NEWS

30 Mar 2023 - Performance Report: Equitable Investors Dragonfly Fund

[Current Manager Report if available]

30 Mar 2023 - Today's surgical robot, tomorrow's robot surgeon

|

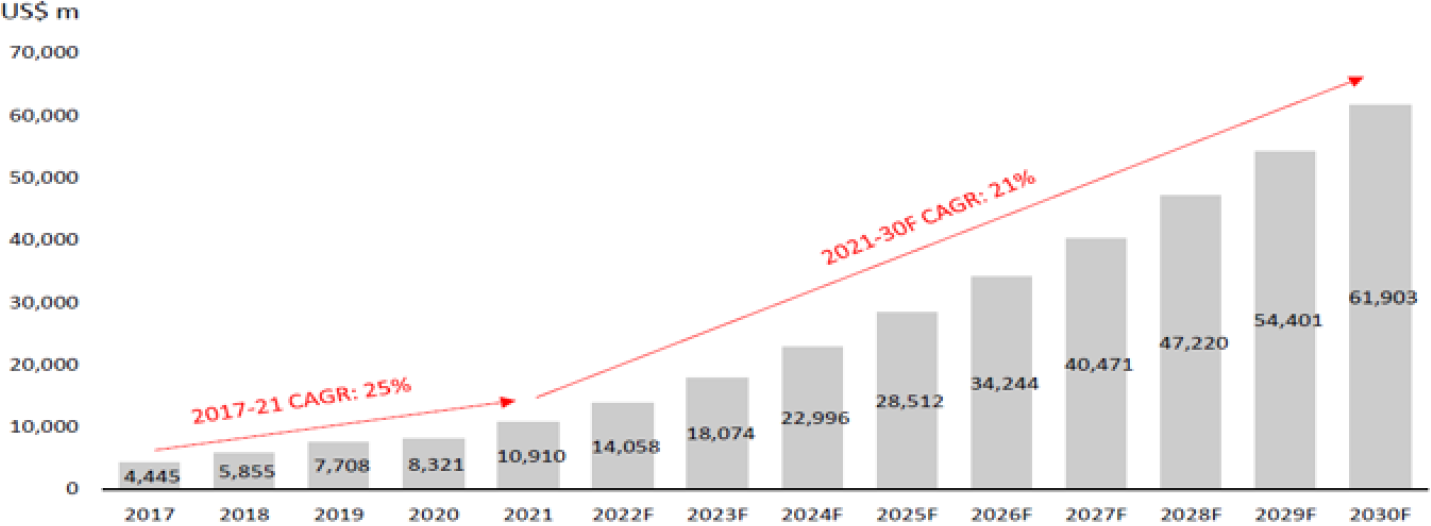

Today's surgical robot, tomorrow's robot surgeon Nikko Asset Management March 2023 Robotic surgery: from science fiction to reality In his 1976 novelette "The Bicentennial Man", the late science fiction writer and visionary Isaac Asimov kicked off the opening plot with the main character Andrew Martin (a humanoid who wants to live and die like a human) requesting a robot surgeon to perform an intricate operation on him so that he will not live beyond the age of 200. "The fingers were long and were shaped into artistically metallic, looping curves so graceful and appropriate that one could imagine a scalpel fitting them and becoming, temporarily, one piece with them. There would be no hesitation in his work, no stumbling, no quivering, no mistakes", wrote Asimov as he described the robot surgeon who altered Martin's positronic brain. Asimov's foretelling vision of surgeries performed autonomously by robots could in fact become a reality in the near future with the rapid advancement of robotic surgery, which is considered to be one of the greatest modern-day medical breakthroughs. Evidently, autonomous robotic surgery has already been initiated on animals, although it has yet to be done on humans. In a ground-breaking experiment in April 2019, bioengineers at the Boston Children's Hospital successfully deployed a self-driving robot which navigated autonomously along the walls of a throbbing, blood-filled heart to repair a leaky cardiac valve of a pig, all without a surgeon's guidance. Undeniably, robotic surgery is transforming the field of surgery and paving the way for a new era of precision medicine. Today's robotic surgery takes the form of a minimally invasive procedure that utilises cutting-edge robotic systems controlled by a surgeon to perform surgical procedures with great precision, control and vision, especially when operating in the very hard-to-reach areas. Unlike the popular science fiction depiction of a shiny, metallic and humanlike robot surgeon, the surgical robot of today is a more humdrum-looking compartmentalised system, which allows a (human) surgeon to control movements of multiple robotic arms—usually four—and cameras that provide 3-D stereoscopic vision via a hand-controlled console when operating on a patient. A typical robotic surgical system comprises a surgeon console with the high-resolution viewer to provide 3D vision; a patient-side cart that consists of manipulators or robotic arms; and a control system with a vision cart that can incorporate additional imaging technology that augments the surgeon's view of the anatomy. With all things revolutionary, robotic surgery—in recent years—has indeed become the buzzword in the medical arena and is increasingly popular with technology-embracing healthcare institutions, as it offers many advantages over traditional surgical techniques. Benefits and drawbacks A main advantage of robotic surgery is its distinct precision. Hand dexterity tends to decline with age, and as surgeons grow older, hand tremors can impede surgical procedure. With traditional surgery, a surgeon's shaky or unsteady hand can lead to slipups or accidental damage to surrounding tissues, leading to excessive blood loss and complications. However, with robotic surgery, the nimble robotic arms that are controlled by the surgeon can move in a smooth and steady manner, allowing for greater accuracy during surgery. In this aspect, robotic surgery has proven to be particularly useful for complex surgeries, as the thin robotic arms (instead of the bulky hands of a surgeon) are capable of making precise movements in tight spaces, enabling surgeons to perform procedures that may be difficult or impossible with traditional surgical techniques. The second benefit of robotic surgery is its minimally invasive nature. In traditional surgery, large incisions are made in