NEWS

26 Apr 2023 - Performance Report: Cyan C3G Fund

[Current Manager Report if available]

26 Apr 2023 - Performance Report: Glenmore Australian Equities Fund

[Current Manager Report if available]

26 Apr 2023 - Tim Toohey: Banking crisis far from over

|

Tim Toohey: Banking crisis far from over Yarra Capital Management March 2023 Tim Toohey, Head of Macro and Strategy, looks at the the key factors behind the collapse of Silicon Valley Bank (SVB) ($209bn of assets) and Signature Bank ($110bn in assets), and notes that there is one thing we know for certain amid a banking crisis: the cost of credit will rise and the availability of credit will fall sharply. Tim details the likely implications for Australia and concludes that despite the coming headwinds, Australian banks will remain resilient. Jay Powell declared to the US House Financial Service Committee on 9 March 2023 that there was no evidence that suggests the US Fed has overtightened policy. Instead he declared that "the ultimate level of interest rates is likely to be higher than previously anticipated. Within 24 hours the 2nd largest retail bank failure had commenced. Collectively the collapse of Silicon Valley Bank (SVB) ($209bn of assets) and Signature Bank ($110bn in assets) exceeds the biggest bank collapse in 2008 (Washington Mutual, $307bn). We are rapidly closing in on the 2008 collective peak of $374bn. Should First Republic Bank, whose share price has fallen 90% from mid-February 2023, also fail then a further $213bn of assets can be added to the total. Despite the size of these collapses, it is important not to confuse the collapse of several regional US banks as a harbinger of the next Global Financial Crisis (GFC). It was the excessive leverage, excessive risk taking and poor regulation of the investment banks that led to the GFC, not a collapse of regional and retail banks. The US does have a long history of bank crises. Most of these crises were a function of excessive speculation in real estate and financial markets and occasionally the cause could be traced to a collapse in commodity markets:

It is the savings and loans (S&L) failures of the 1980s and early 1990s that have the most similarity to today's failures. Simply put, long-dated housing loans written at low interest rates rapidly become uneconomic if funding is short dated and interest rates are rising sharply. The small and fractured natured of most US retail and commercial banks means there is no ability to turn to the equity market to raise capital which makes for fertile ground for bank runs. What has marked the failure of SVB and Signature was that instead of lending recklessly for the purposes of commodity, equity market, or housing market speculation that had brought down banks in the past, it was large falls in the value of 'long duration' crypto and tech start-up assets that proved the source of the failure. The railway bonds and Florida swamp land that had brought down banks decades earlier had merely been replaced by some equally dubiously long duration tech assets. The other relatively interesting aspect about SVB was that it seemingly forgot to do what banks normally do. Instead of making loans to purchase homes and to finance business expansions, it seems to have feasted on cheap money and start-up capital for tech entrepreneurs and purchased Mortgage-Backed Securities and Treasuries at relatively low yields and financed venture capital investments at expensive multiples. As the Fed jacked up rates, tech values fell, investors became nervous and deposits declined slowly. And then they moved very quickly. Being forced to liquidate MBS and Treasury securities at a large loss merely helped expedite the decline. Social media did the rest. Indeed, SVB is likely to be the first bank run played out almost exclusively in digital space. To be clear, this is not likely to be reflective of the average bank in the US banking system. It is not evidence of a systemic threat to the system. And importantly, depositor insurance and the preparedness of the US Treasury to provide selective guarantees for bank deposits for non-systemically important banks does make these type of banking collapses less economically painful. Nevertheless, the failures are incredibly important events for financial markets. Chart 1: US Retail and Commercial Bank Leverage & 'Greed'

