NEWS

2 Sep 2022 - Hedge Clippings |02 September 2022

|

|

|

|

Hedge Clippings | Friday, 02 September 2022 Pendulums swing much like markets do - or maybe that should be the other way around. In the case of a pendulum, the extent of the swing is known as its amplitude, and once reached, it inevitably reverses according to science, returning back through equilibrium to the opposite amplitude. The time it takes to complete the whole cycle is technically known as the period. Yours truly knows this, not from paying attention in science class at school, but thanks to Uncle Google. Where would we be on a Friday without Google to check facts? But back to markets... Markets inevitably swing from one amplitude to the other, however not over a specific period, with the rhythm of science replaced by a multitude of known and unknown unknowns - including human nature and the psychology of greed and fear, economics, inflation, and central banks' reactions. Hence of course why harmonic motion and the pendulum can be taught in a single lesson, but markets continue to baffle and confuse even the experts. The last week has seen a sharp reversal in markets, thanks to comments from Jerome Powell at the Federal Reserve's Annual Jackson Hole Economic Symposium, where he basically said the Fed would do whatever it takes to tame inflation - even at the expense of the US economy being driven into a recession. Markets take notice of central bankers, whether they're right or wrong, and Peter Costello, in his role as Chair of the Future Fund called out our own RBA this week while explaining the fund's negative return of 1.2% for the year to June. The ex Treasurer's criticism may well be valid, but surely the Future Fund has the resources, data, and ability to judge (or understand) when the RBA is heading in the right - or in this case, wrong direction? Not only were the Fed and the RBA "caught napping" in Costello's words, but it sounds like the team at the Future Fund was too. Mind you, plenty of investors and fund managers would have been happy with -1.2% to the end of June 2022. Other pendulums also swing - none more so than politics. The current talkfest in Canberra is a litmus test of the changes following the demise of Scomo in May. Equally in the USA, the swing right to left as Biden replaced Trump heralded a new harmonic motion, although harmony is hardly a word one would use when referring to Trump. This week the death of Mikhail Gorbachev, the last leader of the Soviet Union, also bought into sharp relief the political pendulum's swing in Russia as Putin attempts to turn back the clock and recreate a past empire - preceding even that of the USSR. Putin was no fan of Gorbachev, as evidenced by the fact he reportedly won't attend the funeral. Or could that be on security grounds? Putin's war is not going well - or as well as he had hoped. Russia's great past victories have been repelling invaders (Bonaparte and Hitler) assisted by a long cold winter. This winter will see the boot on the other foot, but assuming no victory either way by Christmas, the long cold winter will see energy shortages across Europe which will certainly test the West's resolve. Finally, while still on Russia, Ravil Maganov dies (officially put down to suicide) as a result of another unfortunate window failure and fall from the 6th floor of a Moscow hospital. Anyone who has read Bill Browder's excellent book "Freezing Order" would understand the likelihood of that! News & Insights New Funds on FundMonitors.com The outlook for equities is unclear | Airlie Funds Management Global equities strengthen | Glenmore Asset Management Outlook Snapshot | Cyan Investment Management |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

