A live webinar with ANZ's economics chief Adam Boyton and Pendal's head of bond strategies Tim Hext.

Find a Fund

Peer Group Analysis View All»

| Index Selector Links | 1 Year | 3 Year | 5 Year |

|---|---|---|---|

6.17% |

5.90% |

6.39% |

|

88.37% |

12.24% |

62.68% |

|

9.12% |

1.75% |

3.56% |

|

17.59% |

5.33% |

7.63% |

|

16.97% |

5.84% |

8.51% |

|

15.94% |

2.77% |

6.10% |

|

21.10% |

7.47% |

8.23% |

|

24.13% |

6.26% |

10.34% |

|

22.60% |

1.67% |

8.24% |

|

28.44% |

4.05% |

9.33% |

|

6.64% |

1.70% |

1.68% |

|

8.82% |

4.46% |

4.47% |

|

7.97% |

6.90% |

6.42% |

|

10.47% |

7.39% |

6.73% |

|

14.51% |

7.86% |

5.50% |

|

12.37% |

4.30% |

6.28% |

|

8.17% |

-2.70% |

1.02% |

Hedge Clippings

22 Nov 2024 - Hedge Clippings | 22 November 2024

|

|

|

|

Hedge Clippings | 22 November 2024 Following the build up, media frenzy and speculation leading to the US election, and then the surprise at Donald Trump's resounding victory (except to The Donald himself), everything has gone quiet, relatively speaking. Maybe it's just the media in limbo, save for regular announcements regarding key appointments. Trump himself, rarely short of a word over the past 6 months, has also gone quiet. Either he's taking a break prior to taking over in January, or maybe he's back on the golf course? Maybe it's just the lull before the storm? There's plenty of speculation on policy implementation, but even more on the reaction from China on tariffs, or immigration, or ending wars "in a day". Back in Australia the government is softening us up prior to the election due by May next year, which according to the polls is going to be much closer than one would have imagined after the last election. Much will come down to the economy (as it did in the end in the US) with inflation and interest rates taking centre stage. Treasurer Chalmers is trying to put a good spin on inflation, but is unlikely to fool anyone, and certainly not the RBA or the market. A big test will come next Wednesday when monthly CPI numbers are due for October. While the headline rate for the September Quarter seemed to be on the right track at 2.8%, that was significantly affected thanks to electricity rebates and lower fuel prices. Underlying inflation remained high at 3.5% which the RBA Bulletin noted was falling more slowly, and was not expected to return to target until the end of 2026 - in fact, the RBA expects that it will pick up in the September quarter 2025 when the energy rebates are due to end. Added to this, as noted in PinPoint Macro Analytics' weekly macro research (see below), the latest inflation figures in four major economies (US, UK, Eurozone and Canada) which had been falling, have all picked up. If Australia's CPI follows suit next week, then the chance of the RBA helping the embattled Albanese government out with a rate cut pre-election slips further. As PinPoint's Richard Grace points out, "the overnight index swap (OIS) market is the purest form of the market's expectation for what the RBA may do, and it is finally starting to push out the timing of the next interest rate cut." PinPoint also warns that the RBA Board has also said it is not ruling anything in or out. That might mean no rate cuts until after the election, or as an outside option, maybe a rate rise. That would certainly cook Albo's goose! News & Insights Manager Insights | East Coast Capital Management Hedge Clippings - Macro Research | PinPoint Macro Analytics US Election 2024: How will markets and sectors respond? | Magellan Asset Management Market Commentary - October | Glenmore Asset Management October 2024 Performance News Argonaut Natural Resources Fund Skerryvore Global Emerging Markets All-Cap Equity Fund Bennelong Long Short Equity Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

29 Nov 2024 - Trump & Uncertainty

29 Nov 2024 - Performance Report: Insync Global Quality Equity Fund

[Current Manager Report if available]

29 Nov 2024 - Performance Report: Insync Global Capital Aware Fund

[Current Manager Report if available]

