Find a Fund

Peer Group Analysis View All»

| Index Selector Links | 1 Year | 3 Year | 5 Year |

|---|---|---|---|

4.76% |

6.29% |

7.07% |

|

6.13% |

3.25% |

2.47% |

|

12.10% |

16.86% |

54.56% |

|

10.12% |

5.08% |

4.57% |

|

8.01% |

4.81% |

7.71% |

|

10.95% |

7.64% |

9.03% |

|

13.35% |

5.51% |

6.14% |

|

8.52% |

7.36% |

9.02% |

|

15.53% |

10.73% |

11.36% |

|

10.65% |

4.44% |

9.53% |

|

16.11% |

8.08% |

9.88% |

|

13.65% |

7.27% |

5.55% |

|

9.07% |

5.13% |

6.77% |

|

8.78% |

7.47% |

6.82% |

|

3.05% |

-3.07% |

0.78% |

|

8.54% |

8.03% |

7.28% |

Hedge Clippings

28 Mar 2025 - Hedge Clippings | 28 March 2025

|

|

|

|

Hedge Clippings | 28 March 2025 All of a sudden, the phoney war is over and the real campaign has begun. Tuesday night's 2025-26 Federal Budget has been handed down, and as expected it turned into a classic pre-election cash splash. Prime Minister Anthony Albanese then made the trip to Government House first thing this morning to call the federal election for 3 May - a five-week sprint to polling day, punctuated by the Easter and Anzac Day break. While Treasurer Jim Chalmers insists his budget is about "building a better future," it's widely seen as a blatant vote-buying exercise, stuffed to the gills with cost-of-living sweeteners. After running two rare budget surpluses, Chalmers has now opened the purse strings: the deficit is expected to hit $27.6 billion this year and $42.1 billion next year. Fiscal purists may wince, but most punters will shrug - those are just mind-boggling numbers on paper, far removed from the average voter's hip pocket. And hip pockets, of course, are exactly where this budget aimed. Sure enough, Tuesday's budget rolled out a Santa's sack of energy rebates, rent assistance, cheaper GP visits and PBS medicines. In other words, the usual household budget pleasers. A last-minute surprise - $17 billion in income tax cuts - gave Labor a rare chance to campaign on tax relief and left the Coalition looking awkwardly flat-footed. Cue Peter Dutton's budget reply, which promised to outbid Labor with a halving of the fuel excise and a vow to repeal those very tax cuts. A strange role reversal for the Liberal Party, but we are in pre-election auction season, where handouts come first and policy coherence later - if ever. Talk of real reform (say, fixing the tax system) didn't even get a look in. Meanwhile, speculation is growing that Albanese may not remain Labor leader for long. Dutton didn't miss the chance to stir the pot, suggesting Jim Chalmers is circling. The Treasurer, who's been on a media blitz since Budget night, certainly isn't shying away from the spotlight. Whether he's positioning himself for a leadership change or just basking in the glow of a very political budget, the message is clear: he's ready, just in case. Markets, for their part, aren't overly fussed. Pre-election budgets tend to play well with voters but don't rattle investors - especially when both sides are throwing money around and avoiding anything too radical. Inflation could get a nudge, but the RBA likely stays on the sidelines for now. In short: more of the same. If all of this seems a bit familiar, that's because it is. Still, there's comfort in a local political drama that, for once, isn't dominated by overseas chaos. Enjoy it while it lasts - not only because next Tuesday is April Fools Day, but because Donald Trump is due to announce his next round of tariffs. News & Insights Manager Insights | Altor Capital on the Business of Sport The future of healthcare: Trump, policy and innovation | Magellan Asset Management Market Commentary | Glenmore Asset Management February 2025 Performance News Equitable Investors Dragonfly Fund Insync Global Quality Equity Fund Insync Global Capital Aware Fund DAFM Digital Income Fund (Digital Income Class) |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

