NEWS

10 Aug 2022 - Performance Report: 4D Global Infrastructure Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The fund is managed as a single portfolio including regulated utilities in gas, electricity and water, transport infrastructure such as airports, ports, road and rail, as well as communication assets such as the towers and satellite sectors. The portfolio is intended to have exposure to both developed and emerging market opportunities, with country risk assessed internally before any investment is considered. The maximum absolute position of an individual stock is 7% of the fund. |

| Manager Comments | The 4D Global Infrastructure Fund has a track record of 6 years and 5 months and has outperformed the S&P Global Infrastructure TR (AUD) Index since inception in March 2016, providing investors with an annualised return of 9.05% compared with the index's return of 8.89% over the same period. On a calendar year basis, the fund has only experienced a negative annual return once in the 6 years and 5 months since its inception. Over the past 12 months, the fund's largest drawdown was -5.82% vs the index's -3.91%, and since inception in March 2016 the fund's largest drawdown was -19.77% vs the index's maximum drawdown over the same period of -24.67%. The fund's maximum drawdown began in February 2020 and lasted 2 years and 2 months, reaching its lowest point during September 2020. The fund had completely recovered its losses by April 2022. The Manager has delivered these returns with 0.38% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 five times over the past five years and which currently sits at 0.71 since inception. The fund has provided positive monthly returns 96% of the time in rising markets and 13% of the time during periods of market decline, contributing to an up-capture ratio since inception of 99% and a down-capture ratio of 98%. |

| More Information |

10 Aug 2022 - Australian Secure Capital Fund - Market Update July

|

Australian Secure Capital Fund - Market Update July Australian Secure Capital Fund July 2022 Australian residential property values fell by 1.3% in July bringing the total quarterly decline across the country to -2%. Inventory levels have also decreased significantly and have now fallen -21.40% from the mid-March peak, helping to keep overall inventory levels low whilst on the demand side sales activity over the three months to July was -16% lower in comparison to the same period last year. While national home sales are also falling from record highs, they are still +9.20% above the previous five-year average for this time of year. With interest rates expected to rise further, there is a good chance that the number of transacted sales will continue to fall as confidence continues to weigh on the housing sector. On a more positive note, however, rents across the country continued to increase through July rising +0.90% for the month to be +2.80% higher for the quarter and +9.80% higher over the past 12 months.

Funds operated by this manager: ASCF High Yield Fund, ASCF Premium Capital Fund, ASCF Select Income Fund |

10 Aug 2022 - Holding your discipline

|

Holding your discipline Airlie Funds Management July 2022 |

|

Portfolio Managers John Sevior and Matt Williams have worked together in funds management for more than 30 years. In this session, they discuss what it's like to invest in the current market and how it compares with past 'extreme market conditions'. In addition, they assess which ASX companies could perform in these conditions. Speakers: Matt Williams, Portfolio Manager Funds operated by this manager: Important Information: Units in the fund(s) referred to herein are issued by Magellan Asset Management Limited (ABN 31 120 593 946, AFS Licence No. 304 301) trading as Airlie Funds Management ('Airlie') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to an Airlie financial product or service may be obtained by calling +61 2 9235 4760 or by visiting www.airliefundsmanagement.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of an Airlie financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Airlie makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Airlie. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any third party trademarks contained herein are the property of their respective owners and Airlie claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks.. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Airlie. |

