NEWS

3 Feb 2023 - Hedge Clippings |03 February 2023

|

|

|

|

Hedge Clippings | 03 February 2023 This week Treasurer Jim Chalmers penned a 6,000 word essay in The Monthly entitled "Capitalism after the crises" in which he argued for "the place of values and optimism in how we rethink capitalism," which as you can imagine drew a variety of responses. Steven Hamilton in the Sydney Morning Herald described it (among other things) as "an incoherent assortment of kumbaya capitalist thought bubbles - the kinds of ideas you might expect from a bunch of virtue-signalling CEOs attending a wellness retreat." We're not quite sure who should be more offended, the Treasurer, or the CEO's, although we're also not sure if that's Steven's real life experience, or what he imagines such a group would conjure up if they made it to a wellness retreat. Graeme Samuel however, writing in the AFR, describes the essay as "deeply insightful" and urged anyone interested "to read the essay carefully and with an open mind" and concluded his opinion piece with "Chalmers has outlined an evolution of capitalism that is both necessary and inevitable." For convenience, and if you have both the interest (and the time) here's a link to the essay so you can judge for yourself. Meanwhile, Charlotte Mortlock on SkyNews admired Chalmers' commitment but suggested the essay was far too long, proposing that a couple of hundred words would have done the trick. (Hopefully, someone gives ex H.R.H. Harry the same advice when he sits down with his therapist (sorry, ghostwriter) to pen his sequel to Spare. Come to think of it, maybe someone should have done that before he wrote Spare?) Hedge Clippings did have a crack at reading the article, but time didn't permit a full analysis, and space doesn't permit a summary of it here. We did try asking ChatGPT for a 500-1000 word summary (we thought a couple of hundred was a little ambitious) but it seems they're on Charlotte's side, as we received the following response:

That suggests to us that Chalmers, who admitted to writing the essay over his Christmas break, could have cut out some of the waffle, but old habits die hard for politicians, just like the rest of us. Our view is that while capitalism is not perfect, neither is socialism, or communism - or as Churchill once famously said, "democracy" (with which capitalism co-exists) "is the worst form of government - except for all the others that have been tried." One of the keys is that capitalism works in a democratic system, and as such, when individual values change, governments change, and so do corporate values. Each constantly evolve. The capitalism of today, much like the social and political values of today, are different than they were before each of the economic crises that Chalmers writes about. Greed, for instance (while it will always exist) is not good - or at least not exalted as such. Corporations, more than ever before, are subject to shareholder and community values, and where, when (and sometimes when not) necessary. |

|

|

News & Insights New Funds on FundMonitors.com Equities 2023 - What's the bigger risk? | Insync Fund Managers Global Matters: 2023 outlook | 4D Infrastructure December 2022 Performance News Bennelong Emerging Companies Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