4 Apr 2025 - Spurious Correlations

|

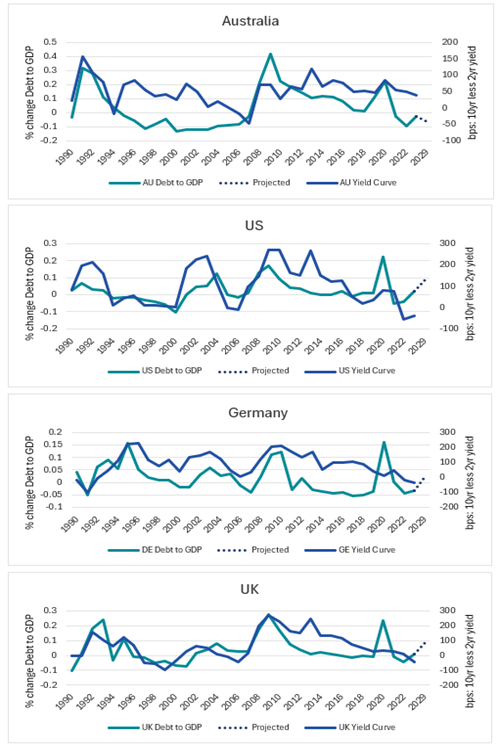

Spurious Correlations Yarra Capital Management March 2025 Debt size doesn't seem to matter!Major government borrowing events have typically been triggered by one-off crisis like the Global Financial Crisis (GFC) and COVID-19, not by interest rates. Before 2008, debt-to-GDP ratios were stable or even declining in many economies, suggesting governments borrow based on necessity, not borrowing costs. Looking at the US, Australia, Germany, and the UK (refer Chart 1), debt levels have risen, yet interest rates haven't followed suit. Germany, for instance, has kept debt-to-GDP in check, yet its bond yields have moved in line with other developed economies. Chart 1 - Debt-to-GDP vs. 10-year yields

|

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

3 Apr 2025 - Trumponomics: What tariffs could mean for small caps

|

Trumponomics: What tariffs could mean for small caps abrdn March 2025 The recent wave of tariffs imposed by President Trump, along with retaliatory measures from affected nations, has created a complex environment for businesses worldwide. While these trade disputes pose risks, they also present unique opportunities for certain US small-cap companies. At the core of Trump's tariff policies is the goal of protecting American industries and reducing trade deficits. Measures that will undoubtedly disrupt global supply chains, drive up the cost of imported goods, and create challenges for businesses reliant on foreign materials. They are expected to, however, incentivize domestic production, potentially benefitting small-cap companies that can step in to replace diminished imports. While not all firms will benefit, we believe companies with resilient business models, pricing power, and strong balance sheets will be best positioned to navigate these economic shifts. Reshoring and supply chain reconsiderationsOne of the primary ways tariffs could benefit small-cap companies is through the reshoring of manufacturing capacity. As tariffs make foreign goods more expensive, many US firms are adapting supply chain strategies to increase domestic sourcing and production. This shift presents new opportunities for smaller companies across a variety of sectors. For instance, reshoring projects will drive demand for local construction crews, concrete suppliers, and equipment rental firms. Regional banks will play a key role in financing these initiatives. Meanwhile, new semiconductor facilities will require specialised HVAC systems with nearby maintenance and repair services. By positioning themselves within these expanding domestic supply chains, small-cap companies stand to benefit from stronger revenue and earnings growth. Tariff-driven innovation and efficiencyAdditionally, tariffs have spurred innovation and efficiency improvements among small-cap companies. Many businesses are investing in automation, advanced manufacturing techniques, and other innovations to offset rising material costs to enhance productivity. These efforts help maintain margins and better position small-cap companies for long-term success. This is especially relevant for technology and industrial companies leveraging innovation to reduce dependence on foreign inputs and strengthen their competitive position. Reshaping the competitive landscapeCounter-tariffs imposed by other nations in response to Trump's policies have also played a role in shaping the competitive landscape. Countries like China have targeted US exports, impacting industries such as agriculture and automotive. While some small-cap exporters face headwinds, others have successfully pivoted to alternative markets. We believe companies that can adapt to shifting trade dynamics and diversify their customer base will be best positioned to thrive. The economic environment remains supportiveWhile we are mindful of the risks associated with recent policy actions, the broader economic environment remains supportive of high-quality small-cap stocks. Despite geopolitical uncertainty, GDP growth is expected to remain in positive territory. Also, many companies have already strengthened operations in response to past disruptions, such as the pandemic and volatility during Trump's first term. These efforts, such as diversifying supply chains and implementing efficiency initiatives, have better-positioned businesses to navigate potential tariffs and raw material inflation. Overall, the US economy is expected to continue expanding, albeit at a more modest pace. This environment allows resilient small-cap companies to capitalise on the new administration's 'America First' agenda while leveraging recent operational enhancements to mitigate near-term risks. ... Along with earnings growthAs we move through 2025, small-cap stocks are gaining attention for several reasons. Investors are increasingly looking to diversify, given the growing concentration of "Big Tech" in large-cap indices. The shift is timely, as small-cap companies are expected to deliver stronger earnings growth relative to their large-cap counterparts (Chart 1). This is an important development as small-cap growth rates have lagged large-caps for several years. Chart 1. Russell 2000 Index (RTY) vs. S&P 500 Index (SPX) positive EPS growth ... And attractive valuationsFurthermore, small-cap stocks are trading at attractive valuations, with their discount to large-caps near historic lows (Chart 2). Chart 2. Small cap relative to large cap forward price/earnings (PE) ratio While multiple factors have contributed to this valuation gap, earnings growth differentials have been key drivers. As small-cap earnings accelerate, this discount should begin to narrow, presenting a compelling opportunity for investors. Final thoughts...Trump's latest tariffs and the retaliatory measures from affected nations are reshaping the competitive landscape for US small-cap companies. While risks remain, the push towards domestic production, supply chain diversification, and innovation can drive earnings growth for many firms over the long term. Coupled with resilient economic conditions and historically attractive valuations, high-quality small-cap stocks present a strong investment opportunity for those looking to capitalise on evolving trade dynamics. |

