|

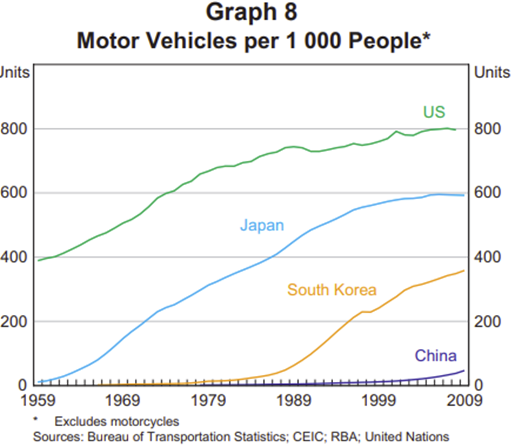

China Autos: Finding the fast lane Ox Capital (Fidante Partners) July 2024 BYD starting in pole position!The rise of the Chinese auto industry is nothing short of remarkable. Thirty years ago, China did not have an auto industry of any scale. China produced only 5,000 passenger cars in 1985! One of the earliest joint ventures (JV) between a foreign car maker and a Chinese company was the Volkswagen JV in Shanghai. Its signature car was the Santana which quickly became a best seller given its superior technology and reliability to competitive offerings at the time.  Fast forward to 2000, China had fewer than 20 million cars on the road, a very low rate of car ownership given its billion plus population. This started to change post the joining of the WTO. With the economy taking off, many other foreign car companies joined in the fray forming JVs in China. These plants were run by foreign management, and were generally highly profitable, as demand was strong, car prices were high and labour costs were low. The blossoming of the domestic auto industry enabled the development of the automotive supply chain. As the Chinese car market grew in scale, manufacturing of key components, for example engines and gear boxes, moved to China  Foreign joint venture partners were typically state-owned companies, with standout successes including Shanghai Auto and Guangzhou Auto. Both companies were able to develop their own car brands, effectively competing in the market. For instance, Shanghai Auto acquired the MG brand and has successfully exported it to other countries. The more enterprising, privately-owned auto manufacturing upstarts have proven to be tougher competitors. After a decade of intense competition, hundreds of private automakers have been whittled down to a handful of survivors. These operators have gained scale and technological knowhow, are extremely cost-conscious and innovative. Notably, the fast iterative product cycles meant the improvement in quality was rapid. Geely Auto (in Chinese Geely means prosperity) quickly accumulated technological knowhow. This was achieved through mergers and acquisition, rigorous investment in research, and sheer hard work. For example, they acquired several companies that have fallen into difficult times - including Volvo, Lotus, London Electric Vehicle Company (London cabs), Renault drivetrain JV amongst others. Now they have developed brands of their own, such as Lynk&Co, Polestar, Zeekr, the Smart Car JV with Mercedes. The Polstar 5, needs no introduction, is in fact ultimately owned by Geely.  One of the highly automated auto plants in China

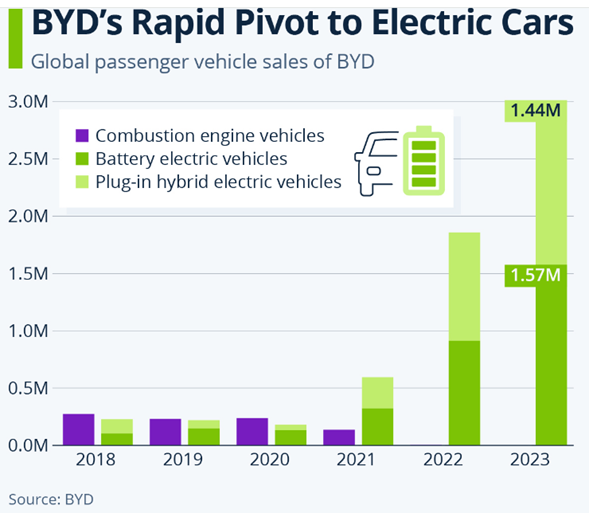

Apart from Geely, another surprising success story is BYD. What's remarkable is that BYD started out as a manufacturer of lithium batteries for PCs and smartphones. The company then chose to transition into electric vehicle production and has now become the largest EV maker in both China and the world!  BYD is early in its growth trajectoryFirstly, BYD spends around USD8 billion a year on research and development. Its product quality and technological leadership is unparalleled. BYD's latest plug-in hybrids have superb fuel efficiency of around 2.9L per 100km. Fully charged and a full tank of fuel, these BYDs can travel in excess of 2000km according to online bloggers! Second, BYD is only getting started in its ambition to conquer the auto market in China and abroad. Despite its success, BYD has only a 10% market share in China's passenger car market. With cost and quality leadership, its domestic Chinese sales is likely to be resilient in coming years. Further, export momentum is strong, with BYD only exporting around 300,000 cars a year, growing at 150% year over year in the month of June. To achieve long term success in global markets, BYD is not standing still, and it is building manufacturing plants in Hungary to supply Europe, along with Thailand and Mexico for ASEAN and Latin America, respectively. Third, prices of BYDs sold outside of China are typically at significant premium to the domestic market. While this higher price tag may partially be a result of transportation cost and tariffs in some cases, profitability per car is likely to be significantly superior in the export market. This is an interesting insight that will drive growth in profitability for BYD going forward. An older BYD rendition.  Twenty years after its first car, BYD is now gaining significant tractions in the global market through a few of its model. For example, BYD Seal 06, the current best-selling sedan, is growing rapidly overseas. Starting price tag in China USD25,000!  Funds operated by this manager: Ox Capital Dynamic Emerging Markets Fund Important Information: This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person's objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriaten |