NEWS

11 Sep 2024 - The Evolution and Benefits of Equity Income Funds in Australia's Growing Retirement Market

|

The Evolution and Benefits of Equity Income Funds in Australia's Growing Retirement Market Merlon Capital Partners August 2024 Australia's growing retirement-age population has seen an increase in demand for and the availability of equity income funds over the last few decades. Australia's unique dividend imputation system means investors can successfully derive meaningful income as well as capital growth from holding Australian equities. Equity income strategies regularly make up a large component of the equity allocation for income-focused clients who seek a more defensive asset mix. Equity income funds have evolved significantly over time, beginning in the 1990s, with MLC and Colonial First State (now First Sentier Investors) launching equity income products. These initial products were not specifically focused on paying a regular, smoothed, tax-effective income but rather designed to grow capital before retirement to provide income once in retirement. The mid-2000s saw the equity income fund reimagined, designed specifically to meet retiree's key objectives - income generation, volatility management and capital growth over time. A number of managers developed products to meet these objectives at this time. The wake of the GFC saw growing recognition of the importance of total return generation from income, limiting the need to sell down holdings during market downturns. As a result, the equity income space continued to grow and through the 2010s, various managers launched new income funds, often with full market exposure. Additionally, with the rising popularity in passive investing through the 2010s, income-focused ETFs also emerged from leading ETF providers with the goal of generating income that exceeds the dividend yield offered by the broader market. With an aging population, the addressable market for equity income funds is only growing. Whilst not all equity income funds remain in existence today, there are a variety to choose from with over 15 Australian fund managers offering a product in this space. The need for regular income in retirement is well known and there are various ways to meet cashflow requirements. However, many of these tend to overlook the particularities of retirement. While fixed income products can help to meet an income objective, they fail to provide capital growth to protect against the impacts of inflation. A diminishing capital value on a real basis is inconsistent with the desire of many retirees for a growing capital base for both peace of mind and to leave an inheritance. Another option is to pursue an equity strategy centred solely on capital growth and simply selling down holdings when cashflow is required, rather than investing in income-generating investments. Yet, this ignores the fact that retirees are much more impacted by periods of drawdown than other investors, especially early in their retirement, amplified by their obligation to draw out from accounts when in pension phase. The GFC market crash and COVID-19 selloff in early 2020 demonstrated the serious consequences of needing to sell at an inopportune time and its long-term impact on total return. Skewing the components of equity total return to income removes the need to sell investments to raise cash when required. Proposed alternatives to equity income also ignore the value of franked dividends, which for retirees in pension phase present significantly more value than unfranked income or capital gains. Australian equity income strategies, when structured and executed appropriately, can provide strong total returns over time through attractive dividend yields and without sacrificing capital growth. The Merlon Australian Share Income Fund was launched in 2005 and led the innovation of contemporary equity income funds. It was the first product of its kind, aiming to provide above-market income with franking, grow capital over time with lower risk than the market. The non-benchmark portfolio has a high active share, blending well with both passive and direct share portfolios which are typically overweight large cap stocks. The Fund delivers above market income, the majority from franked dividends, paid monthly and has demonstrated strong risk-adjusted returns over multiple time periods. The strategy features a risk reduction overlay to insulate the Fund during periods of drawdown whilst retaining 100% of the franked dividend income generated from the underlying portfolio. Funds operated by this manager: Merlon Australian Share Income Fund, Merlon Concentrated Australian Share Fund Disclaimer |

10 Sep 2024 - Emerging Middle Class Megatrend

|

Emerging Middle Class Megatrend Insync Fund Managers August 2024 The era of blindly betting on Western brands to tap into China's burgeoning consumer market is over. Once considered no-brainers, global titans like L'Oreal, Nike and Starbucks are finding their footing increasingly precarious. Despite the allure of its growing middle class the dynamics at play are more nuanced than ever. New generation of Chinese consumers are flexing their economic muscle. No longer in favour of the imported brands that once dominated their preferences they have rotated towards domestic brands that speak to their cultural identity and nationalist pride. LVMH, a beacon of luxury with its Sephora chain, has had to slim down operations in China--a stark indicator of this shifting landscape. Domestic players, such as Anta Sports, are not only catching up but surpassing Western rivals like Adidas in market share. Meanwhile, coffee giant Starbucks, a symbol of Western lifestyle, is ceding ground to local competitors like Luckin Coffee, which captivates the market with aggressive pricing and expansive growth recently surpassing 20,000 stores. The same story echoes across most industries: global brands are no longer the default choice for Chinese consumers. Companies must now navigate a complex web of local preferences, cultural trends, and rising nationalism inside China. Simply assuming that Chinese spending power will translate to Western profits is dangerous. When investing in such global brands, understanding how these nuanced drivers impact stock values and acknowledging that what worked yesterday may not hold sway tomorrow, is now crucial. Founded only in 2017, Luckin Coffee quickly challenged Starbucks in China with lower prices, discounts, and drinks tailored to Chinese tastes, like the coconut latte and collaborations with local brands. By aligning with the "Guochao" trend, Luckin appeals to younger, cost-conscious consumers and benefits from the preference for local brands. With 20,000 stores versus Starbucks' 7,000+, Luckin dominates China's coffee market. Meanwhile, Starbucks reported an 8% revenue decline in its most recent results. Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund Disclaimer |

9 Sep 2024 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

||||||||||||||||||||||

| Resolution Capital Global Property Securities Fund - Series II | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| Resolution Capital Core Plus Property Securities Fund - Series II | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| Resolution Capital Global Listed Infrastructure Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

|

||||||||||||||||||||||

| Blackwattle Small Cap Long-Short Quality Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

|

||||||||||||||||||||||

| Langdon Global Smaller Companies Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

|

||||||||||||||||||||||

| Aikya Emerging Markets Opportunities Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

Want to see more funds? |

||||||||||||||||||||||

|

Subscribe for full access to these funds and over 850 others |

6 Sep 2024 - August Reporting Season - Week Three Update

|

August Reporting Season - Week Three Update Tyndall Asset Management August 2024 The third week of reporting season is always busy, with some 110 companies reporting that represent $716bn of market capitalisation. A similar number of companies are expected to report over the final week. The 2024 earning season has been marked by a mix of optimism and caution, with distortions caused by the COVID-19 pandemic largely now dissipated. However, this normalisation has not been without its challenges, particularly as earnings expectations have generally trended downward. Some of the trends emerging include:

Earnings Performance and Market ReactionsReporting season has so far revealed a mixed performance across the ASX 300, with companies reporting a balanced mix of beats and misses. In aggregate across those ASX 300 companies that have reported (61%), profit before tax beats sit at 25% vs misses at 23%. It is worth reflecting that the final week tends to be more skewed to the downside (48% of results missed by >5% over the past two reporting seasons). Market reactions have been varied, with share prices responding accordingly to the earnings outcomes.

Sector Highlights

Where to next?The final two weeks of reporting season are always brutal, with the sheer number of companies reporting making it difficult to separate the noise from the underlying fundamentals. It is important to determine quickly whether the share price reaction is reflecting the long term, short term or simply how the market is positioned in the stock. As long-term fundamental value investors, excessive moves during earnings season typically bring opportunities. As Benjamin Graham, the father of value investing opined: "In the short run, the market is a voting machine but in the long run, it is a weighing machine." Fear and greed are some of the most powerful long-term alpha generators and thus it is important to have a patient and disciplined process that can find opportunities amongst the dislocations. Author: Brad Potter, Head of Australian Equities Funds operated by this manager: Tyndall Australian Share Concentrated Fund, Tyndall Australian Share Income Fund, Tyndall Australian Share Wholesale Fund |