2 Sep 2022 - Around the world in 200 meetings

|

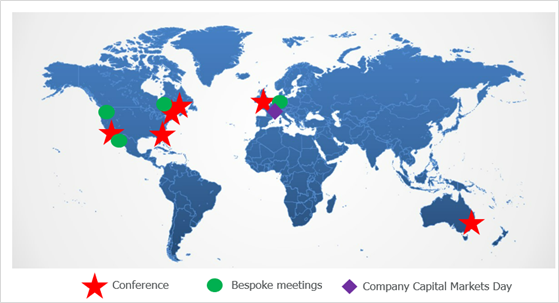

Around the world in 200 meetings Alphinity Investment Management August 2022 The first half of 2022 has been extremely busy for Alphinity's five global portfolio managers. Collectively, they have been on 9 overseas investment trips, travelling to 12 cities across 7 countries, visiting existing and prospective portfolio companies. All in, the team have met with over 200 companies face to face over the past 6 months. Travelling again after two years of Zoom calls is an excellent opportunity to reconnect with corporates, gain valuable on-the-ground insights and find interesting new investment opportunities. In this note we share the key highlights of their respective trips. Including interesting anecdotal stories, notable fundamental themes, and some company specific insights. You can also visit our website for videos with our 5 portfolio managers sharing their key highlights. Alphinity is not currently invested in all the stocks mentioned in this note. Alphinity Global Portfolio Management TeamAround the world in 200 meetings across 12 cities and 7 countriesA few anecdotal stories: long queues, missed flights, labour shortages & increased inequalityGlobal airports, trains, hotels, and restaurants are currently overwhelmed. For every meeting, the team had to navigate long airport queues and of course a much higher price tag to get there. Jeff hit the unwelcome record with every one of his flights delayed or cancelled over a two-week period in Europe. Across in the US, Trent almost got trapped in Santa Rosa after visiting Keysight. Uber coverage has become very patchy outside of the big city centres. At Starbucks he also got bumped from second in the in-store coffee line to 60th. The "order ahead app" option is clearly the new and better way to go! Sadly, not all our on-the-ground insights were positive. Mary observed that COVID has exacerbated the income inequality challenge for America as a society. The increased homelessness is now confronting in many major cities such as Seattle. Unionisation movements and worker demonstrations were also a regular occurrence. From smaller companies (Chipotle) to high-profile companies (Amazon and Starbucks) alike. Fundamental themes across sectors: Supply chains, inventory, labour shortages and a clear delineation between the winners and losersThere were several overarching fundamental themes shared across most of the sectors:

Sector specific insightsConsumer - New York, Seattle & EuropeConsumer spending has remained resilient to date despite consumer sentiment plummeting to levels last seen in the 1900's. With pent-up demand focused on travel, leisure, occasion-based spending (weddings), beauty, entertainment, etc. It's likely that this "revenge spending cycle" won't last very long after the end of the summer holiday season. Low-end consumers are already struggling post the COVID stimulus withdrawal. Higher mortgage rates and deteriorating jobs data will also start to weigh. We continue to prefer exposure to the more resilient high-end consumer at this point in the cycle. A few comments on the sub-sectors below:

Financials - Europe, UK, and CanadaFinancials are facing significant macro challenges. Tailwinds from higher interest rates are offset by growing concerns about slower economic growth, difficult capital markets and potentially higher credit risks. We have recently reduced our exposure to banks on falling earnings momentum, such as Bank of America. We prefer financials that are less geared to rates and offer more defensive characteristics. A few comments on the sub-sectors below:

Technology - San Francisco and BostonThere is also a clear delineation between the winners and losers within the technology sector. Or in the current tech market, we should describe it as the big losers and the lesser losers. Companies exposed to Cloud, 5G and Security are holding up better (Microsoft, ASML). The businesses where the model depended on free and almost limitless external capital, are the big losers (Buy-now-pay-later players, such as Affirm for example). A few comments on the sub-sectors:

Industrials - Europe and UKSupply chains and inventory are front and centre for the industrial players. Feedback from the road suggested that the situation overall remains challenging and highly uncertain, although with some incremental improvements in certain areas. For example, truck manufacturers talked about being back at full production. Despite current cyclical headwinds, it was interesting to note that several sub-industries continue to enjoy strong structural trends. These include decarbonization, electrification, factory automation and, more recently, defence. Ironically the big issues causing a lot of the cyclical headwinds appear to be strengthening the longer-term fundamentals for some of the companies exposed to these thematics. For example, Schneider Electric have seen increased demand and shrinking payback periods for their energy efficient products. Their CEO noted that many of the secular tailwinds underpinning growth are stronger than what they were in January. Companies like ABB, Schneider and Siemens are all beneficiaries of electrification and industrial automation (including robotics). On the sub-sectors:

Health Care - Los AngelesAfter attending the Health Care conference in LA, we maintain our view that the fundamentals of the overall sector remain good, especially relative to the rest of the market. The underlying sub sectors within Health Care have very diverse challenges and drivers. Besides the usual ongoing policy risks (new US reconciliation bill for example), there are also significant FX headwinds for the sector. Multiples also still reflect some growth expectations. On the sub-sectors:

We are happy to be on the road again. The world has changed in positive and negative ways since pre-COVID but we are committed to using on-the-ground meetings and travel insights to hone our understanding of the markets and find exciting, good quality stocks in which to invest. This information is for adviser & wholesale investors only. |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Sustainable Share Fund Disclaimer |