the patient's body to access the surgical spots, and such procedures often result in considerable pain, scarring and a longer recovery time for patients. Robotic surgery, on the other hand, deploys mechanical arms, which are inserted into the patient's body through small incisions, allowing for a lesser invasive procedure. An example of minimally invasive surgery (MIS) is keyhole surgery or laparoscopy, which is a procedure that allows the surgeon to access the organs inside of the abdomen and pelvis without having to make a very large incision. Still, conventional laparoscopy, which makes small cuts and uses long, cumbersome tools and a camera to perform surgery, has its limitations. For instance, conventional handheld laparoscopic tools that enter the body through small incisions have a restricted range of motion and can be challenging to manoeuvre (given the difficulty to extend leverage) even for a seasoned surgeon. That is why robot-assisted laparoscopy techniques are increasingly employed by surgeons to overcome the difficulties faced in conventional keyhole surgeries. The increased precision and minimally invasive nature of robotic surgery over traditional open surgery tends to lead to better surgical outcomes, such as reduced trauma and incision-related complications, faster recovery time for patients, less pain and reduced hospital stay and improved cosmetic results (smaller scars). What is more, a robotic surgery can be carried out remotely by the surgeon away from the operating site of the patient. This is unlike traditional open surgery or a conventional MIS, where the surgeon has to be on-site to perform the operation. In fact, robotic applications to surgery started in 1970s when NASA initiated military projects to provide medical care remotely to astronauts and soldiers on the battlefield. Interestingly, in June 2022, a laparoscopic surgical robot developed by a Shanghai-based medtech company successfully completed two ultra-long-range robotic surgeries in urology through 5G connection between a hospital in Xinjiang and another in Jiangsu Province in China. These two hospitals were nearly 5,000 kilometres apart, making the surgical operations the longest 5G remote robotic surgeries in the world to date. Notwithstanding the many advantages of robotic surgery, there are also some drawbacks to such a progressive surgical procedure, notably the higher costs associated with it. Robotic surgical systems are generally expensive to buy, maintain, and operate, meaning that not all hospitals can afford to adopt this technology. Although operating overheads have come down in recent years, robotic surgeries are still relatively more expensive than traditional ones, making it inaccessible for patients who cannot afford it. Additionally, the use of robots in surgery raises bioethical questions about the role of technology in healthcare and the potential for robots to completely replace human surgeons. With increasing dependence on surgical robots, will humans lose surgical skills? How far do we want to go with surgical robots? Would patients be willing to entrust their lives into the hands of a sentient robot and trust that it can be programmed to handle issues of life and death from a moral perspective? The other potential drawback of robotic surgery is the additional learning curve for surgeons. As with any new technology, there is a learning curve associated with using robotic surgery systems. Surgeons must undergo extensive training and practice before they can become proficient in using the technology. Strong growth of the global surgical robot market Nonetheless, robotic surgery has the potential to take off in a big way in the years to come. US business consulting firm Frost & Sullivan (F&S) is forecasting the global surgical robot market to grow at a compounded annual growth rate (CAGR) of 21% from 2021 to 2030; F&S also predicts the market's size to exceed USD 60 billion by 2030 from nearly USD 11 billion in 2021 (see Chart 1). Chart 1: Global surgical robot market expected to exceed USD 60 billion by 2030

