NEWS

7 Dec 2022 - Performance Report: Argonaut Natural Resources Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | At times, ANRF may consider holding higher levels of cash (max 30%) if valuations are full and it is difficult to find attractive investment opportunities. The Fund does not borrow for investment or any other purposes, but it may short sell securities as part of its portfolio protection strategies. |

| Manager Comments | The Argonaut Natural Resources Fund has a track record of 2 years and 11 months and therefore comparison over all market conditions and against its peers is limited. However, the fund has outperformed the ASX 200 Total Return Index since inception in January 2020, providing investors with an annualised return of 44.72% compared with the index's return of 6.9% over the same period. On a calendar year basis, the fund hasn't experienced any negative annual returns in the 2 years and 11 months since its inception. Over the past 12 months, the fund's largest drawdown was -19.06% vs the index's -11.9%, and since inception in January 2020 the fund's largest drawdown was -19.06% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in April 2022 and has so far lasted 7 months, reaching its lowest point during June 2022. During this period, the index's maximum drawdown was -11.9%. The Manager has delivered these returns with 3.5% more volatility than the index, contributing to a Sharpe ratio for performance over the past 12 months of 1.19 and for performance since inception of 1.73. The fund has provided positive monthly returns 83% of the time in rising markets and 36% of the time during periods of market decline, contributing to an up-capture ratio since inception of 200% and a down-capture ratio of 37%. |

| More Information |

7 Dec 2022 - Economists are idiots!

|

Economists are idiots! Yarra Capital Management November 2022 As a long-time card-carrying member of the economics fraternity Tim Toohey doesn't say this lightly: economists are idiots. Worse still, the forecasts made by the economics community collectively are directly influencing policy decisions at the Federal Reserve, which risk deepening the already likely recession in 1H 2023. Many readers may need little other proof that economists are idiots other than casual observation. The proof, though, comes not only through their collective inability to first detect the inflation shock of the past two years in advance; it is that they have yet to acknowledge that the source of the inflation shock has rapidly reversed. Of course, this is not the first time that economists have collectively failed to detect important economic events in advance, and it certainly won't be the last. However, in a quirk of fate, global monetary policy has arguably never been more influenced by the collective forecasts of private sector forecasters than they are today. The rationale for this increased influence is not because the Fed is actively engaging with more economists. It is because the Fed quietly changed how it decided to implement monetary policy in 3Q 2020. This calibration of monetary policy to a new model of long run inflation gives excessive weight to the forecasts of professional economists. The champion of this change in monetary policy implementation was Richard Clarida, then Vice Chairman of the Federal Reserve and who acted as the economic policy wonk for its non-economist Chair Powell. Now, there is nothing inherently wrong with trying to build a better mouse trap to gauge the vast and varying quality of inflation expectation survey points. Indeed, we noted the shift by the Fed to embrace this new inflation expectation model at the time and we puzzled over the decision to only show the output of this model on a quarterly basis and with a lag (so we replicated the model and converted to a monthly model). As soon as Clarida signalled the new framework, inflation expectations commenced rising steadily. This became a key plank in our forecast for early and sustained Fed rate hikes.