To gain an insight on the vulnerability of other regional US banks, the above Chart 1 provides a broad measure of bank leverage plotted against how fast banks have attempted to expand their balance sheets. The banks that have failed or are under immediate stress are highlighted in red. What should be clear is that although the commonality of lending to tech and crypto assets may have been the source of the initial phase of the crisis, it is unlikely that the names with higher leverage and just as rapid balance sheet growth will all prove to have sufficient loan quality and the asset and liability mismatches that have created bank stresses in the past. The unique feature of the current crisis is the speed at which deposits have been shifted from the smaller regional banks to the large US banks. Electronic transfers make a bank run far more immediate, and social media has been an amplifier of fear and contagion. The other unique feature of this crisis is that the proximity to the GFC has seen major banks and policy makers act far quicker and aggressively than in the GFC. For instance, short term loans made by the Fed to the major banks in exchange for cash has surged well past the peak of 2008, a time where banks were afraid of the stigma of being seen tapping the Fed's emergency liquidity facilities. No such stigma this time around! Meanwhile, commitments from policy makers that they stand ready to do whatever is necessary to support the banking system have come much faster than during 2008, which was marked with successive failures to secure the legislature authority to make emergency funding available. In short, it is unlikely that the US banking crisis is complete and a raft of consolidation of regional banks is feasible, but it is also unlikely to be marked by the same level of confusion, inaction and liquidity shortfalls that prevailed in 2008. Of course, the banking crisis becomes more global in nature if it spreads to the 'globally systemic' banks. In the Chart 2 below, the same analysis is repeated for international listed banks. The gleeful adoption of Quantitative Easing (QE) which fuelled the surge in global money supply and bank lending has helped create plenty of other potential sources of contagion. Chart 2: Global Banking System Leverage & 'Greed'

For a central bank task with controlling inflation and economic stability, these failures and the build-up of excessive leverage are embarrassing. But they are no accident: central banks are at least partly complicit. Why?

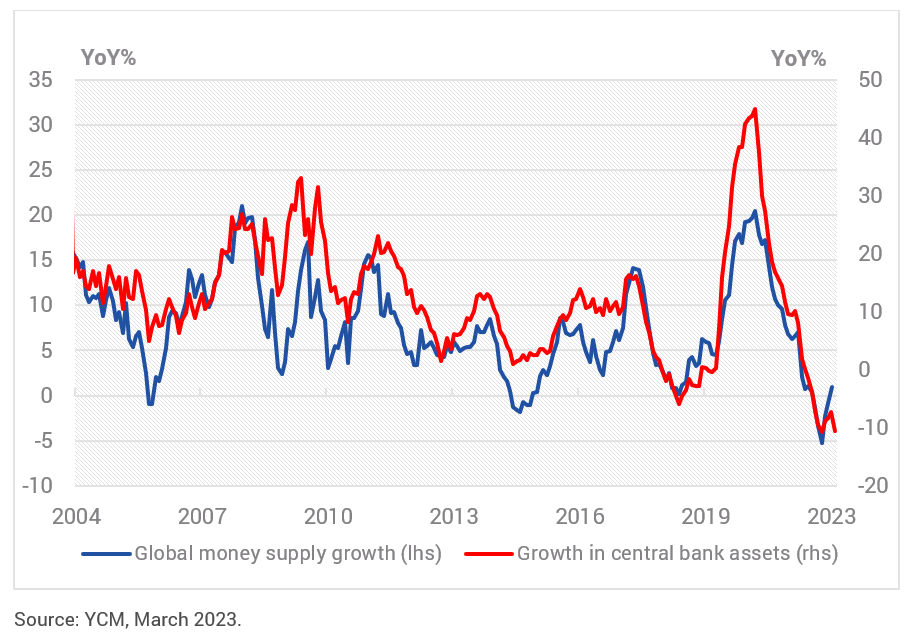

Chart 3: Central Bank Asset Growth and Global Money Supply'