5 Sep 2024 - Can utilities solve the renewable energy storage problem?

|

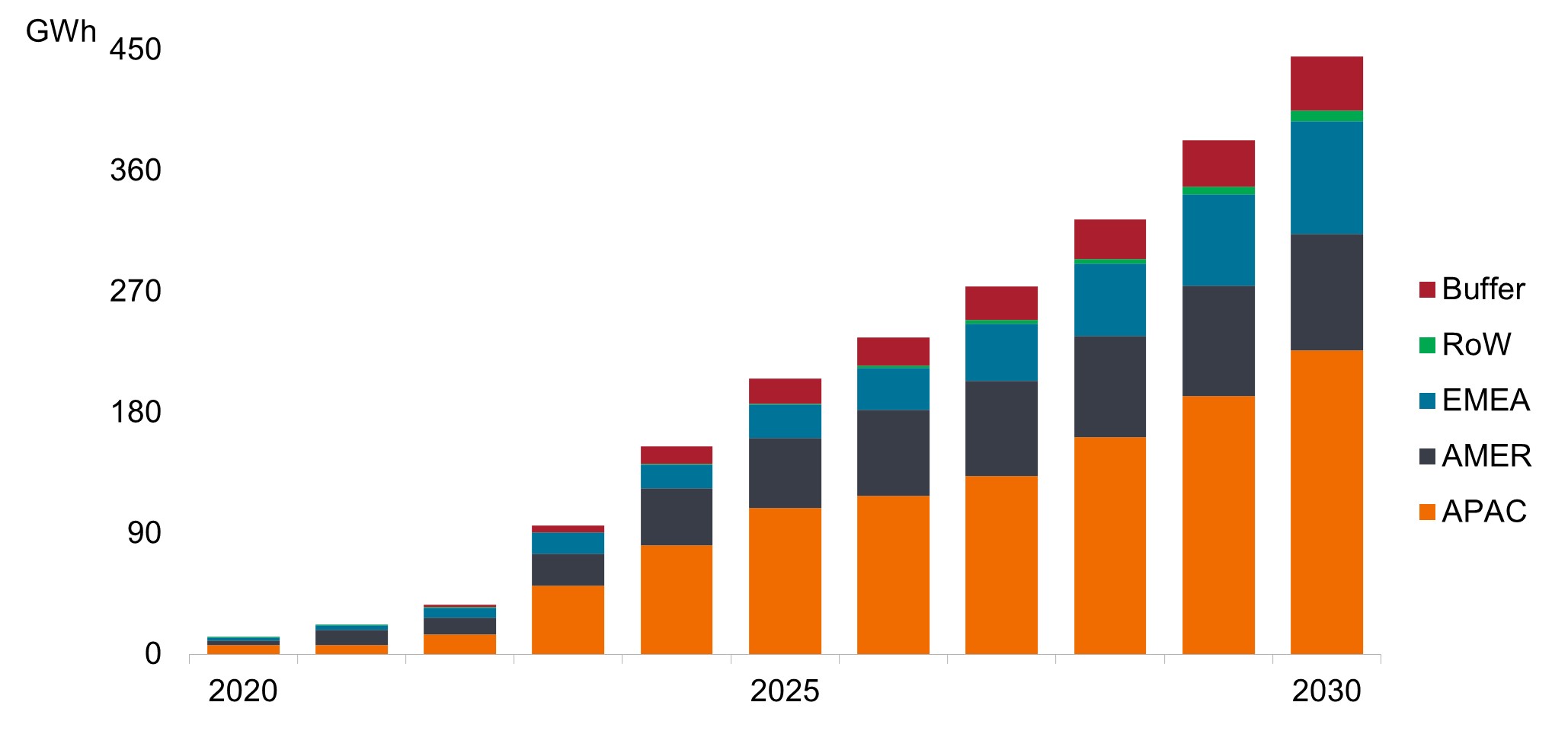

Can utilities solve the renewable energy storage problem? Janus Henderson Investors August 2024 The rapid growth of renewable energy sources like wind and solar power has brought a critical challenge to the forefront: how to effectively store and distribute this intermittent energy. As utilities grapple with increasing load growth and work toward net-zero decarbonization goals, they face a pressing question: How much renewable energy can they integrate before hitting practical limitations? The renewable integration ceilingBased on our discussions with utilities in various locations, the upper limit for renewable penetration in their energy mix without significant storage solutions or major interconnection improvements is somewhere between 30%-40%. Beyond this threshold, the intermittency of wind and solar power begins to pose challenges. While plans vary, many utilities aim for 70%-80% renewables by the early 2030s. While renewables penetration is already high in certain areas, like Texas and California, states in the mid-Atlantic, Northeast, and Pacific Northwest face bigger hurdles in achieving these goals due to less intense wind and solar power generation given weather conditions in those regions. The elusive long-duration storage solutionFor over a decade, utility-scale, long-duration battery storage has been the holy grail for increasing renewable energy penetration. Ideally, this solution would store power for more than 24 hours, and preferably up to a week. However, despite ongoing research, an economically viable option that works at the scale needed to power entire cities or regions has yet to emerge. Current storage solutions often work well on a small scale but struggle when scaled up. The physics may not work, or costs become prohibitive. While breakthroughs in technologies like solid-state batteries, sodium batteries, or hydrogen solutions occasionally make headlines, they often fall short of being able to power a major city during extended outages or prolonged periods of low renewable generation. The need for better storage is twofold: to prepare for multi-day renewable energy shortfalls and to reduce waste. In some regions, like California, excess renewable energy generated during peak times goes unused due to lack of storage capacity. Short-term solutions and alternative technologiesDespite these challenges, utilities are investing heavily in energy storage. The global market nearly tripled last year and is on track to surpass 100 gigawatt-hours of capacity for the first time in 2024 (Exhibit 1). Large regulated utilities like NextEra, Xcel, and AES are leading the charge in building out grid-scale storage. Exhibit 1: Annual global storage installations outlook by region

Current models typically use lithium-ion batteries that can hold only two to four hours of power. These short-duration solutions help manage daily fluctuations - storing electricity during peak renewable generation periods and discharging it back to the grid when electricity demand is high - but don't address longer-term power mismatches or resilience planning. As utilities recognize that lithium-ion batteries probably aren't the ultimate solution for their long-duration, large-scale storage needs, alternative technologies are gaining attention. Flow batteries and sodium ion batteries, for example, use cheap, abundant materials, potentially solving the sourcing and availability issues associated with lithium. While their weight and size make them impractical for electric vehicles, they could work well for stationary storage. Hydrogen is another frequently discussed option, though its promise has remained "10 years out" for some time. The main barriers to widespread adoption of these technologies are cost and efficiency. For instance, green hydrogen production needs consistent, high-uptime operation to be economically viable, which is challenging when relying on intermittent renewable energy sources. Implications and potential scenariosThe lack of a viable long-duration energy storage solution has far-reaching implications: 1. Utilities may need to delay fossil fuel plant retirements and rely more heavily on natural gas as a short-term solution, potentially building new gas-fired facilities. While this could slow progress toward decarbonization goals, it would help ensure grid reliability as electricity demands from AI data center growth and the move to a more electrified economy increase over the next decade. If regulated public utilities prioritize achieving net-zero goals over building new gas-fired facilities, power could potentially be generated by the private sector. Alternatively, electricity prices could increase, potentially slowing data center growth and bringing electricity demand back to a more manageable level. 2. The expansion of wind and solar installations may face limitations as grid operators struggle to balance intermittent supply and demand. This could potentially slow the pace of renewable energy adoption in some regions. Furthermore, installations could slow in regions with an abundance of renewable energy and negative power pricing. Adding more renewables could compound the oversaturation problem in these regions without favorable economics for developers. 3. Data centers, which need constant electricity and have Big Tech clients with ambitious sustainability goals, may explore alternative options like small-scale nuclear reactors to meet their energy needs while maintaining sustainability commitments. 4. Grid stability becomes more challenging without adequate storage capacity, potentially leading to increased volatility in power markets and reliability issues during extended periods of low renewable generation. Incentives could stoke further innovationThe road ahead for renewable energy storage remains uncertain, but incentives for developing and implementing large-scale, long-duration storage solutions are likely to grow. As utilities and tech companies push for solutions, and as the frequency and duration of power outages potentially increase with greater incidence of extreme weather, innovation in this space will be crucial. For investors, the energy storage market presents a complex landscape with very few pureplay public equity investment opportunities. Many companies are still in the early stages of development and face profitability challenges, particularly cash-intensive businesses in a high interest rate environment. The industry can also be volatile and dependent on government support, making it potentially better suited for diversified portfolios. We expect larger utility companies leading in renewable development such as NextEra, AES, and Iberdrola to drive long-term progress in energy storage. While regulated, they are at the forefront of current storage buildouts and are investing in next-generation storage technologies like hydrogen. We believe utilities can eventually solve the renewable energy storage problem. For now, however, despite their progress, the holy grail of energy storage remains just out of reach. Author: Noah Barrett, CFA |

|

Funds operated by this manager: Janus Henderson Australian Fixed Interest Fund, Janus Henderson Australian Fixed Interest Fund - Institutional, Janus Henderson Cash Fund - Institutional, Janus Henderson Conservative Fixed Interest Fund, Janus Henderson Conservative Fixed Interest Fund - Institutional, Janus Henderson Diversified Credit Fund, Janus Henderson Global Equity Income Fund, Janus Henderson Global Multi-Strategy Fund, Janus Henderson Global Natural Resources Fund, Janus Henderson Tactical Income Fund IMPORTANT INFORMATION Energy industries can be significantly affected by fluctuations in energy prices and supply and demand of fuels, conservation, the success of exploration projects, and tax and other government regulations. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned. Volatility measures risk using the dispersion of returns for a given investment. This information is issued by Janus Henderson Investors (Australia) Institutional Funds Management Limited (AFSL 444266, ABN 16 165 119 531). The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Whilst Janus Henderson Investors (Australia) Institutional Funds Management Limited believe that the information is correct at the date of this document, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson Investors (Australia) Institutional Funds Management Limited to any end users for any action taken on the basis of this information. All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson Investors (Australia) Institutional Funds Management Limited is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. |