1 Sep 2022 - Is the current rally premature?

|

Is the current rally premature? Montgomery Investment Management August 2022 I believe there are good arguments the current rally is premature and might reverse. Keep in mind I am still long and heavily invested in equities. I just think the current rally has got ahead of itself. First, S&P500 forward earnings estimates are declining. Not by much but definitely in the wrong direction. Back in July the S&P500 was expected to earn $250.70 per share in 2023. Today that number is $243.81. As I say it's only a 2.7 per cent decline but it is a negative. Secondly, while many indicators suggest headline inflation has peaked, it's the core inflation number that matters and that is driven primarily by service inflation, which in turn, is driven by wages. The Federal Reserve Bank of New York's Global Supply Chain Pressure index has rolled over, as has U.S. ISM Manufacturing Supplier Deliveries Index and the ISM Manufacturers Backlog of Orders Index. Prices for dynamic random access memory and shipping (as measured by the Baltic Dry Shipping Index) are also falling, as is the price of oil. These declines indicate pressure on the supply chain is easing which in turn gives goods supply a chance to catch up to demand. Moving towards equilibrium should ease goods inflation. Equity markets have understandably become excited. With inflation peaking, the current wave of central bank interest rate rises might lead to rate cuts next year, especially if the current wave of rises causes a recession. One element of inflation however not considered in the above narrative is the extent to which Core inflation is impacted by services. Services generally make up about 73 per cent of Core CPI. 'Services' is responsible for four per cent of the six per cent Core CPI reading in July. And the biggest cost to services businesses are wages. Wage inflation meanwhile is high. Indeed, in the U.S., private sector wages and salaries have jumped 5.7 per cent, even though the U.S. economy is slowing down. To put this in perspective private sector salaries rose by two per cent in the first quarter of 2016 and by about 1.75 per cent in the first quarter of 2012. Meanwhile, the employment cost index, a figure U.S. Fed policymakers follow closely, rose 1.3 per cent in the second quarter. This index climbed 5.1 per cent over 12 months, which is a record for the data series that commenced in 2002. And the U.S .Federal Reserve's preferred inflation measure, the Personal Consumption Expenditure price index set a new 40 year high in June. All that tells me is that inflation could prove to be more persistent than the market currently hopes. Of course, if inflation is truly 'old' news and on its way down, then it is possible the lows for the bear market have already been seen. If, on the other hand, the market's current optimism about an end to rate hikes this year and the beginning of rate cuts next year proves unfounded, or even premature, then the current rally is also premature, and investors may yet see another reversal in prices. Finally, keep an eye on global liquidity. Liquidity matters far more than interest rates when debts need refinancing. Currently, the pace of balance sheet unwinding has slowed. The U.S. Fed paused its liquidity squeeze in July, providing a fillip to equity markets. But all major world central banks are in tightening mode, as are 90 per cent of emerging market central banks. Large balance sheet declines are equivalent to material increases in interest rates. According to some analysts, if the U.S. Fed hits its US$6.5 trillion balance sheet target, it will be equivalent to an effective U.S. Fed Funds rate of nearly eight per cent. If the Fed resumes its stated 30-month QT program, further declines in liquidity can be expected. As a net buyer of stocks, we look forward to the opportunity to add to investors' portfolios at cheaper prices. And being near fully invested now, we also look forward to higher prices. Stay tuned. Author: Roger Montgomery, Chairman and Chief Investment Officer Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund |

1 Sep 2022 - Quay Global Podcast - Investment Perspectives: 12 charts we're thinking about right now

|

Quay Global Podcast - Investment Perspectives: 12 charts we're thinking about right now Quay Global Investors August 2022 |

|

Chris Bedingfield speaks with Holly Old about the team's latest - and highly popular - Investment Perspectives article, 12 charts we're thinking about right now.

Speakers: Chris Bedingfield, Principal and Joint Managing Director

|

|

Funds operated by this manager: The content contained in this audio represents the opinions of the speakers. The speakers may hold either long or short positions in securities of various companies discussed in the audio. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the speakers to express their personal views on investing and for the entertainment of the listener. |

31 Aug 2022 - Market volatility creates opportunities

|

Market volatility creates opportunities L1 Capital August 2022 WEBINAR REPLAY | L1 Capital International Fund | August 25, 2022 David Steinthal, CIO of L1 Capital International, provides an update on the positioning of the L1 Capital International Fund and key takeaways from recent results season. • Investment environment (0.45) • Performance and Portfolio recap (4.26) • Results season - Key takeaways (9.12) • Summary (23.13) • Q&A (24.17) Funds operated by this manager: L1 Capital Long Short Fund (Monthly Class), L1 Capital International Fund, L1 Capital Long Short Fund (Daily Class), L1 Long Short Fund Limited (ASX: LSF), L1 Capital Catalyst Fund, L1 Capital Global Opportunities Fund |

30 Aug 2022 - Fund Review: Bennelong Twenty20 Australian Equities Fund July 2022

BENNELONG TWENTY20 AUSTRALIAN EQUITIES FUND

Attached is our most recently updated Fund Review on the Bennelong Twenty20 Australian Equities Fund.

