| Fund Type: | Single | Discretionary/Quantitative: |

Discretionary |

| Strategy: | Equity Long | FUM (millions): | AU$50.4m |

| Style: | Growth | Fund Inception Date: | Since 01 August 2018 |

| Geographic Mandate: | Global | Latest Return Date: | February 2025 |

| Fund Domicile: | Australia | Investor Type: | Wholesale & Retail |

| Status: | Open | Reporting Status: | Pending |

| Manager: | Nikko Asset Management Australia | Total FUM for all funds: | US$10,995m |

|

Manager Overview:

Nikko AM Australia offers investors the benefits of extensive global resources combined with the local expertise and long-standing experience of our Sydney based investment teams, with a history dating back to 1987. The company manages assets for retail and institutional clients across Australia.

Nikko AM Australia is owned by Tokyo-based Nikko Asset Management Co., Ltd., one of Asia's largest asset managers, providing high-conviction, active fund management across a range of Equity, Fixed Income and Multi-Asset strategies. Established in 1959, Nikko Asset Management has offices across 11 countries and enjoys one of the largest distributor networks in the Asian region, serving both retail and institutional clients. The firm's extensive footprint across the Asia-Pacific region includes local offices in Tokyo, Singapore, Hong Kong, Sydney, Melbourne and Auckland, and provides an extraordinary depth of expertise in the local issues that drive investment performance globally. In addition, they gain valuable insights from affiliates in China, India and Malaysia. Offices in New York and London provide support to investors in the US, Europe and the Middle East, as well as expertise in global markets. Nikko Asset Management Australia offers investors the benefits of a large organisational infrastructure with extensive global resources, combined with the local expertise and experience of Australian investment managers based in Sydney. |

Fund/Strategy Overview:

The Nikko AM ARK Global Disruptive Innovation Fund gains exposure to global equities that are relevant to the investment theme of disruptive innovation by investing in the Nikko AM ARK Disruptive Innovation Fund (Underlying Fund), a sub-fund of the Nikko AM Global Umbrella Fund. The Underlying Fund is an open-ended investment company (Company) established under Luxembourg law as a 'societe d'investissement a capital variable' (SICAV). ARK Investment Management LLC (ARK), a strategic partner of the Nikko AM Group is the sub-advisor for this strategy.

ARK believes that innovation is key to growth. ARK seeks to capture long-term outperformance and capital appreciation created by disruptive innovation. ARK believes disruptive innovation is key to long-term growth of company revenues and profits. ARK aim to identify large-scale investment opportunities resulting from technological innovations such as robotics, big data, machine learning, blockchain technology, cloud computing, energy storage and DNA sequencing. |

||

| Other funds operated by manager: | |||

| Nikko AM Global Share Fund | |||

| Minimum Investment: | Minimum Additional Investment: | Minimum Term: | Investment Frequency: |

| AU$10,000 | AU$1,000 | Daily | |

| Regular Savings Option: | Regular Savings Min. Amount : |

Regular Savings Max. Amount : |

Regular Savings Freq.: |

| Yes | AU$250 | Monthly | |

| Redemption Notice: | Redemption Frequency: | Notes: | |

| 1 Days | Daily |

||

| Distributions: | Distribution Frequency: | Last Distribution Date: | Last Distribution Amount: |

| No | n/a | n/a | n/a |

| Offshore/Onshore: | Fund Structure: | Share Classes: |

Trustee/Responsible Entity: |

| Onshore | Unit Trust | AU$ | Nikko Asset Management Australia Limited |

| Administrator: | Prime Broker: | Custodian: | Legal: |

| BNP Paribas Securities Services | N/A | BNP Paribas Securities Services | Internal & External Legal Panel |

| Management Fee: |

Performance Fee: |

High Water Mark: |

Hurdle: |

| 1.3% | 0% | N/A | N/A |

| Buy Spread: | Sell spread: | Early Redemption Fee: | Fees Notes: |

| 0.200% | 0.200% | No |

| Latest Return Date: | Latest Result: | Fund Inception Date: | Annualised Return: |

| February 2025 | -9.18% | 01 August 2018 | 5.24% |

| Latest 3 Months: | Latest 6 Months: | Latest 12 Months: | Latest 2 Years p.a.: |

| 3.05% | 38.65% | 22.08% | 27.73% |

| Latest 3 Years p.a.: |

Latest 4 Years p.a.: |

Latest 5 Years p.a.: |

Latest 7 Years p.a.: |

| 0.59% | -12.46% | 3.29% | N/A |

| % Positive Months (S.I.): |

Average Return: | Average +ve Return: | Average -ve Return: |

| 53.16% | 0.94% | 8.82% | -8.02% |

| Best Month: | Worst Month: | Up Capture Ratio (S.I.): |

Down Capture Ratio (S.I.): |

| 25.54% | -22.65% | 282.22% | 168.58% |

| Largest Drawdown (S.I.): |

Longest Drawdown (S.I.): |

Current Drawdown (%): |

Current Drawdown (Months): |

| -73.55% | 49 months | -45.10% | 49 months |

| Annualised Standard Deviation (S.I.): |

Downside Deviation (S.I.): |

Sortino Ratio (S.I.): |

- |

| 35.29% | 22.06% | 0.15 | - |

| Sharpe Ratio (12 months): |

Sharpe Ratio (3 years): |

Sharpe Ratio (5 years): |

Sharpe Ratio (S.I.): |

| 0.65 | 0.12 | 0.22 | 0.27 |

| Please note, Sharpe and Sortino ratios are calculated using the Australian Risk Free Rate | |||

AFM's Quintile Rankings show performance and Key Performance Indicators (KPI's) of Nikko AM ARK Global Disruptive Innovation Fund compared to a peer group of funds with a similar strategy and geographic mandate. Each green square places a fund in one quintile (or 20%) of its peer group - five indicating that the fund is in the top (best) quintile for the corresponding KPI.