3 Feb 2023 - 2023 Global macro outlook: Ten predictions

|

2023 Global macro outlook: Ten predictions Nikko Asset Management December 2022 No single catch-phrase epitomises the 2023 global macro outlook, but here are ten predictions: 1. 2023 will be a year like no other. Investors should not rely heavily on traditional models of previous economic and financial market recoveries, especially ones that worked best since the mid-1990s, as we are entering a unique era; rather, they should maintain a somewhat cautious and balanced perspective, with targeted risk-taking in select countries, sectors and stocks, as described in our other 2023 outlook pieces. Indeed, active stock selection, in particular, will be more important than ever in 2023, so special attention is required in selecting managers who have excelled in the last several challenging years. 2. Re-balancing and China's positive pivots: China, after a hesitant start, will likely see much improved economic growth in 2023 while most of the rest of the world will be sluggish. Its recent surge in the financing of property development was a major pivot in policy that will greatly support economic growth, although the previous mania for purchasing property and the economy's reliance on such will continue to be diminished. This should help keep global commodity prices fairly stable. Also, the sudden pivot towards détente in foreign policy in mid-November has considerably brightened the 2023 global outlook. There will be, however, many challenges to this détente, and as it is not firmly rooted yet. Especially with the likely visit to Taiwan by the new US House Republican leadership and continued trade restrictions, there is a chance that any rapprochement may prove short-lived. Clearly, both "sides" will benefit from a respite in economic and political tensions. For its part, China will likely resume purchases of US Treasuries after major sales in 2022. It also desires a more stable backdrop as it addresses the weakness in its housing sector and parts of its financial markets, while also improving the troubling situation for ordinary citizens and local governments. Meanwhile, US and other countries' corporations, especially Apple, hope that their factories there can keep producing despite various restrictions, that China will remain an important client and that the entire global supply chain will continue healing. 3. COVID will remain a factor, especially China's citizens' fear of such. We have predicted that China would open up the country sooner than expected, though gradually and somewhat furtively, but such has been accelerated by the recent protests and the increasing weakness in the economy. While cases and casualties will likely rise, the government clearly wishes to promote economic growth now and springtime will likely witness a near full opening in China, especially after the National People's Congress in March. We expect that the fears of such there, and globally, will abate in healthy, sustainable fashion. 4. Central banks, excluding that of Japan, will keep rates high to hamper "second-round effects." These "effects" will be the key factor in how inflation evolves. Labour's wage demands, coupled with the strikes and harmful supply shocks usually affiliated with such, obviously stand out, but the perceived "pricing power" of corporations and landlords will also be key, and they all will be watching how determined central banks will be to maintain high rates given the increasing political pressure as economies weaken further. This is most true in Europe, where inflation is the highest in the developed world and where labour is very powerful, especially in key political, infrastructure and economic channels. The media is not widely covering the strike actions, so investors should often screen the news themselves for such. Conversely, countries with low labour demands should have an advantage, especially Japan and much of Asia excluding Korea. 5. Countries with too much concentration in the tech hardware sector may not flourish, as industry fundamentals will remain challenged, including the upcoming oversupply of semiconductors over the intermediate term as countries around the world rush to build their own fabs for national security and other reasons. Due to this, semiconductor production equipment manufacturers, however, should see improved orders after their recent cutbacks. 6. For overall global risk markets, one should expect neither "Doom and Gloom" ahead, nor a Goldilocks scenario. The US equity market is not cheap, so a strong rally seems unjustified from December levels, but most other countries are quite inexpensive and could perform reasonably well. Europe, however, is suffering from unique difficulties, so it may remain inexpensive. Within this backdrop, stock and sector selection will clearly be the most important key to achieve positive returns. 7. Avoiding Short-term scares; many macro-economic, corporate earnings and credit shocks likely lie ahead in the short-term, as the global economy descends further into a semi-stagflationary period in which former excesses are "cured;" however, this is part of the healing process in which the intermediate-term outlook is actually improving, so investors should not panic in the short-term. Indeed, as for corporate earning shocks, as long as such are not far below analysts' estimates, investors may forgive such, especially if the outlook remains positive. 8. The global crypto infrastructure and some other ultra-growth industries are likely to continue to encounter troubles. The recently exposed lack of due diligence by many institutional investors is shockingly disappointing, as were the attitudes and practices of many industry leaders. Partly because of this, most "growth at any price" companies and industries will now be heavily scrutinized by venture capitalists, public-market investors, banks and regulators. This is bound to expose other problems that could spread. Indeed, ultra-growth companies will likely need to show a clear path to profitability on a GAAP basis in order to entice funding; however, such companies definitely exist and should benefit as they will likely attract much more investor interest. 