NEWS

30 Sep 2022 - Hedge Clippings |30 September 2022

|

|

|

|

Hedge Clippings | Friday, 30 September 2022 Amid all the chaos facing the world at present, ranging from nearly three years of COVID, to the invasion of Ukraine and the subsequent threat of nuclear war, surely the most bizarre is the economic and political chaos now facing the United Kingdom. At first glance, it might seem this has been an instant reaction to a knee-jerk budget from a newly appointed PM, Liz Truss, and her equally new and inexperienced treasurer, Kwasi Kwarteng. Together, and after months of a drawn-out and damaging internal selection process, they announced a mini-budget and tax cuts which prompted an intervention from the Bank of England to prevent a run on pension funds, and a slump in the value of sterling which makes the under pressure Aussie dollar look strong. Truss didn't improve things in a series of disastrous radio interviews on the BBC by trying to blame Putin for her and Kwarteng's own goal, which also drew a warning from the IMF which issued a statement saying "we do not recommend large and untargeted fiscal packages" at a time of high inflation, and suggesting the UK government re-evaluate its plans. Ratings agency Moody's also got in on the act, saying that the unfunded tax cuts were credit negative, and likely to weigh on growth. Truss is between a rock and a hard place: Should she back down and admit she's made a serious boo-boo within weeks of being appointed, or continue to brazen it out, and no doubt in due course lose the next election? In reality, this shambles can all be traced back to the chaos created by her predecessor, Boris Johnson. However, somehow he seemed to have the brass, or b---s to be able to bluff his way through countless crises, until finally "Pinchergate" and "Partygate" finally ended his act. In the case of Truss, there's probably never been a better example of the "Peter Principal" (so named after the 1969 book of the same name written by Laurence J. Peter) which observes that people in a hierarchy tend to rise to a level of respective incompetence. Depending on one's point of view that might also have applied to Boris. Thankfully, although possibly also depending on one's political point of view, it seems that Albo, our new Prime Minister, has hit the ground running, and in spite of troubling global and economic times has yet to put a foot wrong. Of course, it is early days, and long may it last, but it seems a long apprenticeship, both in government and opposition, and a lifelong career in politics, has benefitted Australia and its 31st Prime Minister. Changing tack, and back where we belong to financial services: The latest figures from ASIC covering financial advisor numbers in Australia, compiled by Wealth Data and reported in the AFR, show that AMP's adviser workforce has dropped below 1,000 - a 60% decline since January 2019, and a far cry from the 3,329 advisers it had on its books in 2014. AMP hasn't been the only institution at the "big end" of town to lose advisors, or in the case of the big four banks, leave the business. Over 10,000 advisors have left the sector since the Hayne Royal Commission shone an unwelcome spotlight into some dark corners of certain practices. Many advisers have left the larger dealer groups to set up on their own or in smaller "boutiques" finding that they had greater flexibility to provide high levels of client advice - particularly at the higher end - in spite of the compliance support (or constraints) previously provided by head office. The risk of course is that with lower adviser numbers, but still with a large number of people requiring financial advice, some of the latter are going to miss out. Compliance and regulation in the industry are necessary, albeit often tedious. However, the Treasury's Quality of Advice Review is reported to be considering watering down the requirements for financial advice - and general advice in particular - enabling so-called "finfluencers" to flourish. This would appear to us to be throwing the baby out with the bathwater, but maybe that's the wrong metaphor to use. Let's just say that social media is responsible for enough damage as it is. News & Insights Investment Perspectives: Why rising interest rates aren't working (yet) | Quay Global Investors 10k Words | Equitable Investors Times like these - investing in sustainable growth companies makes sense | Insync Fund Managers |

|

|

August 2022 Performance News Equitable Investors Dragonfly Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