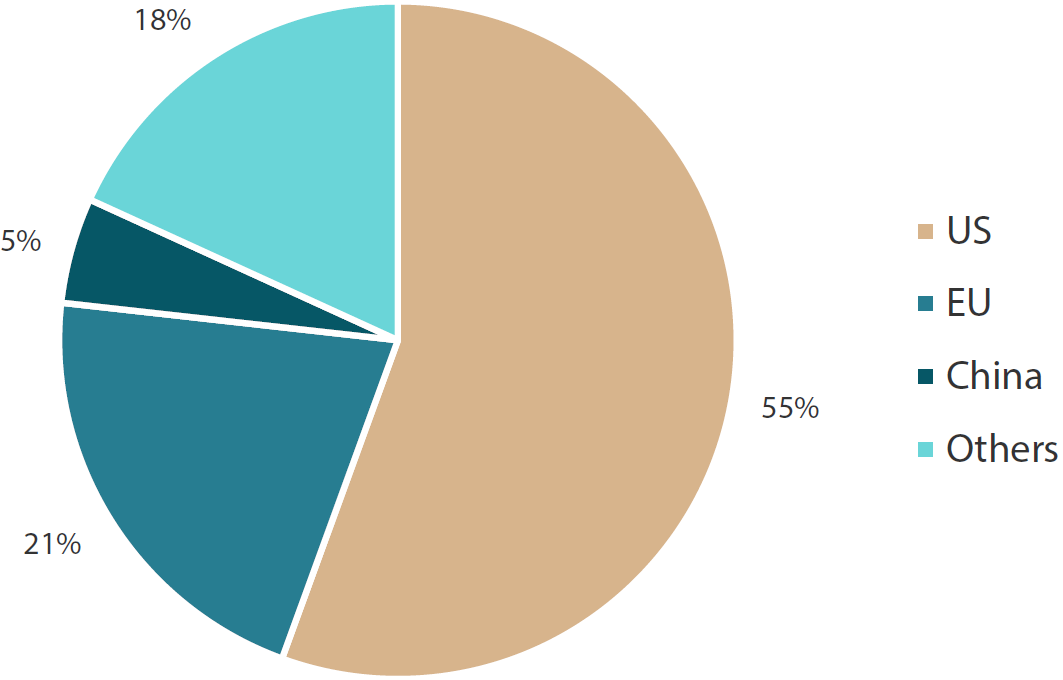

The COVID-19 pandemic in 2020 and 2021 had a significant impact on surgeries, resulting in a drop in worldwide surgical procedures, as many hospitals had to delay non-emergency operations and treatments to ensure adequate care was provided to COVID-19 patients. At the same time, due to restrictions implemented in many countries in 2020 and 2021, many patients had to put off routine, non-emergency diagnostic procedures, such as colonoscopies and PSA testing (a key biomarker for prostate cancer). But as global COVID-19 infections wane and normalcy returns, we have seen a speedy return in patient traffic back to pre-pandemic levels and a sharp recovery in usage of robotic surgical systems, where growth has already picked up from the second half of 2021 and throughout 2022. Presently, robotic surgery has numerous applications in the global medical field. The laparoscopic robotic system is the most commonly used programme worldwide, followed by the orthopaedic robotic system. In the US, an increasing number of prostatectomy procedures are done by surgical robots, in which robotic arms are used to remove the prostate gland (or part of it) in men with prostate cancer. Robotic surgery has also been used in gynaecological procedures, given its greater precision and less invasive techniques. According to F&S, the US and EU currently lead the global surgical robot market with an estimated market share of 55% and 21%, respectively (as at end 2020), while China, which is fast growing, still makes up only 5% of the global surgical robot market (see Chart 2). The growth of China's surgical robot market, however, is likely to be faster than that of the Western nations, in our view. Chart 2: The US and EU dominate the global surgical robot market