- The Bennelong Twenty20 Australian Equities Fund invests in ASX listed stocks, combining an indexed position in the Top 20 stocks with an actively managed portfolio of stocks outside the Top 20. Construction of the ex-top 20 portfolio is fundamental, bottom-up, core investment style, biased to quality stocks, with a structured risk management approach.

- Mark East, the Fund's Chief Investment Officer, and Keith Kwang, Director of Quantitative Research have over 50 years combined market experience. Bennelong Funds Management (BFM) provides the investment manager, Bennelong Australian Equity Partners (BAEP) with infrastructure, operational, compliance and distribution services.

For further details on the Fund, please do not hesitate to contact us.

30 Aug 2022 - Outlook Snapshot

|

Outlook Snapshot Cyan Investment Management July-August 2022 |

|

Outlook |

|

Funds operated by this manager: Cyan C3G Fund |

30 Aug 2022 - Nuclear energy is a promising solution for climate change

|

Nuclear energy is a promising solution for climate change Magellan Asset Management August 2022 |

|

Fukushima, on the northeast of Japan's largest island, is vulnerable to earthquakes and tsunamis. From 1971, the area hosted the Daiichi nuclear plant. Based on global appraisals of tsunamis, the facility was built 10 metres above sea level. The commercial plant and others ensured nuclear energy supplied 30% of Japan's power needs.[1] That is until an earthquake of magnitude 9.0 on the Richter scale struck in 2011. An ocean surge, which peaked offshore at 23 metres, was still 15 metres high when it swamped three reactors at the Daiichi plant. Radioactive material escaped for six days. More than 2,300 people died and over 100,000 were evacuated.[2] Japan was paralysed by what the chairman of a parliamentary inquiry described as "a profoundly man-made disaster".[3] Tokyo reacted to the alarm of a public who watched on TV as the tsunami smashed into land. Within a year, only one of Japan's 54 nuclear reactors was operating. Enthusiasm for nuclear power, which reached a peak of 17% of global energy production in 1996,[4] dimmed around the world.[5] Germany immediately decided to phase out its 17 nuclear plants by 2022. Only three remain but it looks like Europe's energy crisis could delay their closure. In the rest of Europe, the drive to nuclear power stalled such that Italy, Lithuania and nearby Kazakhstan have ditched nuclear while Finland in March opened the continent's first new nuclear plant in 15 years. The US has opened only one reactor (in 2016) since 1996. Reduce one risk but still face another. That danger is climate change. The UN-overseen Intergovernmental Panel on Climate Change warned in April the world is "at a crossroads" in its quest to halve emissions by 2030 to limit the rise in the earth's temperature.[6] The obstacles? Voters oppose carbon taxes. Renewable energy is struggling to match fossil fuels as a source of 'baseload' power on reliability and cost. Declining investment in fossil fuels has boosted hydrocarbon prices. Russia's invasion of Ukraine in February further bolstered oil and gas prices while exposing Europe's reliance on Russian energy as a liability. 'Energy security' has gained renewed political significance. What to do? A large part of the answer could be nuclear energy, which is generated in a process known as fission - when uranium or plutonium atoms are split to release heat that makes steam to spin turbines.[7] Even though radioactive waste is produced during fission that can last forever,[8] policymakers are talking of adding to the 439 reactors in operation across 32 countries (while another 54 reactors are being built) that still supply about 10% of the world's energy needs.[9] The talk is generating action. The US in April announced a US$6 billion effort to prevent more closures among the country's 94 reactors sprinkled across 56 plants that make the US the world's largest generator of nuclear power. Since 2013, 12 US reactors have closed 'early' and another 11 reactors are scheduled to shut by 2025.[10] Nuclear power, first tapped in the US in 1958, has supplied about 20% of US electricity generation since 1990.[11] Europe too is reemphasising nuclear. The UK in April said it would build as many as eight new nuclear plants by 2030.[12] In February before Ukraine was invaded, French President Emmanuel Macron said the world's second-most nuclear-powered country (56 reactors that supply 70% of the country's electricity) needed 14 new reactors by 2050.[13] Earlier the same month, the European Commission added nuclear energy to a list of sustainable energy sources that are valid replacements for fossil fuels.[14] In July, the European Parliament backed the EC decision.[15] Asia hosted all the world's new nuclear capacity in 2021 and more is coming.[16] It's easy to see why leaders are attracted to nuclear energy. As long as countries can source uranium or plutonium, the nuclear option offers energy self-sufficiency and is the lowest-cost greenhouse-gas-free energy - one that is cheaper than all but the lowest-cost fossil fuels. OECD analysis, which assumes long-lasting nuclear plants will spread fixed costs and adds a carbon price of US$30 per tonne of CO2 onto the cost of fossil fuels, estimates nuclear energy could cost as little as US$30 a megawatt hour compared with US$45 for gas and US$75 for coal.[17] Two promising developments could make nuclear more appealing. The first is the coming of commercial mini-nuclear reactors.[18] These mini-reactors would produce between 300 megawatts (small) and 700 megawatts (medium) of power compared with at least 1,000 MW electrical (MWe) produced by standard-sized reactors. The advantages of mini-reactors are lower initial capital costs, less-complex design and that they take only four years to build rather than the decade needed for standard facilities. Mini-reactors can be built and shipped, thus are a better option for remote areas. They are safer because they require no manpower or electricity to shut down.[19] They produce less waste. They are cheaper to decommission. The International Atomic Energy Agency says there are about 50 designs for mini-reactors and four are close to being finished in Argentina, China and Russia.[20] Rolls-Royce says it can have 470 MWe mini-reactors connected to the UK grid by 2029.[21] The second development is nuclear fusion. Whereas in nuclear fission an atom is split, fusion is combining atoms (using special hydrogen, deuterium and tritium as fuel). When fusion occurs, the difference in mass between nuclei and the newly formed heavier-but-lower-mass atom is released as energy. It takes special machines (tokamaks) or lasers to generate the intense heat and powerful magnetic forces required to produce an energy so powerful that one litre of fusion fuel matches 55,000 barrels of oil for energy.[22] Breakthroughs are occurring in mimicking the energy source of the Sun and stars. In the UK in February, a fusion reactor produced a world record of 59 megajoules of heat energy over five seconds, more than double the previous record of 22 megajoules set in 1997.[23] In the US last September, a superconducting magnet needed in fusion broke magnetic field strength records during trials.[24] A month earlier in the US, laser light created enough heat to generate a record yield of laser fusion; 10 quadrillion watts of fusion power for 100 trillionths of a second.[25] Aside from producing greenhouse-gas-free energy, fusion comes with two other notable advantages. One is that fusion eradicates the risk of a nuclear meltdown because, if disturbed, the process stops. The other is that no radioactive waste is produced. Fusion research is expensive, however, and advances whereby fusion reactors offer the world affordable power seem far off and might never happen. That's the best hope too for the devastation that nuclear energy risks. Accidents that include Three Mile Island in the US in 1979, Chernobyl in the former Soviet Union in 1986 and Fukushima are blamed on human error. A possible calamity occurred in March when Russian shelling started a fire at the Zaporizhzhia nuclear plant in Ukraine, which with six reactors is Europe's largest. The incident highlighted the vulnerability of nuclear facilities to war, terrorism, suicidal rage or rogue states turning a nuclear plant into a military base, as Russia has now done with Zaporizhzhia.[26] Many say ageing nuclear facilities pose a threat. Nearby Germans have long had concerns about the state of the Tihange nuclear plant in Belgium. The regional German government has called for the plant to be closed.[27] Nuclear energy's risk tied to the internet age is cybersecurity. The US and Israel in 2010 used Stuxnet malware to interfere with Iran's Natanz plant while a nuclear plant in Germany was reported to have suffered a "disruptive" cyberattack about a decade ago.[28] While the threat might be exaggerated by opponents of nuclear energy, it adds to political challenges of gaining public support for the nuclear option.[29] Even with all the risks, nuclear energy is an established source of power that will gain traction as an answer for climate change, especially if more technological leaps are made. Nuclear energy might be most notable for how its adoption will vary across countries as communities judge their tolerance for the risks surrounding the most-promising energy solution to mitigate global warming. To be sure, nuclear is not touted as the sole solution for climate change. Leaps in renewable technology or its economics could undermine the need for nuclear. But the reverse could apply too. The shift to more nuclear could take too long to contain the rise in the earth's temperature to 2 degrees Celsius. Nuclear energy, with its huge initial investment, might never match the lowest-cost fossil fuels, especially if plants are excessively regulated to soothe public concerns about safety. Some countries such as Australia and Germany are against nuclear though the energy crisis could change that.