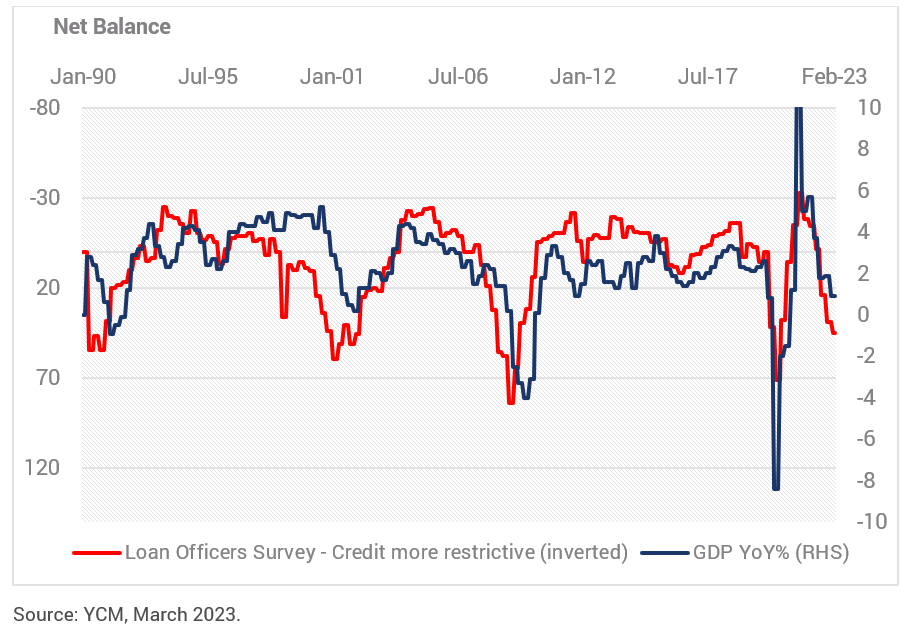

The recent rapid movement in interest rates has been sufficient to unveil some spectacular asset and liability mismatches in some US regional banks and has cast doubts on whether other banks are also sitting on large unrealised losses. Suffice to say, 'good' policy is typically marked by hiking early and in large increments at the start of the cycle and then slowing and spreading out the hikes towards the end of the cycle as incoming information is accessed for signs of a turning point. That is not what central banks have done this cycle. They did the exact opposite. Given central banks know they are already in the restrictive zone for monetary policy, given economic growth is well below trend, given inflation peaked months ago and given long dated inflation expectations are falling, then continuing to hike at this point of the economic cycle risks breaking more than just a few US retail and commercial banks. It continues to risk recession. In this respect, there is one thing we know for certain amid a banking crisis: it is that the cost of credit will rise and the availability of credit will fall sharply. The next several surveys from the US Fed's Loan Officers Survey will show a marked tightening in the availability of credit, and this has always been a rather accurate precursor to US recession (refer Chart 4). So much for the "no-landing" optimists of January and February. Chart 4: Central Bank Asset Growth and Global Money Supply'

To be clear, after its latest 25bps hike, we believe the Fed and the RBA have now completed this hiking cycle. It had been our position since mid-2022 that the economic data would not allow the Fed nor the RBA to persist with their stated interest rate intentions into mid-2023. The fractures in the banking system are by themselves sufficient to guarantee a pause in the hiking cycle, but the reality is the data is telling the central banks that the monetary tightening task is complete even if the central banks have yet to fully acknowledge it. In the case of the Australian banks, most would agree that they have some natural advantages. Capital ratios are higher - and that is a good thing - but by itself this is not a necessary or sufficient reason to avoid contagion. The real security of the big four Australian banks is fivefold: 1. The Australian banks have transformed to be primarily home loan lenders The days of the banks taking on large single loan exposures to big corporates or taking proprietary risk positions on the balance sheet are long gone. Australia's banks are boring by international banking standards, and in times of crisis that is a good thing. In the context of our chart on leverage and asset growth, the Australian banks are in the zone shown by the oval shape. The leverage is only slightly higher than it has been over the past five years and balance sheet growth has been between 11% to 29% since 2019. That's significantly below the offshore banks that experienced difficulties so far. 2. Australia's banks are homogenous To create a genuine bank run, a link with poor asset quality, poor risk controls and poor governance typically becomes the catalyst for a crisis. While Australian banks are not perfect, they do manage asset and liability risk religiously and in the post-Royal Commission period governance has been given a higher priority. But more importantly, the banks are all pretty much the same. Smaller banks were absorbed into the big banks around the GFC, and the lack of competition and underlying profitability of the back book of mortgages makes it difficult to propose a sufficient shock to the system that would see depositors flee any of the major banks. 3. The banks co invest in each other One of the underappreciated aspects of the Australian banks is that they hold large amounts of each other's paper on balance sheet. This creates an additional level of security to the oligopoly. In some ways it is a form of insurance whereby any stresses in the paper of one of the majors is diluted by the ability of the remaining banks to ensure sufficient liquidity and functioning of bank paper. 4. Government backing is clearer in Australia There is a difference between depositors having a formal government guarantee (that exists in Australia) and industry-provided depositor insurance (that exists in the US). In Australia, depositors are protected by a government guarantee up to $250,000 for each deposit holder at each bank, building society or credit union. There is very little risk to the vast majority of household deposit holders given the mean level of deposits at Australian financial institutions inclusive of offset accounts is $82,000. 5. Australian banks have stable funding sources Bank funding is overwhelming sourced from deposits. Almost two-thirds of all bank funding needs are currently met from deposits, up from 52% in 2011. Whilst it is common to think of deposits as merely household deposits, the deposits by corporate Australia, Government, Superannuation funds and other financial institutions holding deposits in banks easily exceed the level of deposits held by households. In other words, to destabilise the deposit base of Australian banks it would take more than fear amongst households. Moreover, the share of bank funding reliant on offshore issuance has declined in recent years, in part due to the cheap access to the government's term funding facility (TFF). Should stresses in international funding markets again become acute, we have the blueprint of the 2008-15 Australian Government Guarantee Scheme where the Government's AAA rating was lent to the banks to issue bonds. Australia is one of only nine countries to be rated AAA by all three major credit rating agencies, and the scheme proved highly successful in mitigating offshore funding difficulties during 2008 and 2009. In addition the Australian banks retain easy access to equity markets to maintain equity buffers. Equity remains less than 10% of bank funding requirements, however, in times of crisis the combination of offering discounted equity placements with fully franked dividends tends to find very ready recipients from both retail and institutional investors. It is worth noting that the big four banks currently offer yields of between 6.1% and 9.0% before franking benefits. Typically, US regional banks offer dividend yields of less than 2%. The combination of large, sticky deposits and ready access to capital markets with attractive yields for Australian banks provides a stark contrast to smaller US banks who are subject to deposit flight and poor access to alternative funding sources. Although Tier 1 bonds will likely remain under some pressure whilst overseas concerns are highest, we see this as more of an opportunity to selectively buy some securities at opportunistic prices. While we expect the Australian banks will underperform the broader equity market as credit growth slows, funding costs rise and P/E ratios de-rate on global concerns, we are not fearful of anything that approximates a banking run amongst the major banks. |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