|

Funds operated by this manager: abrdn Sustainable Asian Opportunities Fund, abrdn Emerging Opportunities Fund, abrdn Global Corporate Bond Fund (Class A), abrdn International Equity Fund, abrdn Multi-Asset Income Fund, abrdn Multi-Asset Real Return Fund, abrdn Sustainable International Equities Fund |

2 Apr 2025 - Making sense of the banking sector

|

Making sense of the banking sector Airlie Funds Management March 2025 |

|

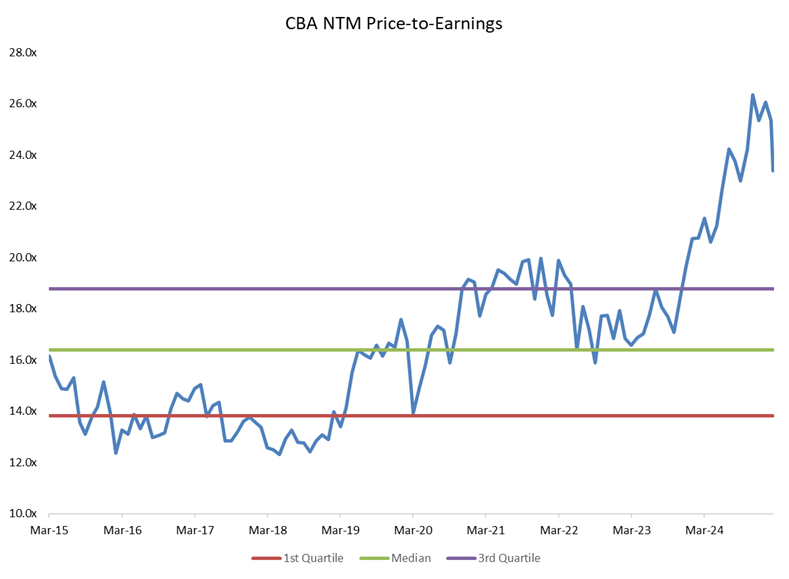

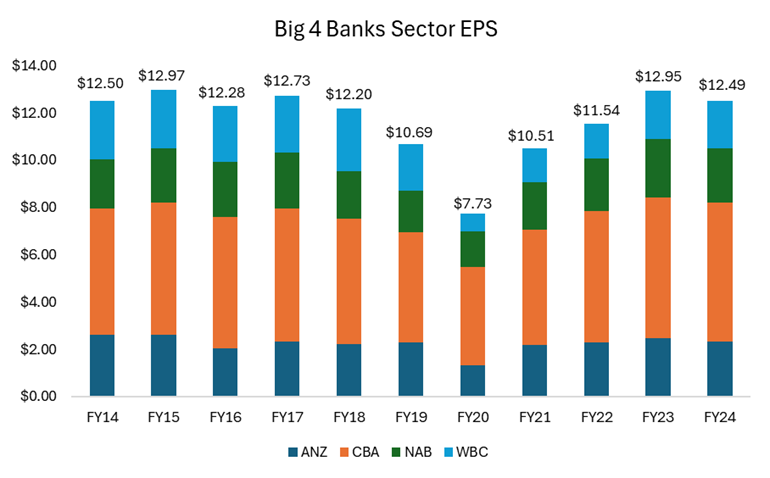

How long will the extraordinary rally continue? The banking sector enjoyed an extraordinary rally in 2024, with the Big Four Banks delivering an average TSR of 33%. As recently as February, Commonwealth Bank (CBA), for instance, enjoyed a price to earnings multiple of 26x- a 60% premium to its historical average. This raises an important question: are these valuations justified for a sector that has not grown its overall earnings per share over the last 10 years?

To look at this in another way, you can see in the chart below that the collective earnings of the Big Four are only today back to where they were in 2018. Yet if we add up the cumulative share prices of the banks, you're paying $233 in total for all four banks versus $157 in 2018 for the same level of earnings. And this is after the recent share price rout; at the banks' peak in February, you would have paid a cumulative $276 for these earnings.

