NEWS

8 Nov 2022 - Performance Report: Quay Global Real Estate Fund (Unhedged)

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund will invest in a number of global listed real estate companies, groups or funds. The investment strategy is to make investments in real estate securities at a price that will deliver a real, after inflation, total return of 5% per annum (before costs and fees), inclusive of distributions over a longer-term period. The Investment Strategy is indifferent to the constraints of any index benchmarks and is relatively concentrated in its number of investments. The Fund is expected to own between 20 and 40 securities, and from time to time up to 20% of the portfolio maybe invested in cash. The Fund is $A un-hedged. |

| Manager Comments | The Quay Global Real Estate Fund (Unhedged) has a track record of 6 years and 10 months and has outperformed the BBAREIT Index since inception in January 2016, providing investors with an annualised return of 6.07% compared with the index's return of 5.09% over the same period. On a calendar year basis, the fund has only experienced a negative annual return once in the 6 years and 10 months since its inception. Over the past 12 months, the fund's largest drawdown was -22.45% vs the index's -12.93%, and since inception in January 2016 the fund's largest drawdown was -22.45% vs the index's maximum drawdown over the same period of -23.56%. The fund's maximum drawdown began in January 2022 and has so far lasted 9 months, reaching its lowest point during September 2022. During this period, the index's maximum drawdown was -22.94%. The Manager has delivered these returns with 1.53% more volatility than the index, contributing to a Sharpe ratio for performance over the past 12 months of -0.85 and for performance since inception of 0.45. The fund has provided positive monthly returns 72% of the time in rising markets and 34% of the time during periods of market decline, contributing to an up-capture ratio since inception of 68% and a down-capture ratio of 72%. |

| More Information |

8 Nov 2022 - How green hydrogen will impact natural gas investors

|

How green hydrogen will impact natural gas investors Pendal October 2022 |

|

REPLACING natural gas with "green hydrogen" is often touted as a way to solve "stranded asset" risk for fossil fuel assets such as gas pipelines. The International Energy Agency believes hydrogen has the "potential to play a key role in a clean, secure and affordable energy future". As part of a renewable energy transition, some natural gas pipeline and storage infrastructure could be repurposed for hydrogen. The clean fuel could even be blended into natural gas. But is it really a solution for investors worried about holding "stranded" fossil fuel assets that no longer have an economic use due to redundant technology or high costs? There is no clear-cut answer right now - and advances are required to make hydrogen technology economical, says Murray Ackman, a credit ESG analyst in Pendal's Income and Fixed Interest team. Stranded asset risk"Stranded asset risk is very tangible for fixed income investors when you're looking at a seven- or 10-year bond," says Ackman. "You have to take a view on what may or may not happen during that time frame. "Credit ratings, access to financing, cost of funding, demand for the products, regulation - those are the kind of ESG risks that we're looking at." Some risks are clear cut: "Coal is something that needs to be phased out very quickly, so if you're coal or coal-adjacent like a train company that hauls coal from the mines, there is a clear stranded-asset risk in the short term. "The cost of funding might become higher and there could be a chance of default or ratings downgrades." But the risks to natural gas assets - and the potential for hydrogen to be a solution - are more difficult to pin down. A natural gas replacementPart of the problem is conflating potential industrial and domestic uses for hydrogen. "There are some very clear uses for hydrogen as a replacement for natural gas in industrial processes like producing fertiliser, powering heavy vehicles and aircraft or making steel," says Ackman. "And there's this moon shot that it will be a one-for-one replacement for natural gas," says Ackman. In that scenario, parts of the natural gas pipeline and storage infrastructure can be repurposed for hydrogen, protecting their value well into the future and saving them from becoming stranded assets. "This is what industry is betting big on. It's tricky because the economics don't stack up yet - but then that was true for solar panels for a long time too." For households, the benefits of hydrogen are less clear cut. Hydrogen can be blended into the natural gas but above about 10 or 20 per cent it can damage some existing pipes. "And if you go any higher 20 per cent, you need to change household appliances anyway - if you're changing your stove to something that can accept hydrogen, why not just change to electricity?" The weighing of these different views is an important part of the investment process, says Ackman. "It's very much a question mark whether it is the solution. In our investable universe, we've got some gas distribution networks. "The question is 'why are you talking about how good hydrogen is?' "Is it because you really believe it? Or is it because it's an existential threat and without it you have a potentially stranded asset in the future?" Author: Murray Ackman, Credit ESG analyst |

|

Funds operated by this manager: Pendal Focus Australian Share Fund, Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Regnan Global Equity Impact Solutions Fund - Class R, Regnan Credit Impact Trust Fund |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

