NEWS

15 Feb 2023 - Performance Report: Bennelong Emerging Companies Fund

[Current Manager Report if available]

15 Feb 2023 - Is now a good time to start considering smaller companies?

|

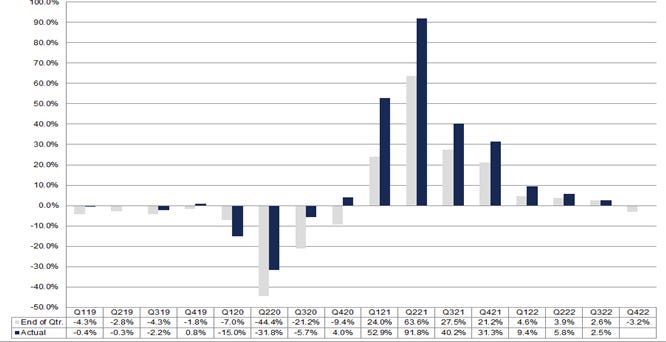

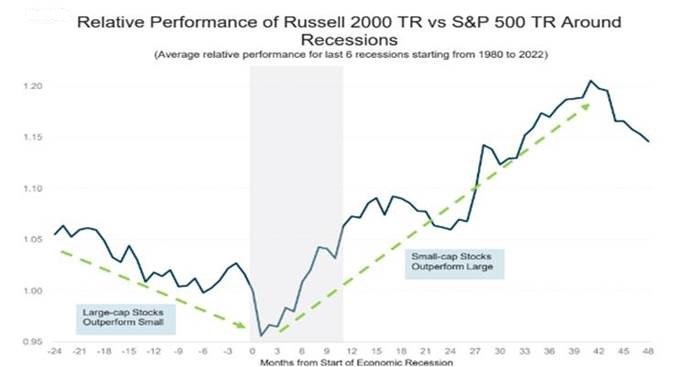

Is now a good time to start considering smaller companies? abrdn January 2023 Last year was terrible for equities. A war in Ukraine, soaring inflation, higher interest rates and weak economic growth all weighed on sentiment. Globally, both small and large caps were firmly in negative territory. Large-cap indices like the S&P 500 were dragged down as technology companies (such as Meta and Tesla) and stocks with high valuations sold off. Meanwhile, risk-averse investors shunned small caps as economic conditions deteriorated. And what about the future? Given the gloomy backdrop, investors are likely to avoid smaller companies for much of 2023. On the surface, this decision seems understandable. History shows that smaller companies tend to underperform larger ones during economic downturns. But dig a little deeper and a surprising conclusion presents itself: the time to start allocating capital to small caps might be sooner than investors think. Small caps outperform earlier than expectedThere are widely agreed assumptions about the performance of smaller and larger companies in different economic scenarios. Chart 1 shows the relative average performance of US small caps versus large caps, before, during and after recessions (dating back to the 1980s). Of course, each recession is different, with different mechanisms at play. Nonetheless, three factors stand out. Chart 1 Source: Bloomberg, William Blair Equity, December 2022 Firstly, larger companies tend to outperform their smaller rivals before, and at the start of, recessions. This makes sense. In economic slumps, risk-averse investors typically favour safer assets. In the equities space, this means more mature, well-established larger companies. Their markets are often less volatile and earnings more stable. By contrast, investors view smaller companies as riskier investments. Many businesses aren't as entrenched as bigger firms. Earnings and profit margins can therefore come under pressure in times of upheaval. Secondly, these factors are turned on their head when we exit a recession. In recovery periods, smaller companies usually outperform their larger rivals. By their very nature, small caps are nimbler and able to react faster than large caps to changes in the business environment. Smaller firms can therefore take advantage of the new opportunities a growing economy offers. The consequent rise in investor risk appetite also helps smaller companies. So far, so predictable. But the third point is not widely known: smaller companies have historically started outperforming large caps soon after a recession starts. As you can see from Chart 1, this rebound can begin as early as three-to-six months into a recession. That's because the market tends to price in an economic recovery before it happens. Yet this phenomenon is not part of the traditional small/large-cap narrative. We believe this disconnect creates opportunities for active investors. A potentially attractive entry pointSmaller companies trailed their larger peers in 2022. In Europe, it was the worst relative year since comparative data began (see Chart 2). This has had a knock-on effect on valuations. Historically, European smaller companies have traded at an average premium valuation of 21%1 above that of larger peers, thanks to superior small cap growth and earnings potential. However, at the close of last year, this difference dropped significantly and is currently at 9%. Given the potential rebound as we exit recession, this could represent an attractive entry point for long-term investors. Chart 2 A similar dynamic is at play in the US. Here, the valuation discount of small caps relative to large caps is as wide as it has been in more than 40 years (Chart 3). We believe this creates excellent long-term opportunities. Indeed, after US small caps reached a similar level of 'cheapness' in early 2001, small-cap stocks materially outperformed larger caps over the subsequent three-, five- and 10-year periods1. Chart 3 What about today's high inflation, high interest-rate environment?As we highlighted, every downturn has its own characteristics - and this time is no different. Today, elevated inflation is a major factor (although it remains benign in much of Asia). Developed market central banks have responded by aggressively hiking rates. The medicine appears to be working. Eurozone and US inflation has retreated from summer highs, recording 9.2% and 6.5% in December, respectively1. Nonetheless, it will take time for inflation to reach pre-pandemic levels. But we believe high inflation shouldn't worry small-cap investors too much. Many smaller companies operate in niche industries or areas of the market with few players. They're also often a critical link in complex supply chains or wider manufacturing processes. As a result, they can dictate higher prices despite their size, allowing them to pass on costs to protect their margins. They also have the agility to change where they source goods and materials, further helping to control costs. What about elevated interest rates? Many assume that higher rates hurt small caps more than larger caps. That's because many small caps are starting out and have weaker balance sheets and lower profit margins. This is the case for some businesses. However, as anyone watching the headlines knows, several larger companies have also been found wanting in the world of higher interest rates. In short, durability frequently comes down to the quality of the company. The importance of qualityThat's why we focus on high-quality firms, irrespective of the macroeconomic backdrop. That is, those with low leverage, strong profitability and consistent earnings. True, quality has underperformed in 2022 as many investors rotated into value stocks. But with the economy deteriorating, we believe investors will increasingly favour companies with robust business models, pricing power, healthy balance sheets and unique growth drivers. Final thoughts…So is now a good time to start considering smaller companies? The traditional answer would be a resounding 'no'. The world economy is forecast to slow further in 2023, with a recession possible in the first half of the year. However, as we have shown, smaller companies might be more resilient in the current inflationary climate than many assume. Using history as a guide, we can also see that smaller companies start to rebound quicker during economic downturns than is widely assumed. With valuations depressed, investors could therefore potentially pick up great long-term opportunities at a discount. Author: Anjli Shah, Investment Director, Smaller Companies Team, Equities |

|

Funds operated by this manager: Aberdeen Standard Actively Hedged International Equities Fund, Aberdeen Standard Asian Opportunities Fund, Aberdeen Standard Australian Small Companies Fund, Aberdeen Standard Emerging Opportunities Fund, Aberdeen Standard Ex-20 Australian Equities Fund (Class A), Aberdeen Standard Focused Sustainable Australian Equity Fund, Aberdeen Standard Fully Hedged International Equities Fund, Aberdeen Standard Global Absolute Return Strategies Fund, Aberdeen Standard Global Corporate Bond Fund, Aberdeen Standard International Equity Fund , Aberdeen Standard Life Absolute Return Global Bond Strategies Fund, Aberdeen Standard Multi Asset Real Return Fund, Aberdeen Standard Multi-Asset Income Fund 1 Bloomberg, 31 December 2023 |

14 Feb 2023 - Performance Report: DS Capital Growth Fund

[Current Manager Report if available]

14 Feb 2023 - Performance Report: Bennelong Concentrated Australian Equities Fund

[Current Manager Report if available]

14 Feb 2023 - Magellan Global Strategy Update

|

Magellan Global Strategy Update Magellan Asset Management January 2023 |

|

Magellan's Portfolio Managers Nikki Thomas, CFA and Arvid Streimann, CFA, discuss how they are viewing the current inflationary environment and chances of a recession. They explain how Magellan's Global Portfolio is positioned to manage these risks and take advantage of thematic investment opportunities. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

13 Feb 2023 - Performance Report: L1 Capital Long Short Fund (Monthly Class)

[Current Manager Report if available]

13 Feb 2023 - Performance Report: Bennelong Australian Equities Fund

[Current Manager Report if available]

13 Feb 2023 - Performance Report: Argonaut Natural Resources Fund

[Current Manager Report if available]

13 Feb 2023 - Performance Report: Altor AltFi Income Fund

[Current Manager Report if available]

13 Feb 2023 - 10k Words

|

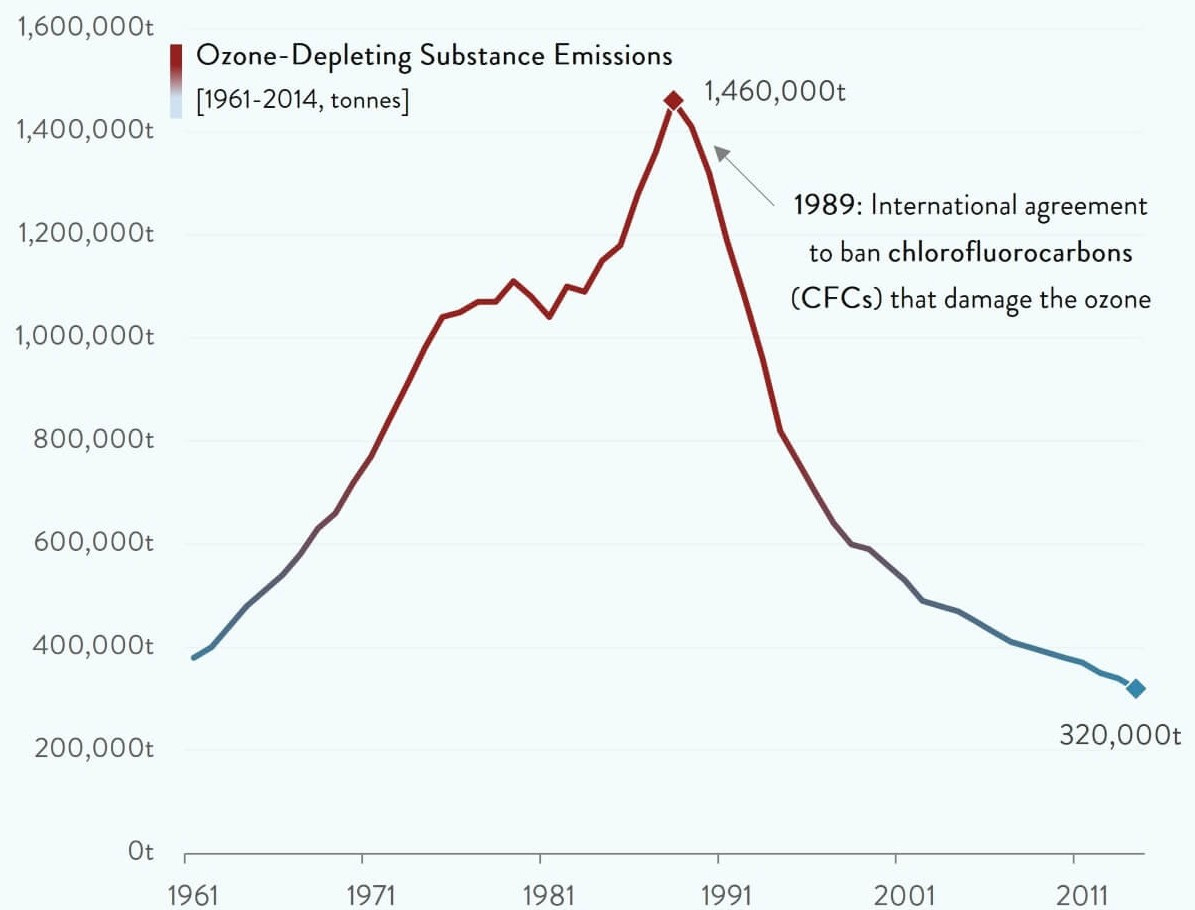

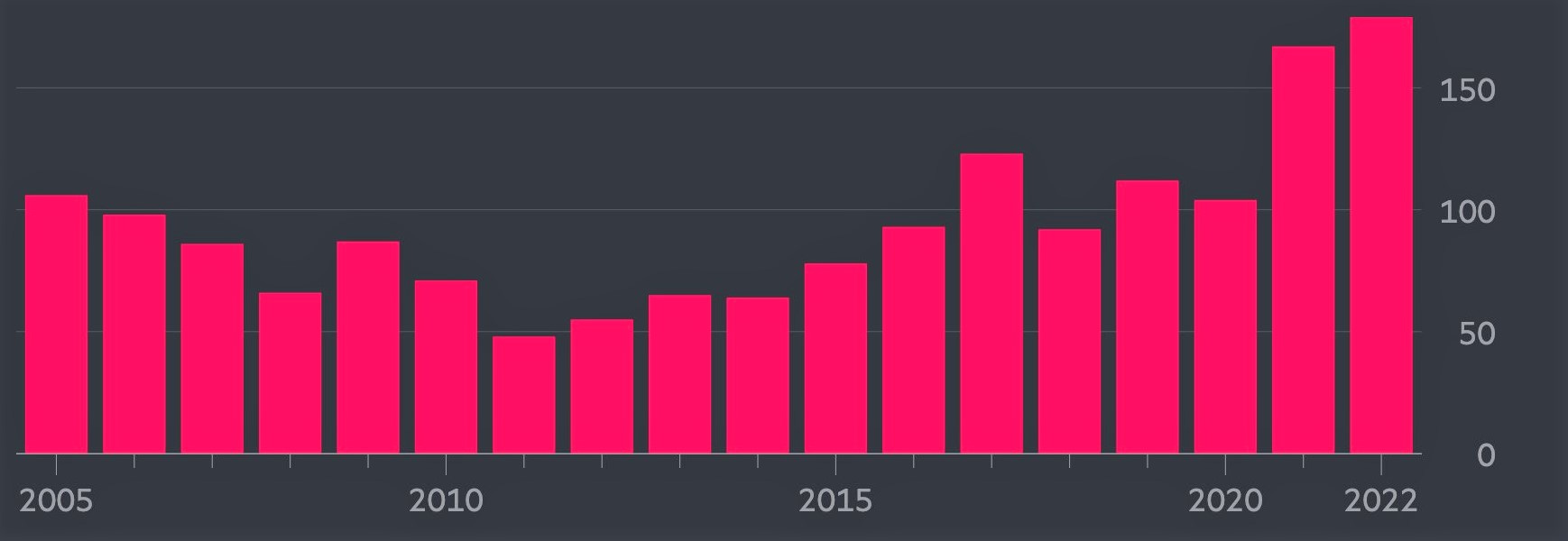

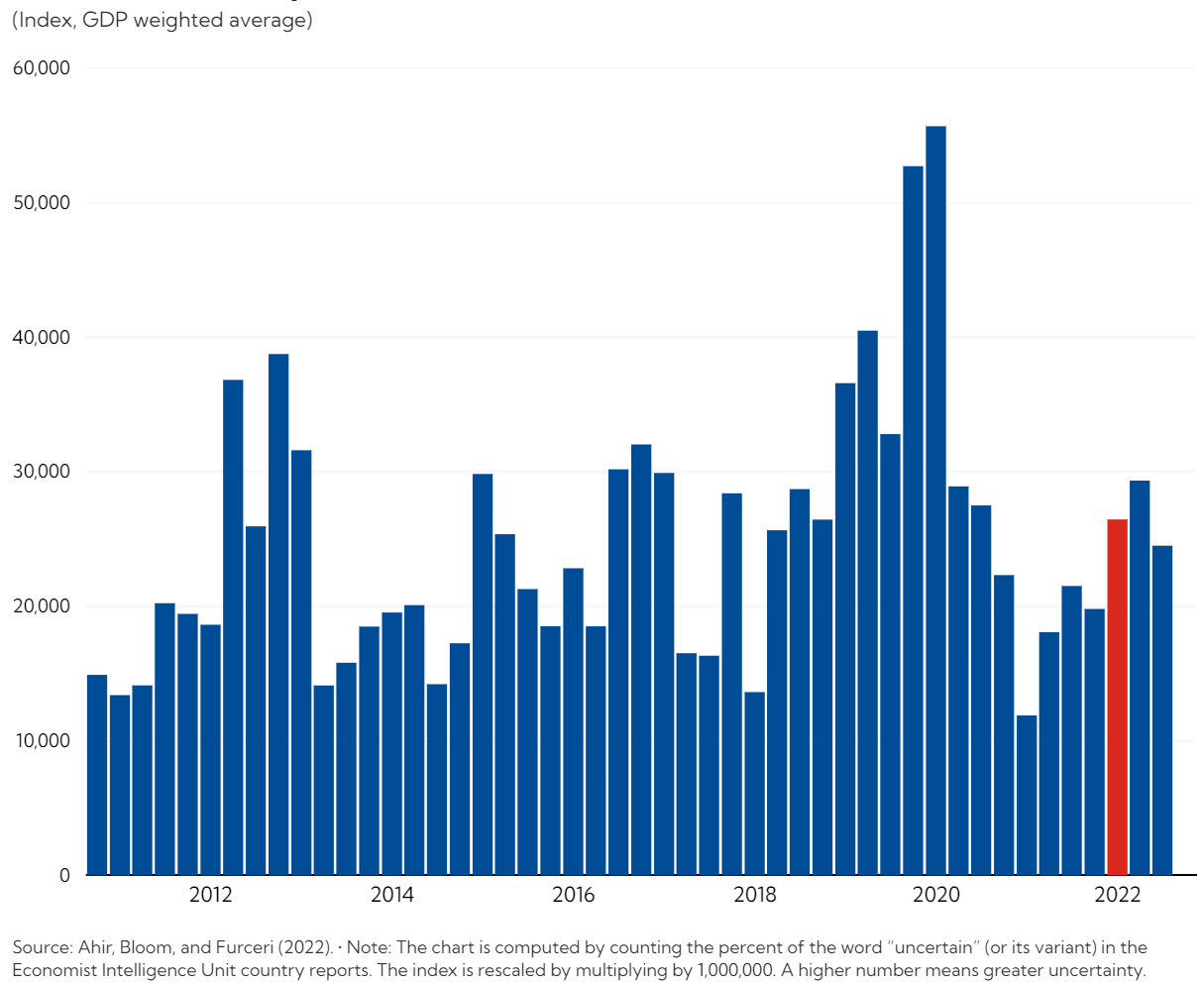

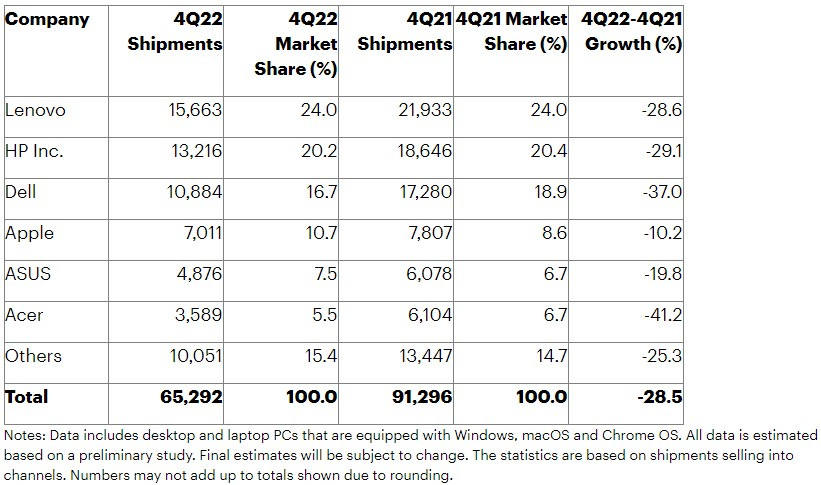

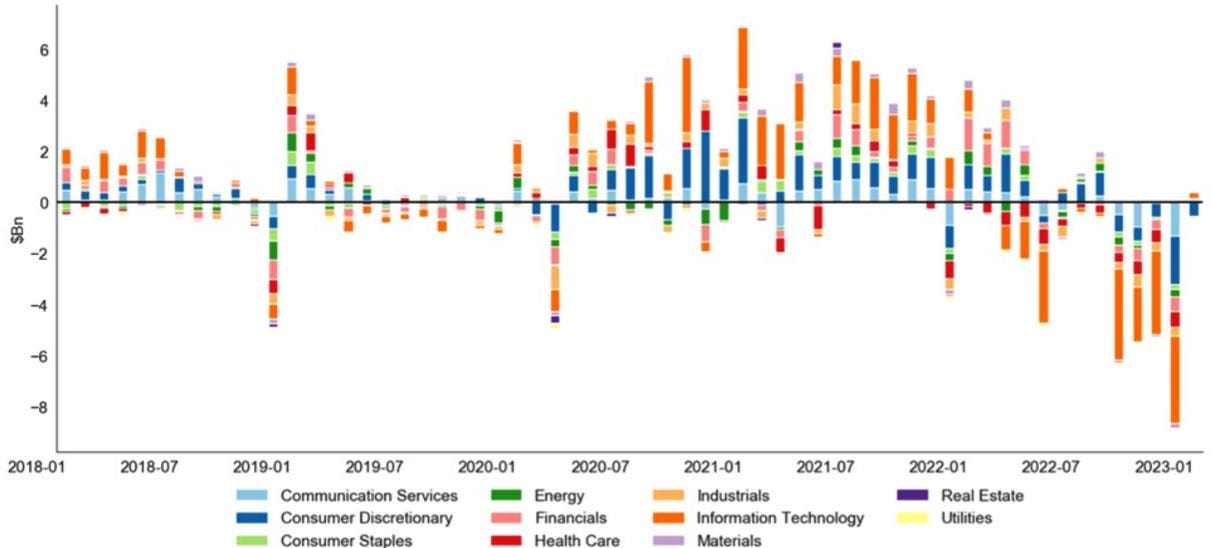

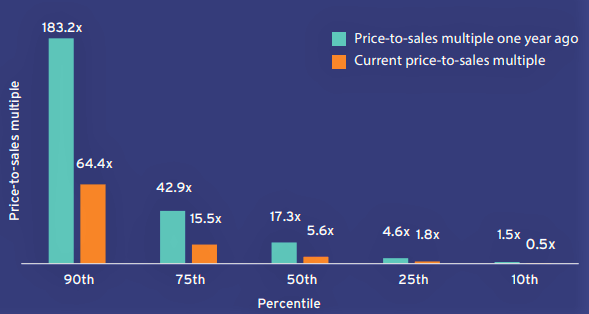

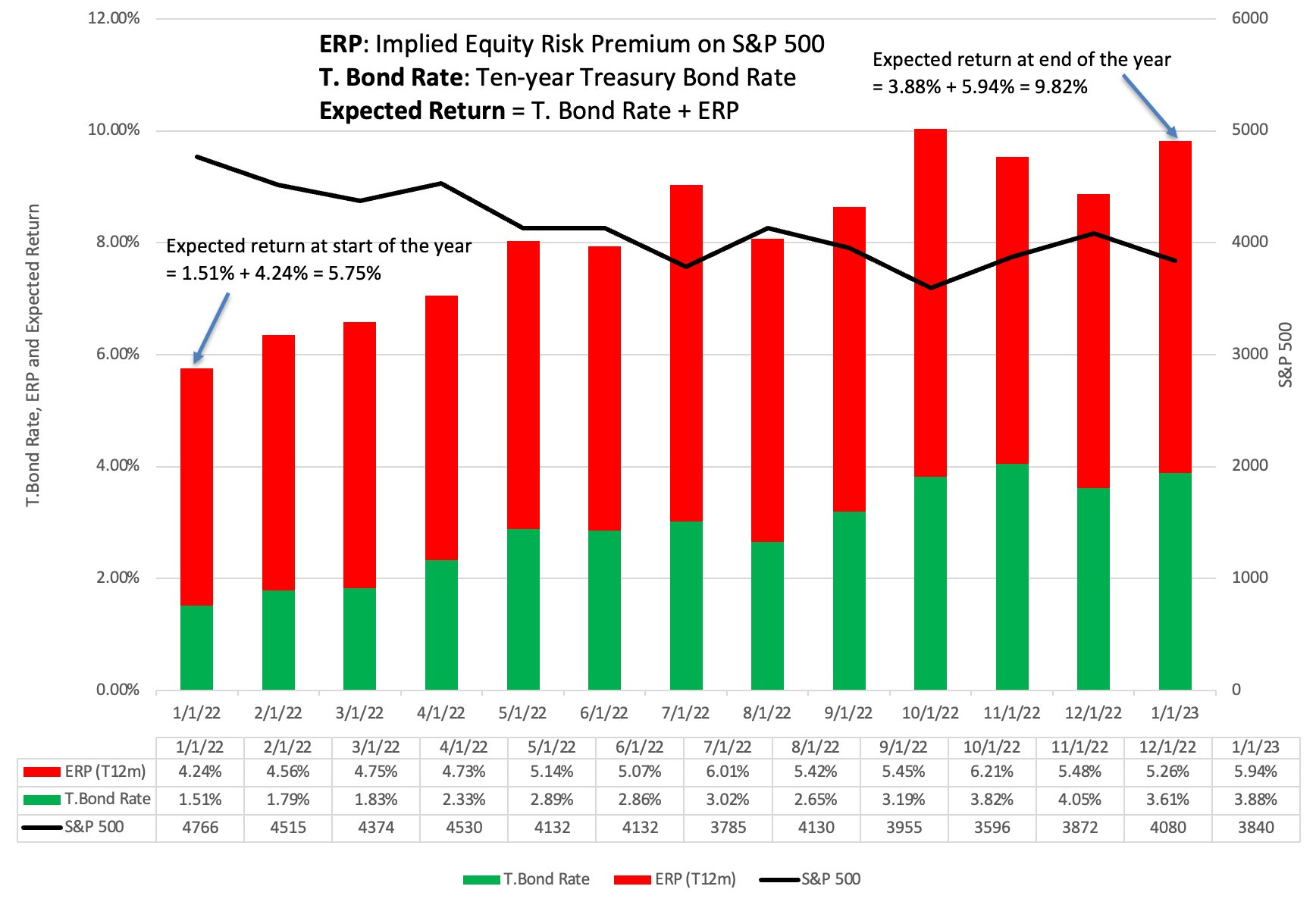

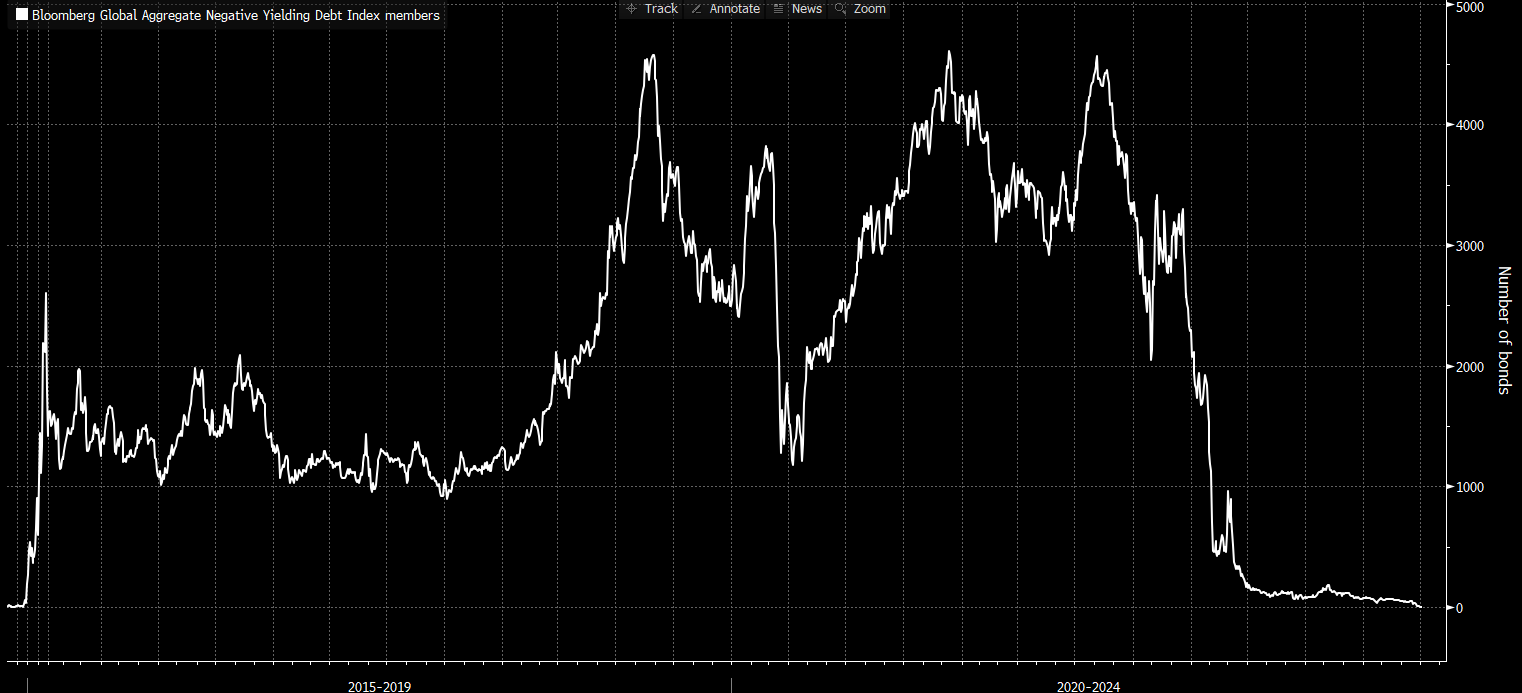

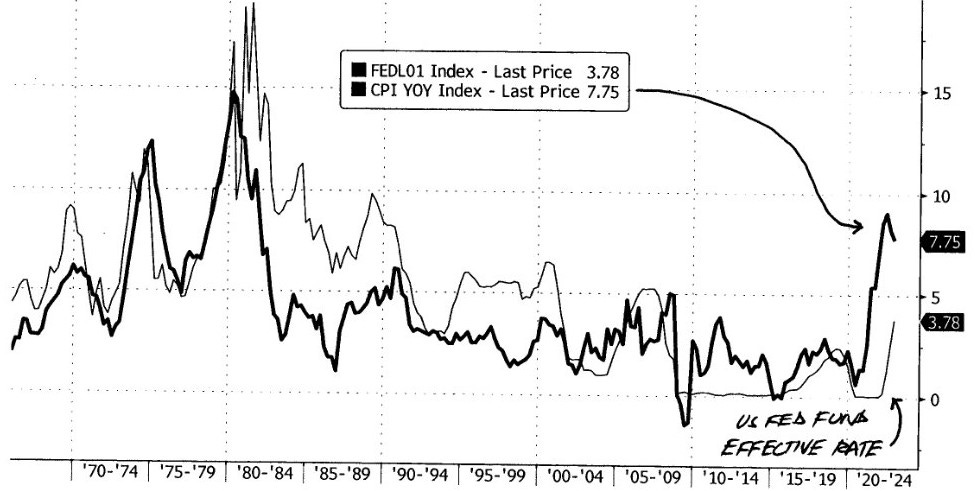

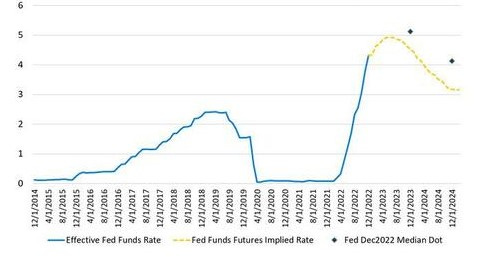

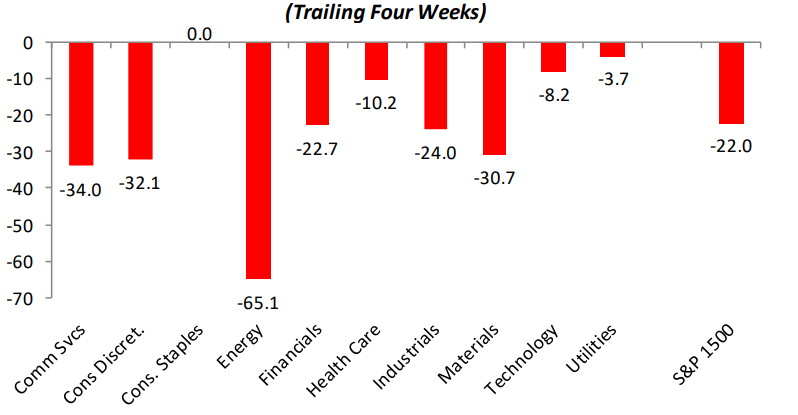

10k Words Equitable Investors January 2023 If there was a year in investment markets where swearing was justifiable, 2022 would be a great candidate. The FT shows us swearing reached new heights on company conference calls. Maybe swearing in 2023 will find a new peak as the feeling of greater uncertainty remains - just look at the IMF's plot. Gartner's estimate of a 28.5% year-on-year decline in global PC sales may cause a few to swear, at least privately. Net flows into tech, as charted by JP Morgan, were hammered right through to the end of 2022. Of course it was the unprofitable segment of tech that Charles Schwab's @LizAnnSonders shows taking the most heat. We can also see that pain in the price/sales multiple contractions highlighted by The Macro Compass' @MacroAlf. There can be no doubt the cost of capital has jumped - Professor Damodaran's expected equity return estimate has increased >4% while Bloomberg's negative yield bond chart lost its last member. Two different schools of thought fight it out over what the Fed needs to do to curb inflation - CLSA shows that when US inflation has spiked above 5%, the Fed had to lift rates to "within spitting distance" of the inflation peak; but DoubleLine is backing the bond market's lower implied rates over the Fed's expectations. Economist @C_Barraud picked up on the decline in Australian house prices as borrowing costs surge. Credit card rates are surging too, as per FRED data, and re: venture consulting sounded the alarm on personal savings in the US diving. The cost of debt is also a growing problem for governments, @CharlieBilello highlights. Looking forward to reporting season, Bespoke sees market expectations in the US have been pulled back across almost all sectors. FactSet's aggregate of S&P 500 earnings estimates shows a 3.9% decline is now the consensus for the December quarter - but the actual earnings growth rate has exceeded the estimated earnings growth rate at the end of the quarter in 38 of the past 40 quarters. Finally, some good news - chart brought to our attention the progressive healing of the ozone layer. Bull market in swearing - frequency of swearing on conference calls Source: AlphaSense, Financial Times

World Uncertainty Index - Ukraine invasion spike in red Source: IMF Global PC shipments in December quarter of CY2022 Source: Gartner Thematic net flows split (excluding ETFs) Source: JP Morgan, @wallstjesus Performance of non-profitable tech stocks (US) Source: Charles Schwab's @LizAnnSonders, Bloomberg Price-to-sales for VC-backed IPOs (US) Source: Pitchbook, Morningstar, @macroalf US Equity Risk Premium Source: Aswath Damodaran The last of the negative yielders Source: Bloomberg When US inflation has spiked above 5%, Fed Funds Effective Rate has had to follow Source: CLSA via @nomad_cap Fed Funds Rate - Market Expectations v Fed Projections

