NEWS

27 Jun 2022 - Managers Insights | Collins St Asset Management

|

|

||

|

Damen Purcell, COO of Australian Fund Monitors, speaks with Rob Hay, Head of Distribution & Investor Relations at Collins St Asset Management. The Collins St Value Fund has a track record of 6 years and 4 months and has outperformed the ASX 200 Total Return Index since inception in February 2016, providing investors with an annualised return of 17.87% compared with the index's return of 10.3% over the same period.

|

17 Jun 2022 - The Rate Debate - Episode 28

|

The Rate Debate - Episode 28 Yarra Capital Management 04 May 2022 Has the RBA hit panic mode? With rates on the rise, higher inflation and wages below expectation, has Australia's central bank panicked by hiking rates by 50bps, the largest monthly move in over 20 years? The RBA's charter is to ensure the economic prosperity and welfare of the Australian people, which increasingly appears to be being overlooked in favour of an inflation target that isn't easily achievable without causing recession. |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

15 Jun 2022 - Manager Insights | Magellan Asset Management

|

|

|

|

Damen Purcell, COO of FundMonitors.com, speaks with Chris Wheldon, Portfolio Manager at Magellan Asset Management. The Magellan High Conviction Fund has a track record of 8 years and 8 months. On a calendar year basis, the fund has only experienced a negative annual return once since its inception and has provided positive returns 88% of the time, contributing to an up-capture ratio for returns since inception of 83.03%.

