NEWS

17 Jul 2023 - Performance Report: Argonaut Natural Resources Fund

[Current Manager Report if available]

17 Jul 2023 - Performance Report: Bennelong Australian Equities Fund

[Current Manager Report if available]

17 Jul 2023 - Investing Essentials: Active vs passive

|

Investing Essentials: Active vs passive Bennelong Funds Management June 2023 |

|

Firstly, let's clarify the difference. A passively managed fund is designed to minimise decision-making and keep costs down. The most common types of passively managed funds are index funds, which replicate the movements (and therefore returns) of a particular benchmark index. These funds are set up so their performance will effectively mirror that of the index - meaning the fund won't outperform the index, but won't underperform it either. An actively managed fund aims to outperform a particular index or benchmark over a defined period of time, with a portfolio manager using research and expertise to select individual securities they believe will perform best. There is also, therefore, a risk of underperforming the benchmark. What sometimes gets lost in the argument of 'which is better' is a genuine understanding of the different approaches - and, importantly, how they can both benefit you as an investor at different times. In a constant effort by investors to reduce fees, the popularity of index funds is understandable. But in a world where performance is becoming harder to come by, an actively managed fund - where investment choices are based on analysis, research, and market knowledge and experience - might be a more attractive option. When deciding on an investment approach, there are three important things you should consider. 1. Your objectives If you're looking for a market level return and you're comfortable with the characteristics of a particular asset class and its benchmark (such as the ASX300 for Australian equities), an index fund could suit your requirements. In terms of performance, whatever the market does is what you'll get - there's no flexibility around this. If you want to try and outperform the market, need a particular style of return (such as income), or have a bias towards a particular characteristic or type of stock, then you could consider an actively managed fund. 2. Fees There are no active investment decisions involved in managing an index fund, so a comparatively smaller investment team is required. As a result, index funds usually have a lower management fee than actively managed funds. In an actively managed fund, the investment team will usually conduct assessment and analysis of individual shares as well as the broader economy and other relevant factors. Given the resources involved in this, and the fact that an active manager expects to outperform its benchmark, actively managed funds tend to have a higher cost than index funds. In the drive to reduce fees and get 'value for money', investors can sometimes become hung up on the investment's cost rather than its outcome. Make sure your investment strategy is aligned to your goals, and you understand the difference between price paid and value received. 3. Investment manager Because it only ever matches an index, an index fund will essentially always do what it says on the tin. If the index goes up, performance goes up, and vice versa. But when it comes to choosing an active manager, not all funds are created equal. This is also why it can be hard to compare the performance of active and passive funds: there are wild variances between active managers, styles, investment approaches, risk, etc. Do your research when it comes to a manager's style, process and philosophy. Do you understand how the fund is managed? Are you clear on what it's aiming to achieve? Above all, though, always remember that past performance is not an indicator of future performance - one of the most important rules of investing! There's no doubt that the debate around 'active versus passive' will continue. But, as with all investments, the key for investors is to be clear on what your own purpose or objective is, and then select the funds that best align to achieving your goals. It doesn't have to be either/or - adopting an investment strategy that combines active and passive elements may in fact deliver the best of both worlds |

|

For more insights visit www.bennelongfunds.com Disclaimer The content contained in this article represents the opinions of the author/s. The author/s may hold either long or short positions in securities of various companies discussed in the article. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the author/s to express their personal views on investing and for the entertainment of the reader. |