7 Nov 2022 - Collins St Convertible Notes Webinar Recording - New Investment Opportunity & Fund Update

|

Collins St Convertible Notes Webinar Recording - New Investment Opportunity & Fund Update Collins St Asset Management Oct 2022 |

|

|

The Co-Founders of Collins St Asset Management, Michael Goldberg and Vasilios Piperoglou, alongside Head of Distribution & Investor Relations, Rob Hay, hosted an interactive webinar where they announced - Announce the details of the October and November capital raisings and the way in which both existing and prospective clients can invest into the Fund. - Provide an update on the performance and positioning of the Fund, including some topical issues around increasing interest rates and the negotiation of conversion prices given recent market volatility. Speakers: Michael Goldberg, Co-Founder, Vasilios Piperoglou, Co-Founder, and Rob Hay, Distribution & Investor Relations

|

4 Nov 2022 - Hedge Clippings |04 November 2022

|

|

|

|

Hedge Clippings | Friday, 04 November 2022

Last week's Hedge Clippings left the subject of Jim Chalmers and his first budget well alone, probably because at first sight there didn't seem to be much to it. Apart from flagging that inflation was an issue, that energy prices were rising, it left the hard decisions to be made in next year's May budget. It seemed to us that for the time being the government was keen to deliver on some core deliverables while making sure they didn't break the core promises made during the election campaign, and in doing so frighten the punters - aside of course from the promise to deliver lower energy prices. As such, Chalmers kicked the can down the road to the May budget, while at the same time softening us up for the fact that times are going to get tougher, and that inflation was "the number one scourge" while there wasn't much he's going to be able to do about it. The fact is that inflation both here and abroad shows no sign of easing - in fact, the opposite, particularly given the lagging effect of floods - and in spite of the efforts of central banks to try to curb it. As such, this week's rate hike came as little surprise, and the RBA's increase of 0.25% seemed almost insignificant compared with the US Fed's 0.75%, with the same from the Bank of England. One thing seems certain - the outlook for inflation is deteriorating, at the same time as its duration is extending. Inevitably interest rates will keep rising until the inflation trend reverses, and in the interim - however long that may end up being - the potential for a recession, particularly in the US, and the UK - keeps rising in line with the interest rates. If we cast our minds back to just 12 months ago, the RBA wasn't expecting inflation (and interest rates) to be where they are today. Now they're forecasting inflation of 8% this year, before falling back to around the 3% mark in 2024. The problem is that their past forecasting record is not too good, so while we hope they're right, we suspect they'll be found to be wrong. |

|

|

Magellan Infrastructure Strategy Update | Magellan Asset Management The storm of inflation | Kardinia Capital |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

4 Nov 2022 - Global equities: Three different scenarios and their probabilities

|

Global equities: Three different scenarios and their probabilities Pendal October 2022 |

|

THE December quarter may see a rally, but equities will be range bound for the next few years, with rotations between value and growth stocks, argues Pendal global equities fund manager Chris Lees. "Our base-case scenario is that this interest rate shock-crisis 'valuation' bear market is morphing into a recessionary 'profits' bear market, with the S&P 500 already down 25% year-to-date. "But we don't expect widespread financial contagion, where markets would fall by more than 50% like in 2008. "Our current scenario analysis is 50% bullish and 50% bearish," says Lees, who co-manages Pendal Global Select Fund with long-time colleague Nudgem Richyal. "Short-term reasons to be bearish include a recession potentially becoming a financial crisis or contagion. "Medium-term reasons to be bullish include the US Federal Reserve regaining credibility with inflation and interest rates stabilising next year," Lees says. Lees breaks down the probability of three scenarios as follows:

What does it mean for investing?In recent months the fund has sold economically cyclical stocks with earnings risk due to recession, and purchased more economically resilient companies, including some in the emerging markets of Brazil and Indonesia. "Not many people know that the Brazilian and Indonesian equity markets have outperformed the USA stock market this year - even in US dollars - which is another example of just how different this bear market is from previous bear markets when they fell much harder," Lees says. The fund is also considering, or as Lees puts it "tiptoeing" around, neighbourhoods where they see positive relative fundamentals and valuations, with stabilising relative share prices. "Some quality growth stocks are already down 50 per cent year to date and are beginning to stabilise," Lees says. "And some emerging markets, notably Brazil and Indonesia." He also says its worth looking for opportunities to arise from the eventual turn in the US dollar, which in his words is "inevitable but not necessarily imminent".

Author: Chris Lees and Nudgem Richyal - co-manages Pendal Global Select Fund |

|

Funds operated by this manager: Pendal Focus Australian Share Fund, Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Regnan Global Equity Impact Solutions Fund - Class R, Regnan Credit Impact Trust Fund |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

3 Nov 2022 - Magellan Infrastructure Strategy Update

|

Magellan Infrastructure Strategy Update Magellan Asset Management October 2022 |

|

Gerald Stack and Ofer Karliner, CFA, discuss the recent reporting season, the European energy crisis and provide an outlook for companies in Magellan's Infrastructure Strategy. Speaker: Gerald Stack Deputy CIO, Head of Infrastructure and Portfolio Manager |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

2 Nov 2022 - Around the world in 200 Meetings, Chris Willcocks: Management Teams

|

Around the world in 200 Meetings, Chris Willcocks: Management Teams Alphinity Investment Management October 2022 From Stockholm to Zurich, then a week in the UK at a European Industrials Conference. Chris Willcocks details his time spent overseas visiting companies, seeing their assets and operations and meeting management teams. Speakers: Chris Willcocks, Portfolio Manager & Elfreda Jonker, Client Portfolio Manager This information is for advisers & wholesale investors only. |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Sustainable Share Fund Disclaimer |