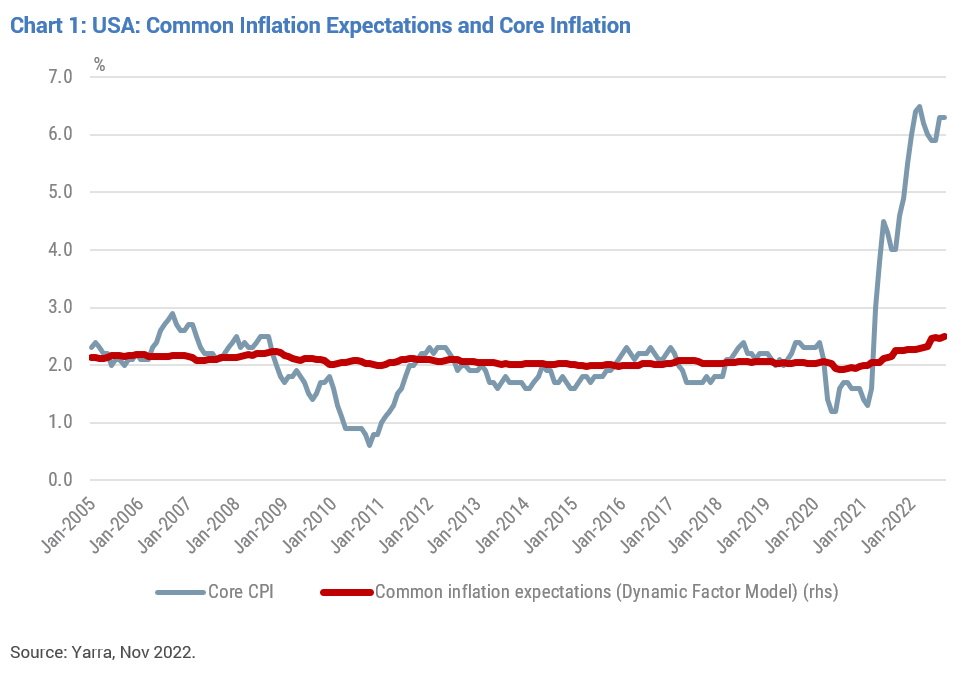

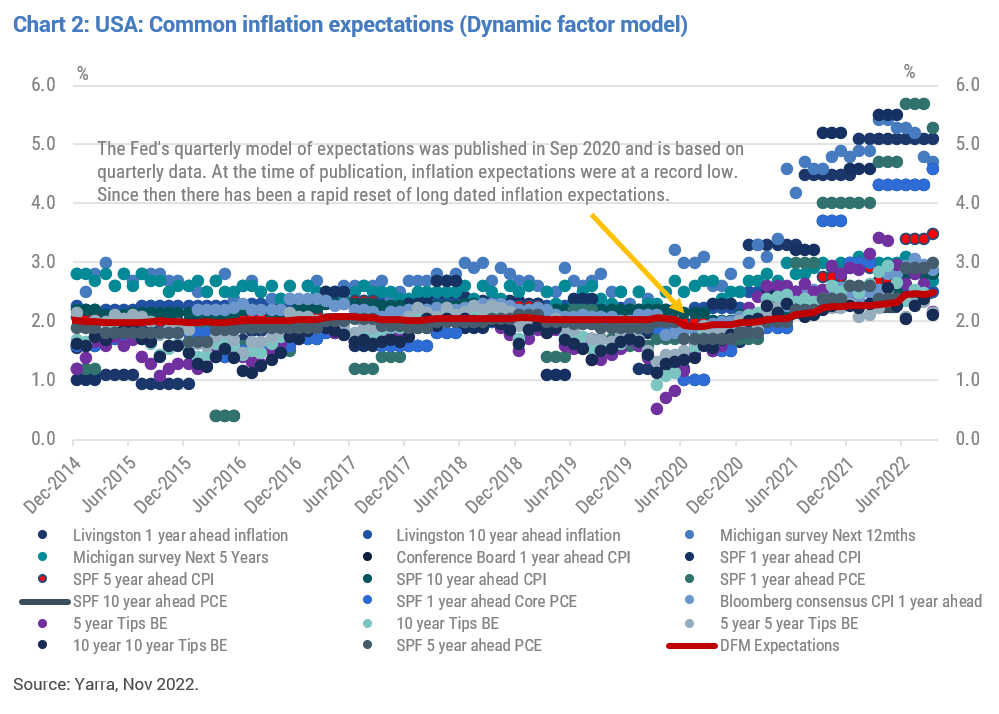

The Fed's official Common Inflation Expectations (CIE) model is currently only estimated up to the June quarter of 2022. As Chart 1 shows, it's more than likely that when the Fed publishes their next update that their CIE model will rise again, and this has no doubt helped reinforce the hawkish rhetoric that has come from all Fed officials in recent weeks. The idea here is that the Fed is still so worried by the rise in inflation expectations becoming embedded that they will commit to an ongoing series of rate rises in coming months. There are many data points that are collated in the CIE model and Chart 2 provides an update of our original model. The red line (DFM Expectations) is Yarra's replication of the Fed's CIE model, updated to the most recent available data. At first glance it's still concerning that there are lots of dots above the red line, suggesting the risks to long run inflation expectations are skewed higher in coming months.