30 Sep 2022 - Performance Report: DS Capital Growth Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The investment team looks for industrial businesses that are simple to understand, generally avoiding large caps, pure mining, biotech and start-ups. They also look for: - Access to management; - Businesses with a competitive edge; - Profitable companies with good margins, organic growth prospects, strong market position and a track record of healthy dividend growth; - Sectors with structural advantage and barriers to entry; - 15% p.a. pre-tax compound return on each holding; and - A history of stable and predictable cash flows that DS Capital can understand and value. |

| Manager Comments | The DS Capital Growth Fund has a track record of 9 years and 8 months and has outperformed the ASX 200 Total Return Index since inception in January 2013, providing investors with an annualised return of 13.24% compared with the index's return of 8.67% over the same period. On a calendar year basis, the fund has only experienced a negative annual return once in the 9 years and 8 months since its inception. Over the past 12 months, the fund's largest drawdown was -21.05% vs the index's -11.9%, and since inception in January 2013 the fund's largest drawdown was -22.53% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in February 2020 and lasted 6 months, reaching its lowest point during March 2020. The fund had completely recovered its losses by August 2020. The Manager has delivered these returns with 1.73% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 five times over the past five years and which currently sits at 0.98 since inception. The fund has provided positive monthly returns 88% of the time in rising markets and 33% of the time during periods of market decline, contributing to an up-capture ratio since inception of 67% and a down-capture ratio of 62%. |

| More Information |

30 Sep 2022 - Times like these - investing in sustainable growth companies makes sense

|

Times like these - investing in sustainable growth companies makes sense Insync Fund Managers August 2022 For the best part of 10 years, we've enjoyed the tranquil waters of low and stable inflation and even lower interest rates. That's all changing.

Many companies will struggle in this new world, however there is a small group who will thrive. And they have one thing in common: sustainable compounding earnings growth. It's never been more important for investors. We anticipate markets are already shifting focus after a recent wild swing backwards impacting all, deserved or not, to the prospect of Goldilocks economic conditions (not too hot nor too cold). The evolving economic backdrop is accelerating the business performances of the type of stocks that we hold at Insync; specific companies backed by our megatrends. Whether it's demographic shifts, digitisation or even pet humanisation; its megatrends like these providing the tailwinds for their growth, irrespective of the economy. And, it's why we remain fully invested despite market swings and the often touted fears by commentators. Investing in the highest quality stocks benefitting from megatrends delivers strong earnings growth over a full economic cycle. This is because of the duration of the megatrends being far longer than mere themes. Recent portfolio examples include Home Depot (see below) and Walt Disney (whom recently increased ticket prices by 7% with zero impact on demand). Our holdings possess high gross margins and strong pricing power, providing strength in both high and more normalised inflation environments. Our portfolio is well positioned as a result for continued delivery of the 5 year aim of both funds, as stock prices over the longer term follow consistent earnings growth. Home Depot (a supersized bunnings) benefits from the 'Household Formation' Megatrend, fuelled by the all-important 'Demographics' Super Driver. Understanding changing demographics across all ages and segments globally is very important in identifying the winning companies of the future. One example is the escalation in the 47 year old age cohort in the United States over the next 8 years (see graph below). The acceleration in the age 47 cohort coincides with the median average age of all home buyers, pushing up construction demand. Additionally a housing supply deficit in the US as high as 3.8m homes exists. On the renovation front, seniors are increasingly reluctant to move into aged care centres, and the increased 'working from home' trend further fuels demand. These are long duration strong tailwinds. Short term interest rate rises, and other macro factors are unlikely to alter this powerful megatrend. Home Depot is a big winner of all this. Think of it as a massive Bunnings network with almost 2,000 stores! They serve both trade and DIY markets, dominating the US building supply industry and run by a highly competent management team. Despite rising interest rates their recent strong results are testament to both the strength of the company and the power of the megatrend. Home Depot delivers very high returns on invested capital with an expected 10-15% p.a. compound annual earnings growth in the years ahead. Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund Disclaimer |

29 Sep 2022 - Sector Spotlight: SGH

|

Sector Spotlight: SGH Airlie Funds Management July 2022 |

|

Hear from Joe Wright as he provides a backdrop on Seven Group; a diversified investment business operating mining and industrials companies including WesTrac, Coates and Boral. Speaker: Joe Wright, Equities Analyst Funds operated by this manager: Important Information: Units in the fund(s) referred to herein are issued by Magellan Asset Management Limited (ABN 31 120 593 946, AFS Licence No. 304 301) trading as Airlie Funds Management ('Airlie') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to an Airlie financial product or service may be obtained by calling +61 2 9235 4760 or by visiting www.airliefundsmanagement.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of an Airlie financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Airlie makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Airlie. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any third party trademarks contained herein are the property of their respective owners and Airlie claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks.. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Airlie. |

29 Sep 2022 - Are we there yet? (Whitepaper)

28 Sep 2022 - Performance Report: PURE Resources Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | |

| Manager Comments | The PURE Resources Fund has a track record of 1 year and 4 months and therefore comparison over all market conditions and against its peers is limited. However, the fund has outperformed the ASX 200 Total Return Index since inception in May 2021, providing investors with an annualised return of 14.28% compared with the index's return of 3.53% over the same period. Over the past 12 months, the fund's largest drawdown was -2.3% vs the index's -11.9%, and since inception in May 2021 the fund's largest drawdown was -2.3% vs the index's maximum drawdown over the same period of -11.9%. The fund's maximum drawdown began in June 2022 and has lasted 2 months, reaching its lowest point during June 2022. The Manager has delivered these returns with 7.23% less volatility than the index, contributing to a Sharpe ratio for performance over the past 12 months of 2.69 and for performance since inception of 2.17. The fund has provided positive monthly returns 78% of the time in rising markets and 71% of the time during periods of market decline, contributing to an up-capture ratio since inception of 39% and a down-capture ratio of -36%. |

| More Information |

28 Sep 2022 - Performance Report: Bennelong Long Short Equity Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | In a typical environment the Fund will hold around 70 stocks comprising 35 pairs. Each pair contains one long and one short position each of which will have been thoroughly researched and are selected from the same market sector. Whilst in an ideal environment each stock's position will make a positive return, it is the relative performance of the pair that is important. As a result the Fund can make positive returns when each stock moves in the same direction provided the long position outperforms the short one in relative terms. However, if neither side of the trade is profitable, strict controls are required to ensure losses are limited. The Fund uses no derivatives and has no currency exposure. The Fund has no hard stop loss limits, instead relying on the small average position size per stock (1.5%) and per pair (3%) to limit exposure. Where practical pairs are always held within the same sector to limit cross sector risk, and positions can be held for months or years. The Bennelong Market Neutral Fund, with same strategy and liquidity is available for retail investors as a Listed Investment Company (LIC) on the ASX. |

| Manager Comments | The Bennelong Long Short Equity Fund has a track record of 20 years and 7 months and has outperformed the ASX 200 Total Return Index since inception in February 2002, providing investors with an annualised return of 12.86% compared with the index's return of 7.94% over the same period. On a calendar year basis, the fund has experienced a negative annual return on 3 occasions in the 20 years and 7 months since its inception. Over the past 12 months, the fund's largest drawdown was -19.27% vs the index's -11.9%, and since inception in February 2002 the fund's largest drawdown was -30.59% vs the index's maximum drawdown over the same period of -47.19%. The fund's maximum drawdown began in September 2020 and has lasted 1 year and 11 months, reaching its lowest point during June 2022. During this period, the index's maximum drawdown was -15.05%. The Manager has delivered these returns with 0.34% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 five times over the past five years and which currently sits at 0.75 since inception. The fund has provided positive monthly returns 64% of the time in rising markets and 60% of the time during periods of market decline, contributing to an up-capture ratio since inception of 5% and a down-capture ratio of -121%. |