As a reference point the equivalent "quintile" performance of the peer group's underlying market index is also indicated by the red dot.

| Lonsec: | Investment Grade, February 2020 |

| SQM: | Superior: 4 stars, January 2020 |

|

Did DeepSeek cause an AI paradigm shift? Nikko Asset Management February 2025 DeepSeek: an AI industry upstartNot too long ago, the term artificial intelligence (AI) was found only in the realm of science fiction novels. It was featured prominently in works such as Phillip K. Dick's "Do Androids Dream of Electric Sheep?" which the cult movie classic "Blade Runner" was based on, and Isaac Asimov's "I, Robot", which also inspired a movie of the same name. Fast forward to today, and the term has since become synonymous with all things digital. It encompasses everything from the smart robot vacuum cleaner assiduously hoovering up all the dirt on your home floor, to the virtual assistant on your smartphone answering all the queries you throw at it. Looking at the multibillion-dollar industry that has coalesced to allow these applications to proliferate in all aspects of daily life, we would assume that massive capital expenditure and time are needed to develop infrastructure and train AI programmes. However, a small, independent research laboratory based in Hangzhou, China, appears to be challenging this conventional wisdom. Founded by entrepreneur Liang Wenfeng, the AI startup's DeepSeek chatbot has roiled the tech world. DeepSeek has performed nearly as well, if not better, than AI models from Microsoft-backed OpenAI's ChatGPT, Meta's Llama and Amazon-backed Anthropic's Claude. What is truly surprising, however, is that the company claimed to have spent less than US dollar (USD) 6 million to build its AI model--approximately ten times less than the amount Meta spent on its product--and achieved this feat in just two short months. Conventional wisdom dictates that companies use Nvidia's expensive, cutting edge H200 or B200 graphical processing units (GPUs) to train their AI models for optimal results. Prevailing sanctions prohibit US companies from selling advanced computer chips to mainland China; however, the programmers of DeepSeek were apparently able to produce results with the older H800 GPUs by wringing out every last bit of performance from them. The revelation shocked the tech industry and sparked a selloff in the shares of semiconductor firms including Nvidia, Broadcom and Micron. In our view, these developments could lead to changes in the way AI models are trained, particularly from a cost and efficiency perspective. DeepSeek's innovation in the field has established that the "mixture of experts" 1 (MoE) approach, which requires less computing power and time, coupled with the "reward system" 2 are as effective as the more resource-intensive chain-of-thought 3 reasoning approach. Falling costs will mean lower barriers to entry, allowing more companies to partake in AI development and grow the ecosystem at a more rapid pace. Additionally, open source AI models, like DeepSeek's, which make the programme's source code available for public use and modification, have now been proven to perform just as well, if not better, to proprietary models from Big Tech. We believe the trend towards using open source inference models with narrower parameters will persist. As a result, we expect to see broader adoption and implementation of AI applications across both corporate and government sectors in the days ahead. We had previously touched on the subject of AI models improving in terms of efficiency and cost-effectiveness in our article A Fundamental Change for AI? Although semiconductor firms such as Nvidia were sold down on fears that their chips might face lower demand, we believe it would be premature to write them off. DeepSeek's AI model training is still based on Nvidia's GPUs and their CUDA software, albeit on older hardware. Hence, we still expect healthy demand for such chips as the training of AI models continues to intensify. China's underrated tech sectorFrom our perspective, the markets may have been discounting China's tech sector, represented by Baidu, Alibaba and Tencent (BAT), in comparison to the broader US industry represented by Facebook, Amazon, Apple, Netflix and Google (FAANG). It is only recently that the markets have started to recognise the potential value of Chinese tech startups, like DeepSeek, which have the prowess to compete on the global stage. Valuation-wise, we have observed that US FAANG firms are approximately twice as expensive as their BAT Chinese counterparts. Chart 1: BAT stocks at a significant discount compared to FAANG stocks

Source: Goldman Sachs, February 2025 Meanwhile, competition within China's domestic market is already intensifying as AI models from Chinese firms such as Baidu, Zhipu and Bytedance's Doubao are being launched. Tech giant Alibaba is even claiming that its Qwen 2.5 version AI model is superior to DeepSeek's V3 AI model. We expect these developments to eventually enable users to switch models in their applications at a low cost. As a case in point, we are now seeing international firms like Perplexity, a San Francisco-based developer of a conversational search engine, incorporate and offer DeepSeek's AI models on their platforms. These events are in line with what we had discussed in the Asian equity outlook 2025, where we explored the implications of generative AI transitioning to the next level of development following massive capital expenditure. Roadblocks to further AI adoptionA major obstacle standing in the way of broader AI usage in light of DeepSeek's claimed breakthrough is the escalation of US-China geopolitical tensions. A technological arms race between the world's two largest economies will certainly hinder any progress in building an ecosystem that would propel AI applications to the forefront of worldwide adoption. There are already news reports that US officials are investigating how DeepSeek was able to procure Nvidia-made AI chips in spite of the ban, and US government workers are prohibited from using the application due to national security concerns. Should the US further tighten export controls to stem the flow of AI chips and technology to China, we believe that it would affect the speed of future AI model training there as domestic supply is currently unable to make up the shortfall. We therefore believe that chip independence should remain a priority for China in order for the country to continue its advancements in the AI field. Data privacy is another significant concern. The integration of AI into all aspects of the internet makes it even more challenging to regulate the personal information we allow to be collected online, given the data-intensive nature of such systems. Then, there is the issue of AI "hallucinations" where generative AI chatbots produce misleading or entirely wrong information due to incorrect or skewed data that the AI model is trained on. This problem reflects an old adage from Computer Science 101: "garbage in, garbage out". However, as AI technology matures, this risk is decreasing as improved data, better architecture, reinforced learning and guardrail filters improve the user experience. Finally, there is the million-dollar question of how AI can be monetised to help enterprises address business pain points. We believe that companies engaged in content production, autonomous driving, robotics and industry-specific SaaS stand to benefit the most from the greater adoption of AI models. Beyond the monetisation question, AI-enhanced efficiency in areas such as automation, robotics, inventory management, cyber security and targeted advertising are significant benefits that no CEOs of large corporations can afford to ignore. In our view, the fields highlighted here have the most potential for robust, sustainable returns. Full steam ahead for AIThe speed at which AI applications are becoming part and parcel of daily life is breathtaking, with DeepSeek's apparent breakthrough merely accelerating an inevitable, fundamental change in the field. We firmly believe these breakthroughs are the key components needed for sustainable, long-term returns. We also are firm believers in the Jevons Paradox, an economic theory that suggests that as technological advancements increase the efficiency with which a resource is used, the overall consumption of that resource actually increases rather than decreases. We have seen this with improvements in fuel efficiency resulting in more people driving, in turn increasing total global fuel consumption. A similar phenomenon was seen during the Industrial Revolution as an improvement in the efficiency of steam engines did not reduce coal consumption but led to a boom in coal demand. We believe that the AI industry is highly likely to follow a similar pattern, leading to even greater long-term demand for AI-related applications. Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way. 1 A machine learning approach that divides an AI model into separate sub-networks (or "experts"). 2 A method in which AI algorithms are trained to make decisions by being rewarded or punished for their actions. 3 An approach allowing models to break down complex problems into simpler steps that can be solved individually. Funds operated by this manager: Nikko AM ARK Global Disruptive Innovation Fund, Nikko AM Global Share Fund Important disclaimer information Please note that much of the content which appears on this page is intended for the use of professional investors only. |

