NEWS

26 Oct 2022 - Performance Report: Altor AltFi Income Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The fund is managed by Altor Credit Partners. The investment committee comprises Harley Dalton and Ben Harrison. |

| Manager Comments | The Altor AltFi Income Fund has a track record of 4 years and 6 months and therefore comparison over all market conditions and against its peers is limited. However, the fund has outperformed the Bloomberg AusBond Composite 0+ Yr Index since inception in April 2018, providing investors with an annualised return of 11.48% compared with the index's return of 0.32% over the same period. On a calendar year basis, the fund hasn't experienced any negative annual returns in the 4 years and 6 months since its inception. Over the past 12 months, the fund hasn't had any negative monthly returns and therefore hasn't experienced a drawdown. Over the same period, the index's largest drawdown was -10.05%. Since inception in April 2018, the fund's largest drawdown was -0.02% vs the index's maximum drawdown over the same period of -12.97%. The fund's maximum drawdown began in March 2020 and lasted 1 month, reaching its lowest point during March 2020. The fund had completely recovered its losses by April 2020. During this period, the index's maximum drawdown was -0.28%. The Manager has delivered these returns with 2.3% less volatility than the index, contributing to a Sharpe ratio which has consistently remained above 1 over the past four years and which currently sits at 3.94 since inception. The fund has provided positive monthly returns 100% of the time in rising markets and 95% of the time during periods of market decline, contributing to an up-capture ratio since inception of 114% and a down-capture ratio of -74%. |

| More Information |

26 Oct 2022 - Performance Report: Skerryvore Global Emerging Markets All-Cap Equity Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Emerging markets refers to countries that are transitioning from a low income, less developed economy towards a modern, industrial economy with a higher standard of living and greater connectivity to global markets. The strategy is index unaware (meaning that the Skerryvore team decides to invest in individual stocks based on their merit and without reference to the composition of the Benchmark) and the Fund's country and sector allocations will reflect the active bottom up investment approach of the Skerryvore team. The Fund also invests in companies that are incorporated and listed in developed market countries which have economic exposure to emerging markets. The difference in allocation against any emerging markets index can be significant. |

| Manager Comments | The Skerryvore Global Emerging Markets All-Cap Equity Fund has a track record of 1 year and 2 months and therefore comparison over all market conditions and against its peers is limited. However, the fund has underperformed the ASX 200 Total Return Index since inception in August 2021, providing investors with an annualised return of -11.41% compared with the index's return of -6.14% over the same period. Over the past 12 months, the fund's largest drawdown was -13.9% vs the index's -11.9%, and since inception in August 2021 the fund's largest drawdown was -17.45% vs the index's maximum drawdown over the same period of -11.9%. The fund's maximum drawdown began in September 2021 and has lasted 1 year, reaching its lowest point during June 2022. The Manager has delivered these returns with 5.38% less volatility than the index, contributing to a Sharpe ratio for performance over the past 12 months of -1.5 and for performance since inception of -1.26. The fund has provided positive monthly returns 67% of the time in rising markets and 38% of the time during periods of market decline, contributing to an up-capture ratio since inception of -5% and a down-capture ratio of 49%. |