9. Geopolitics will continue to be a factor: the "Clash of Systems and Philosophy" will clearly continue, especially with Russia, Iran and China pursuing their own path. The Russia-Ukraine war will continue through 2023, but possibly in much less bloody way, so this may calm risk markets. One also needs to keep a careful eye on the Middle East, especially Iran, as tensions remain greatly elevated given its internal problems and an even more assertive new Israeli government. As mentioned above, it will be important to watch Taiwan as well. One hesitates to mention North Korea, as it is a perennial, unpredictable worry, but hopefully China will restrain it from its increasingly provocative actions so that both "sides" can reduce the tension. 10. Troublesome domestic politics will be important; fiscal stimulus globally is already greatly constrained due to fears of its inflationary effects and as interest expenses surge, but even the normal functioning of fiscal affairs may encounter significant turbulence. In the US, the Republican control of the House of Representatives is bound to cause major disputes in 2023 and if a financial market or economic accident somehow occurs, action will need to be taken. If it is not taken, much like the initial stages of the Global Financial Crisis, financial markets could revolt. House investigations of various political matters are also likely to cause great discord in 2023, as well. In Europe, political dissent beyond strikes is likely to be intense especially as energy subsidies wane due to the need for fiscal restraint. Asia, however, looks much calmer on the political front. ConclusionWe greatly hope that these comments, as well as the other outlook pieces, will prove useful to our investors and we are always willing to address their thoughts and questions. We could all use a bit of good luck in the year ahead after the tumult of the last few years. Author: John Vail, Chief Global Strategist Funds operated by this manager: Nikko AM ARK Global Disruptive Innovation Fund, Nikko AM Global Share Fund, Nikko AM New Asia Fund, Disclaimer Please note that much of the content which appears on this page is intended for the use of professional investors only. This material has been prepared by Nikko Asset Management Europe Ltd (NAM Europe) which is authorised and regulated in the United Kingdom by the FCA. This material is issued in Australia by Yara Capital Management Limited (formerly Nikko AM Limited) ABN 99 003 376 252, AFSL 237563. To the extent that any statement in this material constitutes general advice under Australian law, the advice is provided by Yarra Capital Management Limited. NAM Europe does not hold an AFS Licence. Effective 12 April 2021, Yarra Capital Management Limited became part of the Yarra Capital Management Group. The information contained in this material is of a general nature only and does not constitute personal advice, nor does it constitute an offer of any financial product. It is for the use of researchers, licensed financial advisers and their authorised representatives, and does not take into account the objectives, financial situation or needs of any individual. For this reason, you should, before acting on this material, consider the appropriateness of the material, having regard to your objectives, financial situation and needs. The information in this material has been prepared from what is considered to be reliable information, but the accuracy and integrity of the information is not guaranteed. Figures, charts, opinions and other data, including statistics, in this material are current as at the date of publication, unless stated otherwise. The graphs and figures contained in this material include either past or backdated data and make no promise of future investment returns. Past performance is not an indicator of future performance. Any economic or market forecasts are not guaranteed. Any references to particular securities or sectors are for illustrative purposes only and are as at the date of publication of this material. This is not a recommendation in relation to any named securities or sectors and no warranty or guarantee is provided. Portfolio holdings may not be representative of current or future investments. The securities discussed may not represent all of the portfolio's holdings and may represent only a small percentage of the strategy's portfolio holdings. Future portfolio holdings may not be profitable. Any mention of an investment decision is intended only to illustrate our investment approach or strategy and is not indicative of the performance of our strategy as a whole. Any such illustration is not necessarily representative of other investment decisions. Portfolio holdings may change by the time you receive this. Any reference to a specific company or security does not constitute a recommendation to buy, sell, hold, or directly invest in the company or its securities. The information set out has been prepared in good faith and while Yarra Capital Management Limited and its related bodies corporate (together, the "Yarra Capital Management Group") reasonably believe the information and opinions to be current, accurate, or reasonably held at the time of publication, to the maximum extent permitted by law, the Yarra Capital Management Group: (a) makes no warranty as to the content's accuracy or reliability; and (b) accepts no liability for any direct or indirect loss or damage arising from any errors, omissions, or information that is not up to date. Yarra Capital Management. Copyright 2022. |