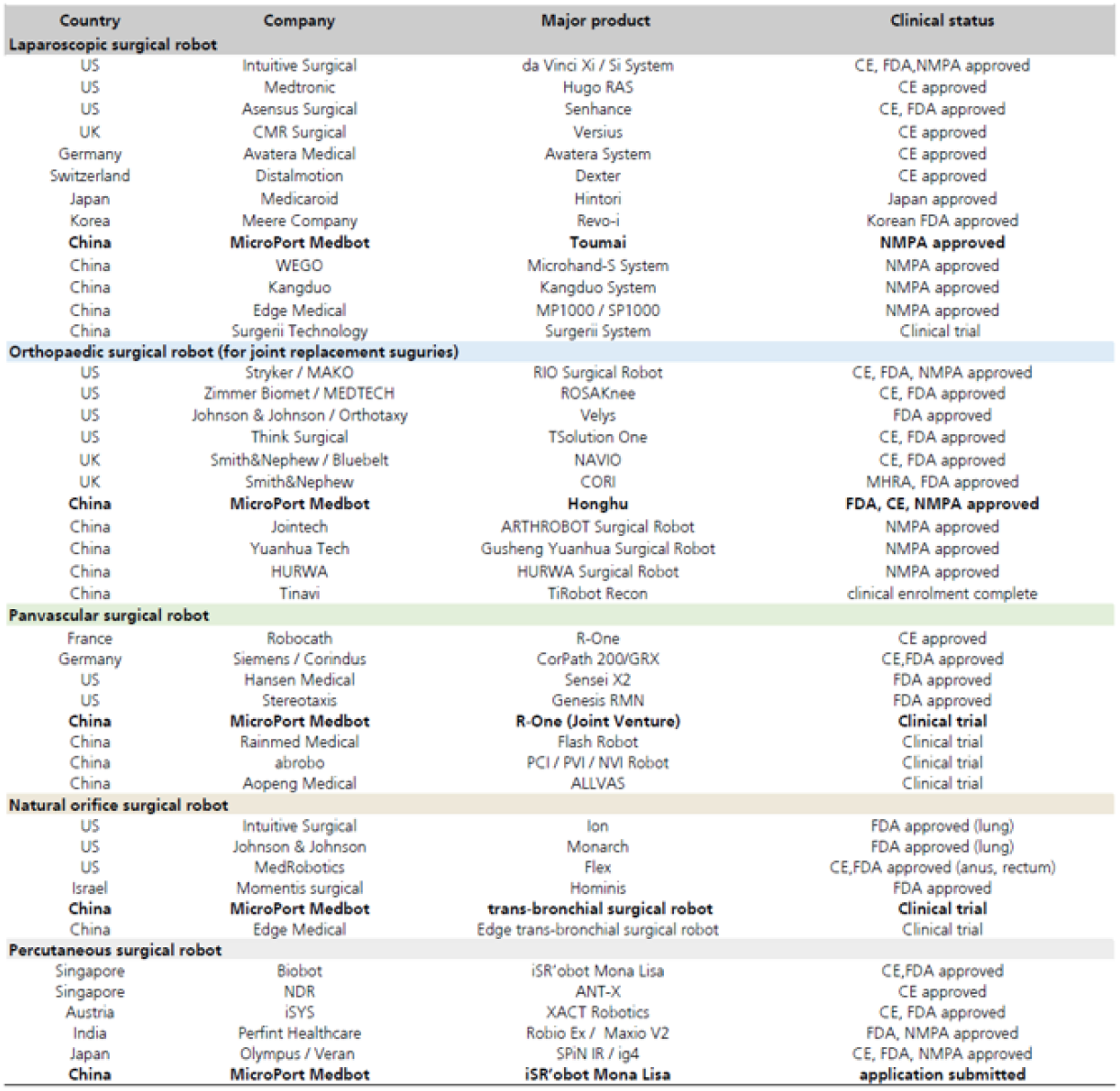

China could be the next growth frontier China has already made rapid progress in robotic surgery over the years. The country's first robotic surgery system was introduced in the mid-2000s, and since then, the technology has advanced by leaps and bounds. Several Chinese surgical robotic companies have developed their own state-of-the-art robotic systems which have been used in a variety of laparoscopic and orthopaedic surgeries. Furthermore, China is investing heavily in the development of artificial intelligence (AI) and 5G technologies, which are expected to drive further advancements in robotic surgery. In our view, China is poised to be one of the fastest growing surgical robot markets over the next decade, owing to growing awareness of the benefits of robotic surgeries, a rise in patients' and surgeons' acceptance rate of such procedures and supportive government policies. As benefits of robotic surgery become more widespread in China, the rate of adoption of such procedure is set to rise in the technology-embracing nation, which is already making plans to accelerate the integration of information technology (IT) into its medical equipment industry by 2025. China's 14th Five-Year Plan, which was drafted in October 2020, introduced a slew of new policy directives and top-down initiatives for 2021 to 2025. Under the country's five-year development plan for its medical equipment sector, the Chinese authorities intend to speed up the assimilation of IT and robotics into medical devices by 2025, with the creation of more domestically produced medical robots and digital health platforms. Recent policies announced by China have been supportive of robotic surgeries in general. In 2021, the Chinese authorities approved an increase in the installation quota of laparoscopic surgical robots from 154 to 225. (Hospitals in China are allocated quotas to purchase and complete the tenders of surgical robots.) To alleviate the financial burden for patients, Shanghai and Beijing also widened the government-backed basic medical insurance coverage in 2021 to include laparoscopic and orthopaedic robotic surgeries, thereby enabling the scheme to partially cover the cost of these procedures. Moreover, in July 2022, China exempted innovative drugs and devices, including surgical robotic systems, from its diagnosis-related group (DRG) hospital payments system, which is being piloted in several cities. The DRG is a system used to classify various diagnoses for inpatient hospital stays into groups and subgroups so that national payors or private health insurance companies can better control hospital costs and determine