14 Jul 2023 - Hedge Clippings | 14 July 2023

|

|

|

|

Hedge Clippings | 14 July 2023 Have We Reached the Tipping Point of Inflation? As widely predicted by all and sundry, and frequently hinted by Treasurer Jim Chalmers, RBA Governor Philip Lowe's seven year tenure will end in September, to be replaced by current Deputy Governor, Michele Bullock. While there's a change at the top, and about to be widespread changes to the bank's board structure and decision making, the appointment provides continuity of the outgoing Governor's thought processes - assuming there was cohesion and agreement between the two over the past couple of years. We'd expect that to be the case. Both are longstanding RBA employees, Bullock with 38 years under her belt, whilst Lowe has 43. Jim Chalmers noted that the incoming Governor will provide a "fresh perspective", but we doubt it will cause major underlying changes to the overall approach, or the bank's actions when it comes to interest rates. Lowe has taken all the heat from the rate rises that the RBA has announced over the past 15 months, and of course for his earlier comments that rates wouldn't rise from an unprecedented 0.1% until 2024. Those earlier comments have been used by all and sundry, plus Chalmers and Albanese, to point the blame at Lowe for the fact that global inflation has caused rates to rise across the western world. The fact is that Australia's inflation rate is less than the UK's, on a par with the Eurozone, and until this week's surprise number, the US as well. Australia's cash rate at 4.1% is less than both the UK and the US, both at 5.0%. The government has been happy for Lowe to be blamed, having done nothing to help. In fact, they did the opposite by supporting wages rises that are yet to flow through the system. They've done nothing to try to control the inflationary impact of higher energy costs in a country where exports account for 70% of thermal coal production, and 82% of our gas. According to the Australia Institute as of 2020, only 1% of the gas produced in Australia is used in Australian manufacturing, less than 10% of the amount the LNG export industry uses itself. Twice as much gas is used just running gas export terminals as is used by Australian households. Whilst we're proud capitalists, and not fans of government control, one would have thought Canberra (on both sides of politics) might have stepped in somewhere or somehow along the line. For Bullock, the timing couldn't be better, and in our humble opinion she's a good choice. She's perfectly qualified, full of appropriate experience, and after 38 years, understands the bank. She comes in at a time of change, but will presumably maintain the current course. And for Chalmers, it allows the blame for mortgage pain to be laid squarely at the feet of Philip Lowe, just as it looks as if he might have achieved his "narrow path" balancing high inflation, low growth, and close to full employment. Just in time US inflation numbers have peaked, with this week's annual figure at 3%, down from 9.1% a year ago. With the delayed effects of the 13 rate rises to date working their way through the system, we may, or may not, see a (mild) recession by the end of the year. If we avoid one, we'll no doubt hear all about it from Dr. Chalmers, but how much credit he'll give to Philip Lowe is less certain. The CPI numbers due on 26th July will be critical. News & Insights Global Matters: The importance of emerging markets to the infrastructure opportunity | 4D Infrastructure Market Update June | Australian Secure Capital Fund June 2023 Performance News Bennelong Long Short Equity Fund Emit Capital Climate Finance Equity Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

14 Jul 2023 - Performance Report: Delft Partners Global High Conviction Strategy

[Current Manager Report if available]

14 Jul 2023 - Performance Report: Airlie Australian Share Fund

[Current Manager Report if available]