1 Nov 2022 - The Value in Securing Critical Mineral Supplies

|

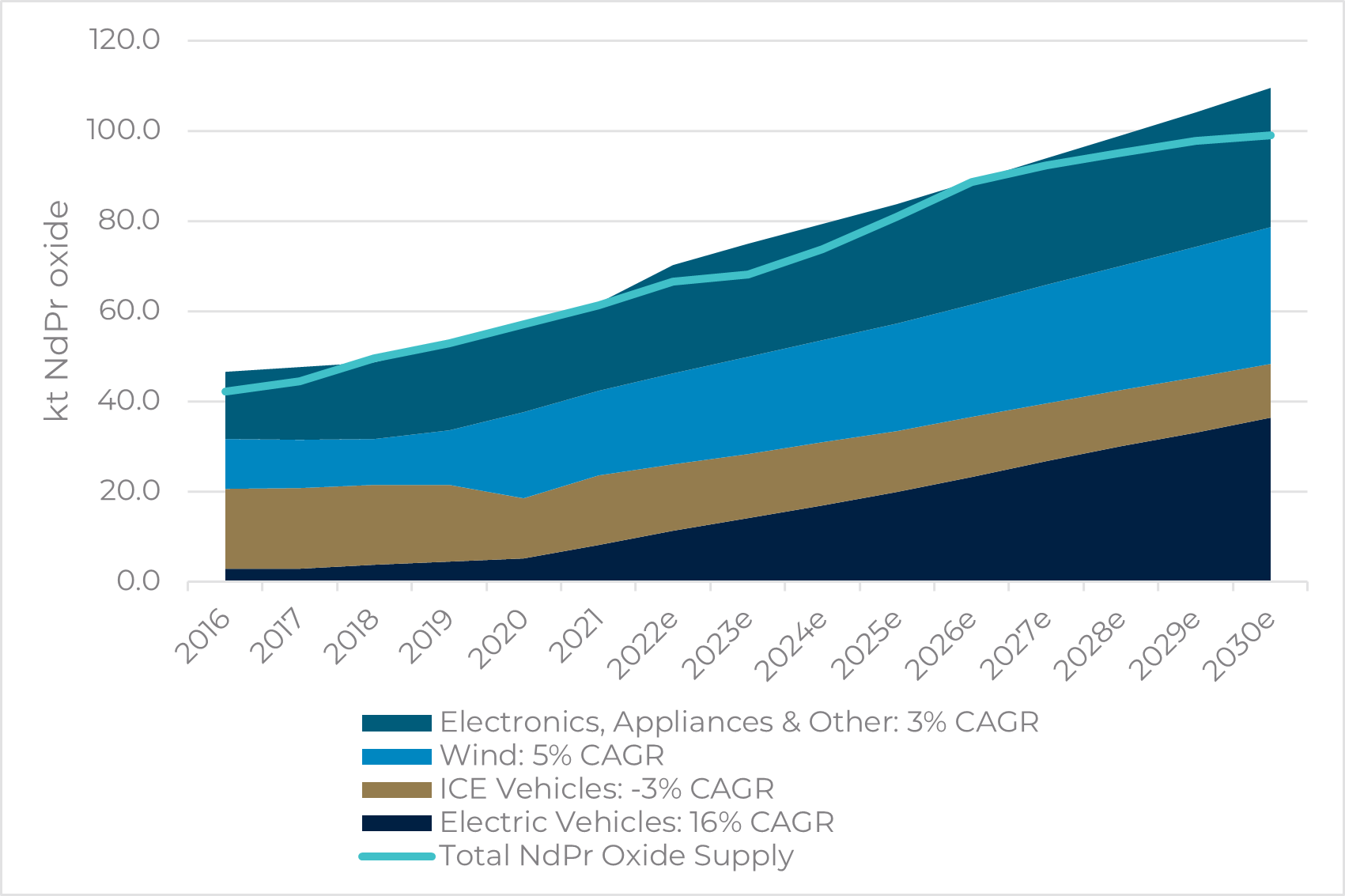

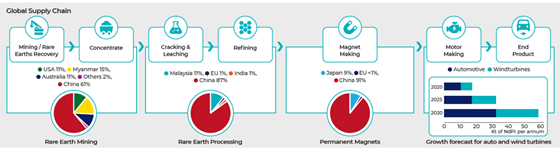

The Value in Securing Critical Mineral Supplies Tyndall Asset Management October 2022 Supply chain risk creates investment opportunities The concentration of supply of critical minerals related to decarbonisation is an issue that has been highlighted by major Western economies as a risk to securing the materials needed to meet climate goals. The US Government acknowledged its concerns around this supply chain risk within the recently passed Inflation Reduction Act. Amongst other issues, this Act outlines potential tax credits for Electric Vehicle purchases if certain conditions have been met, including that no critical mineral used in the vehicle is sourced from a "foreign entity of concern". Figure 1: Rare earths - as Neodymium-Praseodymium Oxide (NdPr) demand - EV's and wind to drive total demand growth of 6% CAGR to 2030 Source: Barrenjoey, Tyndall AM The supply dynamics of key materials needed for decarbonisation are already well understood given they are part of our most consumed metals, including copper and nickel. Others, which form an integral part of the road to electrification, are coming from an almost insignificant demand base relative to their outlook. This includes materials such as lithium, cobalt and rare earths. China's control of these materials needed to transition away from fossil fuels is extraordinary, dwarfing even that of OPEC's control of global oil markets. China controls 80% of battery raw material refining, 80% of solar panel manufacturing and 60% of wind turbine installations. Notably, while the level of market share is high for these manufactured products necessary in the energy transition, China does not dominate the supply of the raw materials needed to produce them. This provides global consumers with the opportunity to support new entrants to these markets to mitigate the risk around supply chains. However, rare earths are an exception. Figure 2: Rare Earths global supply chain