| More Information |

26 Oct 2022 - Global Economic Outlook: a perfect storm

|

Global Economic Outlook: a perfect storm abrdn September 2022 The global economy is facing multiple, mutually-reinforcing headwinds - a scenario which is likely to lead to a deeper global recession sooner than we'd previously forecast. We now expect the Fed's rapid policy tightening to tip the US into recession by Q2 next year. The UK and EU economies are facing a huge, commodity-price induced real-income squeeze, amplified by central bank actions. In China, the rebound from the Shanghai lockdown is petering out, with the prolonging of a 'zero-Covid' policy and property sector weakness weighing on the outlook. Meanwhile, many emerging and frontier economies are caught between their own imbalances and these external shocks. The compounding effect of these various shocks means that what once looked like a series of distinct headwinds emanating from different places at different times, are now coming together into something that looks like a perfect storm for the global economy. Figure 1: Global forecast summary Source: abrdn, as of September 2022 *Forecasts are offered as opinion and are not reflective of potential performance. Forecasts are not guaranteed and actual events or results may differ materially. No US recession this year…US economic activity experienced a sharp, commodity-price driven, slowdown in the second quarter, with the economy posting two consecutive quarters of contraction in the first half of this year. While some observers insist on describing this as a 'technical recession', this is neither the formal definition of a 'recession' nor was what we saw the phenomenon we have in mind when identifying a US recession. With employment growth throughout the first half of the year running well in excess of the rate required to keep unemployment steady, it's not credible to believe the US was experiencing the breadth and depth of downturn that would be consistent with a recession. If anything, underlying demand was still too strong, with imbalances continuing to build - especially in the labour market. In the very near term the economy looks set to accelerate, boosted by the recent fall in many commodity prices. …but we expect it to happen earlier next yearDespite this 'mini recovery', we now forecast the US economy to enter a recession two quarters earlier than we'd originally anticipated. The second quarter of 2023 is now expected to mark the formal end of the current economic cycle, due to more rapid and sustained monetary tightening by the Federal Reserve (Fed), and its transmission through asset prices. But we have more conviction in the recession's inevitability than its timing given the 'long and variable' lags of central bank monetary policy. Powell at Jackson HoleGranted, financial conditions eased following the July meeting of the Federal Open Market Committee (FOMC), which suppressed our short-term recession indicators. But this development predictably proved unsustainable as it reflected a misunderstanding of the Fed's reaction function. Fed Chairman Jerome Powell hammered this point home in his hawkish speech last month at Jackson Hole, the annual gathering of economic policymakers from around the world. That's why the Fed is likely to keep rates elevated, even as the US economy enters a recession, as it awaits convincing evidence that core inflation pressures have moderated (see Figure 2). Figure 2: Elevated core services inflation will keep rates high for longer Source: Haver, abrdn, as at September 2022 What this means for the rest of the worldThis will tend to exacerbate the global spill-overs, with the Fed continuing to export tight financial conditions to the rest of the world through the dollar-based financial system. Emerging market (EM) countries with large external imbalances are likely to be especially vulnerable given the risk of capital flight and currency crises. Even in EMs where external vulnerabilities are low, the global recession will weigh on growth via trade, financial and confidence channels. China's slowdown…China's 2022 growth target is out of reach while headwinds for next year are intensifying. Monetary policy may be easing, but it's difficult to gain traction while structural headwinds from Covid restrictions and the property slump remain in place. While an exit strategy for the country's 'zero-Covid' policy may be revealed during the 20th Party Congress in October, we now think an actual exit may have to wait until the third quarter of 2023. The ramping up of infrastructure spending will help to shore up growth and reduce the risks of a hard landing. However, there are limits to how much this will help. …Europe has its own problemsEven before the US recession hits, Europe faces the prospect of huge terms-of-trade, real income and energy shocks pushing the Eurozone economy into recession by the fourth quarter of this year. Our European gas-supply scenarios envisage further energy rationing to be phased in across various sectors, particularly in Germany. The risks may materialise into even more severe outcomes. Inflation is everyone's problem (for now)Near-term energy supply shortages should keep headline inflation elevated throughout the northern hemisphere winter, especially in Europe. Beyond the short term, however, the global recession will weigh heavily on commodity demand. Supply-chain bottlenecks continue to improve despite the effects of China's zero-Covid policies. As central bank monetary tightening starts to restrict product and labour demand, the scene will be set for significant disinflation - a slowing of price rises - throughout 2023 and especially 2024. With falling headline and core inflation likely to help re-anchor inflation expectations, monetary policy can return to supporting economic growth from the second half of next year. We anticipate the appropriate path for policy, given the likely increase in unemployment and fall in inflation, will see rates once again reach the effective lower bound for much of the developed world. Political changeThe US Inflation Reduction Act demonstrates the kind of constructive, albeit modest, and market-moving legislation that can be passed should the Democrats keep hold of both houses of Congress in November's mid-term elections. However, a Republican victory would usher in another period of stasis. Elsewhere, the upcoming Italian election is likely to result in a new right-wing government, which may exacerbate tensions with the rest of the European Union. In another sign of the impact of inflation on politics, the new UK government of Prime Minister Liz Truss has significantly shaken up the policy mix, with large macroeconomic and market implications. Similar moves are possible in other European countries. Meanwhile, the war in Ukraine will roll on, and sharpen the widening divide between the West and a more closely-aligned Russia-China pairing. Most-likely scenarios lead to recession…Not only does our base-case scenario involve a global recession (see Figure 3), but adding up the probabilities of all the scenarios consistent with recession gives a combined 55% probability. This means a global recession in one form or another is more likely than not, most probably within the next two years. Figure 3: We expect an even deeper, and earlier, global recession than we had previously forecast Source: abrdn, as of September 2022 We're still concerned about imbalances in the Chinese property sector on top of those already included in our base case, motivating our 'China stress and slowdown' scenario. We also think a Covid 'vaccine escape' scenario is still plausible given what we know about viral mutations. Both these scenarios remain consistent with a global recession, but with quite different drivers than in our base case. Meanwhile, we've recalibrated our 'stagflationary shock' scenario - based on expectations of European energy shortages and EM crises - so that it also leads to global recession. That said, another, more positive, scenario - 'Fed walks the tightrope' - may deliver a soft-landing for the global economy. But it would require a lot to go right for this to happen. Author: abrdn Research Institute |