|

26 May 2022 - Infrastructure assets are well placed for an era of inflation

|

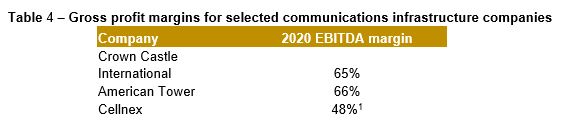

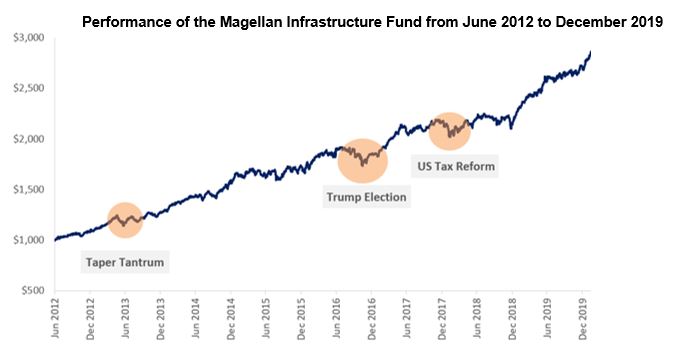

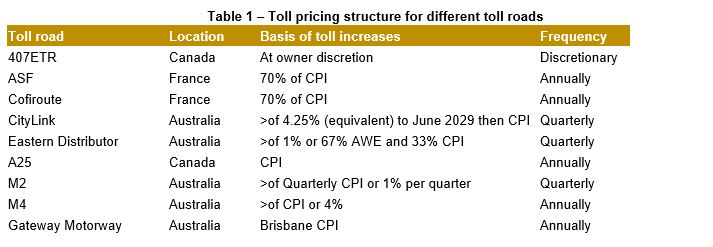

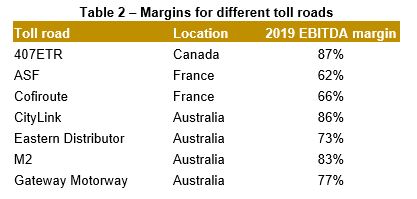

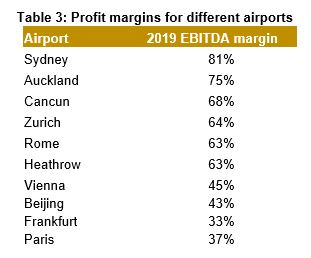

Infrastructure assets are well placed for an era of inflation Magellan Asset Management April 2022 Global stocks struggled early in 2022 because investors were concerned about faster inflation, which has risen to its highest in four decades in the US, a record high in the eurozone and highest in three decades in the UK. Long-term bond yields are climbing (bond prices are falling) because inflation reduces the value of future bond payments. Short-term bond yields are rising as central banks have increased, or are poised to lift, cash rates and terminate, even reverse, their asset-buying programs that supressed interest rates. In times of accelerating inflation and turbulent share markets, investors might find that holding global listed infrastructure securities is one way to help protect a portfolio against inflation. Inflation and asset values Inflation tends to hurt stocks in two ways. One is that inflation reduces the present value of future cash flows, a key determinant of share prices. The other way a sustained increase in inflation undermines stock valuations is that rising input costs and higher borrowing costs reduce profits - unless a business has the pricing power to boost the price of its goods or services to compensate. The lower the expected profits, the less people are willing to pay for shares. Inflation and infrastructure assets As inflation accelerates worldwide, many investors are turning to the few companies that are renowned for their inflation protection. Among these are infrastructure companies. The discussion here assumes companies defined as infrastructure meet two criteria. First, the company must own or operate assets that behave like monopolies. Second, the services provided by the company must be essential for a community to function efficiently. Such companies have predictable cash flows that make them attractive defensive assets. The main sectors within infrastructure are utilities, toll roads, airports, railroads, energy infrastructure, communications (mobile phone and broadcast towers). Each sector exhibits diverse investment characteristics and reacts differently to faster inflation, as explained below. The key thing to note though is most of these businesses are protected from inflation, which should help support their share prices if inflation becomes entrenched. Utilities Utilities include water utilities, electricity transmission (high-voltage power lines) and electricity distribution (urban power lines) and gas transmission and distribution. In most countries, utilities are monopolies. Consequently, government regulators control the prices these entities charge and adjust rates to provide utilities with an appropriate return on invested capital. This process requires regulators to take into account the changes to borrowing, construction and operating costs and changes in the value of the assets that utilities own. While all the regulatory regimes that Magellan considers to be investment-grade feature mechanisms that allow for the recovery of rising utility input and financing costs, the intricacies of different regulatory regimes affect the timeliness of that recovery. Regulatory systems that strike return allowances in real terms, escalate revenues with inflation, and index debt costs to market yields, including those in Australia and the UK, provide the most timely protection against inflation. By contrast, regulatory systems such as those in Spain and the US that strike return and cost allowances in nominal terms protect against inflation with a modest lag. Toll roads The typical business model for a toll road is that a government signs a contract that allows a toll-road operator to collect tolls for a set time and increase those tolls on a regular basis in a defined way. At the end of this contract, the road is returned to government ownership in a good state of repair. In most countries, the toll road is often not the only road route available to motorists. Consequently, the toll road is not a monopoly. The toll road, however, generally exists because alternative routes are much slower. The opening of a toll road inevitably reduces traffic on the free alternative. But over time, the free alternative can become congested more quickly than the toll road. As that occurs, the toll road behaves more like a monopoly and gives toll roads increased pricing power. However, toll price changes are generally pre-defined under a contract. Table 1 shows a cross-section of how toll prices are set in a range of contracts. Sources: Company releases, Magellan As can be seen, the pricing mechanism for many of these toll roads picks up any increases in inflation with minimal lag. Moreover, due to their strong pricing power, toll roads can expect that there will be minimal, if any, loss in traffic when tolls increase so revenues will fully recover the inflationary hit. Additionally, one of the key characteristics of toll roads that insulates them from inflationary impacts is their high profit margins. Table 2 shows the gross profit margins of a selection of international toll roads. The average margin of 75% from the sample is substantially above other industrial companies. Source: Company releases, Magellan The other key area where inflation can hurt profits is by increasing the cost of capital expenditure companies need to undertake. With most toll roads, however, the capital expenditure on operating roads is minimal and generally limited to resurfacing and replacing crash barriers, etc. Airports When looking at airports and inflation, it's best to consider airports as two businesses. The 'airside' operations primarily involve managing the runways and taxiways of the airport. Airside revenue is generated by a charge levied per passenger or a charge levied on the weight of the plane, or a combination. In most jurisdictions, the onus is on the airport to negotiate appropriate charges with the airlines. This side of the operation therefore behaves much like a regulated utility. The other business is the 'landside' operation that involves the remainder of the airport. These operations cover three primary areas: retail, car parking and property development. In most airports, the airport owner does not run the retail outlets. Instead, the owner acts as the lessor and receives a guaranteed minimum rental that is normally inflation-linked plus a share of sales. These revenues are therefore protected from a jump in inflation. The parking operations at the airport generally behave like a monopoly although there is some substitution threat; that is, passengers can use taxis instead of driving. As such, airports have significant ability to increase prices in response to higher inflation. In regard to costs, airport profit margins exhibit much greater variability than toll roads, as evident from Table 3. Source: Company releases, Magellan Efficient airports such as those in Auckland and Sydney are more insulated from faster inflation than those (typically European) airports that are struggling to reduce the workforces that were in place when they were privatised. (Even these less-efficient airports still exhibit higher margins than the average industrial company.) Finally, airports also have the highest capital expenditure requirements of any of the transport infrastructure subsectors. Airside capital expenditure includes widening and extending runways and taxiways. It is generally only undertaken after consultation and agreement with the airlines and regulatory authorities. Over time, airside charges will rise to recover these costs. Landside capital expenditure relates to increasing the retail, parking