Source: DoubleLine

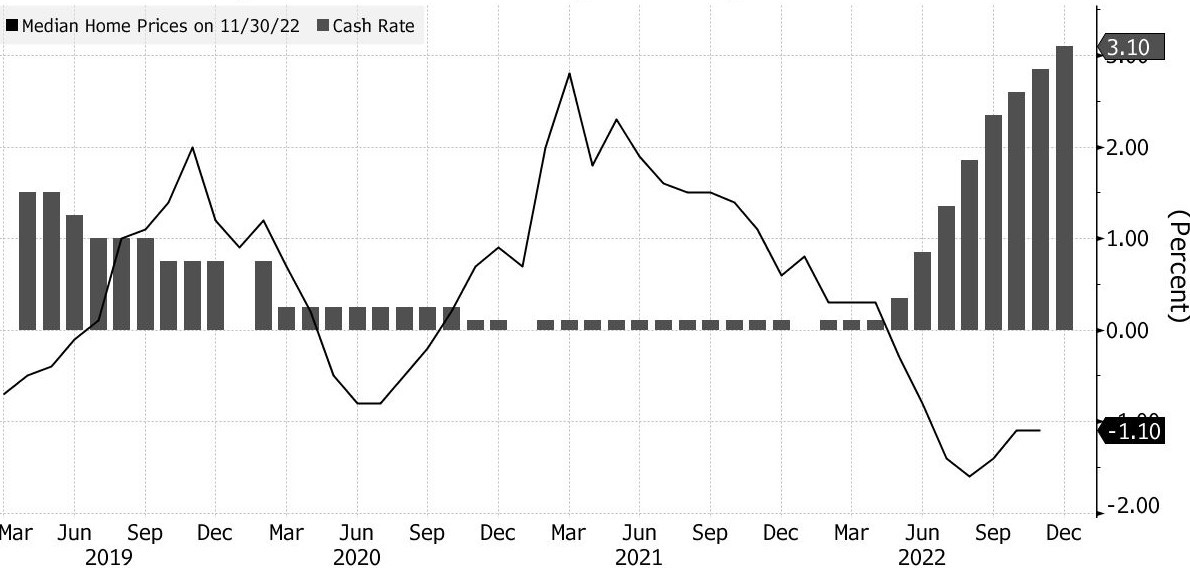

Australian home prices slide as borrowing costs surge

Source: CoreLogic, RBA, @C_Barraud

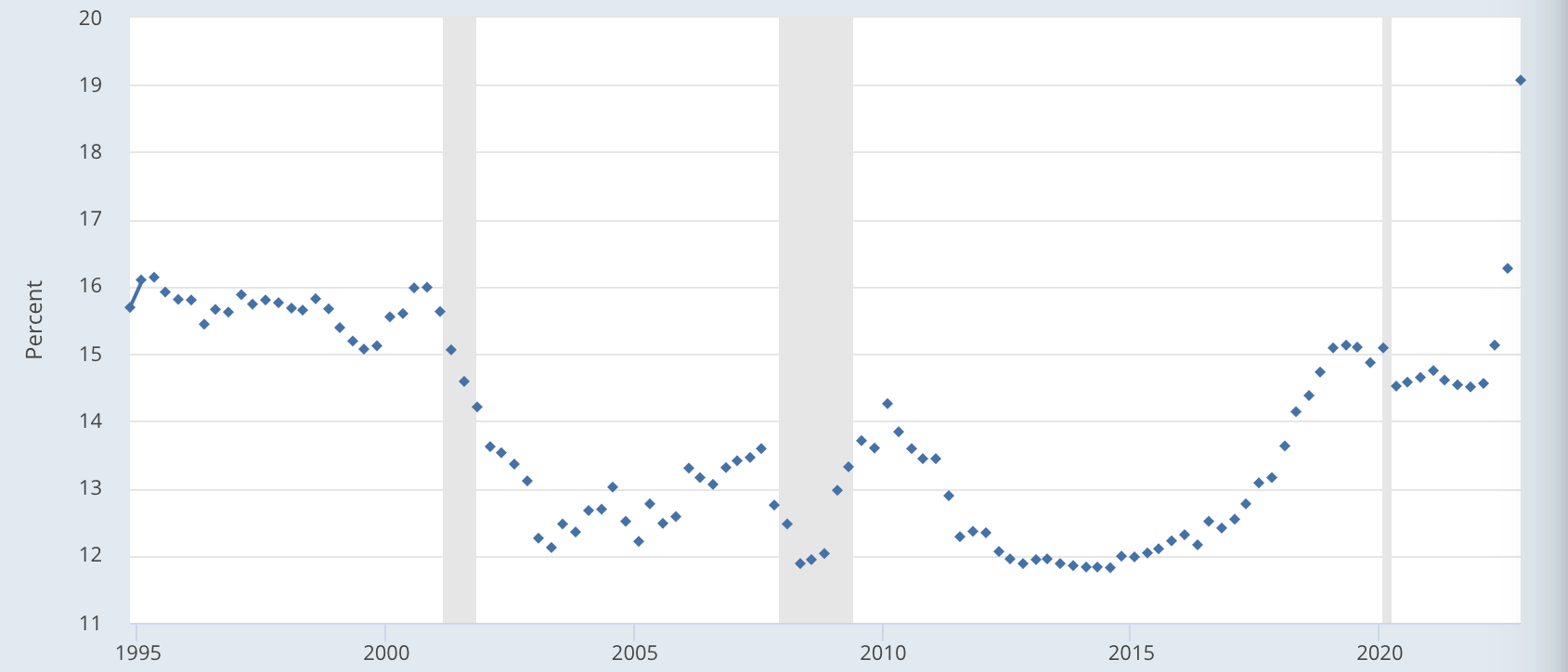

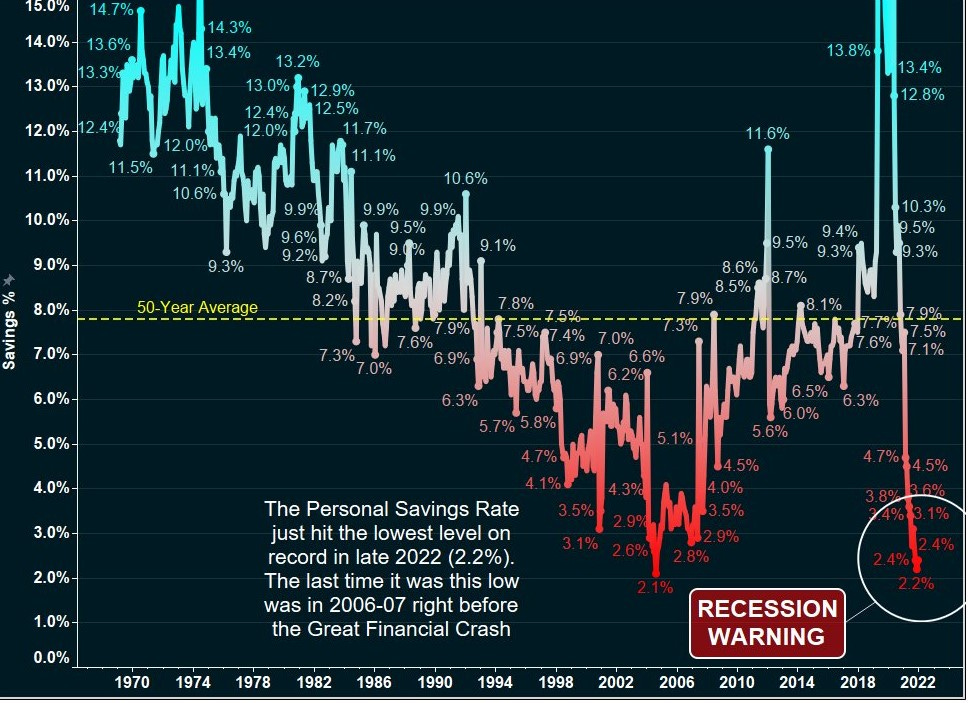

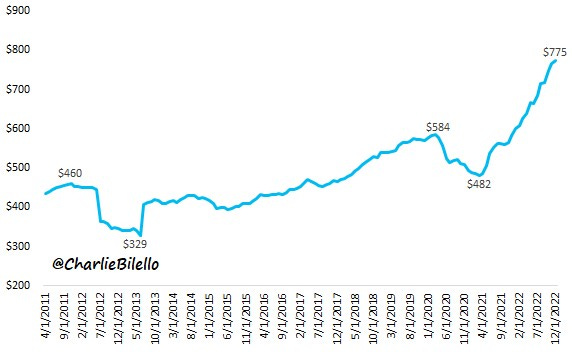

US credit card interest rates surge Source: FRED, Blockworks US personal savings rate hit the lowest level on record in late 2022 Source: re:venture consulting Interest expense on US public debt outstanding Source: @CharlieBilello

US S&P 1500 EPS revisions by sector - the sptread between positive and negative

S&P 500 quarterly earnings growth - estimates and actuals Source: FactSet The ozone layer is healing Source: Hegglin et al, Chartr

January Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions. Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components. Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog |

Source: Bespoke Investment Group

Source: Bespoke Investment Group