[30] Russia exports nuclear technology so its isolation might slow the industry's development. Any nuclear-building spree comes with risks and no doubt cost overruns (a problem too when upgrading ageing facilities). Against this, only three notable accidents in more than six decades is a fair safety record for any industry. Energy security is what gives nuclear energy fresh appeal. Expect more policymakers to push for nuclear. It's just that the next nuclear mishap - and human error, even malevolence, almost guarantees one - might, Fukushima-style, set back the best option to mitigate climate change on every measure but safety. Heavier but less mass Tokamak is a Russian acronym that stands for the 'toroidal chamber with magnetic coils' that was developed in the Soviet Union in the late 1960s. The machine contains a large doughnut-shaped vacuum chamber where a few grams of hydrogen fuel are heated to 150 million degrees Celsius to form a substance known as plasma. This substance allows electrons to roam between different nuclei so they can collide and fuse. The challenges include having sufficient plasma particle density to increase the likelihood that collisions occur and enough confinement time to hold the plasma, which has a propensity to expand, within a defined volume. Within the tokamak, magnetic fields are used to confine and control the plasma.[31] The process is seeking to capitalise on the insights of UK physicist Arthur Eddington (1882-1944).[32] Eddington observed that four hydrogen atoms weigh more than one helium atom. He surmised that if four hydrogen nuclei were fused then some mass must be lost in the process. According to Einstein's famous equation E=MC2, that lost mass must become energy that amounts to the mass lost multiplied by the speed of light. Eddington's brilliance, as revealed in his book Internal constitution of the stars in 1925, was he deduced that hydrogen crashing into hydrogen to form helium under immense gravitational forces is how the Sun and stars produce energy (shine).[33] The hope of many scientists nowadays is that nuclear fusion is the solution to climate change, even the world's energy needs. Many have tried since the explosion of a hydrogen bomb in 1952 to crack nuclear fusion as a source of power. The world's biggest experiment underway to achieve nuclear fusion is the International Thermonuclear Experimental Reactor, or ITER, Project that groups China, the EU, India, Japan, Korea, Russia and the US. ITER's first plasma experiment is scheduled for 2025, 15 years after building the facilities began on a site in the south of France. With 10 times the plasma volume of the largest machine operating now, the ITER tokamak is designed to move on from small-scale fusion experiments. The key quest is to get fusion to reach the point where the energy output from the fusion reaction matches the energy needed to create the conditions that sustain the fusion reaction. A later goal of ITER is to attain 10 times the energy output, which would mean that 50 megawatts of heating power could become 500 megawatts of fusion power.[34] If scientists at ITER or elsewhere achieve these and other feats, nuclear fusion could well power the world. No breakthroughs away from ITER appear imminent while the ITER results won't be known for decades and might prove fruitless. In the meantime, nuclear fission conducted in mini-reactors might be the best option for those countries willing to risk using nuclear power to combat climate change. Number of nuclear reactors by country Author: Michael Collins, Investment Specialist |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund [1] World Nuclear Association. 'Fukushima Daiichi disaster.' Updated April 2021. world-nuclear.org/information-library/safety-and-security/safety-of-plants/fukushima-daiichi-accident.aspx [2] The earthquake and tsunami are estimated to have killed nearly 20,000 people. [3] The National Diet of Japan. 'Official report of the Fukushima Nuclear Accident Independent Investigation Commission.' 2012. Chairman Kiyoshi Kurokawa. Page 9. web.archive.org/web/20120710075620/http://naiic.go.jp/wp-content/uploads/2012/07/NAIIC_report_lo_res.pdf [4] Britannica. 'Nuclear power.' britannica.com/technology/nuclear-power. See also International Atomic Energy Agency. 'Nuclear power status in 1996.' 24 April 1997. iaea.org/newscenter/pressreleases/nuclear-power-status-1996 [5] See Bulletin of Atomic Scientists. 'Nuclear power and the public.' 3 August 2011. thebulletin.org/2011/08/nuclear-power-and-the-public/ t [6] Intergovernmental Panel on Climate Change. Sixth assessment report. Media release. 'The evidence is clear: The time for action is now. We can halve emissions by 2030.' 4 April 2022. ipcc.ch/report/ar6/wg3/resources/press/press-release/ [7] See 'Nuclear 101: How does a nuclear reactor work?' US Department of Energy. 29 March 2021. energy.gov/ne/articles/nuclear-101-how-does-nuclear-reactor-work [8] Plutonium-239 has a half-life of 24,000 years while strontium-90 and cesium-137 have half-lives of about 30 years (half the radioactivity will decay in 30 years). See US Nuclear Regulatory Commission. Last reviewed 23 July 2019. nrc.gov/reading-rm/doc-collections/fact-sheets/radwaste.html [9] IAEA. 'The database on nuclear power reactors.' World statistics. These reactors amount to 393,818 megawatt electrical total net installed capacity, while those being built promise 53,744 MWe more capacity. In Asia, countries building reactors are China (16 under construction), India (six), Japan (two to add to 33 operational reactors), and Korea (four). Two more countries are poised to host nuclear power when the plants under construction are built. Last updated 18 July 2022. pris.iaea.org/pris/ [10] US Department of Energy. 'DOE seeks applications, bids of $6 billion civil nuclear credit program.' 19 April 2022. energy.gov/articles/doe-seeks-applications-bids-6-billion-civil-nuclear-credit-program [11] US Energy Information Administration. 