29 Nov 2024 - The Trump effect on small cap stocks

|

The Trump effect on small cap stocks Montgomery Investment Management November 2024 Since 2022, we have predicted that small cap stocks, especially those representing innovative businesses with pricing power, would do well in an environment of disinflation and positive economic growth. Since the end of 2022, the U.S. Russell 2000 Index of small-cap stocks has risen 36 per cent, the U.S. S&P SmallCap 600 index is up 31 per cent, and the S&P/ASX Small Ordinaries index has risen 12 per cent. Interestingly, most of the gains in the Russell 2000 Index (23 per cent) have been recorded since April this year, and the S&P SmallCap 600 is up 21 per cent over the same period. The bulk of the gains over the last two years have occurred in the last two or three quarters. Given the disinflation/ positive gross domestic product (GDP) picture was no different before April and after April, we can put the acceleration down to something else. That something else may just be bets that a Trump election victory would be positive. If so, why have U.S. small caps done well amid a Trump victory? Answering that question may offer some insights into what happens next (for what it's worth, I believe the small caps rally, which commenced in 2022, should continue into 2025, and we should reappraise the situation towards the end of 2025. Domestic focus: Small-cap companies often derive a significant portion of their revenue from domestic operations. The last Trump administration emphasised policies that stimulated domestic economic growth, such as infrastructure spending and tax reforms, benefiting these companies. Tax cuts and jobs act of 2017: Trump last reduced the corporate tax rate from 35 per cent to 21 per cent. Small cap companies generally paid higher effective tax rates compared to larger, multinational corporations. The reduction in taxes disproportionately benefited smaller companies, improving their profitability. Deregulation efforts: The last Trump administration pursued deregulation across various sectors, reducing compliance costs and operational burdens. Due to these policy changes, small businesses, which have fewer resources to manage regulatory complexities, found it easier to expand and invest. Trade policies: The focus on renegotiating trade agreements and implementing tariffs affected multinational corporations more than domestically oriented small cap companies. Large-cap companies with extensive international operations faced uncertainties and potential losses, whereas small caps were relatively insulated. Economic growth and consumer confidence: The period saw steady economic growth and high consumer confidence levels. Increased consumer spending boosted revenues for small businesses that rely heavily on domestic markets. Stronger U.S. dollar: A stronger dollar can negatively impact multinational companies by making exports more expensive and reducing the value of overseas earnings. With limited international exposure, small-cap companies were less affected by currency fluctuations. Infrastructure initiatives: Proposed investments in infrastructure projects promised potential contracts and growth opportunities for smaller companies in construction, manufacturing, and related industries. Together, the first time around, these factors created an environment where small-cap stocks could outperform their larger counterparts. Under a second Trump term, many investors believe the same is in store, which is why the Russell 2000 Index was up five per cent the day after Trump's win. Of course, it's important to remember honeymoons never last and stock performance is influenced by a variety of factors, including global market conditions, geopolitical conflict, investor sentiment, and, most importantly, profit growth. For now, and until late 2025 (and excepting a war with China), I believe small caps will do well. Author: Roger Montgomery Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund |

28 Nov 2024 - Performance Report: TAMIM Fund: Global High Conviction Unit Class

[Current Manager Report if available]

28 Nov 2024 - The market has eyes only for Trump

|

The market has eyes only for Trump Pendal November 2024 |

|

SEPTEMBER quarter wages data (the Wage Price Index) was released today and, for the third quarter in a row, sat at 0.8%. This sees a 3.2% annualised pace, though the 1.1% outcome from the 2023 December quarter keeps the annual rate at 3.5% for now. All sector WPI, quarterly and annual movement (%), seasonally adjusted (a)

Source: Wages grow 3.5 per cent for the year | Australian Bureau of Statistics Both private and public wages rose 0.8%. A key factor was awards and minimum wage outcomes, which were set at 3.75% in June, down from 5.75% the previous year. This would be very welcome news for the RBA. Wage growth and underlying inflation are now heading back towards 3%. Given the two feed into one another, it reflects a more sustainable path for the medium term. Recent RBA forecasts have underlying inflation at 3% and wages at 3.4% by June next year. If the RBA has more confidence in reaching these levels sooner, it opens the door for rate cuts in the first half of next year. OutlookIn another time or place, this data would have seen a decent market rally. But the market has eyes only for the future of Trump's presidency. This future is viewed as one of increasing government debt and higher tariff-led inflation in the US, feeding out into the globe. As a result, markets now have only 30% chance of an RBA February rate cut and less than one cut by mid-year. On domestic factors alone, this is very cheap, but reconciling it with Trump is proving the problem. We think the Trump impact will be more mixed outside the US. Australia's trade deficit with the US should see us well down the list of targets, but key trading partners are at the top of the list. Either way, Trump's policies are unlikely to hit hard data until the back half of 2025 at the earliest, making central banks' jobs more difficult for now. We maintain the view that upcoming data leaves a February rate cut wide open. At only 30% priced in, the risk/reward is becoming attractive, and we will use the sell-off as an opportunity to enter positions. Further out the curve remains at the mercy of US bonds which, even at 4.5%, don't seem to be finding widespread support. Australia should outperform but yields may still move higher. Author: Tim Hext |

|

Funds operated by this manager: Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Multi-Asset Target Return Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Pendal Sustainable Australian Share Fund, Regnan Credit Impact Trust Fund, Regnan Global Equity Impact Solutions Fund - Class R |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

27 Nov 2024 - Performance Report: PURE Resources Fund

[Current Manager Report if available]

27 Nov 2024 - Performance Report: Bennelong Twenty20 Australian Equities Fund

[Current Manager Report if available]

27 Nov 2024 - A new era dawns for Hybrids?

|

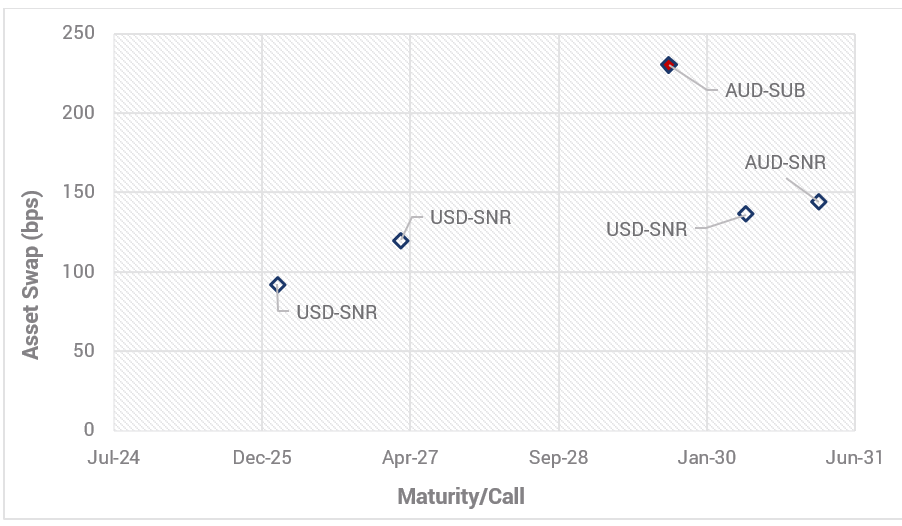

A new era dawns for Hybrids? Yarra Capital Management October 2024 As bank issuance shrinks, corporate hybrids are in the ascendent, with non-financial corporate hybrids potentially instrumental in powering Australia's energy transition. So what do they offer the fixed income investor? Australia's hybrid bond market rarely makes headlines, but in recent weeks it has been firmly back in the spotlight. The Australian Prudential Regulation Authority (APRA) recently revealed plans to phase out Australian banks' use of additional tier one (AT1) capital which APRA believes is riskier, thereby seeking to enhance the overall stability of the banking system. The announcement came on the heels of a surge in interest in corporate hybrids sparked by the successful raising for Australian Securities Exchange (ASX) listed mall operator Scentre Group. Yarra's outlook for Australia's hybrid bond market--of which bank AT1 hybrids make up around $41 billion--considers these latest proposed regulatory changes while focusing on the future potential for hybrids in funding corporate Australia's energy transition ambitions. Investors and issuers alike are now navigating a market partly in transition. More immediately it seems that in the wake of APRA's announcement, some are betting that a shrinking pool of Australian bank hybrids will drive up demand, pushing prices higher and yields lower across Australia's big four banks. Since last month's announcement, spreads for Tier 1 securities have contracted ~16bps--so retail investors are eager to bid up assets and get a larger slice of a shrinking pool. While uncertainty prevails in hybrid bank issuance for now, and short-term opportunities may arise, over the longer-term a broader set of dynamics is emerging for hybrids, particularly in sectors like energy and infrastructure. Expanding role in Australia's energy transitionThe potential scale of the energy transition in Australia offers an exciting growth opportunity for corporate hybrids. As energy transition projects such as new transmission lines and large-scale generation get underway, hybrids can and should play a role in funding the significant upfront capital costs and become a permanent feature of issuer capital structures. We estimate a total system investment of $400 billion is required by 2050 in order to decarbonise Australia's energy market with a focus on new energy generation including investment in wind farms, solar, batteries, and associated transmission assets. It is highly unlikely that equity alone will foot the bill for these expensive projects and that is why we see hybrids as an increasingly popular funding source in Australia's transition to a low-carbon economy, offering flexibility and capital efficiency. The sheer size of the capital requirement means that corporates will need to tap into multiple funding sources, and hybrids offer a lower-cost alternative to pure equity issuance. For large-scale energy transition projects, such as new transmission lines and renewable energy facilities, hybrids offer a way to fund significant upfront capital costs without putting undue strain on a company's balance sheet. For that reason, we expect large blue-chip generation companies like AGL, Origin, APA, and even Woodside and Santos along with transmission companies like Austnet and Transgrid, to tap into hybrid issuance as part of their funding strategies for energy transition plans. The recent success of Scentre's corporate hybrid raising demonstrates this growing interest from non-financial corporates looking to leverage a flexible funding tool, and we expect this interest to grow from here with further non-financial corporate issuance likely in FY2025. While APRA's move signals tighter regulatory scrutiny and a potential decline in AT1 hybrid issuance by banks, there is also the possibility that as major bank issuance retreats in APRA's suggested 2027-2032 transition period, corporate issuers may step in to fill the gap. Bringing it back to fundamentalsAs the APRA development demonstrates, assessing and pricing the inherent risks of hybrids becomes trickier with regulatory change in the mix. But these upheavals should be viewed as atypical events in a sector that is actually offering attractive returns akin to longer term equity market averages, with the 'higher for longer' rates, which are thematic for fixed income assets, here to stay. We are forecasting a new era for tactical fixed income, characterised by sustained, higher yields. In this environment, investors, particularly those focused on investment-grade assets, are