|

Funds operated by this manager: Aberdeen Standard Actively Hedged International Equities Fund, Aberdeen Standard Asian Opportunities Fund, Aberdeen Standard Australian Small Companies Fund, Aberdeen Standard Emerging Opportunities Fund, Aberdeen Standard Ex-20 Australian Equities Fund (Class A), Aberdeen Standard Focused Sustainable Australian Equity Fund, Aberdeen Standard Fully Hedged International Equities Fund, Aberdeen Standard Global Absolute Return Strategies Fund, Aberdeen Standard Global Corporate Bond Fund, Aberdeen Standard International Equity Fund , Aberdeen Standard Life Absolute Return Global Bond Strategies Fund, Aberdeen Standard Multi Asset Real Return Fund, Aberdeen Standard Multi-Asset Income Fund

|

25 Oct 2022 - 10k Words

|

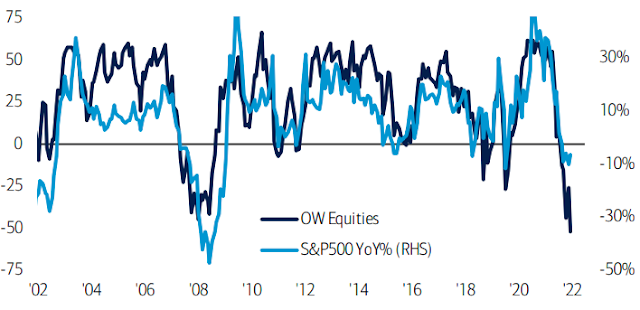

10k Words Equitable Investors October 2022 We are in to the home stretch for CY2022, the December quarter, and can paint a fairly dire picture of how investment and capital markets have faired. Global M&A activity is down 33%, while equity capital raised is down 65% according to dealogic data. Acquisitions of VC-backed businesses have dived in number, as Pitchbook charts. Gavekal shows the drawdown in dollars across equity and debt markets in 2022 dwarfs the GFC. And yet despite the declines, fund managers' equity allocations have been slashed according to both Bank of America and Goldman Sachs. In Australia, economists' inflation expectations have inched higher according to Bloomberg, while consumer sentiment has plunged based on the ANZ-Roy Morgan survey. Meanwhile, HFI Research chart's the decline in hydrocarbons in storage in the US in 2022 tracking well below prior years. EIA's own chart tells a similar story relative to the 5-year range. Global M&A in CY2022 year-to-date relative to same period in 2021 Source: dealogic, WSJ Global Equity Capital Markets activity in CY2022 year-to-date relative to same period in 2021 Source: dealogic, WSJ Acquisitions in the US of VC-backed businesses Source: PitchBook Drawdown in total market capitalisation of US equity & fixed income Source: Gavekal Research, Bloomberg, Macrobond Hedge funds and muutal funds slashed equity exposure Source: Goldman Sachs, ICI (via zerohedge) BofA Fund Manager Survey shows allocation to equities at all-time low Source: Bank of America Fund Manager Survey Survey of Australian economists' inflation expectations Source: Bloomberg ANZ Consumer Sentiment US Big 4 Storage ( Crude with Strategic Petroleum Reserve + Gasoline + Distillate + Jet Fuel) US crude oil stocks Source: US Energy Information Administration October Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions. Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components. Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog |

24 Oct 2022 - Performance Report: Airlie Australian Share Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund is long-only with a bottom-up focus. It has a concentrated portfolio of 15-35 stocks (target 25). The fund has a maximum cash holding of 10% with an aim to be fully invested. Airlie employs a prudent investment approach that identifies companies based on their financial strength, attractive durable business characteristics and the quality of their management teams. Airlie invests in these companies when their view of their fair value exceeds the prevailing market price. It is jointly managed by Matt Williams and Emma Fisher. Matt has over 25 years' investment experience and formerly held the role of Head of Equities and Portfolio Manager at Perpetual Investments. Emma has over 8 years' investment experience and has previously worked as an investment analyst within the Australian equities team at Fidelity International and, prior to that, at Nomura Securities. |

| Manager Comments | The Airlie Australian Share Fund has a track record of 4 years and 4 months and therefore comparison over all market conditions and against its peers is limited. However, the fund has outperformed the ASX 200 Total Return Index since inception in June 2018, providing investors with an annualised return of 8.37% compared with the index's return of 5.79% over the same period. On a calendar year basis, the fund hasn't experienced any negative annual returns in the 4 years and 4 months since its inception. Over the past 12 months, the fund's largest drawdown was -16.29% vs the index's -11.9%, and since inception in June 2018 the fund's largest drawdown was -23.8% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in February 2020 and lasted 9 months, reaching its lowest point during March 2020. The fund had completely recovered its losses by November 2020. The Manager has delivered these returns with 0.02% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 four times over the past four years and which currently sits at 0.53 since inception. The fund has provided positive monthly returns 97% of the time in rising markets and 11% of the time during periods of market decline, contributing to an up-capture ratio since inception of 111% and a down-capture ratio of 97%. |

| More Information |

24 Oct 2022 - Investment Perspectives: A closer look at US housing

21 Oct 2022 - Hedge Clippings |21 October 2022

|

|

|

|

Hedge Clippings | Friday, 21 October 2022 It wasn't so long ago that most Australians were somewhat embarrassed - whatever their political affiliations - by the turnover of residents of The Lodge. It was a tumultuous period, following 11 years of political stability under John Howard. Rudd yo-yo'd with Gillard before the Liberals got into the act with Tony Abbott, Malcolm Turnbull, and then Scomo taking the keys. Oh! to have the government's removalist contract during those heady years! On the face of it, those times seem well past under Albo (PM number 7 since Kevin '07 if you count him twice) introduced his seemingly steady hand. Not to be outdone, it seems the UK is intent on going down the same track. Since Labour's Tony Blair resigned in 2007 after 10 years as PM (interestingly almost shadowing John Howard's tenure, albeit on the opposite side of politics, although both supported the invasions of Afghanistan and Iraq) Great Britain has had 5 PM's, and within a week that will rise to 6. Who knows, it may even herald the return of Boris Johnson to mirror the Gillard - Rudd years? However much we might have felt things were a little crazy in Canberra in those days, surely nothing comes close to the chaos that seems to have enveloped Westminister over the past six months or so. One sort of knew that life under Boris would be a roller coaster - in many ways that's what he promised - even if his eventual demise was akin to something out of Alice in Wonderland and the Mad Hatter's tea party, except Boris always made a show of being hatless, and the tea party was replaced by champagne in the garden at Number 10. The whole selection process for his successor seemed equally bizarre, as two candidates from the same party went hammer and tongs at each other in a series of televised debates, with the loser among their peers getting the nod from the conservative party faithful. The final outcome (with the benefit of hindsight of course) was the elevation of Liz Truss, formerly anti-monarchy, as PM, which seemed a triumph of ambition over ability, or as King Charles lll was heard to mutter; 'Back again? Dear oh dear!'. No wonder! All this might be amusing (or at least "bemusing") were it not so serious. Once looked up to (by some at least) as the centre of democracy, and the cornerstone of the World's economy, the UK is now in political and economic disarray at the very time stability in both is required. One can only hope that given the importance of the task, the next incumbents of Numbers 10 and 11 Downing Street last a little longer, and restore some sense of order. Back home, the Albanese government appears to have restored stability to Australia in an unstable world. Next week the new Treasurer brings down his first budget, with the main thrust well telegraphed via the media either to get feedback (abandon legislated Stage lll tax cuts at your peril) or to soften us up for reality (live within your means, and accept inflation, and higher interest rates). Meanwhile, the week after next the RBA meets on Cup Day, November 1st, with the US FOMC meeting on November 1st & 2nd. Both are likely to result in a rate rise, although the RBA's might only be 0.25%, while the FOMC is poised for a 93% probability of another 0.75% hike according to CME Group's Fed Watch Tool. With reports of mortgage stress and refinancing increasing, and impending price rises as a result of the widespread floods, one would expect that a rise of 0.25% from the RBA will be sufficient. The Inflation Reduction Act will drive US' efforts towards net-zero | 4D Infrastructure 'Small Talk' - Mood Swings | Equitable Investors |