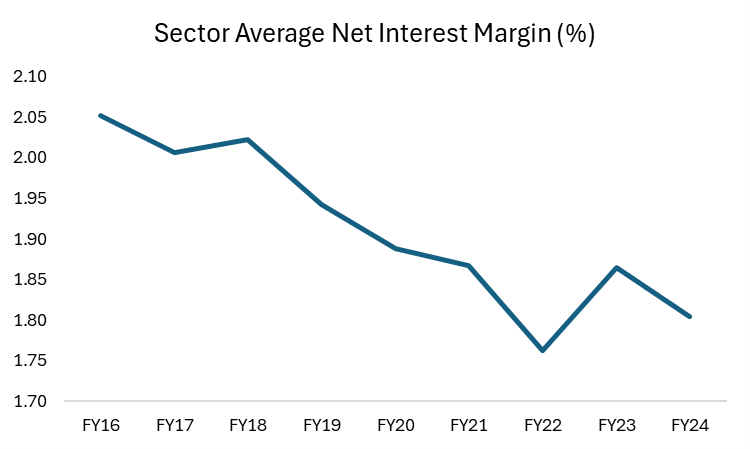

Are banks really making more money? The net interest margin storyAt its core, banking profitability hinges largely on a single key metric: Net Interest Margin (NIM). This is the difference between what a bank earns on loans and what it pays on deposits. The higher the margin, the more profitable the bank. However, over the past few decades, this margin has been steadily shrinking. This decline has been driven by three key structural changes in the industry:

Over the past decade, the share of mortgage broker-originated loans has surged from ~50% to 75%, significantly squeezing bank margins. Banks pay the broker a large upfront commission of ~0.65% of the loan value ($6.5k for every $1m lent) and a trailing commission of 0.15% per year. Moreover, because brokers focus on securing the lowest possible rate for customers, mortgages have become increasingly price-driven, reducing banks' ability to charge more favourable rates. Since brokers earn their largest commission when writing a new loan, they have an incentive to refinance customers regularly, which further erodes bank margins. The Commonwealth Bank estimates that the broker channel is 20-30% less profitable than a loan originated through a bank's proprietary channel.

Over the last decade, Macquarie Group has entered the banking sector, employing a digital, broker-led model where it can operate a lean model without the tech debt and branch costs of its traditional competitors. The company has successfully grown its share to ~5% and its ease of use has made it popular with brokers. Unlike the major banks, Macquarie doesn't need to maintain a constant presence in the mortgage market. It has entered when risk and pricing are attractive and exited when margins tighten, making it a highly agile competitor. This dynamic prevents periods of excess profitability for the Big Four, as Macquarie re-enters the market whenever rates become too favourable for banks.

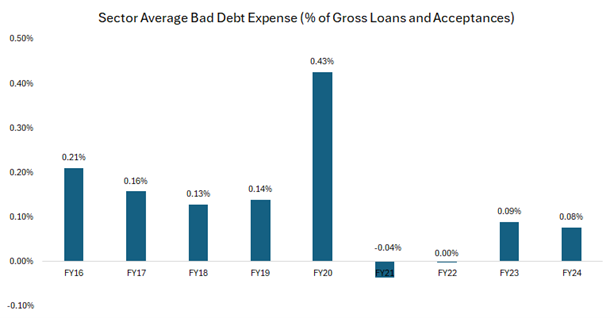

In the past, banks operated in higher-margin businesses such as wealth management and insurance. While these divisions may have distracted them from mortgage competition, they also provided additional profitability. With banks now exiting these areas, mortgage lending has become their primary battleground, intensifying competition and further pressuring margins. Bad debts are low but can this last?One of the biggest risks for any bank is loan defaults, which result in bad debt expenses; that is, the losses banks take when borrowers can't repay their loans. Historically, Australian banks have averaged bad debt expenses of ~0.15% to 0.20% of gross loans and acceptances. In FY24, this figure was just 0.08% - about half the long-term average. While this looks like a positive for bank earnings, the key question is: is this sustainable? Why are bad debts so low right now? There are three key reasons bad debt expenses remain unusually low:

The real risk: Are banks underestimating future loan losses? While bad debts are currently low, history suggests this won't last forever. Since current bank earnings are inflated by unusually low bad debt expenses, it's reasonable to assume:

Bottom line? The current low levels of bad debts make bank earnings look better than they likely are in the long run, suggesting investors should be cautious about assuming today's profits are sustainable. To pick on ANZ as an example - and we chose ANZ because it has the lowest level of provisioning for bad debts - if the bad debts expense were to normalise to ~0.20% of gross loans and acceptances (the pre-covid FY16-19 average) from 0.05% in FY24, its EPS would have been ~13% lower.

