pty Ltd (EI) does not guarantee or make any representation or warranty as to the accuracy or completeness of the information in this report. To the extent permitted by law, EI disclaims all liability that may otherwise arise due to any information in this report being inaccurate or information being omitted. This report does not take into account the particular investment objectives, financial situation and needs of potential investors. Before making a decision to invest in the Fund the recipient should obtain professional advice. This report does not purport to contain all the information that the recipient may require to evaluate a possible investment in the Fund. The recipient should conduct their own independent analysis of the Fund and refer to the current Information Memorandum, which is available from EI. |

14 Jan 2025 - The door for rate cuts opens further

|

The door for rate cuts opens further Pendal December 2024 |

|

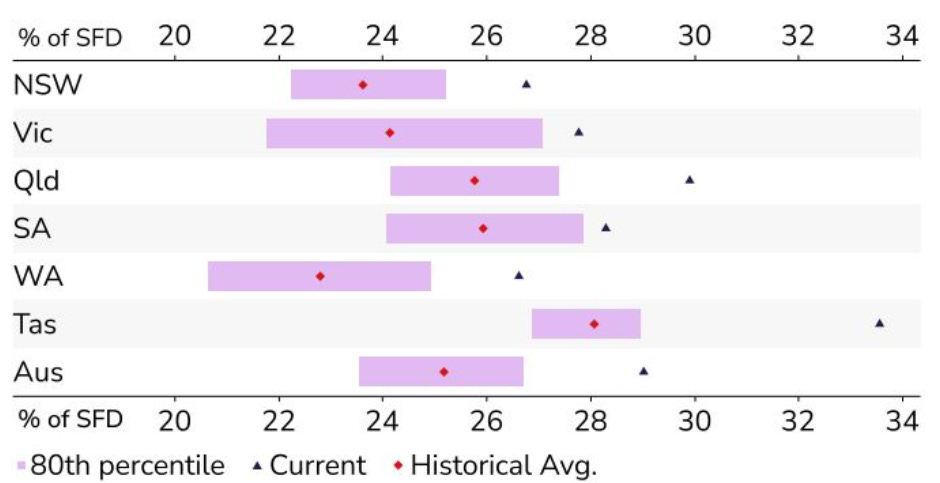

THE Australian economy grew by only 0.3% in the September quarter, once again falling behind population growth. We managed only 0.8% growth for the year, yet the RBA still thinks demand outstrips supply. The September quarter GDP numbers were always going to be more interesting than most. Tax cuts and government subsidies were hitting consumer pockets and the big question was whether they would be spent or saved. For now, it appears consumers have been happy to pocket the extra money. Spending by business and consumers once again flatlined and per capita consumption fell by 2% over the year. The only growth we could find was, once again, the government - which now comprises almost 28% of GDP, up from around 23% for most of the past 50 years. The graph below, courtesy of Westpac, highlights this extraordinary return of big government.  Source: Westpac Economics Source: Westpac Economics

Source: Wages grow 3.5 per cent for the year | Australian Bureau of Statistics The national accounts also provided more information around wage pressures. As the high wage outcomes of 2022 and 2023 have faded from view, these are easing quickly. Average earnings per hour moderated to 3.2%yr, from 6.5%yr in the June quarter. This is consistent with recent wage data at 3.5%. We have weak growth, moderating inflation, wages under control and global easing cycles - so why the hesitation from the RBA? The central bank remains focused on the idea that the labour market remains too tight, as it believes that 4.5% - not the current 4.1% - to be full employment. The data is now suggesting otherwise. OutlookIt will be an interesting few upcoming meetings for the RBA board. February will likely be the last monetary policy board decision for three of the six independent directors. And March or April will see a split into governance and monetary policy boards. Whether this influences thinking remains to be seen, but the current spirit of caution may yet stop a rate cut in February. However, I think the RBA may do a short sharp pivot in the next few months, and view two cuts (in February and May) as still on the cards. The Q4 inflation data at the end of February will be another low number, with even underlying inflation likely to print 0.6%, or annualised at the RBA midpoint. While bond investors will be cheering for a cut, the Labour government will be desperate for one ahead of the "cost-of-living" election. Time will tell if the RBA delivers for them. Author: Tim Hext |

|

Funds operated by this manager: Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Multi-Asset Target Return Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Pendal Sustainable Australian Share Fund, Regnan Credit Impact Trust Fund, Regnan Global Equity Impact Solutions Fund - Class R |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

13 Jan 2025 - Understanding Bridging Loans: A Comprehensive Guide

|

Understanding Bridging Loans: A Comprehensive Guide Australian Secure Capital Fund December 2024 In the world of finance, the term "bridging loan" often comes up in conversations about short-term funding solutions. Bridging finance may seem complex, but understanding its key features can help clarify its benefits and risks. In this article, we'll explore what a bridging loan is, how it works, its advantages and disadvantages, and when it might be the right choice for you.

What is a Bridging Loan?A bridging loan is a type of short-term financing that is designed to "bridge" the gap between a financial need and a long-term financing solution. These loans are typically used when an individual or business needs to access funds quickly, often for a specific purpose, such as purchasing a new property before selling an existing one. Bridging loans are usually secured against an asset, often real estate, and can be arranged relatively quickly compared to traditional loans. Types of Bridging LoansThere are two main types of bridging loans: 1. Open Bridging Loans: These loans do not have a fixed repayment date, meaning they can be paid back at any time. They are usually used in situations where the borrower has not yet sold their existing property or is unsure when they will be able to repay the loan. 2. Closed Bridging Loans: These loans have a specific repayment date, typically aligned with the sale of a property. They are ideal for borrowers who have already exchanged contracts on a property and have a clear timeline for repayment. How Does Bridging Finance Work?Bridging finance operates on a straightforward premise: it provides quick access to funds that can be used for various purposes. The process generally involves the following steps: 1. Application: The borrower submits an application for a bridging loan, providing necessary documentation such as proof of income, details of the property being used as security, and information about the intended use of the funds. 2. Valuation: The lender will conduct a valuation of the property to ensure it is worth the amount being borrowed. This step is crucial, as the property serves as collateral for the loan. 3. Approval and Funding: If the application is approved, the lender will issue the funds, usually within a matter of days. This quick turnaround is one of the main advantages of bridging finance. 4. Repayment: The borrower will repay the loan either upon the completion of the intended project (e.g., selling a property) or on the agreed-upon repayment date for closed loans.

Advantages of Bridging LoansBridging loans come with several benefits that make them an attractive option for many borrowers: 1. Speed: One of the most significant advantages of bridging loans is their speed. Traditional loans can take weeks or even months to process, while bridging finance can be arranged in a matter of days. 2. Flexibility: Bridging loans offer flexibility in terms of repayment options. They can be tailored to fit the borrower's specific needs, whether it's a short-term loan for a few weeks or a few months. 3. Access to Funds: Bridging finance can provide access to funds that might not be available through traditional lending routes, especially for borrowers with less-than-perfect credit histories. 4. No Early Repayment Penalties: Many bridging loan providers do not impose penalties for early repayment (depending on the terms), which can be a crucial factor for borrowers looking to reduce their overall interest costs. Disadvantages of Bridging LoansWhile bridging loans offer many benefits, they also come with some drawbacks that should not be overlooked: 1. Higher Interest Rates: Bridging loans typically have higher interest rates compared to traditional mortgages. This is due to their short-term nature and perceived risk associated with bridging loans. Borrowers should compare options to find a product that fits their circumstances. 2. Fees: Borrowers may encounter various fees associated with bridging loans, including arrangement fees, valuation fees, and legal fees, which can add to the overall cost. 3. Risk of Repossession: Since bridging loans are secured against an asset, failure to repay can result in the lender repossessing the property used as collateral. 4. Short-Term Solution: Bridging loans are not meant to be a long-term financing solution. Borrowers need to have a clear plan for repayment, as these loans usually need to be settled within a few months. When to Consider a Bridging LoanBridging loans may be a suitable financial tool in specific situations, depending on your circumstances and the terms provided by the lender. Here are a few scenarios where bridging finance might make sense: 1. Property Transactions: If you are in the process of buying a new home but have not yet sold your current property, a bridging loan can provide the funds needed to make the purchase without the stress of timing the two transactions perfectly. 2. Investment Opportunities: Investors might use bridging loans to seize opportunities that require quick financing, such as auction purchases or real estate investments that need renovation before resale. 3. Business Funding: Businesses may need immediate capital for various reasons, such as purchasing new equipment or covering operational costs during a slow period. Bridging finance can provide that necessary cash flow. Bridging loans may offer a short-term financial solution for those who meet the lender's criteria and have a clear repayment strategy. While they come with higher interest rates and various fees, their speed and flexibility make them an attractive option for many borrowers. Whether you're looking to purchase a new home, invest in real estate, or fund a business need, understanding bridging finance can help you make informed decisions about your financial future. As with any financial product, it's essential to weigh the pros and cons carefully and consult with a financial advisor if needed. Bridging loans can be an excellent tool in your financial arsenal -- just ensure you know how to use them wisely. Author: Mikaela Gladden Funds operated by this manager: ASCF High Yield Fund, ASCF Premium Capital Fund, ASCF Select Income Fund The content on this page is intended solely for general informational and educational purposes and should not be interpreted as financial advice. Although we make every effort to ensure the accuracy and relevance of the information, it may not always reflect the latest legal or financial changes. We strongly recommend seeking guidance from a qualified financial advisor or professional before making any financial decisions. Use the information at your own discretion. |

20 Dec 2024 - Hedge Clippings | 20 December 2024

|

|

|

|

Hedge Clippings | 20 December 2024 As we in Australia end the year as it started - with the RBA's cash rate stuck at 4.35% - in the US the FOMC cut rates 0.25% to 4.25 to 4.50%, leaving markets unimpressed - not so much because they were hoping for more, but because Jerome Powell flagged a slow down in the rate of cuts in 2025.

News & Insights Investment Perspectives: Why a Trump presidency could be deflationary | Quay Global Investors Proprietary Data - Strategic AI Advantage | Insync Fund Managers Market Commentary - November | Glenmore Asset Management November 2024 Performance News Glenmore Australian Equities Fund TAMIM Fund: Global High Conviction Unit Class Digital Income Fund (Digital Income Class) Equitable Investors Dragonfly Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

20 Dec 2024 - Performance Report: Insync Global Quality Equity Fund

[Current Manager Report if available]

20 Dec 2024 - Performance Report: Insync Global Capital Aware Fund

[Current Manager Report if available]