|

In a matter of months, we've experienced a remarkable turn-around when it comes to Australian equity income and right now it's safe to say dividends are back.

After a thorough analysis of the February reporting season, the Plato team has updated its Australian equity income outlook. We now forecast the ASX200 will return a 4.8% gross yield in the coming 12 months and think high-quality active management should be able to deliver an additional 2-3% on top of the index.

For self-funded retirees who ain't got a lot to spare, this is great news.

At every RBA cash rate cut over the past decade, self-funded retirees have been dealt a blow and earlier this year they would have heard the RBA Governor state any increase to the cash rate is unlikely until at least 2024.

Generating meaningful returns from cash in the bank or bond yields has been near impossible for a number of years now and when dividends were slashed at height of the COVID-19 crisis, many would have been wondering how they were going to make ends meet. Thankfully, the dividend recovery has been swift.

The dividend income ascent

The last article I penned for the Plato Academy in the days ahead of February reporting season, was titled Cash rate locked, dividends unshackled. I highlighted a number of reasons why we believed dividends had been 'unshackled', including APRA repealing restrictions imposed on bank dividends and Federal Labor confirming it would no longer pursue changes to franking credits for retirees. This 'unshackling' certainly eventuated and has now evolved into what can best be described as a dividend income ascent.

Below, we have illustrated the change in our ASX200 index income forecast over just 2 months - from 31 December 2020, to 2 March 2021.

When we look into this ascent, 59% of the increase (which equates to 30 basis points in yield) comes from Financials. Few predicted such a rapid COVID-19 recovery in bank dividends.

Of the Big 4, we think Commonwealth Bank looks to be a compelling opportunity for income investors today. It declared a $1.50 dividend which was 25% lower than its February 2020 dividend, but importantly it equates to only 67% of earnings. The bank has said its pay-out ratio is likely to be 70-80% this year, so we expect a stronger second-half dividend.

However, what's most enticing about CBA, is the possibility it will use excess franking credits on the balance sheet to undertake an off-market buyback in the coming year. We've previously detailed why buybacks are great for retirement income.

Dividend strength is also evident outside of the Big 4. Bendigo and Adelaide Bank's half-year result came in at almost 30% above expectations. Cash earnings of $220 million were up 2% from the prior corresponding period and a whopping 156% on the second half 2020 result. The 28-cent dividend announced equates to a prudent payout ratio of 68% and a gross yield of 4.2%.

The dividend ascent amongst the banks is not only supported by the removal of APRA restrictions on payouts, but also somewhat surprisingly strong profit announcements. This is due to fewer than expected COVID-19-related bad debts across the industry, resulting in the unwinding of provisions. In a show of confidence, even before Job-Keeper ends on March 31, both ANZ and Westpac felt confident enough to write back some of their COVID-related provisions and barring any further outbreaks or deterioration of the economy, we expect even more write-backs.

Other sectors to watch

Mining stocks are the other big contributor to the dividend ascent. 39% of the increase illustrated above (20bps in yield) comes from mining stocks.

Plato has been banging the drum on miners for a number of years now and mining dividends just keep on delivering. For income investors this is a space, you simply can't afford to ignore.

Of the top six dividend payers in Australia right now, three are mining stocks - Fortescue Metals, BHP Group and Rio Tinto. For dividend investors these are the 'new banks' and you can see here just how much cash they're delivering to investors.

Over the past 3 years, while many income-focussed investors have ignored these three mining stocks, they've delivered our investors 3.4% p.a. gross income and we believe the income will keep coming in the foreseeable future. The supply and demand fundamentals for iron ore prices remain in-tact and even if prices do come off $50-100 dollars per tonne, these companies still remain quite profitable. Furthermore, management at the big miners seem to have learned from past mistakes about over-investing in new mines.

Much like the banks, there is also significant strength outside the big players. Mineral Resources is a great example of a smaller miner, offering exceptional income. Last month it announced a $1.00 dividend (3.9% gross yield) on net profit up 111%.

The remanding major contributor to the dividend ascent of the ASX200 index is Consumer Discretionary stocks. In this space, many leading retailers have been thriving and we think investors will continue to reap the dividend rewards throughout the remainder of the year.

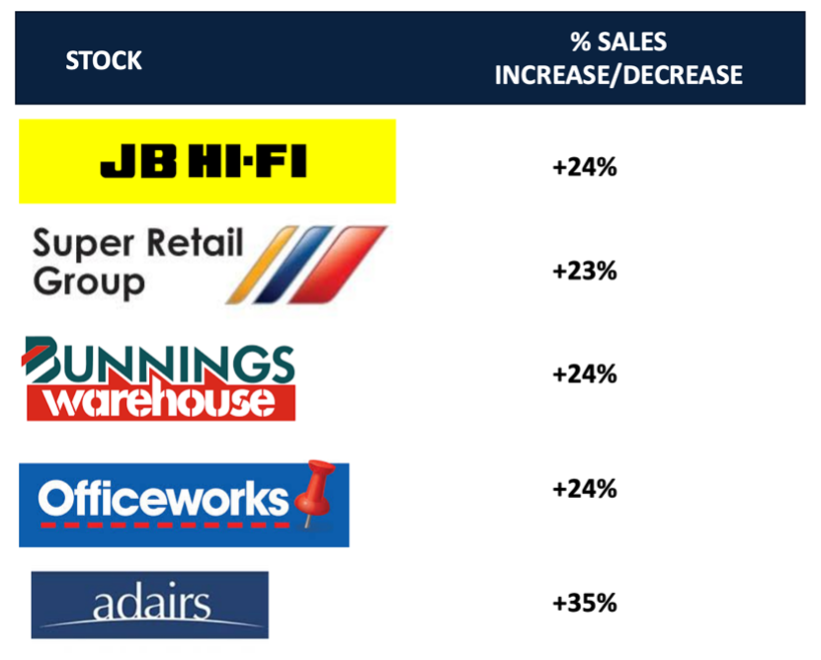

JB Hi-Fi is one of our holdings that has delivered a stellar half-year result for income investors. Its record $1.80 dividend equates to a gross yield of 5.1%. Its half-year NPAT was up 86%. What is significant for the outlook is January 2021 like-for-like sales were up 17%. This is something also seen across other leading ASX-listed retailers and we believe this demonstrates the COVID-19-fuelled retail sales momentum has further to run.

Making the most of the dividend ascent

While this analysis is broadly based on the ASX200, as mentioned we believe active portfolio management is key to maximising income for retirees. A large number of dividend traps are hidden within the ASX200 - avoiding these is just as important as identifying the dividend stars.

Over the past few years, we've also witnessed why a set-and-forget strategy is a sub-optimal income solution for self-funded retirees. Many Australian income investors have historically just sat on the Big 4 banks and Telstra, but if you look at our chart below, you can see how this set-and-forget strategy would have resulted in significant capital underperformance along with a reduction in dividend income over the past 5 years.

FY19 was the last time the Plato team labelled a period a 'dividend bonanza'. Dividends are certainly not back to that level yet, but yeah, they're getting bigger. We think the best way to ride the ascent is a highly diverse portfolio of dividend paying equities, actively managed to optimise after-tax returns.

The Plato Australian Shares Income Fund is targeting gross yield of around 8% in the coming 12 months - an additional 3% to the market delivered through our tired-and-test active investment process.

|