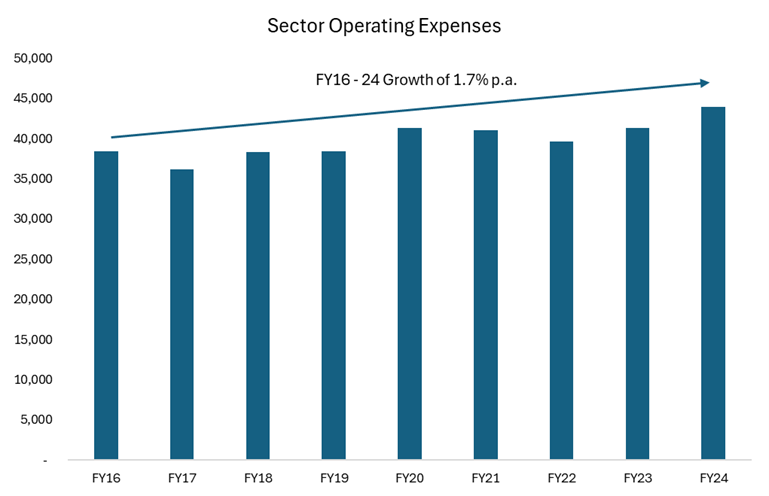

ExpensesOne area where banks could justify a higher valuation is through improved efficiency. However, the track record here is mixed. While banks have closed physical branches and pushed digital banking, these savings have been offset by rising IT spending, cybersecurity costs and regulatory compliance. Additionally, employee expenses account for ~70% of a bank's cost base and wage pressures remain high. The net result? Banking cost bases have proven resilient, making it difficult for them to structurally improve profitability through expense reduction. Since FY16, bank expenses have grown at ~1.7% p.a. compared to income growth of just 0.9% p.a.

This means that despite cost-cutting efforts, banks struggle to convert these savings into higher profits because any efficiency gains are competed away in lower prices for customers. As a result, cost-cutting alone is unlikely to drive meaningful margin expansion at the sector level.

|

1 Apr 2025 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

||||||||||||||||||||||

| Ophir Global High Conviction Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

||||||||||||||||||||||

| Datt Capital Small Companies Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

||||||||||||||||||||||

| Atlas Australian Equity Income Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

||||||||||||||||||||||

| Ziller Asset Management Founders Global Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

Want to see more funds? |

||||||||||||||||||||||

|

Subscribe for full access to these funds and over 900 others |

31 Mar 2025 - Manager Insights | Altor Capital on the Business of Sport

|

Chris Gosselin, CEO of FundMonitors.com, speaks with Benjamin Harrison, Chief Investment Officer at Altor Capital. Ben discussed the growing investment opportunities within the global sports industry, highlighting its diverse revenue streams and Altor's strategic focus on both team ownership and related support sectors. The conversation underscored the potential for meaningful investor involvement beyond just elite-level teams, particularly within Australia's mid-market sports landscape.

Disclaimer This video presentation (the "Content") has been prepared by Australian Fund Monitors Pty Ltd, "AFM" (AFSL 324476) and has been prepared without taking into account the investment objectives of the viewer or recipient. The Content is intended for information purposes only, and recipients should conduct full research and take appropriate advice prior to making any investment decisions. The Content is believed to be accurate at the time of publication, but past performance is not guaranteed. Copyright, Australian Fund Monitors Pty Ltd. October 2024. |

28 Mar 2025 - Performance Report: ASCF High Yield Fund

[Current Manager Report if available]