| More Information |

28 Sep 2022 - 10k Words

|

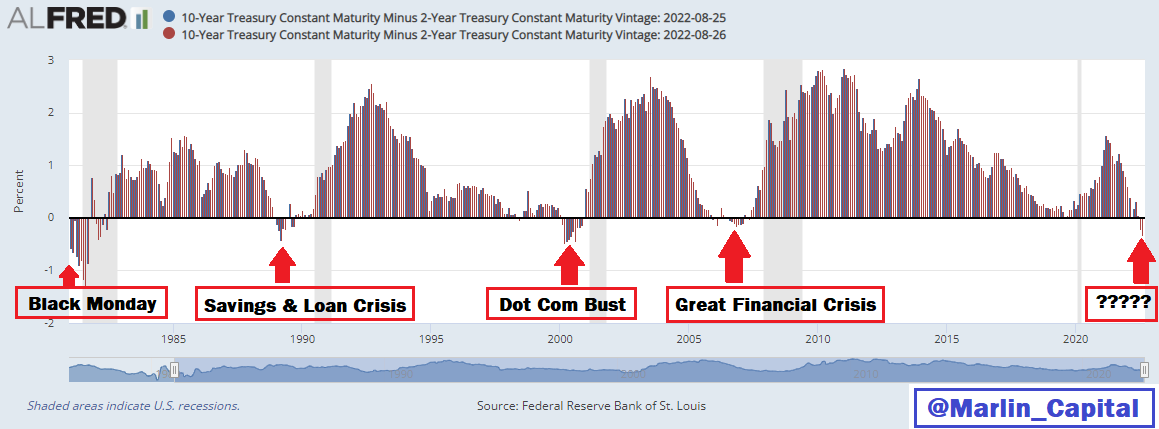

10k Words Equitable Investors September 2022 Earnings season on the ASX has come to a close with a historically low number of downgrades on the FY22 numbers, as tracked by Wilsons, but more downgrades than upgrades to EPS and dividend guidance for FY23, based on Evans & Partners' numbers. The one year return on Bloomberg's benchmark for the bond market is down 19% over the past 12 months. While the Australian yield curve is sloping upwards, the US yield curve is currently inverted. An inverted yield curve has historically led to some type of "break" in the system, @Marlin_Capital warns. But the inflation data is potentially turning - Yardeni highlights plunging US gasoline prices. Given the European situation, nuclear power and uranium are seeing a revival of sorts, at least with Japan revisiting its stance. Uranium equities have been advancing and the Washington Post ran a Blooomberg piece highlighting the unsavoury sources of current uranium supply. Taking a look at equities, Bespoke's optimistic take on the June half-year's poor showing is that such a poor first six months is typically followed by 12 months of 20%+ returns for the S&P 500. We thought it was interesting how closely the Grayscale Ethereum Trust has traded in comparison with the ARK Innovation ETF - a speculative cryptocurrency vehicle alongside a high growth tech investment vehicle. And potentially adding some colour to that is Visual Capitalist's charting of the demise of long-term investing. Aggregate ASX earnings downgrades announced over course of 12 month reporrting cycle Source: Wilsons Net guidance upgrades for FY23f for the S&P/ASX 200 Source: Evans & Partners Bloomberg Global-Aggregate Total Return Index Value Unhedged USD Source: RBA Australian and US yield curves

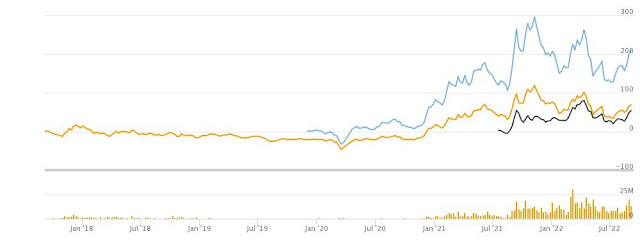

Source: worldgovernmentbonds.com An inverted yield curve has historically led to some type of "break" in the system Source: @Marlin_Capital, Federal Reserve of St Louis US gasoline priced have plummeted as consumption is reduced relative to a year earlier Source: Yardeni Research North American uranium ETFs on the rise (URA, URNM, U.U) Source: TIKR, Equitable Investors Authoritarian nations dominate the world's uranium production