and general property leasing facilities. Higher inflation may change the financial viability of such capital expenditure. But airports, having an unregulated monopoly in these areas, can increase prices to compensate for inflation. Consequently, inflation is unlikely to hurt the value of an airport asset. Railroads (Class 1 freight rail) The railroads that meet Magellan's definition of infrastructure are primarily North American Class 1 railroads. These railroads typically have no regulator-approved capability to pass through inflation. Instead, their respective national regulators provide for lighter economic regulation using a broad 'revenue adequacy' standard. Thus, regulations have allowed railroad operators to charge rates that support prudent capital outlays, assure the repayment of a reasonable level of debt, permit the raising of needed equity capital, and cover the effects of inflation whilst attempting to maintain sufficient levels of market-based competition. Arguably, this framework has provided railroads with greater discretion around the rates they charge customers and thus, the ability to more than account for inflation. Chart 1 shows how North American railroads have increased rates at levels well ahead of inflation over the past 20 years. Source: US Bureau of Labor Statistics; Federal Reserve and AAR This isn't to suggest that regulation provides the key source of inflation protection for North American railroads. Rather, we think the rails generate most of their inflation protection from pricing power (which is derived from the lack of alternatives and the regional duopolistic regional markets) and operating efficiencies. Energy infrastructure The energy-infrastructure companies that meet our definition of infrastructure have dominant market positions and real pricing power, which is reflected in long-term, typically inflation-linked, take-or-pay contracts or regulated returns. Given the long-term nature of energy infrastructure contracts, pipeline and storage operators typically use pre-agreed price increases to protect real revenues and hedge against rising costs. Given the strategic and monopolistic nature of some assets such as transmission pipelines, some of these pipelines are regulated. Australia, for instance, has a mix of regulated and unregulated gas pipelines. In Canada, tariffs are negotiated within a regulatory framework. In the US, the regulator sets pipeline rates to allow the operator to earn a fair return on their invested capital. All methods protect these companies from inflation. Tank-storage providers that meet our definition of infrastructure need to have terminals in favourable locations and typically sell capacity, predominantly under long-term contracts, with no exposure to movements in commodity prices. Long-term storage contracts are usually indexed in a similar way to pipeline contracts. Netherlands-based storage provider Royal Vopak has long-term contracts (longer than one year) linked to the CPI of the country where the storage takes place (with annual indexation), while the bulk of costs are in the local currency of those countries, which provides a strong hedge against inflation Communications infrastructure Communications infrastructure, as defined by Magellan, is comprised of independently owned communication sites designed to host wireless communication equipment, primarily towers. Although these sites are mainly used by wireless carriers, they may host equipment for television, radio and public-safety networks. Despite the complexities of the technology that underpins wireless communication networks, the business model for these tower companies is simple. These companies generate most of their revenue through leasing tower space to wireless carriers such as mobile-service providers that need a place to install equipment. In return for providing this space, the tower company receives a lease or services agreement that provides a long-term and reliable income stream. The terms of these contracts are usually favourable for tower companies because data demand is strong and competition is low. Thus, leases are long term and revenue increases are priced into the contract. Source: Magellan Even so, we consider some, primarily US-based, communication towers to be relatively more sensitive to changes in inflation than other infrastructure sectors. This is due to communication towers in the US typically having limited inflation protection on the revenue side in the near term. In sum, we consider their protection to be partial. The second order effect of higher interest rates The traditional policy approach from central banks in response to higher inflation is to raise nominal interest rates, which has potentially two effects on our investment universe: The impact of changes in interest rates on the underlying financial performance of the businesses in which we invest; and the impact on the valuation of those businesses. As discussed above, regulated utilities can recover the cost tied to a rise in inflation through the periodic regulatory process. This generally includes the costs of servicing higher interest rates on their debt, thus exposure to interest rates will be limited to the length of time between reset periods, albeit in practice those utilities that are exposed to this kind of risk tend to hedge it by issuing fixed rate debt with a term that aligns with the regulatory period. Overall, the past decade has witnessed a significant lengthening in the duration of the debt portfolio for the majority of infrastructure and utilities businesses. Many of these companies are well protected from higher rates because they have taken advantage of the low interest rates of recent years to lock in cheap, fixed rate debt for long periods. Ultimately, we are confident that any shifts in interest rates will not hamper the financial performance of the companies in the portfolio for the foreseeable future. In terms of valuation, an increase in interest rates can be expected to lead to a higher cost of debt, and an increase in the rate at which investors value future earnings (the higher this 'discount rate', the less investors are willing to pay for future income streams). While our forecasts and valuations take these factors into account, the history of financial markets leads us to expect increasing uncertainty if rates rise or look like rising. Companies that are regarded as 'defensive' are often shunned when interest rates rise as investors prefer higher-growth sectors. However, it is our experience that provided businesses have solid fundamentals, their stock prices over the longer term will reflect their underlying earnings. In recent history, there have been three occasions where we have seen a spike in US 10-year yields of about 0.9%. At face value, these three increases in prevailing interest rates appear to have led to declines in the market value of listed infrastructure. However, if we look over the combined period then a different picture emerges. The following chart shows the performance of the Magellan Infrastructure Fund from June 2012 to December 2019. The chart shows that the hit from higher interest rates was short term. Once the interest-rate rises were digested and it was established that the outlooks for infrastructure businesses were largely unaffected then the share prices recovered. Conclusion Infrastructure remains well placed in an environment of increasing inflation due to its inflation-linked revenues, low operating costs and consequent high margins, with the second order impact of higher interest rates being muted by the lengthening of company debt portfolios over the past decade. These characteristics offer investors a haven when inflation is at decade highs around the world. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund [1] This is on a post-lease payments basis. Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