increasingly comfortable holding instruments such as hybrids, viewing the attractive yields on offer as ample compensation for assumed risk. We see further opportunities for investors to access the higher yields and risk-adjusted returns that have made the hybrid instrument so popular recently. Further, with APRA's decision to phase out AT1 hybrids, there is an expected shift of a substantial pool of capital, estimated to be around $41 billion, that will be seeking new investment avenues. This development is likely to create significant opportunities for corporate hybrids to emerge as a viable alternative for retail investors who are in search of yield. Consequently, we anticipate that corporate hybrid instruments could play a crucial role in filling the gap left by the diminishing bank hybrid market. This shift could potentially lead to a resurgence of hybrid issuance on the ASX, ensuring that investors continue to have access to the attractive yields they have grown accustomed to with bank hybrids, but now through corporate issuance by larger, investment-grade companies. In addition to the rise of corporate hybrids, another area that warrants close attention as AT1 hybrids are phased out is the potential for Bank Tier 2 paper - that is, subordinated debt which provides an additional layer of protection for banks - to become more prominent on the ASX. It is conceivable that banks may opt for increased Tier 2 issuance as a strategic move to maintain access to retail capital pools and fulfill their capital requirements while they gradually wind down their AT1 hybrid instruments. This strategic shift towards Tier 2 issuance could provide banks with the necessary flexibility to navigate the changing regulatory landscape and continue to meet their capital needs effectively. Hybrids in portfolio constructionA key performance factor here is the issuer's credit strength--when dealing with investment-grade hybrids from strong issuers, the chance of conversion or extension is significantly diminished but investors still get rewarded for taking on what are essentially low-probability events. These features allow investors to effectively double the credit spread, significantly increasing returns without taking on a disproportionate increase in risk. For instance, investors in Scentre Group's recent hybrid issuance picked up a credit spread that was 1.8 to 1.9 times the spread on the company's senior debt, providing a return close to 6%. Chart 1: Scentre Group Bond Curve - 4 September 2024

|

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

26 Nov 2024 - Performance Report: PURE Income & Growth Fund

[Current Manager Report if available]

8 Aug 2023 - Webinar Podcast 01 Aug 2023 | Infrastructure Funds - Analysing the Opportunities and Risks

|

Webinar Podcast | Infrastructure Funds - Analysing the Opportunities and Risks FundMonitors.com 01 August 2023 |

|

Listen to the podcast to discover the key insights and opportunities in this dynamic investment landscape. In this informative 45-minute session, we explored the potential benefits and risks of investing in infrastructure funds and uncovered the various types of infrastructure assets, including transportation, energy, and social infrastructure. Our panel consisting of Sarah Shaw from 4D Infrastructure, Ben McVicar from Magellan, and Matt Lorback from Atlas Infrastructure also delved into the regulatory and policy considerations impacting infrastructure investments. |

3 Aug 2023 - In Conversation with Airlie's Analysts

|

In Conversation with Airlie's Analysts Airlie Funds Management July 2023 |

|

Airlie Australian Share Fund Portfolio Manager, Emma Fisher, engages in a conversation with Airlie's senior analysts, Vinay Ranjan and Joe Wright. Emma discusses the performance of the Australian market during the past 12 months and asks Joe and Vinay to share insights on how some of their stocks have performed during the year within the Fund. This includes Mineral Resources, QBE Insurance and James Hardie. Funds operated by this manager: Important Information: Units in the fund(s) referred to herein are issued by Magellan Asset Management Limited (ABN 31 120 593 946, AFS Licence No. 304 301) trading as Airlie Funds Management ('Airlie') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to an Airlie financial product or service may be obtained by calling +61 2 9235 4760 or by visiting www.airliefundsmanagement.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of an Airlie financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Airlie makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Airlie. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any third party trademarks contained herein are the property of their respective owners and Airlie claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks.. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Airlie. |

