NEWS

2 Jun 2023 - Hedge Clippings | 02 June 2023

|

|

|

|

Hedge Clippings | 02 June 2023 Phillip Lowe had a subtle shot at politicians this week, and Treasurer Jim Chalmers in particular, when fronting a Senate Estimates hearing in Canberra, asking the Senators to consider whether fighting inflation should only be left to the RBA? "In a perfect world, you'd have a different set of arrangements," Lowe proposed. "The other way you could reduce aggregate demand at the moment is to increase taxes or reduce government spending." Of course that might involve some of the senators in question losing their jobs, which they'd rather not do. He could also have added something about the government not supporting wage rises, but sensibly kept away from that, even going so far as saying he didn't think the budget was adding to inflation, but actually reducing it. It's still unknown if Lowe will keep his job when his term (or time) is up in September, and Chalmers has given no hint of support, suggesting that he won't. Whether he does or not is unlikely to change his successor's focus on inflation, and therefore the upward direction of interest rates, even though Lowe's claims that the 11 rate rises over the past year are working. The Fair Work Commission's 5.75% increase in minimum wages awarded to 2.6 million workers, and 8.6% for 180,000 on the lowest rate, won't be helping when the RBA announces the outcome of next Tuesday's board meeting. As a result, a bevy of bank economists are forecasting a further 0.25% rise, with some now suggesting that a peak of 4.6% - or three more increases - is not out of the question. Not only are interest rates a blunt instrument with which to manage inflation, their effect on the economy is a lagging one. As a consequence, when the results show up in the statistics the RBA use in their monthly determinations, the tipping point in the economy has already occurred. Hence rates inevitably rise (and fall) too far. For many people - those under mortgage or rental stress, or minimum wages - that tipping point has already occurred, so if a cash rate of 4.6% is on the cards there'll be some serious pain, and certainly Lowe's increases will have worked. Even if he's not going to be there to take the credit - or the blame - when or if inflation returns to the 2-3% target, and rates gradually follow suit. On Tuesday afternoon next week at 4.15 we are holding the next in our series of Fund Manager Round Table Webinars, this time focusing on the Hybrid Credit sector. Register here to join Ben Harrison from Altor Capital, Nick Thomson from AquAsia Funds Management, and Patrick William from Rixon Capital for their take on the opportunities and risks for the sector. |

|

|

News & Insights Market Update April | Australian Secure Capital Fund The golden opportunities for infrastructure in a challenging environment | 4D Infrastructure April 2023 Performance News Insync Global Capital Aware Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

2 Jun 2023 - Performance Report: Equitable Investors Dragonfly Fund

[Current Manager Report if available]

2 Jun 2023 - Performance Report: PURE Resources Fund

[Current Manager Report if available]

2 Jun 2023 - Are we still catching cold when America sneezes?

|

Are we still catching cold when America sneezes? Pendal May 2023 |

|

Investors concerned about the banking crisis and recession fears in the US may be missing out on finding investment opportunities in other parts of the world, says Clive Beagles. MARKETS are watching the US closely as its banking system reels from the impact of higher interest rates on regional bank bond portfolios. Three US banks have been shuttered during the rolling crisis and regional bank shares have been volatile as markets weigh up the prospect of further failures. But the crisis has also swept up banks and markets outside the US, which may offer opportunities for investors who can keep calm amid the noise. Last week Pendal's Samir Mehta argued that the US regional bank turmoil shouldn't discourage investors from considering Asian bank stocks. Clive Beagles, a senior fund manager at Pendal's UK-based asset manager affiliate J O Hambro, has similar things to say about British bank stocks. "Many of the UK banks are posting returns on equity of close to 20 per cent in the first quarter," says Beagles. "But they all trade at a discount to book value -- some of them at 0.4 or 0.5. That includes big names like Natwest and Lloyds. "Discounts to book value for that kind of return on equity just look silly." Beagles says the US market is acting like a "rotating firing squad" that seems to be picking a different name every other day to sell off. But he believes the banks that are failing in the US are smaller players which are not globally significant. "The differential between how the US has been regulating their banks and how the UK and Europe are regulating banks is becoming ever clearer -- which is frustrating because they have been dragged down a bit by the noise. Is everyone else still catching cold when America sneezes? Beagles says the underlying concern many investors have is of a global recession triggered by a downturn in the US. "There's an old assumption that when the US sneezes everyone else catches a cold. But I do slightly wonder if it's going be different this time. "If this is a crisis, it's the first one we've had where the US dollar is going down rather than up. "Normally, you head to the dollar for safe haven status." Beagles believes the US dollar weakness indicates something different is going on from the usual global contagion. It could point to a period where the US is one of the slower-growing economies in the developed world rather than its traditional role as one of the fastest. "The banks are just a microcosm of that -- they will need more capital and need to be more tightly regulated in a slower US." Beagles also cautions against comparisons to previous banking crises. "In 2008, UK banks had tier-one capital ratios of 4 per cent. Today they have tier-one ratios of 14 per cent." Tier-one capital refers to bank's most reliable and highest-quality capital. A higher tier-one capital ratio generally suggests a bank is better equipped to absorb losses and maintain its financial stability. "In 2008, there were something like £400 billion more loans than there were deposits -- today it's the other way around. "The UK as an economy is under-geared rather than over-geared." Author: Clive Beagles, Senior Fund Manager |