10 Aug 2022 - Could a credit crunch be more important than a recession?

|

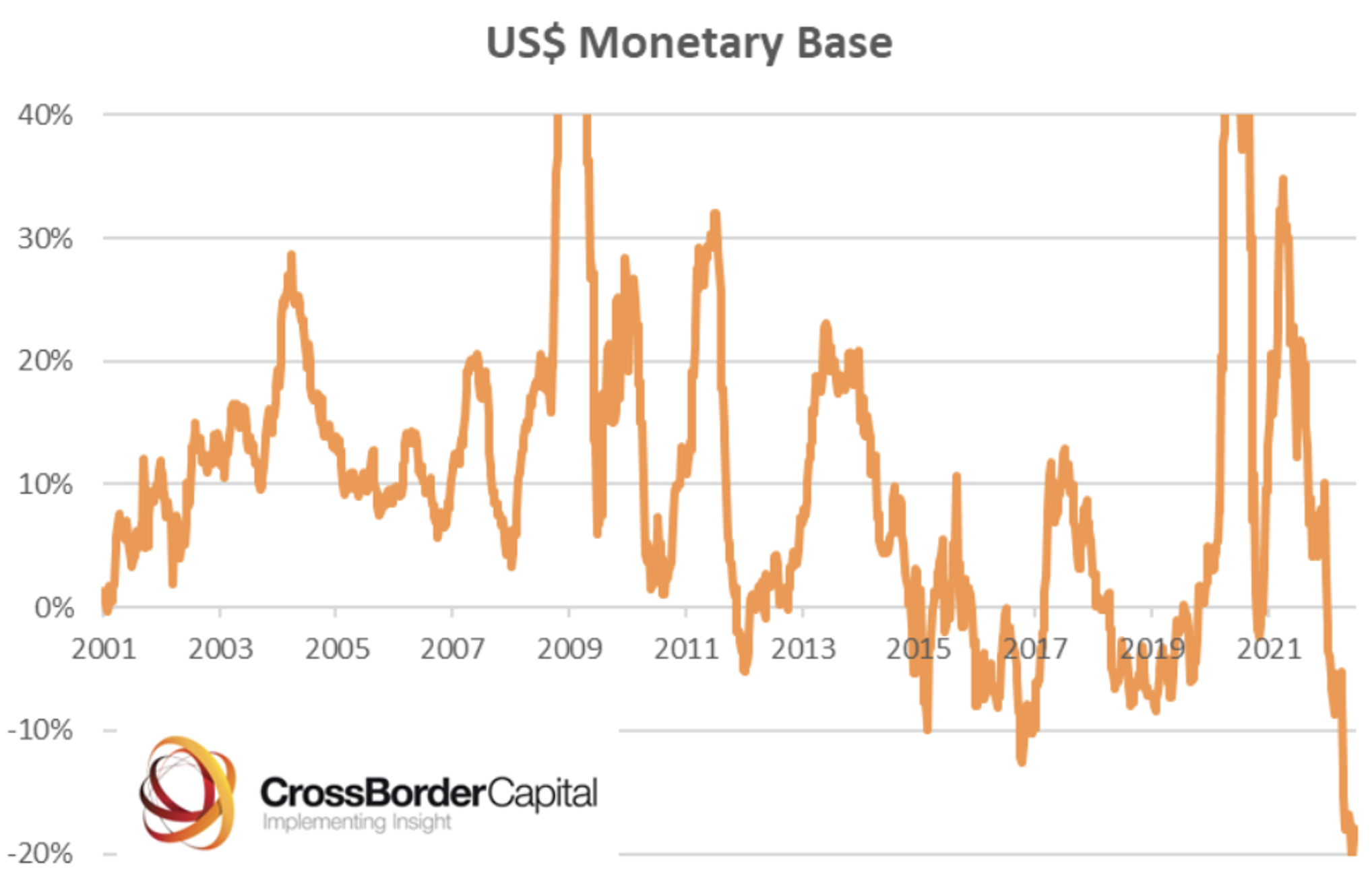

Could a credit crunch be more important than a recession? Montgomery Investment Management 20 July 2022 Some say its two quarters of negative growth. If that's the case, then the Atlanta Fed's GDPNow tool is predicting the U.S. is in a recession. Meanwhile, the U.S. National Bureau of Economic Research says a recession is a significant decline in economic activity that is spread across the economy and lasts more than a few months. If that's the case the 488,000 new jobs created in May would void any assessment of recession. Elsewhere, given inflation is at nine per cent in the U.S., and growth is a far cry from that number, the real economy is going backwards, validating the person-in-the-street's perception of recession. And finally, the U.S. yield curve has just gone negative, confirming an economic slowdown. Central banks are in a quandary Even though economies appear to be losing momentum, inflation remains unacceptably high. And even though we might be near a peak in inflation, the decline is unlikely to be fast enough to placate Central Banks. Consequently, I agree with the idea downside surprises in inflation are the outcome of recession, not an indicator we will avoid one - whatever your definition of recession actually is. The last time U.S. inflation was this high was 1981, but as analyst Ben Carlson points out the circumstances are very different. In 1981, savings accounts offered a 10 per cent yield (today they provide a one per cent yield). Mortgage rates then were 17 per cent, today they are five per cent. In 1981 U.S. treasury bond yields were 13 per cent, today they are at three per cent. And finally, Robert Shiller's Cyclically Adjusted P/E ratio was just eight times in 1981. Today it's still at 28 times. There are a multitude of differences today to any other time in history. Searching the past to discern what happens next may be a fools errand. Instead, I believe it is most important to look to liquidity. Giant swings in the availability of money, especially in modern debt-based financial systems, do more to explain the vicissitudes of markets than macroeconomics. And on that front, Crossborder Capital's chart of the liquidity cliff in the supply of the USD worldwide, including off-shore, suggests a major credit crunch is ahead.