'Nuclear explained. US nuclear industry.' Last updated 21 April 2021. Figures are for the end of 2020. eia.gov/energyexplained/nuclear/us-nuclear-industry.php [12] BBC. 'Energy strategy: UK plans eight new nuclear reactors to boost production.' 7 April 2022. bbc.com/news/business-61010605. See UK government. 'Nuclear energy: What you need to know.' 6 April 2022. gov.uk/government/news/nuclear-energy-what-you-need-to-know [13] France 24 news services hosting article by Agence France-Presse. 'Macron calls for 14 new reactors in nuclear 'renaissance'. 10 February 2022. france24.com/en/live-news/20220210-macron-calls-for-14-new-reactors-in-nuclear-renaissance [14] European Commission. 'EU Taxonomy: Commission presents Complementary Climate Delegated Act to accelerate decarbonisation.' 2 February 2022. ec.europa.eu/commission/presscorner/detail/en/ip_22_711 [15] European Parliament. 'Taxonomy: MEPs do not object to inclusion of gas and nuclear activities.' 6 July 2022. europarl.europa.eu/news/en/press-room/20220701IPR34365/taxonomy-meps-do-not-object-to-inclusion-of-gas-and-nuclear-activities [16] IAEA. 'Nuclear power reactors in the world.' 2022 edition. pub.iaea.org/MTCD/Publications/PDF/RDS-2-42_web.pdf. Page 2. [17] Organisation of Economic Cooperation and Development with the International Energy Agency and the Nuclear Energy Agency. 'Projected costs of generating electricity 2020 edition.' Page 14. oecd-nea.org/upload/docs/application/pdf/2020-12/egc-2020_2020-12-09_18-26-46_781.pdf. See World Nuclear Org. 'Economics of nuclear power.' Updated September 2021. world-nuclear.org/information-library/economic-aspects/economics-of-nuclear-power.aspx [18] The US military first used smaller reactors in 1962. World-nuclear.org. 'Small nuclear power reactors.' Updated December 2022. world-nuclear.org/information-library/nuclear-fuel-cycle/nuclear-power-reactors/small-nuclear-power-reactors.aspx [19] TIME. 'As Putin threatens nuclear disaster, Europe learns to embrace nuclear energy again.' 22 April 2022. time.com/6169164/ukraine-nuclear-energy-europe/. See 'Table 1. Safety enhancement and cost reduction benefit-challenges analysis.' Page 16. International Atomic Energy Agency TECDOC series. 'Benefits and challenges of small modular fast reactors.' 2021. pub.iaea.org/MTCD/Publications/PDF/TE-1972web.pdf [20] International Atomic Energy Agency. 'Small modular reactors.' iaea.org/topics/small-modular-reactors [21] 'Green light for mini-nuclear reactors by 2024, says Rolls-Royce.' The Telegraph of the UK. 19 April 2021. telegraph.co.uk/business/2022/04/19/green-light-mini-nuclear-reactors-2024-says-rolls-royce/ [22] Bloomberg News. 'Nuclear fusion could rescue the plant from climate catastrophe.' 29 September 2019. bloomberg.com/news/features/2019-09-28/startups-take-aim-at-nuclear-fusion-energy-s-biggest-challenge. For the same mass of material, fusion produces four times more energy than fission. International Thermonuclear Experimental Reactor, or ITER, Project. 'Advantages of fusion.' Undated. iter.org/sci/Fusion [23] ITER Newsline. JET makes history, again.' 14 February 2022. org/newsline/-/3722 [24] Massachusetts Institute of Technology. 'MIT-designed project achieves major advance towards fusion energy.' 8 September 2021. news.mit.edu/2021/MIT-CFS-major-advance-toward-fusion-energy-0908 [25] National Ignition Facility. 'National Ignition Facility experiment puts researchers at threshold of fusion ignition.' 18 August 2021. llnl.gov/news/national-ignition-facility-experiment-puts-researchers-threshold-fusion-ignition [26] 'Russia's army turns Ukraine's largest nuclear plant into a military base.' The Wall Street Journal. 5 July 2022. wsj.com/articles/russian-army-turns-ukraines-largest-nuclear-plant-into-a-military-base-11657035694 [27] John Kampfner. 'Why Germans do it better.' Atlantic Books. Paperback edition 2021. Pages 252 to 253. [28] Infosec. 'Cyberattacks against nuclear plants: A disconcerting threat.' 14 October 2016. resources.infosecinstitute.com/topic/cyber-attacks-against-nuclear-plants-a-disconcerting-threat/ [29] Public opposition to waste solutions is always a hurdle. See 'The nuclear power dilemma: Where to put the lethal waste.' The big read. The Financial Times. 6 February 2022. ft.com/content/246dad82-c107-4886-9be2-e3b3c4c4f315 [30] See 'Why Germany is resisting calls to ease energy crunch by restarting nuclear power.' 20 April 2022. Germany along with Austria, Denmark, Luxemburg and Portugal even opposed the EU adding nuclear to the taxonomy. ft.com/content/229c21c7-991c-4b44-a2f9-20991670a4ba [31] ITER Project. 'What is fusion?' and 'What is a tokamak?' sections. iter.org/proj/inafewlines#3 [32] Britannica. 'Arthur Eddington, British scientist.' britannica.com/biography/Arthur-Eddington [33] Rivka Galchen. 'Can nuclear fusion put the brakes on climate change?' The New Yorker. 4 October 2021. newyorker.com/magazine/2021/10/11/can-nuclear-fusion-put-the-brakes-on-climate-change [34] Daniel Andruczuyk, associate research professor, nuclear, plasma and radiological engineering at the University of Illinois Urbana-Champaign. 'Will nuclear fusion ever power the world?' 28 December 2021. gizmodo.com/will-nuclear-fusion-ever-power-the-world-1848149991. Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

29 Aug 2022 - Fund Review: Bennelong Kardinia Absolute Return Fund July 2022

BENNELONG KARDINIA ABSOLUTE RETURN FUND

Attached is our most recently updated Fund Review. You are also able to view the Fund's Profile.

- The Fund is long biased, research driven, active equity long/short strategy investing in listed ASX companies.

- The Fund also has a strong focus on capital protection in negative markets. Portfolio Managers Kristiaan Rehder and Stuart Larke have significant market experience, while Bennelong Funds Management provide infrastructure, operational, compliance and distribution capabilities.

For further details on the Fund, please do not hesitate to contact us.

29 Aug 2022 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

|

|||||||||||||||||||

| Ausbil Australian Geared Equity Fund | |||||||||||||||||||

|

|||||||||||||||||||

|

Ausbil Australian Emerging Leaders Fund |

|||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

Ausbil Balanced Fund |

|||||||||||||||||||

|

|||||||||||||||||||

|

Candriam Sustainable Global Equity Fund |

|||||||||||||||||||

|

|||||||||||||||||||

| View Profile

|

|||||||||||||||||||

|

|||||||||||||||||||

| Fortlake Sigma Opportunities Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

Fortlake Real-Income Fund |

|||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

Fortlake Real-Higher Income Fund |

|||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

Want to see more funds? |

|||||||||||||||||||

|

Subscribe for full access to these funds and over 700 others |