|

Funds operated by this manager: Pendal Focus Australian Share Fund, Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Regnan Global Equity Impact Solutions Fund - Class R, Regnan Credit Impact Trust Fund |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

1 Jun 2023 - Performance Report: Insync Global Quality Equity Fund

[Current Manager Report if available]

1 Jun 2023 - The maths of commercial real estate lending - April 2023

|

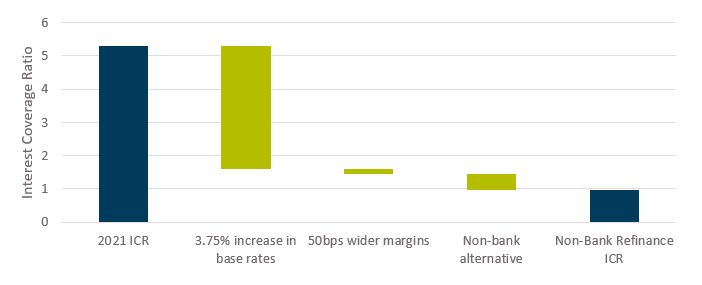

The maths of commercial real estate lending - April 2023 Challenger Investment Management May 2023 So much of financial analysis is comparative. We look for allegories; similar themes and narratives that could inform us about our current situation. In part due to the significant exposure of US regional banks to commercial real estate, risks in real estate lending markets have been front and centre of investors' minds. The obvious question is whether the stress in US commercial real estate markets could also emerge in Australia. And there is stress in the United States. As discussed in our recent quarterly review of markets the office sector is facing nationwide vacancy rates of 20%. In San Francisco, office vacancy rates are 30%, up from 3% in 2019. Average rents are almost 20% below the peak in 2019. In April, the Wall Street Journal reported on an office tower in San Francisco which was valued at US$300 million in 2019 is expected to be sold for US$60 million, an 80% decline in value over 4 years. Adding to this stress is higher interest rates and wider credit spreads. The drop in operating income and increase in cost of debt is resulting in much weaker debt serviceability. As shown below, a loan written in 2019 will struggle to cover its interest bill if current levels of interest rates and credit spreads are sustained. The maths doesn't work which is why rating agencies are downgrading deals and defaults are picking up. US Commercial Real Estate Serviceability (Office)

Here we have used the ICE BofA US Fixed Rate CMBS Index to estimate movements in interest rates and credit spreads. If interest rates increase another 100 basis points or the net operating income on the asset declines another 10% the interest coverage ratio on the loan will drop below 1 times. To get to a passing ICR for a bank loan (which we define as starting of 1.75x), new equity needs to be contributed to the deal. We estimate up to 50% of the original equity cheque would be required to right-size the bank loan. If the deal slips into the non-bank market where a passing ICR might be more like 1.15 times but the debt cost is significantly higher which reduces the required equity cheque to more like 20% with little in the way of post interest earnings available to equity. These findings tie into research from Deutsche Bank and Cohen and Steers which showed around one-third of 2023 maturities have a DSCR of less than 1.25 times[1]. Serviceability is very tight. Before we turn to Australia, it is worthwhile firstly to highlight some key differences with the U Australia Commercial Real Estate Serviceability (Office)

Again, for Australia, to get to a passing ICR for a bank (which we still define as starting of ICR 1.75x), new equity needs to be contributed to the deal. We estimate up to 20% of the original equity cheque for a bank deal. This is much better than the US in large part due to the fact that credit margins have to date held up in the bank market in Australia and rents have been stable as opposed to declining. However here if the deal slips into the non-bank market where funding margins are much wider (by >2%), Australia starts to look a lot like the US with significant equity contributions required to pass minimum ICR thresholds. So, what happens from here? It's abundantly clear there are serviceability issues in the United States and Australia. Absent equity contributions we think lenders will respond in the following ways:

The upshot of all of this is that equity valuations will likely need to come down. We all know this. The vast bulk of the market cannot be sustainably financed on existing capital structures at the current level of interest rates. But domestically we do not see a catalyst that will force a sharp revaluation across the market - as sales start to emerge through 2023 then valuations will start to adjust. This is not the not the case in the United States where the regional banking sector, a significant lender to US commercial real estate, is experiencing a meaningful tightening in financial conditions. The extend and pretend option is far less available as an option as regional banks clearly need to reduce the size of their portfolios. Nor is it available to the CMBS market which needs to be refinanced. Looking forward, we expect defaults to be heavily weighted towards deals originated during the low interest rates of 2021 and 2022 which will come due in the next couple of years. Not all the defaults will occur in the next couple of years; lenders and borrowers will extend for as long as they can see a path to recovery but the seeds for the losses have already been sown. New deals completed today will reflect the new reality of interest serviceability which at least in part will result in lower loan to value ratios and lower risk and a much improved risk return outcome. The next couple of years could well prove to be the best CRE lending opportunities since the post-GFC period. Author: Pete Robinson Head of Investment Strategy - Fixed Income Funds operated by this manager: Challenger IM Credit Income Fund, Challenger IM Multi-Sector Private Lending Fund [1] https://www.cohenandsteers.com/insights/the-commercial-real-estate-debt-market-separating-fact-from-fiction/ Disclaimer: The information contained in this publication has been prepared solely for solely for the addressee. The information has been prepared on the basis that the Client is a wholesale client within the meaning of the Corporations Act 2001 (Cth), is general in nature and is not intended to constitute advice or a securities recommendation. It should be regarded as general information only rather than advice. Because of that, the Client should, before acting on any such information, consider its appropriateness, having regard to the Client's objectives, financial situation and needs. Any information provided or conclusions made in this report, whether express or implied, do not take into account the investment objectives, financial situation and particular needs of the Client. Past performance is not a guide to future performance. Neither Fidante Partners Limited ABN 94 002 895 592 AFSL 234 668 (Fidante Partners) nor any other person guarantees the repayment of capital or any particular rate of return of the Client portfolio. Except to the extent prohibited by statute, Fidante Partners or any director, officer, employee or agent of Fidante Partners, do not accept any liability (whether in negligence or otherwise) for any errors or omissions contained in this report. |

31 May 2023 - Performance Report: Altor AltFi Income Fund

[Current Manager Report if available]

31 May 2023 - A fundamental change for AI?

|

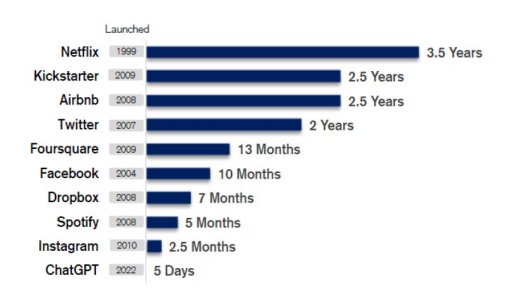

A fundamental change for AI? Nikko Asset Management May 2023 A new spark in AI It is said that artificial intelligence (AI) will revolutionise societies in a way fire transformed humanity in the prehistoric era. Akin to a spark that triggers a wildfire, the ushering in of ChatGPT in late 2022 has ignited an explosion of enthusiasm among the masses towards generative AI, potentially kickstarting a new era of rapid growth for machine learning. Amazingly, it took less than a week for ChatGPT—a free-to-use AI chatbot developed by Microsoft-backed OpenAI— to become the fastest-growing consumer application (app) in history when active users reached a million in just five days following its low-key launch in late November 2022 (see Chart 1). Chart 1: ChatGPT achieves 1 million users in record time