Source: Crossborder Capital And according to Michael Howell, "The economic cost of this big liquidity squeeze is world recession" adding "Central Banks are making a major error by hammering down too hard on the brake. World recession is inevitable." Meanwhile the U.S. Treasury yield curve is seeing collapsing term premia. The term premium is the amount by which the yield on a long-term bond is greater than the yield on shorter-term bonds. Collapsing premia means short term rates are rising at a higher rate than long term rates. The mix of higher front-end rates raises cost of capital for corporates, while lower rates at the long end of the yield curve reflects meaningful demand for safe assets. In other words, no appetite for riskier corporate debt. In combination, it suggests a credit crunch is afoot. It's arguably much more important than whether we are heading for a recession - whatever your definition. Author: Roger Montgomery, Chairman and Chief Investment Officer Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund |

9 Aug 2022 - Performance Report: Argonaut Natural Resources Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | At times, ANRF may consider holding higher levels of cash (max 30%) if valuations are full and it is difficult to find attractive investment opportunities. The Fund does not borrow for investment or any other purposes, but it may short sell securities as part of its portfolio protection strategies. |

| Manager Comments | The Argonaut Natural Resources Fund has a track record of 2 years and 7 months and therefore comparison over all market conditions and against its peers is limited. However, the fund has outperformed the ASX 200 Total Return Index since inception in January 2020, providing investors with an annualised return of 43.06% compared with the index's return of 4.93% over the same period. On a calendar year basis, the fund hasn't experienced any negative annual returns in the 2 years and 7 months since its inception. Over the past 12 months, the fund's largest drawdown was -19.06% vs the index's -11.9%, and since inception in January 2020 the fund's largest drawdown was -19.06% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in April 2022 and has lasted 3 months, reaching its lowest point during June 2022. During this period, the index's maximum drawdown was -11.9%. The Manager has delivered these returns with 3.92% more volatility than the index, contributing to a Sharpe ratio for performance over the past 12 months of 1.5 and for performance since inception of 1.65. The fund has provided positive monthly returns 81% of the time in rising markets and 40% of the time during periods of market decline, contributing to an up-capture ratio since inception of 196% and a down-capture ratio of 34%. |

| More Information |

9 Aug 2022 - Activism by prominent Australians

9 Aug 2022 - Will falling house prices tip Australia into a recession?

|

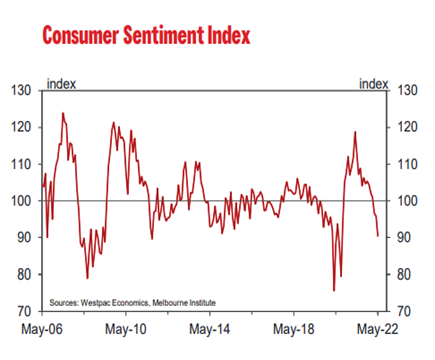

Will falling house prices tip Australia into a recession? WaveStone Capital 25 July 2022 With the RBA tightening cycle firmly underway, the impact for Australian households is only starting to be felt. Dwelling prices are falling most notably in Sydney and Melbourne where 39% of households reside but have 53% of total housing debt1. The pace of rate hikes is at levels not seen since 1994 and combined with rising energy costs and higher food prices it is not surprising that consumer sentiment has fallen sharply as shown in the chart below.

What does this mean for consumer spending and is a recession on the cards?Relative to other developed markets, Australia's economy has been strong; boosted by high commodity prices, lower relative interest rates, a weak Australian dollar and solid household balance sheets. A lower exposure to long duration technology stocks (which have been hardest hit) has also provided some insulation from the global equity sell-off. For the six months ending June 30, 2022, the total return for ASX300 is -10.4% compared to -20% for the S&P500 and -20.3% for MSCI World. Looking forward from here, vulnerabilities are apparent and none more so than in the housing market. Having spoken to bank executives, real estate businesses and developers over the past year, we expect a contraction in the housing market. The evidence is mounting even though price falls have been modest thus far.