24 Apr 2023 - Performance Report: Collins St Value Fund

[Current Manager Report if available]

24 Apr 2023 - Altor AltFi Income Fund - Quarterly Webinar Update

|

Altor AltFi Income Fund - Quarterly Webinar Update Altor Capital As the Altor AltFi Income Fund has achieved a five-year track record, we are pleased to invite you to the March 2023 quarterly performance update on Wednesday, 26 April at 11:00am AEST. The webinar will be led by Altor Capital's Chief Investment Officer and Portfolio Manager Benjamin Harrison and there will be an opportunity for investors to ask questions. Register Now Speakers BENJAMIN HARRISON Ben has extensive experience in advising and investing in companies. He began his career as a project manager for a large international engineering consulting firm and later moved into investment banking then investment management. Ben is a founder and the Chief Investment Officer of Altor Capital. He is also portfolio manager for Altor's private credit fund, the Altor AltFi Income Fund. TOM COCHRANE Tom is an Associate Portfolio Manager within the Altor team and has diverse experience across corporate advisory, private credit, private equity and public equities. His role at Altor encompasses deal flow, investment analysis, investment structuring and corporate advisory within all of Altor's funds with a focus on private equity and private credit. Funds operated by this manager: |

24 Apr 2023 - Altor Emerging PIPE Fund - Quarterly Webinar Update

|

Altor Emerging PIPE Fund - Quarterly Webinar Update Altor Capital

Altor Capital is pleased to invite you to the Altor Emerging PIPE Fund's March 2023 quarterly performance update on Wednesday, 26 April at 12:00pm AEST. The webinar will be led by Altor Capital's Chief Investment Officer and Portfolio Manager Benjamin Harrison and there will be an opportunity for investors to ask questions. Date: Wednesday, 26 April 2023 Speakers BENJAMIN HARRISON Ben has extensive experience in advising and investing in companies. He began his career as a project manager for a large international engineering consulting firm and later moved into investment banking then investment management. Ben is a founder and the Chief Investment Officer of Altor Capital. He is also portfolio manager for Altor's private credit fund, the Altor AltFi Income Fund. Funds operated by this manager: |