|

|

September 2022 Performance News Insync Global Quality Equity Fund Bennelong Twenty20 Australian Equities Fund Quay Global Real Estate Fund (Unhedged) |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

21 Oct 2022 - RBA shows some patience with a return to neutral territory

|

RBA shows some patience with a return to neutral territory Pendal October 2022 |

|

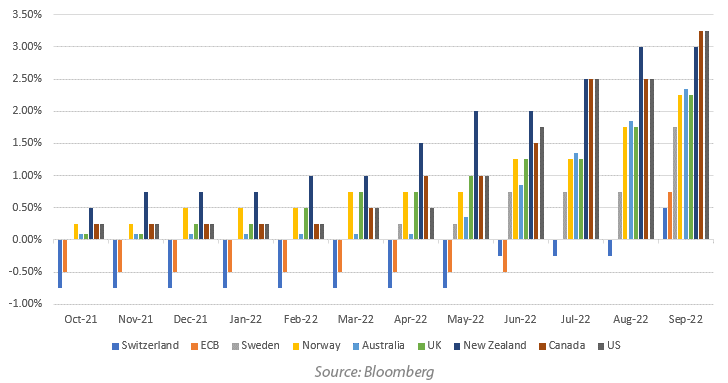

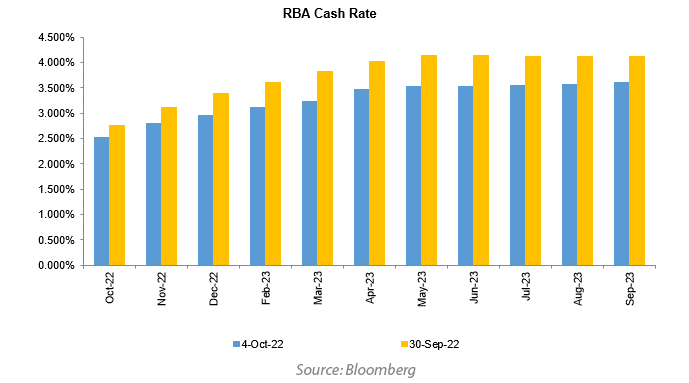

The Reserve Bank of Australia (RBA) surprised the market this month when raising the cash rate by 25 basis points to 2.60%. The market had assigned an 85% probability of the RBA hiking by 50 basis points. Governor Lowe dropped a hint last month that the pace of tightening would slow when he commented that "the case for a slower pace of increase in interest rates becomes stronger as the level of the cash rate rises". It was a case of a rising tide lifts all boats. As the following graph shows, central banks globally continued to tighten monetary policy aggressively in September. In Sweden the Riksbank tightened by a more than expected 100 basis points. The Federal Reserve, Bank of Canada, European Central Bank and Swiss National Bank (the last remaining member of the negative interest rate policy club) all raised their rates by 75 basis points. The RBA, Bank of England and Norges Bank were all in the 50 basis point hike camp last month.