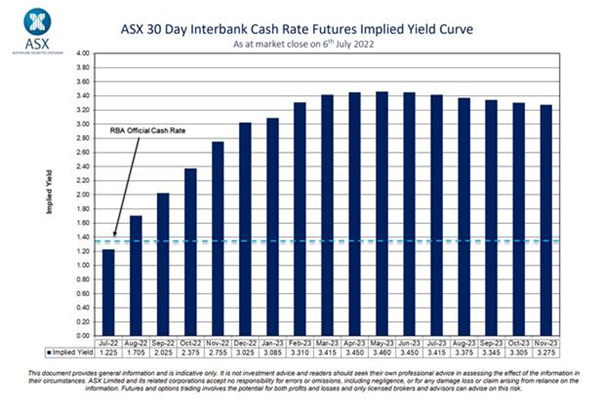

However, in our view, the outlook is not as grim as media reports would suggest with a fall of 15% likely over the next 18 months. This is due to the expected influx of immigration now that borders are open as well as the structural shortage of housing stock which puts a floor on house prices. While a 15% fall in the housing market would be material, there is also a wealth effect to consider. The magnitude of the hikes is massive at the margin. Even for those who do not face mortgage stress, higher mortgage payments dent consumer confidence and spending. The consequences are wide-reaching with impacts for the banking sector, construction, and ancillary businesses such as law firms and architects. Further, there is a significant refinancing event looming in 2023 as a large swathe of fixed rate loans roll off and many households will face a 40% increase in their repayments as they move to variable rates (based on current rates). History teaches us that tightening cycles usually lead to a de-rating of P/E multiples for the banking sector. While steady interest rate rises are seen as a positive tailwind, with every 25bps increase leading to a 1-2bps positive boost to net interest margins, the sheer pace of the current increases creates a different outlook. While the banking sector is already down by 10% since the start of June, and has underperformed the broader market, looking forward the downturn in the housing market will lead to lower credit growth, lower margins and higher bad and doubtful debts. According to Jarden Research, new home growth leads bank share prices by approximately 3 months and bank share prices lead house prices by 5 months given the lag in house price data and the forward-looking nature of markets. A de-rating of major bank share prices occurred in Australia during the 1999-2000 and 2009-2010 cycles when multiples fell by an average of 2.0x in the first three months after the first hike and 4.2x by the time of the last hike2. New Zealand, which is further ahead of Australia on rates is already experiencing a slowdown in credit growth. While Australian banks are well capitalised with very strong balance sheets, the medium-term outlook for their share prices will be negatively impacted by a housing downturn. A slump in consumer discretionary spending is expected as households tighten their belts. The question for investors is how much of this is already priced in? Many stocks in this sector have already fallen significantly as consumers have shifted their spending from goods to services and earnings have normalised. Despite this, in our view, the consensus forecasts for FY23 and FY24 are still too optimistic. We have not seen earnings downgrades yet and this could occur in the coming weeks. While reporting season is likely to show strong results on a historical basis, analysts will focus their attention on forward looking guidance for earnings - or lack thereof. For retailers, in addition to the rising cost of debt, analysts will be watching inventory levels. In many cases, inventory levels have been rising as supply chain issues ameliorate and are indicative of falling demand. The US provides a good indicator of the outlook for Australia given their rate hiking cycle and emergence from pandemic lockdowns is about 6 months ahead of Australia. What is evident is that retail is struggling with rising mortgage costs impacting consumers spending patterns. This is most evident for furniture, electronics and hardware sales which are highly correlated with housing growth. Whether or not we get a recession in Australia will depend largely on how aggressive the RBA is in raising rates. A neutral rate of 2.5% for example would dramatically impact borrowing capacity. Future inflation prints will determine whether the RBA stops there, and time will tell whether the current level of pessimism is overdone. As shown in the chart below, the market is expecting rates to peak in May 2023 with softer economic growth leading to rate cuts thereafter.

We have assessed the implications of a downturn in the housing market and falling consumer spending for investee companies on a bottom-up basis. We are underweight sectors such as financials and property trusts as well as those retailers more likely to be impacted by lower discretionary spending. We have long been overweight healthcare, which has proven to be resilient in previous downturns. |

|

Funds operated by this manager: WaveStone Australian Share Fund, WaveStone Capital Absolute Return Fund, WaveStone Dynamic Australian Equity Fund 1 Source: Macquarie, July 20222 Source: Morgan StanleyThis material has been prepared by WaveStone Capital Pty Limited (ABN 80 120 179 419 AFSL 331644) (WaveStone). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon. Past performance is not a reliable indicator of future performance. Neither any particular rate of return nor capital invested are guaranteed. |