|

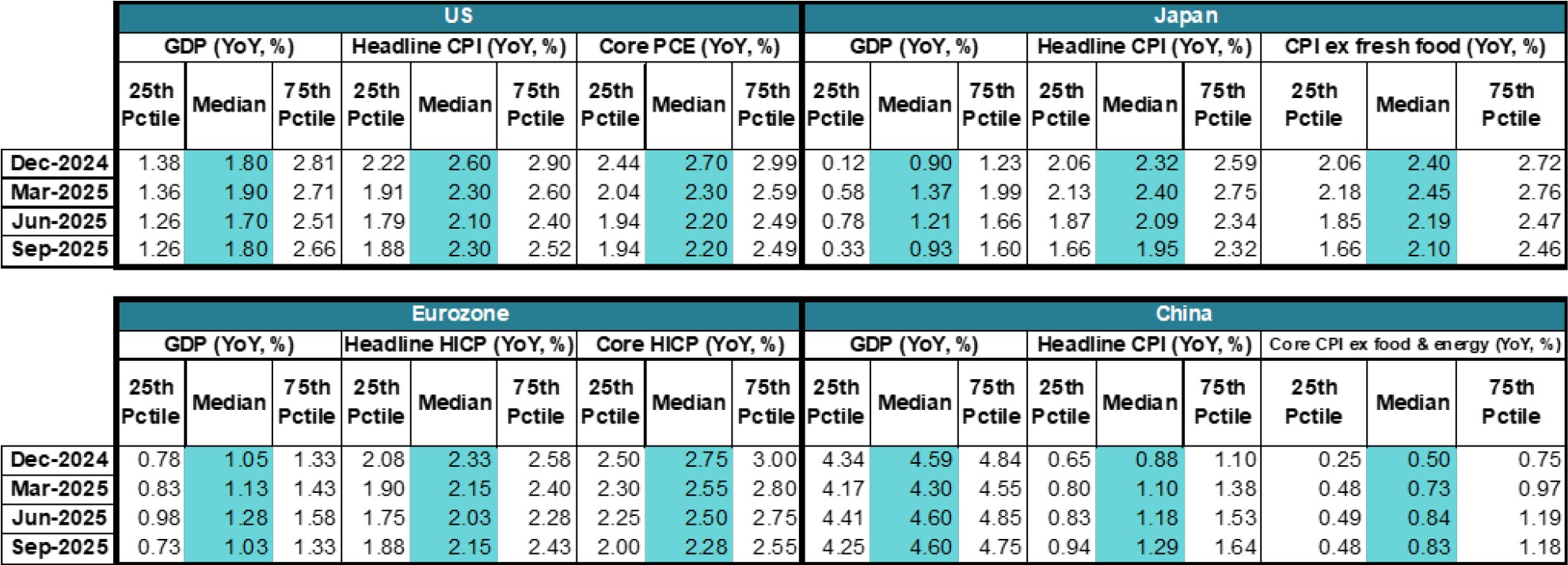

Global Investment Committee's outlook: low risk no longer Nikko Asset Management October 2024 As the Global Investment Committee (GIC) convened on 26 September, our Q2 outlook for resilient though somewhat softer US growth had materialised. However, our US EPS growth estimates (consistent with strong but softer GDP growth) remained slightly more conservative than market estimates. Going forward, we perceive heightened risk to both growth (two-way) and inflation (upside) compared to our Q2 guidance. Nevertheless, our central near-term scenario remains for slowing but positive growth in the US, alongside slowly moderating prices. Key takeaways are as follows:

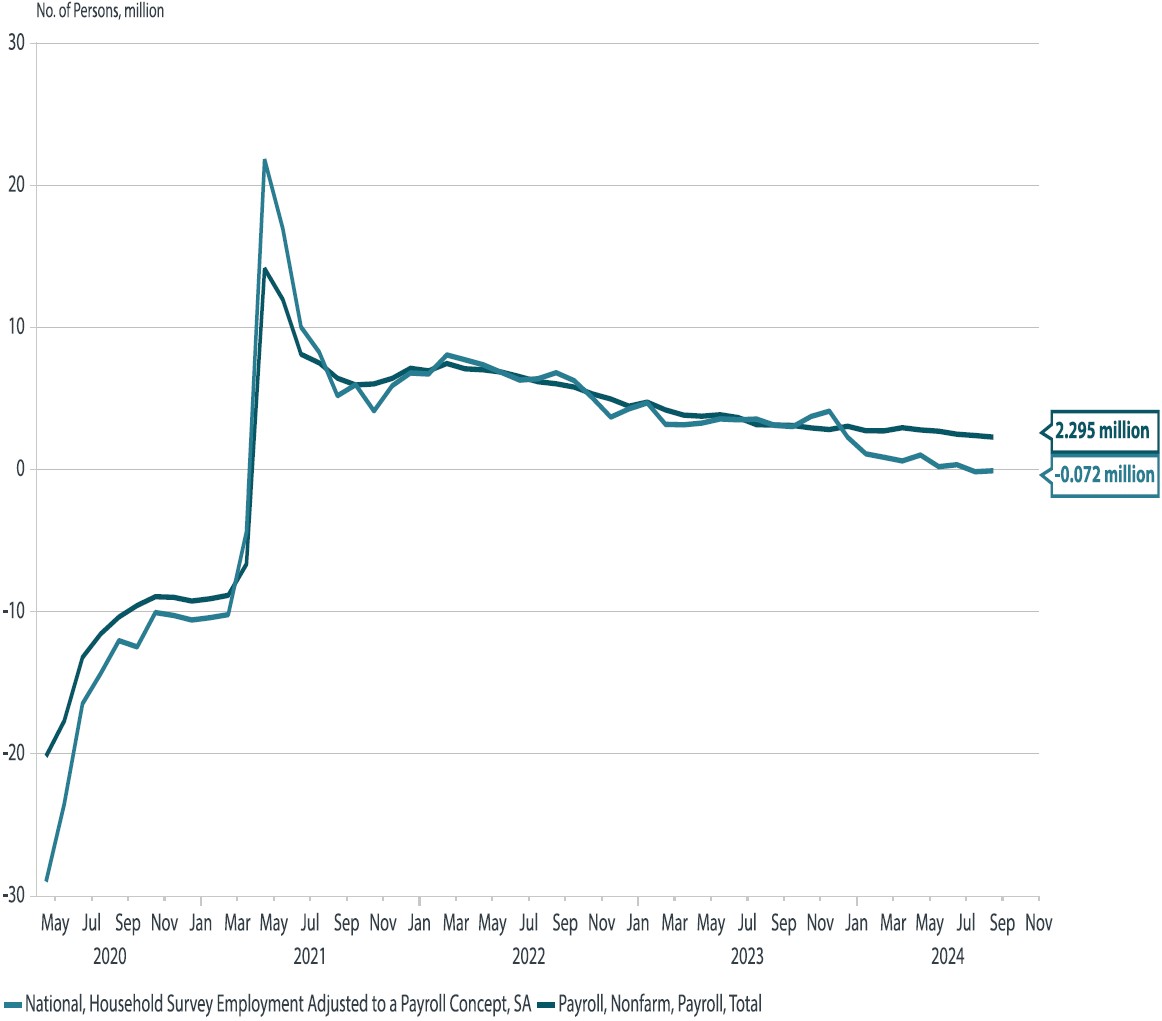

Q3 2024 in review: the "great dispersion" in stocks and bondsOver the course of Q3, the market experienced a change of course on several factors. Following a surprise rate hike from the Bank of Japan (BOJ) in July (the central bank took overnight rates to 25 bps), a downside surprise in US non-farm payroll data triggered speculation of imminent Fed rate cuts. This, in turn, led to the unwinding of speculative yen-funded "carry trades", triggering both a sudden drop in dollar-yen as well as unexpected volatility in Japanese equities--the target investments of short-term overseas investors utilising borrowed yen. Markets recovered quickly from the volatility, although dollar-yen appears to have corrected decisively lower from highs above 160. Domestic investors went bargain hunting as Japanese indices sold off and Japanese corporates used their large cash balances to buy back their shares at lower prices. Underweight institutional investors accumulated domestic equities to rebalance their portfolios while households, unfazed by speculative selling, continued to exercise the tax advantages that accrued to them under the New NISA. We convened an Extraordinary GIC at the time and shifted our guidance, primarily to allow for greater volatility. Aware that volatility tends to cluster and that markets may be at the threshold of a new volatility regime, we widened our ranges for both US GDP and the FOMC to admit downside risks. We also implemented new ranges for valuation (P/E) alongside existing earnings ranges for Japanese indices. Meanwhile, on the eve of the GIC on 26 September, markets had received news of surprise stimulus from China, on the heels of a larger-than-expected 50 bp rate cut from the FOMC on 19 September which had prompted bond markets to price in a succession of significant US rate cuts. Equity markets subsequently broke to new highs, even as bonds priced in a sombre macroeconomic scenario, though they barely reacted to the Fed's move on 19 September as the market had already priced in multiple 50 bp interest rate cuts. Meanwhile, toward the end of Q3, both Japanese stock markets and dollar-yen were influenced by speculation that Japan's ruling Liberal Democratic Party (LDP) would elect a new Abenomics-inspired leader (and thus prime minister). However, the LDP leadership vote on 27 September resulted in disappointment for the markets, which had to lower their expectations for the BOJ to end or indefinitely postpone its interest rate hike cycle. The LDP elected Shigeru Ishiba as its new leader and prime minister, who subsequently called a snap election for 27 October. However, as we noted in our insight, "Less may be more in Japan's LDP leadership contest", the situation is very different now than at the start of the Abenomics era when inflation struggled to turn positive. In Q3, we not only saw Japanese Q2 corporate earnings remain consistently strong but we also witnessed incipient signals of stronger consumption demand, backed by the advent of positive year-on-year (YoY) real wage growth. Global macro: growth risks persist, inflation tamer vs. Q2 on surfaceUS: From a macroeconomic standpoint, there is not enough clear motivation from underlying economic indicators to price in an imminent US recession, even despite softening data. Although the GIC foresees US GDP growth dipping below the 2% level, our outlook is for YoY growth to remain above 1.5% in the year to September 2025. The US consumer has remained resilient, even despite a softer job market, with consumption among higher-income households assisted by the "wealth effect" of gains in US stocks. While much slower than in early 2024, the US continues to add over two million jobs to non-farm payrolls YoY (see "What the Fed's rate cut tells us about current financial conditions"), which is stronger than job growth typically tends to be immediately prior to a US recession. That said, the unemployment rate has triggered the Sahm rule (typically a forward indicator of recession), due in part due to the widening disparity between the household survey (which shows YoY job growth already in contraction), and based on which the unemployment rate is calculated and the establishment survey, which tabulates non-farm payrolls. Chart 1: Employment conditions in the US