However, unlike other central banks, the RBA has shown some patience with this move. Rate hikes normally take 2 to 3 months to show up in any data given lags between the RBA hikes and the higher rates hitting mortgages. One of the key lines out of the statement yesterday was "One source of uncertainty is the outlook for the global economy, which has deteriorated recently". The UK Government's mini budget released last month was the source of much financial turmoil last month, the moves (and lack of liquidity) were astonishing late in the month. The RBA is also acutely aware of the large amount of fixed rate mortgages that roll off over 2023. The national accounts also reflected a drop in the household savings rate, indicating that the large savings buffers that households have built over the past 2 years may start to be called upon as cost of living pressures rise. The decision to raise by a less than expected 25 basis points yesterday resulted in the market pricing in a terminal cash rate of 3.6% in 1 years time. At the end of September this was around 4.1%.  Back around neutral the RBA now thinks it has time on its side. Their hope will be for better behaved CPI numbers in the quarters ahead. The Sep Quarter CPI, due out later this month, should show elevated yet slowing CPI. Our initial forecast is for a 1.4% increase, although electricity subsidies in WA and Victoria, and a lesser extent Queensland, could mean a lower number. 1.4% would be no cause for celebration but after a 2.1% and a 1.8% in recent quarters it is in the right direction. Governor Lowe will likely take his next round of speeches reiterating their preparedness to tackle inflation with above neutral rates if needed. "The Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that" was the final line of yesterday's decision. For now though, reopening of supply chains, anchored inflation expectations and falling commodity prices are working in their favour. The key domestically will be how tight labour markets feed into wage outcomes over the next year. The RBA is prepared for 3.5% to 4% increases to wages, as many agreements are now showing, but will be alert for any trend higher. Immigration is making a welcome comeback and may well impact enough in the next 12 months for the RBA to get their way. However, the jobs market is unlikely to be back at pre COVID conditions until 2024 so the RBA patience, although welcome, may be tested again. Author: Tim Hext, Portfolio Manager and Head of Government Bond Strategies |

|

Funds operated by this manager: Pendal Focus Australian Share Fund, Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Regnan Global Equity Impact Solutions Fund - Class R, Regnan Credit Impact Trust Fund |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

20 Oct 2022 - Performance Report: Insync Global Capital Aware Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Insync invests in a concentrated portfolio of high quality companies that possess long 'runways' of future growth benefitting from Megatrends. Megatrends are multiyear structural and disruptive changes that transform the way we live our daily lives and result from a convergence of different underlying trends including innovation, politics, demographics, social attitudes and lifestyles. They provide important tailwinds to individual stocks and sectors, that reside within them. Insync believe this delivers exponential earnings growth ahead of market expectations. The fund uses Put Options to help buffer the depth and duration that sharp, severe negative market impacts would otherwide have on the value of the fund during these events. Insync screens the universe of 40,000 listed global companies to just 150 that it views as superior. This includes profitability, balance sheet performance, shareholder focus and valuations. 20-40 companies are then chosen for the portfolio. These reflect the best outcomes from further analysis using a proprietary DCF valuation, implied growth modelling, and free cash flow yield; alongside management, competitor, and industry scrutiny. The Fund may hold some cash (maximum of 5%), derivatives, currency contracts for hedging purposes, and American and/or Global Depository Receipts. It is however, for all intents and purposes, a 'long-only' fund, remaining fully invested irrespective of market cycles. |

| Manager Comments | The Insync Global Capital Aware Fund has a track record of 13 years and has underperformed the Global Equity Index since inception in October 2009, providing investors with an annualised return of 9.16% compared with the index's return of 10.04% over the same period. On a calendar year basis, the fund has experienced a negative annual return on 2 occasions in the 13 years since its inception. Over the past 12 months, the fund's largest drawdown was -29.45% vs the index's -15.77%, and since inception in October 2009 the fund's largest drawdown was -29.45% vs the index's maximum drawdown over the same period of -15.77%. The fund's maximum drawdown began in January 2022 and has lasted 8 months, reaching its lowest point during September 2022. The Manager has delivered these returns with 0.95% more volatility than the index, contributing to a Sharpe ratio which has fallen below 1 five times over the past five years and which currently sits at 0.65 since inception. The fund has provided positive monthly returns 81% of the time in rising markets and 21% of the time during periods of market decline, contributing to an up-capture ratio since inception of 60% and a down-capture ratio of 85%. |

| More Information |

20 Oct 2022 - The Rate Debate: Are central banks at risk of blowing up markets?

|

The Rate Debate - Episode 32 Are central banks at risk of blowing up markets? Yarra Capital Management 04 October 2022 The RBA hiked rates for the sixth consecutive month. With lead indicators showing signs of inflation coming off the boil and European banks starting to see stress, cracks are forming in the credit and equity markets. Have central banks tightened too aggressively risking a recession? Speakers: |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

.jpg)

%20-%20HFI%20Research.png)