4 Sep 2024 - RBA minutes - inside a meeting of two-handed economists

|

RBA minutes - inside a meeting of two-handed economists Pendal August 2024 |

|

IF anyone complains about RBA transparency, they are not paying attention. The minutes from the central bank's early August meeting were released today, though I am not sure minutes is the correct word - at 3,667 words, transcript might be a better term. Together, with the post-meeting press conference, the RBA is putting its best foot forward in communicating with the public, as encouraged by the RBA review. There was so much to say but so little confidence in anything. Even the new Deputy Governor Andrew Hauser chose a recent speech to warn of false prophets and said we should have little confidence in any forecasts. In the minutes we were treated to such gems as:

However, the one thing the RBA was keen to say is that if the Board was to do anything near term it is hiking - not cutting. It believes there is less spare capacity in the economy than previously thought. If that does not improve, then inflation will be too slow to fall. Very little spare capacity when GDP is barely growing? Sounds like the Board still believes we have a supply problem. Otherwise, its message could be summarised as "we need a recession to beat inflation", which is a variation of Paul Keating's "recession we had to have". I am not sure it would want that headline. We disagree with the RBA's current concerns, finding more agreement with the ex-RBA chief economist - now Westpac Chief economist - Luci Ellis. She describes the RBA as "skating to where the puck used to be" due to the fact that the RBA is focused on where the labour market was, not is. Recent data showing increasing participation and supply, falling hours worked per person, and improving real incomes means the puck has moved. In the months ahead, the RBA should be increasingly comfortable with labour market dynamics helping lower inflation. This should change its narrative and see it follow other central banks by cutting rates early next year. Remember, the RBA stated in February 2022 that "while inflation has picked up, it is too early to conclude it is sustainably within the target range" and that "there are uncertainties about how persistent the pick-up in inflation will be as supply side problems are resolved". In May 2022, it hiked. OutlookMarkets for now are largely ignoring the RBA anyway. Three-year bonds remain near 3.5% and ten-year bonds finally seem to be holding just below 4%. At these levels, bond markets are no longer super cheap but, at the risk of becoming a two-handed fund manager, they are also not expensive. It is important to remember the cycle has turned and, when that happens, yields will trend lower for an extended period. Author: Tim Hext |

|

Funds operated by this manager: Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Multi-Asset Target Return Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Pendal Sustainable Australian Share Fund, Regnan Credit Impact Trust Fund, Regnan Global Equity Impact Solutions Fund - Class R |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

3 Sep 2024 - What not being born and not dying is doing to investments

|

What not being born and not dying is doing to investments Insync Fund Managers August 2024 Are we experiencing a permanent change to a major economic driver that has underpinned an investor assumption for the past 100 years? That assumption being that ever more people would be working decade to decade? Most developed nations since the 2000's have been experiencing dramatic shifts in the makeup of their populations, spelling big challenges for societies and also for investors. It used to be commonplace that more younger people entered the workforce than left it, had two or more kids and did not live too long after retiring. This meant there was always a growing labour supply and growing tax revenues, and aged health and social care was a controllable tax-funded expense. Not anymore. Birth rates have been falling for decades. A 2.1 birth rate replenishes a population, anything less means decline. Australia's current 1.6 birth rate is down from 2 only 15 years ago. KPMG analysed Australian Bureau of Statistics (ABS) data and found 2023 had the lowest birth rate since 2006 and it is falling by 4.6% per year. Even though a drop of this magnitude occurred in the 1970s, the longer-term trend is one of decline. This finding is echoed across the globe in Korea, Japan, Ukraine, Germany, UK, USA, Russia, China, France, Italy, Scandinavia and so on. Back in 2011, the world experienced its 'peak child' maximum population count with most of these residing in poor nations. Many towns and regional cities globally are in decline. Reducing poverty, women being able to choose whether or not to have children, and being empowered economically, have impacted birth rates. India and Indonesia are as we used to be, but they're rapidly approaching the same situation. Declining birth rates however are just half the issue. The other half is that globally, according to the United Nations' UN75 project, the number of people aged 65 plus outnumber the number of children under five. They are the fastest growing age group and by 2050, will outnumber those aged 15-24. We may reach a point where older people not working will outnumber people who are. This is because the older are living much longer and fewer children are transitioning to adulthood. Today the life expectancy in Australia for men is around 81 and for women around 85. This compares to around 74 for men and 80 for women 30 or so years ago. Medical advances and technology mean that we are set to live older still. Stanford University research suggests that it won't be unusual for babies born in America in 2050 to live to 100. Other studies suggest that humans might one day live to 150. In a nutshell - we are not procreating like we used to, and we are not dying like we used to either. This means fewer people building economic growth, driving demand, consuming goods and services and - paying taxes. Older people consume less in almost everything except healthcare and rely on government support far more, while paying very little tax. To some extent a country can offset and delay the worst of demographic problems via strong immigration (Australia, Canada and the USA are examples). Over 8 years ago the German government forecast a need for a million immigrants a year for 20 years just to replace its current workforce. When they brought in the first million, riots and a government collapse was only narrowly averted. In an ever-divisive world, immigration is reliant on popular support and in any event, it is really just robbing Peter to pay Paul. What does this all have to do with investment? I'm glad you asked. Firstly, products, services and even entire industries that are dominant today can see their markets dry up or radically change in only a few years. Understanding how purchasing habits are shifting in the dominant working age population of GenZers is key. Their values, drivers and preferences are different to those that today's 60-year-olds hold, and likely held, back in their late 20's to early 30's. If you're an investor in companies reliant on old brands, products or services delivered in traditional ways you will need to be extra vigilant. Kraft is an example of a company that had not factored in the impact of demographic change. Its failure to properly invest in R&D, while pumping short term profits, spelt disaster in long term earnings as its decades old food brands no longer appealed to younger people. But secondly, there are positives for those who look well ahead and align their portfolios to what the economic ripple effect caused by demographic change is having. For example, the megatrend known as 'the Silver Economy' made up of companies specialising in products and services for older people, especially retirees. The most obvious of these are healthcare, leisure, and pharmaceutical, but there are more obscure companies behind the scenes in such megatrends that also have the capacity to deliver handsome rewards. The Silver Economy is only one megatrend benefiting from tectonic demographic shifts. Others include Pet Humanisation, Trading-Down and Emerging Middle Incomes. The challenge for investors is how to identify, then best ride the positive demographic driven megatrends already underway and reducing or even exiting those investments on the wrong side of demographic change. The rewards in doing both are substantial. Author: Grant Pearson, Head of Strategy and Distribution Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund Disclaimer |

2 Sep 2024 - Stock Story: Stryker

|

Stock Story: Stryker Magellan Asset Management August 2024 |

|

Stryker Corporation: transforming patient care for over 150 million patients annually. Innovation leadership is a key hallmark of a high-quality business. When we think about major innovation trends globally, the most prominent headlines usually spotlight the technology sector. Recent excitement about artificial intelligence and its many applications is a prime example. However, less visible yet equally transformative is the pace of innovation in a sector often considered more constant: healthcare. The pace of healthcare innovations has accelerated dramatically in recent decades, leading to significant advancements in healthcare services and improving quality of life. For instance, the world witnessed the rapid development of the mRNA vaccine platform, which played a crucial role in combating the covid-19 pandemic. Additionally, new GLP-1 agonists are showing potential in addressing the growing global obesity epidemic. The healthcare subsector of medical devices stands out as a vital contributor to enhanced medical treatments. This is due primarily to the adoption of new and innovative medical technologies by physicians and health systems worldwide. These technologies have been clinically proven to deliver superior patient outcomes, improved surgical techniques, and operating room efficiencies. A standout leader in the medical devices subsector is Stryker Corporation. With a diverse product portfolio spanning orthopaedics, medical and surgical equipment, and neurotechnology, Stryker's products are available in over 75 countries, affecting more than 150 million patients annually. If you have ever been treated in an operating room in a hospital, chances are you encountered one or more of Stryker's products.