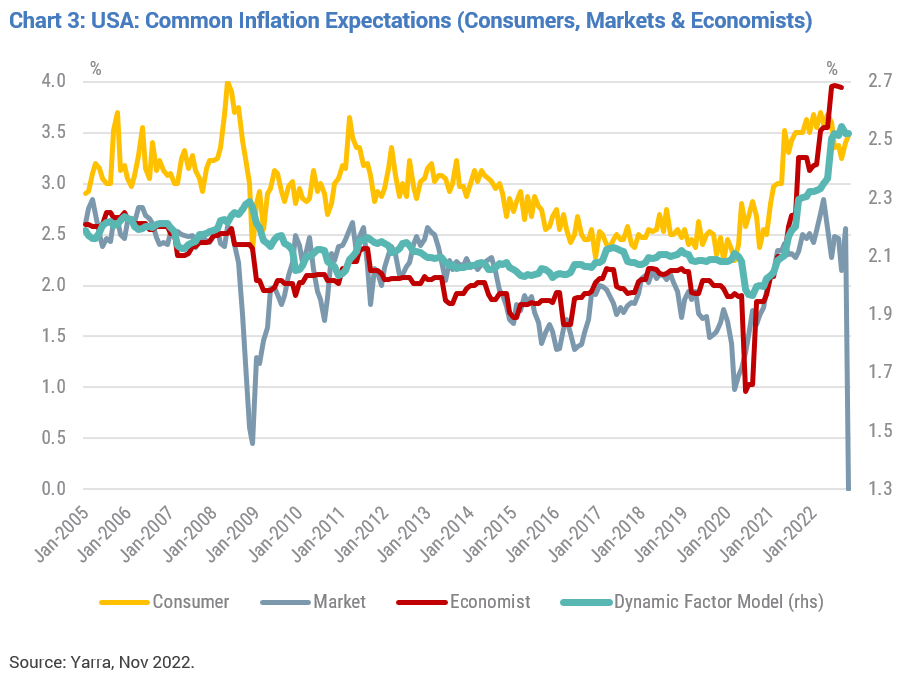

However, if we split data into the broad source of the inflation expectations - consumer, financial markets and economists - we start to see a different picture. Chart 3 shows that consumer and financial market average inflation expectations have already commenced a significant decline in long run inflation expectations.

So why is it that the common inflation expectation estimate, shown on the right-hand side of chart 3, has not peaked? The answer is simply because the Fed's model gives a higher weight to inflation expectations over longer term horizons since the design of the CIE model provides a bias to the 10-year projections from the survey of profession forecasters(1). In a knife fight to determine who is correct most often, I think most would conclude that the bond market has highly motivated participants constantly looking for signs on the direction of future inflation and focused on cashflow constrained consumers at the coal face of inflation who are acutely attuned to shifts in prices. The objective of the financial market economist is to formulate a view of how the world will evolve, communicate and defend that view - even if some of the incoming data is challenging that view - until the evidence is so overwhelming that they move to a different view of the world. This may be sub-optimal, but it is the reality. I should know, I've been doing it for over 25 years! There is clear inertia in their forecasting, with herding behaviour to other economists' views and a tendency to shadow the central bank economic forecasts (partly under the assumption of information asymmetry given that the central banks are vastly better resourced and notionally spend most of their time thinking about inflation). Financial market economists can also be shameless chameleons. I know of no other profession that will pass themselves off as health experts amid a pandemic, political analysts in the lead up to an election, tax professionals in the lead up to a Budget, valuation experts amid a market crash and, of course, military experts amid a global conflict. The point of all this preamble is to make the point that surveys of professional economists will not provide a lead on the consumer or financial markets when it comes to detecting major shifts in expectations. It is in this sense that economists are idiots. However, if a central bank chooses to calibrate its actions by giving a higher weight to economist surveys, then it makes them something worse than idiots. The recent release of the Fed minutes for September reveals the FOMC believes inflation expectations are relatively high but 'well anchored'. Perversely, though, they are forecasting virtually zero growth in 2022, years of future sub-trend economic growth and a rise in the unemployment rate consistent with recession. Yet they have lifted their inflation forecasts and, worse, declared the risks to their inflation forecasts remain skewed to the upside. What the FOMC should have noted was that inflation expectations have clearly peaked, inflation risks are clearly skewed to the downside and the sharp tightening of financial conditions via higher bond yields, wider corporate bond yields, weaker equity markets and booming US$ has made the need for further rate tightening redundant.

Collectively, financial markets and consumers have proven to be more alert to the signal of easing inflationary pressures whilst the economics profession has been relegated to facing the wall in the Dunce's corner. If economists are indeed relative idiots when it comes to forecasting inflation, then in gauging the all-important direction of inflation expectations, the Fed's decision to ascribe more weight to the forecasts of professional economists makes the FOMC worse. |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