reimbursement rates. The DRG exemption offers a favourable backdrop for wider application of robotic surgery as hospitals and surgeons will now have the flexibility to perform robot-assisted operations. We believe that China's public hospitals—following the directives of the country's central government—will likely implement more robot-assisted surgical procedures. Presently, China has around 1,500 Class 3A-rated hospitals, which are considered to be the best medical institutions with the highest level of medical technology, equipment, quality and service provision. The increased adoption of robotic surgeries in these high-quality hospitals, on the back of the government-led initiatives, may spur growth for both international and domestic surgical robotic manufacturers operating in the world's most populous nation. The rise of China's surgical robots The competitive pricing and localised strategies of up-and-coming surgical robot manufacturers in China to drive product penetration in the world's second largest economy are starting to have an impact on their global, more dominant rivals, such as US robotic surgical system manufacturer Intuitive Surgical Inc. Intuitive Surgical, the leading player in the global surgical robot market, was established in 1995 and is listed on Nasdaq. Its main product, the da Vinci robotic surgical system, currently dominates the global laparoscopic robot market by holding an estimated market share of over 80%. In 2000 the da Vinci robotic surgical system became the first robot-assisted laparoscopic surgical system to be approved by the US Food and Drug Administration. Intuitive Surgical builds its success using its "System+Consumables+Services" business model, with system installations allowing it to ramp up recurring revenues over the longer term. Essentially, the company sells its robotic surgical systems to medical institutions globally, and as its installation base grows over time, the revenue contributions from consumables (namely robotic arms) and maintenance services grow as well. Intuitive Surgical entered the Chinese market in 2006. Despite operating in China for nearly 17 years, the US robotic surgical manufacturer has only achieved limited success in penetrating the Chinese robotic surgical market; as at end June 2021, less than 10% of all Class 3A hospitals in China were using the da Vinci system, according to UBS data. The competition landscape may have changed with the recent entrance of four domestic surgical robotic companies, whose products are priced 30% to 40% cheaper than the da Vinci system. More products are coming as can be evidenced in Table 1. Table 1: Globally launched surgical robots*