21 Jul 2023 - Why railroads are an attractive investment and how PSR is helping

|

Why railroads are an attractive investment and how PSR is helping Magellan Asset Management June 2023 |

|

Yathavan Suthaharan, Investment Analyst, discusses why railroads are an attractive infrastructure investment, recent events at Norfolk Southern and what the hype is around PSR. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Any third party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

3 Jul 2023 - Webinar Recording 27 June 2023 | Resource Funds - Analysing the Opportunities and Risks

|

Webinar Recording | Resource Funds - Analysing the Opportunities and Risks FundMonitors.com 27 June 2023 |

|

Resource funds can offer a unique avenue for capitalising on the growing demand for natural resources and the global shift towards sustainable energy and materials. In this webinar, we looked at the strategies and approaches employed by three successful resource fund managers and learn how they navigate the opportunities and risks associated with this asset class. Watch the recording of our manager round table webinar, where we were joined by Dan Porter from Pure Asset Management, David Franklyn from Argonaut Funds Management, and Matthew Langsford from Terra Capital. They shared their views on this interesting and diverse market sector. |

27 Jun 2023 - Banks, interest rates and opportunities in the finance sector

|

Banks, interest rates and opportunities in the finance sector Magellan Asset Management June 2023 |

|

Alan Pullen, Portfolio Manager, discussed the recent bank defaults, the impact of interest rates on banks in general and where he sees opportunities in the financial sector. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

13 Jun 2023 - Chat GPT and the implications of this new technology

|

Chat GPT and the implications of this new technology Magellan Asset Management May 2023 |

|

Magellan Investment Analyst, Adrian Lu explains what Chat GPT is, how it works and what impacts this could have on society. He also discusses what this means for Microsoft and Alphabet. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

6 Jun 2023 - ESG Policy: The real-world impacts

|

ESG Policy: The real-world impacts Magellan Asset Management May 2023 |

|

Elisa Di Marco, Portfolio Manager - MFG Core International and Core ESG Fund, discusses ESG-linked government policies, the real-world impacts of these policies and the importance of proxy voting |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

15 May 2023 - Webinar Recording 09 May 2023 | The Future for Small Caps

|

Webinar Recording | The Future for Small Caps FundMonitors.com 09 May 2023 |

|

Small cap stocks, both locally and globally, have under-performed large cap stocks in the past 12 months, as shown by the average performance of Australian small cap equity funds of -11.63%. However, their performance over the past 3 years was +17.42%, indicating the highly cyclical nature of the sector. Performance over the past six months has improved, leading many to wonder if markets have been over-sold and are now poised for recovery, or with the threat of prolonged inflation and the potential for a global recession, that small caps may be in for further pain. Watch the webinar recording for we asked a panel of three Small Cap Managers' opinions on the opportunities and the threats for the sector. |

15 May 2023 - Airlie Quarterly Update

|

Airlie Quarterly Update Airlie Funds Management April 2023 |

|

Emma Fisher, Portfolio Manager, provides her views on the current market environment and discusses her recent trip to Europe where she visited CSL and QBE Insurance, which are two holdings in the Airlie Australian Share Fund. Author: Emma Fisher, Portfolio Manager Funds operated by this manager: Important Information: Units in the fund(s) referred to herein are issued by Magellan Asset Management Limited (ABN 31 120 593 946, AFS Licence No. 304 301) trading as Airlie Funds Management ('Airlie') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to an Airlie financial product or service may be obtained by calling +61 2 9235 4760 or by visiting www.airliefundsmanagement.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of an Airlie financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Airlie makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Airlie. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any third party trademarks contained herein are the property of their respective owners and Airlie claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks.. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Airlie. |

8 May 2023 - Magellan Global Fund Update

|

Magellan Global Fund Update Magellan Asset Management April 2023 |

|

Global Portfolio Managers Nikki Thomas, and Arvid Streimann, discuss the unfolding interest rate cycle and the effect it's having on market sentiment and company valuations. They provide an update on the portfolio's recent performance and its positioning for the current environment. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

Online Applicatons

Free, simple and secure

Olivia123 - the fast simple and secure online alternative to completing paper based application forms.