While there are numerous factors limiting Russia's ability to borrow at present, the absence of credit ratings effectively means it is locked-out of the global public debt markets and needs to find funds from other sources.

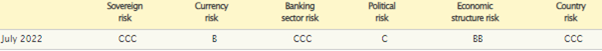

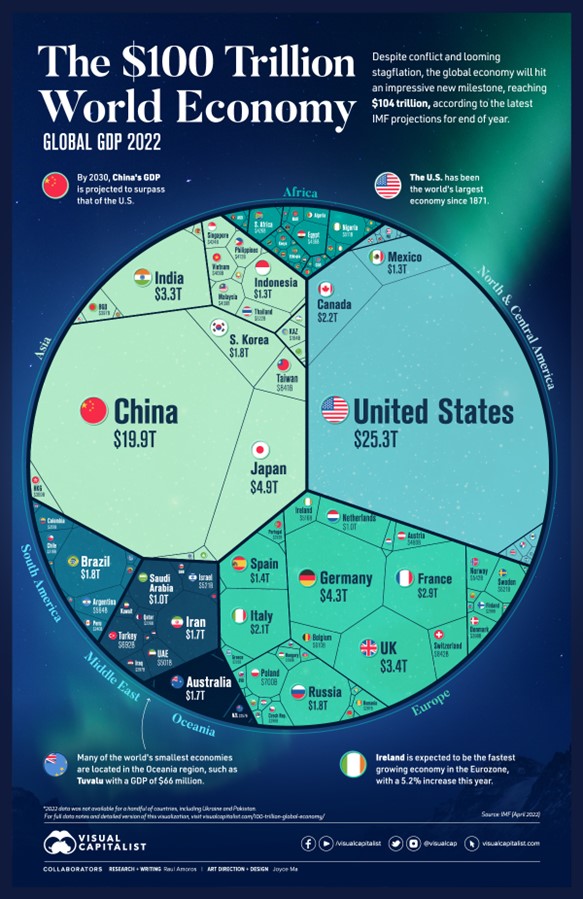

MSCI's ESG rating downgrade

Russia has been downgraded from B, with a negative outlook to CCC - the lowest possible MSCI rating.

MSCI ESG ratings for Russia