Source: Statista Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security.Nor should it be relied upon as financial advice in any way With the ability to create original jokes, write essays on any topic and even offer tips on relationships, ChatGPT has been on everyone's lips of late after becoming an overnight sensation. In a flash, ChatGPT has enlivened the consumer market for generative AI, which produces different types of content (including texts, images, sounds and other forms of data) on a prompt. Inadvertently, it has also triggered fresh competition among technology heavyweights in their AI offerings. Hot on the heels of OpenAI, some of the world's biggest technology platform companies have in recent months skurried to roll out their own version of AI tools to either take on ChatGPT or ride the popularity of this all-the-rage generative AI chatbot. In February 2023, software giant Microsoft rolled out a new version of its search engine Bing (with a new Bing AI chatbot), powered by GPT-4, an upgraded version of the same AI technology that ChatGPT uses. In March, searchengine behemoth Google launched its AI chatbot called Bard, after declaring a "competitive code red" in January, and Chinese search engine Baidu unveiled the Ernie Bot, which is powered by its own deep-learning model. Not to be outdone, Alibaba Cloud, the Chinese e-commerce giant's cloud computing arm, rolled out a similar AI chatbot called Tongyi Qianwen in April, and the list goes on. To be sure, the excitement about AI and the deep learning capability of machines are not new; we have been talking about these technology buzzwords for the past 20 years. But relative to five years ago, AI is at a point where it is becoming all-encompassing and moving rapidly up the s-curve (an s-shaped graph that represents a start, exponential growth and eventual plateauing over a period of time). Generative AI is already here, and rapid progressions are also taking place in other key areas of interest in next generation AI, such as self-supervised learning, decision intelligence, responsible AI and advance virtual assistants, as well as human-machine touchpoint augmentation—namely multimodal user interface, Internet of Things devices integration and voice biometrics. Exponential growth of AI kicks in In our view, AI is now near the exponential growth area of the s-curve, and it is surprising people in terms of the speed of its evolution. As investors whose investment philosophy is focused on fundamental change, we are excited about the opportunities that have emerged with the recent advancement of AI. As we see it, AI growth beneficiaries can be found not only in the developed world but also in Asia. Evidently, ChatGPT's meteoric rise to fame and its ability to draw millions of active users to its AI chatbot in a short span of time have hastened big tech companies (big techs) to offer and monetise their state-of-the-art AI tools to multiple platforms, including the enterprise-focused and consumer-centric ones. This intense competition is seen leading to more spending in the area of high-performance computing and the production of AI-focused microchips, such as graphics processing units (GPUs) and application-specific integrated circuits (ASICs), all of which are expected to benefit the high-end chipmakers. In a recent report, market intelligence firm IDC estimates that worldwide spending on AI, including hardware, software and services for AI-centric systems, will hit US dollar (USD) 154 billion in 2023, up 27% from 2022. According to IDC, the global AI spending will surpass USD 300 billion in 2026, and the current integration of AI into numerous products will result in a compound annual growth rate (CAGR) of 27.0% from 2022 to 2026.

AI models getting better with higher efficiency and lower costs Many AI foundational models or neural networks, where huge amount of data is processed and unsupervised machine learning/trainings are carried out, have achieved significant progress and are becoming highly efficient in recent years. For example, OpenAI's newly-launched GPT-4, which is able to analyse and comment on graphics and images, has improved considerably from its previous version called ChatGPT-3.5 that is primarily text-focused. Research1 has shown that GPT-4 has 53% less hallucination (responses by AI that sound plausible but are either incorrect or nonsensical) and is 110% more truthful (degree of AI's ability not to produce untruthful content) as compared to

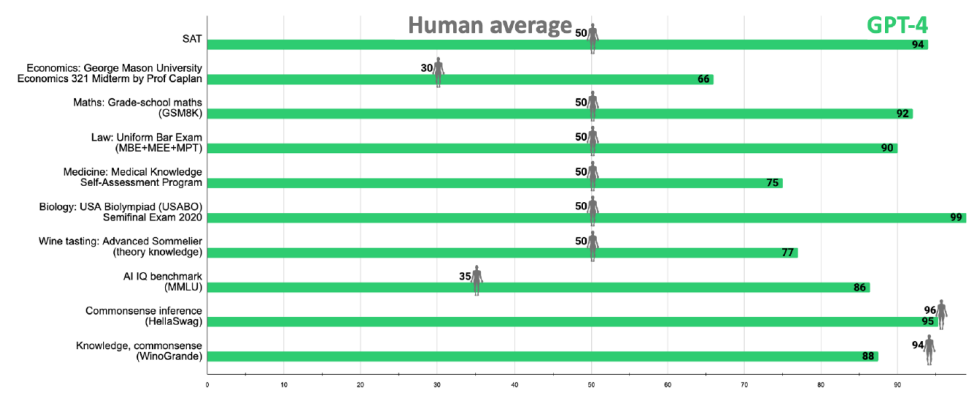

ChatGPT-3.5. Furthermore, this newest version of OpenAI's multimodal model has a pass rate of about 90%2 for the Uniform Bar exams (compared to 10%2 of GPT-3.5), amongst others (see Chart 2). Foundation models generally need to be at an optimisation level, without too many parameters and data points, to be efficient. By and large, the more specific the parameters are, the better outcomes a model will generate. As efficiency increases over time, the costs of training an AI model will come down. The training costs for ChatGPT-3 (an earlier version of OpenAI's AI model released in June 2020), for instance, were significantly lower than those of Google's DeepMind AI model, which was acquired by the tech giant in 2014. Chart 2: ChatGPT-4 versus human exams