2 Feb 2023 - Is private debt ready for recession?

1 Feb 2023 - Did Amazon cancel Christmas?

|

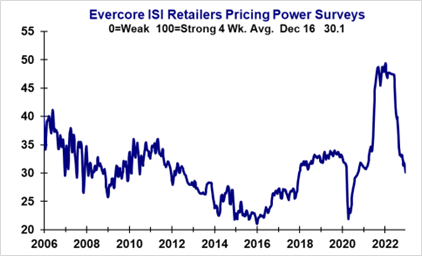

Did Amazon cancel Christmas? Alphinity Investment Management December 2022 Christmas fever was running high with beautifully decorated trees and colourful lights cheering us on every corner. The tone was however a lot less cheery when Amazon recently reported their 3Q22 results and downgraded their 4Q22 revenue guidance. Similar sentiments were reflected across a large range of consumer names noting pricing pressure and a lack of holiday shopping visibility. There is also clear evidence that inventories have been building across US retailers with supply chain constraints lifting and post covid "revenge spending" tapering off. We maintain our preference for companies with strong pricing power, exposure to the more resilient high-end consumer and companies with global reach that can also benefit from a China reopening. LVMH, MercadoLibre and Starbucks are three diverse consumer names that we believe can withstand a less cheery Festive Season. Why Amazon's revenue downgrade is a concernAmazon is a behemoth e-commerce platform with tentacles across most consumer channels and verticals. They have access to extensive supporting data that can paint a clear picture of the general consumer outlook. Historically we have seen Amazon downgrade earnings expectations, but this is the first time in many years that they've downgraded revenue expectations. The fourth quarter outlook is specifically prevalent given that it includes big spending days in the US, such as Black Friday, Cyber Monday, and Christmas. Amazon cited slowing consumer trends particularly in the US and Europe and a lack of holiday season visibility. Whilst there were several consumer companies that reported relatively good 3Q22 results, outlook statements echoed Amazon's concerns and remained cautious around peak season sales and beyond. Consumers are still nervous and hunting for bargainsSofter economic data points are now becoming more frequent following the flurry of central bank interest rate hikes year to date. The US composite PMI slipped to just 44.6 in December, US housing continues to cool down, layoffs are surging, and consumer sentiment remains at levels last seen in 2009 despite a recent recovery. US consumer spending has remained relatively resilient during 2022 as households continued to draw on excess savings accumulated during the pandemic. Post COVID pent up demand have been driving a revenge spending cycle focused on travel, leisure, occasion-based spending (for example weddings), beauty, entertainment and more. Recent data points however suggest a softening in these trends with consumer wallets facing more constraints (softer macro/inflationary pressures). According to Evercore ISI's December company surveys, current holiday sales remain focused on consumer staples products while discretionary category sales are slow, and consumers are focused on discounted goods. More broadly pricing power continues to soften across industries from elevated levels as global growth slows. Pricing power continues to soften across industries