6 May 2022 - The Rate Debate - Episode 27

|

The Rate Debate - Episode 27 Yarra Capital Management 04 May 2022 Is the RBA risking a recession to solve inflation? The RBA hikes rates by 25bps, with more set to come in 2022 as Australia's central bank attempts to keep a grip on inflation. With oil and commodity prices set to continue to be at elevated levels due to Russia's war with Ukraine, could a series of rapid rate hikes rates push the Australian economy into recession?? Tune in to hear Darren and Chris discuss this in episode 27 of The Rate Debate. |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

4 May 2022 - Update on Q1 2022 Webinar Recording

|

Update on Q1 2022 Webinar Recording Laureola Advisors April 2022 On Wednesday, April 27, Laureola Advisors shared an update on Q1 2022. Request for the recording now! ABOUT LAUREOLA ADVISORS The best feature of the asset class is the genuine non-correlation with stocks, bonds, real estate, or hedge funds. Life Settlement investors will make money when others can't. Like many asset classes, Life Settlements provides experienced and competent boutique managers like Laureola with significant advantages over larger institutional players. In Life Settlements, the boutique manager can identify and close more opportunities in a cost effective manner, can move quickly when necessary, and can instantly adapt when opportunities dry up in one segment but appear in another. Larger investors are restricted not only by their size and natural inertia, but by self-imposed rules and criteria, which are typically designed by committees. The Laureola Advisors team has transacted over $1 billion (US dollars) in face value of life insurance policies. Funds operated by this manager: |

3 May 2022 - Twitter bids, social media monetisation and control in volatile markets

|

Twitter bids, social media monetisation and control in volatile markets Forager Funds Management 02 May 2021

In this episode, CIO Steve Johnson is joined by whisky-naysayer (and Senior Analyst) Chloe Stokes to discuss the bid for Twitter, social media monetisation, and control in volatile markets. Chloe also shares her experience as a younger investor and reveals the stocks (and burgers) currently on her watchlist. "As shareholders, we can't help but be disappointed. We bought [Twitter] because we thought the platform had a lot of potential," Chloe tells Steve. "It's obvious that we think it's worth more than the bid, because we held it through periods where it was trading much higher and still thought it was worth more than those higher prices. So, we are definitely not happy from a price perspective, but on the other hand, we can't stop talking about it." Timestamps 02.30 Start |

|

Funds operated by this manager: Forager Australian Shares Fund (ASX: FOR), Forager International Shares Fund |

20 Apr 2022 - The Ardea Alternative - Foreign Currency Management

|

The Ardea Alternative - Foreign Currency Management Ardea Investment Management 28 March 2022 Key Portfolio Construction Trade-Offs Dr. Laura Ryan and Tamar Hamlyn are joined by Dr. Nigel Wilkin-Smith to discuss the importance of currency management for AUD investors, along with the backdrop created by the regulatory environment in superannuation, particularly the YFYS performance test. |

|

Funds operated by this manager: Ardea Australian Inflation Linked Bond Fund, Ardea Real Outcome Fund |

7 Apr 2022 - The Rise of the Contactless Economy

|

The Rise of the Contactless Economy Insync Fund Managers March 2022 Fingertip readers and facial recognition used to be something we only saw in Hollywood movies, now they are staples in our economy. The way we purchase has dramatically adjusted to the new normal. Covid-19 has created an unprecedented global change in how we pay for things. There has been a profound and permanent change in behaviour in Australia and many parts of the world. Payment apps are easy to use, they offer improved security and the work from home offers balance, since Covid means more time to browse from home via laptops and phones.

Insync's Portfolio Manager, John Lobb tells us more on the The Rise of the Contactless Economy Megatrend: Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund |

6 Apr 2022 - Paragon - Quarterly Update & Outlook Webinar (1-Apr)

|

Webinar recording: Quarterly Update & Outlook Webinar (1-Apr)

|

.JPG)