8 Aug 2022 - Performance Report: ASCF High Yield Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Does not require full valuations on loans <65% LVR. Borrowing rates are from 12% per annum on 1st mortgage loans and 16% per annum on 2nd mortgage/caveat loans. Pays investors between 5.55% - 6.25% per annum depending on their investment term. |

| Manager Comments | The ASCF High Yield Fund has a track record of 5 years and 5 months and has outperformed the Bloomberg AusBond Composite 0+ Yr Index since inception in March 2017, providing investors with an annualised return of 8.56% compared with the index's return of 1.69% over the same period. On a calendar year basis, the fund hasn't experienced any negative annual returns in the 5 years and 5 months since its inception. Over the past 12 months, the fund hasn't had any negative monthly returns and therefore hasn't experienced a drawdown. Over the same period, the index's largest drawdown was -12.13%. Since inception in March 2017, the fund's largest drawdown was 0% vs the index's maximum drawdown over the same period of -12.4%. The Manager has delivered these returns with 3.96% less volatility than the index, contributing to a Sharpe ratio which has consistently remained above 1 over the past five years and which currently sits at 22.31 since inception. The fund has provided positive monthly returns 100% of the time in rising markets and 100% of the time during periods of market decline, contributing to an up-capture ratio since inception of 79% and a down-capture ratio of -78%. |

| More Information |

8 Aug 2022 - The Rate Debate: Can the RBA thread the needle?

|

The Rate Debate - Episode 30 Can the RBA thread the needle? Yarra Capital Management 03 August 2022 After hiking for the fourth consecutive month, the RBA's tone has shifted to suggest a pause at the September meeting is possible, reflecting in part the troubling signals emanating from markets as the US teeters on the brink of recession and conditions continue to cool across the globe. As lead indicators continue to flash red - consumer confidence remains at alarming levels and housing is rolling over - can Australia's central bank successfully thread the needle and avoid an outright stalling of the Australian economy?

Speakers: |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

8 Aug 2022 - 2 quality stocks for when the tide goes out

|

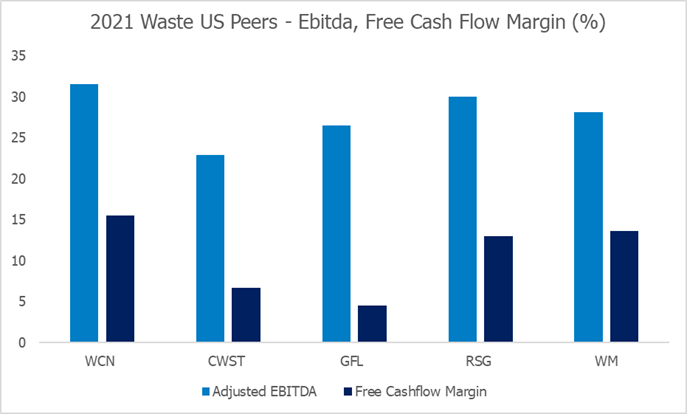

2 quality stocks for when the tide goes out Alphinity Investment Management 25 July 2022 Warren Buffett famously said that "only when the tide goes out do you discover who has been swimming naked." We have been hitting lower tides in recent months as the world of 'free money' comes to an end, which is exposing 'naked' companies and assets that have crashed. The low tide is however also highlighting great companies with strong management teams that are suited up to steer their customers - and investors - to safety during these difficult times. Great management teams can navigate challenging periods like the present and come out stronger on the other side. There are many examples of best-in-class management teams represented across our Global and Australian funds and several management teams that have specifically done a phenomenal job managing the increasing risks. Some Australian examples include Goodman Group, Super Retail Group, CBA, Medibank, and Orora Group. On the global side, we can commend the teams at McDonalds, PepsiCo, Diageo, and Waste Connections. Below we look at 2 lesser-known domestic and global management teams. 1. Waste Connections (WCN) - Pragmatic & differentiatedWaste Connections is the 3rd largest solid waste services company in North America. They provide non-hazardous waste collection, transfer, and disposal services to millions of customers across the US and Canada. WCN was founded by the current Chairman and this entrepreneurial culture runs deeply through the organization. WCN runs a decentralised structure where decisions and PNL responsibility is pushed out of HQ and down into the operating businesses around the country. You often see this type of management structure in Scandinavian capital goods companies, but we rarely see it in the US. If done well, it creates a dynamic and flexible business that can respond rapidly to a changing environment. With the challenges that the waste companies have faced over the past 6 months, this approach has been a meaningful advantage for Waste Connections. We see the outcomes of this decentralisation through their industry leading margins and cashflow generation. WCN has industry-leading profit margins