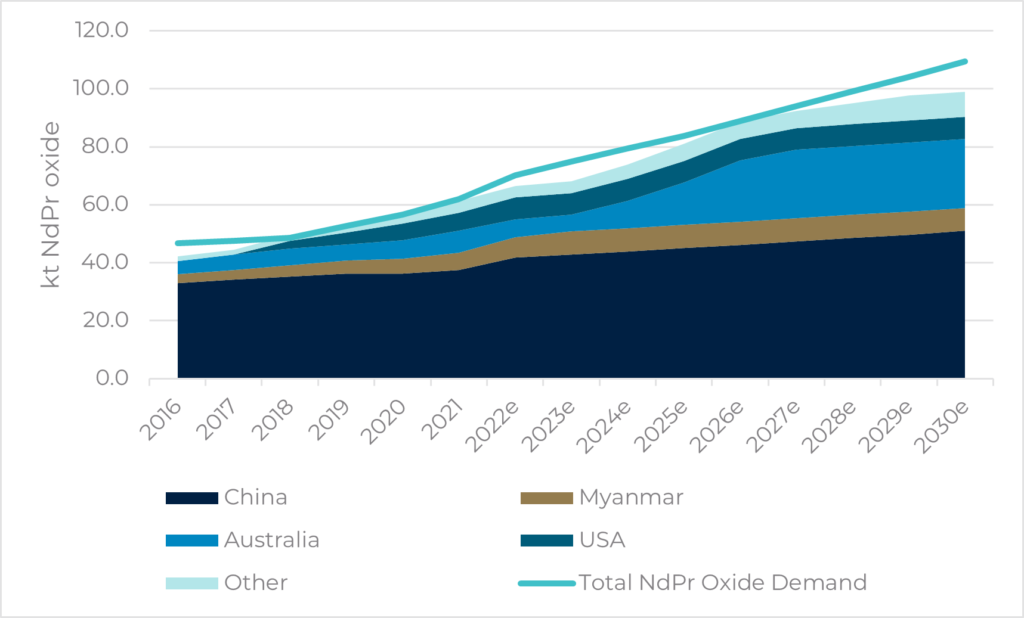

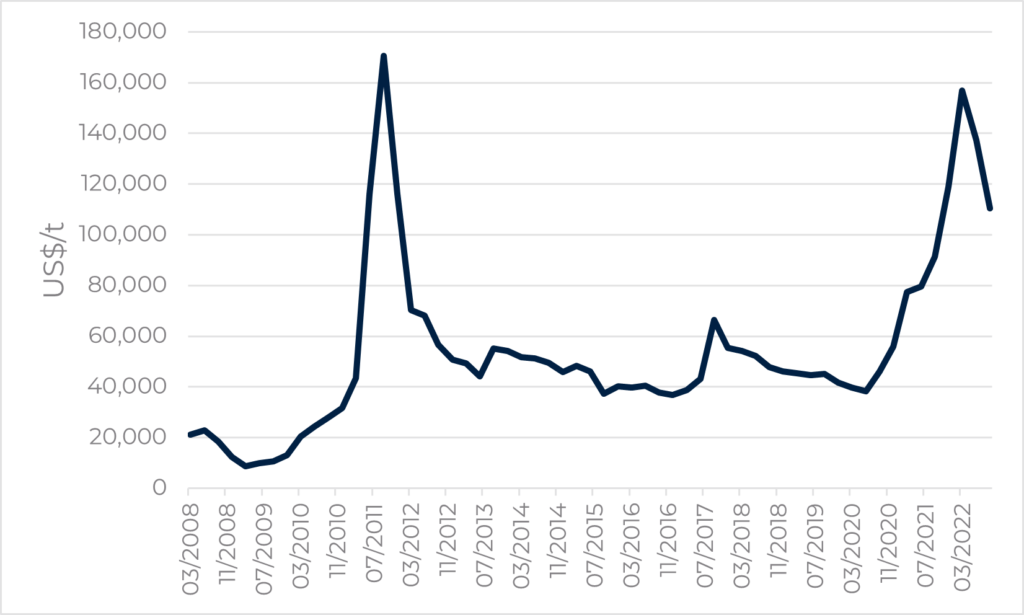

Source: Lynas Rare Earths China controls almost 90% of rare earth processing and over 60% of rare earth mining. This number could be considered closer to 75% when including Myanmar volumes which are generally trucked across the border, implying an element of control over these mines by the Chinese. The high level of market control exerted by China historically has allowed its government to manage rare earth prices to levels that have generally deterred international competition. Figure 3: Rare Earths (as NdPr) supply by region - China expected to remain dominant, but significant growth forecast out of Australia

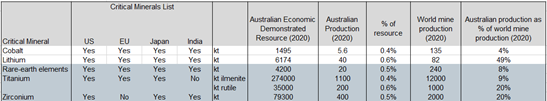

Source: Barrenjoey, Tyndall AM Environmental risks to supply chains China's growth and dominance in rare earth mining and processing were driven by lax environmental standards which resulted in some exploitation of the country's abundant resources. The Chinese Government's credible environmental efforts saw the introduction of regulations to reduce environmental harm, including through forced industry consolidation to improve monitoring and the introduction of an export quota system to limit over-production. While environmental standards have increased, China's largest producers of rare earths still have low ESG scores. For example, China Northern rare earths is rated by Sustainalytics as "Severe Risk" and ranks the company second last out of the 14,647 stocks covered. Myanmar's nascent rare earth industry is facing substantial claims of environmental and social damage, with an Associated Press exposé highlighting substantial ecological harm and major negative impacts to Myanmar from mining practices. Land of plenty Australia can capitalise on this dynamic. It is already a key supplier of many critical minerals vital for decarbonisation, although current production is only a small fraction of the country's demonstrated resource. This provides significant scope for growth. Figure 4: Key critical minerals on major economy lists and their Australian resource endowment

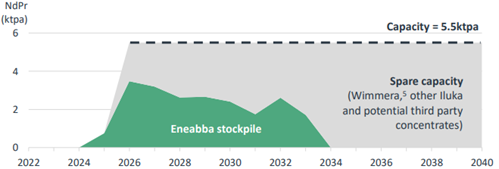

Source: Tyndall AM, Geoscience Australia Iluka's Eneabba project, located some 300km north of Perth in Western Australia, will be Iluka's relatively low-risk entry into rare earth production. It is slated to produce 2.7mtpa NdPr initially, scaling up to 5.5mtpa in later stages which equates to 7% of forecast demand (for reference, Lynas rare earths currently produces 6ktpa NdPr). Figure 5: Iluka's illustrative rare earth (as NdPr) production profile from Eneabba and the expected total capacity of the operation

Source: Iluka Resources While we usually have a healthy amount of scepticism when miners attempt to move beyond core competencies, the Eneabba project has several attributes that make it relatively low risk. These include:

While no new development is ever a lay-down misère, it is rare to find a development in the resources space with relatively low technical and financial risk to the operator. We believe the project could ultimately be worth in excess of A$2bn and account for almost half of Iluka's value, when factoring in contributions from other resources. It is also rare to find a business fully exposed to key critical minerals at material levels of market share including elements so strategically important for decarbonisation. Conclusion As Western economies pivot to ensure supply security along entire decarbonisation supply chains, we expect the market's appreciation of Iluka's rare earth exposure will grow and add significant value to our investment. The US Inflation Reduction Act's rules around critical mineral sourcing away from "foreign entities of concern" creates a strong rationale for Australian rare earths to attract a valuation premium. We expect this will be priced into Iluka over time. Figure 6: NdPr price history (the key rare earth elements used in battery manufacture)