* - This is not an exhaustive table and only representative companies are included. The table also includes representative companies in China with robots in clinical trials. In our view, the progressive and competitive Chinese surgical robot manufacturers have the potential to rapidly grow their market share not only in China but in the rest of the world, especially in emerging markets. As shown in Chart 2, the surgical robot market outside of the US, the EU and China remains highly under-penetrated. The future of robotic surgery The future of robotic surgery looks exciting. With a notable reduction in human error as robotic surgeries gain acceptance and become more widely adopted, many experts believe that going under the knife via a highly precise and less invasive procedure, with surgeons assisted by robots, will become the norm for more types of surgeries in the coming decades. Moreover, robotic surgery technology is expected to continue improving and its integration of AI could enable machines to make better and more accurate decisions, leading to safer and more efficient surgeries. With the help of high-speed internet, such as 5G, and advanced communication technologies, robotic surgery may also enable doctors to carry out surgeries remotely from anywhere in the globe or even in space. As with any innovative technology, the costs are likely to come down over time as more competitors enter the fray, breaking the monopoly enjoyed by Intuitive Surgical over more than two decades, to meet the demand of the mid-range value-for-money patient segment. Over time, as robotic surgery becomes more widely accepted around the world, it is likely that economies of scale will set in, driving costs down even further, making it more accessible to patients and healthcare providers. With the advent of autonomous robotic surgery, which will be made possible with advanced sensors, machine learning algorithms, and AI, the notion of today's surgical robots becoming tomorrow's robot surgeons could indeed come true in the not-too-distant future, just as Asimov envisioned in his science fiction novels. The question we need to answer is: Will the Three Laws of Robotics1 envisioned by Asimov be sufficient to protect humans from robots? Author: Kathy Ng, Senior Equity Analyst Funds operated by this manager: Nikko AM ARK Global Disruptive Innovation Fund, Nikko AM Global Share Fund, Nikko AM New Asia Fund, Important disclaimer information References to any particular security is purely for illustration purpose only and does not constitute a recommendation to buy, sell or hold any security or to be relied upon as financial advice in any way. 1 The following are Asimov's Three Laws:

|

29 Mar 2023 - Performance Report: Bennelong Long Short Equity Fund

[Current Manager Report if available]

29 Mar 2023 - How can investors help close the gender wealth gap?

28 Mar 2023 - Performance Report: Insync Global Quality Equity Fund

[Current Manager Report if available]

28 Mar 2023 - Australian Secure Capital Fund - Market Update

|

Australian Secure Capital Fund - Market Update February Australian Secure Capital Fund March 2023

Property in Sydney recorded growth of 0.3% for the month, whilst Perth (-0.10%), Adelaide (-0.20%) and Darwin (-0.30%) all recorded minor reductions. Brisbane (-0.40%), Melbourne (-0.40%) and Canberra (-0.50%) also recorded smaller monthly falls than in recent months, with only Hobart (-1.4%) recording a reduction of more than 1%, with all capital cities still recording values above pre-pandemic levels. New listing volume remains low, with 24,658 listings over the 4 weeks ending February 26, 17% below that of 2022 and 11.9% below the 5-year average. The last weekend of February recorded the highest number of auctions for the year (2,393), which was up 29.6% on the previous week (1,846); however this was still 29.3% lower than the same weekend last year (3,386). This trend is likely to continue until such a time that interest rates stabilise and confidence returns. Whilst volumes are down, clearance rates are relatively strong, with Adelaide leading the way with an 88.6% clearance rate (83.8% last year), contributing to a national average of 69.7% (70.9% last year). The clearance rates for Sydney and Melbourne were also strong, recording 71.8% (72.6% last year) and 68.2% (67.6% last year), respectively. Brisbane's clearance rate was slightly weaker at 64.8% (70.6% last year) as was Canberra with 59.8% (74.4% last year). We believe prices should start to stabilise from here due to a fundamental under-supply of housing stock. The easing of the rate in which prices are declining is likely due to this lack of supply, and with many economists forecasting that we are nearing the end of the rate rise cycle, buyer demand is likely to increase through the second half of the year and into 2024 as confidence returns. Funds operated by this manager: ASCF High Yield Fund, ASCF Premium Capital Fund, ASCF Select Income Fund |