S&P 500 has been up at least 22% in the year following prior 20%+ two-quarter drops Source: Bespoke Grayscale Ethereum Trust (orange) and ARK Innovation (green) moving together Source: TIKR, Equitable Investors The average holding period of shares on the NYSE has fallen to new lows Source: Visual Capitalist September Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions. Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components. Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog |

27 Sep 2022 - Performance Report: PURE Income and Growth Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | For fund investors, The Income and Growth Fund offers a unique risk/return profile. This form of investing includes a high yield, yet retains equity exposure to successful growth stories. Furthermore, the Fund's superior position in the investee Company's capital structure insulates investors from capital loss. PURE targets a return of 15% per annum through a mixture of Income (8-9%) and capital growth. While most investments involve ASX listed companies, the fund mandate retains modest flexibility to capitalise on attractive pre-IPO opportunities. |

| Manager Comments | The PURE Income and Growth Fund has a track record of 3 years and 9 months and therefore comparison over all market conditions and against its peers is limited. However, the fund has outperformed the ASX 200 Total Return Index since inception in December 2018, providing investors with an annualised return of 15.36% compared with the index's return of 9.63% over the same period. On a calendar year basis, the fund has only experienced a negative annual return once in the 3 years and 9 months since its inception. Over the past 12 months, the fund's largest drawdown was -3.58% vs the index's -11.9%, and since inception in December 2018 the fund's largest drawdown was -5.86% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in February 2020 and lasted 3 months, reaching its lowest point during March 2020. The fund had completely recovered its losses by May 2020. The Manager has delivered these returns with 4.22% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 two times over the past three years and which currently sits at 1.14 since inception. The fund has provided positive monthly returns 71% of the time in rising markets and 43% of the time during periods of market decline, contributing to an up-capture ratio since inception of 45% and a down-capture ratio of 2%. |

| More Information |

27 Sep 2022 - Performance Report: Delft Partners Global High Conviction Strategy

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The quantitative model is proprietary and designed in-house. The critical elements are Valuation, Momentum, and Quality (VMQ) and every stock in the global universe is scored and ranked. Verification of the quant model scores is then cross checked by fundamental analysis in which a company's Accounting policies, Governance, and Strategic positioning is evaluated. The manager believes strategy is suited to investors seeking returns from investing in global companies, diversification away from Australia and a risk aware approach to global investing. It should be noted that this is a strategy in an IMA format and is not offered as a fund. An IMA solution can be a more cost and tax effective solution, for clients who wish to own fewer stocks in a long only strategy. |

| Manager Comments | The Delft Partners Global High Conviction Strategy has a track record of 11 years and 1 month and has outperformed the Global Equity Index since inception in August 2011, providing investors with an annualised return of 14.1% compared with the index's return of 12.56% over the same period. On a calendar year basis, the strategy has experienced a negative annual return on 2 occasions in the 11 years and 1 month since its inception. Over the past 12 months, the strategy's largest drawdown was -8.81% vs the index's -15.77%, and since inception in August 2011 the strategy's largest drawdown was -13.33% vs the index's maximum drawdown over the same period of -15.77%. The strategy's maximum drawdown began in February 2020 and lasted 1 year, reaching its lowest point during July 2020. The strategy had completely recovered its losses by February 2021. During this period, the index's maximum drawdown was -13.19%. The Manager has delivered these returns with 1.1% more volatility than the index, contributing to a Sharpe ratio which has fallen below 1 four times over the past five years and which currently sits at 1.05 since inception. The strategy has provided positive monthly returns 88% of the time in rising markets and 14% of the time during periods of market decline, contributing to an up-capture ratio since inception of 96% and a down-capture ratio of 90%. |

| More Information |

.png)