Stryker's journey began in Michigan, USA, in 1941, founded by a prominent orthopaedic surgeon and medical device inventor Dr Homer Stryker - which is fitting given the company has been at the forefront of medical innovation in the orthopaedic surgical category over the past decade. Beyond continuous enhancements in knee and hip implant designs, such as cementless designs that better promote bone growth, Stryker revolutionised the field in 2017 with its Mako Robotic-Arm, assisting surgeons in performing knee and hip replacements with unprecedented precision. Clinical studies highlight that Mako Robotic procedures result in meaningfully higher patient satisfaction rates, with lower post-operative pain, faster recovery times, more accurate bone resections and implant placement and reduced soft tissue damage. This has accelerated surgeon adoption, with over 60% of knee and 30% of hip implants sold by Stryker in the US now implanted using a Mako Robot. Despite significant investments by competitors in R&D, they have struggled to dethrone Stryker's leadership. This underscores Stryker's R&D strength, driven by its unique 'bottom-up' capital allocation model and the 'innovation flywheel' effect stemming from long-standing relationships with leading surgeons and teaching hospitals. Stryker holds over 5,000 patents, 400 of which are in its digital robotics platform - a ten-fold increase in the past decade. Plans are underway to extend the Mako Robot to new surgical indications, including upper extremities (shoulder) and spine. Stryker's innovation is not limited to orthopaedics. The company is advancing surgical planning and navigational software for cranial and spine procedures with its Q Guidance System and improving surgical visualisation and fluorescence imaging for minimally invasive surgeries with its 1788 platform. The growing installed base of Stryker's systems, alongside the lack of superior alternatives from competitors, underscores the impressive nature of its advancements. Importantly, impactful innovation can lead to pricing power through a combination of patient/physician preferences and patent protection, and higher switching costs due to the invasive nature of surgical products and the growing clinical evidence of improved patient outcomes. This gives us confidence in Stryker's above-peer growth outlook, which is particularly bolstered by its ability to benefit three key stakeholders in health systems worldwide where expenditure continues to reach new heights: patients, surgeons, and hospitals. By Wilson Nghe, Investment Analyst |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund, Magellan Core ESG Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Any third party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

30 Aug 2024 - Global Investment Committee review: still positive, with downside risk caveats

|

Global Investment Committee review: still positive, with downside risk caveats Nikko Asset Management August 2024 On 13 August, the Global Investment Committee (GIC) held an extraordinary session to review the impact of recent volatile market movements, as well as the growing concerns over slower US growth. In summary, our conclusions were as follows:

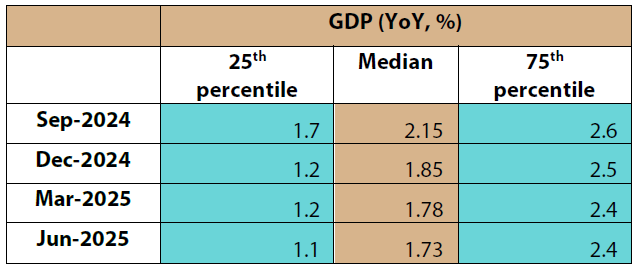

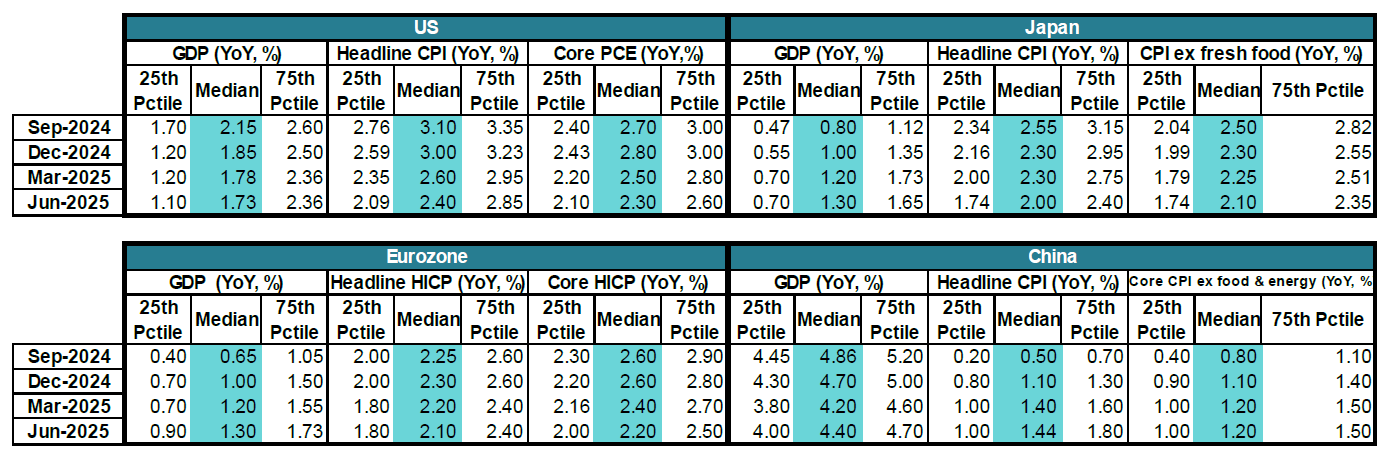

Global macro: increased downside risks to US GDP growth outlookNew developments in US GDP growth and inflation since Q2: In the US, following several substantial downward revisions to past data, the July nonfarm payrolls came in significantly softer than expected. The US unemployment rate also rose to 4.3% (although, importantly, labour participation rose). The Sahm rule1 was triggered, and some market participants began to fear that a recession was imminent, giving rise to some calls for 50 basis point (bp) Fed rate cuts within 2024. June's core CPI cooled further while US manufacturing activity contracted in July by the most in eight months, weighed by subdued orders and production in addition to the largest ISM employment drop in four years. However, there were also caveats to the weak data. Although consumer sentiment remains soft, average weekly earnings continued to expand in June, as did retail sales. Meanwhile, despite the softer June CPI print, the Fed's favoured core PCE indicator failed to decelerate as expected in June. Additionally, in spite of disclaimers by the Bureau of Labor Statistics that the weather (hurricane Beryl) had "no discernible effect" on the weak nonfarm payroll figure, the data appear to indicate otherwise. Most of the layoffs were temporary (with permanent job losses little changed) and the decline in job losses in the establishment survey was concentrated in transit and ground passenger transportation sectors, which were likely to have been influenced by the weather. Moreover, the increase in the US unemployment rate comes amid steady growth in the US labour force (thanks to immigration) and a steadily increasing labour participation rate. As such, this decrease does not owe purely to a deterioration in employment. GIC perspective: slower but positive growth trajectory intact while volatility contributes to downside risks With inflation, though showing some signals of slowing, still above the Fed's 2% target, we were reluctant to react to one month of soft US data. Meanwhile, several Fed speakers have since tempered expectations for aggressive easing, including multiple 50-bp reductions or inter-meeting cuts. That said, we note the reaction of financial markets to the softer data with the VIX spiking to highs above 60 as speculative "carry trades" were unwound. While we admit that it may be somewhat circular to reference financial market turbulence as a harbinger of slower growth, it is worth noting that financial markets have been great contributors to accommodative financial and monetary conditions. As such, we found it unwise to overlook downside risks to the economy should financial market volatility return and prove disruptive to growth. Therefore, we have downgraded our 25th percentile US growth estimates as outlined below, which also slightly impacts the median GIC estimates of US growth.