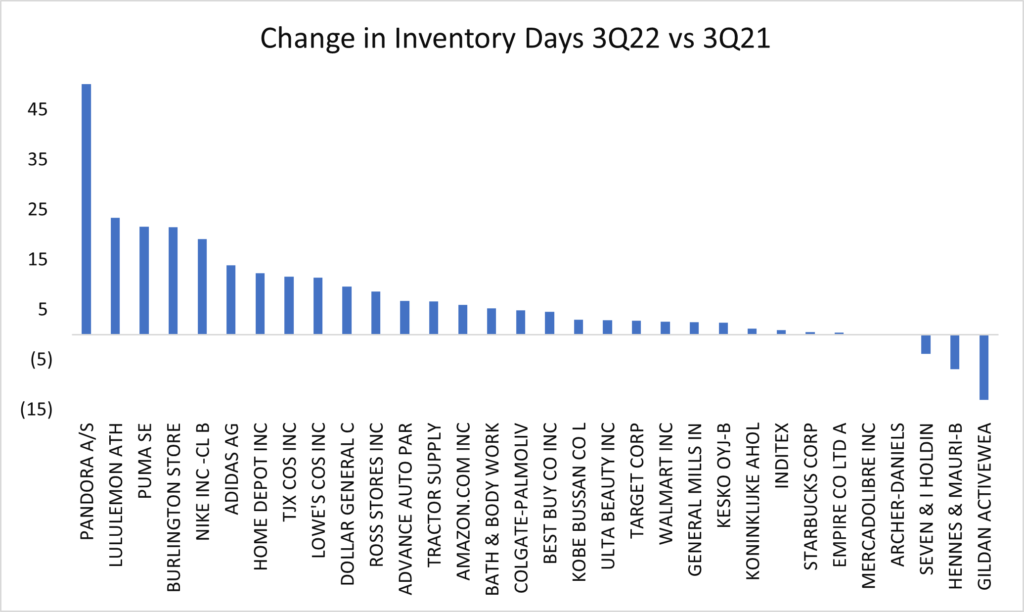

Source: Evercore ISI, December 2022 Signs of inventory build are intensifyingMany companies across a range of sectors reported higher inventory levels during the 3Q22 results season. A result of continued supply chain disruption improvement and softer demand. Target (US general merchandise discount store) and Nvidia (inventor of graphics processing units) were two examples of big bellwethers that guided to big inventory build, - adjustments, and/or write-offs. Our detailed analysis of inventory levels for a sample of 30 global consumer stocks across retailing, food, and apparel, suggest a sobering level of inventory build across the consumer landscape. We looked at the change in inventory as a % of sales and inventory days (average number of days a company holds its inventory before selling it) between the latest reported quarterly numbers (3Q22) and the same quarter last 2021 heading into the Festive Season (3Q21). The results showed that there are only 3 stocks with lower inventory days and only 5 stocks with lower inventory as a % of sales in our sample. There is specifically a clear inventory build in sportswear with Adidas, Puma, and Lululemon the worst offenders. For example, Adidas's inventory to sales is now almost 30% up from c17% at 3Q21 and Lululemon's inventory days are up from 126 days to 150 days (see chart below for the change in Inventory Days) over the same period. Increased inventories a concern across many consumer names

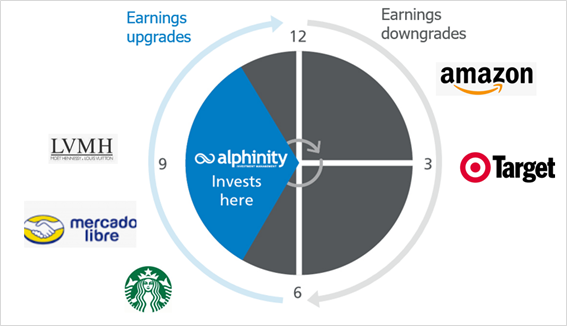

Source: Alphinity, Bloomberg, December 2022 Positioning in companies with strong inventory management and pricing powerAlphinity invests in quality companies that are in an earnings upgrade cycle that trade at a reasonable valuation. In our view, excellent inventory management skills and strong pricing power will be critical in determining the winners vs losers in the 2023 consumer race. Companies that can withstand margin pressures in an environment where business offload excess inventory and consumers hunt for bargains. Investing in quality companies at the right time in their earnings cycles

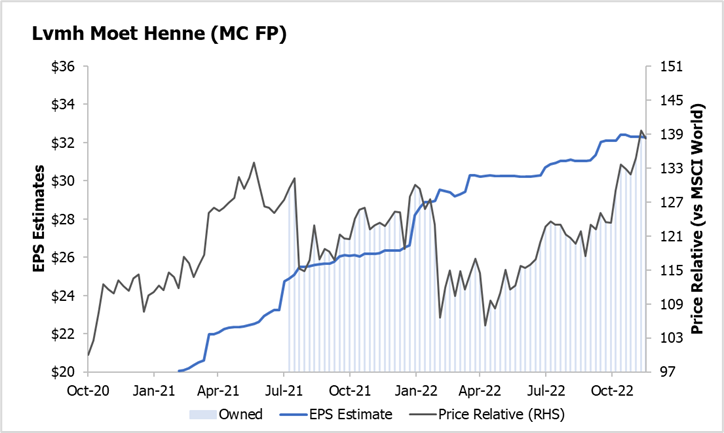

Source: Alphinity, December 2022. Note: Alphinity currently owns LVMH, MELI & SBUX, but not AMZN & TGT. Pricing power remains critical: LVMH, the world's largest luxury group, is currently our biggest position in our Global Equity Fund as we head into 2023. Demand for their luxury products have remained resilient despite slowing macro trends, with the company able to pass through inflation given their very price insensitive customer base. LVMH has been in an impressive earnings upgrade cycle since 2020, delivering earnings growth across sub-segments, brands and increasingly across geographies. Management also remains confident in a demand recovery in China once restrictions have lifted. Despite the relative strong performance of the last 12 months, the company still trades at an undemanding 22x 12-month forward Price to Earnings, which is at the bottom of its 5-year trading range (20-35x) LVMH - Strong pricing power & resilient demand drive an impressive earnings upgrade cycle