27 Mar 2023 - Performance Report: PURE Income & Growth Fund

[Current Manager Report if available]

27 Mar 2023 - Investment Perspectives: Is the Aussie residential market bottoming?

24 Mar 2023 - Hedge Clippings | 24 March 2023

|

|

|

|

Hedge Clippings | 24 March 2023

What defines the best managed fund? This week we thought we'd give politics and politicians a rest, as well as tax and the superannuation system. We're not even going to elaborate on the frailty or otherwise of the US or global banking system, except to say "who ever thought the Swiss would run into trouble?" Instead, we're looking at the performance of equity markets, and managed funds - and specifically the best performing ones, over varying time frames. We also refer to an excellent article (see link) by Romano Sala Tenna, Portfolio Manager at Katana Asset Management in Graham Hand's excellent "First Links" newsletter. The essence of the article is that time, and patience, are the keys to successful long term investing in the equity market. While there may be some volatility along the way, Romano clearly shows that the market's direction (given time) is always upwards. Which of course begs the question why so many investors try to "punt" the market, with highly variable results. Maybe it is simply the love of the punt, or possibly one, the other, or both of the two most common flaws of investing; greed and fear. As Romano points out, the sharpest fall (3 months) in the history of the ASX was in early 2020, thanks to COVID. Those who sold in February or March 2020 missed out on one of the strongest rallies which followed. He also points out that the market has averaged a return of 10.8% over the last 147 years. That may be longer than most fund managers propose, but you probably get the point. Romano's message is to invest for the long term and stay patient. As the chart below shows, on a rolling basis if you had invested in the market for any 8 year period since 1875, you won't have experienced a negative return. Some might wonder why, given Fund Monitors' focus is on managed funds, we're looking at investing directly in the market. Quite simply, choosing a managed fund is not so easy investing in the index. Managed funds come in all shapes and sizes, and performance varies between them. Performance also varies over time, and we would agree that when analysing the performance of funds one has to look at performance over the longer term. However, some of the best performing Australian Long Only funds over one year don't always back it up, year after year. The top 10 performing funds over the longer term however (7 years) don't always appear in the top 10 over 5, 3, and 1 year. Careful analysis shows consistency (at least in the top 10 list) is difficult to achieve. For the record, Romano's Katana Australian Equity Fund makes the Top 10 list in all four time frames - 1, 3, 5, and 7 years. Rob Gregory's Glenmore Asset Management doesn't have a 7 year track record but makes the top 10 over 5, 3, and 1 year. DMX Capital Partners and Anacacia's Wattle Fund appear in the top 10 tables 3 times, each over 7, 5, and 3 years. Analysis of managed funds isn't as simple as just selecting the top performing funds. Join our webinar "Making the Most of Fund Monitor's Data" next week, either on Tuesday 28th at 11:30 in the morning, or alternatively on Thursday 30th at 4:00 in the afternoon (both AEST) and we'll give you a site tour and tips on how to use the website to compare and track over 700 funds. |

|

|

News & Insights Experiences Rule! | Insync Fund Managers Trip Insights: Americas | 4D Infrastructure February 2023 Performance News Digital Asset Fund (Digital Opportunities Class) Insync Global Capital Aware Fund Bennelong Emerging Companies Fund Emit Capital Climate Finance Equity Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

24 Mar 2023 - Performance Report: Digital Asset Fund (Digital Opportunities Class)

[Current Manager Report if available]

Source: Frost & Sullivan

Source: Frost & Sullivan Source: Frost & Sullivan, as at end 2020

Source: Frost & Sullivan, as at end 2020 Source: FDA, MHRA, NMPA, EMA, companies' data and UBS, as at November 2022

Source: FDA, MHRA, NMPA, EMA, companies' data and UBS, as at November 2022