Source: Nikko AM, BLS Motivating the divide in part are disperse conditions between higher income households (where both job conditions and investment income are more supportive) and lower-income households, which are a higher proportion of the household survey than the establishment survey. Meanwhile, we see inflation as likely to stay on a gradual downward trajectory, although our median US core PCE outlook is for prices to show above 2% YoY growth over the course of the year to September 2025. Meanwhile, our voter survey shows a less dispersed central tendency for both headline and US inflation compared to Q2 as inflation subsides gradually. Notwithstanding, several members cite heightened inflationary tail risks. Many of the risks cited by voters have the potential to extend beyond the one-year outlook horizon. Macro vs. forward-looking financial market indicators: We are carefully observing the "great dispersion" of scenarios priced into financial markets, particularly in equities and bonds. We are unconvinced that the circular logic of aggressively lower rates could justify ever-higher equity valuations. This is particularly so given the messaging from the Fed. Although the FOMC did comply with market expectations for a "jumbo" cut in July, Fed Chair Jerome Powell continues to warn against assuming this would be the "new pace" of monetary easing in the absence of clear deterioration of economic conditions. Meanwhile, should economic conditions deteriorate (which is the bond market's signal) we are doubtful that the optimistic scenarios priced into the equity markets would indeed come to pass. Japan: Despite financial volatility in August, Japanese GDP appears to be on a trajectory to continue growing above-trend (potential GDP has been estimated at around 0.6% by the BOJ). Nonetheless, the median GIC voter offers more conservative estimates of Japanese GDP growth than in Q2 (no longer above 2% YoY) thanks in part to slower--albeit positive--growth in the US and other export markets. Meanwhile although headline CPI is foreseen dipping below 2% as early as the September quarter of 2025 with imported price inflation allayed by a slowly strengthening yen, our median GIC outlook is for ex-food inflation to remain above 2% over the year to September 2025. Euro area: The median GIC voter meanwhile foresees Eurozone GDP growth as likely to break above 1% YoY and remain at these levels over the year to September 2025, although both headline and core inflation are likely to remain stubbornly in excess of the European Central Bank (ECB)'s 2% medium-term target. However, immediate upside inflationary risks have been somewhat downgraded since the Q2 GIC, when much greater upside dispersion was seen among voters' estimates of future European inflation in both headline and core HICP. China: were it not for China's recent fiscal and monetary stimulus packages, GIC voters would have likely downgraded their GDP growth outlook, which they expect to still remain in the upper 4% range (but under 5%) over the year to September 2025. According to GIC voters, compared to the beginning of Q3, when stimulus was not priced in, moves by the Fed and the People's Bank of China (PBOC) have shifted the growth outlook. At the beginning of Q3, growth was perceived to come from abroad while now there is much more focus on domestic recovery. Meanwhile, communication between the PBOC and the government, which had previously been much more compartmentalised, now demonstrates greater coordination and a tone of shared urgency among Chinese officials. Their aim extends beyond simply stemming the decline in the housing market, focusing instead on stimulating domestic demand growth. Voters note that Chinese stimulus has been delivered at a time when markets are particularly sensitive to easing, though the size is half of what was delivered in 2009 (CNY 4 trillion vs. CNY 2 trillion in debt-funded fiscal easing in 2024) when the economy was one-third the size it is now. GDP growth is now less likely to falter near the 4% level (compared to the 5% target), particularly in the near-term--specifically, in the fourth quarter of 2024 and the first quarter of 2025. That the package also includes consumption coupons issued by an administration that once eschewed what it deemed "welfarism" underscores the priority for China to keep social unrest at bay given its sluggish domestic economy. Nonetheless, the outlook for headline CPI remains on the 1% handle, with core CPI still foreseen below 1% YoY over the year to September 2025. This is because voters perceive difficulties for China in lifting prices successfully; rather, attempts to date to allay weakness in the much greater consumer economy with investment in industry and export could potentially mean some degree of exportation of deflationary price pressures on exported Chinese goods. However, the impact of such pressures on trade partners could be limited in comparison to the early 2000s given today's higher relative price levels, reduced global trade openness and rise in trade barriers. That said, exported deflationary pressures are not always persistent. Though many Chinese firms do compete on price to gain market share, once gained, price increases often follow in an attempt to expand margins. Interest rates: the power of financial markets, a double-edged swordFOMC: In line with our relatively softer growth and inflation guidance over the year to September 2025, we have also downgraded our FOMC outlook relative to Q2. As mentioned in the "macro" section, softer indicators--particularly pertaining to US jobs--reinforce the need for further rate normalisation, as also apparent in the FOMC's own downgraded "dot plots" for growth, inflation and rates. The median GIC voter took the Fed's own forecast at face value to bring rates another 50 bp lower by the end of 2024. This is less dovish than the outlook currently priced into the bond market, which foresees potential for up to 75 bps in cuts by the end of 2024. Subsequently, the GIC foresees roughly 25 bps of easing per quarter, with a median outlook of 3.7% and an interquartile range between 3.45% and 3.95% by the end of September 2025. BOJ overnight rates: In Q2, we had priced in a partial but not a full probability of a July rate hike, which we saw as a modest surprise. However, following our August review, we saw little risk of the BOJ following up its surprise July hike with immediate additional tightening prior to gauging the impact of its move in Q3. Moreover, the BOJ called out both financial markets volatility as well as uncertainty abroad (e.g. in US growth) as one reason to remain on hold in September. Much like the influence that the markets appear to have had on the Fed's "pre-emptive" 50 bp cut, we see the BOJ's stance as being much more market-conscious than it was prior to the volatility experienced in early August. We do foresee potential for another rate hike before year-end, but such a move would most likely come after the October inflation data is published. According to the media, consumers will face price hikes on 2,900 food and drink items in the month of October (the broadest price increase in 2024 so far), as firms pass along higher raw material costs to consumers. GIC voters are therefore pricing in prospects of another hike prior to year-end (with the median guidance at 0.3%). There remains the risk that if financial market volatility resurges, the BOJ may remain on hold--all else being equal--at any point over the coming year. Conversely, if inflation surprises to the upside, there is also the risk that the BOJ could deliver a larger hike; our voters attribute a 25% or less chance that rates may rise to 0.45% before the year-end. Subsequently, the median GIC voter foresees rates as likely to rise to 50 bp by June 2025, and to 75 bps by September 2025. ECB: After the Q2 median guidance of 3.65% for the September-end refinancing rate came in close to the actual outcome, the GIC modestly downgraded its ECB outlook for the coming year. The Fed's larger-than-expected rate cut in September may have opened the door for more aggressive easing by the ECB. The median GIC voter predicts that it is somewhat likely for the ECB to reduce overnight rates before the year-end, with the interquartile range by the end of December 2025 at 3.075% to 3.575%). Nonetheless, given persistent services inflation, especially in Europe, the rate cut outlook is more conservative compared to the FOMC. Our median voter foresees a further 75 bps of cuts as likely in 2025. This compares to the FOMC's 80 bps foreseen for 2025, in addition to the 50 bps of cuts in Q4 2024. 10-year interest rates: Despite the uncomfortable positive correlation between equities and 10-year bond prices (with long-term bonds affording insufficient diversification from market risk), it is hard for participants in the bond market to "fight the Fed" given the apparently strong influence financial markets have on policy. This may paradoxically dilute the power of financial market indicators, including term structures of interest rates, as forward indicators of economic activity. Moreover, the positive correlation across geographies in longer-term bond markets is also apparent, even despite disparate policy trajectories. For example, in spite of improved prospects for near-term BOJ hikes since Q2 as priced into the short end of the JGB yield curve, the term structure of Japanese yields has flattened modestly since July, possibly influenced by Fed easing. Meanwhile, long-term US Treasury yields have declined even though the inversion between the 2- and 10-year benchmark Treasury yield has corrected. GIC voters foresee limited movement in 10 year Treasury yields from their current levels, even despite additional FOMC cuts, due to many of the cuts already being priced into the bond curve. Likewise, voters' central scenario is for little movement in 10-year Bunds over the coming year. One significant caveat--though not a central scenario among voters that inflation will disrupt the Fed's rate cut trajectory-- inflationary surprises and fiscal risk have registered higher than in Q2 in both probability and impact among voters' tail risks (see "Risks to Our Outlook* below). Foreign exchange: gradual yen appreciationFollowing volatility in August, we adjusted our outlook on the Japanese yen to allow for greater appreciation by the currency, as did the market as a whole. Partly responsible for this outlook adjustment was the prospect for narrowing yield differentials as the Fed eased and the BOJ tightened. Also, after observing one round of carry-trade unwinding and observing that market volatility tends to cluster, we upgraded the potential for volatile moves; volatility tends to come alongside yen appreciation. Meanwhile, the dollar's prospects have been downgraded modestly across currencies. The downgrade is less pronounced against the euro, pound and Australian dollar compared to the yen. Noting that the September 2024 BOJ Tankan survey released on 1 October references a fiscal year-end dollar-yen rate of 144.31, which is reasonably close to the spot rate at the time of writing, additional appreciation may impact exporters' overseas revenues, which we cover in the Japanese equities section. Mild upside to commodities, dispersed view on gold and oilIn line with the downward adjustment in oil prices thanks to supply and demand factors, the GIC downgraded its Q2 assumptions on Brent crude, foreseeing oil to remain below USD 80 per barrel for the year to September 2025. Any upside surprise, meanwhile, may result in an upgrade to inflation expectations. While this is not our central scenario, we do see rising tail risks connected to geopolitics, including violence in the Middle East. As its central scenario the GIC foresees mild upside to commodity prices over the coming year. Meanwhile, we expect the quest for diversification away from market risk, along with the inconvenient positive correlation between equities and US Treasuries (a traditional risk haven) will prove very supportive for gold in the coming year. Although the market prices a correction to near USD 2,500 per ounce over the next year, the GIC median voter sees potential for gold to rise above USD 2,700, with a 25% chance of the precious metal climbing to USD 2,800 or higher over the year to September 2025. Earnings growth and equity valuation: making way for higher asset volatilityOver the immediate horizon, the Fed's pre-emptive rate cut has had positive effects. Ongoing stimulus may continue to offer potential for resilient earnings growth from US stocks over the year to September 2025. We foresee double-digit YoY earnings growth still remaining intact over the year to September 2025. However, we also flag risks associated with ongoing market concentration (see "Risks to Our Outlook" below). Although our earnings outlook remains roughly in line with consensus, we foresee the potential for valuations to overshoot near-term due to Fed stimulus, and then gradually moderate over the course of the year to September 2025. We also anticipate potential for rebounds in lower-valued indices, such as the STOXX and Hang Seng. We believe that the latter can capitalise on its recent trough as Chinese stimulus takes effect and earnings growth recovers. But we expect valuations to remain on a downtrend for the STOXX, while we see earnings recovering over the course of the year to September 2025. Japan equities: low valuation + earnings growth + volatility = opportunityAlthough we foresee a rising trend in Japanese earnings and some adjustments in valuation over time, we expect volatility and dips in price creating significant opportunities for new purchases among longer-term investors. Notwithstanding the volatility, we see potential for broad-based Japanese corporate earnings growth, plus significant ability for the index to regain ground after sharp dips. This is due not only to comparatively reasonable valuation relative to US stocks, whose P/E ratios are well above their historical 20-year range, but also Japan's strong structural growth backdrop. This is evidenced by the gathering momentum of domestic consumption and investment alongside improving governance among corporates. We also note the presence of structural buyers in the form of domestic corporates buying back their own shares, institutions topping up domestic shareholdings to meet allocations and households exercising the tax advantages inherent in the new NISA. However, we do not discount the potential for interim negative surprises, particularly among large exporters, given the smaller buffer that current yen rates provide to exporters in terms of overseas revenues and investment income windfalls. Broader price ranges reflecting reactions to earnings surprises and valuation shifts: In August, we had introduced ranges not only for EPS growth but also for P/E ratios. We calculate price ranges taking into account the combined maximum and minimum impacts of earnings growth and valuation shifts. The highs within the price range represent our anticipated upper end of index fluctuations due both to earnings surprises and valuations, which we believe will experience bouts of interim volatility so long as market trading remains dominated by foreign investors (who on aggregate trade more frequently than domestic investors) even though many classes of domestic investors are likelier to buy and hold. Chart 2: Percentage of total TSE trading volume by foreigners