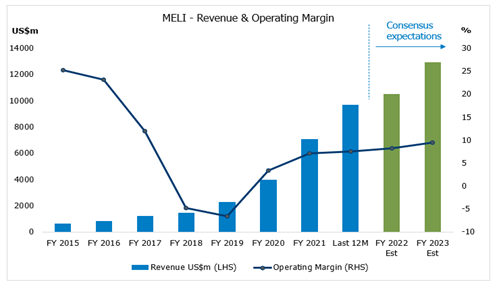

Source: Alphinity, Bloomberg, December 2022 The US consumer is not the global consumer. Certain emerging market countries, such as Brazil, are ahead in the business cycle vs major developed markets, where inflation, interest rates and unemployment are already past peak levels. MercadoLibre (MELI), is the largest e-commerce and fintech company in Latin America, with over 88 million subscribers and exposure across 15 countries. MELI has a unique eco-system model with their marketplace, payments, credit, logistics and other services all reinforcing each other, driving strong top line growth. MELI's reported very strong 3Q22 results well above their peer group, with accelerating sales growth and margin expansion reflective of their core strengths, including their broad category base, continued logistics improvements and a step change in marketing. Management noted they continue to "manage for growth and market share leadership" MELI consistently delivering strong Revenue growth and Operating margin expansion

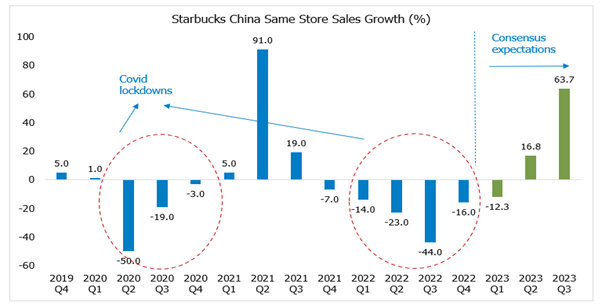

Source: Bloomberg, December 2022 China reopening will be an important earnings driver of 2023 earnings for multi-national companies: Starbucks (SBUX), is the leading specialty coffee retailer in the world, operating across more than 80 markets through company-operated and franchised stores. SBUX experienced a tough time during COVID, with many store closures resulting in a big drop off in sales and margins across all markets. Looking ahead, we expect their new strategy to drive a strong recovering in same store sales growth across their international markets and a return to profitability. SBUX is also well positioned to benefit from a China reopening, where they continued to open new stores during the pandemic (going from 4123 stores at the end of 2019 to 6000), that can return to profitability. China Same Store Sales Growth - Potential to rebound on reopening

Source: Bloomberg, December 2022 We will only know during the first quarter of 2023 if Amazon did indeed cancel Christmas and if general market jitters were justified. Regardless, good inventory management, strong pricing power and the right geographical exposures will remain critical elements for consumer companies as they navigate yet another tough macro year ahead. At Alphinity we will continue to do bottom-up analysis and global company visits to find the highest quality companies that have these attributes and can deliver higher than expected earnings. Author: Elfreda Jonker (Client Portfolio Manager) This information is for advisers & wholesale investors only. |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Sustainable Share Fund Disclaimer |

31 Jan 2023 - Performance Report: Delft Partners Global High Conviction Strategy

[Current Manager Report if available]

31 Jan 2023 - Performance Report: PURE Resources Fund

[Current Manager Report if available]

31 Jan 2023 - Performance Report: Bennelong Twenty20 Australian Equities Fund

[Current Manager Report if available]

31 Jan 2023 - Global Matters: 2023 outlook

30 Jan 2023 - Performance Report: Altor AltFi Income Fund

[Current Manager Report if available]

30 Jan 2023 - Performance Report: PURE Income & Growth Fund

[Current Manager Report if available]