28 Mar 2025 - DeepSeek is much more than the Sputnik Moment

|

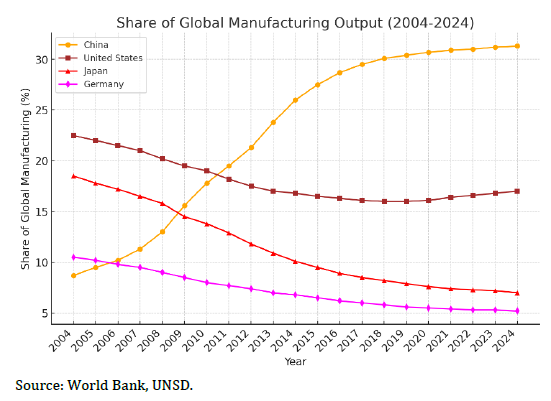

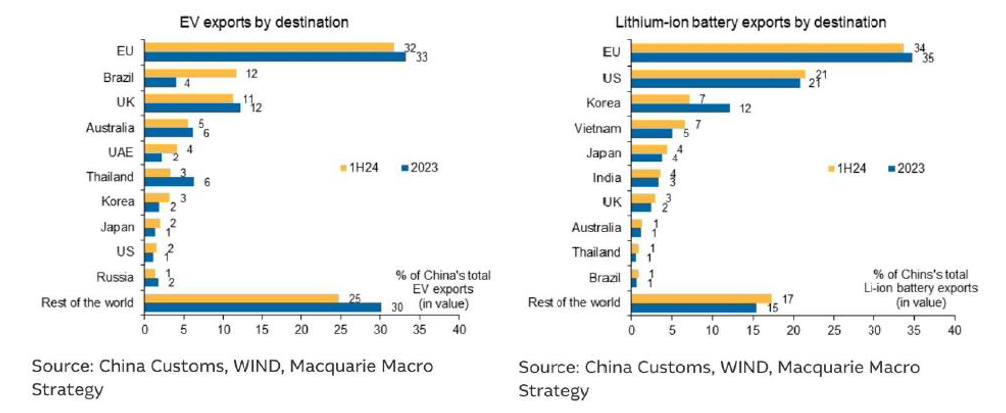

DeepSeek is much more than the Sputnik Moment Ox Capital (Fidante Partners) February 2025 The introduction of DeepSeek into the market exemplifies the technological advancements that Chinese companies have achieved in recent years. Through company visits and discussions with local experts, we are seeing significant technological advancements in China. These developments are partly driven by necessity, in response to increasing restrictions from its global competitor, the United States. In addition to DeepSeek, platforms like TikTok and Temu have grown on Western consumers. They are leapfrogging the traditional internet platforms and driving convergence in social and e-commerce. Beyond these visible changes, there are numerous technological advancements that may not be immediately apparent to consumers. These include developments in robotics, electric vehicles, batteries, renewable energy such as solar and wind, and nuclear energy. The large domestic market, availability of low-cost and skilled engineers, access to capital, and affordable infrastructure have contributed to China's significant share in global manufacturing. China accounts for about ~33% of global manufacturing capacity, exceeding that of G7 countries combined. This percentage is expected to grow as Chinese companies make progress in new (and higher value) industries. Consequently, the economy can produce a wide range of products at very low cost at scale, except for high-end semiconductors (at present).

With its huge, educated work force, ample spare capacity, and large domestic market, entrepreneurs are afforded a runway to build great businesses. For instance, a hedge fund manager has managed to innovate and develop DeepSeek, a cost-effective AI solution. Similarly, several Chinese companies are poised to become significant players in robotics and are likely to be major suppliers of robotics components globally. Robotics may be the next high tech success story in China, following the footsteps of the domestic EV makers. The challenging transition in China was due to a realization by domestic authorities that the ever-expanding construction sector would eventually lead to negative consequences for the economy. Therefore, a shift towards quality and sophisticated products was deemed necessary. This transition is nearly complete, and the benefits of these efforts are expected to emerge as these new growth sectors begin to offset the decline in traditional industries such as property construction, which has experienced a significant reduction of approximately 70% from its peak. The re-orientation towards quality has resulted in local players gaining market share in almost all industrial and technological sectors domestically. This trend may extend to the rest of the world, depending on trade dynamics in the coming years. The cost and quality advantages of Chinese cars, batteries, robots, and AI are expected to be highly appealing globally. While some countries may choose to block BYD or DeepSeek, they will be stuck with gas guzzlers and expensive AI models while the rest of the world get to benefit from having stronger ties with China and its companies! At Ox Capital, we own a number of innovative businesses in China that we believe will become global champions. We firmly believe we own companies that are going to disrupt industries rather than those that will be disrupted. Given the negativity that is still prevalent on Chinese (particularly in Hong Kong) shares, the plethora of opportunities is too good to ignore!  Funds operated by this manager: Ox Capital Dynamic Emerging Markets Fund Important Information: This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person's objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriaten |

27 Mar 2025 - Performance Report: TAMIM Fund: Global High Conviction Unit Class

[Current Manager Report if available]

27 Mar 2025 - Tim Hext: Three key takeaways from Australia's latest national accounts data

|

Tim Hext: Three key takeaways from Australia's latest national accounts data Pendal March 2025 |

|

IT'S been five years this week since the Covid chaos emerged. Aftershocks have kept rolling in since then. But is the Australian economy finally starting to look more "normal"? The latest set of Australian national accounts (see below) shows Gross Domestic Product growth at 0.6% for the December quarter, suggesting that conditions may, indeed, be moving closer to normal. Why is that? Below are three takeaways from the latest data.

The consumer is finally emerging, albeit tentatively, as a positive impact on the economy. Household consumption grew by 0.4%, contributing 0.2% to the 0.6% overall GDP growth. The contribution had been near zero over the previous year. Consumers finally had positive real wages growth in 2024 (3.2% wage growth versus 2.5% inflation). Consumers also spent some of the Stage 3 tax cuts since July. We estimate that around 25% was spent and 75% saved, helping the savings rate to climb to 3.8% from below 3% a year ago.