14 Jul 2023 - Australian Secure Capital Fund - Market Update June

|

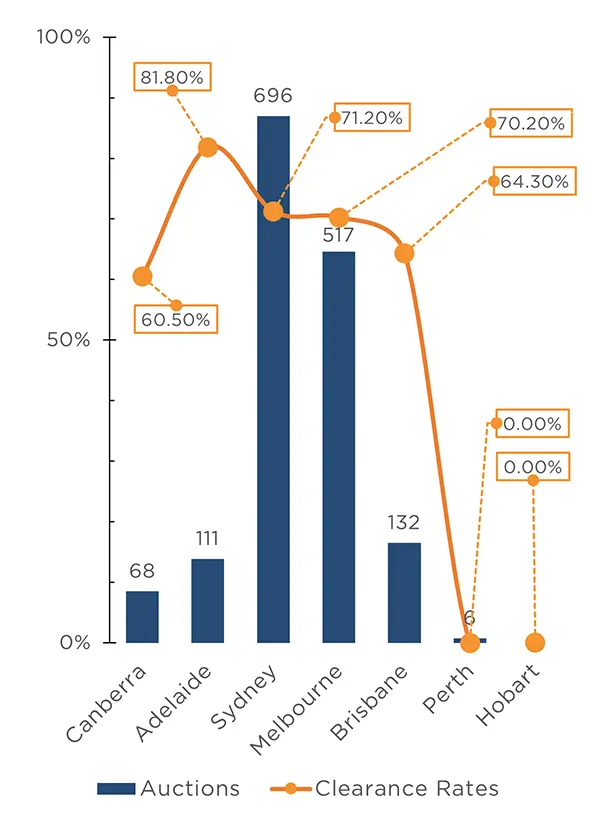

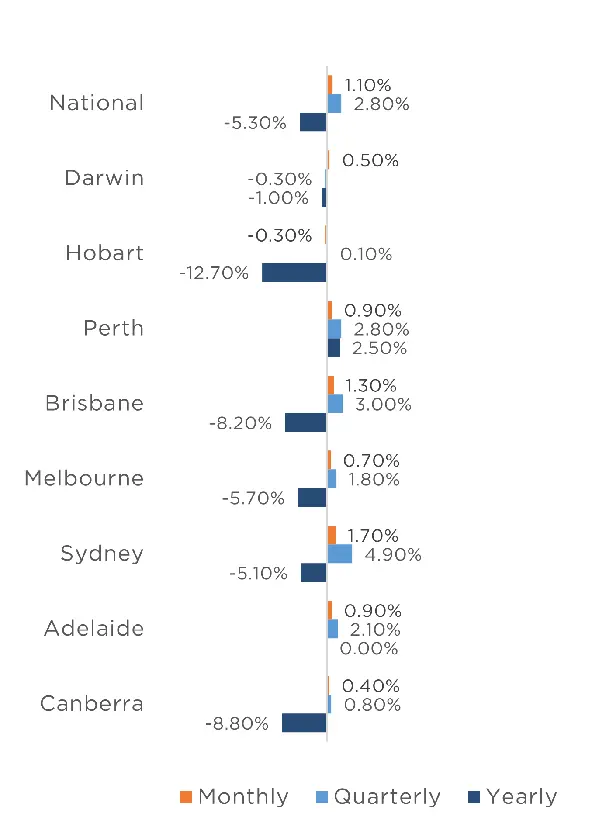

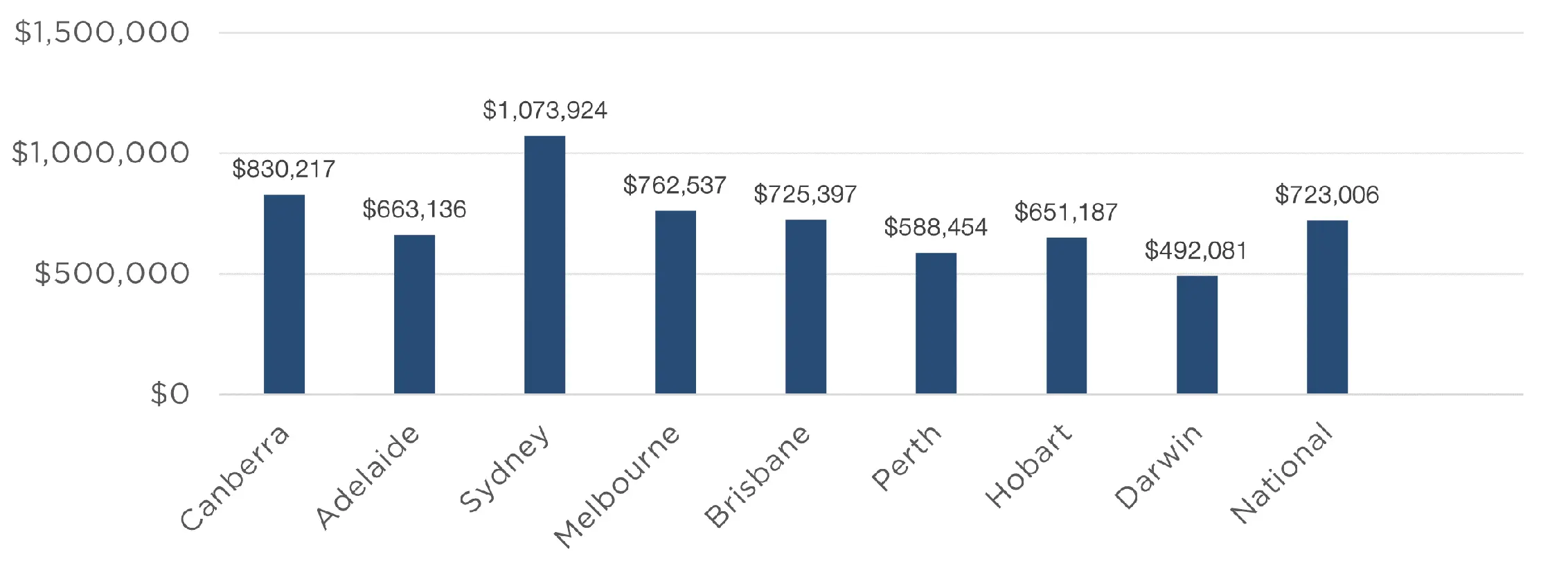

Australian Secure Capital Fund - Market Update June Australian Secure Capital Fund July 2023 The Australian housing market finished the financial year strongly, increasing by 1.1% in June according to CoreLogic's national Home Value index. All capitals except for Hobart (-0.3%) recorded growth for the month, with Sydney the standout with a 1.7% monthly increase. Brisbane was not far behind (1.3%) followed by Adelaide (0.9%), Perth (0.9%), Melbourne (0.7%), Darwin (0.5%) and Canberra (0.4%). The regions also performed strongly with only regional Victoria (-0.4%) and Tasmania (-0.3%) recording a reduction. Regional Queensland and South Australia performed best, with both recording a 1% increase. Regional New South Wales and Western Australia also saw a modest increase of 0.3%. The particularly strong performance over the past two months resulted in very favorable quarterly results, with all markets except for Darwin and regional Victoria experiencing growth. Auction numbers continue to be bellow that of last year, with 1,530 auctions taking place on the first weekend of July, down from 1,881 in the previous year. This further highlights the lack of supply in the housing market, with all capital cities recording fewer auctions than the same weekend of 2022. Sydney recorded the most auctions with 696 taking place with Melbourne not far behind with 517. Brisbane, Adelaide, Canberra and Perth recorded significantly fewer auctions with 132, 111, 68 and 6 respectively. There were no auctions held in Tasmania, however there was also only 1 auction on the same weekend last year. This lack of supply is resulting in higher than usual clearance rates, with the weighted average clearance rate of 70.3% for the weekend, up from 53.2% in the previous year. Once again, clearance rates are higher across all capital cities than last year, with Adelaide performing the strongest at 81.8% (up from 65.4% last year). Sydney (71.2%), Melbourne (70.2%), Brisbane (64.3%) and Canberra (60.5%) all performed strongly and well above previous years results of 49.9%, 55.8%, 45.2% and 52.9% respectively. Clearance Rates & Auctions 26th June - 2nd of July 2023

Property Values as at 30th of June 2023

|

13 Jul 2023 - Performance Report: Collins St Value Fund

[Current Manager Report if available]

13 Jul 2023 - Performance Report: DS Capital Growth Fund

[Current Manager Report if available]

The world held up even better than we expected, especially equities.

