|

Renewable energy stocks: changing winds?

Firetrail Investments

October 2023

Decarbonisation is one of the most important challenges of our time, but it is also often one of the most difficult to successfully invest in.

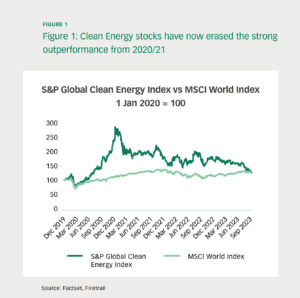

Renewable energy stocks have been among the most popular and talked about investments in recent years, thanks to low interest rates, government subsidies, and strong demand from consumers and investors who want to support a greener future.

However, valuations of these stocks became very expensive, reflecting their current leadership rather than their future potential.

In this article, we will explain why we have been cautious about investing in renewable energy stocks and where we see better opportunities in the energy sector.

What are the challenges?

One of the main challenges for renewable energy stocks is that they are very sensitive to changes in interest rates. Renewable energy projects have long-dated cashflows that depend on the future price of electricity and the cost of capital. When interest rates are low, these cashflows are more valuable and attractive to investors. However, when interest rates rise, as they have recently, these cashflows are discounted more heavily and lose some of their appeal. This is especially true for projects that rely on debt financing, which becomes more expensive as interest rates increase.

Another challenge for renewable energy stocks is inflation. Renewable energy projects often require large upfront investments in equipment and infrastructure, such as solar panels, wind turbines, and transmission lines. These costs are subject to inflationary pressures, which can erode the profitability of the projects over time. Recent downgrades of wind turbine manufacturers have demonstrated that costs have risen dramatically. This means that renewable energy projects need to generate higher revenues to cover their rising costs, which may not be possible in a competitive market.

A third challenge for renewable energy stocks is local regulation. Whilst there may be federal incentives, renewable energy projects often face opposition from local communities who do not want projects like a wind farm in their backyard. For example, wind farms can face resistance from residents who complain about noise, visual impact, wildlife disruption, and property value decline. Renewable energy projects may also face regulatory hurdles from environmental agencies, landowners, grid operators, and other stakeholders who have different interests and agendas. These factors can delay or derail renewable energy projects, reducing their expected returns.

However, the biggest long term challenge for renewable energy stocks in our view is that most renewable energy sources provide intermittent rather than baseload power. This means that they depend on weather conditions and cannot guarantee a constant supply of electricity. This creates a problem for grid stability and reliability, which requires a balance between supply and demand at all times.

Energy storage in batteries is often seen as a solution for this problem, but it still has a long way to go before becoming widespread and cost-effective. According to the International Energy Agency (IEA), battery storage capacity needs to increase by more than 40 times by 2040 to support the growth of renewables.

Opportunities: Where to invest?

Given these challenges, we have been looking for opportunities in both providers of existing baseload power from sources such as hydro and nuclear, as well as solutions for reducing energy demand.

One example of the latter held within the Firetrail S3 Global Opportunities fund is Schneider Electric, a French company that provides products and services for energy efficiency and management. This is a solution that can be implemented now, as an immediate solution.

Schneider Electric helps its customers reduce their electricity consumption and carbon footprint by offering solutions such as smart meters, sensors, software, automation, lighting, heating, cooling, and electric vehicle charging. Schneider Electric benefits from growing demand for energy efficiency solutions from various sectors such as buildings, industries, data centres, and infrastructure. Schneider Electric also has a diversified geographic exposure and a solid financial performance.

S3 Characteristics are important!

We believe that decarbonisation is important, but we also believe that we need to approach investing in the sector in a pragmatic way. We are not interested in chasing popular or overvalued stocks that may not deliver on their promises or expectations. We are interested in finding undervalued or overlooked stocks that offer sustainable earnings and cashflows, sustainable business models, as well as sustainable positive change.

As one company executive we met recently said: "One of the most important facets of sustainability is remaining a going concern". We think this is very true in the current environment.

Funds operated by this manager:

Firetrail Absolute Return Fund, Firetrail Australian High Conviction Fund, Firetrail Australian Small Companies Fund, Firetrail S3 Global Opportunities Fund, Firetrail S3 Global Opportunities Fund (Hedged)

Disclaimer

This article is prepared by Firetrail Investments Pty Limited ('Firetrail') (ABN 98 622 377 913, AFSL 516821) as the investment manager of the Firetrail Australian High Conviction Fund (ARSN 624 136 045), the Firetrail Absolute Return Fund (ARSN 624 135 879), the Firetrail Australian Small Companies Fund (ARSN 638 792 113) and the Firetrail S3 Global Opportunities Fund (ARSN 653 717 625) ('the Funds'). Pinnacle Fund Services Limited ('PFSL') (ABN 29 082 494 362, AFSL 238371) is the product issuer of the Fund. PFSL is not licensed to provide financial product advice. PFSL is a wholly-owned subsidiary of the Pinnacle Investment Management Group Limited ('Pinnacle') (ABN 22 100 325 184). The Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') of the relevant Fund are available via the links below. Any potential investor should consider the PDS and TMD before deciding whether to acquire, or continue to hold units in, the Fund.

Links to the Product Disclosure Statement: WHT3810AU, WHT5134AU, WHT3093AU, WHT7794AU

Links to the Target Market Determination: WHT3810AU, WHT5134AU, WHT3093AU, WHT7794AU

For historic TMD's please contact Pinnacle client service Phone 1300 010 311 or Email [email protected]

This communication is for general information only. It is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. It has been prepared without taking account of any person's objectives, financial situation or needs. Any persons relying on this information should obtain professional advice before doing so. Past performance is for illustrative purposes only and is not indicative of future performance.

Whilst Firetrail, PFSL and Pinnacle believe the information contained in this communication is reliable, no warranty is given as to its accuracy, reliability or completeness and persons relying on this information do so at their own risk. Subject to any liability which cannot be excluded under the relevant laws, Firetrail, PFSL and Pinnacle disclaim all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information. This disclaimer extends to any entity that may distribute this communication.

Any opinions and forecasts reflect the judgment and assumptions of Firetrail and its representatives on the basis of information available as at the date of publication and may later change without notice. Any projections contained in this presentation are estimates only and may not be realised in the future.

Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this communication is prohibited without obtaining prior written permission from Firetrail. Pinnacle and its associates may have interests in financial products and may receive fees from companies referred to during this communication.

This may contain the trade names or trademarks of various third parties, and if so, any such use is solely for illustrative purposes only. All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with, endorsement by, or association of any kind between them and Firetrail.

|