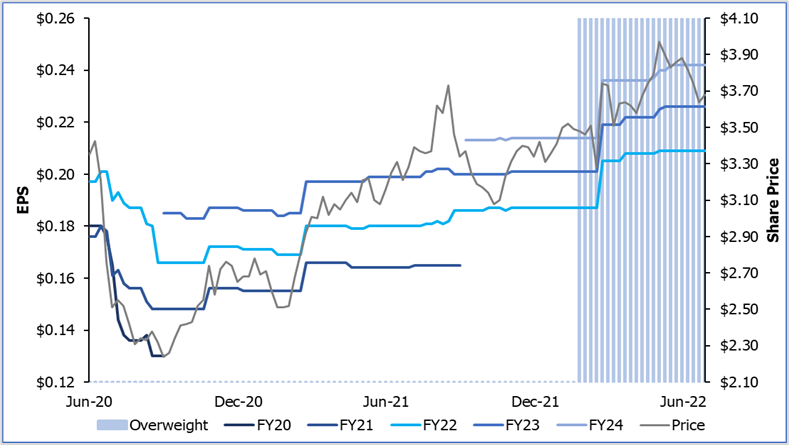

Source: Bloomberg Further, the company generally seeks to avoid highly competitive, large urban markets and instead management target markets where they can attain high market share either through exclusive contracts, vertical integration, or asset positioning. WCN defines their markets as either "competitive" or "exclusive/franchise" based. Competitive markets are markets where pricing is a function of supply & demand and WCN deliberately focus on the underserved markets, which are less competitive. This affords WCN very strong pricing power and market shares. The remaining 40% of revenues are generated from markets they serve on an exclusive/franchise model basis, where pricing for contracts is done on a CPI-like or returns based basis. Similar to its peers, WCN has faced numerous challenges of late, including input price pressures (fuel spikes), labour shortages/higher wages (with drivers and mechanics extremely sought-after) and truck shortages to name a few. Despite this, they are managing the business well and continuing to execute on their strategy. At their recent results management achieved very strong pricing outcomes, talked to building M&A momentum, and maintained their full year FCF guidance. Waste Connections is a stable, defensive grower with an enviable track record worth backing in our view. 2. Orora (ORA) - Optimise, enhance & investOrora (ORA) is an Australia-based company that provides packaging products and services. It manufactures glass bottles and beverage cans in Australia and manages a medium sized packaging distribution services in North America. From China wine tariffs to old legacy IT systems to higher input cost pressures, the ORA team has not had a shortage of challenges to deal with over the last few years. In response, they have addressed each of their challenges in a logical and systematic way and announced a clear growth strategy for the next few years. Over the last few years, ORA has done a complete SAP integration process in the US that after some significant implementation challenges are now resulting in improved operational efficiencies and management of input cost pressures. They have also implemented a mix shift towards higher product-to-package ratios (for example the recent contract with Tesla for car parts) and enhanced their digital capabilities through an e-commerce custom design platform and diversified their product portfolio. ORA -- A quality, defensive enjoying earnings upgrades

Source: Alphinity, Bloomberg, 28 June 2022 ORA has also been able to find low risk capacity expansion opportunities such as beverage cans in Australia. Following a thorough review of some poorly judged and executed acquisitions in the US by previous management the company believes they are now ready to look at new M &A opportunities. While not without risk we would back management given their conservative approach and successful management of the company since taking the reins. Finally, and importantly, ORA is pivoting investment towards more sustainable products and operations with a clear commitment and path to net zero greenhouse gas emissions by 2050. Despite the tough environment, ORA has recently reiterated their guidance for FY22 EBIT to be higher than FY21. In combination with a robust balance sheet, meaningful returns to shareholders (both dividends & buybacks) and attractive Return on Capital (25%), we view ORA as a high quality, defensive company in safe hands. Spending more time with managementWhen uncertainty increases and the environment becomes more challenging, we make a concerted effort to spend even more time with the management teams that are steering our investments, to understand their thinking and approach to ongoing and new challenges. We meet with various members of the management teams across seniority levels, responsibilities, and divisions. Our due diligence process also includes site visits and meetings with the company's suppliers, competitors, and clients. Through the ebb and flow of investment cycles, investors should continuously focus on identifying quality management teams that can perform well during high tides, but even better during low tides. Author: Elfreda Jonker, Client Portfolio Manager This information is for adviser & wholesale investors only |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Sustainable Share Fund Disclaimer |