13 Jul 2023 - Global Investment Committee's outlook

|

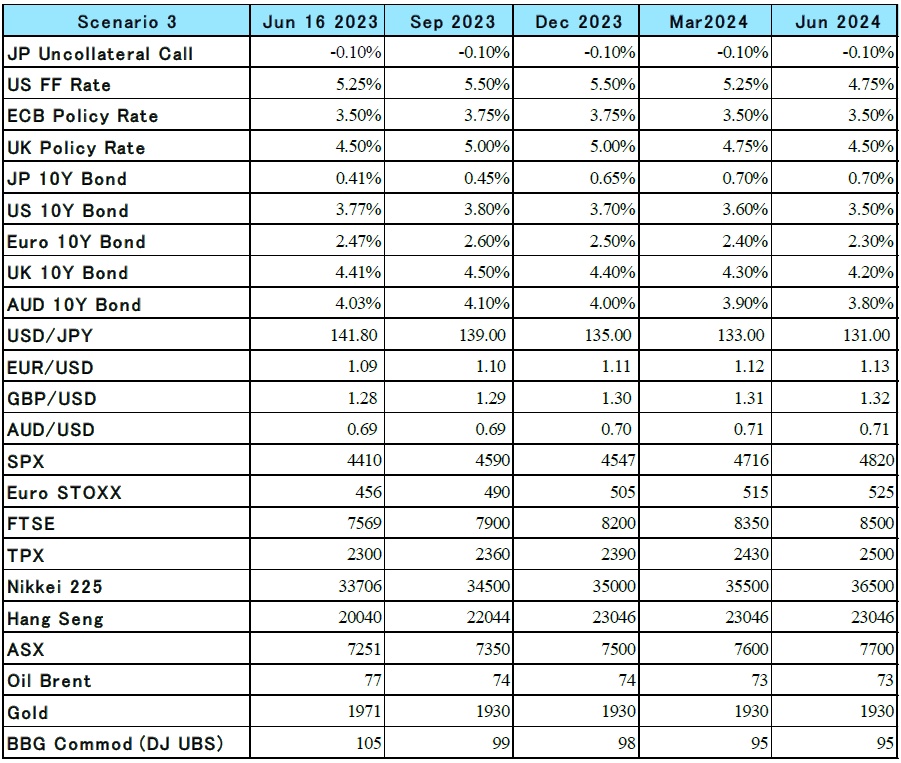

Global Investment Committee's outlook Nikko Asset Management June 2023 The world held up even better than we expected, especially equities Our March meeting's overall theme of "Rocky, but acceptable global returns" seems to have been, so far, somewhat too cautious, at least for the 2Q, as global equities have surged vs. our estimate of a moderate gain, with few financial accidents occurring and the global economy holding up moderately better than our low, but non-recessionary, forecasts. Specifically, our 2023 GDP forecasts, which were moderately below consensus at the time, are now lower than the current consensus for the US and Japan, while Europe is slightly below, and China matches such. Indeed, China recovered much as we expected in our December and March meetings, with increasing signs of headwinds to consumption after the initial rebound already occurring, also in line with our predictions. The détente in foreign affairs has held up fairly well, although tensions are very high, and much depends upon China's actions regarding its assistance to Russia and the development of the war in Ukraine. The Taiwan situation also remains crucially important. Globally, our central bank expectations were accurate for the 2Q, but our calls for mild Fed and ECB cuts in the 4Q23 are no longer consensus. Lastly, our positive stance on global equities was correct, but they gained much more than we expected so far through the 2Q. We predicted a small gain for global bonds in USD terms, but they actually lost ground moderately as yields rose. The weakness in the yen played a major role in the global bond index, which is based in USD. Our preference for equities over bonds was quite also correct, especially as we predicted major equity gains on a 9-12-month view, through which intermediate-term investors could ride out the bumps. As for geopolitics, our view that such would be worrisome but not very impactful on markets has been correct so far. Looking forward, on 22 June our committee unanimously decided on a macro-economic scenario (among the six presented) in which financial accidents in the West (but not in Asian developed markets) continue to play a role in weakening the economy and restraining investment optimism, but not stopping progress. We judge this to be very close to the consensus view in the markets. We do not necessary expect any bank runs, although such are far from impossible, private lending, private equity, commercial real estate (including CMBS and bank lending to such) are highlighted areas for likely trouble. Markets are now more attuned to the risks in commercial real estate, but given that it is fairly opaque, with booked prices often lagging reality, and that it is one of largest asset classes in Western economies that is deeply entwined with both large and small banks, it is highly likely that the risks are underappreciated, especially as conditions in many of its subsectors are further worsening to distressing levels, at least in the office sector, in the US and Europe. Other sectors' pricing is also hit by higher interest costs as well as higher cap rates that lower prices of buildings. The risks are even more true now that bank regulators will now be more diligent regarding the pricing of assets and the sectoral concentration of risks, while banks will very likely be turning much more cautious anyway and forced to charge higher rates to clients given that funding costs (except perhaps for the largest banks but possibly for them too as investors continue to shift away from low-rate accounts) are rising. Given this as a backdrop, our scenario predicts that globally, GDP will virtually match consensus in the next four quarters. Thus, we forecast: US GDP up 0.0% on a Half on Half Seasonally Adjusted Annualised Rate (HoH SAAR, as used in all references below) in the 2H23 and 0.4% in the 1H24; Eurozone GDP at 0.8% and 0.7%, respectively; Japan at 1.0% and 0.9%; and China at 4.5% and 4.9%. For CY23 GDP growth, the US, the Eurozone, Japan and China should be 1.1%, 0.5%, 1.3% and 5.7%, respectively with CY24 at 0.6%, 0.9%, 0.9% and 4.7%. Clearly, consensus is quite subdued for the global economy, with quite a few economists predicting recessions, and indeed, we will likely see one in a technical sense in the 2H in the US, but only a shallow one that could be considered a soft landing. Meanwhile, Europe and Japan should avoid recession. Economic growth will likely be constrained by inflation and disruption related to strikes, especially in Europe (but not in Japan), and if such occurred a deeply disturbing way, a significant global recession is likely. As for China, we expect much more significant economic stimulus ahead, with the central government also alleviating the debt burden for local governments. We expect that services consumption in China remains quite firm and will increasingly drive economic growth in the quarters and years ahead. Geopolitics Not only will the Ukraine conflict continue to be a major problem, but North Korea, China/Taiwan and the Middle East require close monitoring. However, we do not expect these issues to roil markets very long, though they will likely cause quite a bit of occasional volatility. As for US political risk, the country remains mired in conflict and we expect continued turbulence. House Republicans will continue to investigate Democrats, including President Biden, which will likely prove unsettling. The net result of all of this should make risk markets and business leaders somewhat wary, but normally, as long as the economy and corporate profits are not impacted by political turbulence, US markets often overlook such. Fortunately, urgent government action does not seem needed at this time and we expect annual fiscal appropriations to squeak through just like the debt limit did. It's hard to believe, but by the end of this forecast period, we will be deep into the next Presidential election, which will likely be full of surprises and uncertainties. Our detailed forecasts:

Central banks: Fed and ECB peak in 3Q and start cuts in 1Q Our new view on central banks is not too different than consensus, although perhaps a tad more dovish than such in the short term. We expect the Fed to hike 25 bps in the 3Q, and then pause until cutting 25 in the 1Q and 50 in the 2Q. As for the ECB, we expect a similar path, but without the 2Q24 cut. The BOJ will likely increase the YCC band to 75 bps in 4Q, and maintain it there, without hiking policy rates (although it may tinker with the negative interest rate policy's tiering system to make them less onerous to banks). Furthermore, the Fed and ECB will proceed with QT and also, along with the BOJ, reduce their balance sheets by winding down special pandemic-related lending programs. US and European bond yields begin downward in 4Q, with yen's major rebound For bonds globally, weak economic growth, financial sector accidents and a continuing decline in inflation should help restrain yields, although the final ECB and Fed hikes and continuing QT certainly will prove to be headwinds. Due to the financial scares, yields have already dropped substantially, and we see only moderate scope for continuation of such. Thus, for US and German 10Y bonds, we expect rates to be relatively flat through September, but to decline 10 bps in each following quarter, whereas for Japan we expect stability until rising to 0.7% in the 4Q. Regarding forex, we expect the USD to decline ahead with the yen rising a great amount as 1) the BOP trade deficit in goods and services finally returns to surplus led by increased auto exports, a further surge in tourism receipts as group tours from China (which used to account for about 50% of tourists, but has only slightly recovered so far), 2) a continued surge in foreign investment in Japanese equities and 3) a sharp 4Q narrowing in the USD policy rate differential. One should remember that fixed mortgage rates, though down from their highs, have soared globally, and even if they decline a bit, they will continue to cause a major headwind to residential property market prices, which in turn should cause negative wealth effects and also credit problems. Also, in many countries, especially the UK, anyone with a variable mortgage rate will suffer major cost increases that will likely lead to a significant number of defaults. Also, overdue residential rent cases in the US are surging and many tenants will likely exit their apartments, leaving landlords and any securities based on housing (with a similar situation for commercial properties) vulnerable to shocks. We forecast that the FTSE WGBI (index of global bonds) should produce in USD terms a 1.6% unannualised total return from our base date of 16 June through September, 4.0% at year-end and 9.0% by next June. Thus, we are very positive on bonds. For yen-based investors, however, this index in yen terms should return only -0.5%, -1.0% and 0.7% through those respective periods due to yen strength, with JGBs returning -0.2%, -2.0% and -2.3%, respectively, so bonds should be avoided. The Brent oil price will likely be volatile occasionally, but decline, in our view, to around USD 74 in each of the next four quarters. Of course, the Russian and Iran questions loom large, both geopolitically and as regards global oil supply, but we think that supply will adjust to any troublesome conditions in relatively short order. Chinese demand should remain quite firm along with its economic growth, in particular the increase in travel abroad stimulating jet fuel demand. Other commodity prices should decline mildly, in our view. Greatly due to the high base effect caused by the peak of commodity prices in 2022, coupled with deceleration in other prices (but not the oddly calculated medical cost component that will likely rebound after October), we expect the headline and core CPI readings to approximate the consensus estimates of considerable deceleration ahead, with the former at 3.2% and 2.6% in December 2023 and June 2024, respectively, and the latter at 3.8% and 2.7%. As for further details, housing rent will likely decelerate sharply, with airfares, new and used cars, apparel, home furnishings and many services prices softening too due to stagnant demand. Eurozone and Japanese CPIs should decelerate greatly ahead too, although the Eurozone will take even longer to approach the ECB's target, as second round effects and labour strikes are quite pervasive. Equities should continue rising, with the US underperforming Obviously, our scenario is quite positive for global equities, so we have a positive view on global equities for the four quarters ahead. Aggregating our national forecasts from our base date, we forecast that the MSCI World Total Return Index in USD terms will grow 5.2% through September, 6.0% through December and 13.2% through June (3.1%, 0.9% and 4.6% in yen terms, so Japanese investors should clearly prioritise investing domestically). In the US, the SPX's PER on its next-twelve-months (NTM) consensus EPS estimate is very high at 19.0, but earnings should bottom soon and then rebound in 2024, buybacks remain strong and the prospect of a dovish Fed should encourage investors despite some financial accidents. Thus, in sum, we expect somewhat moderate gains for the SPX as follows: to rise to 4,590 (4.5% total unannualised total return from our base date) at end-September, to 4,547 in December (4.0% return), then to 4,820 at end-June 2024 (10.9% return), with