Source: Nikko AM, Tokyo Stock Exchange Risks to our outlook: harbingers of inflationDespite the generally benign outlook to global growth and inflation, our voters cited the following heightened risks that were biased toward the inflationary upside:

Investment strategy conclusion: stay invested, insure against inflationOur anticipated economic outlook remains benign. Although we anticipate a slowdown in US growth, we do not foresee recession as imminent, with the Fed's pre-emptive rate cut already contributing to accommodative financial conditions due to its anticipatory impact on financial markets. Accommodative financial conditions remain supportive near-term. Meanwhile, though it remains difficult to anticipate the timing of market-related corrections, we also signal heightened tail risks associated with policy uncertainty surrounding elections in the US as well as the potential for even small disappointments in economic data and policy to exercise a greater impact on asset markets and therefore growth in the future. We see the risks as biased toward the inflationary, and also foresee the disparity in outlooks priced in by the US bond and stock markets as ultimately unsustainable. In the event of upside risks to inflation, holding stocks (however volatile) may help protect the future purchasing power of investors, while upside may be limited for bonds, even if central banks do deliver easing as anticipated. For this reason, we continue to see demand for assets that are typically resilient to inflation that may also provide diversification hedges against US market risk. We favour gold and increasing exposure to Japanese domestic demand, which is showing signs of sustainable structural recovery and is less correlated with US growth and stimulus than export-oriented firms. The GIC's guidance ranges may be found in Appendix 1 of this document. A note on changes to the Global Investment Committee Process: In June 2024, we made changes to the Global Investment Committee, as to align our quarterly Outlook more closely with the views underlying our portfolio investments. In lieu of forecasts, we have chosen to provide guidance ranges for indicators and indices that we feel most closely relate to the asset classes we manage. In place of forecasts the Global Investment Committee now provide aggregate guidance at the median for our central outlook, and at the 25th and 75th percentiles. The asset classes represented in our Outlook can change over time, depending on what is most representative of our active investment views. In the event full ranges are not available, this may be interpreted as to mean that the asset class is not a central focal point for our highest conviction investment views. Appendix 1: GIC Outlook guidanceGlobal macro indicators

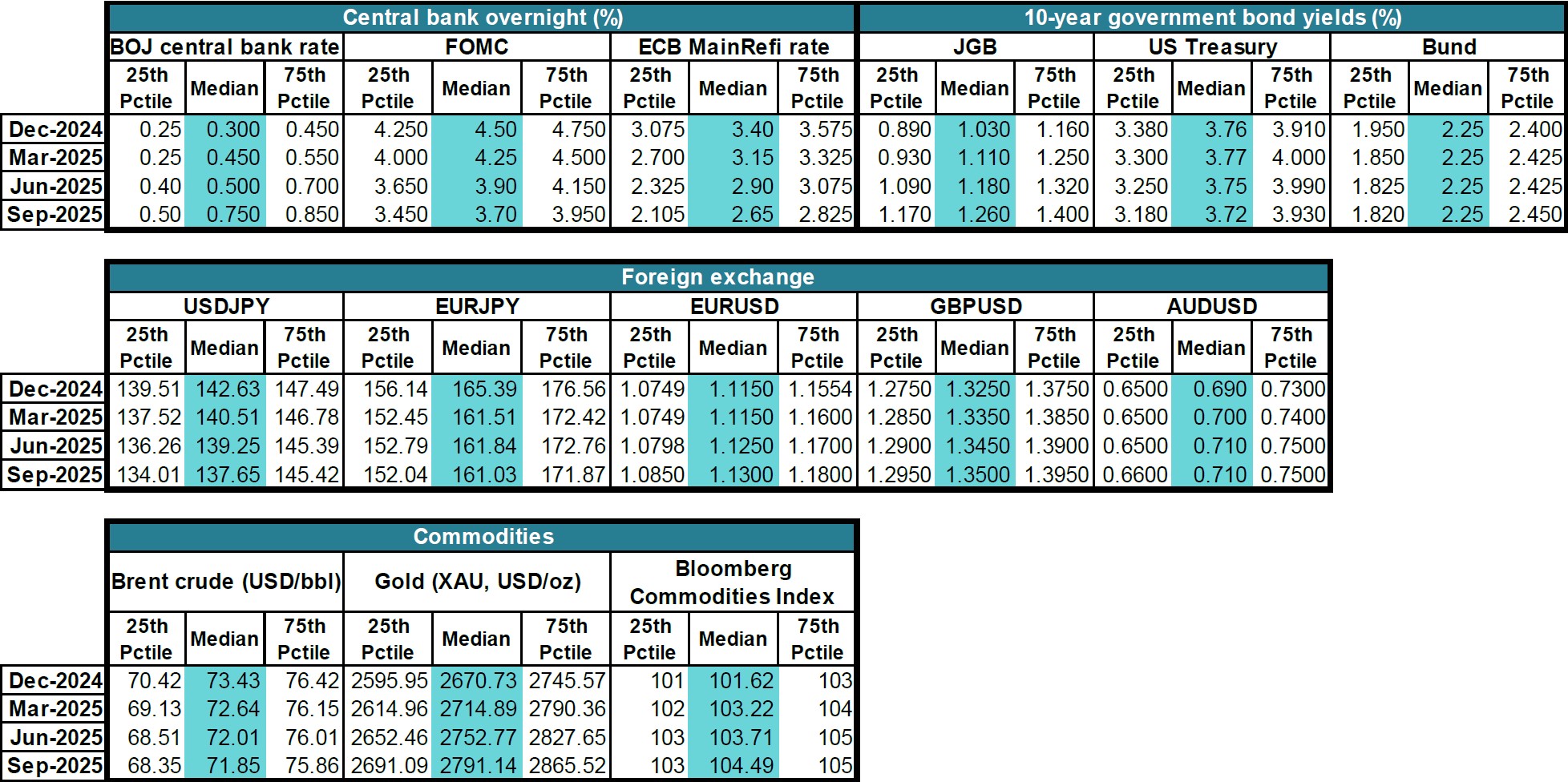

Central bank rates, forex, fixed income and commodities

Equities

Funds operated by this manager: Nikko AM ARK Global Disruptive Innovation Fund, Nikko AM Global Share Fund Important disclaimer information Please note that much of the content which appears on this page is intended for the use of professional investors only. |

|

Change as the only constant: investing in a world in transition Nikko Asset Management August 2024 Q1: Does the AI investment theme still offer significant long-term potential?When we are confronted with truly significant change, we can often react in ways that are not entirely rational. If the change represents a perceived threat, our fight or flight response can be triggered, leading us to resist the change or ignore it in the hope that it might go away. While there are clearly risks, resisting the opportunities presented by artificial intelligence (AI) and ignoring its development would seem to be dangerous for investors. Bill Gates has been quoted as saying that the impact of new technologies is often overestimated on a two year view but greatly underestimated over time periods of ten years or more. When we view technological development in its long-term context, the change it represents can become less overwhelming and we can see patterns from history which might give us a clue as to where we stand today, what might happen next and who the big winners might be. It should be fairly obvious to investors today that we are in the middle of a very strong, AI-driven cycle for IT hardware as the infrastructure for an AI based platform of computing is being developed at a rapid pace. Yet, obvious questions remain, such as "how long will this last?" and "are we once again overestimating the short-term significance and underestimating the long term impact?" To put this in context, it might be useful to look at previous hardware cycles and their characteristics as the various computing platforms have evolved over the last 60 years or so. Chart 1: The evolution of computing platforms

Source: Jeffries Equity Research Chart 1 above shows the evolution of computing platforms since the 1950s. We can see that each era lasts around 10 to 15 years and with each passing cycle, the number of devices connected to the network has increased tenfold. As a result, technology has penetrated more and more industries and been applied to more and more aspects of everyday life. What is less clear from the chart is that in each era, there has been one or two companies that have typically captured 80% or more of the hardware value chain. IBM in the mainframe era, DEC in mini-computers, Microsoft /Intel in PCs, Nokia and then Apple in cell phones and so far Nvidia in the parallel processing/IoT era powered by an AI datacentre at its core. It's probably fair to assume that we are likely in the early stages of the AI-related infrastructure build, perhaps at a point equivalent to the mid-1990s when the internet was still being constructed. While this rapid growth phase for hardware is likely to slow down, there is still a long runway of adoption to go if prior cycles are any guide. One significant difference between the AI infrastructure boom and the growth in fixed and mobile internet infrastructure is the fact that the internet rollout was largely financed by debt raised by telecom companies and IPOs raised by often loss-making early stage companies. Today's AI infrastructure, however, is being built using cash flows from large and very profitable businesses. This factor alone may give the hardware cycle more longevity than its predecessors. In terms of applications and profitable use cases for AI, it appears that we are in a position similar to the mid-to-late 1990s when the internet was being developed. Back then, we expected navigation, entertainment and e-commerce would likely become the main applications for the internet. It took a further decade for the smartphone to reach the mass market and fully enable the potential of the network, allowing companies like Apple, Meta Platforms, Alphabet, Amazon and others to flourish. AI may yet be applied to new industries and revolutionise the competitive landscapes therein. Drug discovery, self-driving cars, media content production and software code writing could all become the main applications for AI in the longer term. However, it is too early to make definitive predictions. The emerging risk of a classic hype cycle seems fairly clear. If profitable use cases are not delivered soon enough, this may slow the infrastructure boom. This was certainly the case in the late 1990s early 2000s. However, back then the internet infrastructure collapsed under an unsustainable mountain of debt, which was paid out in the form of expensive 3G licences. During this period, Apple disrupted the telecom value chain with the power of iTunes and then the smartphone. This time, the spending is funded by cash flow and earnings, and while it may slow down, it seems unlikely to collapse any time soon. In conclusion, the impact of AI clearly has the scope to be far-reaching and is likely a factor investors will have to contend with for a long time to come. Q2: Will the market leadership broaden beyond technology names into other sectors?The possibility of stock market leadership broadening beyond technology names and into other sectors, in our view, depends on several factors. These include economic conditions, the level of real rates, sector-specific earnings, cash flow developments and investor sentiment. In general, market leadership so far in 2024 has been driven by upgrades in earnings and cashflow. Five mega-cap AI stocks--Nvidia, Alphabet, Amazon, Meta and Microsoft--have accounted for almost all of the market's return. However, value stocks in areas such as energy, banking and insurance have also performed well, while defensives such as consumer staples and healthcare have largely underperformed. The market seems to be assuming that we are in the middle of a business cycle of indeterminate length--all underpinned by a gradual disinflationary environment. It is only natural to question if this is a fair assessment. Does it all add up? How should we construct portfolios in this environment? So far in 2024, changes in earnings have had a greater influence on the market than changes in real interest rates (Chart 2). The chart shows how much of the returns can be explained by changes in earnings. Rather ominously, similarly high readings were seen just before major market events, such as the Asian financial crisis of 1998, the dot.com bust of 2000, and arguably, the Global Financial Crisis (GFC) of 2007/2008 and the European debt crisis of 2012. Chart 2: Proportion of S&P 500's large-cap stock returns attributable to changes in earnings

Large capitalisation stocks' share of the return dispersion explained by the dispersion in earnings surprise measured over nine-month windows from 1993 through mid-May 2024. Past performance is not indicative of future performance. Source: Empirical Research Partners Naturally, investors are wondering if there is something equally damaging around the corner which may cause this benign central scenario to unravel. If we examine each factor, listed below, we may be able to draw some conclusions.