6 Dec 2022 - Investment Perspectives: No, bond vigilantes don't exist for a monetary sovereign

5 Dec 2022 - Stock Story: ASML

|

Stock Story: ASML Magellan Asset Management October 2022 |

|

Lithography is the process by which powerful, fast and cheap microchips are made. Advances in how lithography systems imprint electronic circuitry patterns on silicon wafers govern enhancements in microchips and memory. In more detail, a lithography system is essentially a manufacturing machine whereby light is projected through a blueprint of the pattern to be printed. The system's optics shrink and focus the pattern onto a photosensitive silicon wafer (whereby a wafer is covered with chemicals that react with light). A series of other non-lithography steps are also carried out. To make a microchip, the process is repeated layer upon layer to create the components of the chip including the transistors, which are miniaturised semiconductor devices. The most advanced chips have up to 150 layers. So advanced is lithography, the latest chips are printed at a scale of nanometres, where a nanometre is one billionth of a metre. The A16 processor in the iPhone 14 will contain about 16 billion transistors. Lithography is so key to making the best microchips, the US stops the company that makes the most advanced of these manufacturing systems from selling its product to China. That company is ASML. The Netherlands-based group sold 309 lithography systems on the way to earning revenue of 18.6 billion euros in fiscal 2021. The most advanced ASML lithography system today costs about 160 million euros. ASML, which formed as a venture between Philips and ASMI of the Netherlands in 1984 and listed in 1995, extended its industry leadership in lithography with its development of 'extreme ultraviolet' lithography, which is an advance on its 'deep ultraviolet' lithography system. This system is regarded as the best system for reliably printing transistors on wafers at high volume using a light wavelength of just 13.5 nanometres. ASML's customers are microchip manufacturers such as TSMC of Taiwan, Intel, Micron, Samsung and SK Hynix of Korea. All semiconductor producers rely on ASML's equipment to produce the most advanced chips. From an investor's point of view, ASML's technology leadership is its core competitive advantage that has given it an 83% stranglehold on one of the world's most crucial industrial systems. Nikon of Japan is ASML's nearest, even a distant, competitor. Couldn't Nikon or another company invent a lithography system that betters that of ASML? Such questions have always existed but competitors have only fallen further behind over time. ASML's advantage is not in any singular aspect of the lithography system but across the many complex technologies, including the light source, optics, wafer stage, software, and process control, that need to come together in perfect unison. All of this would take incredible effort to replicate. ASML has also set up a sophisticated production network underwritten by exclusive agreements whereby it outsources the making of components to about 4,000 companies around the globe. Many of the parts are complex. The mirrors in ASML's lithography machines, for instance, are the smoothest structures produced on earth. In fact, they are so flat, if someone expanded a mirror to the size of Victoria, the highest mountain would be 1 millimetre tall. No rival, even if possessing a better design for a lithography system, could quickly or easily build a similar global manufacturing network. The biggest semiconductor manufacturers in the world have a vested interest in ASML's commercial success. At the very least, it seems ASML is poised to hold onto its market dominance for the foreseeable future; in recent years, the company has widened its lead over competitors as it achieved double-digit sales growth. The stock is found in the Magellan global portfolio because ASML has the potential to generate excess returns on capital for the foreseeable future. Even the best-placed companies, however, face challenges. Among threats to ASML, the shrinking of transistors could reach its physical limits in terms of tininess and finesse. If so, it would buy time for rivals to one day catch up to ASML's lithography standards. But somehow microchip-related technology keeps advancing. Another threat is the Chinese government. Beijing understands the strategic worth of microchips and is investing billions of dollars to catch up with the West and is willing to ignore patents to do so. ASML warned in February that an affiliate of a Chinese company it had accused of stealing its trade secrets is marketing products that could infringe on its intellectual property rights. Hence Washington is keen to keep ASML's lithography systems out of China. ASML, however, has a record of delivering ever-improving lithography machines on time to its customers. If the company keeps doing that, investors will be looked after too. Sources: ASML Annual Report 2021, company filings, Bloomberg and Dunn & Bradstreet. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

5 Dec 2022 - Manager Insights | Collins St Asset Management

|

Chris Gosselin, CEO of FundMonitors.com, speaks with Rob Hay, Head of Distribution & Investor Relations at Collins St Asset Management. The Collins St Value Fund has a track record of 6 years and 9 months and has outperformed the ASX 200 Total Return Index since inception in February 2016, providing investors with an annualised return of 14.17% compared with the index's return of 9.16% over the same period. Rob also discussed Collins St Asset Management's new Fund, the Collins St Convertible Notes Fund.

|

2 Dec 2022 - Hedge Clippings |02 December 2022

|

|

|

|

Hedge Clippings | Friday, 02 December 2022 For the first time this year market analysts - or at least the media - are hinting that the interest rate medicine we've collectively been taking to curb inflation might be working, and as a result, the US Fed and Australia's RBA might take a breather on the size of future rate increases. Jerome Powell indicated as such this week, saying they might start as soon as December, while also cautioning that there was "still a long way to go in restoring price stability." Meanwhile, in Australia the ABS released monthly inflation figures this week, for the first time providing a monthly rather than a quarterly report, which showed annual inflation at 6.9% to the end of October, down from September's number of 7.3%. In his last statement on November 1, RBA Governor Philip Lowe expected inflation to peak around 8% by the end of the year, so there's some cause for optimism, even though his past (admittedly longer term) forecasting hasn't always been spot on. There's also a slight caveat on the make up of the ABS' monthly inflation numbers, which only measures 63% of the CPI basket, excluding for instance electricity and gas prices, which - unless you're living "off the grid" or under a rock - you might have noticed have been on the rise recently. With their board meeting next Tuesday, we won't have long to wait to see if the RBA holds off on their next rate increase, but most economists think not, having "only" increased them by 0.25% in October and November, and with a 2 month gap to the next meeting in February 2023. Meanwhile, it's worth remembering that in the US there's room to "ease off" as rates there rose by 0.75% in each of June, July, September, and November. Meanwhile, equity markets, renowned for pricing in future conditions and earnings, are pretty confident that the worst is over, with the ASX 200 in November posting its second successive monthly rise of over 6%, to take its 12 month return into positive territory, up (just) 0.39%. Adding in dividends, the total 12 month return was a not so shabby 5%, or just over 2% YTD since January. That doesn't mean everything has recovered, with the ASX Small Industrials down 21% over 12 months and the same YTD. For comparison purposes, the S&P 500's Total Return was down 9.21% over 12 months to the end of November, and -13.1% YTD, while for some really eye watering gyrations, the S&P Cryptocurrency Broad Digital Market Index has toppled -71% over 12 months, having been UP 296% over 12 months to November 2021. All this goes to show that markets move in different ways at different times. There is no "one" market, hence the need for analysis and asset allocation. Investors and fund managers understand the cycles, even if they are frustrated by them at times when their preferred strategy or sector is facing headwinds, while other sectors are benefiting from tailwinds. This was shown best by the growth/value divergence (and subsequent reversal) of the past five years and is also reflected in the popularity and performance of specific investment strategies and sectors we see in the FundMonitors.com database. One such sector has been the significant, but often overlooked, fixed income sector, encompassing debt and credit funds which lack popular media appeal while equities (and the tech/growth sector in particular) often dominate investor and media interest. In falling markets the attraction of regular income and capital protection come into their own, potentially with a yield of 6-10%. Out of this has emerged a Peer Group of hybrid funds, blending credit and equity, or equity like elements, designed to provide the regular income needs of investors, coupled with either equity upside and/or downside protection. While no two funds are the same, the Hybrid Credit Peer Group comprises a variety of funds with varying investment processes and performances, and their returns and risk profiles have shown the benefits of the approach. For example, FundMonitors has recently completed a FACTORS Research Report on the *Altor AltFi Income Fund, which "invests via a portfolio of private credit instruments (loans) across a selected group of small to medium enterprises. Investors receive quarterly cash distributions, and gain further upside through free attaching equity exposure on selected debt investments the Fund makes" and has returned over 11% p.a. over 4 years since inception, with a Sharpe Ratio of 3.93%. Along similar lines is a new fund from *Collins St. Asset Management, which invests in convertible notes, targeting distributions of 2% per quarter [8% per annum], with the potential for equity upside on conversion of the loan at the end of the term. This week we caught up with Rob Hay from Collins St. to discuss the strategy, and you can watch the video below. These funds also seek to fill a gap in the funding market for smaller and medium sized companies, both listed and private, which was created post the Hayne Royal Commission as Banks and traditional lenders left the market, or restricted lending to the sector. *Both these funds are only open to wholesale or sophisticated investors. Past performance is no guarantee, and investors should seek appropriate advice. |

|

|

Manager Insights | Collins St Asset Management The Long and The Short: Five stocks for the next five years | Kardinia Capital 10k Words | Equitable Investors October 2022 Performance News |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

2 Dec 2022 - This latest market rally provides investors with another wonderful opportunity...

|

This latest market rally provides investors with another wonderful opportunity… Wealthlander Active Investment Specialist November 2022

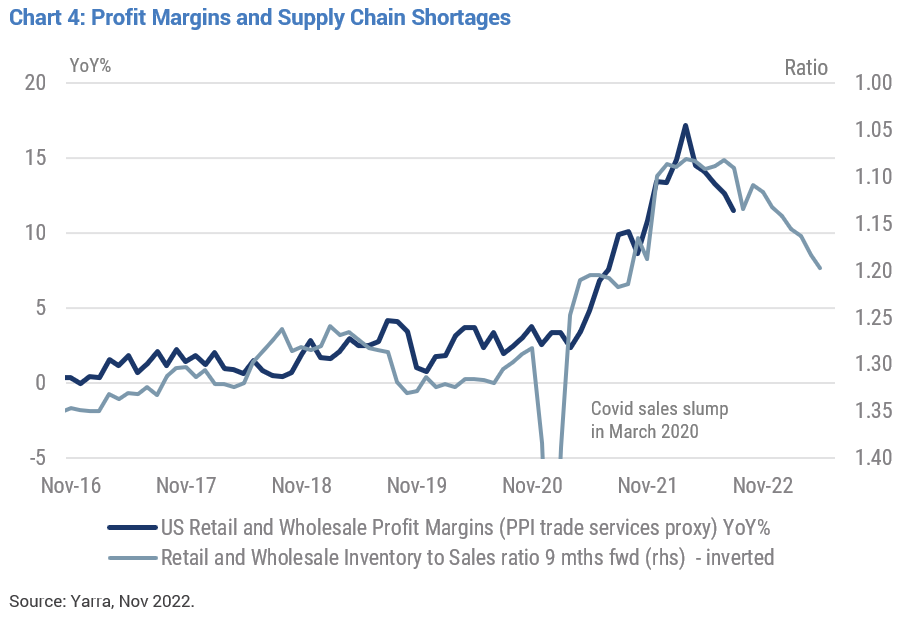

The latest US CPI and PPI have come below consensus expectations, precipitating an equity market recovery. Is this the opportunity of a lifetime and the start of a new bull market after months of bear market pain? Over a year ago, nearly everyone thought interest rates would have to be low for a very long time and according to central banks, inflation was transient. Hence, the shock of seeing inflation rise further and be anything but transient, combined with escalating geopolitical pressures, has turned 2022 into a harrowing year to remember. Rising inflation and escalating geopolitical risk were foreseeable. Despite this, the extent of the world's economic and political challenges has been a shock to all and sundry. However, there is genuine cause for optimism that the worst of inflation and interest rate rises are now behind us. Bulls are excited because higher interest rates and persistent inflation have been the main cause behind the market's falls. With inflation pressures easing, for now at least, there is less need for further aggressive interest rate rises hurting stock valuations and economic values. This has precipitated a fierce equity market rally and challenged a bearish consensus in October. Bear market rallies can be aggressive and substantial in scope, and seasonally the market may be stronger post-mid-term elections and into Christmas. Why then, isn't this the start of a new bull market for equities? The bulls are likely confusing a temporary market rally and opportunity with a permanent one. The lower inflation figures are not just due to a recovering supply chain but primarily due to economies slowing fast as the lagged effect of previous rate increases take their toll. Most importantly, an earnings recession is highly likely in 2023 as historically high margins continue to erode, and recession hits. Importantly, The US equity market isn't priced for recession. While risk assets may rally for a month or two, eventually they'll work out that inflation receding isn't occurring in a vacuum and that a recession is right in front of us in many countries around the world. If history is any guide, this may not only see us retest the equity market lows but possibly even break below this. To put numbers on this, S&P earnings in 2023 of 180 on a multiple of 16.5 could see the US S&P500 at 3000 in 2023, more than 25% below today's level of over 4000. While these figures and falls may appear dramatic, they are by no means unrealistic. Hence a market rallying above 4000 likely provides another incredible opportunity - potentially the last one in this cycle (I have written about this before) - for investors to sell out of traditional risk-heavy portfolios in favour of less overvalued and better-suited investment approaches and assets for today's world. The second reason the bulls may be wrong is that they continue to assume the Federal Reserve will pivot. But the FED is very unlikely to pivot today (cut interest rates) with inflation still too high, a rising stock market and loosening financial conditions unless a significant financial or economic event force them to. The latter means the market likely has to fall before a FED pivot occurs. The bulls may have their timing about a FED pivot wrong and may be entirely wrong if the FED raises further and then holds interest rates higher for longer - as they say they will. Jerome Powell has been clear that he wants to avoid making the mistake of his predecessors and ensure inflation is under control before changing track. He is emphasising the current data and not forward-looking data, having previously been heavily scarred by the FED's inaccurate economic forecasts; this is something the market doesn't seem to realise and means that the FED will likely still raise interest rates well beyond the point when they need to, again causing further damage to the economy and company earnings in 2023. The third reason why the bulls may be wrong is that they may be utterly wrong about inflation. Services inflation may be more persistent even if goods inflation recedes somewhat. The latest CPI print benefits from a one-off improvement in health insurance inflation. While inflation may recede, it is unlikely to get to target and stay there in a favourable way. If geopolitical risks escalate further in the short term, energy and supply side issues may resume, and inflation may remain sticky and come back in another wave. The boomers may continue to spend and redeem their risky assets as inflationary expectations set in and they consider their lifetimes finite. Waves of higher inflation - or alternating inflation and deflation (i.e. unstable inflation outcomes) - would likely be extremely challenging for policymakers and markets alike, given current valuation levels. It is also crucial to remember the big picture and see the forest for the trees. The world and many countries appear to be run in no small part by many bad actors, including sociopaths, autocrats, criminals and frauds with scant regard for anything but their lust and greed. Is it any surprise then that bad things are happening to us? Is this a world which can effectively address some of the most significant governance challenges of all time - some of which require global coordination, including growing diplomatic, governance, corruption and environmental challenges? Some of these bad actors want war for various reasons including the opportunity for graft and funding of their war machines - as well as to further their power ambitions and vision of how the world should look. This could quickly turn the 2020s into one of the most dangerous decades the world has ever seen as our "leaders" take huge risks. They ultimately don't provide favourable asset price policy settings! War tends to be inflationary or stagflationary and extremely wealth destructive if you're on the losing side or are occupied by enemies. Growing corruption turns previously wealthy societies into submerging markets and lowers asset valuations. Real growth is likely to be low for various reasons, including years of mal-investment, higher debt loads, ageing demographics and greater involvement of inefficient governments in capital allocation. Furthermore, we are coming off one of the biggest bubbles of all time. Much wealth destruction is still required to realign asset values (still high) with the size of the actual underlying global economy and deteriorating real wealth and purchasing power. This will likely need to occur through both higher inflation and lower asset values, as it is unlikely to occur through productive economic growth. This also probably won't happen smoothly and will be a shock to many who remain confused about why markets don't always go up, having seen nothing else during their (historically short) careers, or who take their investment advice from promotional material, young and ignorant influencers or the mainstream media. FTX is an example of what happens when you do that and a warning sign to us all. Note: To put numbers on this, S&P earnings in 2023 of 180 on a multiple of 16.5 could see the US S&P500 at 3000 in 2023, more than 25% below today's level of over 4000. While these figures and falls may appear dramatic, they are by no means unrealistic (although are purely for demonstration purposes and do not represent forecasts). In this environment, it is naïve and foolish to bet all on believing that good things will persistently happen to traditional risk-heavy portfolios, which depend on real growth happening, higher valuation levels and markets going up persistently. While equity markets still provide selective good long opportunities, these are the exception rather than the rule meaning the index and index-like approaches (so favoured for their "cheapness") are well past their use-by date. While we can all hope for a benign and highly favourable but less likely outcome, that is no way to invest safely. Markets are far more likely to range trade, meaning long-only managers will continue to provide among the poorest risk-adjusted returns and miss out on good opportunities to short overvalued loss-making enterprises. Historically, the 2020s are more likely to look more like the 1970s or the 1940s than the 2010s. In this environment, better risk-adjusted returns will be achieved by genuine value-adding approaches and more active dynamic and long-short approaches that are better suited to today's macroeconomic conditions and which don't simply rely purely on markets going up to make money. While still capable of making returns, these strategies should be much less likely to lose substantial sums than buy-and-hold approaches - risk management and capital preservation is equally if not more important in this environment than seeking high returns Buffett famously says that when the tide goes out, you see who has been swimming naked. If your superannuation fund, broker or fund manager is charging you to provide you with significant double-digit losses so far in 2022 (as we warned may would), perhaps take the hint while you still can and look around for a better option which has adapted to today's more challenging investment environment. 2022 is a year in which many are flying blind and as for years before that - well any fool can make money in a bull market and many fools did. Seek genuine diversification and preference good risk managers over speculation because the future is uncertain and risky. There will always be great opportunities to make money over time as the world changes, but this is most likely for those who (like it or not) assess and admit to what is going on with the world today. Avoiding and reducing the risk of significant losses is an excellent place to start. Funds operated by this manager: WealthLander Diversified Alternative Fund DISCLAIMER: This Article is for informational purposes only. It does not constitute investment or financial advice nor an offer to acquire a financial product. Before acting on any information contained in this Article, each person should obtain independent taxation, financial and legal advice relating to this information and consider it carefully before making any decision or recommendation. To the extent this Article does contain advice, in preparing any such advice in this Article, we have not taken into account any particular person's objectives, financial situation or needs. Furthermore, you may not rely on this message as advice unless subsequently confirmed by letter signed by an authorised representative of WealthLander Pty Ltd (WealthLander). You should, before acting on this information, consider the appropriateness of this information having regard to your personal objectives, financial situation or needs. We recommend you obtain financial advice specific to your situation before making any financial investment or insurance decision. WealthLander makes no representation or warranty as to whether the information is accurate, complete or up-to-date. To the extent permitted by law, we accept no responsibility for any misstatements or omissions, negligent or otherwise, and do not guarantee the integrity of the Article (or any attachments). All opinions and views expressed constitute judgment as of the date of writing and may change at any time without notice and without obligation. WealthLander Pty Ltd is a Corporate Authorised Representative (CAR Number 001285158) of Boutique Capital Pty Ltd ACN 621 697 621 AFSL No.508011. |