Source: https://lifearchitect.ai/iq-testing-ai/, Dr Alan D. Thompson Monetising AI Among the big technology platform companies, Microsoft currently has a big advantage in AI due to its longstanding partnership with OpenAI, which has helped the US software heavyweight commercialise and monetise advanced AI technologies and tools as premium services on its platform. Microsoft was early to the party in terms of launching AI models on its platforms and getting these models embedded into its different suite of product offerings. The first was Microsoft's GitHub, a programmer's app used to set up new apps and businesses. In 2021, Copilot—a cloud-based AI tool developed by GitHub and OpenAI—was launched as a subscription-based service to support GitHub users via several additional assistive features. In February 2023, Microsoft also embedded more AI-powered capabilities—leveraging on the Azure OpenAI service and GPT—to its customer relationship management system called Viva Sales, which was launched in 2022. Microsoft is also offering premium services that give access to AI tools of OpenAI. Microsoft Teams (a communication platform), for example, is going into a premium structure, bundling existing features with access to OpenAI's models as well offering real time or immediate translation across 40 languages. The holy grail for Microsoft is to bundle AI tools with Office 365, and observers are expecting that to come through in the near future. Office 365 apps already have suggestive functionality but more of such features are expected to be added going forward, such as a possible virtual AI assistant, powered by OpenAI's models, for users willing to pay for such premium add-ons. On the whole, Microsoft, which is charging significant premiums on its platforms with AI functionality, is seen to have a competitive edge relative to other big technology platform companies when it comes to commercialising its AI capabilities.

Feeling the pressure after having invested a lot of money in AI, Google, which recently rolled out AI chatbot Bard, is trying hard to keep up in the AI race after having lost the first mover advantage to OpenAI and Microsoft. Facebook and Microsoft. In the Asia region, one big technology platform company that we believe is well positioned in terms of AI capabilities is Baidu, which has the most competitive AI product offerings among the Chinese competitors, in our view. Hardware producers and chipmakers riding the AI growth The rapid advancement of AI technology has brought about a surge in the production of AI-microprocessors, AI accelerators (or specialised hardware/computer systems designed to accelerate machine learning applications) and many other hardware that enables high performance computing, which is the ability to process data and perform complex calculations at high speed. This trend is likely to gather pace, benefiting many high-end chipmakers and AIfocused hardware manufacturers. For the high-end hardware and AI-centric microchip markets, American GPU manufacturer Nvidia Corporation and Taiwanese chip manufacturing giant Taiwan Semiconductor Manufacturing Company (TSMC) are best positioned to ride the AI boom, as the go-to suppliers for AI-focused tech companies, in our view. Among the AI processors, which commonly include GPU, ASIC and field programmable gate array (FPGA) chips, the relatively low-cost GPUs are currently most widely used for deep learning applications due to their high parallel computing power and ability to handle large amounts of data. Nvidia has dominated the global AI GPU market as the world's leading supplier with over 80% of market share.The most customised and resource-heavy ASIC and FPGA chips are more expensive to design and manufacture as compared to GPUs, which are considered a mass market, off-the-shelf type of processors. Producers of these two customised AI-centric chips are also not able to upscale the way Nvidia is doing for GPUs. The global GPU market, estimated at more than USD 40 billion in 2022, is expected to grow at a CAGR of 25% from 2023-2032, according to global market research firm Global Market Insights in its February 2023 report. In the high-end semiconductor market, TSMC, with a near monopoly on the production of three-nanometre cuttingedge chips, appears well poised for growth as AI takes off. To begin with, Nvidia uses TSMC as the main foundry for the production of GPUs and all of its high-end processors. The Taiwanese chipmaking titan also leads as the main foundry for ASIC chips for tech hyperscalers, such as Google, Intel/Havana, Amazon and others. Chips for highperformance computing (HPC) now accounts for over 40% of TSMC's sales and that trend will most likely continue in 2024 and 2025, in our view. Logic chips, which are generally considered the "brains" of tech equipment and devices, process information to complete tasks. Central processing units (CPUs), GPUs and neural processing units (designed for machine learning applications) are examples of logic chips. A decade ago, Intel was the dominant producer of logic chips. Since then, TSMC, which is the largest foundry company in the world with over 45% of market share in logic chip production, has taken the market away from Intel, and that trend is accelerating today, given the strong demand for high-end logic chips. Other key beneficiaries of the AI boom Alchip, which focuses mainly on the designs of ASIC microchips, benefits from the outsourcing trend of global big tech companies, many of which are pushing into chip production for their internal HPC, AI and machine learning needs. Likewise, Accton is expected to gain from the increasing demand for higher bandwidth and greater speed for networking connections as AI technology proliferates and low latency in computing networks takes off. As a large player in the white box server switch market, Accton will profit from an imminent switch to 400G cloud infrastructure, in our view. With four times the maximum data transfer speed over 100G, 400G is the next generation of cloud infrastructure, offering solutions to increasing bandwidth demands of network infrastructure providers. Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way Geopolitical risks In October 2022, the US barred its domestic firms—including major chipmakers—from supplying semiconductor chips and processor-making equipment to Chinese companies. In late 2022, the US government broadened its crackdown on Chinese technology companies by adding over 20 Chinese firms in the AI chip sector to the US Commerce Department's restricted entity list. The US has shown that it will continue to aggressively legislate in the AI and chip segments and may add more companies (particularly those from China) to the US Entity List, which adds another layer of risk for the Asian semiconductor and hardware sectors. At the moment, Chinese technology platform companies have limited access to high-end microchips manufactured by US chipmakers, and as chip upgrades continue to progress, the Chinese players could find themselves further behind the technology curve. Conclusions and ESG considerations We are just beginning to understand the impact of AI on other industries outside of technology and its implications on data ownership, utilisation of information and human rights. AI technology, for instance, is likely to have huge effects on labour forces, with the potential to displace many white-collar jobs. At the same time, widespread adoption of AI can have an impact on the environment as AI models and algorithms require substantial computing power, which in turn consumes considerable amounts of energy. All in all, there are AI-related ESG risks as well as legislation threats to consider when investing in AI companies, which could potentially be subject to increasing restrictions in the future. For now, we are selective on Chinese AI companies but remain constructive on South Korea's and Taiwan's technology leaders, especially the AI growth beneficiaries—which we believe represent a significant fundamental change to be harnessed for years to come. Author: Timothy Greaton, Senior Portfolio Manager Funds operated by this manager: Nikko AM ARK Global Disruptive Innovation Fund, Nikko AM Global Share Fund Important disclaimer information |

30 May 2023 - Performance Report: ASCF High Yield Fund

[Current Manager Report if available]

30 May 2023 - Glenmore Asset Management - Market Commentary

|

Market Commentary - April Glenmore Asset Management May 2023 Globally equity markets were mixed in April. In the US, the S&P 500 rose +1.5%, the Nasdaq was flat, whilst in the UK, the FTSE 100 rose +3.1%. In Australia, the ASX All Ordinaries Accumulation Index rose +1.8%. Top performing sectors were Real Estate, Technology and Industrials, whilst materials significantly underperformed, driven by fears around the Chinese economy and a sharp decline in the iron ore price. Of note, gold stocks continued their stellar performance in recent months. Bond yields in the US and Australia were broadly flat over the month. Commodities were weaker, with coal (thermal and coking), copper, iron ore and oil prices all declining. Regarding monetary policy in Australia, after 10 hikes in a row since May 2022, the RBA paused in April, stating a desire to see what impact the recent rate rises are having on the economy. To recap, the RBA has increased the official cash rate by 350 basis points or 3.5% in less than a year, the fastest tightening cycle on record. Inflation in Australia is currently ~7%, which continues to be well above the RBA's targeted range of 2%-3%, however there are some early signs that it may have peaked. At this point, it is difficult to forecast how the central banks will approach the current environment where inflation is still too high, albeit showing clear signs of moderating. Realistically we believe more rate hikes may be needed over the next 6-12 months, however we believe we are near the end of the rate hiking cycle. On a more positive note, and of more relevance for equity investors, we continue to see increasingly attractive valuations across a wide range of small to mid cap stocks on the ASX, where investor sentiment remains weak due to uncertainty around the earnings impact from the interest rates rises over the last 12-18 month. Funds operated by this manager: |