Government consumption grew by 0.7% in Q4, driven largely by the states. This is at least moderating from near 1.5% growth a quarter earlier. Government investment also moderated but remains high at 1.8% over the quarter. Overall, the public sector contributed 0.2% to the 0.6% growth. The government needs to keep moderating spending and investment if the re-emerging consumer is to avoid causing inflationary pressures. In many areas of the economy, the private and public sectors compete for supply of labour, capital and goods.

Private investment rose only by 0.3% in the quarter. Business investment is showing some signs of life, but dwelling investment is falling -- not helped by high rates. There are, as always, different stories in different sectors. But the overall picture is productivity continuing to flat-line. GDP per hour worked fell again and is 1.2% lower over the year. The focus on Australia's poor productivity is becoming a bigger issue. Everyone has their reasons for it and different lobby groups will shift blame, promoting their own solutions (which normally involve government hand-outs). However, I did come across the graph below courtesy of Minack Advisors.

Put simply, as our capital-to-labour ratio has fallen, so has labour productivity. Net investment to GDP is around the lows of the past 50 years against labour force growth at the highs (courtesy of immigration and participation). Overall, the latest today's national accounts report offers some hope of GDP moving back to the 2% to 2.5% the RBA is looking for. However, unless we can start improving productivity, we will be running to stand still. Author: Tim Hext |

|

Funds operated by this manager: Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Multi-Asset Target Return Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Pendal Sustainable Australian Share Fund, Regnan Credit Impact Trust Fund, Regnan Global Equity Impact Solutions Fund - Class R |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

26 Mar 2025 - Performance Report: DAFM Digital Income Fund (Digital Income Class)

[Current Manager Report if available]

31 Mar 2025 - Manager Insights | Altor Capital on the Business of Sport

|

Chris Gosselin, CEO of FundMonitors.com, speaks with Benjamin Harrison, Chief Investment Officer at Altor Capital. Ben discussed the growing investment opportunities within the global sports industry, highlighting its diverse revenue streams and Altor's strategic focus on both team ownership and related support sectors. The conversation underscored the potential for meaningful investor involvement beyond just elite-level teams, particularly within Australia's mid-market sports landscape.

Disclaimer This video presentation (the "Content") has been prepared by Australian Fund Monitors Pty Ltd, "AFM" (AFSL 324476) and has been prepared without taking into account the investment objectives of the viewer or recipient. The Content is intended for information purposes only, and recipients should conduct full research and take appropriate advice prior to making any investment decisions. The Content is believed to be accurate at the time of publication, but past performance is not guaranteed. Copyright, Australian Fund Monitors Pty Ltd. October 2024. |

25 Mar 2025 - Manager Insights | Insync Fund Managers

|

Chris Gosselin, CEO of Australian Fund Monitors, speaks with Monik Kotecha Chief Investment Officer at Insync Fund Managers. Insync Fund Managers operate two funds, the Insync Global Capital Aware Fund (hedged) and the Insync Global Quality Equity Fund (unhedged). The two funds have the same strategy, the only difference being that one is hedged and the other is unhedged. The Insync Global Capital Aware Fund has a track record of 15 years and 5 months and has underperformed the All Countries World (AUD) benchmark since inception in October 2009, providing investors with an annualised return of 11.16% compared with the benchmark's return of 11.99% over the same period. At the same time, the Insync Global Quality Equity Fund has a track record of 15 years and 5 months and has outperformed the All Countries World (AUD) benchmark since inception in October 2009, providing investors with an annualised return of 13.06% compared with the benchmark's return of 11.99% over the same period.

|

24 Mar 2025 - Manager Insights | Seed Funds Management

|

Chris Gosselin, CEO of Australian Fund Monitors, speaks to Nicholas Chaplin, Director and Portfolio Manager at Seed Funds Management. The Seed Funds Management Hybrid Income Fund has a track record of 9 years and 5 months and has outperformed the Solactive Australian Hybrid Securities (Net) benchmark since inception in October 2015, providing investors with an annualised return of 6.46% compared with the benchmark's return of 4.83% over the same period.

|

7 Mar 2025 - Manager Insights | East Coast Capital Management

|

Chris Gosselin, CEO of FundMonitors.com, speaks with Richard Brennan, Strategy Ambassador at East Coast Capital Management. East Coast Capital Management's trend-following futures strategy has delivered strong risk-adjusted returns by dynamically adapting to market trends across currencies, commodities, and futures. In this discussion, they explore recent market volatility, key investment trends, and the role of trend-following in portfolio diversification. The ECCM Systematic Trend Fund has a track record of 5 years and 1 month and has outperformed the SG Trend benchmark since inception in January 2020, providing investors with an annualised return of 16.49% compared with the benchmark's return of 7.64% over the same period.