yen-based returns of 2.5%, -1.0% and 2.5%, respectively. We expect the US to underperform greatly in the quarters ahead. European equities' PER is only 12.9 times NTM EPS consensus estimates, which is around its historical average. A key factor for performance (along with, of course, the Russia-Ukraine situation) will be how pervasive labour strikes (and the resulting wage increases) are. We are a bit pessimistic on that front, given the confrontational socialist backdrop there, but we believe this problem will likely peak soon. Meanwhile, there could be some problems associated with Europe's commercial and residential property sectors will likely cause some banking troubles, but given that EPS expectations will likely increase further due to the stable global backdrop, we expect the Euro Stoxx index to rise to 490 at end-September and FTSE to 7,900, which translates to a total return of +8.3% (unannualised from our base date) for MSCI Europe through then in USD terms (with the euro rising moderately for this and later periods). Thereafter, we expect 13.7%, through December and +21.8% through March, which argues for an overweight of the region. Japanese equities have performed quite well in USD terms year-to date, with TOPIX rising about 20% in yen terms and about 10% in USD terms, but the latter lags the SPX and Eurostoxx returns of around 14%. Corporate profit margins remain very high with sales rebounding nicely in yen terms. Given the full re-opening of the economy (including inbound tourism), consumer optimism is rebounding. High inflation, which has worried consumers, looks set to decline ahead, especially given our anticipated rebound in the yen. Notably the import price index is now solidly negative YoY and we expect commodity prices to fall further, so this index should be even more negative ahead. The auto sector, which is a major portion of the stock market and economy, is finally recovering, but exports have lagged because there was so much pent-up domestic demand to fulfil. But we expect auto exports to accelerate further ahead. Meanwhile, global tech sector demand is widely predicted to recover ahead, which would be a boon to Japan's exports. China's economic rebound is also helping Japan's exports and its factories there. As noted above, tourism will likely be boosted by increased numbers from the crucial origin of China. Meanwhile, Japan has low political risk and structural reform is continuing, especially in digitalization and alternative energy. Japan's low exposure to Russia is fortunate, and it has secured its natural gas supplies from Sakhalin for the intermediate term. Meanwhile, the country will benefit greatly from lower commodity prices. TOPIX's PER is now up to 15.1 times its NTM consensus EPS, which is likely a bit too low. Also supporting the market are strong share buybacks and the market's dividend yield, which at 2.3% remains extremely attractive vs. bonds. Thus, with a fairly stable global backdrop, especially from China, we forecast TOPIX to rise to 2,360 at end-September, 2,390 at end- December and 2,500 next June for total unannualised returns of 5.4% in USD terms (3.3% in yen terms), 10.4% (5.1% in yen terms) and 20.2% (11.1% in yen terms), respectively, from our base date through those periods. As for the Nikkei, it should hit 34,500, 35,000 and 36,500, respectively. Thus, returns are decent in yen terms, but very attractive in USD terms for both domestic and global investors, so we have an overweight stance on the market. Developed Pacific-ex Japan MSCI: Australia will likely be hurt by declining commodity prices and lower global growth. Meanwhile, the domestic downturn in property prices is a headwind for many consumers due to the wealth effect, and for banks and construction firms too. Improved demand from China and more tourists from there and elsewhere are tailwinds, however, as is the decline in domestic bond yields after the 3Q. Hong Kong's stock market, which is dominated by PRC firms, rebounded sharply in the 4Q when China pivoted, but has softened since then. Hong Kong is certainly benefitting from a revival in tourism and the rebounding local property market certainly helps too, as will dovish central banks after the 3Q. The positive global market trend is bound to weigh on local stocks too, so we expect very strong gains from Hong Kong. Thus, we expect the region's MSCI index returns in USD terms (total unannualised) at 5.7% through September, 10.9% through December and +15.9% through June. Thus, developed Asia is highly evaluated in the quarters ahead, but not the top choice. Investment strategy concluding view We expect occasionally quite volatile, but positive trends for the global economy, financial system and markets in each of the next four quarters. Regionally, we prefer the European market for the next two quarters, and also include Japan's on a 9-12-month view. Overall, this clearly leads to an overweight view for equities during the year ahead. As for bonds, we are also quite optimistic globally, excluding Japan, for USD based investors over the each of the next four quarters. Our stronger yen scenario means, however, that Japan's investors should overweight their own stock market, not only vs. JGBs and global bonds, but vs. overseas equities, as well. Author: John Vail, Chief Global Strategist Funds operated by this manager: Nikko AM ARK Global Disruptive Innovation Fund, Nikko AM Global Share Fund Important disclaimer information |