21 Apr 2023 - Hedge Clippings | 21 April 2023

|

|

|

|

Hedge Clippings | 21 April 2023 This week Treasurer Jim Chalmers released his "independent" Review of the Reserve Bank of Australia and by all accounts he intends to accept all recommendations of the Review's three person expert panel. By and large the panel was broadly critical of the Bank board's structure and governance, with most of that criticism, implied or otherwise, and rightly or wrongly, falling on the shoulders of the RBA's embattled governor, Dr. Philip Lowe. Lowe's been a convenient punching bag for a while now, but in particular, he's copped criticism from those who took as gospel his mid Covid forecast that the then cash rate of 0.1% wouldn't rise before 2024. History of course tells a different story, and hindsight is easy, but Lowe was only echoing what most central bankers were saying at the time at the height of the COVID panic, and before Putin invaded Ukraine. However the expert panel's Review of the RBA went much further than that, and the ramifications will be significant, with the change in the Bank's mandate to take into account both managing inflation and, or while maintaining full employment. In future there will be dual boards, one responsible for governance, and another, whose members will have greater economic expertise, responsible for setting monetary policy. The external Monetary Policy Board will meet 8 times a year, with policy decisions to be more transparent, including a press conference after each meeting. Board members should speak publicly "occasionally" about the work of the Board. Chalmers has wasted no time in appointing two new members of the Board, Iain Ross and Elana Ruben. This is in spite of the Review's recommendation that "External Monetary Policy Board members should be appointed through a transparent process. Positions should be advertised for expressions of interest, drawing on a matrix of required skills and experience. A panel comprising the Treasury Secretary, the Governor and a third party should recommend options for suitable candidates to the Treasurer." We're not doubting Ross or Ruben's skills and experience, but we're not too sure about the transparency, or the positions being advertised for expressions of interest. As for Philip Lowe's reaction to the criticism, implied or otherwise, he was his usual measured self, albeit no doubt through gritted teeth. In the RBA's official release when defending the organisation he heads up, he included this quote: 'The Review Panel rightly acknowledged the substantial contribution the Bank has made to Australia's economic success and the skills and dedication of the staff. It also acknowledged the RBA is highly regarded and respected in Australia and overseas.' He was even more defensive at a press conference later, describing the overall review's finding as "kind of excellent" and saying the panel's comments about the workings of the board "didn't really resonate with me". Lowe's term as RBA Governor is up in September, and although he's offered to continue (if asked), we suspect the writing's on the wall. Meanwhile, tucked into the appendices at the back of the 282 page Review was a list of the 137 people who contacted, or were contacted by, the expert panel. Fourteen were members of parliament, including understandably both the Treasurer and Shadow Treasurer. Of the remaining twelve, two (Costello and Frydenberg) were former Treasurers, leaving eight of the final ten being Independents, including Jacqui Lambie. We're not sure if it's relevant that Pauline Hanson wasn't on the list, but her absence probably didn't affect the outcome of the final report! Overall (Philip Lowe excepted) the Review's findings have been well received, but particularly by Treasurer Jim Chalmers, who having initiated it, accepted 100% of its recommendations. It's a shame he won't take the same approach to the more important reform of Australia's taxation system, starting with his budget due next Tuesday week. |

|

|

News & Insights The Lipstick Effect | Insync Fund Managers Quay podcast: FORA - fear of renting again | Quay Global Investors Why quality matters? | Magellan Asset Management March 2023 Performance News |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

21 Apr 2023 - Performance Report: Bennelong Long Short Equity Fund

[Current Manager Report if available]