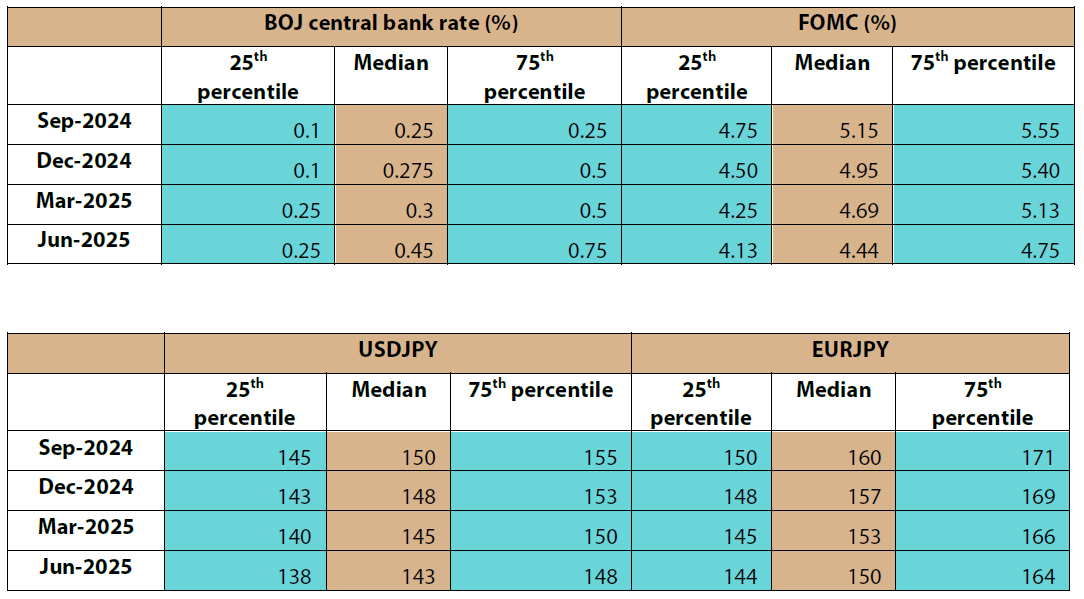

Central bank rates and forex: yen unlikely to revisit lows; downside risks to FOMCNew developments in central bank rates and forex since Q2: The BOJ surprised many market participants by hiking interest rates to 25 bps on 31 July. The BOJ's statement signalled upside risks to prices and a modest upgrade to the upper end of longer-term core inflation within the quarterly Outlook for Economic Activity and Prices. The BOJ meeting was soon followed by the July FOMC and Chair Jerome Powell's statement cemented expectations for a September rate cut. We should note that Powell, who signalled that a rate cut could come "as soon as" September, also did not rule out the possibility of "zero cuts" and indicated that any easing would depend on data. Dollar/yen meanwhile showed somewhat of a muted reaction to the 31 July BOJ decision. The market was subdued until the 2 August release of the US July nonfarm payrolls, which surprised on the downside. Subsequently, the BOJ's summary of opinions released on 8 August made a reference to a terminal interest rate of "at least" 1% (largely reflecting rising long-term inflation expectations) and was therefore perceived as hawkish. The US data disappointment combined with the BOJ's perceived hawkish stance helped to trigger a succession of events in financial markets. Large speculative yen shorts crumbled as US recession fears prompted some market speculation that the Fed was "behind the curve" or that the BOJ would engage in a series of rate hikes without ensuring that markets would successfully absorb them. Volatility has since abated somewhat, but what remains clear is that relative interest rate differentials (of late, real interest rate differentials) have been driving the carry trade. As a result, even a small narrowing of the spread caused leveraged players to bow out. Subsequent to the resurgent market volatility, BOJ Deputy Governor Shinichi Uchida offered assurance that further rate hikes would not come amid unstable markets, and with many speculative yen shorts liquidated (at least, according to the IMM Commitment of Traders report), dollar/yen stabilised above the 145 level (modestly above Japanese corporates' FY-end expectations per the BOJ's July Tankan report). That said, many current estimates of purchasing power parity puts 1 dollar at slightly less than 100 yen, which implies that "fair value" may exercise a downward pull on the currency pair given the outlook for gradually narrowing interest rate differentials. GIC perspective: dollar/yen to remain range-bound with limited downside to Q2 2025 With speculative yen shorts apparently largely cleared after building up to multi-year highs, we feel that there is limited impetus for dollar/yen to resume its sharp drop in the near term. The BOJ has been duly warned by currency volatility and it has committed itself to making its next move in calmer markets. We maintain that BOJ policy, still accommodative by most measures, will likely tighten at some point. However, we believe that there is sufficient reason for the BOJ to continue to gauge not only data (which has been positive of late, such as buoyant private demand-fuelled Q2 GDP growth and positive June real wage growth) but also overseas data and financial market conditions. We therefore maintain our BOJ outlook (we had foreseen one rate hike from the BOJ sometime between July and September) although we modestly downgraded our dollar/yen and euro/yen guidance ranges. Meanwhile, the heightened downside risks that we see to US GDP growth also correspond to higher downside risks to Fed policy rates, as follows:

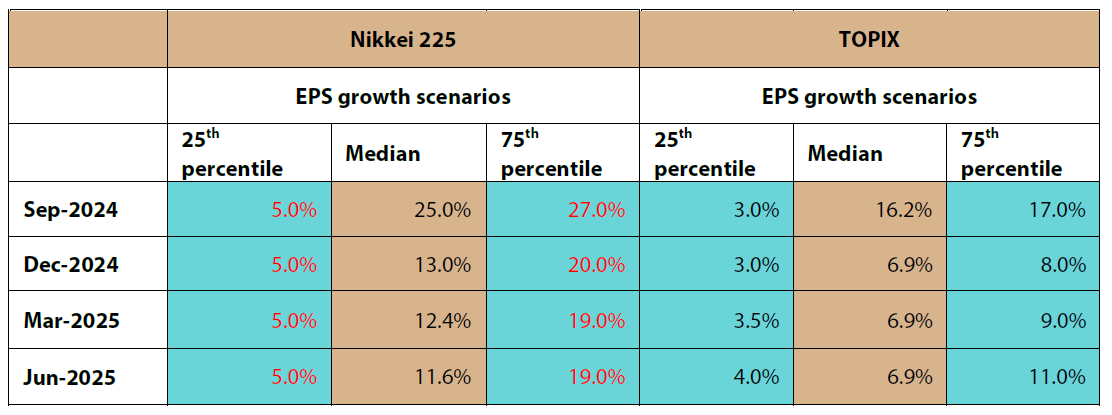

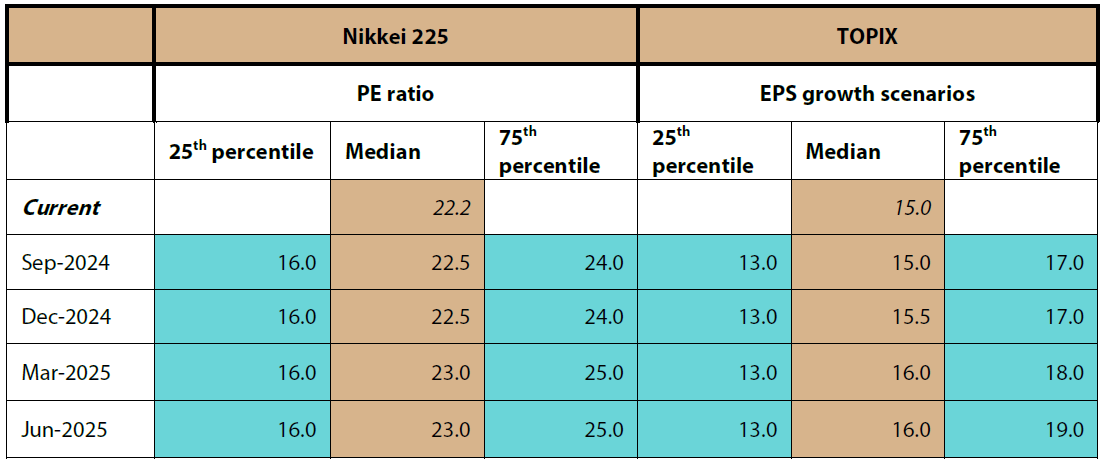

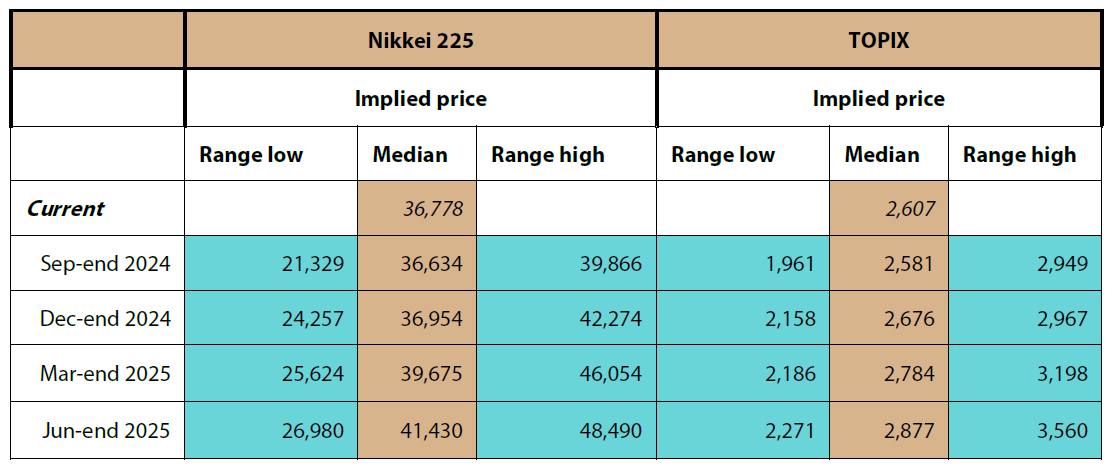

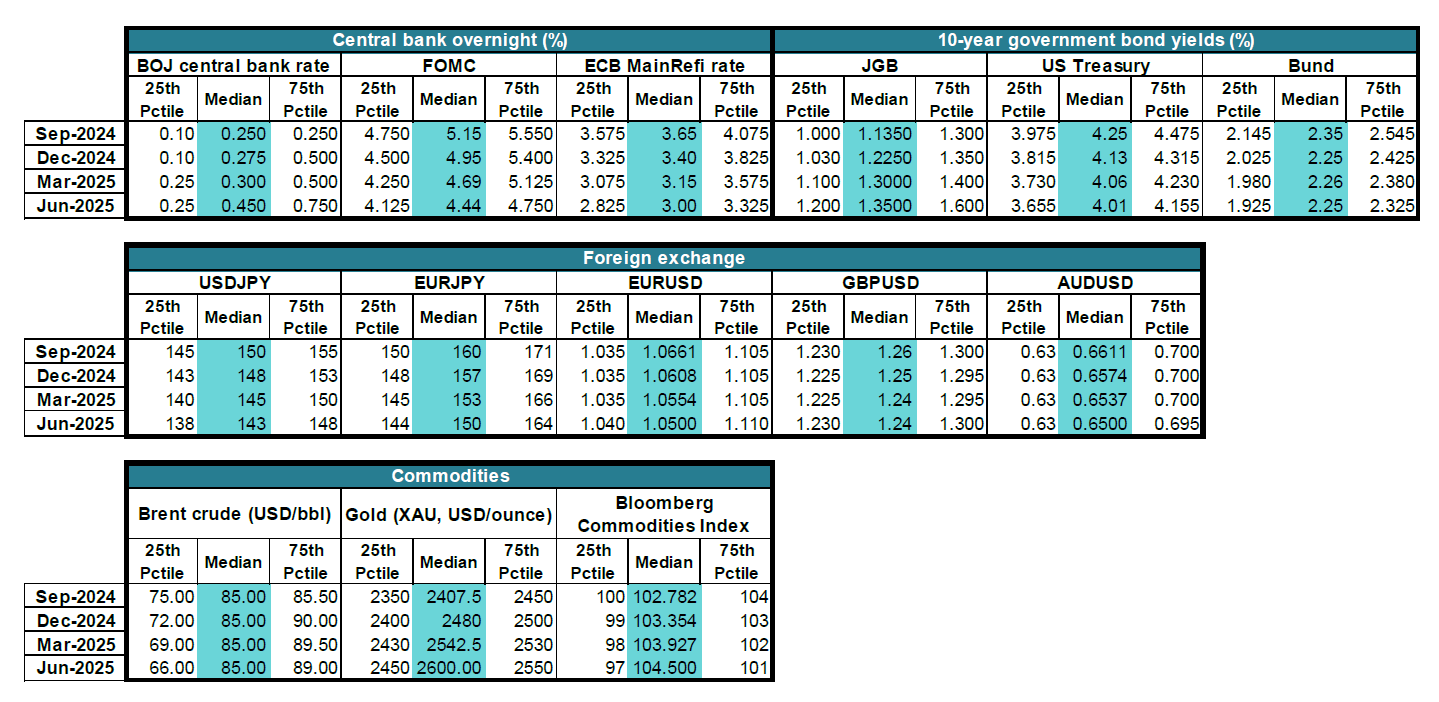

Japan equities: volatility, dollar yen impact temporary but non-negligibleNew developments in Japanese equities since Q2: As the market re-rated the "carry trade", the CBOE VIX index (a proxy for equity market risk over the next 30 days) spiked on 5 August to above 60 from below 20, after which volatility has slowly abated. The Nikkei 225, which is price-weighted and therefore volatile, saw three-month at-the-money implied volatilities (a slightly longer horizon measure than the VIX) surge above 37 on 5 August before slowly pulling back. The TOPIX, typically less volatile, also saw three-month at-the-money implied volatilities spike near 30 and then ease somewhat. Japanese stocks were oversold (with TOPIX price/earnings ratios sinking to the mid-11 handle), and the decline became a good opportunity for companies to buy back shares and institutional investors to accumulate stock. The TOPIX index subsequently staged a comeback, with price/earnings recovering to 15. Early observations by sector: Financials and trading company stocks were the hardest hit amid the sell-off but domestic demand and defensive names (e.g. medical equipment) remained more resilient. Similarly, many cash-rich stocks, as well as firms investing in human capital and consequently experiencing increased productivity, have also remained robust. Meanwhile, the sell-off significantly affected semiconductor and auto stocks. The sell-off may have undervalued high dividend yield names, which could be poised for an eventual comeback. GIC perspective: With volatility still higher than before the recent market shock, the rebound by Japanese stocks appears to be limited below prior highs. That said, earnings in the first quarter of Japan's current fiscal year (FY24) appear solid so far. Signals of domestic demand, including both consumption and investment, becoming a stronger driver of growth continue to support Japan's "virtuous circle". Firms appear to retain pricing power even as real wage growth has turned positive. The outlook appears structurally sound for the longer-term, though near-term, we suspect that the impact of stock volatility as well as a stronger yen (which would impact firms with significant overseas revenue) may exercise an interim drag on earnings in some sectors. Although we remain positive on earnings growth overall, it is possible that we may see some sector rotation, allowing for domestic demand sensitive firms that have underperformed to date to catch up with those more driven by overseas revenues. We continue to expect Japanese corporates to generate healthy single-digit earnings growth across the TOPIX, which represents the majority of our Japan equity investments. However, we foresee valuations being affected by potential ripple effects from the recent market volatility and carry trade unwinding. We estimate that the impact may last for three to six months. Additionally, there is a risk that a weaker dollar/yen could, with a lag, exert a downward pull on the earnings of large cap exporters with overseas revenues, particularly among Nikkei constituents. Although we remain firm in our conviction that Japan's structural recovery is likely to continue supporting Japanese equities, we acknowledge the possibility for an interim resurgence in equity volatility. The GIC is shifting from single valuation assumptions (P/E) in Japanese stocks to a guidance range for P/E. This is similar to our guidance range for earnings per share (EPS) guidance, with which we aim to capture probabilities between the 25th and 75th percentiles of consolidated earnings growth. We are also making modest adjustments to our EPS guidance ranges and adding 25th and 75th percentile indicators for Nikkei-listed large-caps. Earnings guidance ranges: We foresee year-on-year (YoY) earnings growth for the TOPIX ranging between 3% and 8% YoY (excluding base effects adjustments) over the second half of 2024. We expect earnings growth to recover to between 4% and 11% in the first half of 2025, once near-term volatility abates and companies have adjusted to a mildly stronger yen. We foresee the Nikkei's earnings range between 5% and 20% YoY for H2 2024 (excluding base effects adjustments) and between 5% and 19% over the first half of 2025, with a more lasting impact likely to be felt among large exporters and firms reliant on substantial overseas revenue. In the near-term, we anticipate an adjustment in YoY EPS growth in September, due mostly to the low base effects of September 2023's EPS. We believe that in the September quarter of 2024 there will be a one-off adjustment in YoY EPS growth terms in order for annual EPS to be kept on a gradually increasing trajectory. EPS growth guidance

Valuation ranges: We expect price/earnings to show greater fluctuations than what we have observed very recently. This is due to the market appearing more vulnerable to swings as uncertainty over economic growth impacts markets. We are therefore expanding our P/E estimates from single assumptions to a range, estimating outcomes between the 25th to 75th percentile. We expect the Nikkei's P/E range to fluctuate between 16 and 24 in H2 2024, followed by a range of between 16 and 25 in H1 2025. We anticipate an upward bias over time given ongoing structural transformation among Japan's corporates, led by large caps. For the TOPIX, we foresee a range of 13-17x in H2 2024 and 13-19x in H1 2025, with a similar upward trend over time. P/E ratio guidance

Implied price (indicative only): price trends to be driven by EPS and higher valuation over time As we noted in our Q2 GIC Outlook, we have made changes to the GIC process. This includes more closely aligning our Outlook with the views underlying our portfolio investments and therefore providing indicative guidance ranges as opposed to point forecasts of index prices for indicators and indices. As a result, we have shifted to guidance centred on variables that are of interest to us as investors, including earnings growth and valuation. For the convenience of our readership, we calculate indicative prices as implied by our EPS growth (using Bloomberg's "BEst" Earnings estimates of realised earnings per share for the base year) and price/earnings guidance ranges, for reference purposes only. Based on the guidance provided above, the implied index prices are as follows: Implied price (using 2023-2024 BEst EPS as base)