Q3: What are the main risks and challenges equity investors may face in the remainder of 2024?Whether it's about the level of the CPI, the direction of economic growth, credit quality in the consumer and corporate sector, the housing market, supply of USTs, elections, geopolitics or even an outright stock market bubble, the list of investor worries and concerns seems as long as one can remember. Yet the market continues to push higher. Are we headed for a fall or are we in an economic sweet spot with moderate growth and declining inflation that could go on for some time? Like any journey, to really understand the benefits of the destination, we should also understand our starting point. Taking a long-term view makes this a little more straightforward and likely helps us draw some better insights, given the myriad of potential outcomes which exist in the short-term. The last 15 years have been characterised by unprecedented fiscal and monetary stimulus to keep the cost of money low following the GFC and more recently to support economies during the pandemic. The low cost of capital reached a pinnacle in a 2021 stock market bubble of money-losing growth stocks, which burst spectacularly as the cost of money increased. The next 15 years seem unlikely to be a repeat of the last 15, with the direction of real rates being the primary concern for investors. Our best guess is that we are now faced with a sustainably higher cost of capital than the abnormally low level we witnessed following the GFC. A number of factors contribute to this, including (but not limited to) the high forthcoming supply of government debt to fund a burgeoning fiscal deficit, the impact of geopolitics on trade restrictions and the inflationary implications of the energy transition. If real rates are indeed set to rise over the next decade or so, this will have implications for stock picking as immediate profits become more valuable to investors than the hope of potential profit a decade from now. This might explain why the companies in the market related to the AI theme are performing so well, as they are also experiencing sharp increases in earnings and cash flow. This contrasts sharply with long-duration growth stocks, which continue to lag the market as the anticipated earnings for 2035 or beyond remain just that--hope. Yet, perhaps the biggest risk to investors with time horizons of 10 years or more is missing out on the opportunities a well-diversified portfolio of global equities can offer. As a smart investor once said, "time in the market is far more important than timing the market". This seems as true today as ever. We are on the verge of a further breakthrough in productivity, enabled by the ongoing evolution of computing platforms, and we stand ready to tackle arguably the most pressing challenge in human history--climate change. Throughout history, equity investors have benefitted from maintaining a long-term view and an optimistic outlook on humanity's ability to prevail in the face of adversity. This might once again be the case, meaning that the biggest risk might be not having exposure to the highest quality earnings streams through a diversified portfolio of global equities. Perhaps we have already mentioned that we know professionals who can be of assistance in such matters.

Global Equity strategy composite performance to June 2024 |

Historical Performance (all figures shown here are net of fees unless otherwise stated)

| Year | Jan % | Feb % | Mar % | Apr % | May % | Jun % | Jul % | Aug % | Sep % | Oct % | Nov % | Dec % | YTD % |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025 | 10.56 | -9.18 | N/R | N/R | N/R | N/R | N/R | N/R | N/R | N/R | N/R | N/R | 0.41 |

| 2024 | -9.28 | 13.09 | -2.11 | -10.80 | -3.19 | 3.08 | 4.68 | -3.47 | 3.70 | 3.35 | 25.54 | 2.63 | 24.74 |

| 2023 | 22.82 | 3.59 | 2.87 | -9.04 | 14.52 | 6.54 | 12.58 | -9.43 | -9.42 | -9.36 | 24.12 | 9.81 | 65.73 |

| 2022 | -17.91 | -9.17 | -8.21 | -22.65 | -7.58 | -5.90 | 9.16 | -5.18 | -4.13 | 2.47 | -5.78 | -17.11 | -63.44 |

| 2021 | 10.76 | -6.51 | -6.30 | -1.05 | -7.10 | 19.19 | -6.65 | 3.22 | -7.43 | 5.17 | -8.40 | -12.29 | -19.88 |

| 2020 | 8.53 | 4.86 | -12.08 | 15.62 | 12.59 | 8.12 | 8.19 | 13.87 | -0.37 | 1.16 | 17.39 | 7.22 | 120.08 |

| 2019 | 11.09 | 10.24 | 0.65 | 2.12 | -12.26 | 15.77 | 2.85 | -6.19 | -3.37 | 0.24 | 15.33 | -4.07 | 32.20 |

| 2018 | N/R | N/R | N/R | N/R | N/R | N/R | N/R | 0.54 | -5.41 | -8.70 | 0.79 | -9.62 | -20.90 |

Historical Financial Year Performance (all figures shown here are are percentage per month net of fees unless otherwise stated)

| Year | Jul % | Aug % | Sep % | Oct % | Nov % | Dec % | Jan % | Feb % | Mar % | Apr % | May % | Jun % | FYTD % |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2024/2025 | 4.68 | -3.47 | 3.70 | 3.35 | 25.54 | 2.63 | 10.56 | -9.18 | N/R | N/R | N/R | N/R | 40.10 |

| 2023/2024 | 12.58 | -9.43 | -9.42 | -9.36 | 24.12 | 9.81 | -9.28 | 13.09 | -2.11 | -10.80 | -3.19 | 3.08 | 2.00 |

| 2022/2023 | 9.16 | -5.18 | -4.13 | 2.47 | -5.78 | -17.11 | 22.82 | 3.59 | 2.87 | -9.04 | 14.52 | 6.54 | 15.35 |

| 2021/2022 | -6.65 | 3.22 | -7.43 | 5.17 | -8.40 | -12.29 | -17.91 | -9.17 | -8.21 | -22.65 | -7.58 | -5.90 | -65.30 |

| 2020/2021 | 8.19 | 13.87 | -0.37 | 1.16 | 17.39 | 7.22 | 10.76 | -6.51 | -6.30 | -1.05 | -7.10 | 19.19 | 66.14 |

| 2019/2020 | 2.85 | -6.19 | -3.37 | 0.24 | 15.33 | -4.07 | 8.53 | 4.86 | -12.08 | 15.62 | 12.59 | 8.12 | 45.60 |

| 2018/2019 | N/R | 0.54 | -5.41 | -8.70 | 0.79 | -9.62 | 11.09 | 10.24 | 0.65 | 2.12 | -12.26 | 15.77 | 1.14 |