21 Apr 2023 - Innovative companies can conserve and protect our precious water resource

|

Innovative companies can conserve and protect our precious water resource abrdn March 2023 Water is a precious, finite resource and essential to life on earth. However, progress on establishing universal access to basic sanitation, and encouraging the protection and responsible use of ocean resources is woefully lagging. Every year, International Water Day is marked on 22 March to draw attention to these issues and agitate for change. Efforts to ensure universal access to clean drinking water and basic sanitation are faltering. An estimated two billion people across the globe don't have safe drinking water, and a further 3.6 billion lack safely managed sanitation. We are also degrading the world's water ecosystems at an alarming rate. Over the past 300 years, over 85% of the planet's wetlands have been lost. Increasing acidification threatens marine life, while plastic pollution is choking the ocean. In 2022, we saw multiple extreme weather events across every continent, with severe and devastating storms, droughts and floods. Heavy monsoon rainfall in Pakistan caused flash flooding and landslides, destroying 1.7 million homes, displacing 32 million people, killing 1,700 people and pushing nearly nine million into poverty. Meanwhile, the Horn of Africa experienced the longest and most severe drought on record. Across Somalia, Kenya and Ethiopia, 21 million people now have food insecurity. This includes over three million people at 'emergency' levels or higher, meaning they will go days without eating and have been forced to sell belongings to buy food. With a growing global population, solutions that enable more efficient use and management of water, as well as promote better care of our oceans, are essential to help meet the increasing demand and reliance on our water resources. Within our sustainable funds, but also more broadly in core funds, we look for companies with strong runways for growth. Given the unmet need, companies whose products and services improve access to clean water and sanitation, and improve efficiencies in existing infrastructure, are tapping into significant revenue opportunities. There are also opportunities in companies showing water leadership by minimising water use, or reusing water as much as possible, which should also lower costs. Companies whose products and services improve access to clean water and sanitation are tapping into significant revenue opportunities. So where do we think there are opportunities?One example of a business improving water usage is Tetra Tech, a leading resource management consultant specialising in water services. It helps clients across a range of water-related projects, from water reuse work in Mongolia and addressing water loss in Jordan, to groundwater replenishment and reuse in California. Tetra Tech supports 70,000 projects across 100 countries around water reuse and conservation. These include flood prevention projects, stormwater management, wastewater treatment and managing water supplies. Where possible, the company uses natural solutions, such as the creation of a 'living breakwater' to stabilise the marsh shoreline and support biodiversity in Alabama. It also uses green stormwater infrastructure to transform the way stormwater is managed in Raleigh, North Carolina. Last year, Tetra Tech helped treat, save or reuse 328,000 megalitres of water, while protecting, managing or restoring 178 million hectares of land and water. The company's projects also avoided 20.6 million metric tonnes of CO2e. Another company is DSM, a Dutch business specialising in health and nutritional products. These include food supplements and ingredients containing plant-based fish alternatives. The company offers vegan fish flavouring, as well as algae omega-3 alternatives and natural algal oil for fish feed. Just one tonne of DSM's Veramaris natural algal oil saves catching 60 tonnes of wild fish to produce salmon feed, protecting marine biodiversity in our oceans. Companies whose main business is not water-related can still improve their water management and consumption. Azure Power is just one example. A leading solar power company in India, Azure Power builds and operates some of the largest solar power projects in the country. However, India is a water-stressed nation and solar panels, which attract dirt and dust, require regular washing to work effectively. The company has introduced robotic solar panel brushes to keep water use to a minimum and it also recycles 50% of the groundwater it uses. The company is aiming for net water neutrality this year. Final thoughts…These are just a few examples of businesses taking action. As we see increasing demand and need for solutions, we believe corporates can offer innovative ways to tackle our water needs. In the years ahead, this will be increasingly essential as we work to ensure that life on earth can access clean, safe and plentiful supplies of water and that life in the oceans is protected. Companies are selected for illustrative purposes only to demonstrate the investment management style described herein and not as an investment recommendation or indication of future performance. Past performance is not a guide to future results. Author: Sarah Norris, Investment Director |

|

Funds operated by this manager: Aberdeen Standard Actively Hedged International Equities Fund, Aberdeen Standard Asian Opportunities Fund, Aberdeen Standard Australian Small Companies Fund, Aberdeen Standard Emerging Opportunities Fund, Aberdeen Standard Ex-20 Australian Equities Fund (Class A), Aberdeen Standard Focused Sustainable Australian Equity Fund, Aberdeen Standard Fully Hedged International Equities Fund, Aberdeen Standard Global Absolute Return Strategies Fund, Aberdeen Standard Global Corporate Bond Fund, Aberdeen Standard International Equity Fund, Aberdeen Standard Multi Asset Real Return Fund, Aberdeen Standard Multi-Asset Income Fund |

20 Apr 2023 - Performance Report: Bennelong Concentrated Australian Equities Fund

[Current Manager Report if available]

Some familiar 2008 players are back again - i.e. Lloyds, Barclays and Credit Agricole - it is the emergence of a new batch of banks ranging from Japan, the Nordics, Canada and the Middle East that could be new sources of contagion. Nevertheless, few of these banks have attempted the same sort of balance sheet growth as the US banks that have already failed.

Some familiar 2008 players are back again - i.e. Lloyds, Barclays and Credit Agricole - it is the emergence of a new batch of banks ranging from Japan, the Nordics, Canada and the Middle East that could be new sources of contagion. Nevertheless, few of these banks have attempted the same sort of balance sheet growth as the US banks that have already failed.