The lows within the range represent the lower end of our anticipated price fluctuations, which takes into account the combined effect of earnings impact and valuation shifts. The highs within the range represent the upper end of our anticipated price fluctuations. Appendix 1: GIC outlook guidance revisionsGlobal macro

Central bank rates, forex, fixed income and commodities

Equities

Funds operated by this manager: Nikko AM ARK Global Disruptive Innovation Fund, Nikko AM Global Share Fund Important disclaimer information 1 The Sahm rule is a heuristic measure of determining whether the economy has entered a recession using unemployment relative to recent history. The Sahm rule compares the three-month moving average of the national unemployment rate to its low over the prior twelve months (with an indicative threshold of 0.5% above the prior 12-month low). |

29 Aug 2024 - What happened to the post-COVID savings buffer?

|

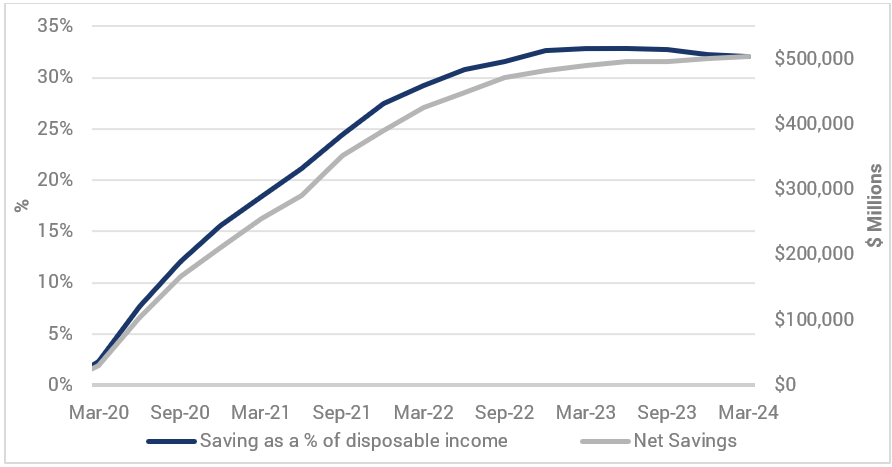

What happened to the post-COVID savings buffer? Yarra Capital Management August 2024 Remember when the RBA consistently referred to the buffer of "excess savings" accumulated during the post COVID period? Have you noticed that they have largely stopped talking about it in their public communications? In this latest note, Tim Toohey, Head of Macro and Strategy, highlights that calculations of excess saving buffer are illusionary. We show that there is no longer an excess of liquid savings accumulated since COVID, and explain why the RBA should take a more pre-emptive approach to monetary policy and commence easing late-2024. The RBA initially estimated that this excess savings buffer was $260bn, then as time progressed the estimate was revised up to over $300bn. The RBA stopped providing a running total on the estimate some time ago which is probably sensible, given the imprecision in which it is measured. Nevertheless, it was always a simple calculation, and it is worth noting that on our estimates the accumulation of excess savings recently topped a massive $500bn, or 32% of annual household disposable income. Chart 1: Estimates of excess household saving since COVID-19 are misleading

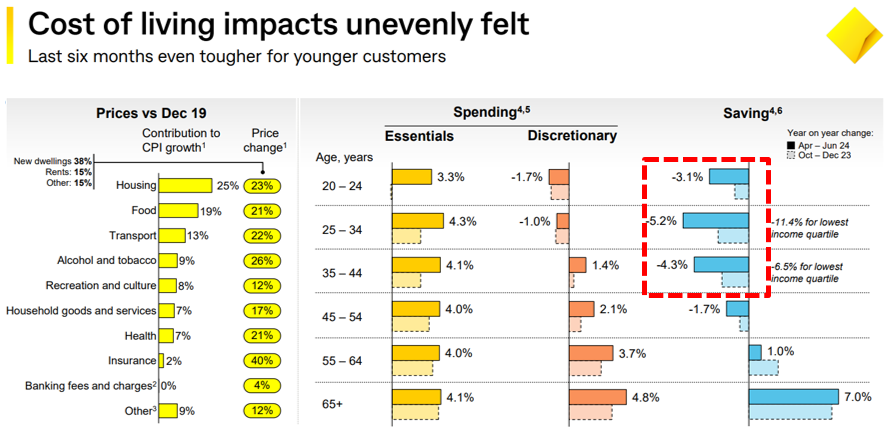

Source: ABS, YCM.Clearly, if households collectively decided to spend that excess savings Australia would have a massive consumption boom. Spending $500bn could sustain nominal private consumption growth at its 10-year average pace of 4.6% p.a. for four years in the absence of any income growth. To be clear, that is not a forecast. Indeed, the purpose of this paper is to illustrate that liquid "excess savings" are now exhausted and no longer available to smooth near-term consumption. In many ways the initial observation from the chart is to ask the question as to why the stock of savings hasn't been dipped into much earlier and in much larger scale? After all, what we can say empirically is that during periods of rising household wealth the household saving ratio normally declines and given the extent of cost-of-living pressures, it is entirely reasonable to have expected households to engage in consumption smoothing. The traditional inverse relationship between wealth and the saving ratio has indeed occurred in the past few years with the flow of household savings (i.e. the income left over post tax, interest and consumption each quarter) declining as household wealth rose. The saving rate is now proximate to zero. In theory, the household saving rate can move negative if households perceive the wealth gains to be permanent and households have few constraints to access credit. In the early 2000's this was facilitated via mortgage equity withdrawal, although other mechanisms are now possible including, as we have learnt in recent years, via early access to superannuation. That is, it is possible to sustain consuming more than you earn, for a limited period of time, at least at an individual level. But the idea that households will collectively unlock wealth gains by again using their homes as an ATM or their Super balances as piggybank to be raided and thereby drive the national saving rate collectively negative is not at present a high probability outcome. However, at the aggregate level, as more and more households commence the retirement phase, it may well be feasible that the household saving ratio to move negative for an extended period of time[1]. This would merely be due to retired households consuming at a faster rate than the returns being generated from their superannuation and other income generating assets. This is what the superannuation system was designed to do. The system was based under the assumption that the superannuation balance would be drawn down towards zero by the time of death. In practice, poorer households have struggled to build up meaningful superannuation balances and appear destined to be reliant on the pension system, while wealthier households with high superannuation balances have tended to consume less than the income generated from their superannuation holdings, seeing their balances continuing to compound during retirement. For now at least, it seems we are stuck with a two-tiered superannuation system: failing to meet its objectives for the bottom half of income earners, and remaining a great wealth accumulation device for the top 20%. Whether the household saving rate moves negative as the Baby Boomers retire is difficult to know with certainty as it will be conditional on superannuation reforms, asset returns, and confidence in the system itself. However, if nothing else changes on the policy front, it is more likely that for the next few years Super will be a force that lifts the national saving rate, both by compulsion and by compounding, even if lower income households would prefer to consume their Super now rather than at some distant point in the future. A slide from the recent CBA earnings results presentation (refer Chart 2, over page) supports this observation. Younger and more indebted households (red box) have engaged in consumption smoothing, running down their saving to fund essential spending and enabling a relatively modest decline in discretionary spending. Conversely, retirees have seen a sharp rise in their deposit savings and their discretionary spending growth has been largely unimpeded. This CBA chart matches what we suggested would occur in our note "Cashflow Pothole in the Energy Transition Journey" (Dec 2022) where we suggested in our analysis of upcoming hits to cashflow that "retail sales will slow from the rapid rate of close to 20% (y/y) to zero growth by mid-2023", despite this being the exact period the RBA was pointing to $260bn in excess saving buffers that would sustain spending growth. It was a controversial forecast at the time, but for the record, retail sales did slow to just 1% (y/y) by mid-2023 - propped up somewhat by stronger population growth and additional government subsidies. Chart 2: CBA cost of living analysis

Source: CBA Results Presentation, Aug 2024. 1. ABS, as at June 2024. 2. Reported by ABS as deposit and loan facilities (direct charges). 3. Including education, stamp duty and conveyancing, clothing and footwear, communication. 4. Per customer. For spending 13 weeks to end of quarter, for saving the average balance as at end of quarter. Consistently active card customers and CBA brand products only. 5. Spending based on consumer debit and credit card transactions data (excluding StepPay). 6. Includes all forms of deposit accounts (transaction, savings and term) and home loan offset and redraw balances. Trimmed mean excluding top and bottom 5% of customers within each age band. Income quartile calculated across all ages based on customers with income payments to CBA accounts in the 13 weeks to 30 June 2024, considering salary, wages and government benefits).