|

24 Feb 2025 - Magellan Global Quarterly Update

|

Magellan Global Quarterly Update Magellan Asset Management January 2025 |

|

Arvid Streimann explores significant market trends and explains how the global strategy is set to take advantage of new opportunities while keeping an eye on potential risks. Arvid also talks about the recent adjustment to the portfolio's maximum cash level and comments on the market impact following Trump's election. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Core Infrastructure Fund, Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged) Important Information: Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Any third party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

14 Feb 2025 - AI Shake-Up: DeepSeek's Shocking Impact on Nvidia & Big Tech

|

AI Shake-Up: DeepSeek's Shocking Impact on Nvidia & Big Tech Marcus Today January 2025 |

|

More downloads than ChatGPT, Nvidia down 17%, and big questions about the future of AI. But was this just a market overreaction or a real turning point? Meanwhile, the Fed, inflation, and another week of Trump's 'Revolution of Common Sense' continue shaping global markets. From AI disruption to tariffs, rate cuts, and shifting investor sentiment--where does it all lead? Markets react, but the bigger picture is still unfolding. |

|

Funds operated by this manager: |

5 Feb 2025 - Responsible AI use in corporates with Jessica Cairns

|

Responsible AI use in corporates with Jessica Cairns Alphinity Investment Management January 2025 |

|

Jessica Cairns joins the Greener Way Podcast with Rose Mary Petrass to discuss the RAI Framework. With the rapid adoption of artificial intelligence, companies are facing growing pressure to ensure their AI practices are ethical, transparent, and aligned with environmental, social, and governance (ESG) principles. |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Global Sustainable Equity Fund, Alphinity Sustainable Share Fund This material has been prepared by Alphinity Investment Management ABN 12 140 833 709 AFSL 356 895 (Alphinity). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon. Past performance is not a reliable indicator of future performance. Neither any particular rate of return nor capital invested are guaranteed. |

3 Feb 2025 - Trump's TikTok Intervention

|

Trump's TikTok Intervention Magellan Asset Management January 2025 |

|

TikTok, one of the largest social media platform in the US along with Meta's Facebook and Instagram, has faced ongoing uncertainty regarding its existence in the US due to national security concerns under Chinese ownership. President Trump intervened in the Supreme Court's decision to ban TikTok in the US. Investment Director, Elisa Di Marco chats with Investment Analyst, Claire Britton reflecting on the implications of this intervention, the potential sale of TikTok, and its impact on the social media landscape, particularly for Meta. They discuss how Meta stands to benefit from the increased likelihood of a sale and the potential shifts potential shifts in user engagement and market dynamics.

|

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Core Infrastructure Fund, Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged) Important Information: Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Any third party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

29 Jan 2025 - Airlie Australian Share Fund Quarterly Update

|

Airlie Australian Share Fund Quarterly Update Airlie Funds Management December 2024 |

|

Emma Fisher discusses key drivers and insights from the recent quarter and how the portfolio was positioned to navigate the market. Emma also highlights the best performers for the fund and outlines opportunities the team continues to monitor as we move into 2025. Funds operated by this manager: Airlie Australian Share Fund, Airlie Small Companies Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 trading as Airlie Funds Management ('Airlie') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to an Airlie financial product or service may be obtained by calling +61 2 9235 4760 or by visiting www.airliefundsmanagement.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of an Airlie financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Airlie makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Airlie. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Airlie will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Any third party trademarks contained herein are the property of their respective owners and Airlie claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Airlie. |

9 Dec 2024 - How Trump will impact equity markets

|

How Trump will impact equity markets Magellan Asset Management November 2024 |

|

The United States has spoken. President Trump will return to the White House in the new year. But how can we cut through the noise to reveal the investment, economic and geopolitical ramifications? Magellan's Head of Global Equities and Portfolio Manager, Arvid Streimann, has over 25 years' experience of following markets and politics, and over this time has built up a network of trusted contacts, he can offer a measured, independent view of the situation, including his expectations on Donald Trump's policy initiatives and decision making. He's joined by Investment Director Elisa Di Marco for an exploration of the implications of a Republican clean sweep, including the impact on standards of living and consumer sentiment, as well as the potential for deregulation, and President Trump's promise to adopt protectionist policies in an effort to develop self-sufficiency. They share insights into geopolitical dynamics, including U.S.-China relations, Iran and Ukraine, and discuss the risks and opportunities for investors. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Core Infrastructure Fund, Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged) Important Information: Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Any third party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

Online Applicatons

Free, simple and secure

Olivia123 - the fast simple and secure online alternative to completing paper based application forms.