1 Dec 2022 - Global equities: It's time for 'Covid losers' to shine

|

Global equities: It's time for 'Covid losers' to shine Pendal November 2022 |

|

A WEAKER earnings season in the US is indicating a recession is likely next year, but there is evidence it could be mild and short-lived as capital spending offsets slowing consumer demand, says Pendal's Ashley Pittard. Nine in ten S&P 500 companies have reported their third quarter earnings, with results largely in line with analysts' expectations. In a market where the average company typically beats earnings forecasts by 2.7 per cent, the overall picture is one of a weakening economy, says Pittard, who heads Pendal's global equities team. Pittard says one of the most telling signals out of reporting season was the way companies were punished by the markets when they missed forecasts. "On average, when a company missed this earnings season its share price fell more than 6 per cent. That's the biggest average fall ever. What that tells us is that we are at a tipping point in the markets," he says. Mild recessionThere was also a spike in the number of companies mentioning softening demand in their earnings reports this quarter. That's a measure that traditionally rises prior to a recession, says Pittard. "In this earnings season, the number of companies mentioning weak demand is at the same highs as it was in the global financial crisis and Covid," he says. Still, indications are that any recession should be mild because there are signs companies are stepping up their investment in rebuilding supply chains post the pandemic. "Capital expenditure by corporations is up 24 per cent year on year — that's a real positive that may help any recession be milder," says Pittard. "It's companies 're-shoring' supply chains and bringing jobs back to America." To be sure, the strong US dollar is counting against corporate America, with the foreign exchange rate at its highest levels for seven years. "It's a mixed bag. It's like a rip tide dragging out to sea while the tide's coming in — there's choppy waters ahead. "You've got all of these positives, but you've also got a few negatives." Which sectors look good in 2023For global equities investors, the story of the coming year will be one of correcting a "misallocation of capital" that occurred during the pandemic, says Pittard. "You don't want to be in the Covid winners, you want to be in the Covid losers. "During the last few years there has been an over-investment into technology and the cloud and a misallocation away from industrials, supply chain, energy and those sorts of companies. "You're now seeing that misallocation of capital unwind." He points to "strong-demand" commentary from companies like Delta Airlines, United Airlines and Visa, alongside negative commentary from Microsoft, Meta Platforms and Google. United claimed there had been a "permanent structural change in leisure demand because of the flexibility that hybrid work allows", saying "this is not pent-up demand. It's the new normal". Visa said consumers are "still spending the same amount of money… as they did before". Meanwhile Microsoft and Meta announced layoffs, along with a slew of other US tech companies. Microsoft reported "materially weaker PC demand" and Google noted a "pull-back in spend" by advertisers. Look to industrial and financial stocks"It's that misallocation of capital that will drive the hits and misses on the markets," says Pittard, "If you look at new job postings, they are down 50 per cent from their peak of 2021 and 41 per cent of consumers are saying it's tough paying their bills compared to 38 per cent in Covid. "There's no doubt stresses are increasing. There's no doubt the macro is getting weaker. "But as an investor, you want to look through it. "Our cash level is at the lowest that it's ever been, but you've got to have the tide going with you. "That's why the answer is the industrial companies and the financials. "Dividend yield on the banks is more than 8 per cent. "If you hold those kinds of stocks, you're getting paid to just wait for the economy to turn around." Author: Ashley Pittard, leads Pendal's Global Equities investment boutique |