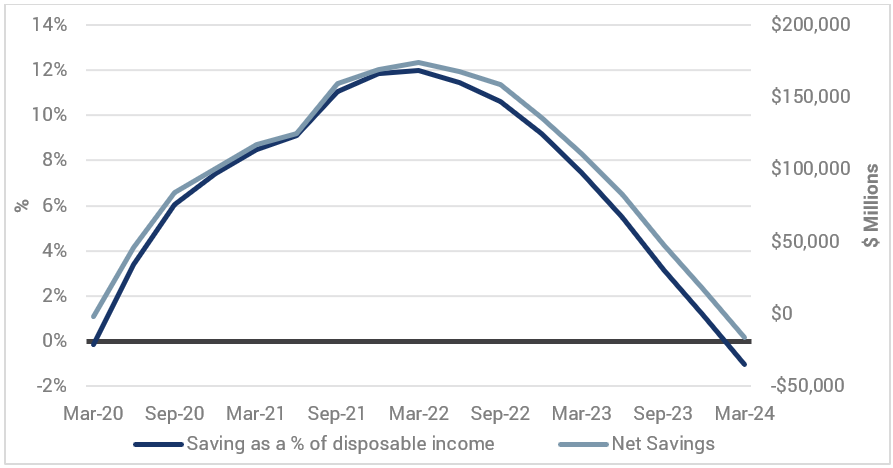

The CBA chart also accords with our note "This is Going to Hurt" (March 2023) where our analysis suggested that discretionary cashflow for the bottom 20% of households would plummet in 2023, the 35-44yo cohort had no accumulated precautionary savings post-COVID and that the vast majority of the $260bn had been accumulated by those over 45yo. As the above CBA chart shows, it has indeed been a painful period for younger and more indebted households and those with few precautionary saving buffers. It would be a mistake to assume that younger and working age households can continue to draw upon savings to fund spending growth. Chart 3 again shows the level of excess savings since the start of COVID, but this time we exclude mandatory superannuation inflows. This is a much better measure of liquid excess savings that can be drawn upon by working households, and as of the March quarter of 2024 that buffer has now been completely depleted! If the CBA data is reflective of the broader society, then given the 65+ age group has continued to expand their savings in recent years it follows that the excess savings ex-Super since COVID for those sub-65yo must currently be negative. Chart 3: Excess household saving accumulated since COVID-19 (excl. mandatory superannuation contributions)

Source: ABS, YCM.The message for policy makers is that there is no longer a liquid buffer of excess household savings to draw upon, and it's likely that most households in the sub-65yo age bracket have drawn down savings buffers to below pre-COVID levels. Deputy Governor Andrew Hauser's recent speech made it clear that the RBA are unsure of what will happen with household savings and spending in the face of recently enacted tax cuts, rising household wealth and the lagged impacts of monetary policy. That's OK, and if you believe the odds are evenly balanced then it argues for doing nothing on policy until you have a clearer picture. For our part, we have been focussed for some time on trying to disentangle the puzzle of the impact on the saving rate from the key drivers of wage income, taxes, housing, financial and superannuation wealth and the shift in the superannuation guarantee levy. In our note "Big Super's Big Impacts" (Nov 2023) we directly modelled the savings rate and found a stable and sensible relationship between the saving rate and these key drivers. One of the key conclusions of that that study was that a rising SG levy acts as a material brake on the domestic economy's near-term growth. It concerns us that 9 months on, no one else seems aware of the dynamic yet we are rapidly lifting the SG levy whilst policy makers simultaneously consider further rate hikes. On our modelling a shift in the Superannuation Guarantee (SG) levy by 100bps has just as large an impact upon spending as a 100ppts interest rate rise. That is, the 1 July 2024 rise in the SG levy of 0.5% to 11.5% is equivalent to a 50bp interest rate hike for the consumer. The same model suggested that over half of the 1 July income tax cut would likely be saved, particularly as it is skewed to higher income households. We estimated that the net impact of the simultaneous rise in the SG levy and the income tax cut is broadly neutral for the aggregate consumer. Obviously under these two policies, spending that skews to older and wealthier spending categories will be a net beneficiary, whilst working age households will be mildly worse off. That is, the model suggests the RBA need not be as concerned about a post-tax cut surge in spending for most Australians. Nor should they be concerned that, should consumers suddenly turn more optimistic, there is a large buffer of liquid excess savings that can be deployed. The RBA obviously lacks the tools to curtail the spending habits of debt-free retirees. The RBA have been clear that it wants to suppress aggregate demand, without prompting a sharp labour market deterioration, in order to return inflation to target. But the argument that the RBA needs to curtail problematic services inflation, by making room in the rest of the economy is fine until you realise that only one third of the CPI basket is in discretionary spending and just 9% of the CPI basket is discretionary services spending. Raising rates to suppress demand led inflation in just 9% of the basket is debatable in the first place, but what portion of this 9% of excess demand for discretionary services is cashed up retirees? In contrast, 37% of the CPI basket is in essential services, and rising prices for these items overwhelmingly negatively impacts lower income households. That is, excess services inflation currently has little to do with excess private demand growth of working age Australians. As the CBA chart highlights, most of the excess spending in discretionary spending is being done by those who are already in retirement and are impervious to - or even benefit from - higher interest rates. If we are looking to the RBA to curtail cashed up and retired Baby Boomers then we will end up with an unbalanced and intrinsically unfair economic system. That job clearly rests with the tax system. It is also worth noting that per capita consumption is currently contracting at -1.1% (y/y) - the same rate as the depths of the 1991 and 1983 recessions. With population growth set to slow sharply into 2025, total consumption growth will risk resembling the current per capita growth trajectory. Together with a further SG levy increase scheduled for mid-2025 acting as an additional headwind to consumption growth, waiting until mid-2025 before considering interest rate relief could prove a costly error. In other words, we know with some certainty that key non-monetary policy decisions on immigration and superannuation will constrain future consumption and lift future savings. For a central bank that says it no longer gives forward guidance, the irony of the RBA ruling out interest rate reductions in 2024 should be lost on no one. We agree with the Deputy Governor that policy making under uncertainty requires a healthy degree of humility and that is indeed lacking in some financial market commentators that proffer their strongly worded advice on a weekly basis. Where we disagree with the RBA current view is that they believe there is symmetry in potential outcomes for the saving rate. On our estimates, excess liquid saving buffers are already depleted, a saving rate around zero mutes the wealth effect on future consumption growth, the impact of the recent income tax cut will be neutered by the rise in the SG levy on 1 July 2024 and the certainty of the final rise in the levy on 1 July 2025 to 12% is, by definition, an event that lifts the household saving rate. In other words, there is a much greater chance that the savings rate will rise than fall in the year ahead. In conjunction with a policy-led decision to reduce population growth sharply in 2025, the implication is that the risk to economic growth is skewed to the downside. In the Deputy Governor's own words, in situations where there is asymmetry of potential outcomes, the Bank should take a more activist or forward-looking approach to interest rates. It is precisely because of this asymmetry why we continue to suggest that the RBA should take a forward-looking activist position and commence its easing cycle in December 2024. We conclude that there is not symmetric risk to the saving rate looking into 2025 and 2026 and this will have big implications for the outlook for economic growth, employment and inflation. The starting point is a saving rate that is already close to zero, banks are not facilitating mass access to liquidity for households to consume prior wealth gains, the superannuation system remains in a state of net inflow and the recent rapid rise in the SG levy in addition to a further rise in 2025 essentially guarantees the saving rate will rise rather than fall in the period ahead. In concert with the observations that the buffer of liquid excess savings in the post-COVID period has now been completely depleted and a clear trend rise in the unemployment rate, it is likely that a bout a precautionary saving ensues in the months ahead. It's clear from the RBA's current guidance that there are no rate cuts on the horizon until mid-2025. But a lot can change between now and the end of 2024. A shift in the RBA perception of the directional risk to the saving rate would be one key step in the RBA returning to be a pre-emptive central bank, opening the door to a late 2024 rate cut. |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

Source: BloombergNEF, 1H 2024 Energy Storage Market Outlook, April 25, 2024. Note: RoW = Rest of the World; EMEA = Europe, Middle East, and Africa; AMER = US, Canada, Latin America; APAC = Asia-Pacific; Buffer = headroom not explicitly allocated to an application.

Source: BloombergNEF, 1H 2024 Energy Storage Market Outlook, April 25, 2024. Note: RoW = Rest of the World; EMEA = Europe, Middle East, and Africa; AMER = US, Canada, Latin America; APAC = Asia-Pacific; Buffer = headroom not explicitly allocated to an application.