Source: Steelhome Author: Stefan Hansen, Senior Research Analyst Funds operated by this manager: Tyndall Australian Share Concentrated Fund, Tyndall Australian Share Income Fund, Tyndall Australian Share Wholesale Fund Important information: This material was prepared and is issued by Yarra Capital Management Limited (formerly Nikko AM Limited) ABN 99 003 376 252 AFSL No: 237563 (YCML). The information contained in this material is of a general nature only and does not constitute personal advice, nor does it constitute an offer of any financial product. It does not take into account the objectives, financial situation or needs of any individual. For this reason, you should, before acting on this material, consider the appropriateness of the material, having regard to your objectives, financial situation, and needs. The information in this material has been prepared from what is considered to be reliable information, but the accuracy and integrity of the information is not guaranteed. Figures, charts, opinions and other data, including statistics, in this material are current as at the date of publication, unless stated otherwise. The graphs and figures contained in this material include either past or backdated data, and make no promise of future investment returns. Past performance is not an indicator of future performance. Any economic or market forecasts are not guaranteed. Any references to particular securities or sectors are for illustrative purposes only and are as at the date of publication of this material. This is not a recommendation in relation to any named securities or sectors and no warranty or guarantee is provided. |

31 Oct 2022 - Performance Report: Delft Partners Global High Conviction Strategy

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The quantitative model is proprietary and designed in-house. The critical elements are Valuation, Momentum, and Quality (VMQ) and every stock in the global universe is scored and ranked. Verification of the quant model scores is then cross checked by fundamental analysis in which a company's Accounting policies, Governance, and Strategic positioning is evaluated. The manager believes strategy is suited to investors seeking returns from investing in global companies, diversification away from Australia and a risk aware approach to global investing. It should be noted that this is a strategy in an IMA format and is not offered as a fund. An IMA solution can be a more cost and tax effective solution, for clients who wish to own fewer stocks in a long only strategy. |

| Manager Comments | The Delft Partners Global High Conviction Strategy has a track record of 11 years and 2 months and has outperformed the Global Equity Index since inception in August 2011, providing investors with an annualised return of 13.72% compared with the index's return of 12.13% over the same period. On a calendar year basis, the strategy has experienced a negative annual return on 2 occasions in the 11 years and 2 months since its inception. Over the past 12 months, the strategy's largest drawdown was -9.85% vs the index's -15.77%, and since inception in August 2011 the strategy's largest drawdown was -13.33% vs the index's maximum drawdown over the same period of -15.77%. The strategy's maximum drawdown began in February 2020 and lasted 1 year, reaching its lowest point during July 2020. The strategy had completely recovered its losses by February 2021. During this period, the index's maximum drawdown was -13.19%. The Manager has delivered these returns with 1.07% more volatility than the index, contributing to a Sharpe ratio which has fallen below 1 four times over the past five years and which currently sits at 1.02 since inception. The strategy has provided positive monthly returns 88% of the time in rising markets and 14% of the time during periods of market decline, contributing to an up-capture ratio since inception of 96% and a down-capture ratio of 90%. |

| More Information |

31 Oct 2022 - Performance Report: DS Capital Growth Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The investment team looks for industrial businesses that are simple to understand, generally avoiding large caps, pure mining, biotech and start-ups. They also look for: - Access to management; - Businesses with a competitive edge; - Profitable companies with good margins, organic growth prospects, strong market position and a track record of healthy dividend growth; - Sectors with structural advantage and barriers to entry; - 15% p.a. pre-tax compound return on each holding; and - A history of stable and predictable cash flows that DS Capital can understand and value. |

| Manager Comments | The DS Capital Growth Fund has a track record of 9 years and 9 months and has outperformed the ASX 200 Total Return Index since inception in January 2013, providing investors with an annualised return of 12.13% compared with the index's return of 7.88% over the same period. On a calendar year basis, the fund has only experienced a negative annual return once in the 9 years and 9 months since its inception. Over the past 12 months, the fund's largest drawdown was -21.56% vs the index's -11.9%, and since inception in January 2013 the fund's largest drawdown was -22.53% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in February 2020 and lasted 6 months, reaching its lowest point during March 2020. The fund had completely recovered its losses by August 2020. The Manager has delivered these returns with 1.53% less volatility than the index, contributing to a Sharpe ratio which has fallen below 1 five times over the past five years and which currently sits at 0.88 since inception. The fund has provided positive monthly returns 88% of the time in rising markets and 33% of the time during periods of market decline, contributing to an up-capture ratio since inception of 67% and a down-capture ratio of 66%. |

| More Information |