|

Funds operated by this manager: Pendal Focus Australian Share Fund, Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Regnan Global Equity Impact Solutions Fund - Class R, Regnan Credit Impact Trust Fund |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

30 Nov 2022 - Performance Report: Digital Asset Fund (Digital Opportunities Class)

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund offers a choice of three investment classes, each of which adopts a different investment strategy: - The Digital Opportunities Class identifies and trades low risk arbitrage opportunities between different exchanges and a number of digital assets; - The Digital Index Class tracks the performance of a basket of digital assets; - The Bitcoin Index Class tracks the performance of Bitcoin. Digital Opportunities Class: This class appeals to investors seeking an active exposure to the digital asset markets with no directional bias. The Digital Opportunities Class employs a high frequency inspired Market Neutral strategy trading 24/7 which uses a systematic approach designed to offer uncorrelated returns to the underlying highly volatile cryptocurrency markets. The strategy systematically exploits low-risk arbitrage opportunities across the most liquid and active digital asset markets on the most respected exchanges. When appropriate the Fund may obtain leverage, including through borrowing cash, securities and other instruments, and entering into derivative transactions and repurchase agreements. DAFM has a currency hedging policy in place for the Units in the Fund. Units in the Fund will be hedged against exposure to assets denominated in US dollars through a trading account with spot, forwards and options as directed by DAFM. |

| Manager Comments | The Digital Asset Fund (Digital Opportunities Class) has a track record of 1 year and 6 months and therefore comparison over all market conditions and against its peers is limited. However, the fund has outperformed the S&P Cryptocurrency Broad Digital Market Index since inception in May 2021, providing investors with an annualised return of 36.37% compared with the index's return of -42.75% over the same period. Since inception in May 2021, the fund hasn't had any negative monthly returns and therefore hasn't experienced a drawdown. Over the same period, the index's largest drawdown was -71.98%. The Manager has delivered these returns with 50.57% less volatility than the index, contributing to a Sharpe ratio for performance over the past 12 months of 2.18 and for performance since inception of 1.5. The fund has provided positive monthly returns 100% of the time in rising markets and 100% of the time during periods of market decline, contributing to an up-capture ratio since inception of 5% and a down-capture ratio of -48%. |

| More Information |

30 Nov 2022 - Performance Report: Glenmore Australian Equities Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The main driver of identifying potential investments will be bottom up company analysis, however macro-economic conditions will be considered as part of the investment thesis for each stock. |

| Manager Comments | The Glenmore Australian Equities Fund has a track record of 5 years and 5 months and has outperformed the ASX 200 Total Return Index since inception in June 2017, providing investors with an annualised return of 21.35% compared with the index's return of 7.55% over the same period. On a calendar year basis, the fund hasn't experienced any negative annual returns in the 5 years and 5 months since its inception. Over the past 12 months, the fund's largest drawdown was -16.18% vs the index's -11.9%, and since inception in June 2017 the fund's largest drawdown was -36.91% vs the index's maximum drawdown over the same period of -26.75%. The fund's maximum drawdown began in October 2019 and lasted 1 year and 1 month, reaching its lowest point during March 2020. The fund had completely recovered its losses by November 2020. The Manager has delivered these returns with 7.41% more volatility than the index, contributing to a Sharpe ratio which has fallen below 1 four times over the past five years and which currently sits at 0.94 since inception. The fund has provided positive monthly returns 91% of the time in rising markets and 36% of the time during periods of market decline, contributing to an up-capture ratio since inception of 244% and a down-capture ratio of 104%. |

| More Information |